Bitcoin: Buy, Buy, Buy Alert!

RoboStreet – July 4, 2019

Believe It Or Not – Bitcoin Is Back

These are crazy times for stock market investors. The major averages are within a whisker of new all-time highs while global bond yields are plunging to new historic lows amid a flood of economic data pointing to a broad-based slowdown in growth among both developed and emerging countries.

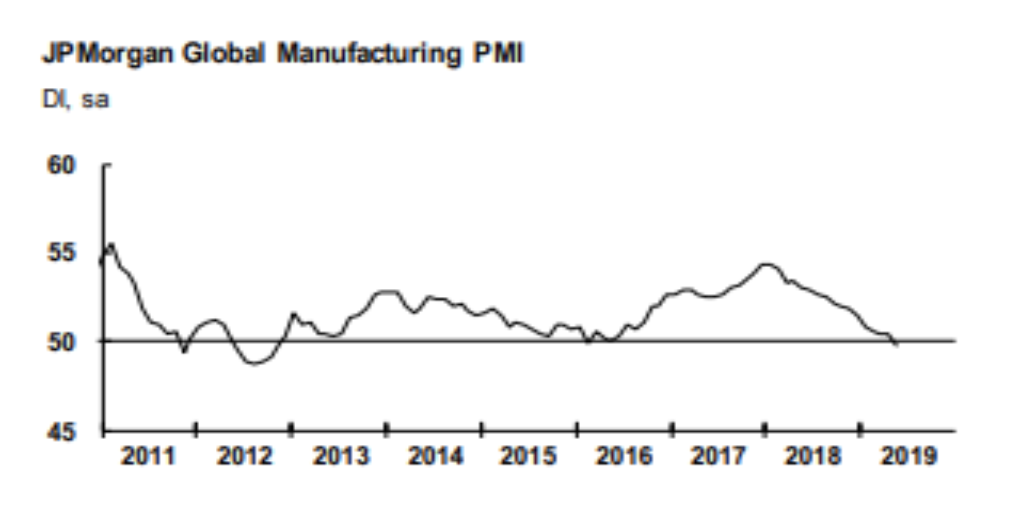

Global PMI lowest reading since October 2012

This past week Global PMI surveys signaled that manufacturing further contracted during the month of May, posting its lowest reading since October 2012. The J.P.Morgan Global Manufacturing PMI – a composite index produced by J.P.Morgan and IHS Markit – posted 49.8 in May, down from 50.4 in April. Any number below 50.0 shows the world’s factory output is contracting.

(Want free training resources? Check our our training section for videos and tips!)

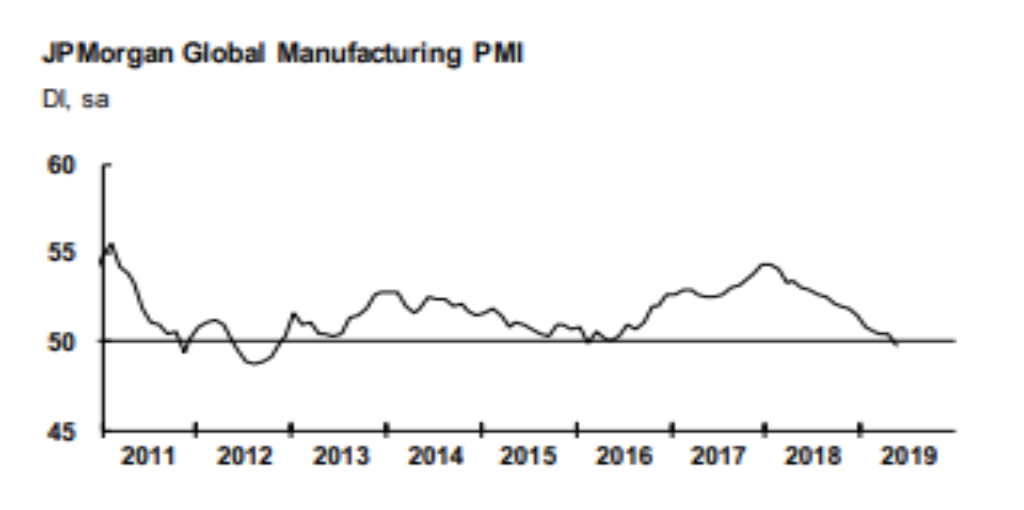

ISM Manufacturing PMI in the U.S. slowest pace of expansion since October 2016

More importantly, the ISM Manufacturing PMI in the U.S. fell to 51.7 in June from 52.1 in May, marking the slowest pace of expansion in the factory sector in October 2016. Being that the U.S. economy accounts for 21.6% of global GDP, China at 12.7%, Japan at 7.7%, Germany at 4.8% and France at 3.6% – when this group that makes up 50.4% of global GDP sneezes, the rest of the world gets a cold.

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

(Want free training resources? Check our our training section for videos and tips!)

U.S. the main driver of the slowdown in global manufacturing PMI

According to the JP Morgan Global Manufacturing PMI report “The downshift in growth in the U.S. was the main driver of the slowdown in global manufacturing, as the U.S. PMI slipped to its lowest level in almost a decade (September 2009).

Further trade war lead global economy into a recession

With this information in hand before last week’s G20 Summit in Osaka, both President Trump and President Xi were well aware that furthering the trade war risked putting the global economy into a recession.

(Want free training resources? Check our our training section for videos and tips!)

Reasons for stocks around the globe are at their highest levels

Market pundits have been all over the map trying to explain why stocks around the globe are trading at their highest levels for 2019 while deteriorating data such as global PMIs are telegraphing slower growth ahead. Well, investors have bought into the macro argument that the Federal Reserve will begin aggressively cutting interest rates while central banks in China, Japan, and Europe will also pursue more aggressive fiscal stimulus measures.

Negative bond yields help stocks go higher

It’s believed that coordinated central bank intervention among the most powerful economic nations will provide a floor under equities. And with no less than 14 countries having negative bond yields within their sovereign debt, higher yields from stock dividends are driving capital flows into equity markets. This might be why PE multiples are expanding while earnings growth is decelerating.

(Want free training resources? Check our our training section for videos and tips!)

FOMO and conundrum at the same time

It’s a conundrum for sure, and at the same time the “fear of missing out” or FOMO as it is referred to, has underinvested professional and retail investors paying up for stocks leading to a melt-up of sorts this past week. So much for summer doldrums in the stock market. Investors should expect more fireworks after the 4th of July for sure.

No wonder gold and Bitcoin have exploded higher recently

With this high level of uncertainty surrounding the race by central banks to devalue their currencies, it’s no wonder gold and Bitcoin have exploded higher recently. Millions of investors are looking for an alternative to currency manipulation and the flooding of money into the global banking system. What is going on is unprecedented and is driving up a huge interest in alternative safe havens.

Anonymous transfer of wealth main advantage of bitcoin

In addition, capital flight from China and other restrictive nations into the U.S. have also been unprecedented. Using Bitcoin as the main mechanism of transferring wealth affords investors to do without being identified by the authorities.

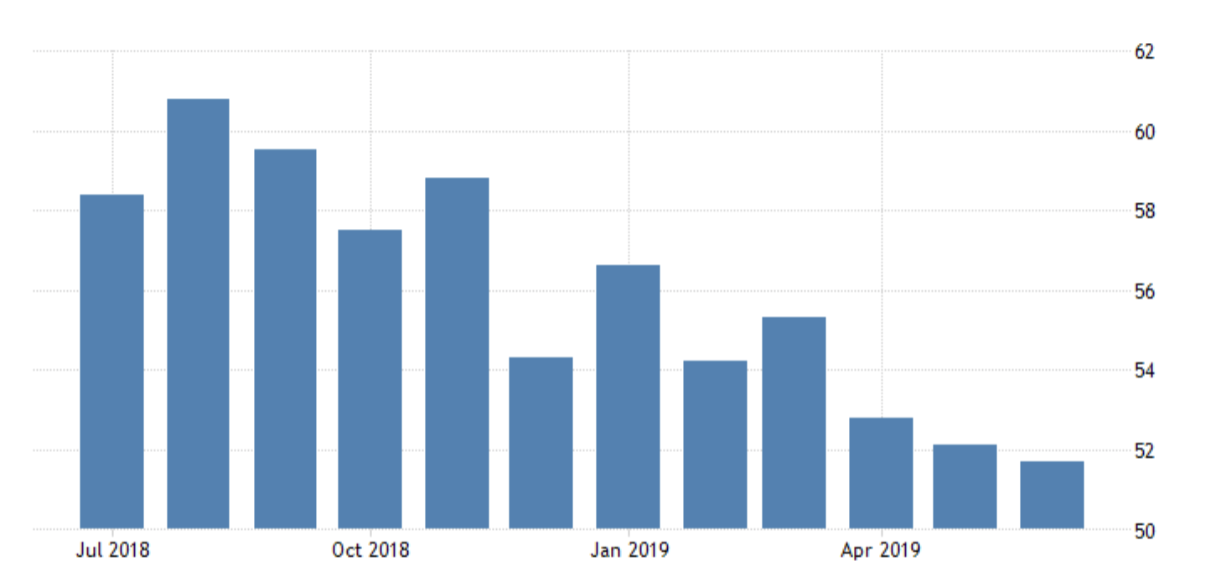

From $7,700 on June 4 to $11,836 on July 4

The level of activity in Bitcoin has surged in the past two months as the chart from Coinbase shows below. Bitcoin was trading at $7,700 on June 4 and today as of July 4, it’s trading at $11,836.

(Want free training resources? Check our our training section for videos and tips!)

Libra reason for skyrocketing bitcoin price

But sparking the latest pop in Bitcoin was most likely the announcement on June 18 that Facebook was launching its own digital currency – Libra.

Bitcoin gains more credibility

For a company that has a member following of over 2 billion people around the world, it brings more credibility to the whole Bitcoin investment proposition. The plan by Facebook is ambitious in light of what may be a pending antitrust case by the government, but the news lit a fire under the digital currency space and particularly that of Bitcoin.

(Want free training resources? Check our our training section for videos and tips!)

Trading Bitcoin involves having a special account at one of the cryptocurrency exchanges, and for many conventional investors. That’s just not an appealing option in that these exchanges and brokerage firms that deal exclusively in cryptocurrencies are highly unregulated where accounts are not insured in the event of loss, hacking or if the brokerage firm goes out of business.

Very real risks in dealing in this space outside of regulated brokers

There are very real risks in dealing in this space outside of regulated brokers that have protections in place against fraud, theft, and bankruptcy on the part of participating brokerage firms.

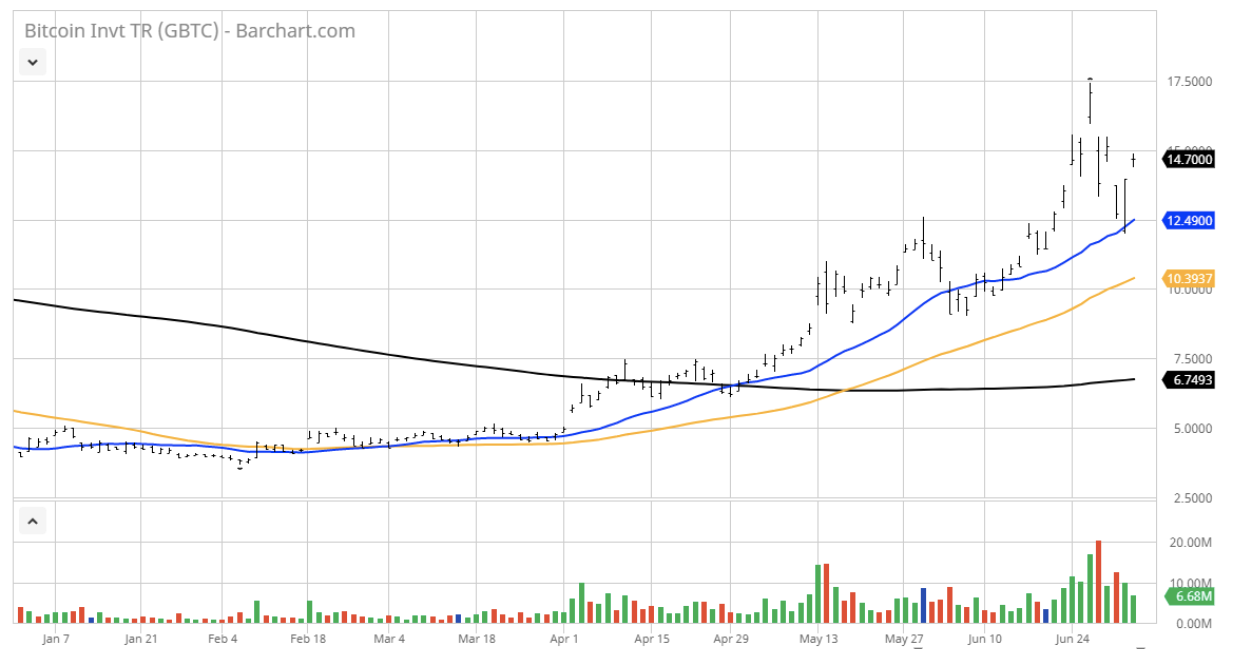

Greyscale Bitcoin Trust, the only publicly traded proxy for Bitcoin

To capture the full excitement of trading and owning Bitcoin, investors can trade shares of Greyscale Bitcoin Trust (GBTC), the only publicly traded proxy for Bitcoin that tracks the cryptocurrency.

GBTC shares 365% higher from its mid-December low

And shares of GBTC trade like water, averaging about 5 million shares traded daily. When Bitcoin was trading at $3,179 back on December 4, 2018, shares of GBTC were trading at $3.76. Today, with Bitcoin trading $11,836 or 372% higher, shares of GBTC traded this past week at $17.50 or 365% higher from its mid-December low.

(Want free training resources? Check our our training section for videos and tips!)

GBTC makes for a fine substitute for Bitcoin

GBTC makes for a fine substitute for Bitcoin and doesn’t tie up almost $12,000 to buy just one coin if investors want to risk smaller amounts of investment or trading capital.

Against this unequivocal rally for stocks and Bitcoin, my Tradespoon AI indicators have been busy recommending several sales of positions into strength. Just within the past four weeks, for our RoboInvestor Portfolio, we rang the register for nice profits in Whirlpool (WHR), Materials Select Sector SPDR ETF (XLB), Walmart (WMT), Applied Materials (AMAT), SPDR S&P Homebuilders ETF (XHB), VanEck Vectors Gold Miners ETF (GDX) and Medtronic (MDT).

(Want free training resources? Check our our training section for videos and tips!)

At present we are working orders to sell Honeywell International (HON), Industrial Select Sector SPDR ETF (XLI) and iShares MSCI Emerging Markets ETF (EEM) for more profits. In fact, our winning trades percentage is a whopping 94.20% thanks to the power of an “always thinking, always working” AI platform that is producing these kinds of results.

My recommendation is to not invest or trade stocks, ETFs and Bitcoin without the tools provided by my AI platform and our RoboInvetor advisory service. Our team at Tradespoon has put a tremendous amount of work, energy and time into providing what we believe is a stock and ETF picking service second to none. We’re making money for our subscribers over 94% of the time going back to April 2018.

More difficult market to trade for the second half of 2019 and beyond

Arm your portfolio with the proven tools applied to RoboInvestor for what will likely be a more difficult market to trade for the second half of 2019 and beyond. Markets can get considerably more challenging to trade, but that doesn’t mean you have to make less. It just means you have to trade smarter. RoboInvestor is whip-smart, and who doesn’t want to be whip-smart when it comes to making money.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.