Vlad’s Best Santa Claus Rally Picks

RoboStreet – October 28, 2021

Earnings Season Full Of High Profile Beats And Misses

Despite some big disappointments from several Wall Street blue blood companies, the market has traded to new all-time highs this week on the back of generally strong third-quarter results. Shares of IBM Corp. (IBM), Intel Corp. (INTC), Texas Instruments Inc. (TXN) Facebook Inc. (FB), and Visa Inc. (V) are just some of the prime examples of how resilient the market is to bad news and severely bearish price action.

With about 60% of S&P 500 companies having posted their Q3 numbers, roughly 80% are coming in above estimates, which is keeping a positive bid under the market even as the breadth of the rally has narrowed to some extent. The bulls have been able to hang the hats on big upside beats by Microsoft Corp. (MSFT), Alphabet Inc. (GOOGL), Netflix Inc. (NFLX), Tesla Inc. (TSLA) Nvidia Inc. (NVDA), Advanced Micro Devices Inc. (AMD), Goldman Sachs Group (GS), Bank of America Corp. (BAC) and a host of other institutional favorites.

Bond yields also retreated, even if for only a brief time, as did crude prices and other commodity prices, tempering the inflation fears that have gripped investor sentiment for the past several weeks. The market is awash in liquidity that is targeting equities as we enter what is seasonally the strongest time of the year for stock performance. At present, the S&P is overbought short-term and will likely back and fill next week once the earnings parade runs its course. From then on, buying winning stocks on dips will be the way to ride the year-end bull wave higher.

CURRENT MARKET LANDSCAPE

The $SPY pulled back today and settled right below the recent all-time high, $456. The value/reflationary stocks traded lower, down 1.4%, and closed above the recent break out ($VTV at $453), key short-term support. The technology stocks closed in the green, up 0.25%, and settled near the all-time high. $MSFT, $GOOGL, and a strong rebound in $TLT (treasury) provided support for $SPY and the technology stocks. The $DXY is short-term overbought and retesting key long-term support at $93.5 (break of this support will be bullish for the reflationary stocks). The $TLT had a strong rebound (lower yield) and settled above its 50-day moving average.

The $SPY short-term support level is at $450, followed by $445. The SPY overhead resistance is at $455/$460. Short-term, the market is overbought and due for a shallow pullback in the next few sessions. Based on our models, the market (SPY) will trade in the range between $445 and $465 for the next 2-4 weeks.

Costco Wholesale Corp. United Parcel Service Inc. stand out for consideration as additions

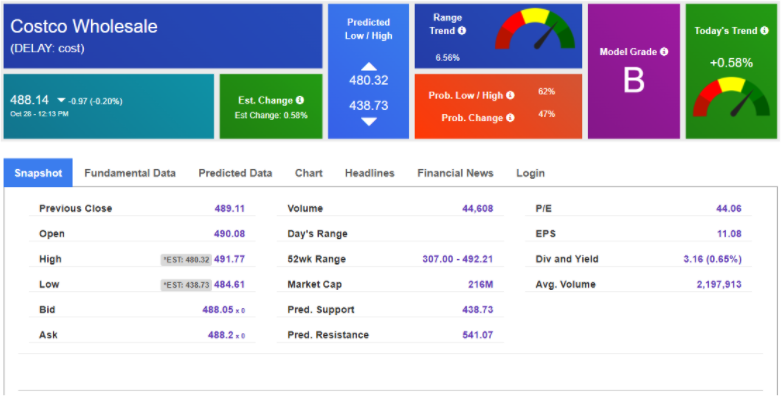

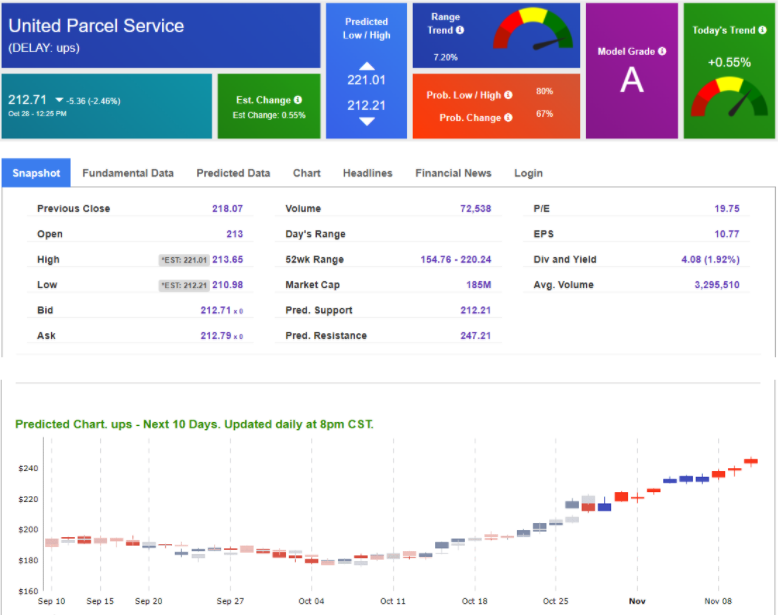

Speaking of strong earnings, two stocks that stand out for consideration as additions to our RoboInvestor portfolio are Costco Wholesale Corp. (COST) and United Parcel Service Inc. (UPS). Both companies put up stellar quarterly results, handily exceeding estimates and raising guidance for the fourth quarter.

It’s this bullish combination that the market is rewarding most and heading into the holiday shopping season, these are two of the best-positioned companies to leverage what is forecast to be the biggest spending season on record.

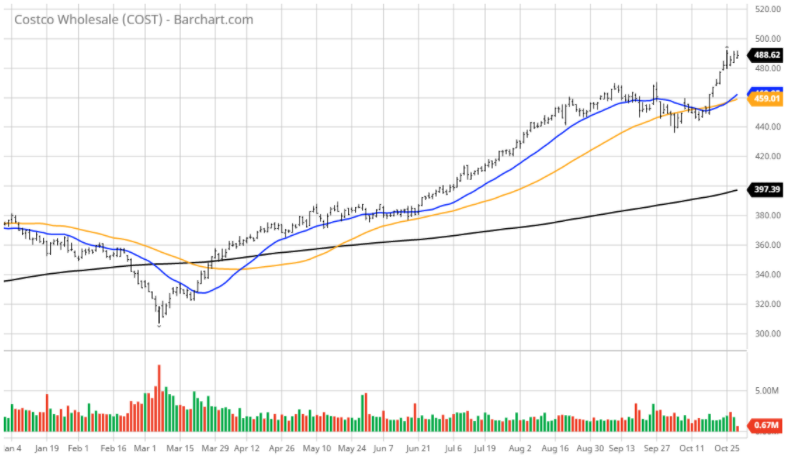

Taking a technical look at Costco, the stock has made a sharp move to new all-time highs and will likely consolidate over the next couple of weeks to test its rising 20-day moving average.

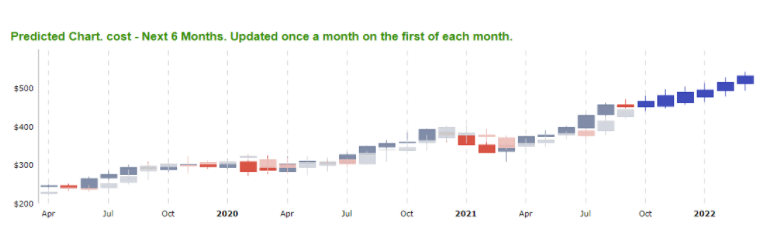

When we apply our AI-driven Forecast Toolbox we get a Model Grade “B” rating with a Predicted Resistance price target of $541, implying a move higher of 11% over the intermediate-term.

The technical picture for UPS is also just as impressive with the stock gapping to a new all-time high in reaction to the blowout earnings report, leaving a big air pocket underneath that will likely be filled in the coming days.

Once again, we input UPS into our Forecast Toolbox and we get a Model Grade “A” rating with a near-term upside price target of $247, or 16% higher than where the stock currently trades. This is a powerful upside breakout and will be a timely purchase in the next week or so per our AI signals, and a trade that investors won’t want to miss out on.

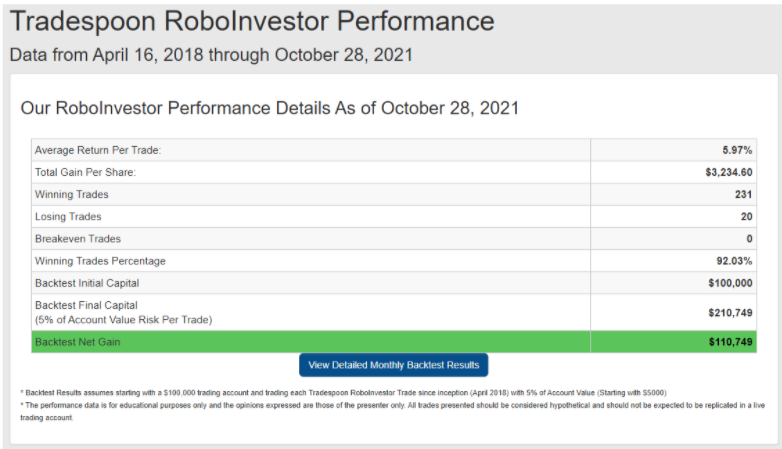

Our Winning Trades Percentage is a phenomenal 92.03%

Within the RoboInvestor advisory service, I recommend blue-chip stocks and ETFs of indexes, market sectors, commodities, interest rates, currencies, volatility, and shorting opportunities. There are no constraints on which asset classes our AI platform identifies as superior risk/reward strategies.

To date, going back to early 2018, our Winning Trades Percentage is a phenomenal 92.03%. A performance record that to my knowledge not found anywhere in the marketplace for advisory services. We booked profits on 27 straight trades without a loss, which took place in April of this year.

This is how investing should be and could be in your portfolio. Winning on over 9 out of every 10 trades you put your investment capital to work. It’s how wealth created and preserved. We manage a dynamic portfolio of roughly 20-25 holdings and rotate our capital accordingly.

Every two weeks we email out the RoboInvestor newsletter with two new AI-screened recommendations that hit your inbox over the weekend so you have money-making opportunities to act on when the market opens Monday morning. Make the best trade of the year, put RoboInvestor to work 24/7 today, and catalyze your portfolio for the balance of 2021 and into 2022.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. Not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.