Surprisingly Strong Week Could Shift September Narrative

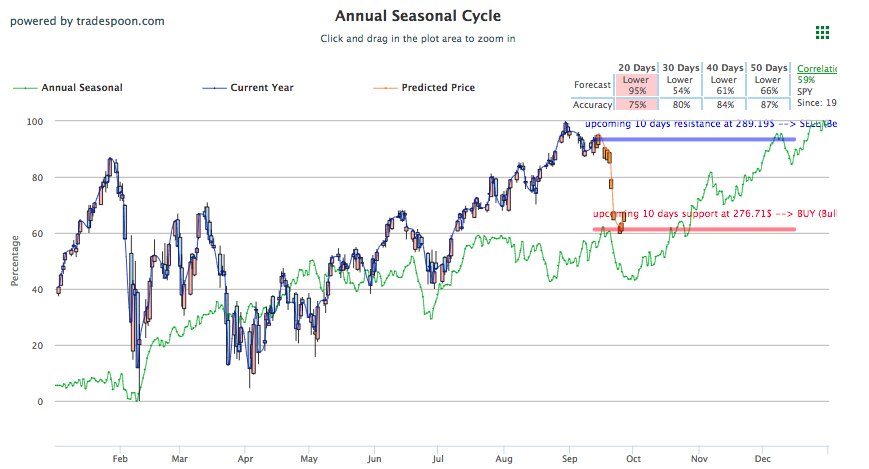

U.S. Stocks are up today and are looking to extend and unlikely streak after a few up and down days that ultimately ended in gains, all behind a surprising boom in the tech sector which has had a troublesome and underperforming start to the month. Although September is usually a slow month for trading, today’s action has seen a noticeable uptick. Still, volume remains low and will continue to do so until further developments in the ongoing China-U.S. trade-related saga. Further tariff escalation could be buoyed by a recent invitation extended to China from the U.S. to talk trade. Both sides are looking to come together later this month and the meeting, if worked out, should provide optimism, hopefully easing or removing trade-tension between two of the world’s biggest economies. SPY Seasonal Chart is shown below:

Other major news includes the recent European Union decision to not change interest rates until summer 2019 and are still on track to end their bond-buying program in December. These developments look to bode well for the European and overall emerging markets. The Turkish lira was able to rally after the country’s central bank raised interest rates only to drop significantly in after European markets closed. Still, European markets are up today as well Asian markets, rebounding after a shaky couple of days. This is probably due to the renewed optimism in trade-relations between U.S. and China after recent White House invite was extended to Beijing. Investors should watch for more developments on the potential trade talk and the reaction thereafter.

In U.S. consumer reports, Consumer-Price Index rose by 0.20% in August which is the fifth straight monthly increase for the index. That, along with a recent drop in jobless claims has U.S. markets optimistic today, counter to the usual September sentiment. Still, investors should watch for volatility as the low volume month of September often welcomes it.

Using the ^GSPC symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.11% moves to -0.56% in five trading sessions. The predicted close for tomorrow is 2,890.59. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On September 12th, our ActiveTrader service produced a bullish recommendation for Waters Corp (WAT). ActiveTrader included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

WAT entered the forecasted Entry 1 price range of $192.48 (± 0.59) in its second hour of trading and moved through its Target price of $194.40 in its first hour of trading the following day. The Stop Loss was set at $190.56.

We are going to do something that we RARELY do!

Today only, anyone who signs up for our Stock Forecast Toolbox Membership will be automatically upgraded to our Tools Membership at NO ADDITIONAL COST!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click here to read more…

Friday Morning Featured Stock

Our featured stock for Friday is Exxon Mobil Corp (XOM). XOM is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $82.47 at the time of publication, down 0.79% from the open with a -0.21% vector figure.

Friday’s prediction shows an open price of $82.88, a low of $82.87 and a high of $84.02.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for October delivery (CLV8) is priced at $68.62 per barrel, down 2.47% from the open, at the time of publication. Oil prices and futures are falling sharply as global output is expected to decline with oncoming Iranian sanctions along with an increase in global supplies for the month of August, as reported by the EIA. With Hurricane Florence approaching the east coast initially causing a rally in oil has since been downgraded to a category two hurricane, weakening its expected fallout.

Looking at USO, a crude oil tracker, our 10-day prediction model mostly all negative signals. The fund is trading at $14.45 at the time of publication, down 2.33% from the open. Vector figures show -1.27% today, which turns -1.89% in two trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for December gold (GCZ8) is down 0.22% at $1,208.30 at the time of publication. Although the dollar is down today, the recent positive economic reports along with a more-positive than expected outlook from the recently reported beige book have gold continuing to trend lower.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $113.88, down 0.25% at the time of publication. Vector signals show +0.05% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is down 0.37% at 2.96% at the time of publication. Treasury yields climb higher ahead of important inflation report which will likely inform the next interest rate decision in the upcoming FOMC Meeting. Shorter-dated yields are up today, probably behind the recently reported rise in Consumer price index for last month.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.18% moves to -1.15% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is down 5.18% at $12.46 at the time of publication, and our 10-day prediction window shows mostly positive signals. The predicted close for tomorrow is $13.17 with a vector of +0.18%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

We are going to do something that we RARELY do!

Today only, anyone who signs up for our Stock Forecast Toolbox Membership will be automatically upgraded to our Tools Membership at NO ADDITIONAL COST!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!