Alert! Big Rail Trade Comin’ Down The Track

RoboStreet – April 9, 2020

Fed Unleashes Fire Hose Stimulus

Against a grim set of employment data, the FED responded with an all-out attempt to provide a massive infusion of liquidity to stressed sectors of the capital markets, like Collateralized Mortgage Obligations (CLOs), non-agency mortgages and high-yield corporate bonds to bridge some of the widespread dislocations.

Initial claims more than 16.5 million over the past three weeks

There were nearly seven million initial claims filed last week, bringing the total recorded over the past three weeks to more than 16.5 million. However, the announcement about another wave of job losses was overshadowed by the Fed’s decision to introduce another $2.30 trillion in emergency lending capacity for businesses and municipalities.

Stocks to their highest level since the March 23 low

The latest announcement of more stimulus boosted stocks to their highest level since the March 23 low amid momentum buying from a deeply oversold market to pronounced short-covering by professionals. SPY is now trading back up to $280 where a downward sloping 50-day MA sits just overhead and represents a roughly 50% rebound from the losses incurred from top-to-bottom correction.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

(Want free training resources? Check our our training section for videos and tips!)

Earnings season begins to unfold next week

Look for the market to consolidate at current levels as earnings season begins to unfold next week with a heavy emphasis on the mega-banks. The market is expecting dismal earnings data, but forward guidance remains a moving target. Outside a vaccine being revealed over the weekend, the market has priced in most of the good and bad news and could easily give back some ground next with minor support for SPY at $265 and then down at $240.

VIX below 40.0 and the dollar (DX) trading below 98.0 would be bullish for the near-term trend

VIX is down to 43.0 and a reading below 40.0 and the dollar (DX) trading below 98.0 would be bullish for the near-term trend. Gold has spiked higher on the Fed flooding the market. GLD traded to a new 52-week high of $159.37 Thursday with the least path of resistance higher. The bottom line is the Fed is on the bid of the debt markets across the board where pullbacks of 10%-15% for equities should be bought aggressively.

(Want free training resources? Check our our training section for videos and tips!)

Attractive investment proposition in the the railroad stocks

One of the most sensitive sectors to economic downturns and upturns are the railroad stocks. Carload data is sure to have plunged in the current quarter, but looking out a year from now when business conditions have fully recovered, there lies an attractive investment proposition. Plus, this is an easy layup for buying into the space. There are only four listed U.S. railroad stocks to buy – Union Pacific Corp. (UNP), Norfolk Southern Corp. (NSC), CSX Corp. (CSX) and Kansas City Southern (KSU).

iShares Transportation Average ETF (IYT) have heavy railroad exposure

All four stocks have rallied 30%-40% off the recent lows and are currently in overbought territory, as with much of the market’s leaders. For many investors, just buying an ETF with heavy railroad exposure is most attractive. In this case, the iShares Transportation Average ETF (IYT) where all four railroad stocks are within the top 10 holdings, with 3 of them occupying the top 3 spots.

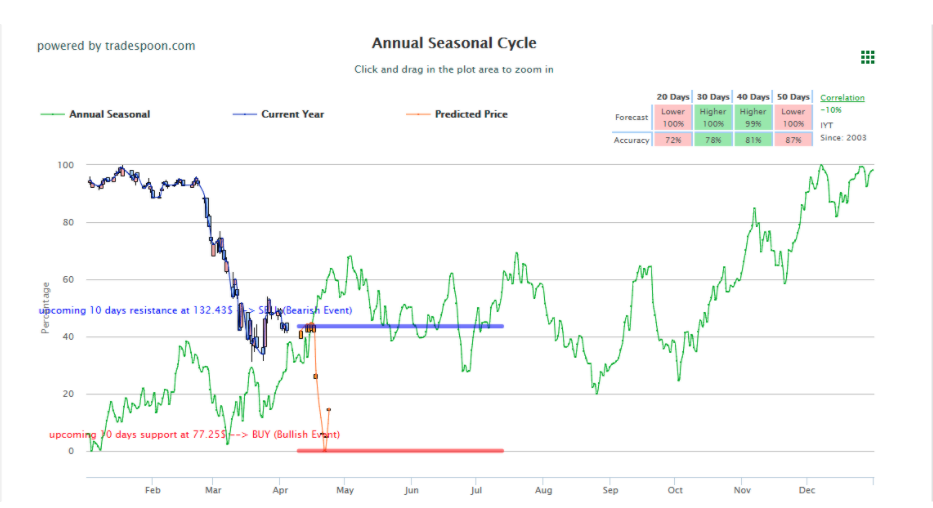

When applying my Tradespoon AI platform to IYT, we see how this trade is setting up. For the next 20 days, expect the stock to pull back, which would coincide with an overbought short-term market. Depending on the degree of the pullback, and how my AI indicators read the stock, I’ll be looking to put IYT to work for our RoboInvestor subscribers.

(Want free training resources? Check our our training section for videos and tips!)

Tradespoon Winning Trades Percentage stands at 87.31%

I honestly don’t know how investors operate in a market such as the present without the power of AI tools to manage risk and reward. Especially since we at Tradespoon make it so affordable, while boasting a track record where our Winning Trades Percentage stands at 87.31%.

This kind of win rate was something retail investors could only dream of in years past, as algorithm-based platforms were reserved for only hedge funds and professional pools of money. Today, these same tools which are much more advanced, and always learning, are available, but at a fraction of the cost.

My recommendations generate profits in almost 9 out of every 10 trades

I’ve spent several years coding and fine-tuning my algorithms to a point where my recommendations generate profits in almost 9 out of every 10 trades. And we haven’t lost any momentum in current correction. We’ve traded QQQ, GLD, and VXX for excellent profits while booking some heady gains in KO and AKAM this past week.

Take me up on my offer to steer your portfolio through this difficult market landscape. My personal trading capital is invested in every trade. I’m with there for you all the way. When my skin is in the game, rest assured my focus is intense and riveted on executing precise entry and exit points.

This is what differentiates Tradespoon from other trading services masquerading at having cutting-edge technology with unpublished track records. Join RoboInvestor today and take control of building your wealth 90% of the time you put your money to work. It is life-changing. Enjoy the Easter/Passover holiday and stay healthy!

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”