Alert! Vlad’s Best Hedge Against August Sell Off

RoboStreet – July 23, 2020

August Is A Good Time To Add Portfolio Insurance

Investors are enjoying a Fed-fueled rally accompanied by no less than five Congressional stimulus packages, the latest to be finalized this week to the tune of what looks to be around $1.5 trillion. It’s an amazing time for how the government and central bank intervention to fight the deep economic impact from the pandemic is providing the needed financial support to avert what would be a very severe recession.

(Want free training resources? Check our our training section for videos and tips!)

Financial, energy, real estate, utilities, and industrial sectors still trading below their respective 200-day moving averages

Both bond and equity markets have fully embraced the fiscal backstopping, sending the Nasdaq to new all-time highs with the Dow, S&P and Russell 2000 not far behind. Led by mega tech and health/biotech sectors, the market is struggling to broaden out as reflected in financial, energy, real estate, utilities, and industrial sectors still trading below their respective 200-day moving averages.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

(Want free training resources? Check our our training section for videos and tips!)

Click Here – To See Where I Put My RoboInvestor Money

The second-quarter earnings season is in the early going

The second-quarter earnings season is in the early going but is delivering some decent results in what can only be described as driving in a fog of guidance where the effects of COVID-19 are being felt in every industry. What is revealing is how well companies have adopted to dealing with such adverse business conditions, of which many adjustments will be permanent changes (aka – remote workforce).

August is historically a tough month for the market to add to gains

While the market is elevating on the expectation of a vaccine by year-end and more stimulus, we’re heading into the month of August which is historically a tough month for the market to add to gains. Most of the good earnings reports from the market leaders will be reported by the end of July, Congress will have passed its latest coronavirus spending bill, leaving the market devoid of any new catalysts.

(Want free training resources? Check our our training section for videos and tips!)

Uptrend is vulnerable to negative headlines

Without further bullish news to feed off of, the uptrend is vulnerable to negative headlines surrounding rising COVID-19 caseloads, China tensions, dollar weakness, social upheaval, and the elections. It would not be a surprise if the SPY, currently trading at $326, pulled back to test its 50-day moving average at $308, a 5.5% decline, or maybe even its 200-day moving average down at $301, representing a decline of 7.7% – that would surely get the attention of everyone long the market.

Change in the narrative ever so slightly and a sudden 5% -7% slide in the major averages is almost assured

The bullish sentiment regarding the “Fed put” evokes a sense of complacency in that every bout of selling is very well contained and bought with vigor by what is considered a world awash in liquidity. And while this mindset is logical, it doesn’t mean that traders and investors alike won’t look for excuses to book profits in overbought stocks and ETFs. All it takes is for the narrative to change ever so slightly and a sudden 5% -7% slide in the major averages is almost assured.

(Want free training resources? Check our our training section for videos and tips!)

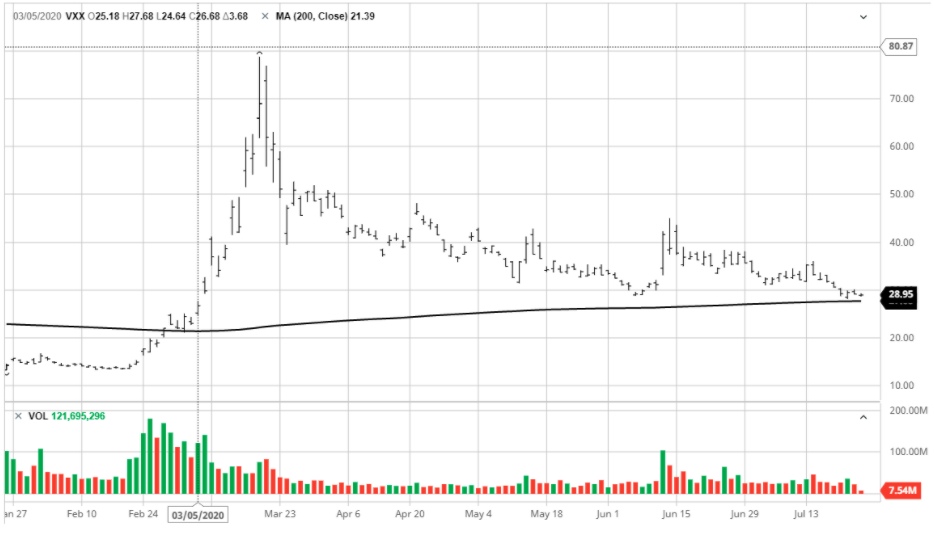

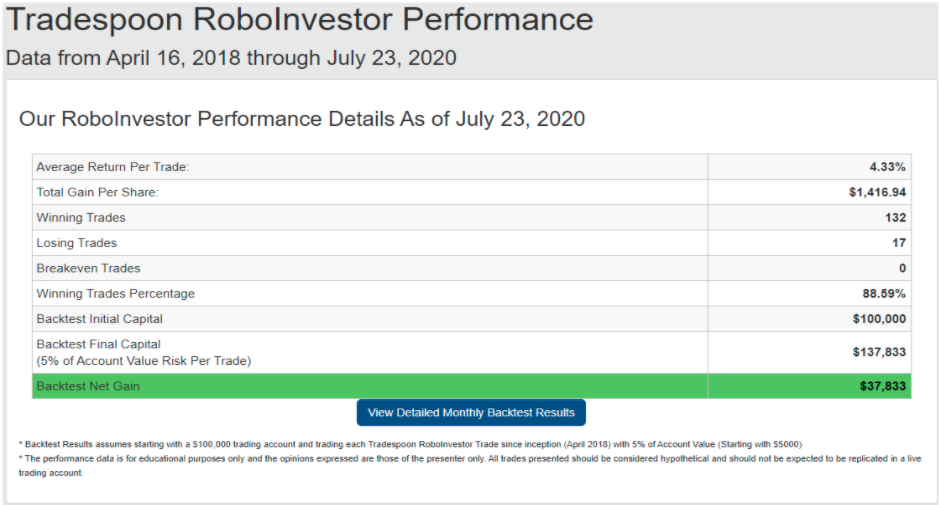

Shares of VXX are trading at $29 and sitting just above their 200-day moving average

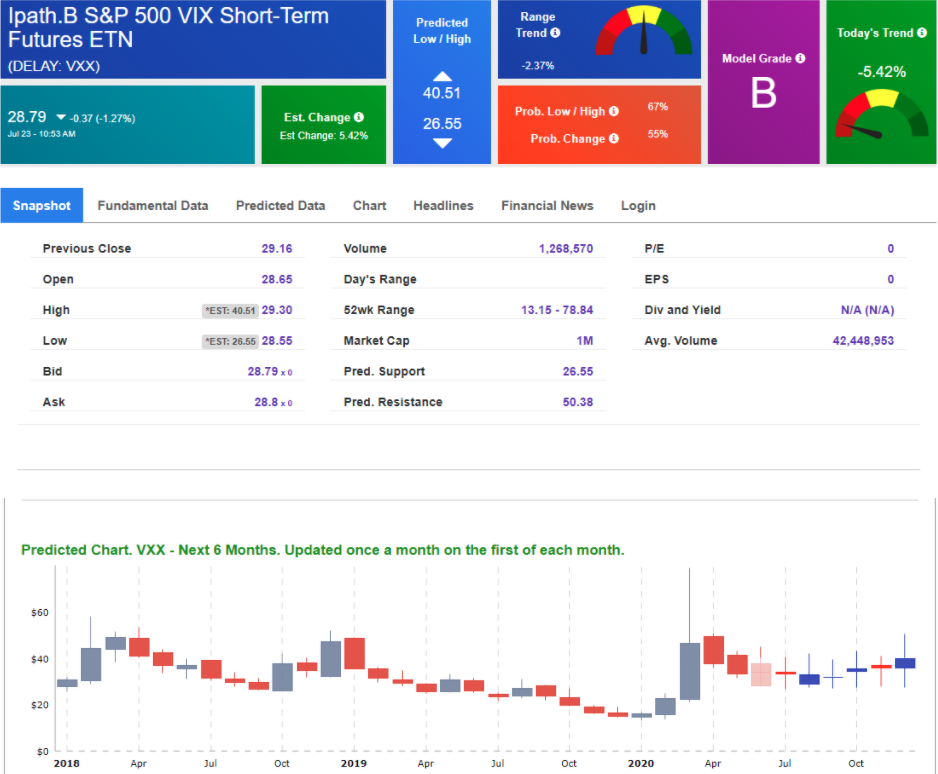

To hedge against this potential scenario unfolding as August approaches, I like to put into play the iPath S&P 500 VIX Short-Term Futures ETN (VXX) to capture any possible spike in volatility. Back in late March, when fear was highest, VXX traded as high as $78.84. Today, shares of VXX are trading at $29 and sitting just above their 200-day moving average. Back in mid-June when the S&P gapped lower by 7%, VXX traded at $45. So, there is an excellent upside correlation when fear hits the market.

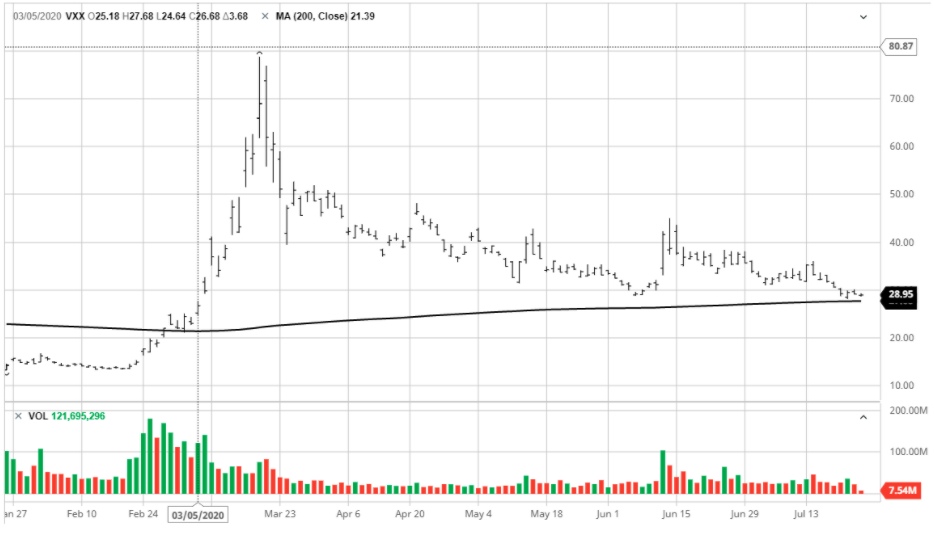

Strong run in stocks like Abbott Labs (ABT), SPDR Gold Shares ETF

For our RoboInvestor Portfolio, I’ll be looking to incorporate VXX into our holdings as my AI tools dictate. To date, we’re having a strong run in stocks like Abbott Labs (ABT), SPDR Gold Shares ETF (GLD), Workday Inc. (WDAY), Target Corp. (TGT) and Cisco Systems (CSCO). We logged 23 straight winning trades and haven’t booked a losing trade since March 9. In fact, our long-term Winning Trades percentage is 88.59%.

(Want free training resources? Check our our training section for videos and tips!)

A healthy pullback for stocks may be in the offing

Every time the market does get too comfortable with itself, there are bouts of selling that can shake the confidence of even the most ardent bulls. And based on some of the external conditions that are out of control of the market – namely a further spike in the pandemic and cold war with China, a healthy pullback for stocks may be in the offing.

Support for VXX at $26.55 andresistance up at $50.38

My AI-driven Stock Forecast Toolbox shows predicted support for VXX at $26.55 and predicted resistance up at $50.38. This is a serious risk versus reward scenario that should be considered by those looking to mitigate downside risk within their portfolios during the next few months.

(Want free training resources? Check our our training section for videos and tips!)

RoboInvestor trade all sectors of the market, stocks, metals

If you’re not operating in this financially engineered bull market with a cutting-edge set of algorithms to better navigate when to press your capital and when to dial it back, then join RoboInvestor today and let me and my team provide that needed guidance. We trade all sectors of the market, stocks, metals, commodities, bonds, indexes, currencies, and market hedges. Our selection process is unrestricted because there is always a bull market somewhere and our AI platform has a great track record at finding where they are.

Our bi-monthly updates and daily alerts will keep your investment capital working overtime in trades with exceptionally high rates of probability for profits. Make RoboInvestor a daily part of your investment acumen and experience a wealth changing impact on your portfolio.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

(Want free training resources? Check our our training section for videos and tips!)