Beijing Trade Talks and Fed Speeches Fill First Full Week of 2019

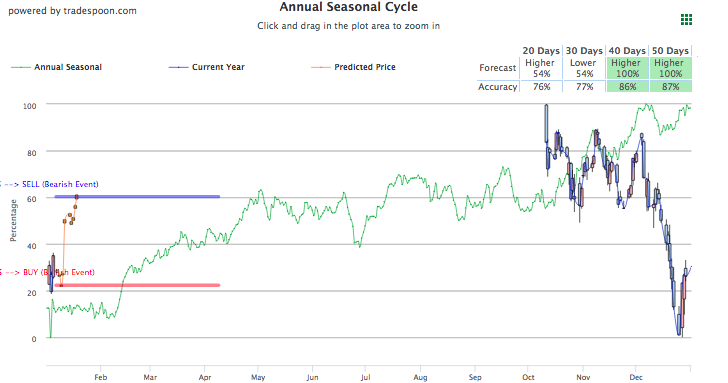

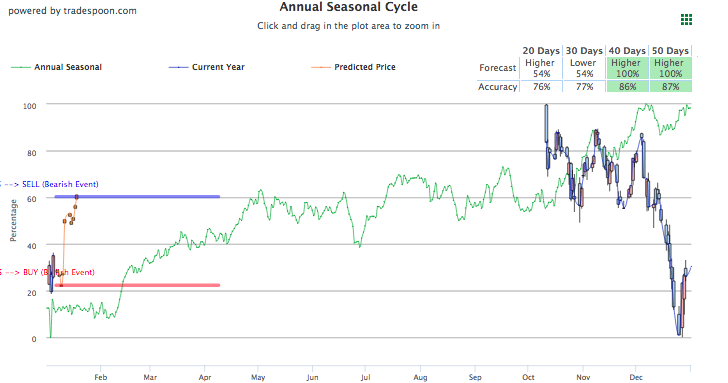

Today, markets are on the move up with all three major U.S. indices on track for their second straight day of gains. After a turbulent start to 2019, markets found their footing on Friday behind optimism in the upcoming China-U.S. trade talks. Major news to keep an eye on this week includes the first meeting between U.S. and Chinese delegation taking place today, several speeches from Fed officials including Chairman Powell, and the FOMC minutes from the December meeting as well as the Federal budget. As 2018 wrapped up, new lows were set for the SPY at $230-233. The market continues to trade in the range of $233 and $254 with $240 as the key support level to monitor. Unless SPY breaks $254 on above-average volume, consider the short-term market overbought and prone to a short-term correction. For reference, the SPY Seasonal Chart is shown below:

With the 90-day timeframe to broker a deal and the partial tariff pause between U.S. and China in effect since the new year began, global trade tensions have eased. News of the two sides meeting today has encouraged investors and supported markets that had been poorly affected by the global unrest. Adding to that were words of encouragement from the Chinese Foreign Ministry which vowed “good faith” in working with the U.S. towards resolving trade conflicts and concerns. The meeting will continue in Beijing through tomorrow and while optimism is high a completed deal might take longer to achieve. Globally, Asian markets closed higher today while European markets modestly closed lower.

The partial U.S. government shutdown is going on its 17th day and while it has affected some economic reports from releasing, most reports will continue to be released regularly. The Consumer Price Index will come at week’s end along with the Federal budget from December while wholesale inventories, jobless claims, consumer credit, and job opening reports will fill out the rest of the week. On Wednesday, minutes from the December Federal Reserve meeting will be released. The week will also be heavy on Fed speeches as Chairman Powell is scheduled to speak on Thursday while Fed Reserve Presidents from Chicago, Atlanta, Boston, and St. Louis will speak earlier in the week. Look for a handful of earnings to be released this week but really pick up next week when major banks report.

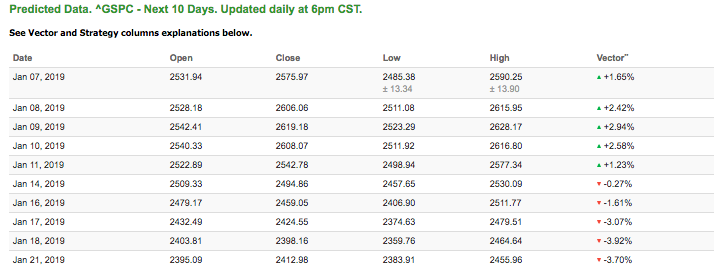

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +1.65% moves to -0.27% in five trading sessions. The predicted close for tomorrow is 2,606.06. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Special Offer:

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 6 months of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

In addition, you will get Lifetime Access to our ActiveTrader service which includes daily high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!

Click Here to Sign Up

Highlight of a Recent Winning Trade

On January 2nd, our ActiveTrader service produced a bearish recommendation for CMS Energy Corp. (CMS). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

CMS opened in its forecasted Strategy B Entry 1 price range (49.65, ± 0.26) and passed through its Target price (49.15)within the first hour of trading on 01/02/18. The Stop Loss price was set at $50.15.

Tuesday Morning Featured Stock

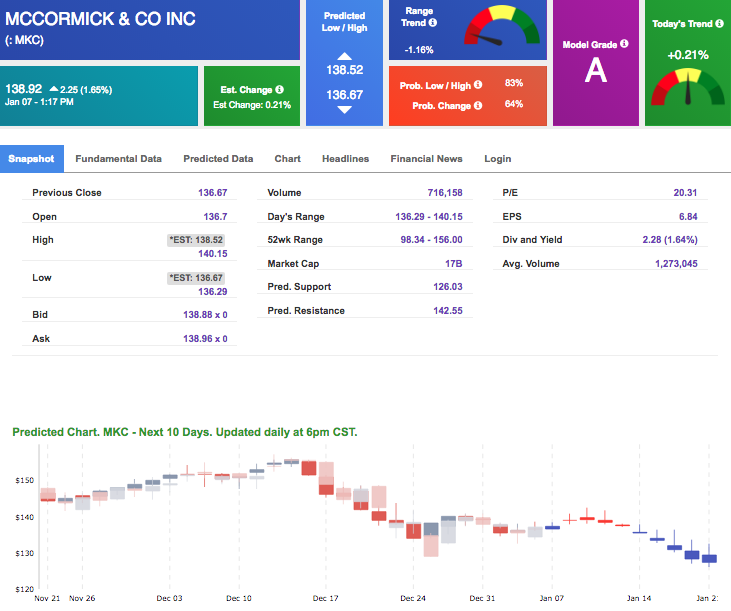

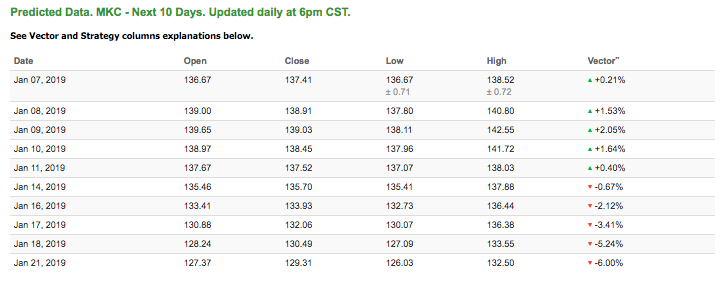

Our featured stock for Tuesday is McCormick & Company (MKC). MKC is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $138.92 at the time of publication, up 1.65% from the open with a +0.21 % vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

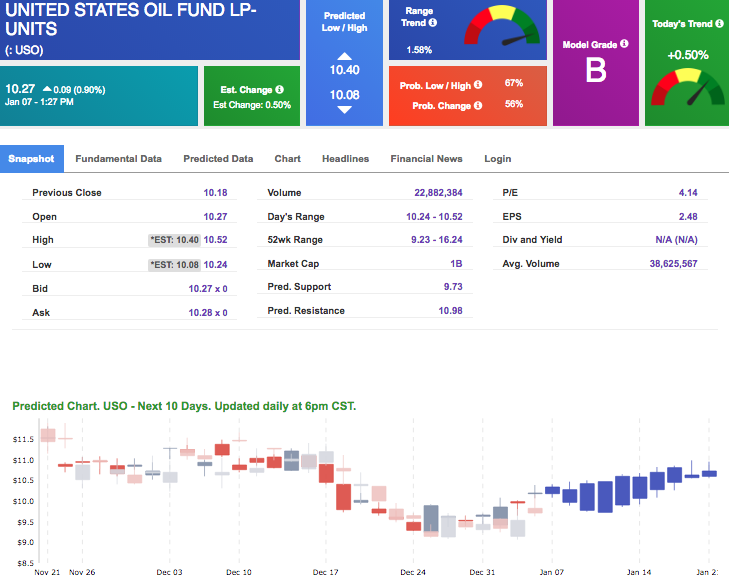

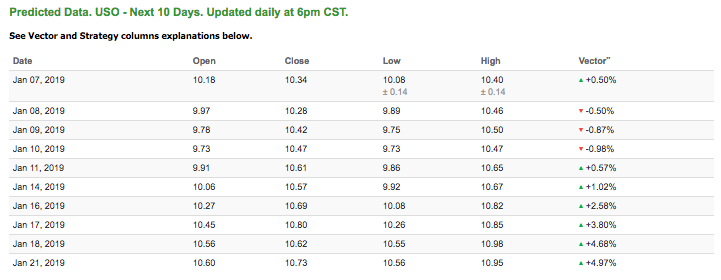

West Texas Intermediate for February delivery (CLG9) is priced at $48.87 per barrel, up 1.42% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $10.27 at the time of publication, up 0.90% from the open. Vector figures show +0.50% today, which turns +1.02% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

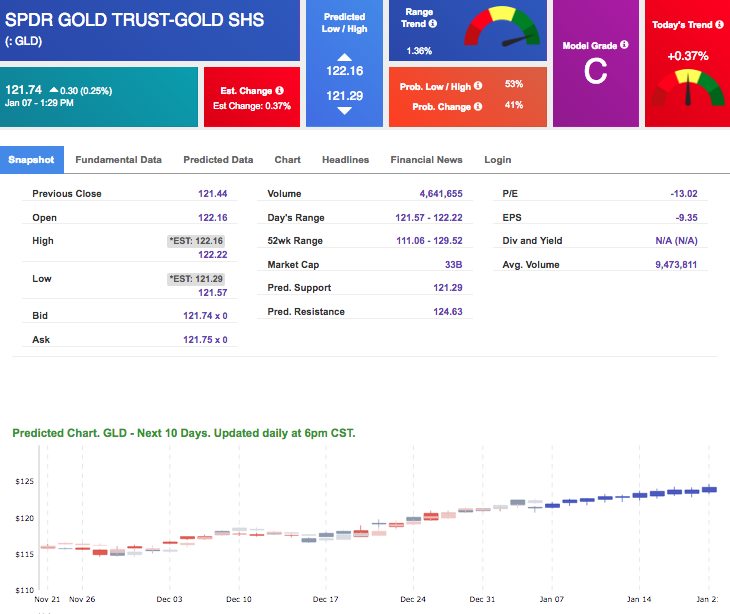

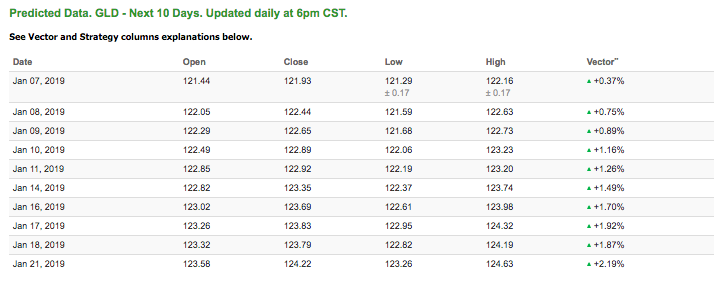

The price for February gold (GCG9) is up 0.29% at $1,289.50 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $121.74, up 0.25% at the time of publication. Vector signals show -0.37% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

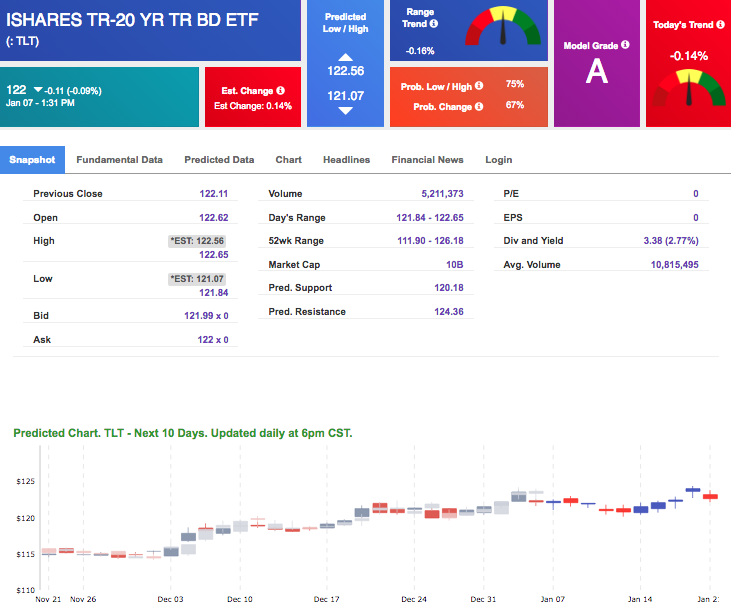

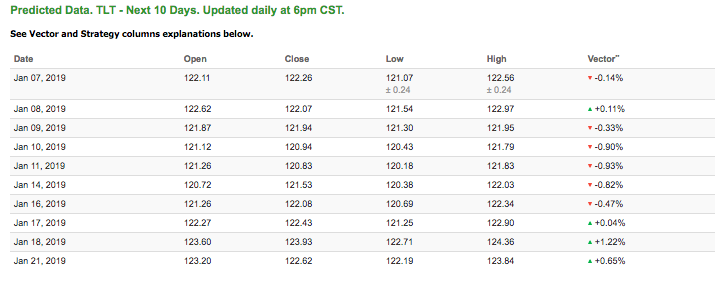

Treasuries

The yield on the 10-year Treasury note is up 0.13% at 2.67% at the time of publication. The yield on the 30-year Treasury note is down 0.61% at 2.97% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of -0.14% moves to -0.90% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

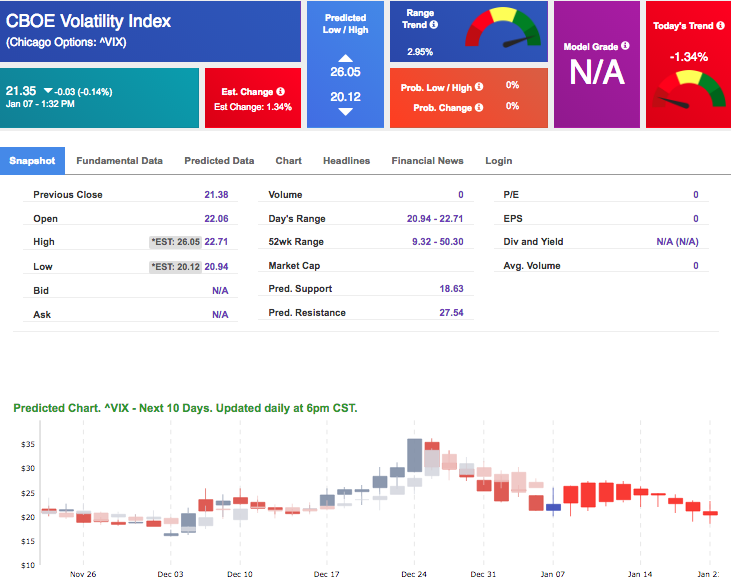

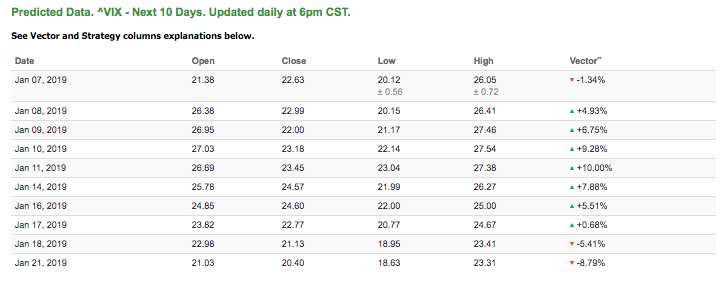

Volatility

The CBOE Volatility Index (^VIX) is down 0.14% at $21.35 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $22.99 with a vector of +4.93%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Special Offer:

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 6 months of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

In addition, you will get Lifetime Access to our ActiveTrader service which includes daily high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!