Boeing, Brexit, and Delayed-Data Dominate Headlines

Major U.S. indices are on track to close higher for the third straight day. Market influencers today include Boeing’s crash aftermath, the continued rollout of delayed U.S. economic data, and another Brexit draft defeated in Parliament. Chief Trade negotiator Robert Lighthizer provided encouraging statements yesterday regarding progress in U.S.-China trade negotiations, stating “we are in the final weeks of an agreement.” Currently trading at $280, SPY is above the 200-day moving average, $274, with resistance at $282. Continue monitoring both levels for a good indicator of market momentum. We are bullish in the long term but could see a retrace in the coming weeks if we drop below 200-day moving average level. For reference, the SPY Seasonal Chart is shown below:

The S&P, Dow, and Nasdaq are currently on track to close the day higher, making it a third straight day while the quarterly outlook is also positive, as long as the indices avoid any major hiccups in the last few days of Q1. Recent economic data has returned split but has not slowed or hindered market activity this week. We continue seeing reports from January that were delayed by the government shutdown, including durable goods and price indices. U.S. wholesale goods rose last month as the producer price index reported a slight increase while the overall cost of good rose 0.4%. Yearly data showed wholesale inflation up almost 2%, which peaked over the summer at 3.4%. Durable goods for the month of January rose by 0.4% although most economists projected a slight decline ahead of the data’s release. Holding back orders data were autos, metals, and computers which all saw a decline in the range of 1% for the month.

After a bad weekend for Boeing shares following the fatal Etopan Airlines crash, Boeing shares slide further to start the week before rising slightly early Wednesday. Gains did not hold as Boeing currently sits slightly down. The crash, involving 737 MAX 8 jet, killed all 157 passengers onboard. An investigation is ongoing and many countries around the world have suspended the use of 737 MAX 8’s. Yesterday, U.S. aviation regulation stated it would not ban the plane. Boeing is currently down 11% for the week.

Brexit progress seems to be once mare stalled as another no-deal vote was issued in Parliament. Prime Minister Theresa May’s latest effort was defeated by over 100 votes and pushed the U.K. government to publish a temporary tariff regime. This would last 12 months and provide more time for a proper exit though could add more complications down the line. The temporary regime would cut customs duties on almost all goods imported into the U.K. while roughly 13% of goods would still be taxed. Look for more clarity on the temporary deal and its execution in the days to come. European markets closed higher today while Asian markets closed in the red.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows negative signals. Today’s vector figure of -0.11% moves to -2.12% in five trading sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

You Have a Second Chance!

You Have a Second Chance!

Yesterday, we sent out a ridiculous offer with LIFETIME ACCESS to our Tools Membership!

It was a huge success and many people jumped at the opportunity but we also had our fair share of complaints because some people didn’t open the email until this morning and missed out.

So, we decided to open up this offer for one more day, but act fast, because at midnight, the offer is GONE!

We are offering LIFETIME ACCESS to our Tools Membership for less than the regular price we normally charge for only 1 year of service!

In addition, you will get Lifetime Access to our ActiveTrader and MonthlyTrader services which includes daily and weekly high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!

This offer is only available until Midnight, so please act Fast before you miss out!

Click Here to Sign Up

Highlight of a Recent Winning Trade

On March 12th, our ActiveTrader service produced a bullish recommendation for Apple Inc (AAPL). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

AAPL entered its forecasted Strategy B Entry 1 price range $178.90 (± 1.01) in its first hour of trading and passed through its Target price $180.69 in the first hour of trading, reaching a high of 181.98. The Stop Loss price was set at $177.11

Thursday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Our featured stock for Thursday is Facebook (FB). FB is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $173.93 at the time of publication, up 1.00% from the open with a +0.18% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for April delivery (CLJ9) is priced at $58.16 per barrel, up 2.27% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $12.09 at the time of publication, up 2.00% from the open. Vector figures show -0.69% today, which turns -1.57% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for April gold (GCJ9) is up 0.86% at $1,309.30 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $123.63, up 1.00% at the time of publication. Vector signals show -0.26% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is up 0.07% at 2.61% at the time of publication. The yield on the 30-year Treasury note is up 0.41% at 3.01% at the time of publication.

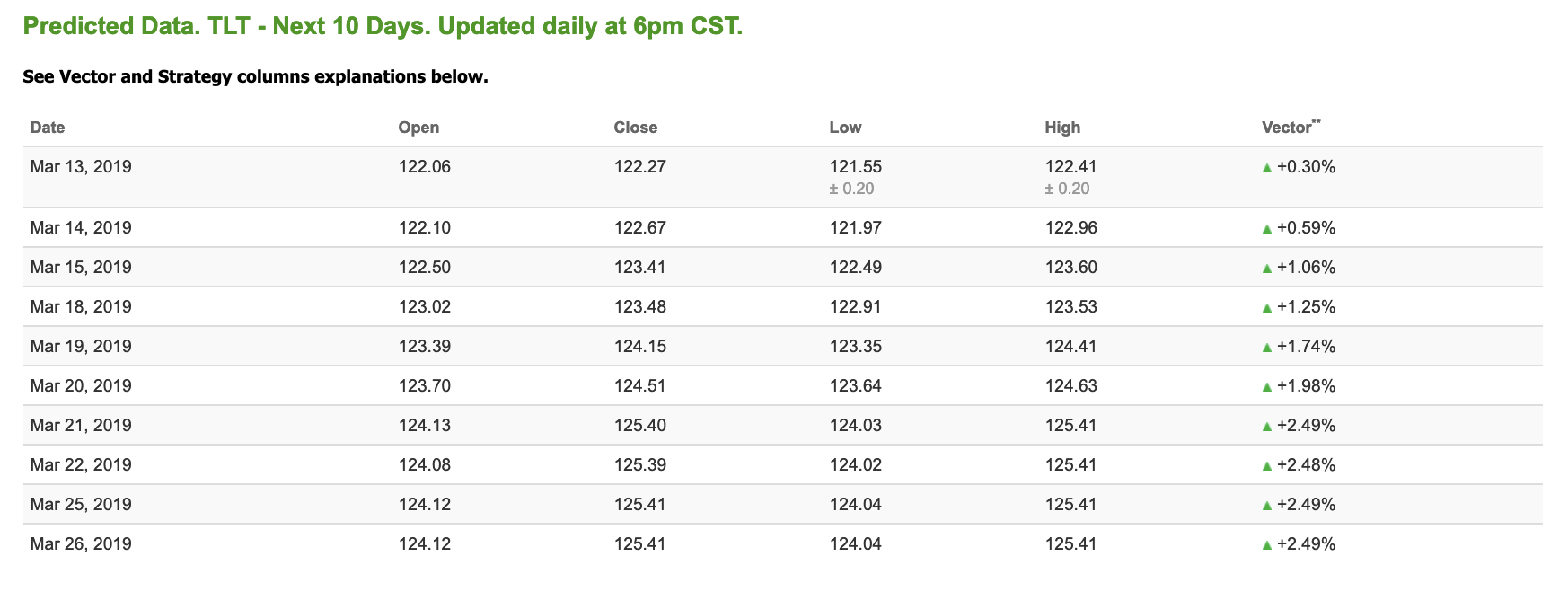

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.30% moves to +1.25% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is down 1.38% at $13.58 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $14.46 with a vector of +5.51%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

You Have a Second Chance!

You Have a Second Chance!

Yesterday, we sent out a ridiculous offer with LIFETIME ACCESS to our Tools Membership!

It was a huge success and many people jumped at the opportunity but we also had our fair share of complaints because some people didn’t open the email until this morning and missed out.

So, we decided to open up this offer for one more day, but act fast, because at midnight, the offer is GONE!

We are offering LIFETIME ACCESS to our Tools Membership for less than the regular price we normally charge for only 1 year of service!

In addition, you will get Lifetime Access to our ActiveTrader and MonthlyTrader services which includes daily and weekly high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!

This offer is only available until Midnight, so please act Fast before you miss out!