Buy Alert! Big Bank Set To Spike Higher

RoboStreet – December 3, 2020

Hot Sector Sets Up For Bigger Move

News that a compromise stimulus bill is getting traction on Capitol Hill is helping to fuel the uptrend for the market, that in many respects is technically extended. However, like the famous economist John Maynard Keynes said “the markets can remain irrational longer than you can remain solvent.” And anyone trying to short this market has had their head handed to them.

Market keeps getting good news and continues to draw capital from the sidelines

Several companies in the hot cloud-software sector reported earnings late Wednesday that impressed the market greatly, with big up moves some on Thursday. The market keeps getting good news and continues to draw capital from the sidelines to push the major averages to higher highs. Best of all, the rally is broad-based.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

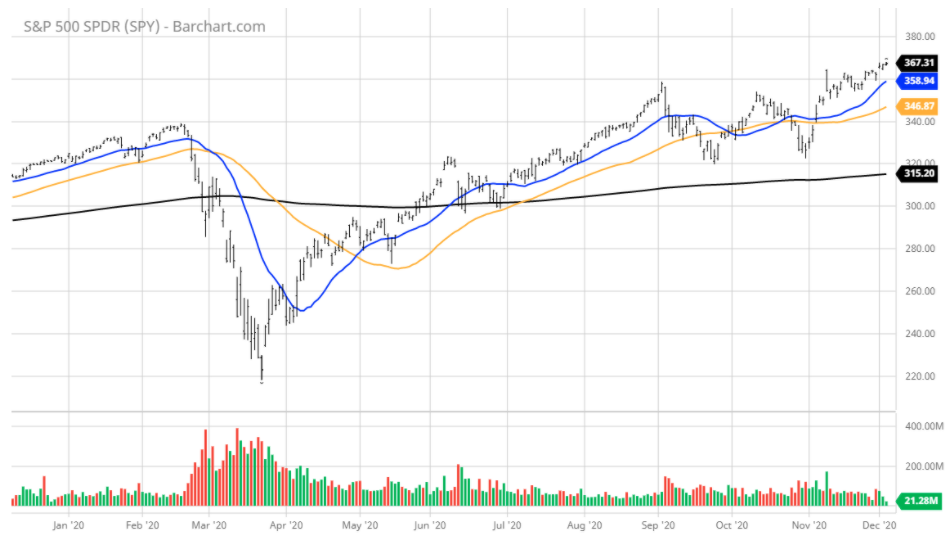

The technical picture is pretty interesting. The SPY continued to make incremental gains and trades near an all–time high record. Both Technology (QQQ) and Value (VTV) stocks are facing major overhead resistance levels. The market is due for a shallow pullback back to the $350 level in the next 1-2 weeks.

The $350 level for SPY is a key support for the bulls. I expect short term corrections to be shallow and the bull’s rally to continue. As long as the SPY is trading above the $350 level, the SPY will break out from the current range to the upside and potentially can reach the $370-$385 level by the end of this year.

U.S. Treasuries (TLT) continued to trade in the downward channel

The U.S. Dollar ($DXY) is trading below the $94 level and U.S. Treasuries (TLT) continued to trade in the downward channel. GLD and SLV have started their bottoming process. Value stocks continue to lead the market (XLF, XLE, and XME). A weaker dollar benefits the bottom line of multi-national companies and higher bond yields portend more vibrant economic growth ahead. As long as these moves by the dollar and treasuries are incremental, it’s bullish for stocks.

My opinion has not changed. The bull market has resumed its rally and will retest recent highs in December. I would be a buyer using any short-term corrections and use a dollar-cost averaging strategy to accumulate positions at this level.

One particular sector that has my attention where values are not stretched is the financial sector, and specifically the big banks. As bond yields rise, the net interest income (NIM) spread widens and becomes more favorable to banks. The spread is defined by what overnight rate banks can borrow at versus what rate they are able to lend money at. This week has seen the NIM spread wideout.

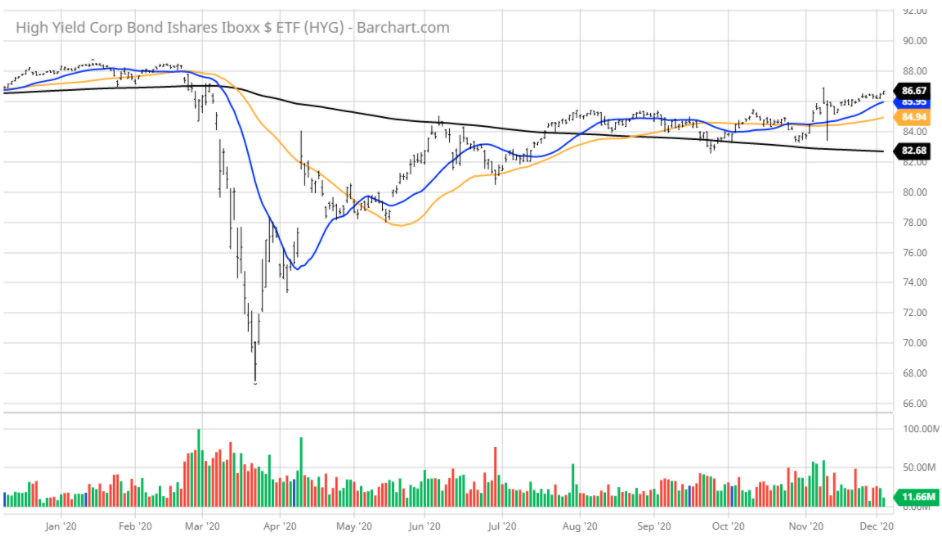

High-yield corporate debt is also trading firmly higher. Even as most of the sub-investment grade are bonds, they tend to trade upon the notion that the underlying creditworthiness of the issuers is improving, thereby reducing the risk of default. Shares of the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) are turning higher after building a multi-month base and are headed to their pre-pandemic highs.

JPM earnings growth in 2021 by at least 22% to $9.10 per share

When talking up the bank sector, there is no substitute for a proxy other than America’s largest bank and Dow component JPMorgan Chase & Co. (JPM). The company sports a $372 billion market cap, pays a 3% dividend yield and is forecast to grow earnings in 2021 by at least 22% to $9.10 per share.

JPMorgan is also known for having the highest-rated stock market research available anywhere that fuels a vibrant trading department that adds materially to quarterly profits in a near-zero interest rate world. It’s a true Wall Street juggernaut.

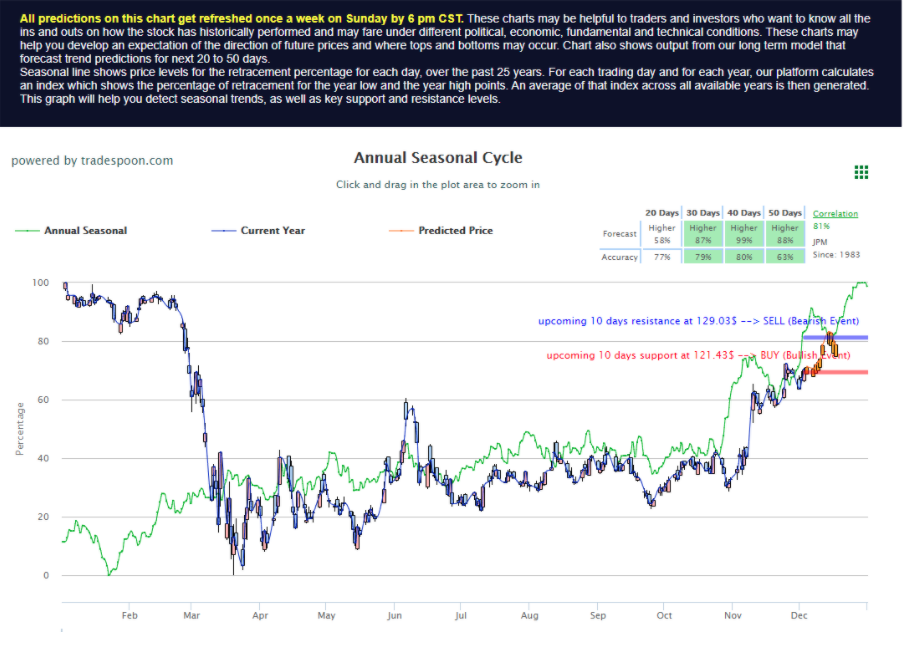

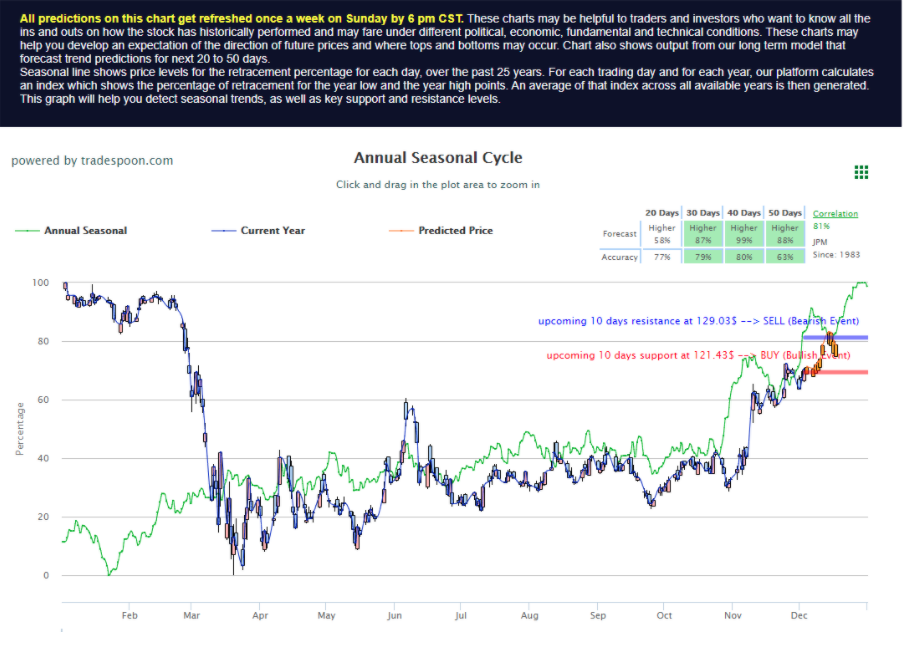

In terms of how JPM measures out with our AI platform, it doesn’t get any better when we get four “Higher” probability readings for the next 20, 30, 40, and 50-day periods. The only thing that isn’t certain is at what price to buy the stock during the near-term.

This is where members of our RoboInvestor advisory service benefit most – when we provide the exact buy signals to get long the stock, and just as important, the sell signals to exit the position. It’s how we’ve amassed a stellar track record that stands alone in the stock and ETF world of investing.

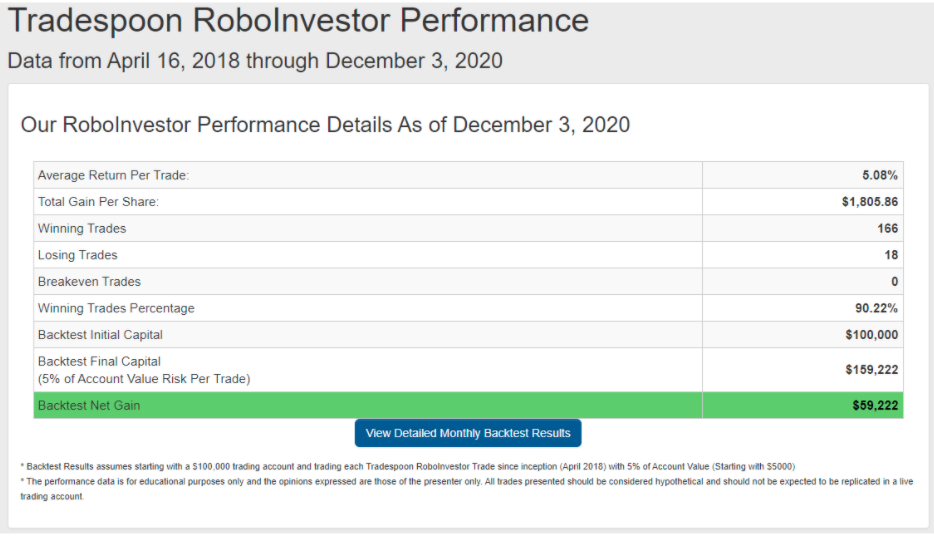

Going back to when we launched RoboInvestor in April 2018, our Winning Trades Percentage is a phenomenal 90.22% with the average trade returning 5.08%. When investors can book gains on 9 out of every 10 trades, it’s kind of a no-brainer to be a part of this system.

14 out of 15 trades being profitable

We’ve been busy ringing the register for RoboInvestor members during November, with 14 out of 15 trades being profitable. Only the highest quality stocks and ETFs are utilized for our investing purposes.

Just super liquid blue-chip stocks and ETFs

No thinly traded securities, small caps, or esoteric instruments are considered – just super liquid blue-chip stocks and ETFs of any asset class that our AI-driven system brings to our attention. Without cutting-edge artificial intelligence-based tools, trying to profit from this market in 2020 is like going into a boxing match with one hand tied behind your back. Our AI tools are always learning, always thinking 24/7. That’s a fact.

Put RoboInvestor to work for you right away

With the market starting to trade in rarified air, there is no time better than the present to take us up on our offer and join RoboInvestor today! Treat yourself to an early gift and put RoboInvestor to work for you right away. It truly is the gift that keeps on giving!

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.