Buy Alert – Microsoft

RoboStreet – November 1, 2018

Relief Rally Under Way Following Red October

Closing the books on the month of October couldn’t come soon enough for most investors. Roughly 90% of all stocks are trading well off the late September highs, some high-PE growth stocks as much as 40%-50%. About the only asset classes that have worked have been being long the dollar, utilities, a few healthcare companies and some other defensive plays like McDonalds, Procter & Gamble and Phillip Morris. By and large though, the sell-off inflicted heavy share price damage that is now under repair.

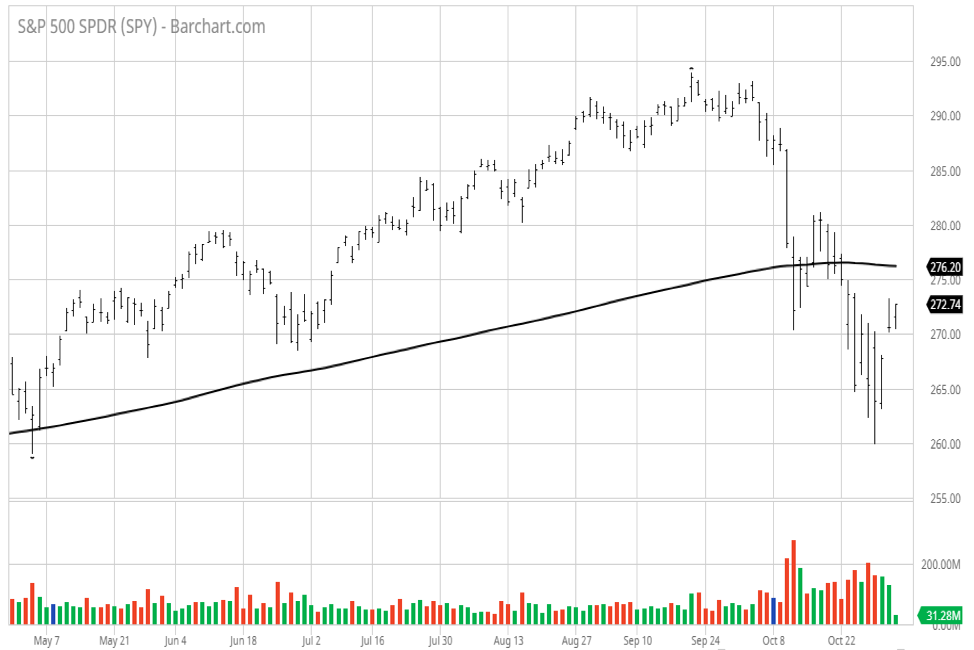

The oversold rally seen this past week was inspired by the S&P 500 finding key support at the 2,600-level coupled with some strong earnings reports and hints of fresh dialogue between the U.S. and China. A couple of Fed presidents also spoke out about how fiscal policy wasn’t a lock to raise rates if economic data softened over the next few weeks. Fear of rising rates has boosted the dollar back up to its 2018 highs.

With the 2-year Treasury Note yield at 2.85% and just off its high of 2.91%, the notion of a higher dollar and higher short-term rates is a definite headwind for the market. Until the S&P 500 clears its 200-day moving average that sits overhead at 2,765, I think the market will chop back and forth at least through next week’s midterm elections to be held Tuesday. Assuming the Republicans hold on to the Senate, the market should attempt to add to the current rebound. November has proved to be the second-best month for stocks during the past five years and if President Trump gives any indication that trade talks can progress, the market will really warm up to that development.

So, with that said, the confluence of worries that engulfed investor sentiment in early October are one-by-one being addressed. The PCE Index that measures inflation that the Fed watches most came in at 2.2% versus a 2.3% estimate and that reading should come down after WTI crude has fallen about $10 to $65/bbl this week.

Additionally, the strong 3.5% GDP read for the third quarter was attributed to inventory building by companies getting in front of the second round of tariffs, accounting for as much as 1.0%-2.0% of the number. This implies the fourth quarter read will be somewhere between 2.5%-3.0% giving the Fed room to consider waiting on a rate hike.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

As to the ongoing concern over Italy’s beleaguered bond market, Standard & Poor’s this past week assigned Italy’s debt as investment grade. This takes into account the assumption that the European Central Bank will backstop and support that market should it come under further distress. The updated rating alleviated, at least for now, widespread fear of systemic contagion surrounding emerging market debt held by Italian banks.

The collection of these- and well-entrenched caution about slowing global growth rates reflected in the slightly downward adjustment by the IMF to 3.4% from 3.6% in early October- also gave the bearish camp another catalyst to take the market down. But now those concerns are lifting with stocks for the past three sessions and yet I expect some back and filling following the current rebound.

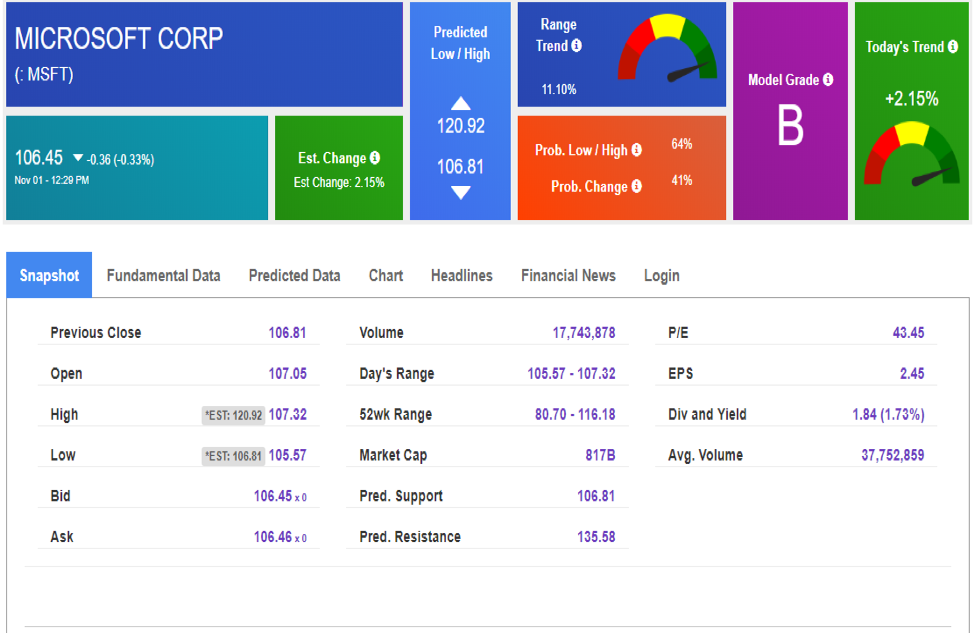

While there is technical damage galore in many of the most coveted tech stocks like Amazon.com, Google, Facebook and Micron Technology, there is one stock that stands out among all others as a cornerstone and bellwether of the market’s hearth. That stock is Microsoft (MSFT), which has now moved into the number two position as the biggest company by market capitalization in the world behind only Apple with a market value of $815 billion.

Shares of Microsoft traded as high as $116.18 in the first week of October right as the market topped out. After retracing the September gains, the stock traded down to $102 before reporting a blowout third quarter of $1.14 per share, 18 cents better-than-expected $0.96 estimate. Revenues came in at $229.08 billion versus the $27.92 billion estimate. Growth was strong across all divisions – Windows Software up 15%, Office 365 up 36%, Azure Cloud up 76%, LinkedIn up 33% and Xbox up 36%. Just a stunning quarter all around for the entire company accompanied by solid forward guidance.

As powerful as the quarter was for Mr. Softie, the weight of the market sell-off took the stock down to its 200-day moving average this week that tested its technical fortitude and a level that all four FANG stocks have sliced through to the downside. The number of big cap tech stocks that have held their 200-day m.a. is a short list. They include Adobe Systems, Salesforce.com, Cisco Systems and Intuit.

My Tradespoon Stock Forecast Toolbox carries a bullish outlook for Microsoft. As of this week the stock has a rating of B, which implies there is probably a bit more technical work to do at its current level of around $107 before its resumes its upside trend. The stock has rebounded 6% in just three days, which is a lot for company the size of Microsoft and snap-back rallies typically pause, pull back at least once more to put in a successful retest, form a double-bottom and begin a sustainable rally.

Within a stable market, the stock has potential to trade as high as $135 by the end of April, implying a 20.7% return not including dividends. That’s a fantastic risk/reward proposition against what has become a much more difficult market going forward, both from a fundamental and technical basis. The question in front of investors is when to buy it and at what price. Will the stock revisit $100? Does it need to be bought now? Is the stock going to trade in a tight range for a while?

As a RoboInvestor subscriber, those questions are answered and when I pull the trigger on buying Microsoft, I hope everyone reading this column will be in on that trade with me. I want to catch the quintessential entry point, but some variables regarding the market need to be cleared up. There has been a rotation out of some of the crowded growth stocks and into value of late and investors need to be sure they don’t’ get trapped in an outgoing tide out of habit of buying every dip the market provides.

Again, there is widespread technical damage, massive sector rotation and PE compression from a lower growth outlook for 2019. Stock selection is at a high premium because fewer stocks are going to ride the back of the bull on the next leg higher. Now is when having the right investing tools will pay off big time when the cream rises later this year and into 2019- and being a RoboInvestor is the best way to capture the very most this more discriminating market will provide. Become a RoboInvestor today and start being a much smarter investor tomorrow.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.