China Cuts 2025 Initiative, Stocks Mixed Today

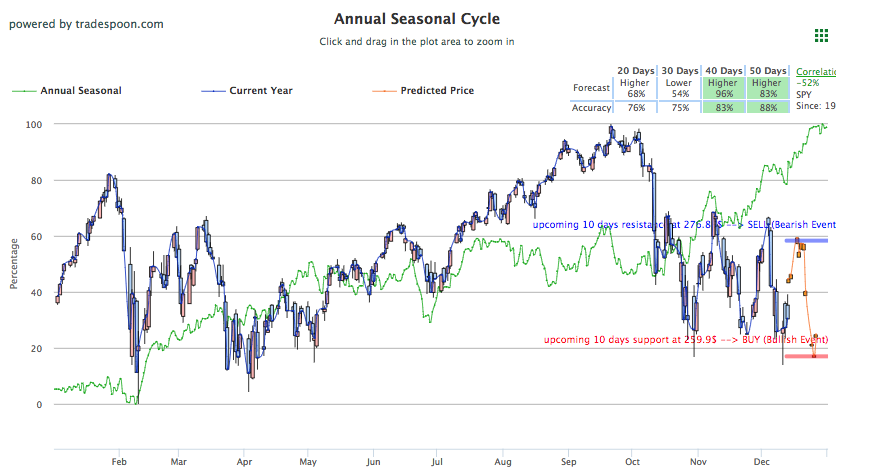

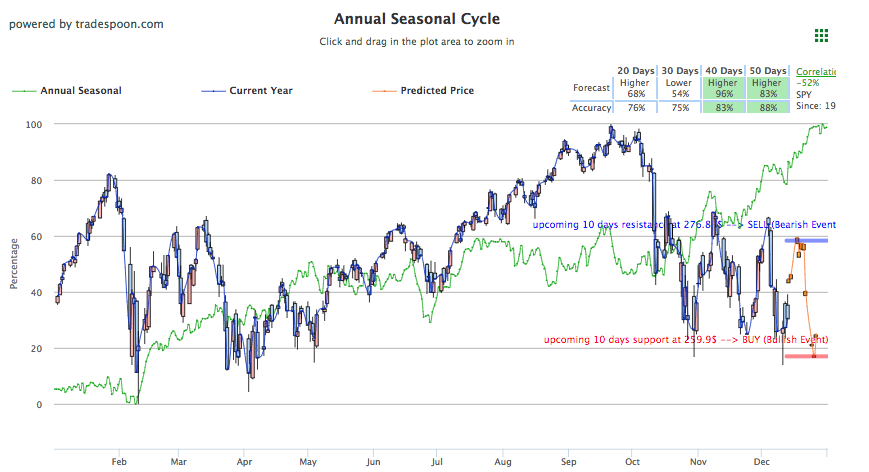

Markets are marginally mixed today behind continued efforts to improve China-U.S. trade relations. The Dow Jones rose in early morning trading while the S&P and Nasdaq were also on the move up before erasing gains in the afternoon. Before next week’s Federal Reserve meeting several economic reports, including labor, and a small batch of earnings will release. Apple and Qualcomm round out today’s major financial headlines, while yesterday U.K. Prime Minister Theresa May survived a confidence vote to retain her position amid a divided parliament and an unsettled Brexit strategy. The U.S. Consumer Price Index, a key indicator of inflation, returned flat while core prices rose slightly. Key support level for SPY remains at $260 while short-term overhead resistance for SPY is at $272. For reference, the SPY Seasonal Chart is shown below:

The recent string of U.S.-China trade-related news has turned from pessimistic to optimistic as both sides are showing genuine attempts to improve relations and construct a satisfying trade deal. China has begun looking into adjusting their industrial policy and subverting tariffs on U.S. auto while Trump has vowed help in the recent arrest of Huawei’s CFO Meng Wanzhou in Canada. The latest promising report comes from Beijing and shows the central government has removed the controversial “Made in China 2025” initiative from the recent guidelines issued to local governments. The plan was an attempt at advancing China’s high-tech sector by providing benefits and incentives for local governments and business. Both the Huawei situation and recent efforts by China are worth monitoring as we go into the new year where the 90-day trade-deal timetable, set up in the G20 summit, will begin.

Yesterday’s U.S. labor reports showed unemployment lowered significantly last week after a spike around the Thanksgiving holiday that caused some concern. The recent plunge in unemployment applications has erased those fears and turned investors attention to next week’s FOMC. Elsewhere, Apple announced it would spend $1 billion for a new center in Austin, Texas while the next five years they are planning to open more data centers and spend an additional $10 billion. Another bit of Apple news comes from Qualocom Inc. as they are looking for a ban on imported iPhones that use Intel chips. The U.S. International Trade Commision will continue to review Qualcomm’s case against Apple and will come to a decision in February. The judge will also review a patent infringement claim. Both Apple and Qualcomm are up today. Globally, both Asian and European markets closed higher today.

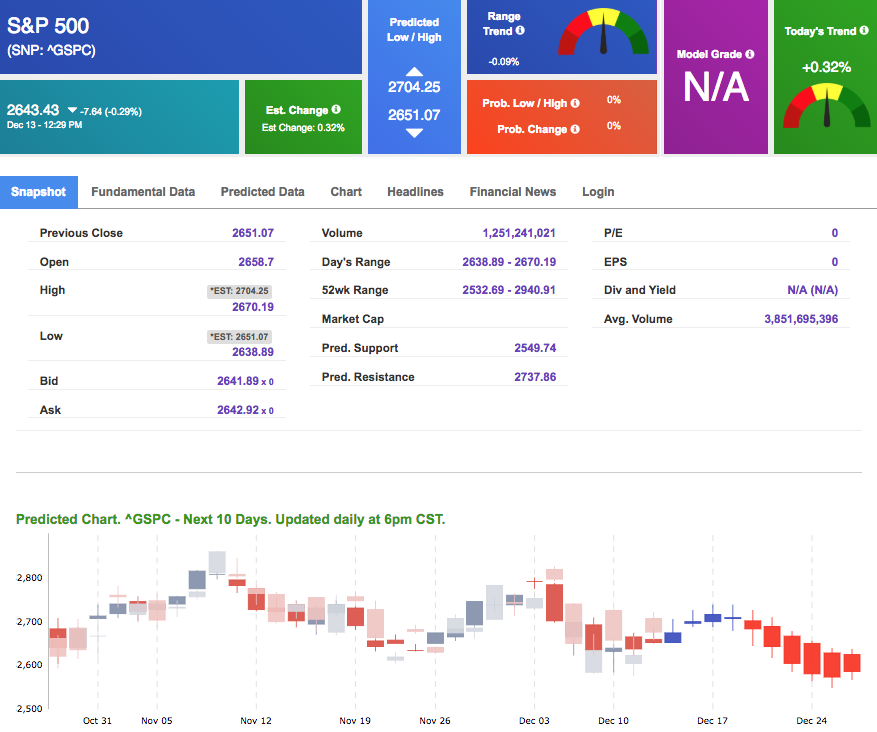

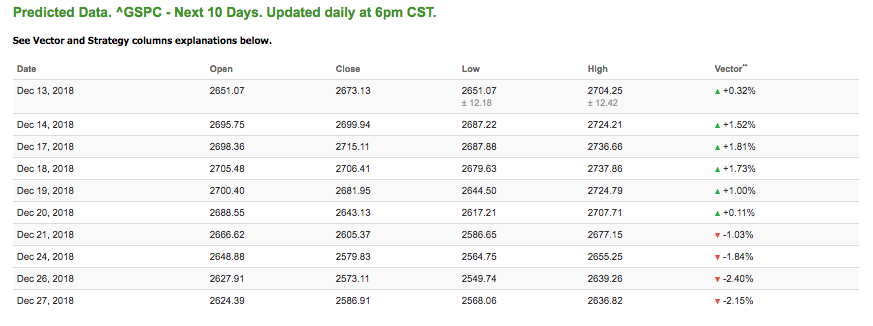

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.32% moves to -0.11% in five trading sessions. The predicted close for tomorrow is 2,699.94. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Holiday Sale: LIFETIME ACCESS to Tools Membership!

Get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

In addition, you will get Lifetime Access to our ActiveTrader and ActiveInvestor services which includes exact entry/exit prices!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click Here to Sign Up

Highlight of a Recent Winning Trade

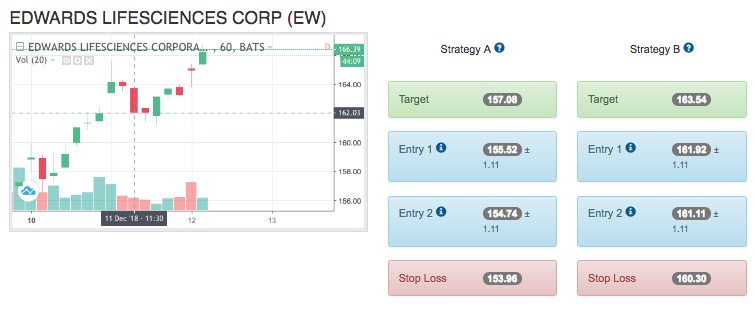

On December 11th, our ActiveTrader service produced a bullish recommendation for Edwards Lifesciences Corp (EW). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

EW entered the forecasted Entry 1 price range of $161.92 (± 1.11) in its third hour of trading and hit its Target price of $163.54 in that second to last hour of trading that day. The Stop Loss was set at $160.30.

Friday Morning Featured Stock

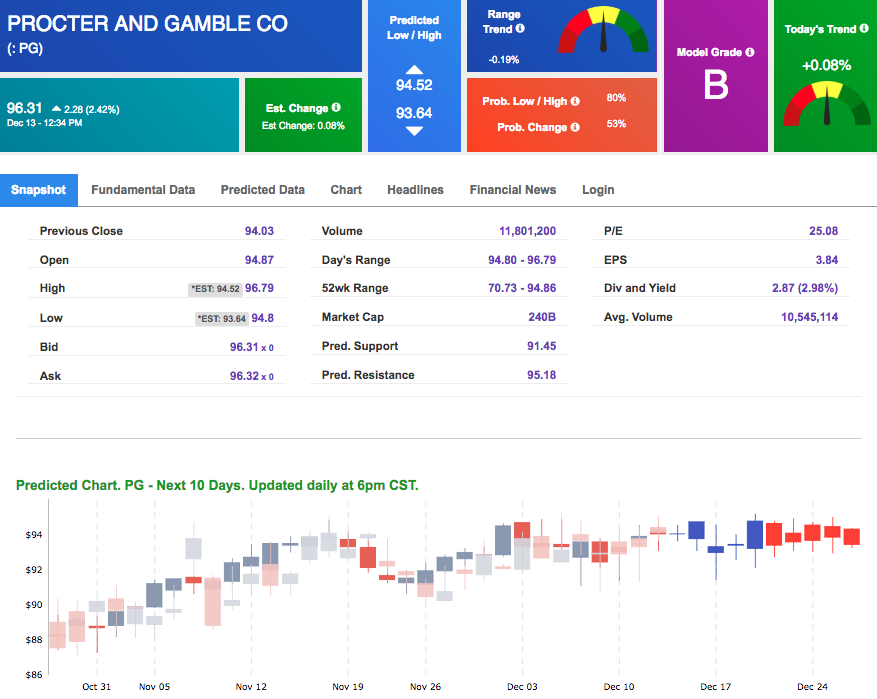

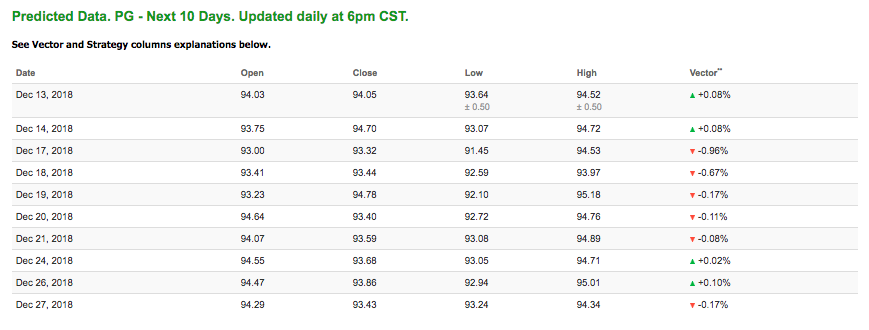

Our featured stock for Friday is Procter and Gamble Co. (PG). PG is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $96.31 at the time of publication, up 2.42% from the open with a +0.08% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

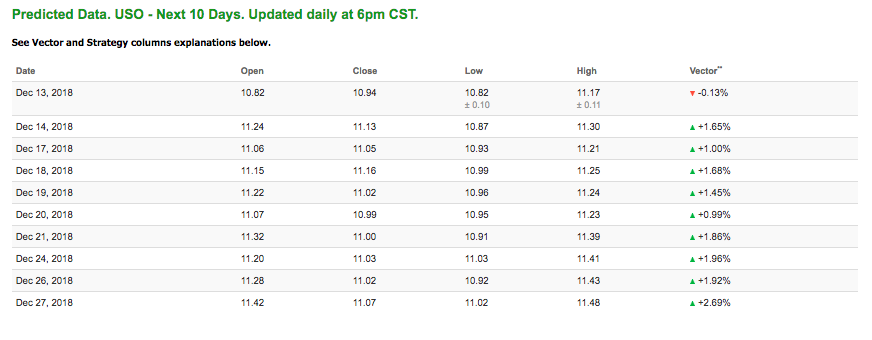

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

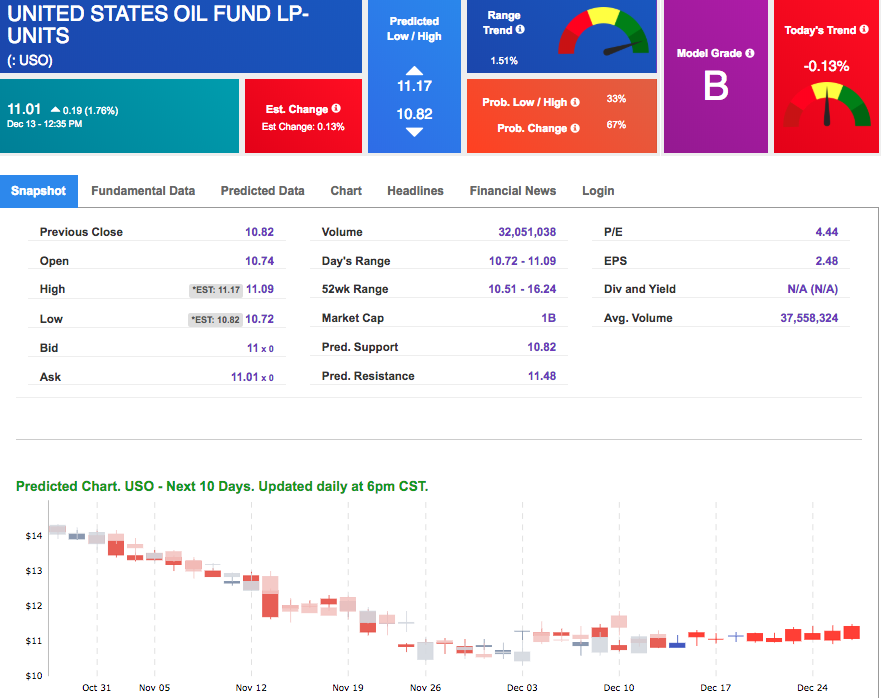

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $52.06 per barrel, up 1.80% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mostly positive signals. The fund is trading at $11.01 at the time of publication, up 176% from the open. Vector figures show -0.13% today, which turns +0.99% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

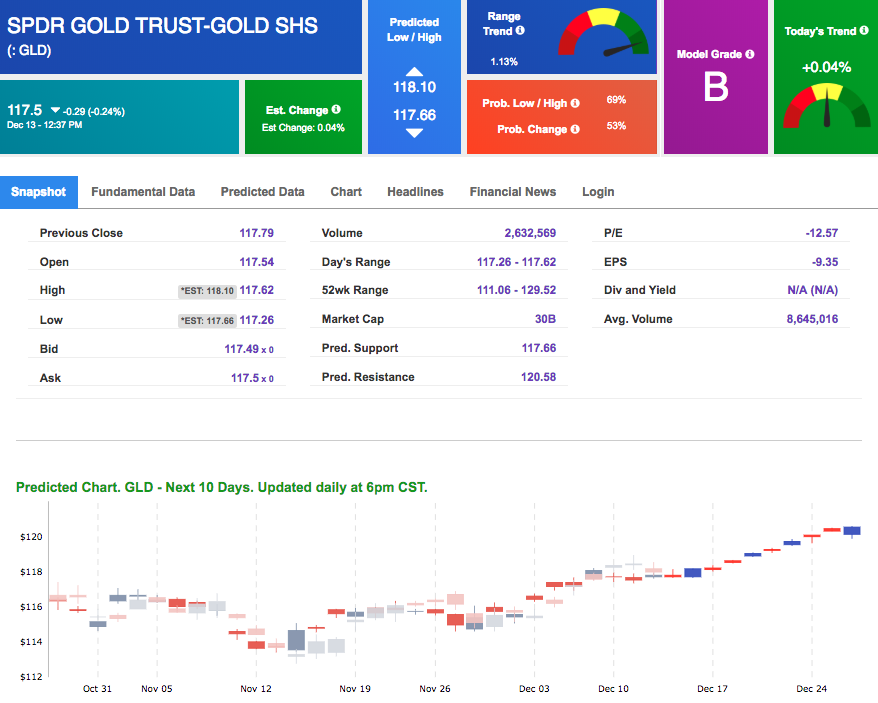

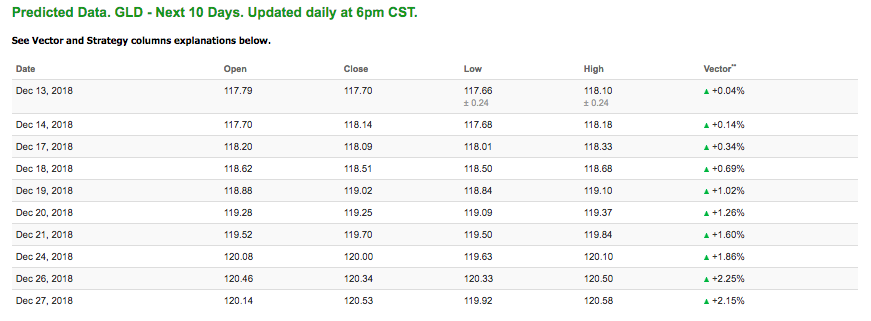

Gold

The price for February gold (GCG9) is down 0.23% at $1,246.80 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $117.5, down 0.24% at the time of publication. Vector signals show +0.04% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

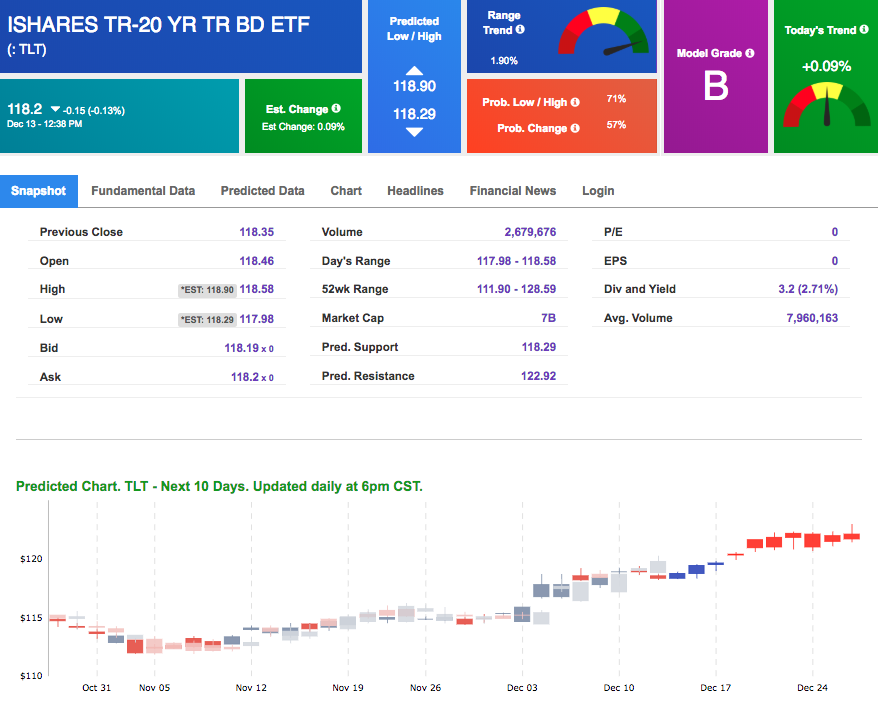

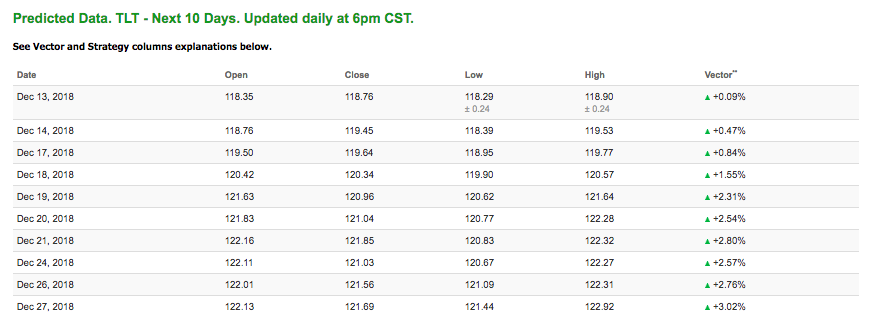

The yield on the 10-year Treasury note is down 0.31% at 2.90% at the time of publication. The yield on the 30-year Treasury note is up 0.11% at 3.15% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.09% moves to +1.55% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

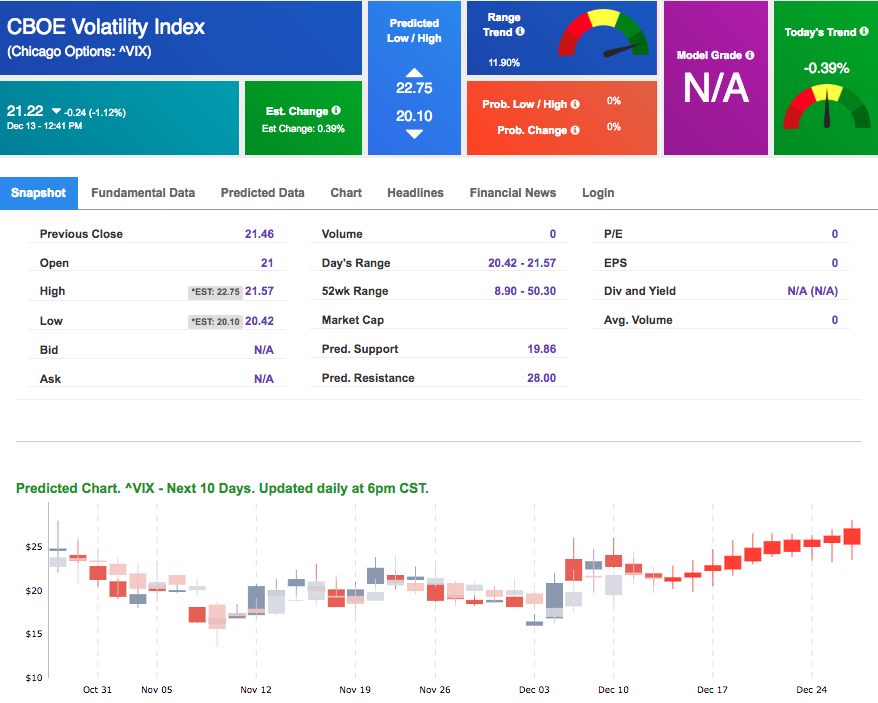

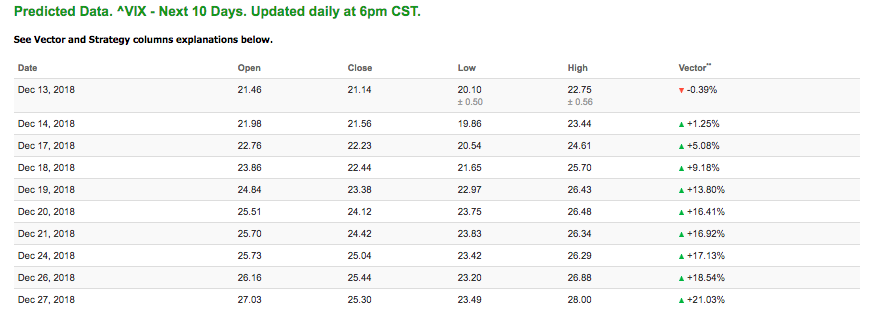

Volatility

The CBOE Volatility Index (^VIX) is down 1.12% at $21.22 at the time of publication, and our 10-day prediction window shows mostly positive signals. The predicted close for tomorrow is $21.56 with a vector of +1.25%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Holiday Sale: LIFETIME ACCESS to Tools Membership!

Get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

In addition, you will get Lifetime Access to our ActiveTrader and ActiveInvestor services which includes exact entry/exit prices!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!