China-U.S. Trade Deal Supports Global Markets but U.S. Indices Lower

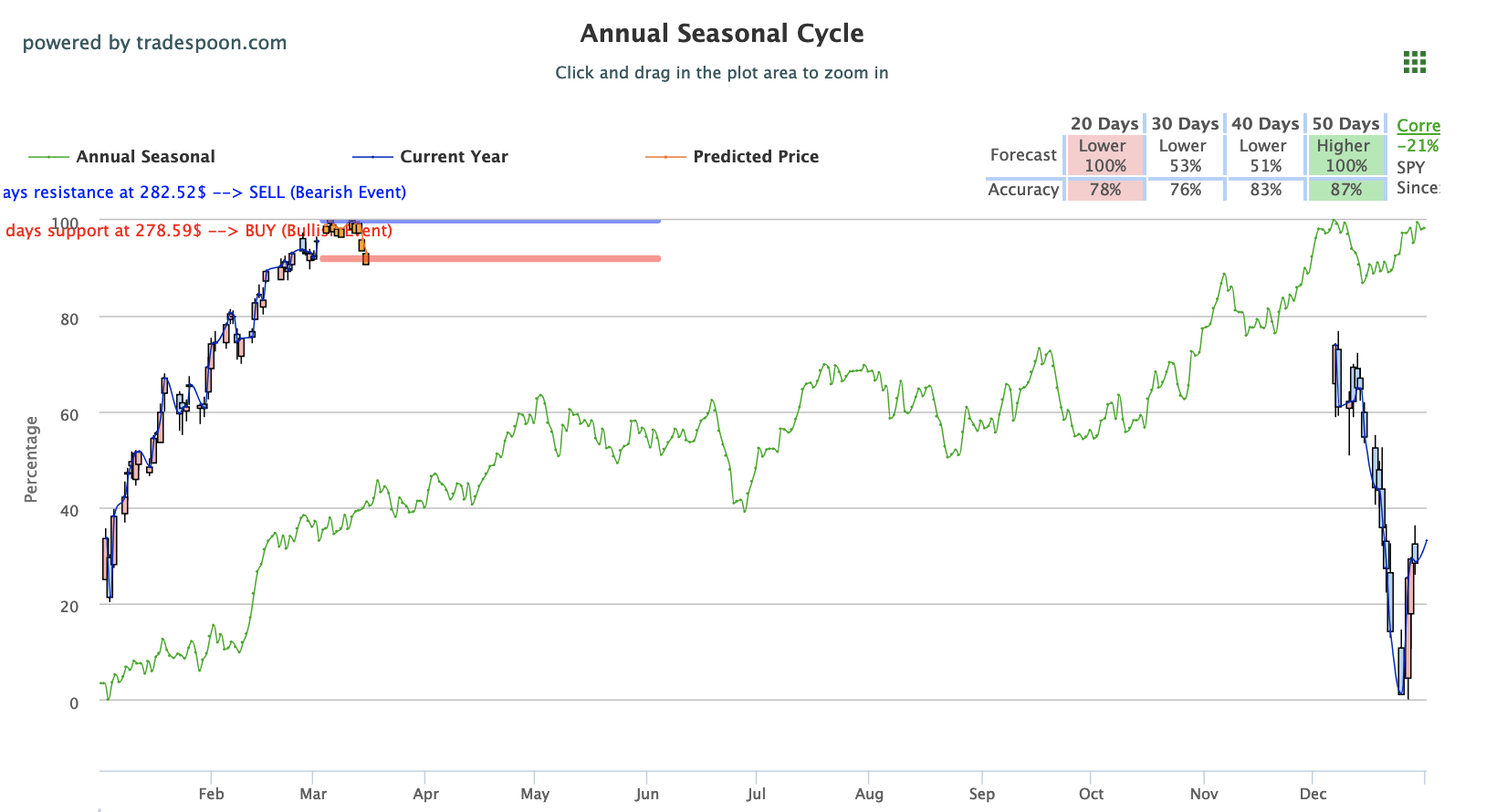

Major U.S. indices edged higher in early morning trading after news that a U.S.-China trade deal was on the horizon, sparking global optimism in trade and helping lift Asian and European markets before they closed. U.S. markets have since reversed course, lowering to multi-week low’s and currently on track to close the day in the red. After last week’s GDP report returned better than expected, the next major economic release to monitor is this week’s employment data for the month of February. Salesforce.com earnings are scheduled to release after market close today and tomorrow we will see fourth-quarter reporting from Target, Kohl’s, and Ross Stores, while Costco and Kroger report later in the week. The current 200-day moving average for SPY sits at $274 and if SPY drops below this level expect some continued downward momentum. For now, we encourage our highly valued members to avoid chasing the market and look to buy on the selloffs. For reference, the SPY Seasonal Chart is shown below:

News that a U.S.-China trade deal would soon be finalized made waves in early morning trading, providing optimism and support for the market that has since decreased. Details of the deal are not clear yet and we will certainly find out more before the next Trump-Xi summit which is currently on track for happening at the end of the month. Early reports show China is requesting the recent $200 billion in tariffs be removed as a starting point for the deal though whether these will be removed gradually or suddenly is also up in the air. The overall global sentiment of the deal was positive, pushing European and Asian markets higher today, though lack of detail and clarity on enforcement have lowered markets in the U.S. thereafter. Resulting in one of the biggest swings in recent memory, the Dow was up over 100 points to start the day only reverse course and drop over 300 points. Other details of the deal thus far include an agriculture and energy purchase requirement from China as well as further tariff removal.

This week’s key economic data to monitor includes housing and employment data after last week’s GDP report returned positively and supported markets. February employment data looks to remain positive though expectations are mixed, some predicting better than expected data while others are keeping in line with previous growth. December new home sales report and January Federal Budget data are set to release tomorrow, while Wednesday will see the release of the Fed’s Beige Book.

Kraft-Heinz is currently experiencing a slight rebound from last week’s horrendous lows while AT&T is down after news the company will consolidate its ad sales department and affiliates within the company. Salesforce.com is also slightly down, ahead of its earnings tonight after the market closes. Major retailers such as Target and Kohl’s are set to report this week providing an indicator of the retail sector performance and growth. Other news to note include Lyft’s recent filing for an IPO as well as Huawei’s plan to sue the U.S., both of which could have more implication on the market as each respective situation develops.

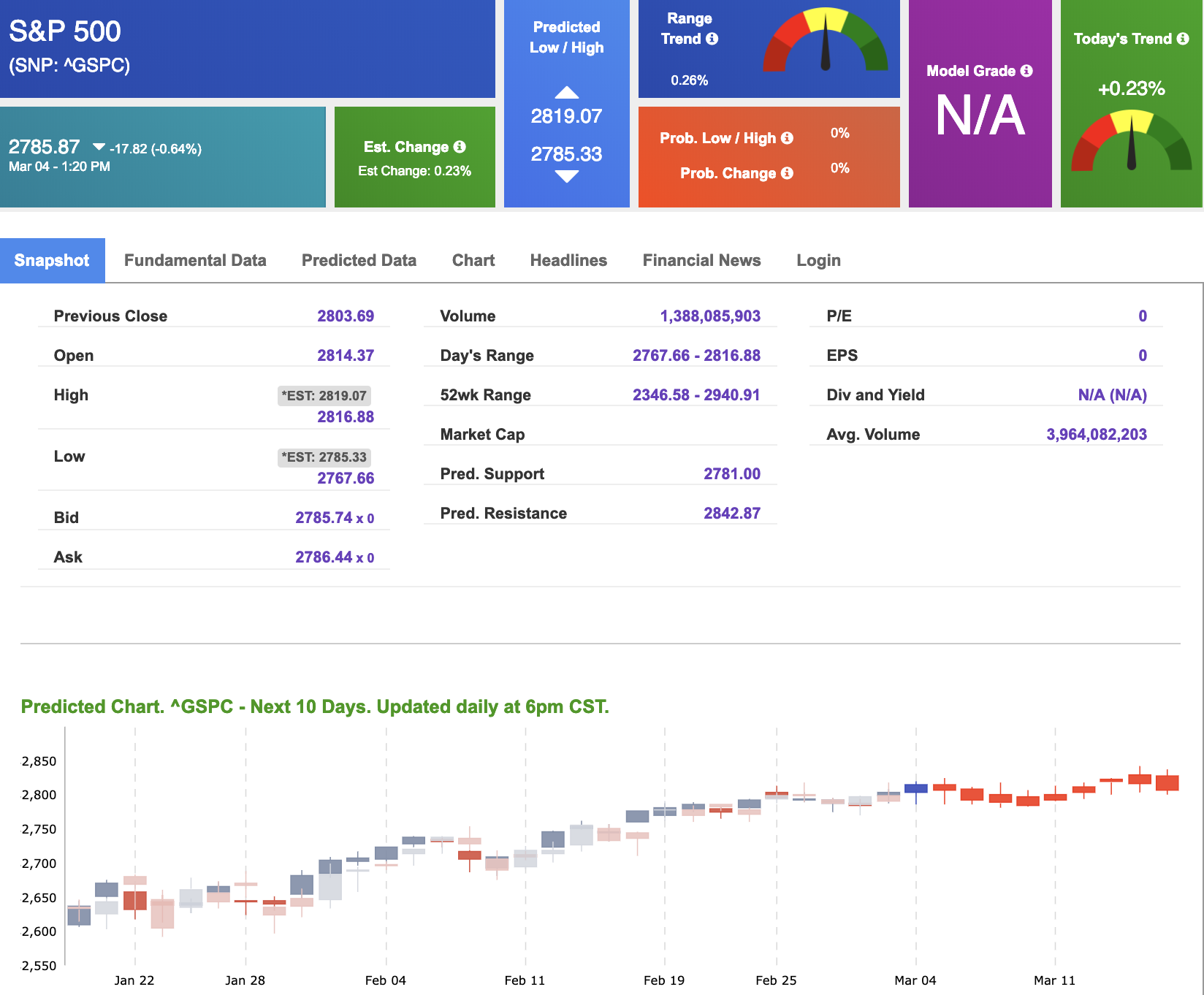

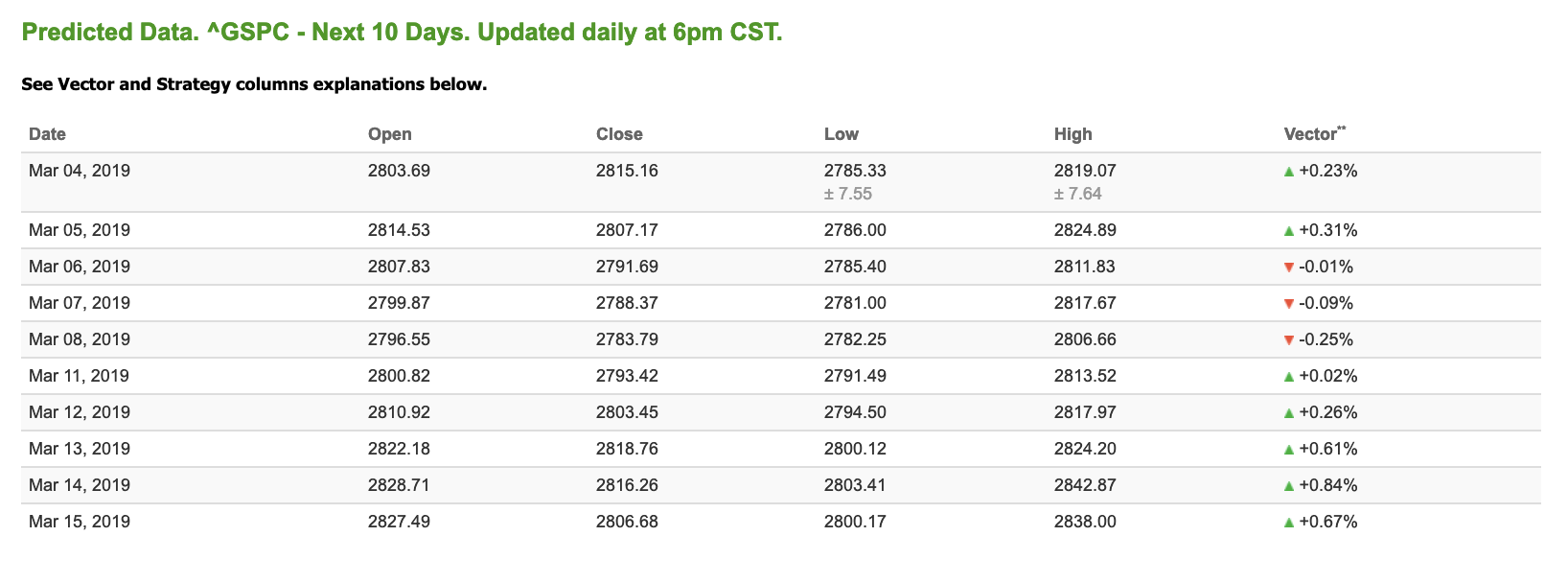

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.23% moves to +0.02% in five trading sessions. The predicted close for tomorrow is 2,807.17. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 6 months of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

In addition, you will get Lifetime Access to our ActiveTrader service which includes daily high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!

Click Here to Sign Up

Highlight of a Recent Winning Trade

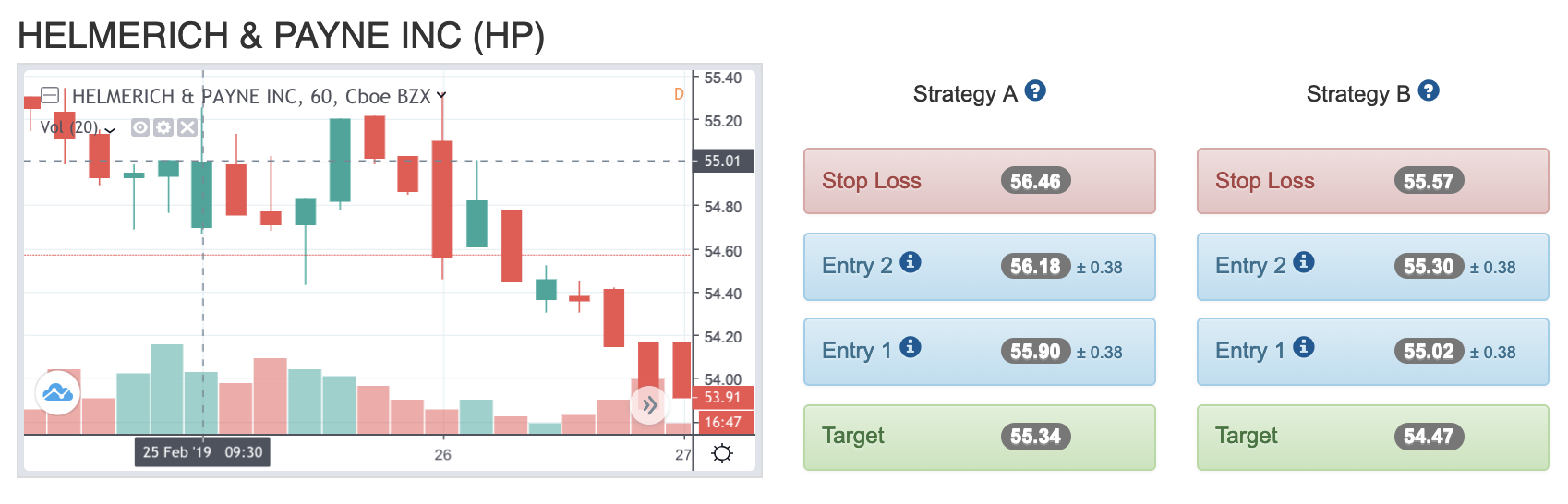

On February 25th, our ActiveTrader service produced a bearish recommendation for Helmerich & Payne Inc (HP). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

HP entered its forecasted Strategy B Entry 1 price range $55.02 (± 0.38) in its first hour of trading and passed through its Target price $54.47 in the first hour of trading the following day. The Stop Loss price was set at $55.57

Tuesday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

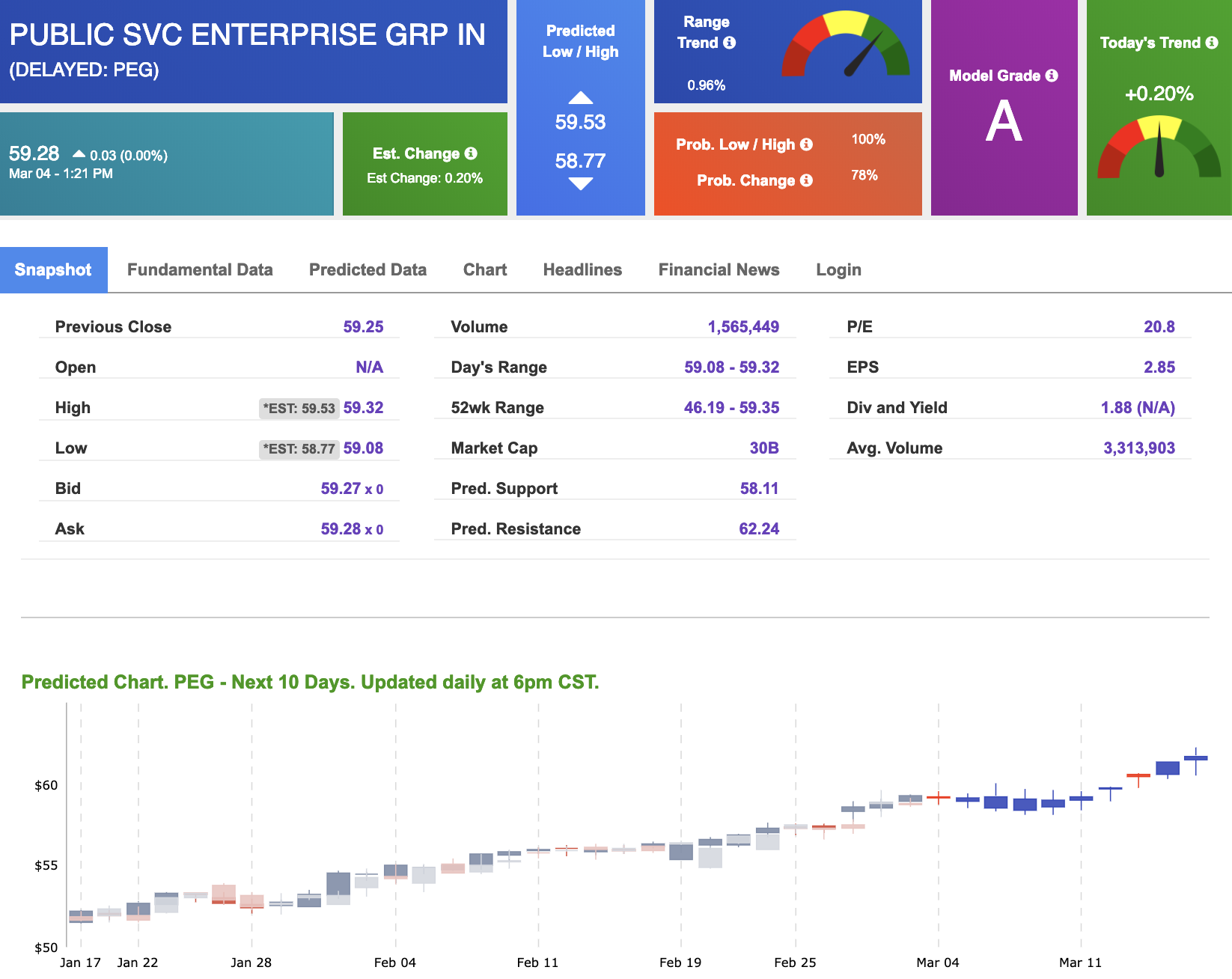

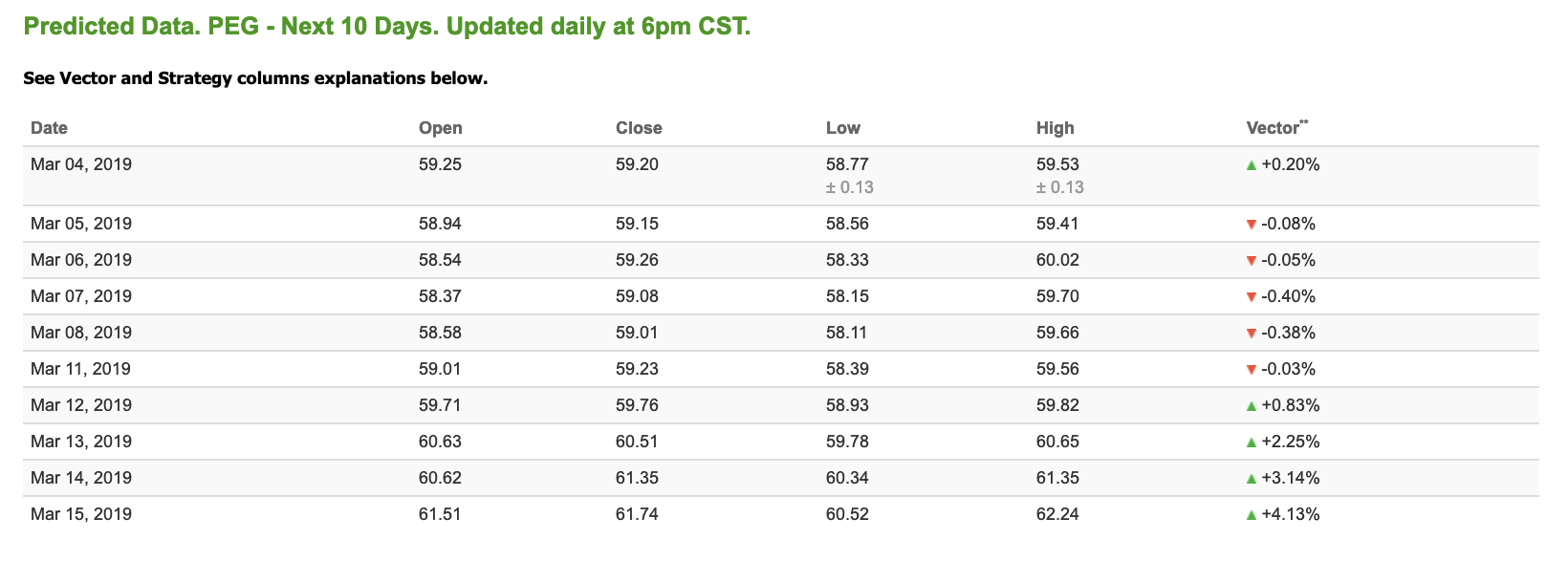

Our featured stock for Tuesday is Public Service Enterprise Group (PEG). PEG is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $59.28 at the time of publication, with a +0.20% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

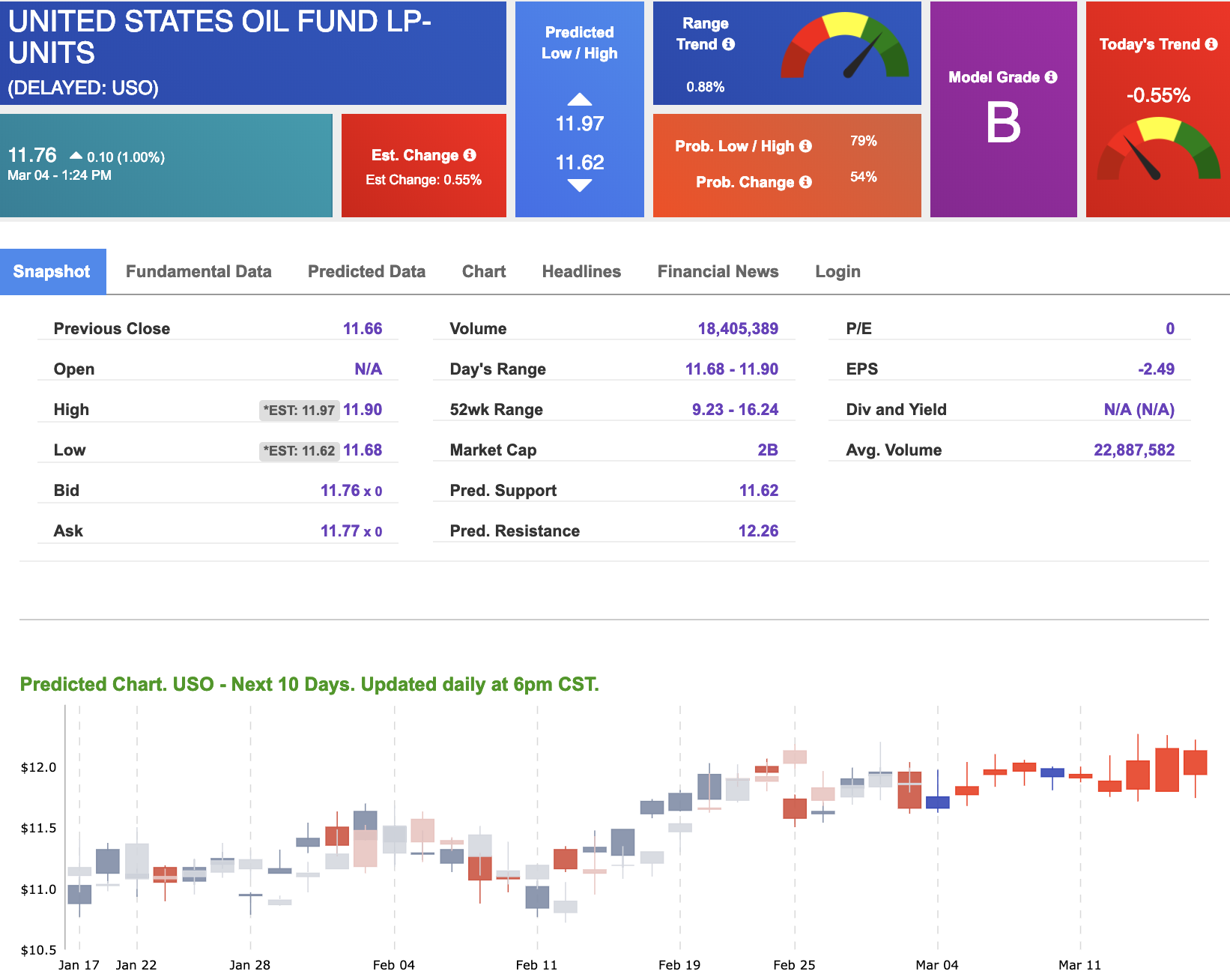

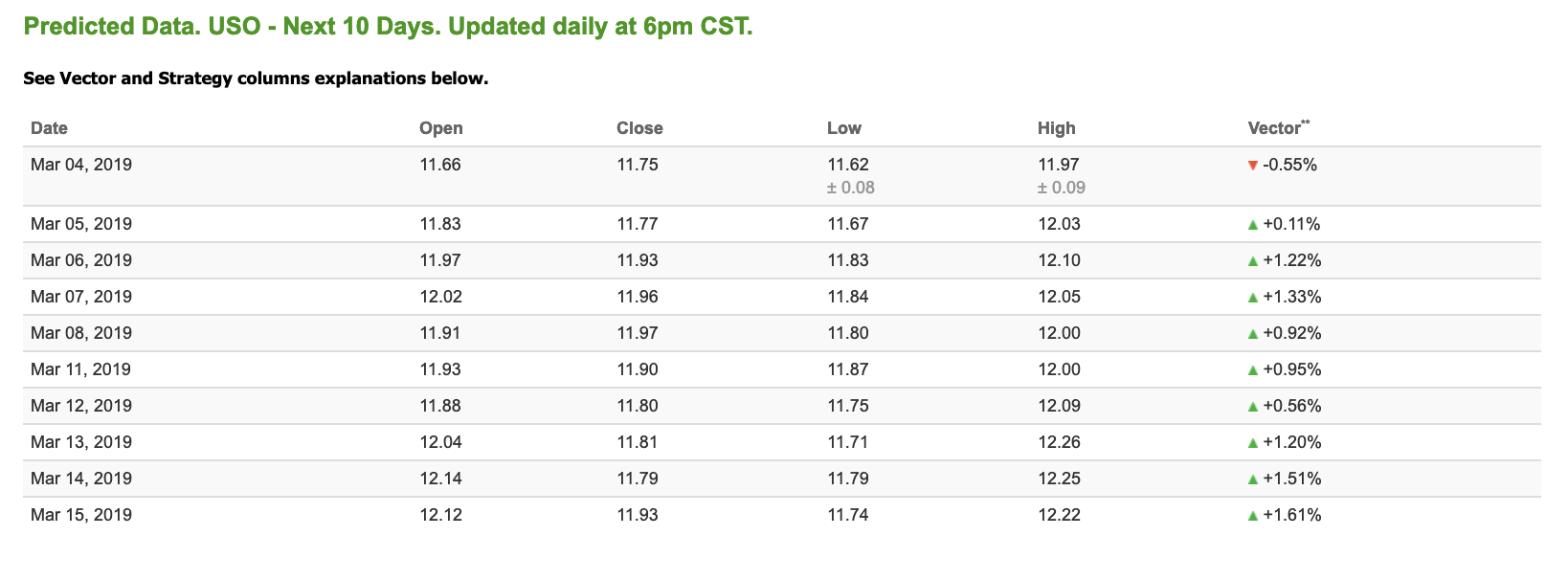

Oil

West Texas Intermediate for April delivery (CLJ9) is priced at $56.54 per barrel, up 1.33% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mostly positive signals. The fund is trading at $11.76 at the time of publication, up 1.00% from the open. Vector figures show -0.55% today, which turns +0.95% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

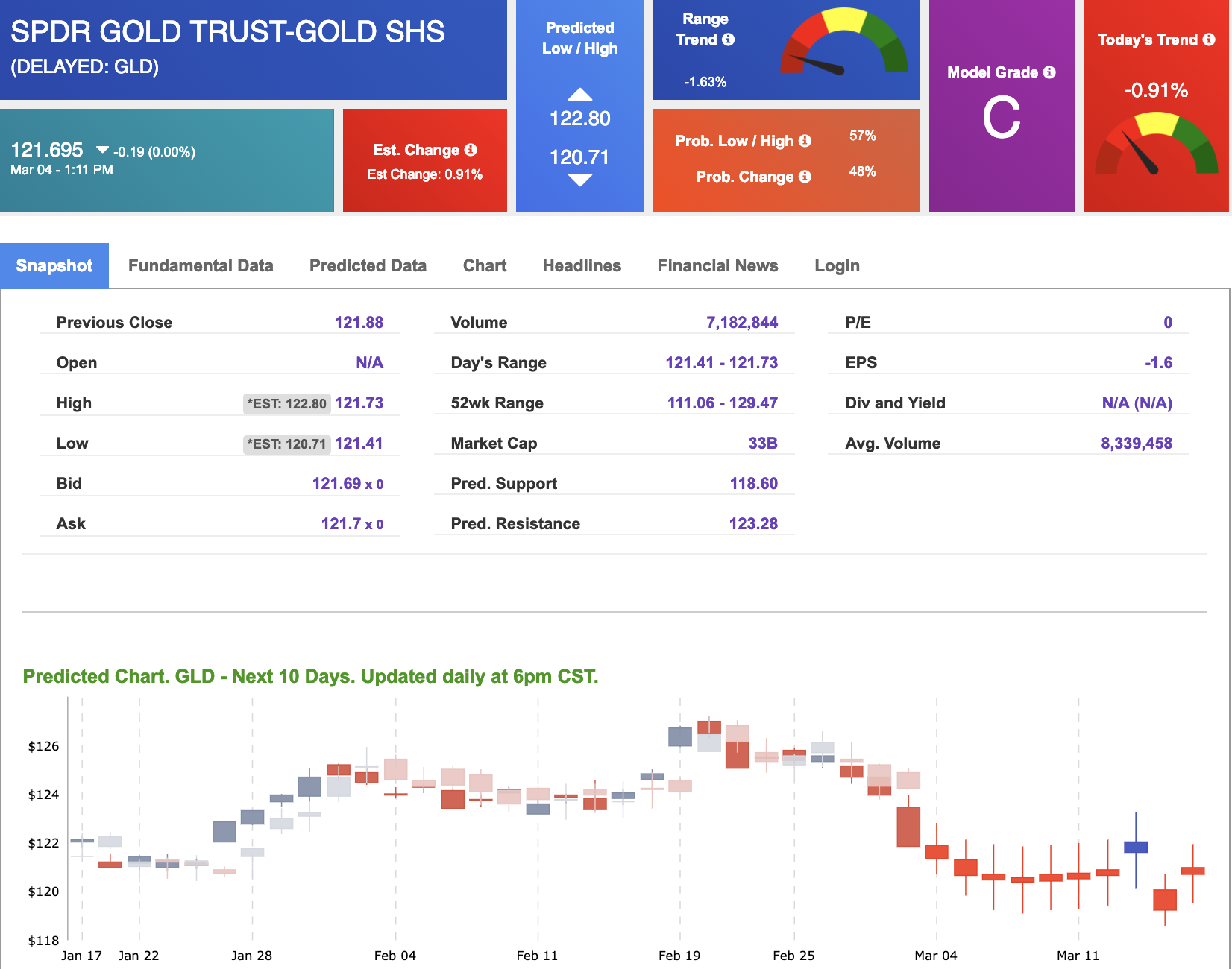

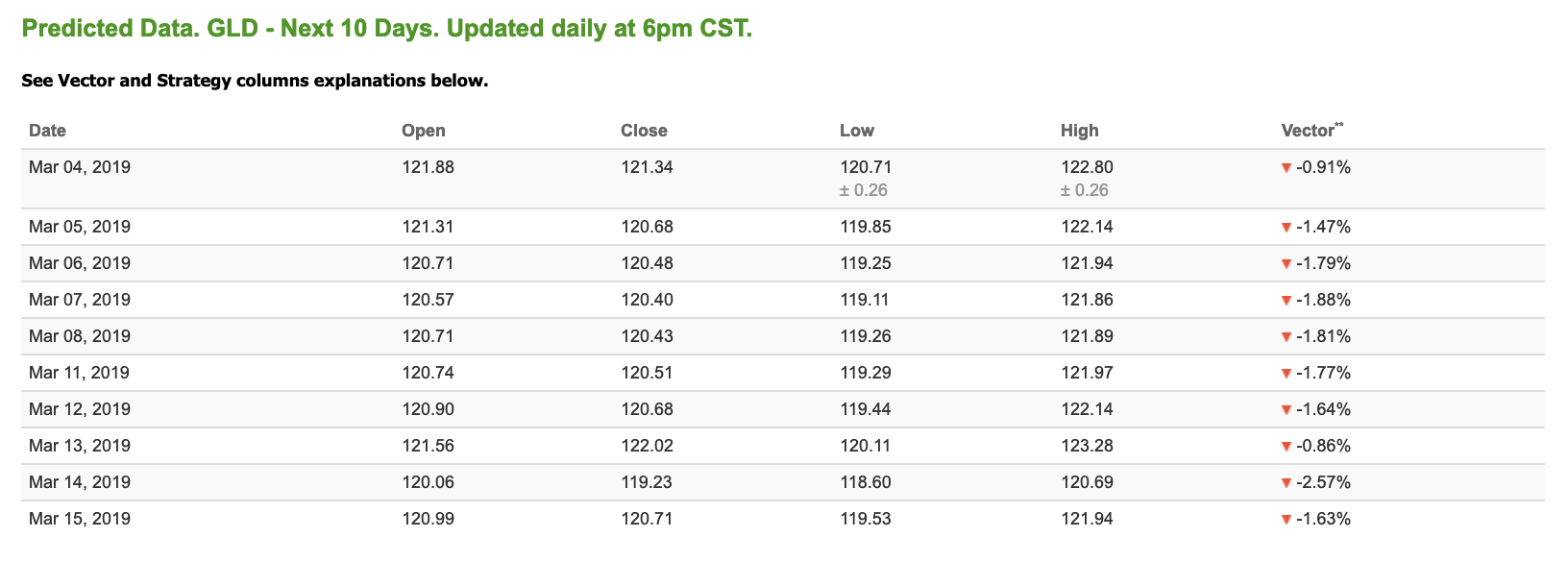

Gold

The price for April gold (GCJ9) is down 0.79% at $1,228.80 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows all negative signals. The gold proxy is trading at $121.69, at the time of publication. Vector signals show -0.91% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

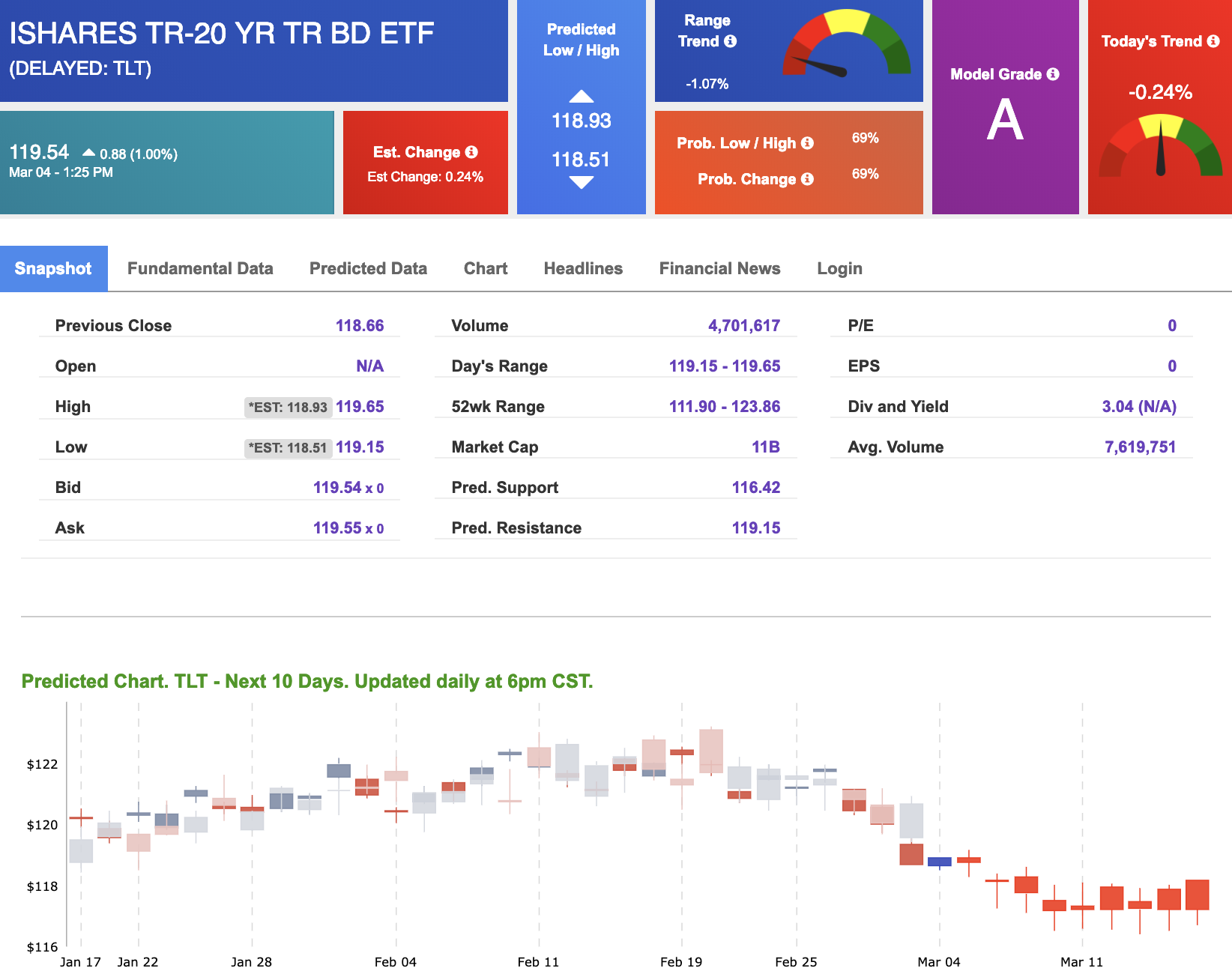

Treasuries

The yield on the 10-year Treasury note is down 1.05% at 2.73% at the time of publication. The yield on the 30-year Treasury note is down 0.82% at 3.10% at the time of publication.

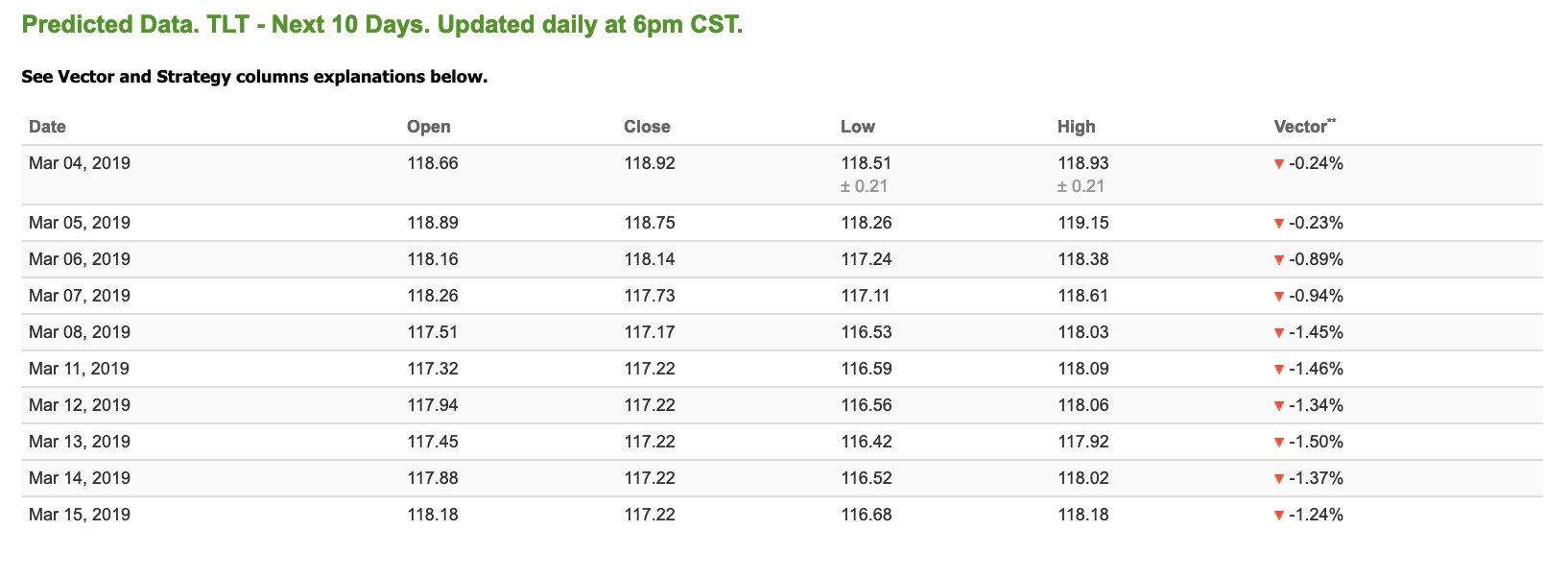

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.24% moves to -0.94% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

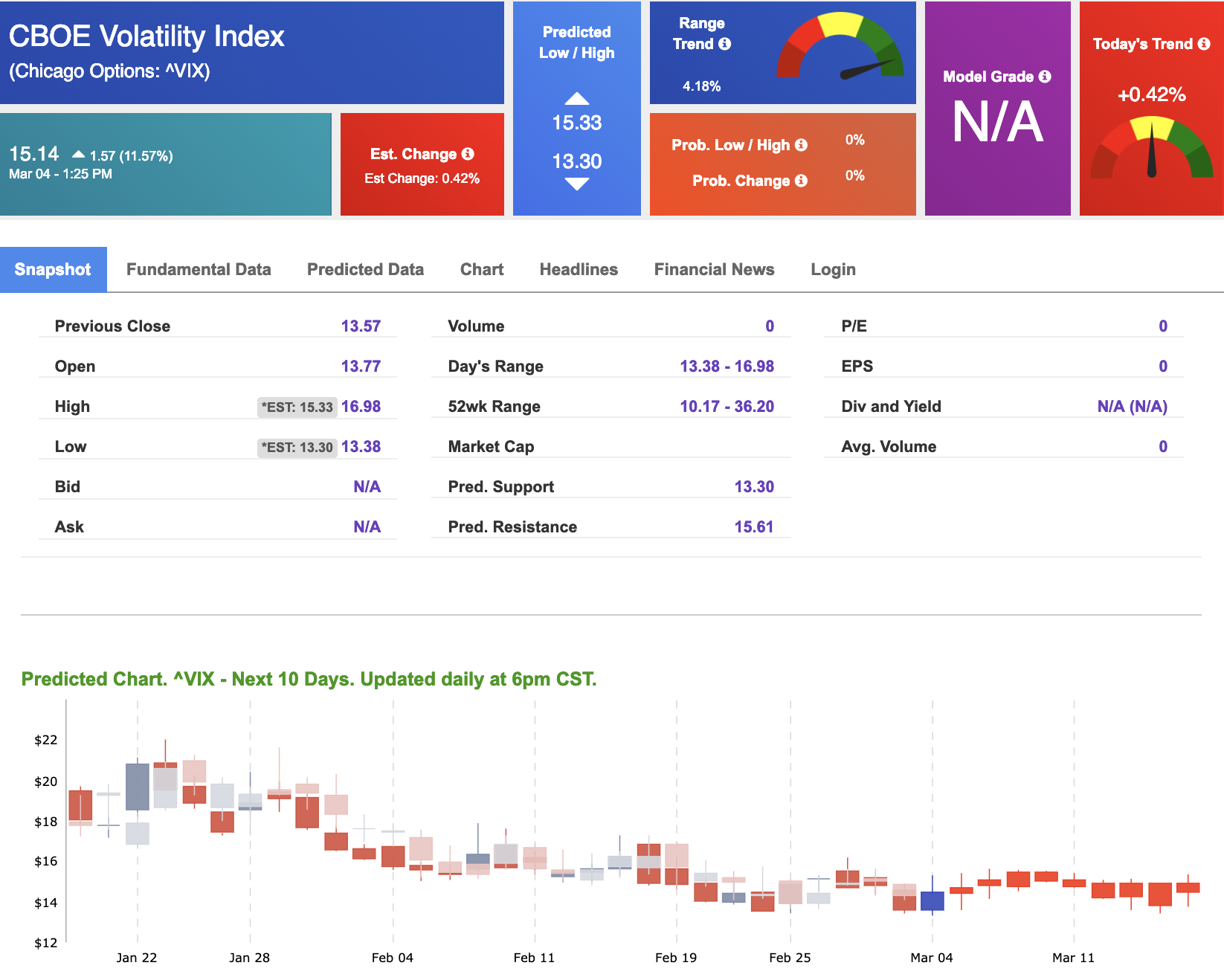

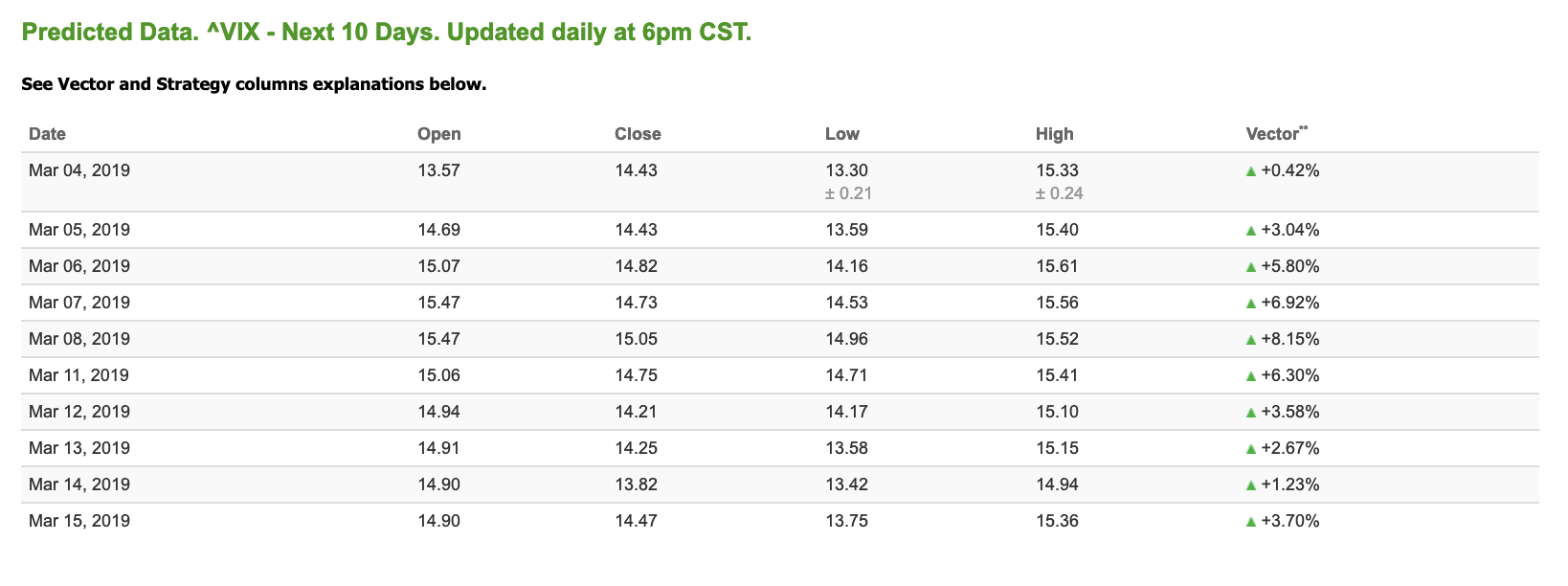

Volatility

The CBOE Volatility Index (^VIX) is up 11.57% at $15.14 at the time of publication, and our 10-day prediction window shows positive signals. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 6 months of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

In addition, you will get Lifetime Access to our ActiveTrader service which includes daily high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!