Earnings Power Strong Rallies, Global Concern Erase Daily Gains

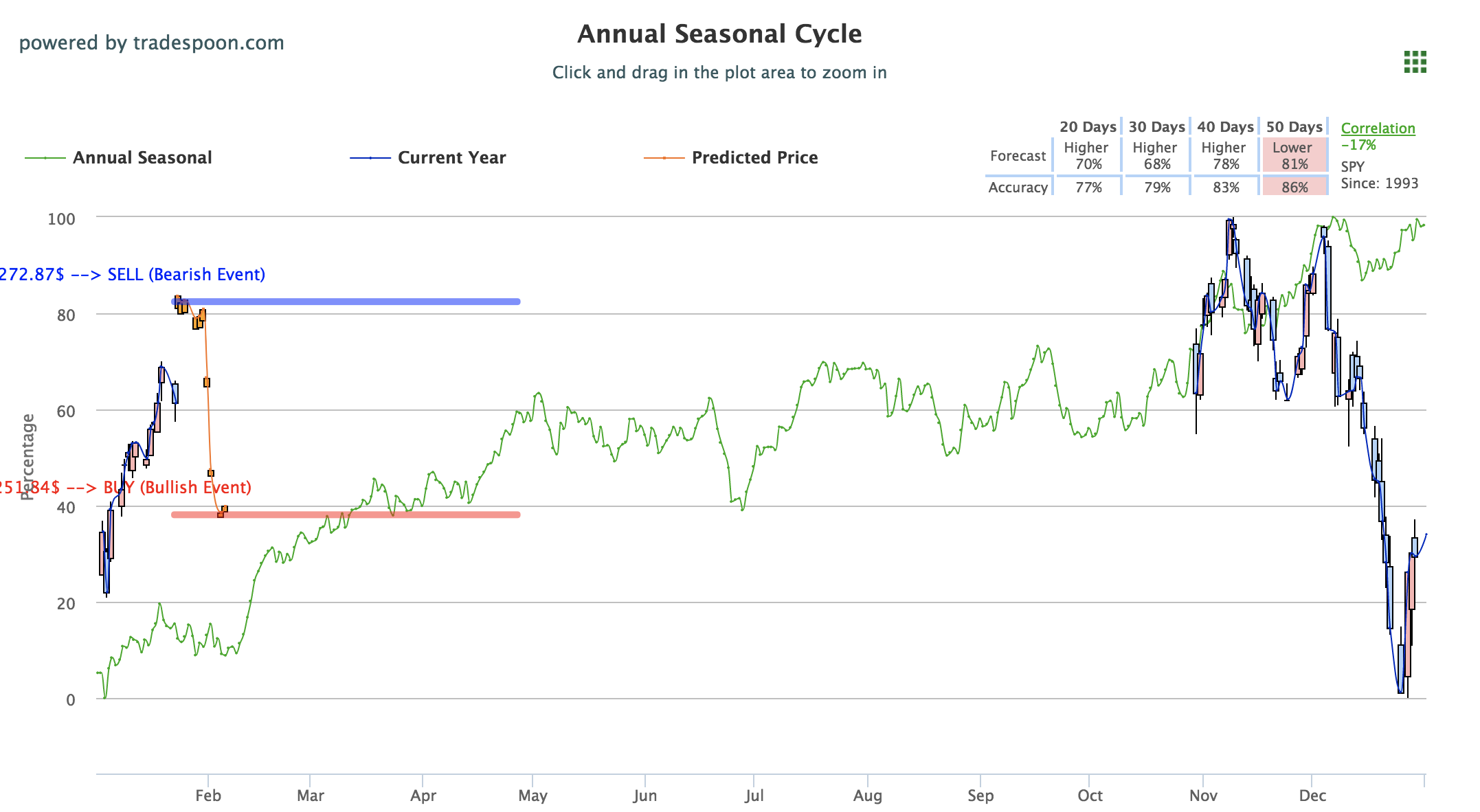

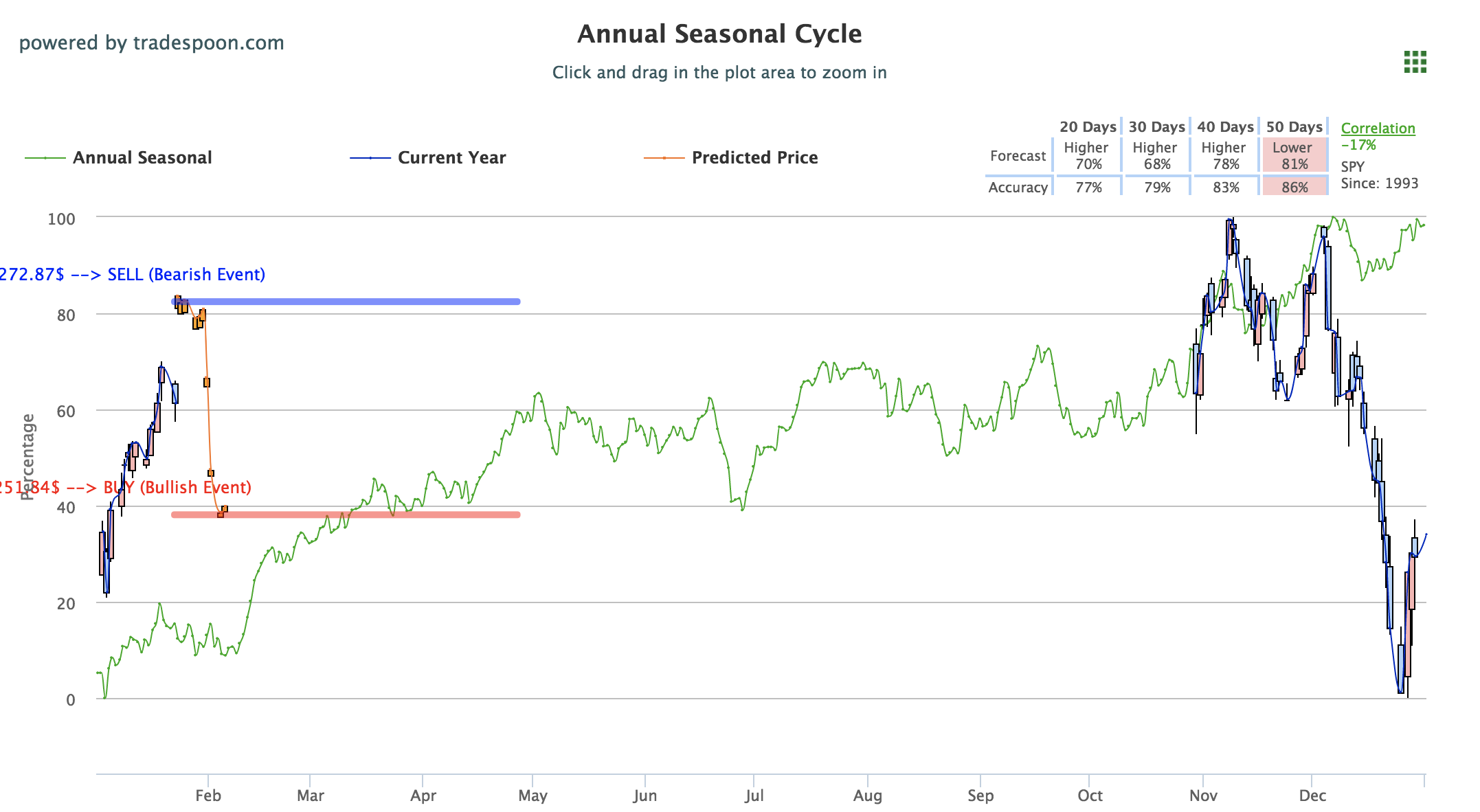

Market has had one of the strongest rebounds going back 40 years during the first quarter of 2019, bouncing back from the historic lows of last December. Our strategy remains buying when the market sells off and not chasing the rallies. At this point, the market is overbought, based off most technical indicators, and we dissuade our members from chasing the market. The market could revert back to $254-$257 level for SPY in the next 2-3 weeks but we do not see market retesting December lows until summer of 2019. By the end of first quarter 2019, we believe the market will rebound to $274-$280 level. For reference, the SPY Seasonal Chart is shown below:

Today, strong earnings helped stocks rally in early trading only to fall in the afternoon behind trade concern and continued uncertainty regarding the partial U.S. government shutdown. Positive premarket release of Comcast earnings and yesterday’s aftermarket release of IBM powered major U.S. indices into gains, though only briefly as news of a canceled meeting between U.S. and Chinese officials made rounds lowered indices and pressured markets. Dueling Senate bills were also halted as policymakers are deciding between voting on a temporary solution to reopen government agencies while negotiating a long term solution or continuing the shutdown through the funding negotiations and border dispute.

Currently, the Dow is the only major index on track to record gains however both S&P and Nasdaq are only modestly down. Comcast shares rose, up 4%, behind strong revenue and sales numbers while Abbott Labs struggled, currently down 2%, after earnings missed fourth quarter expectations. Also benefiting from positive earnings, Procter & Gamble Co. shares rose 4% after beat expectations. Ford is set to report after market close today while Intel, ETrade, and Southwest Airlines are due to report tomorrow.

Globally, Asian markets closed to mixed results while European markets were mostly down. Although Brexit progressed has slowed, several companies are beginning to make accommodations for the future move of the U.K. out of the EU. Sony, for example, has already put in motion plans to relocate headquarters from England to the Netherlands. Previously, Dyson, the vacuum cleaner and hair dryer company, announced their move from England to Singapore in light of Brexit.

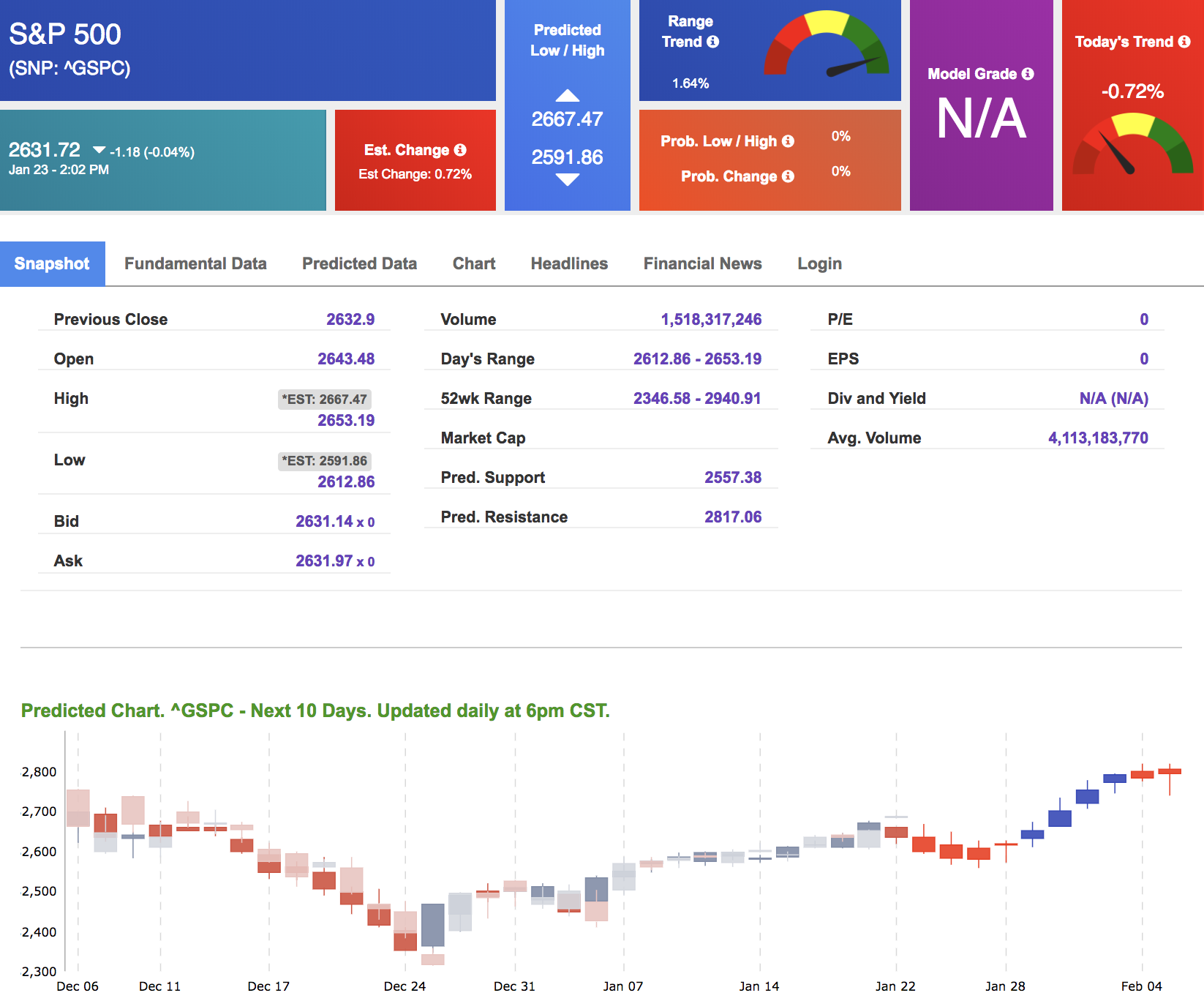

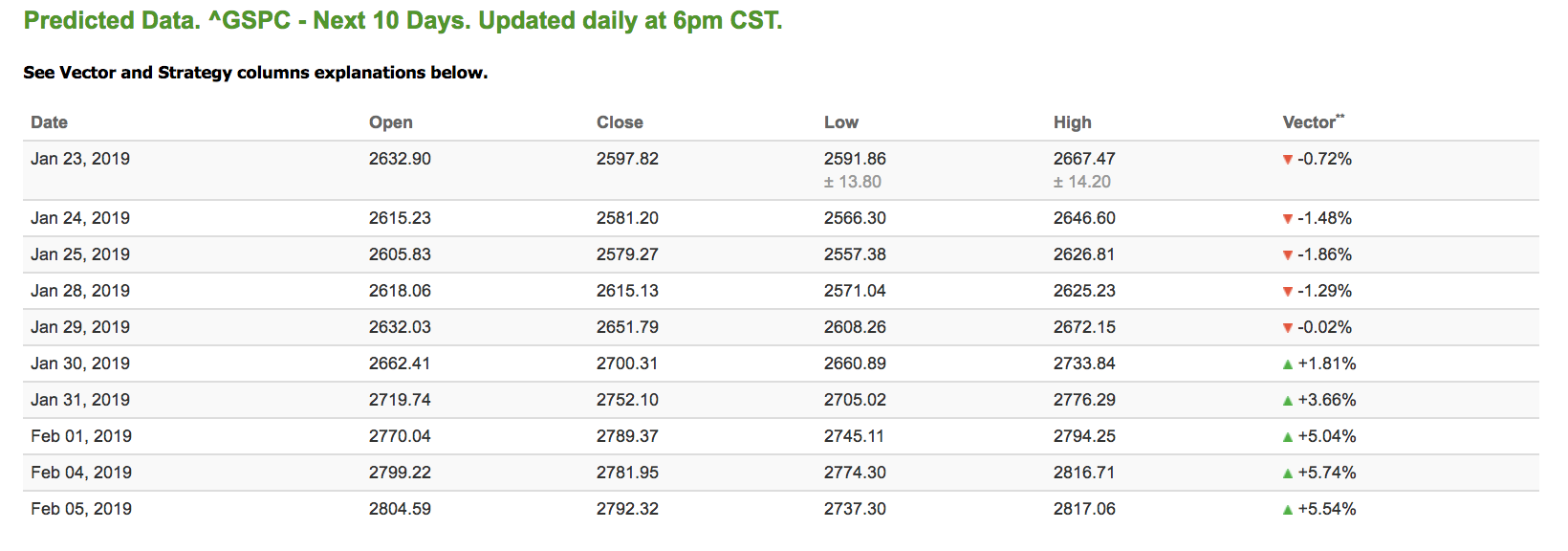

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.72% moves to -1.81% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Trailing 18-month return. . . 1,064%!

That can turn $100,000 into $1,164,415 in just 18 months!

- No way this offer will ever be repeated!

- Prices are going up significantly next week!

- One-time offer expires midnight tonight.

Click Here for a brief outline of what you get…

Highlight of a Recent Winning Trade

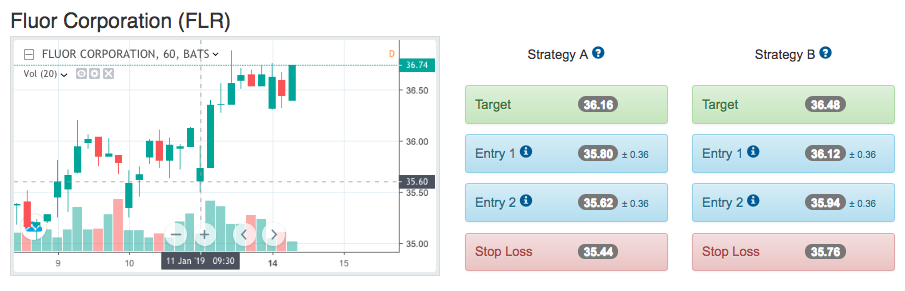

On January 11th, our ActiveTrader service produced a bullish recommendation for Fluor Corporation (FLR). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

FLR opened in its forecasted Strategy A Entry 1 price range $35.80 (± 0.36) and passed through its Target price $36.18 within the second of trading. The Stop Loss price was set at $35.44.

Thursday Morning Featured Stock

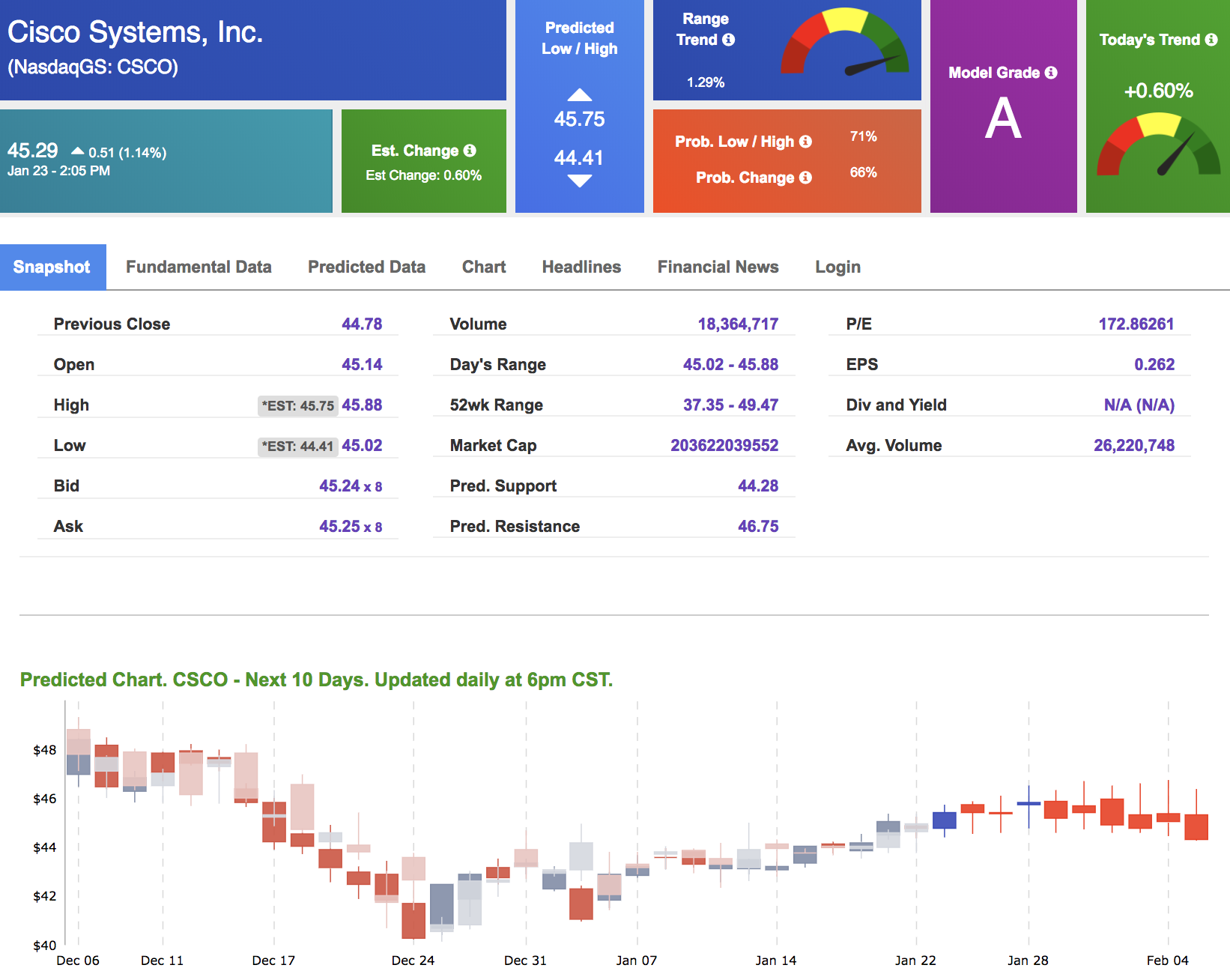

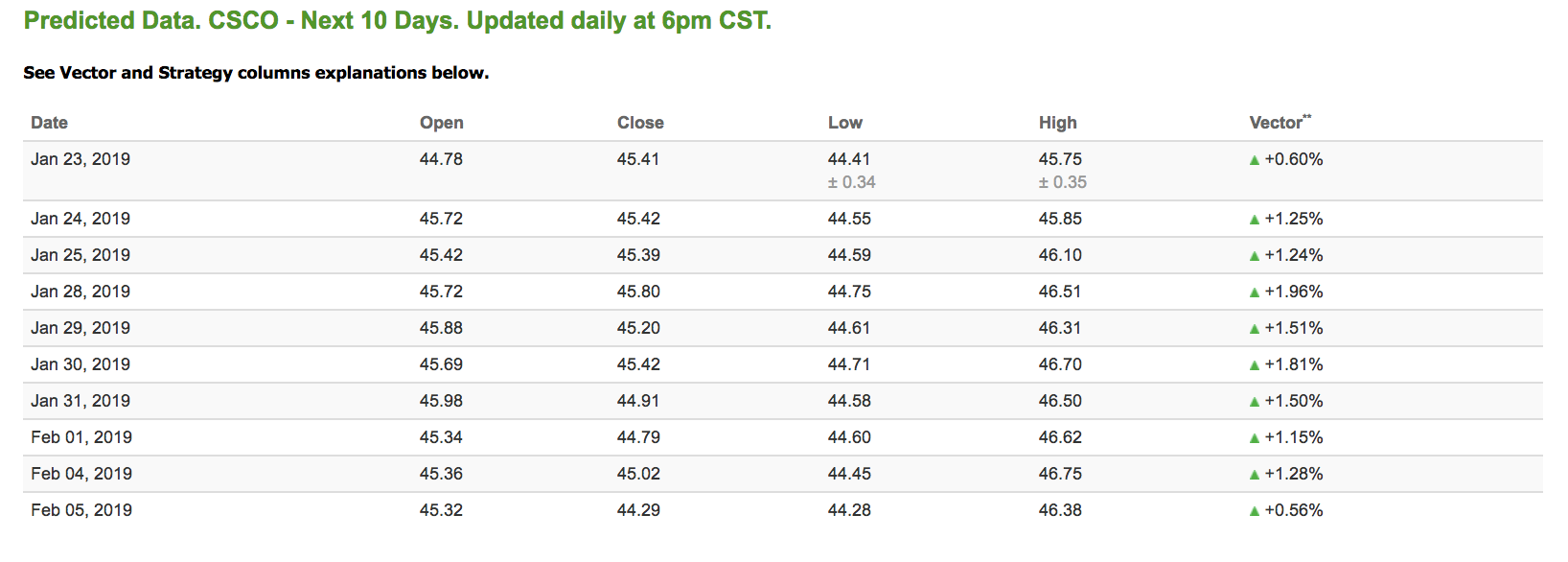

Our featured stock for Thursday is Cisco Systems, Inc. (CSCO). CSCO. is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $45.29 at the time of publication, up 1.14% from the open with a +0.60% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

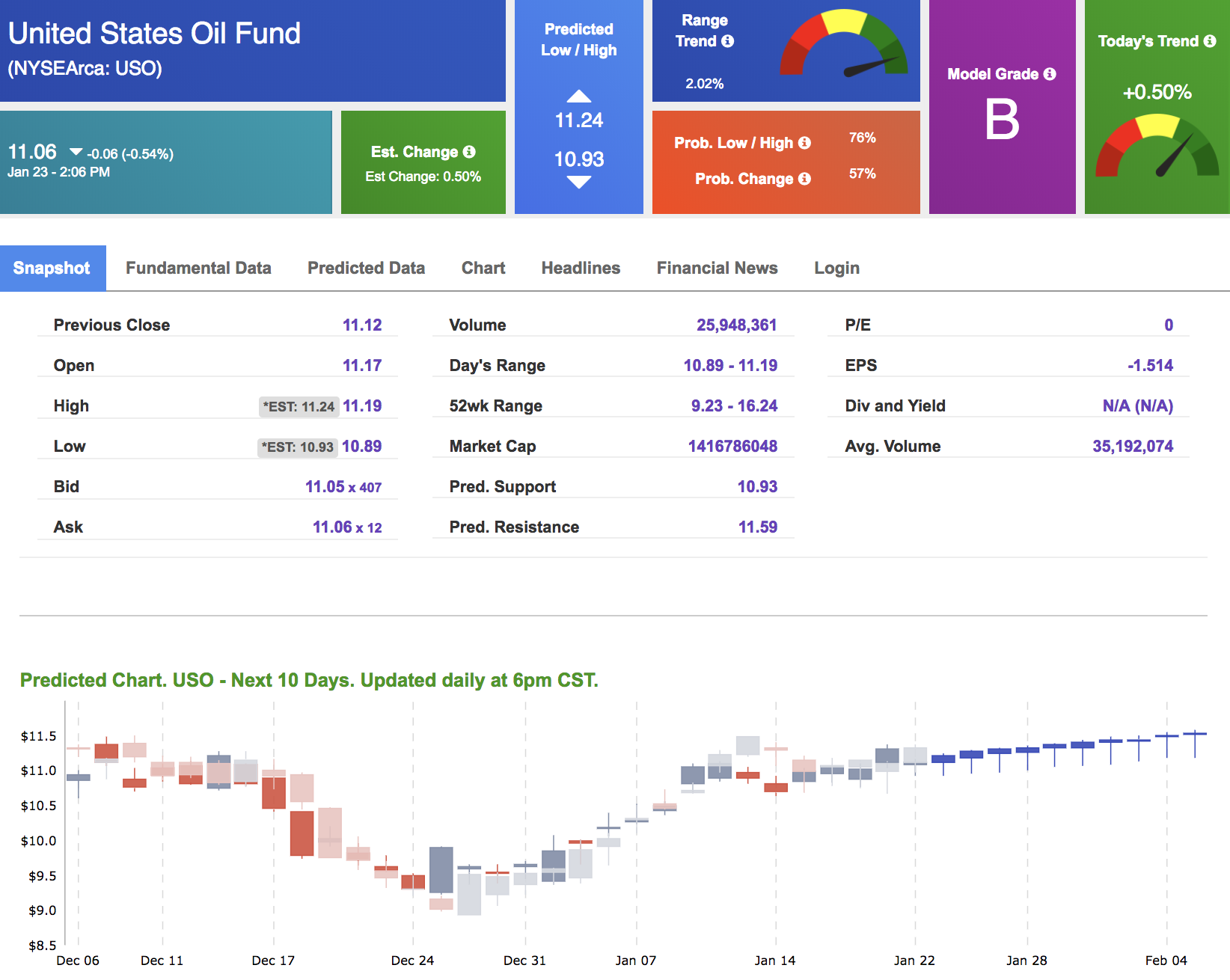

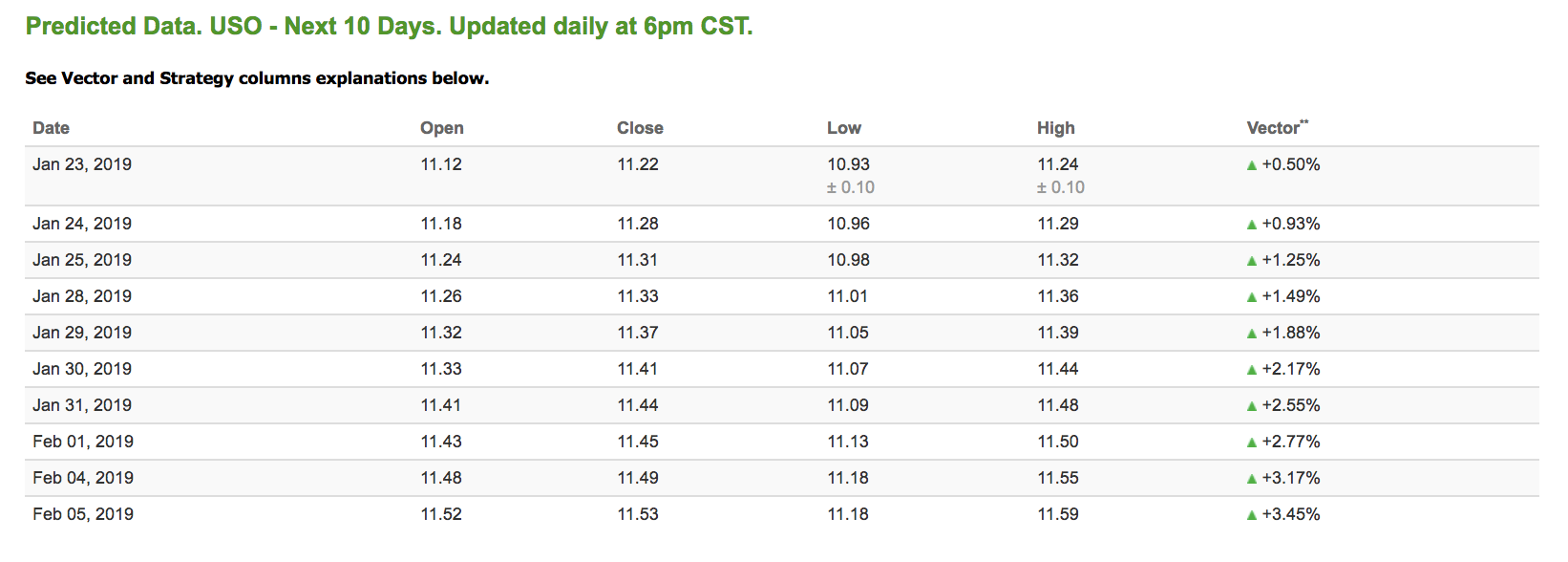

Oil

West Texas Intermediate for March delivery (CLH9) is priced at $52.68 per barrel, down 0.60% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $11.06 at the time of publication, down 0.54% from the open. Vector figures show +0.50% today, which turns +2.17% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

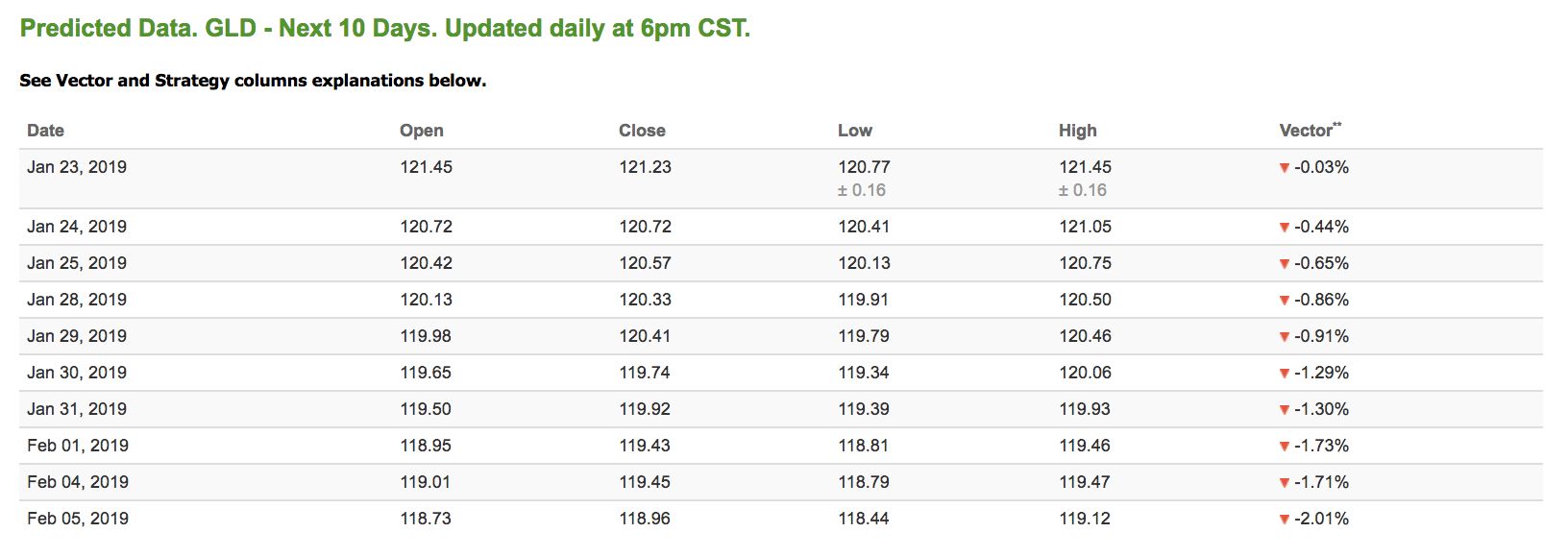

Gold

The price for February gold (GCG9) is down 0.05% at $1,282.70 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $121.29, down 0.13% at the time of publication. Vector signals show -0.03% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

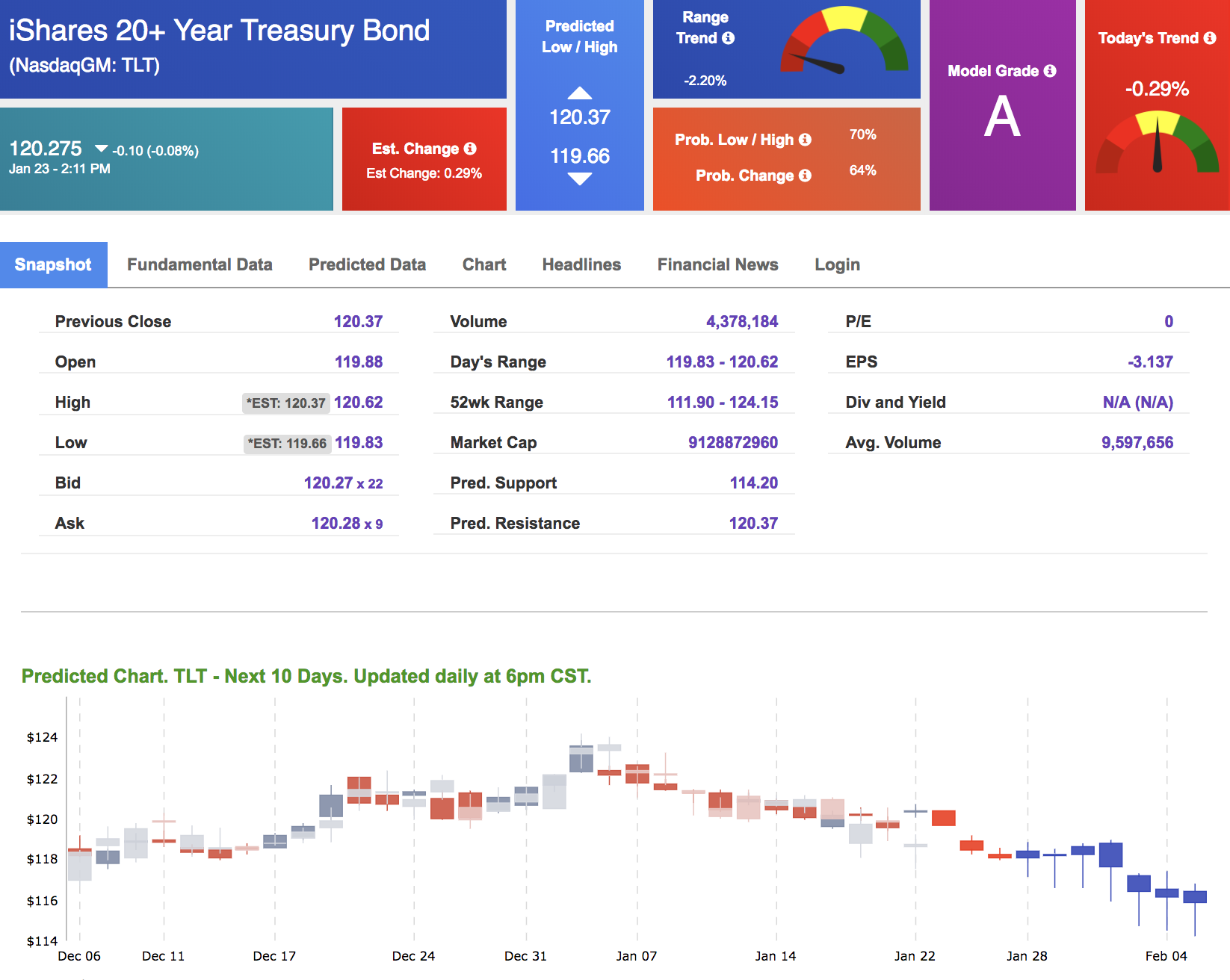

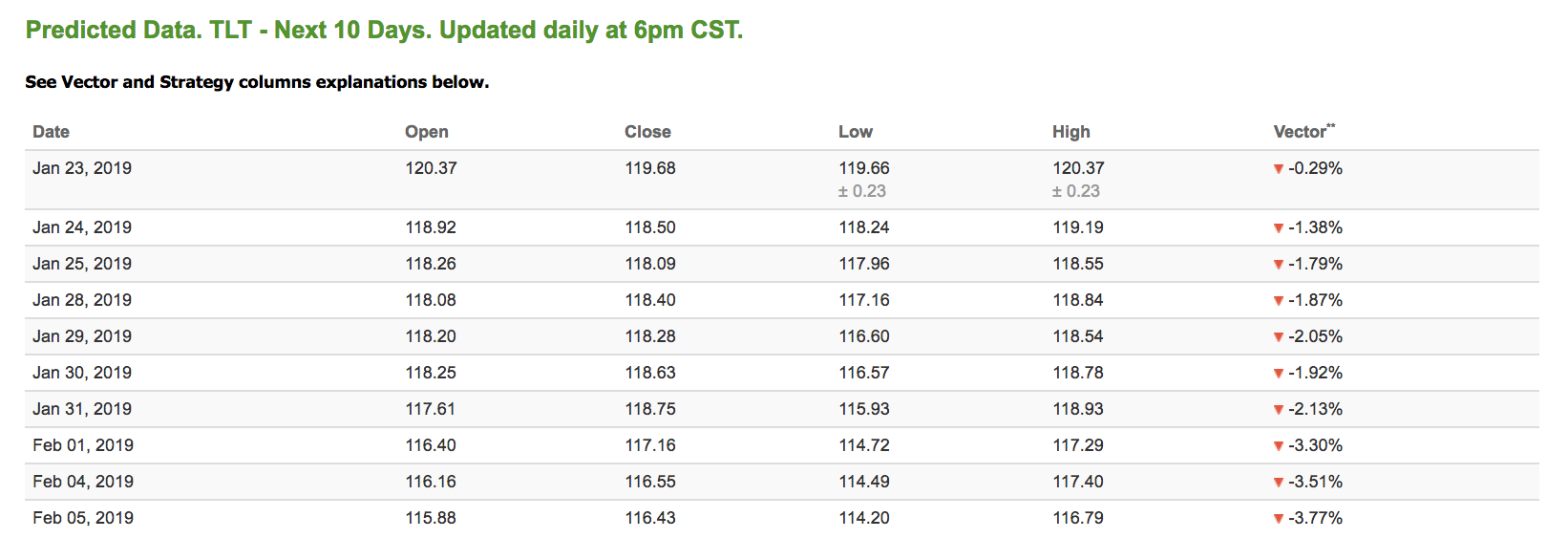

The yield on the 10-year Treasury note is up 0.52% at 2.75% at the time of publication. The yield on the 30-year Treasury note is up 0.22% at 3.07% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.29% moves to -1.87% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

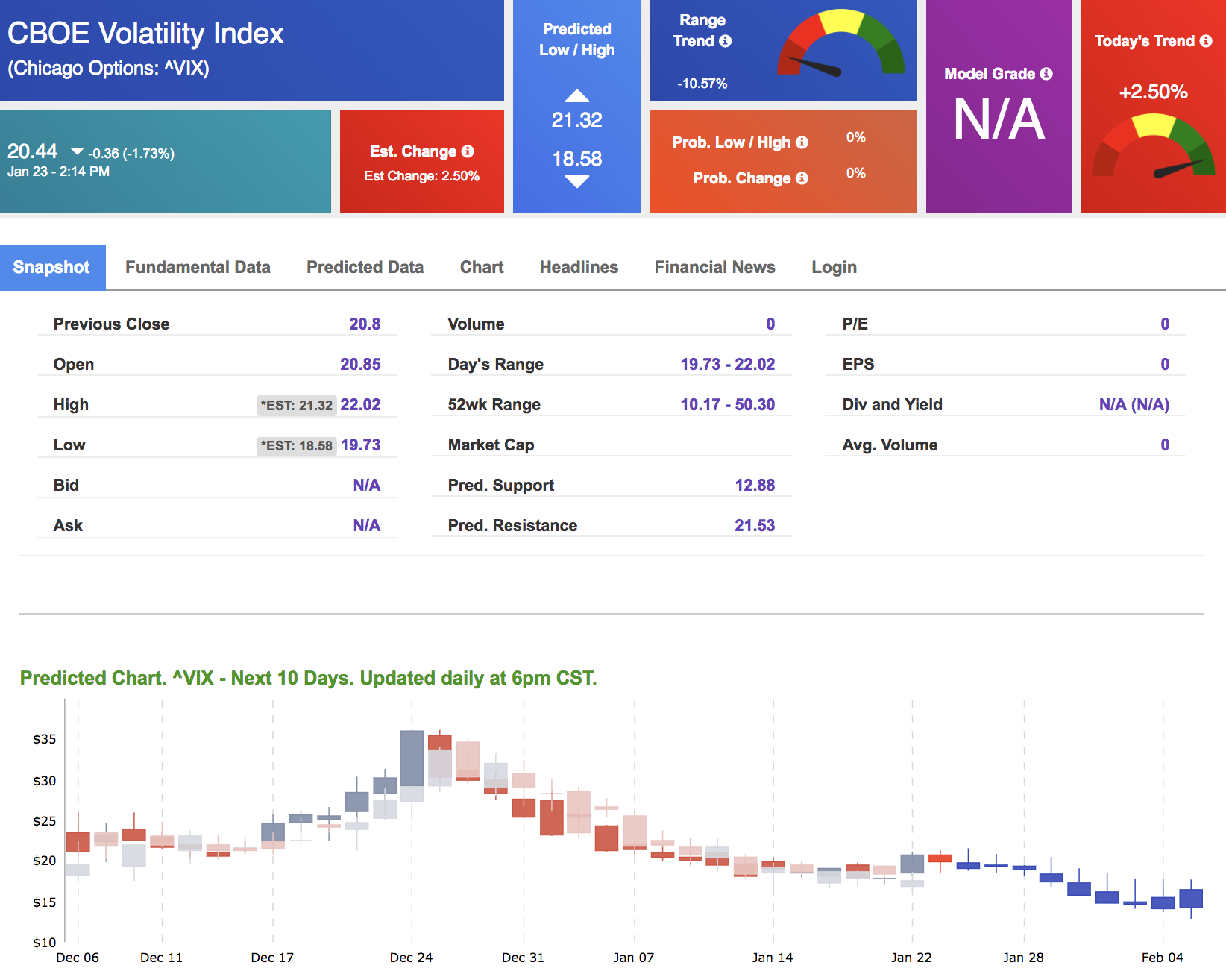

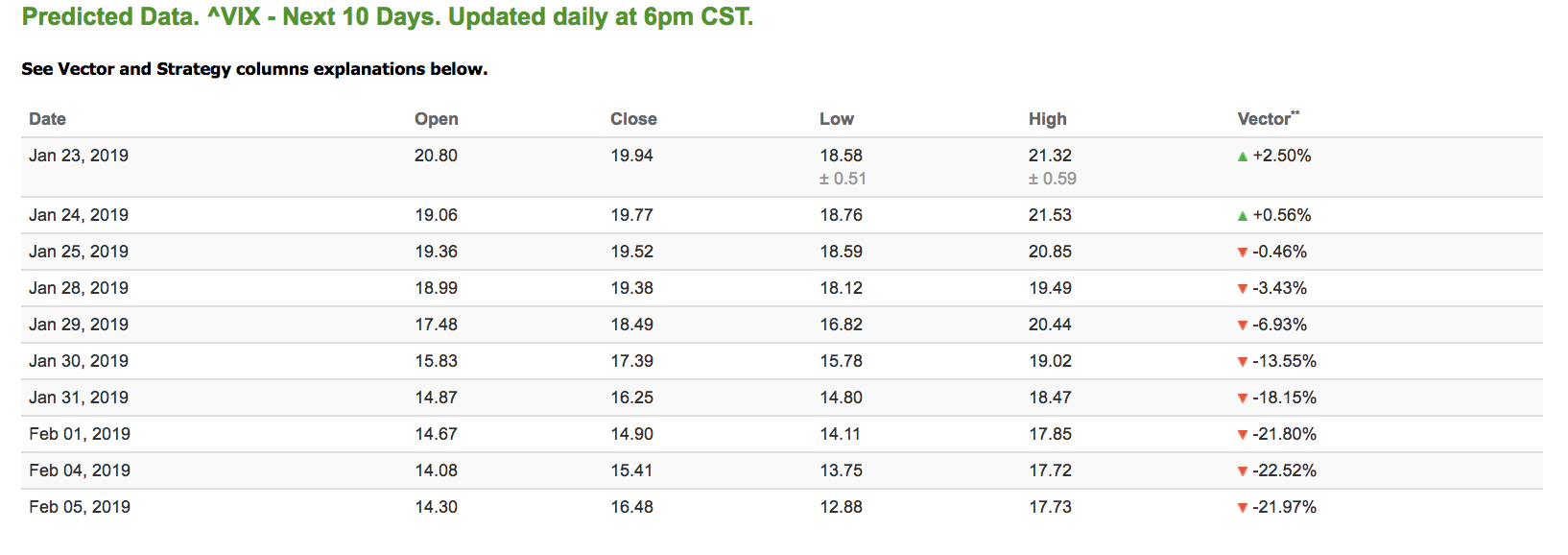

The CBOE Volatility Index (^VIX) is down 2.61% at $22.36 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $19.77 with a vector of +0.56%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Trailing 18-month return. . . 1,064%!

That can turn $100,000 into $1,164,415 in just 18 months!

- No way this offer will ever be repeated!

- Prices are going up significantly next week!

- One-time offer expires midnight tonight.