Financial and Tech Sectors Support Major U.S. Indices to Multi-Day Streaks

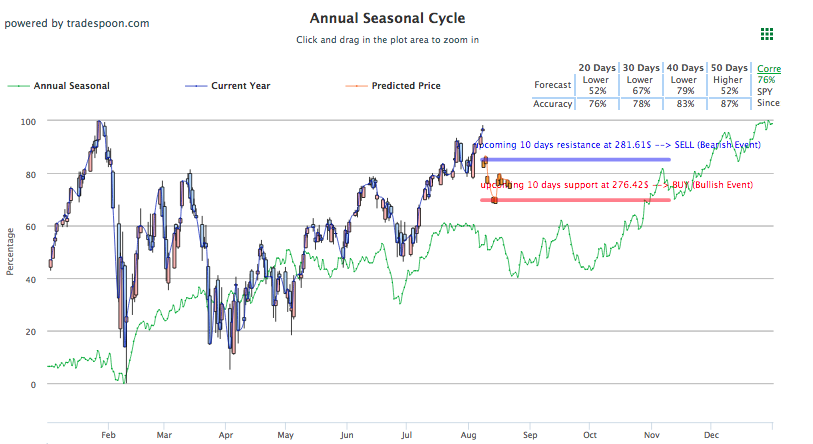

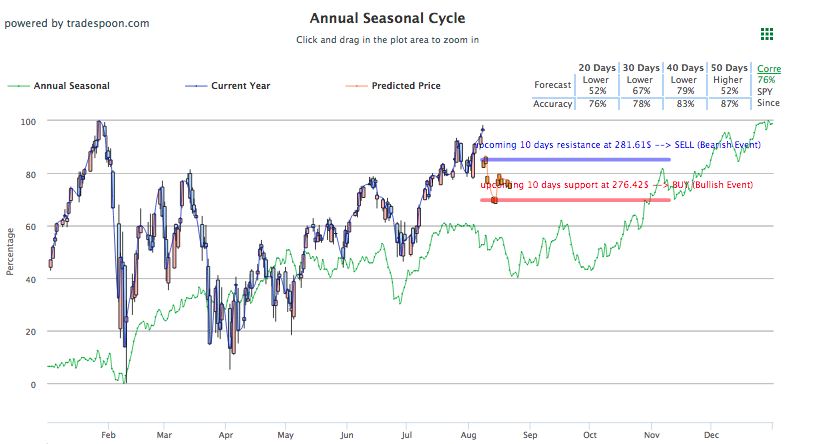

As earnings season nears an end the market remains overbought in my opinion. Investors and traders should look to hedge while the market awaits its next economic stimuli to take it above its 52 week high. Tech and financial sectors continue to lead the way as the S&P looks for its fifth straight day of gains, while the Nasdaq is on track for its seventh straight session of gains. CVS. Fox Inc and Twenty-First Century Fox, Prudential Public, and Southern report today. Tomorrow, Coca-Cola, Bridgestone, Pandora, Adidas, and Viacom report their second-quarter earnings. Monitor Seasonal Charts, SPY shown below, for optimal entry and exit positions and 20,30, 40, and 50-day forecast and accuracy predictions.

While geopolitical tensions have seemed to ease off markets, as more and more earnings came out, recent tariff action on both U.S. and China’s end indicate the summer of tariffs may not be over. China recently levied more tariffs while just today the U.S. released a list of companies said to be affected by the oncoming $16 billion in tariffs the U.S. plans to place on Chinese imports. Beijing has already responded declaring another $110 billion worth of tariffs could be coming. No major economic releases, other than earnings, or speeches are planned for the rest of the week.

Disappointing earnings for both Snap Inc. and Disney saw each company drop in early morning trading and continue to trend negatively. After originally seeing positive movement to the tune of 10% gains in response to Elon Musk’s consideration of taking Tesla private, the company has since begun to trend down, currently down 2% for the day. Yesterday, underperforming earnings reports from Marriott and Discovery saw both stocks down. Surprisingly, Office Depot saw a boost in sales when it reported earnings yesterday which boosted the stock’s shares through today, up 14% yesterday and holding an impressive 5% gain for today, at the time of publication. By the end of the week, over 80% of companies will have already reported and earnings will continue lightly the following week.

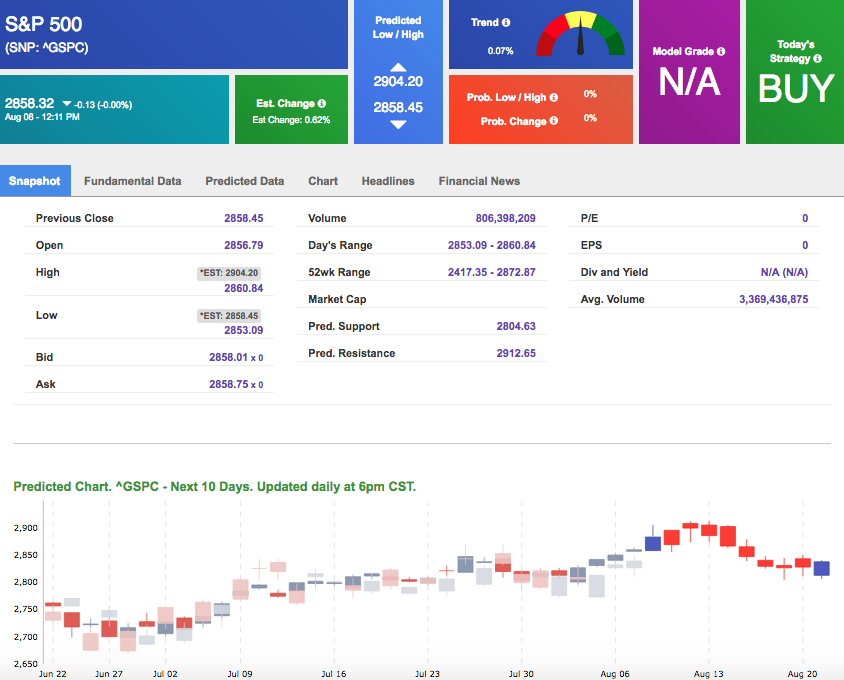

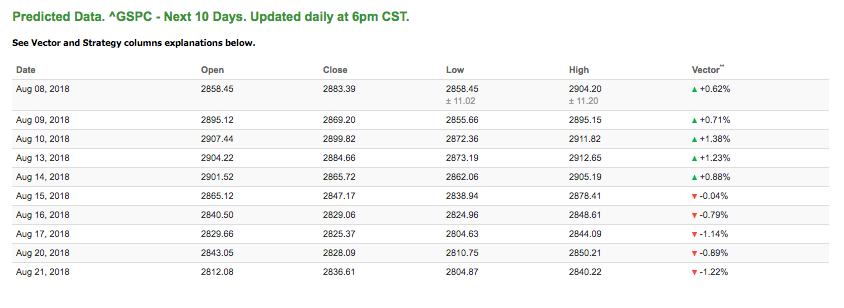

Using the ^GSPC symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.62% moves to -0.04% in five trading sessions. The predicted close for tomorrow is 2,869.20. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On August 7th, our ActiveTrader service produced a bullish recommendation for Archer Daniels Midland Co (ADM). ActiveTrader is included in all paid Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

ADM opened within Entry 1 price range of $49.90 (± 0.16) and moved through its Target price of $50.40 within the second hour of trading, reaching a high of $50.53. The Stop Loss was set at $49.40.

Live Trading Room Update

See how we traded in volatile conditions and what you might expect in our next Live Trading Room. During recent volatility, we held Live Trading Room Session where our winning trades ranged 8.16% to over 122% ROI!

Symbol Net Gain%

| TJX | 8.16% |

| ALL | 50.00% |

| ES | 9.37% |

| TJX | 122.22% |

| PH | 20.83% |

| XLY | 29.31% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time, but these Live Trading Sessions are only available for Premium Members.

We wanted to share the recording with you so you can see the profits you might be missing- even during volatile markets.

Must Watch Amazing Video: Click here to learn how Vlad picked 6 out of 6 big winners just yesterday. More to come…

Thursday Morning Featured Stock

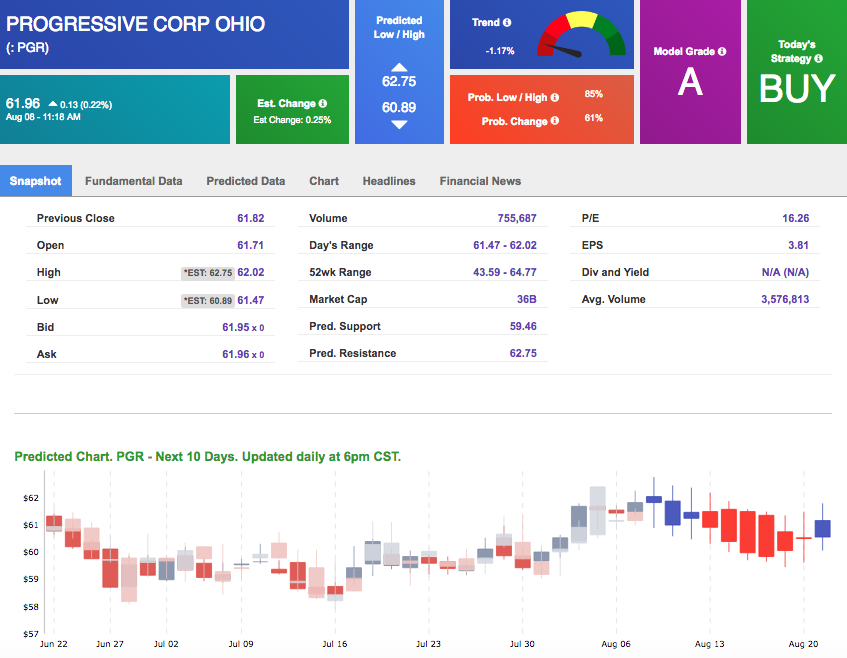

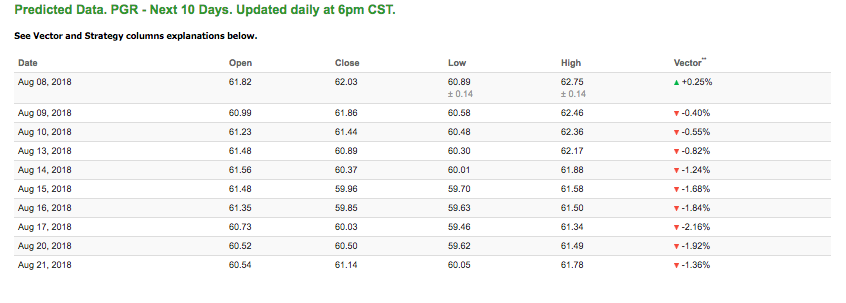

Our featured stock for Thursday is The Progressive Corp(PGR). PGR is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $61.96 at the time of publication, up 0.22% from the open with a +0.25% vector figure.

Thursday’s prediction shows an open price of $60.99, a low of $60.58 and a high of $62.46.

The predicted close for tomorrow is $61.86. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for September delivery (CLU8) is priced at $66.61 per barrel, down 3.73% from the open, at the time of publication. U.S. oil traded sharply lower today as prices neared a two-month low. Domestic crude supplies, as reported by the EIA, have unexpectedly dropped, while stockpiles have increased.

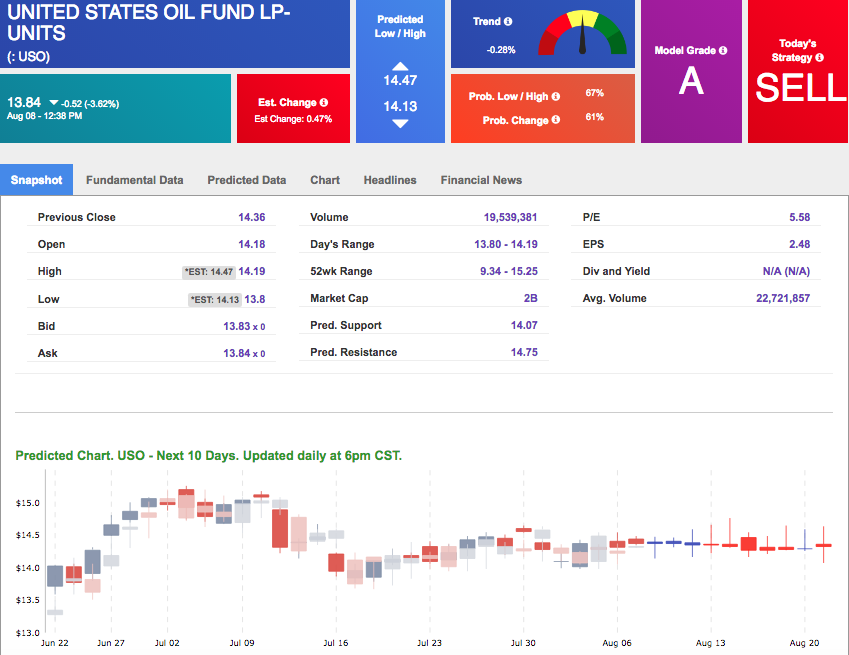

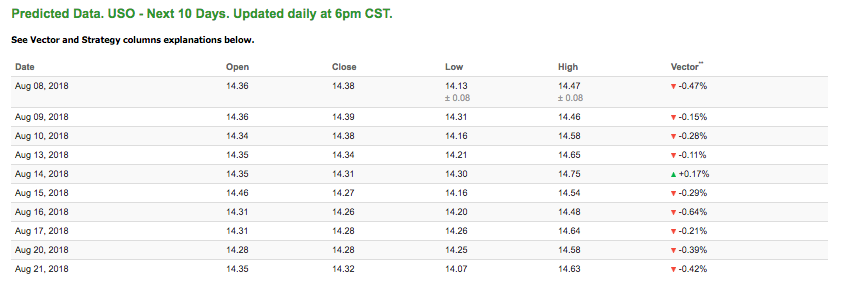

Looking at USO, a crude oil tracker, our 10-day prediction model mostly all negative signals. The fund is trading at $13.84 at the time of publication, down 3.62% from the open. Vector figures show -0.47% today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

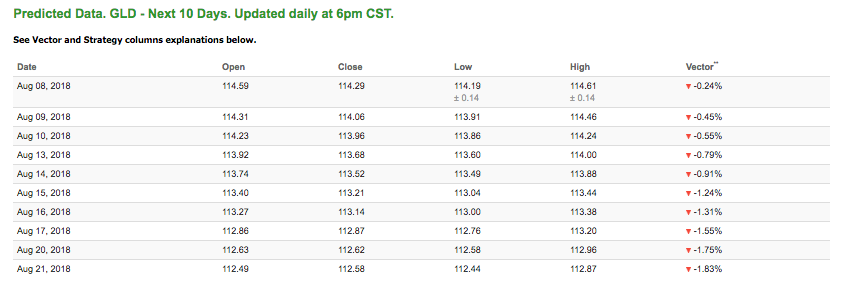

Gold saw some early morning action that had the commodity on the rise before lowering as it has all week. Counter to a strong dollar, this morning’s positive action by gold was a surprise, making modest gains. The price for December gold (GCZ8) is up 0.20% at $1,217.40 at the time of publication.

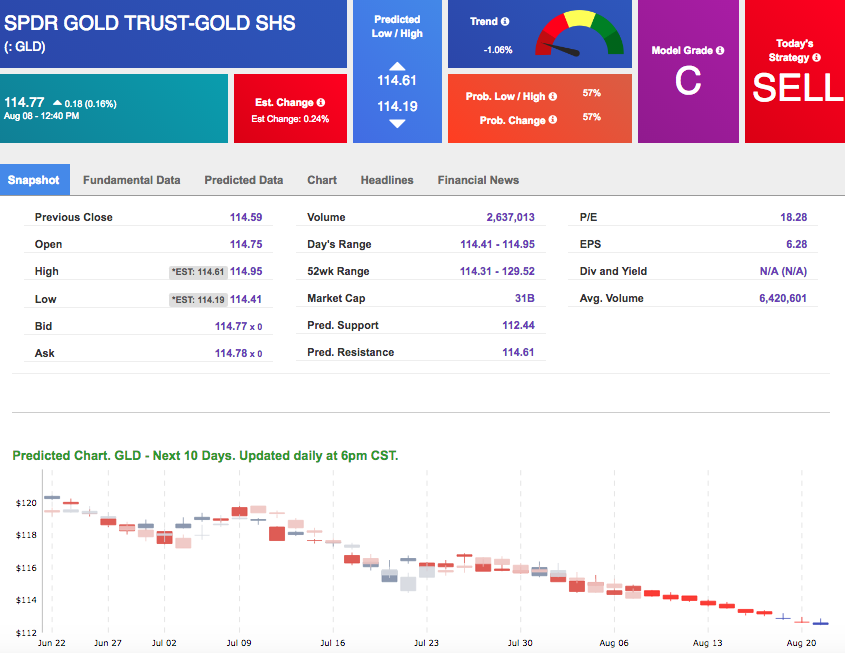

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows all negative signals. The gold proxy is trading at $114.77, up 0.16% at the time of publication. Vector signals show -0.24% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

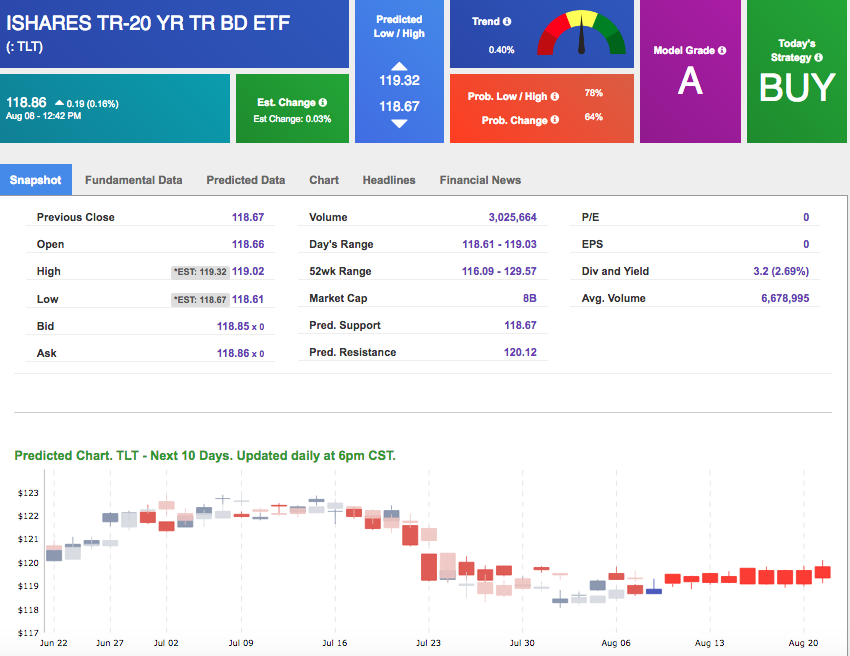

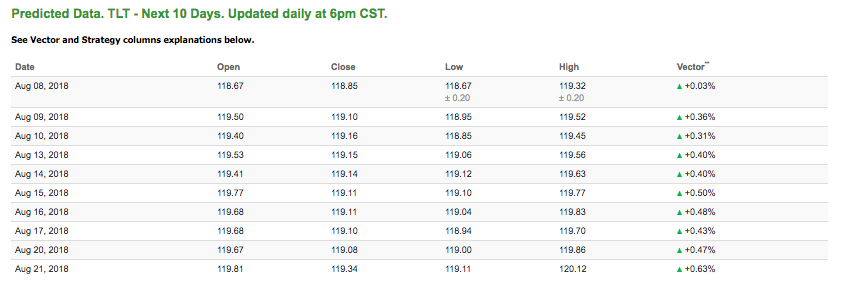

U.S yields rose ahead of 10-year note auction but have since dropped off. As prices rise, yields fall. The yield on the 10-year Treasury note is down 0.47% at 2.96% at the time of publication. The yield on the 30-year Treasury note is down 0.29% at 3.11% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see all positive signals in our 10-day prediction window. Today’s vector of 0.03% moves to 0.40% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

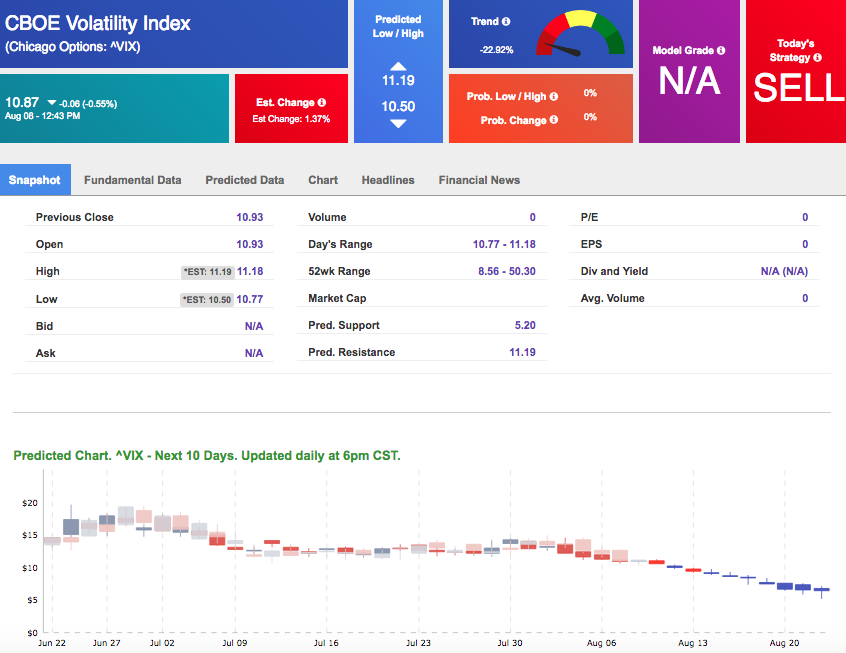

Volatility

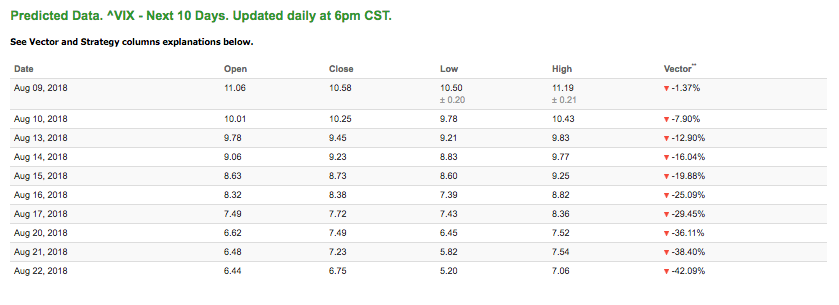

The CBOE Volatility Index (^VIX) is down -0.55% at $10.87 at the time of publication, and our 10-day prediction window shows all negative signals. The predicted close for tomorrow is $10.25 with a vector of -7.90%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Must Watch Amazing Video: Click here to learn how Vlad picked 6 out of 6 big winners just yesterday. More to come…