Flash Alert! Vlad Turns Bullish On Dirt Cheap Currency

RoboStreet – May 21, 2020

Bulls Embracing Reopening With Open Arms

News of all 50 states in the U.S. moving ahead with various phases of reopening their places of business and public facilities have been very well received by the stock market this past week. The timing of the passage in the House of Representatives of the $3 trillion HEROS Act this past Friday, Jerome Powell’s 60 Minutes interview last Sunday, and positive news of an early vaccine trail provided a strong catalyst for the rally.

Only a matter of time for SPY to trade above 200-day MA

The rally though isn’t without some fresh risks. The market paused on Wednesday on the news that Senate passed the bill to potentially delist Chinese companies from Exchanges. At this point, I expect only short term pullbacks and it is only a matter of time for SPY to trade above 200-day MA ($300 level by end of May/end of June.) Short term, if SPY trades below $289 level, there is still a high probability for the market to retest recent lows at $276.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Three percent daily market moves to persist

I expect the market volatility and the three percent daily market moves to persist. At this point, I believe we have set the bottom (the market can overshoot support and resistance levels especially when VIX is elevated.)

I believe the worst part of the sell-off is behind us. Please monitor VIX level as current levels are above the historical average. My strategy is to buy 5-10% market corrections.

(Want free training resources? Check our our training section for videos and tips!)

Based on our models, the market (SPY) will trade in the range between $270 and $310 for the next 4 weeks.

As the week progressed, there has been a noticeable move up in the euro, and one which looks to add to its gains. In a sign of unity, France and Germany agreed to support a $500 billion aid package to help EU regions and sectors hit hardest by the coronavirus pandemic.

The announcement saw the euro climb to $1.0955 as Chancellor Angela Merkel said the bonds issued by the European Commission would be repaid from the EU budget, most of which is covered by Germany.

“The plan amounts to a historic step by Germany away from its long-held opposition to mutual debt to fund other EU member states,” stated analysts at Eurasia group.

(Want free training resources? Check our our training section for videos and tips!)

Time to get long on EURUSD exchange rate

It might be time to get long the Invesco CurrencyShares Euro Trust ETF (FXE) which tracks the EURUSD exchange rate. There is a narrowing of the real yield differential between Germany and the U.S. that historically has led to the euro rallying in excess of 10% relative to the dollar.

There are also those that argue Europe’s economy will recover faster than that of the U.S. because they are coming out of COVID-19 sooner. This too might explain the recent bullish action in shares of FXE.

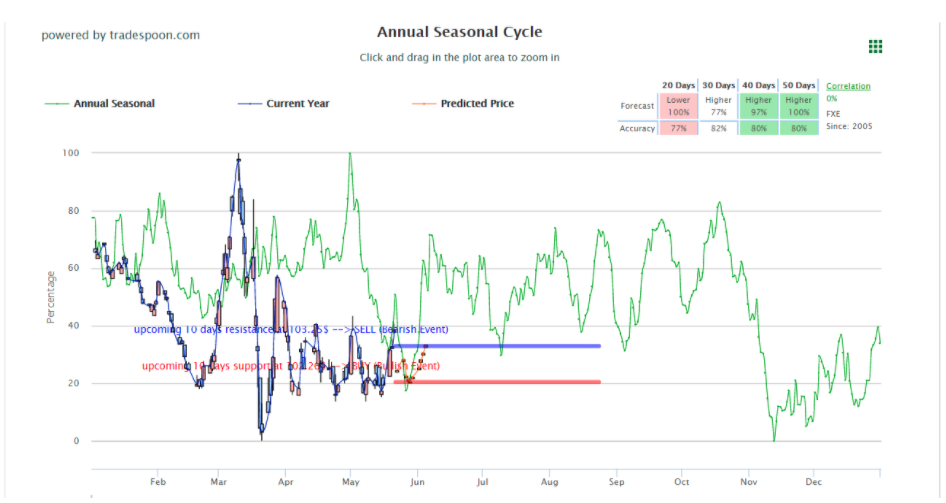

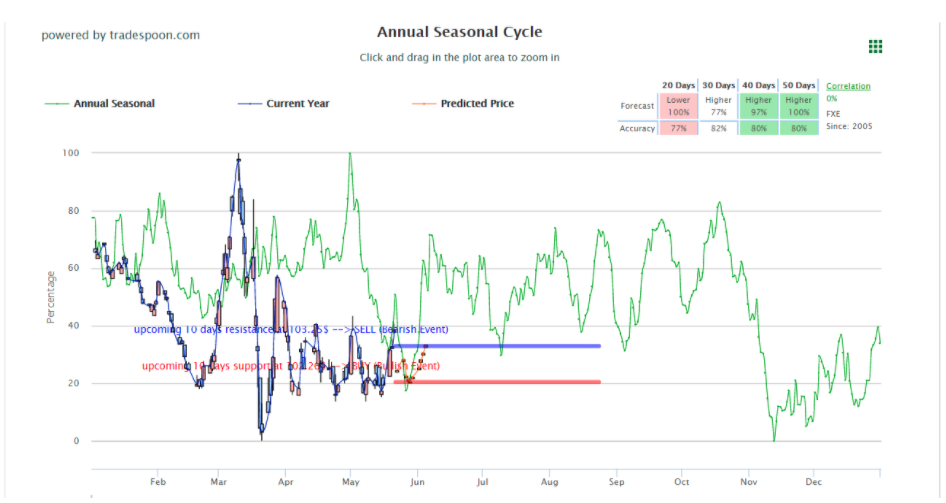

FXE resumption of the recent upside breakout trend for the next 20, 30, 40 and 50-day periods

Applying our Tradespoon AI tools to the FXE trade, we see our Seasonal Chart is showing FXE to be a bit overbought for the next 10 days and then a resumption of the recent upside breakout trend for the next 20, 30, 40 and 50-day periods.

Investors that want to follow my lead on this trade and other winning trades should join our RoboInvestor advisory service today. Within the RoboInvestor Portfolio, I recommend stocks and ETFs that cover the spectrum of individual equities, sub-sectors for equities, bonds, oil, gold, currencies, and volatility.

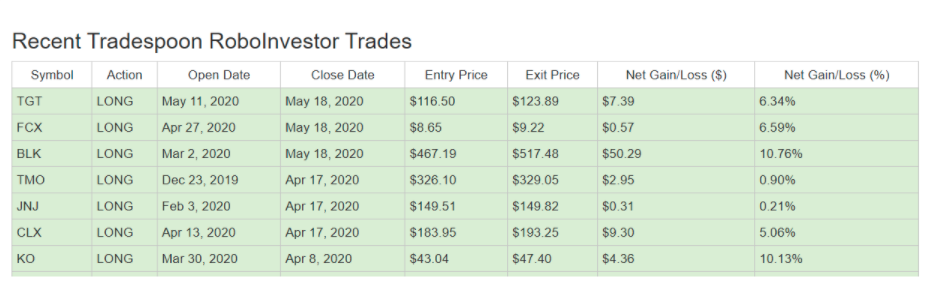

Our AI-driven asset selection algorithm has a winnings percentage rate of 87.86%

Our AI-driven asset selection algorithm has a winnings percentage rate of 87.86%, meaning we make money on about 9 out of every 10 trades we recommend. This kind of consistent money-making from the market is simply not found anywhere else. Below is a table of our most recent trades closed out – no losses, only profits.

My money is right beside yours on every trade

If you take your investment portfolio as seriously as I do, then don’t wait another day. Do yourself and your nest egg the biggest favor possible – put the power of AI to work full time 24/7 for your assets. Let RoboInvestor guide your way to market riches. My money is right beside yours on every trade. Join up, become a member, and do it today!

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”