Flash Alert! Vlad’s Top Bank Stock To Buy

RoboStreet – January 28, 2021

Shake Out Or Fake Out?

Wednesday’s steep sell-off followed by Thursday’s sharp rebound is a flashpoint for markets that have enjoyed a smooth ride to all-time highs. When volatility enters the fray, then it’s a sign that there might be a pause in the bullish action ahead that needs to be warranted. Plus, some of the market’s leading stocks are selling off on better-than-expected earnings reports, which also raises the caution flag.

On the flip side, there is so much cash sloshing around the globe from unlimited QE and stimulus that these capital flows continue to find their way into the equity markets, which helps explain the market’s ability to contain bouts of selling to just a day or two. Let’s leading up to this week, the buyers have outweighed the sellers by a wide margin, but when the buying starts to dry up in the ETF market, then it becomes a tug-o-war.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

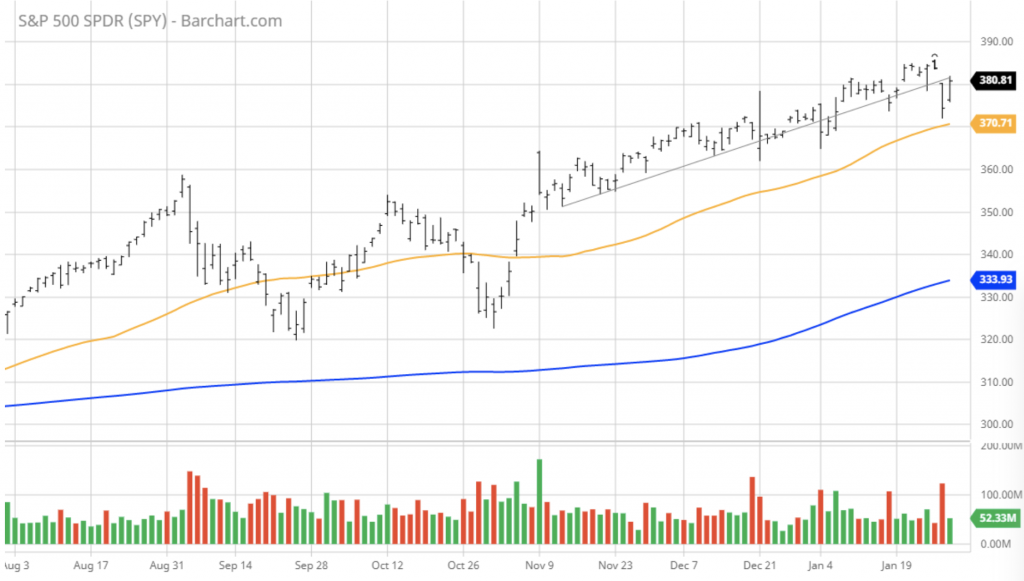

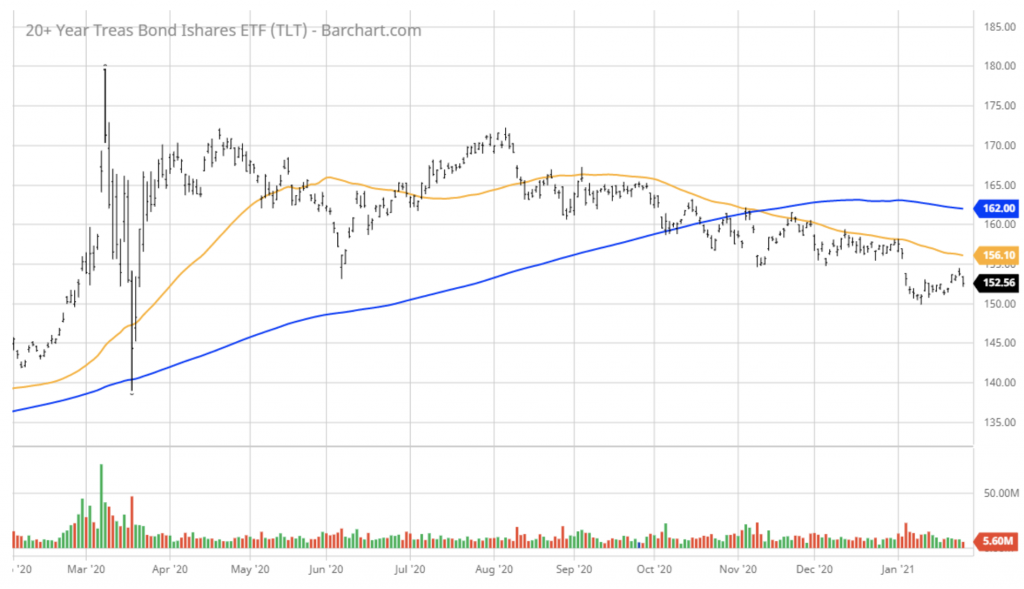

The SPY sold off on no specific news and reached $371 level. All sectors underperformed with the exception of retail (XRT). MSFT beat analyst estimates and NASDAQ was able to lead a rebound after strong earnings from FB, TSLA, and AAPL. However, there is no clear leadership in the market and more sell-off pressure is ahead of us. TLT and DXY are able to stage a small rebound. All eyes are on DXY and TLT, if they both continue to rebound from oversold levels, the SPY will have more pressure from the sellers.

The key support remains at $372 (worse case $364). Values stocks (JPM, CVX, etc) are approaching bullish entry levels (50 days MA). The bulls have been losing momentum and I still expect up to a 5% correction in early February after which the bull market will resume its long-term rally and will continue to make new highs into March-April. I would be a buyer using any short-term corrections and use a dollar-cost averaging strategy to accumulate positions.

As noted above, with all the talk of more stimulus coming through Congress and Fed Chairman Powell’s press conference this week that further affirmed $120 billion per month in QE until further notice, it stands to reason there is going to be downward pressure on the dollar.

However, Treasury Secretary Janet Yellen supports a strong dollar and if the market buckles, the dollar will hold its current level and may even rally a bit further, but longer-term the chart is bearish.

A third chart that bears monitoring is the direction of Treasury yields, which look to be heading higher. Shares of TLT broke their primary uptrend back in October and have been drifting lower as yields have been ticking higher. Higher yields are historically a good development for the stock market as money comes out of bonds and moves into equities per an acceleration of earnings growth.

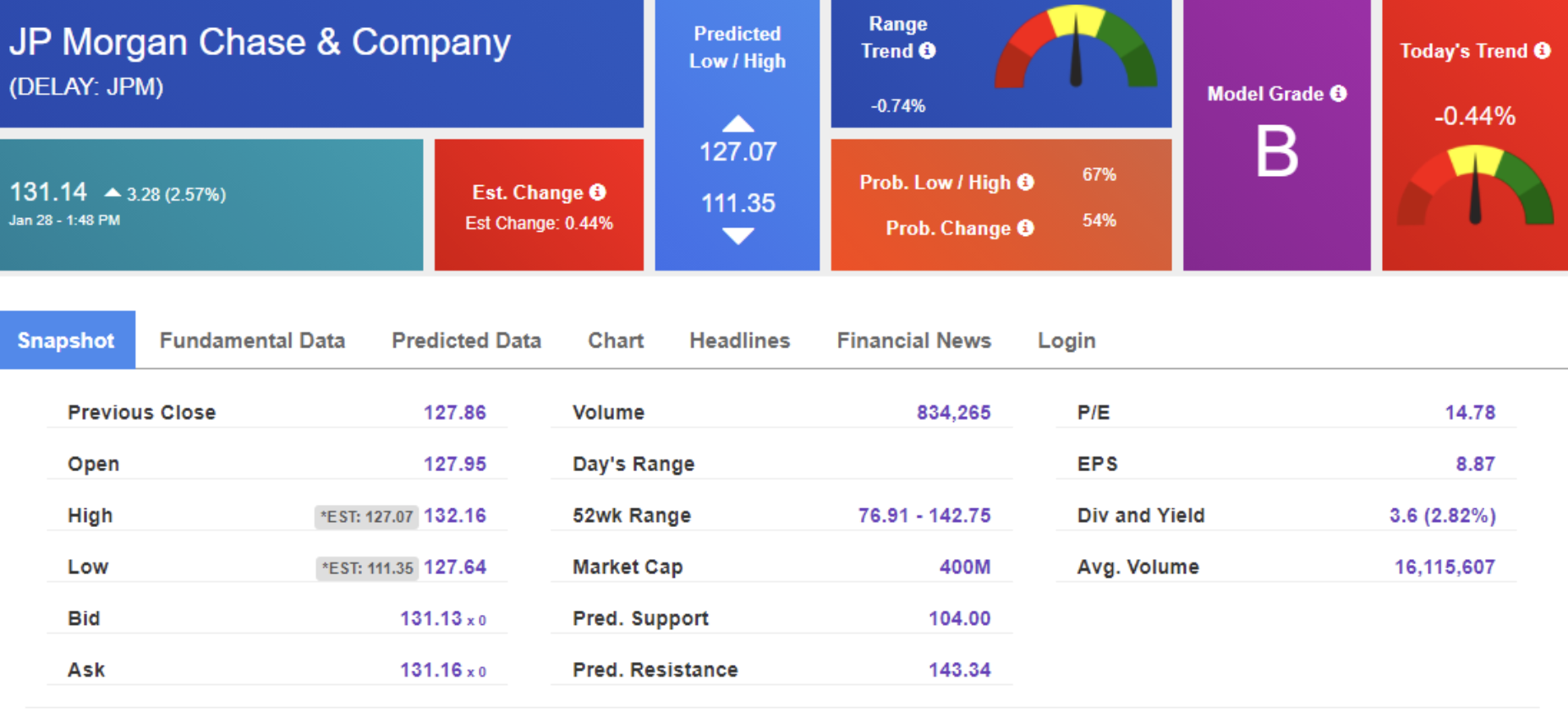

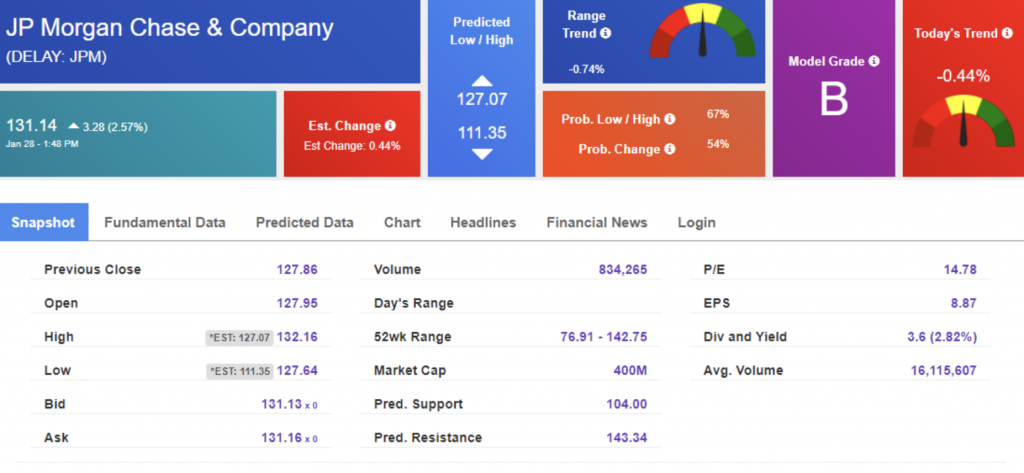

Higher yields are music to the bank sector, JP Morgan Chase & Co. (JPM) being our favorite name in the sector with which our RoboInvestor portfolio is active in. Using our AI-driven Forecast Toolbox we get a Predicted Resistance price target of $143.34 that implies a 10.3% move higher from its current level of $130 over the intermediate term.

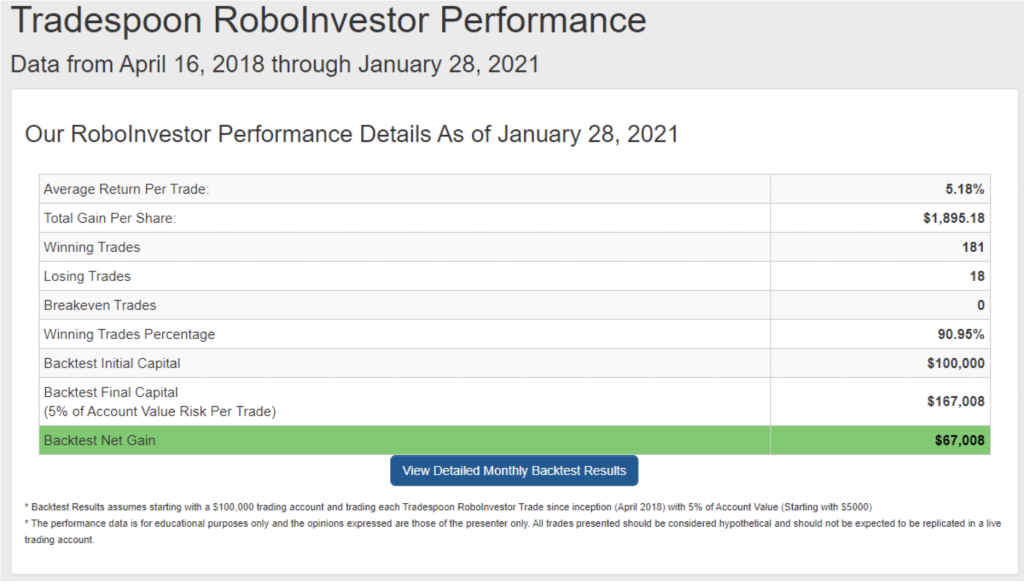

It’s this kind of rotation into financials and other economically sensitive sectors that we are skewing our RoboInvestor portfolio to where capital flows are on the rise. Investors that want the power of AI on their side to guide them through a more volatile market landscape can do so with confidence by being a RoboInvestor member. We’ve booked 20 straight winning trades going back to November 16. In fact, our Winning Trades percentage is an amazing 90.95%, meaning we profit on nearly every trade we put capital at risk.

Better than 9 out of every 10 trades generates a gain going back to April 2018 – a track record to the best of my knowledge is unmatched in the marketplace for investment advisory services. We trade blue-chip stocks and ETFs in indexes, sectors, currencies, commodities, interest rates, bonds, and volatility. We can go long or short.

My AI platform has been developed over many years and it continues to be refined, always thinking, always learning, always data crunching 24/7. We provide two trades every other weekend so you can act on Monday morning as to our latest strategies. We use daily alerts to exit positions when our AI indicators signal to do so. It’s that easy! And my own capital is invested in every recommendation. Give RoboInvestor a place in your 2021 wealth-building plans and be a part of a winning formula that has proven to be a powerful platform for growing portfolios.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.