Flash Alert! Vlad’s Top Dollar Trade

RoboStreet – September 3, 2020

Momentum Begets Momentum Until It Doesn’t

The frothiness of the past few weeks finally ran into some well-deserved profit-taking on virtually no news aside from a softer-than-expected ISM Non-Manufacturing index for August that slipped to 56.9% (consensus 56.7%) from 58.1% in July.

A notable pickup in the Prices Index

The key takeaway from the report is that it featured a notable slowing in the New Orders Index (56.8% from 67.7%) and a notable pickup in the Prices Index (64.2% from 57.6%). Some big declines in the mega-caps and growth stocks dragged the market away from record territory.

The pullback in these tech-related stocks is rooted in how crowded they became in recent days, simply got stretched and experienced upside price exhaustion that feeds on itself when triggered.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

TLT trade at the key support level ($165)

TLT and DXY price action support incremental gains in the stock market. DXY continued to trade in the well-defined range, and TLT is trading at the key support level ($165). Market dynamics support the reflationary trade where the value stocks will outperform the growth stocks (VTV is up 1.75% and testing the highest level since June).

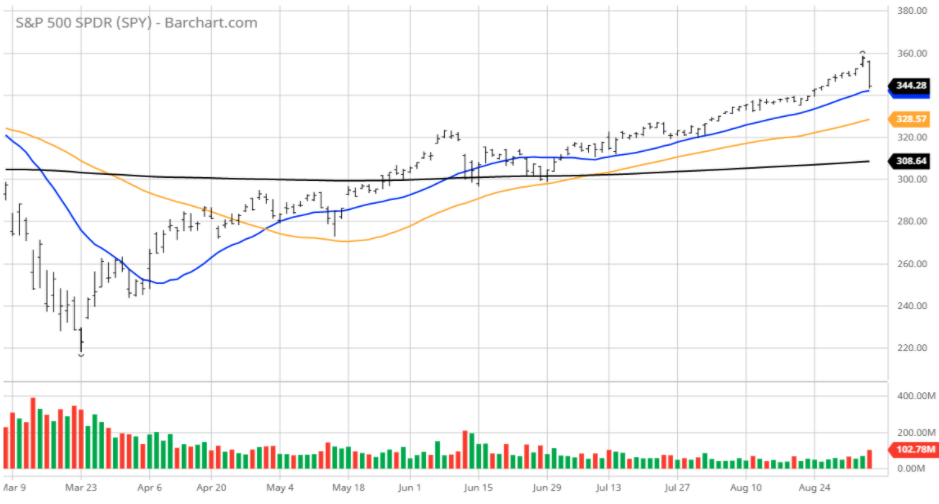

The short-term bottom is at $340

The short-term bottom is at $340 and potentially can be retested early September. SPY longer-term overhead resistance is at $360. I would be a buyer using any short-term corrections and use a dollar-cost average to accumulate positions.

Based on our models, the market (SPY) will trade in the range between $340 and $360 for the next 4 weeks.

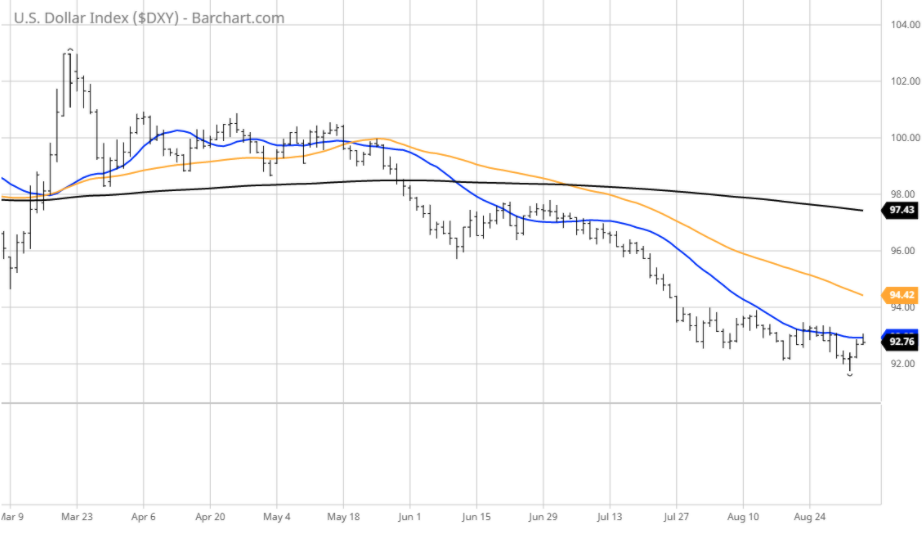

As the market consolidates its gains, investors should pay close attention to the direction of the dollar, which is on the verge of breaking down further against the euro and other key currencies. Shares of the Dollar Index (DXY) tested key support at $92 and got a brief oversold bounce up to its 20-day moving average.

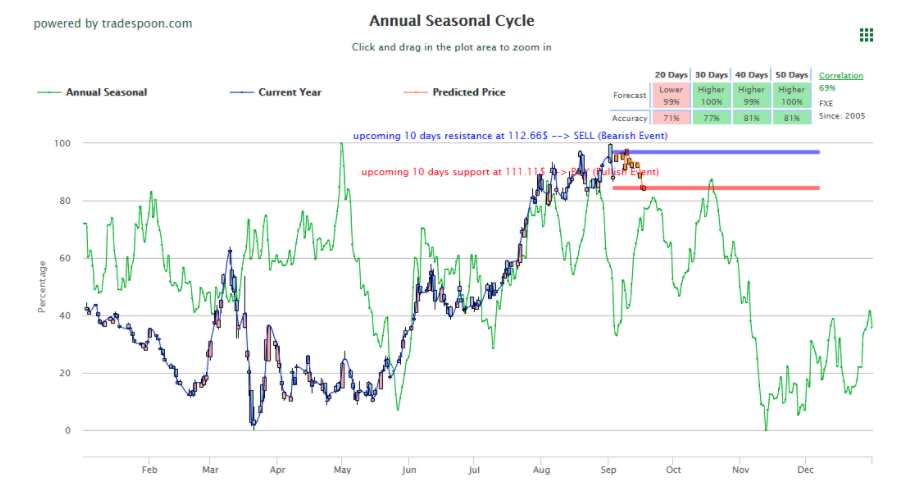

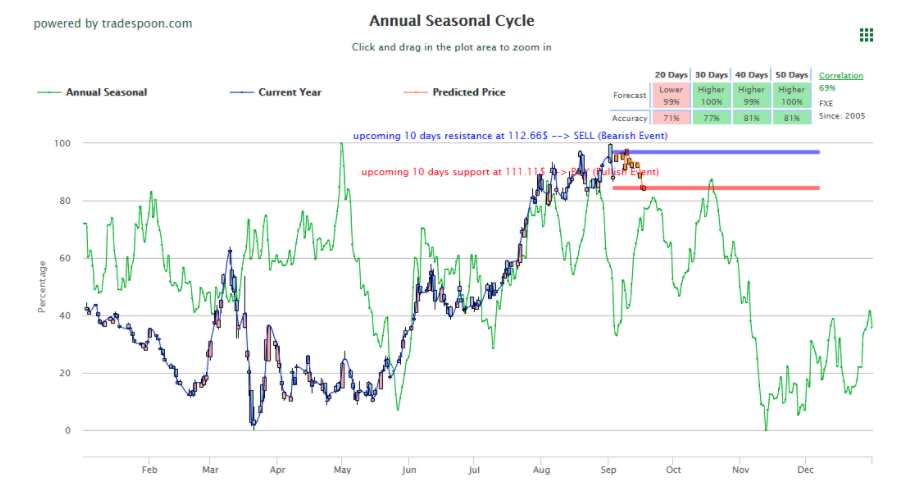

Looking at the Invesco Currency Shares Euro Currency Trust ETF (FXE) as a premier vehicle, our AI-driven Seasonal Chart shows that the current pullback in the share off recent highs is providing a buying opportunity in the next 20 days and then is expected to resume its uptrend for the next 30, 40 and 50-day periods.

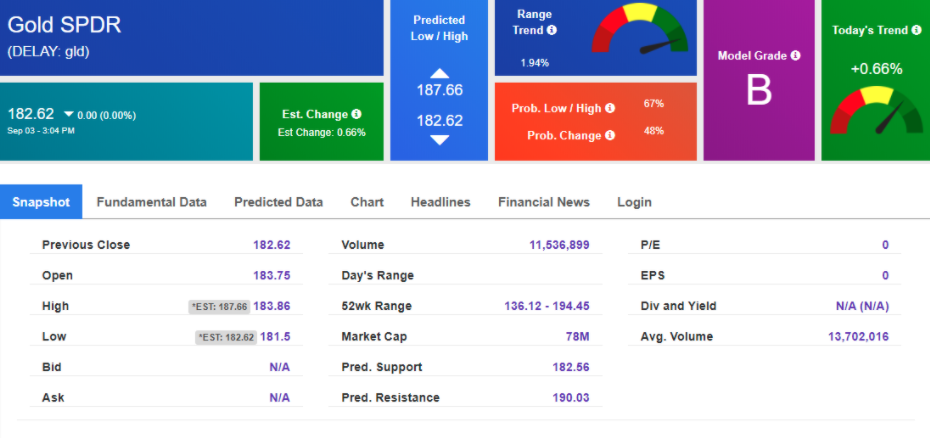

We just rounded out a full position in the SPDR Gold Shares (GLD)

The other beneficiary of a weak dollar is gold, and we just rounded out a full position in the SPDR Gold Shares (GLD) for our RoboInvestor Portfolio. Another of our tools on our AI platform, the Stock Forecast Toolbox, shows the next predicted technical resistance level for GLD is $190, implying a nice move higher from its current level.

(Want free training resources? Check our our training section for videos and tips!)

When the stock market runs into a period of higher volatility and uncertainty, having the power of AI working for your portfolio isn’t just a preferred advantage, it’s an essential set of always thinking tools.

(Want free training resources? Check our our training section for videos and tips!)

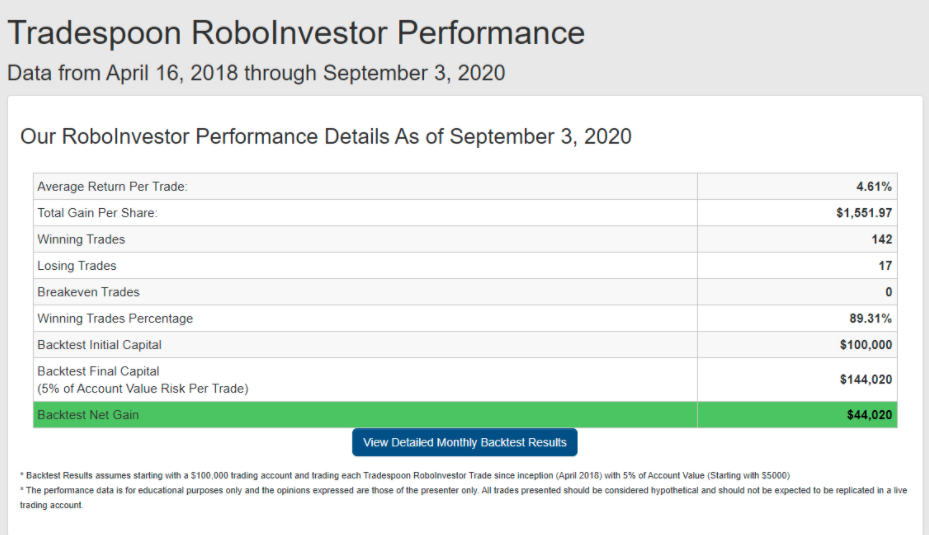

Our Winnings Trade Percentage is 89.31%, meaning every time we put capital at risk in the market, we profit on about 9 out of every 10 trades, with an average return per trade of 4.61%. Members of RoboInvestor enjoy a smooth ride to wealth building when they own only the highest-quality blue-chip stocks and ETFs.

Our AI platform ferrets out great trades in commodities, currencies, precious metals, bonds, and volatility

We don’t limit our RoboInvestor Portfolio to only equities either like so many advisory services. Our AI platform ferrets out great trades in commodities, currencies, precious metals, bonds, and volatility. If we get into a bear market, we’ll adjust our strategies to profit from downside momentum.

We’re buying the dips in the primary bull trend

At present, the primary bull trend is intact and we’re buying the dips per our proprietary indicators that guide us during times when uncertainty is running high. And this week, we’ve just entered one of those periods. Investing without a cutting-edge AI platform is like climbing a tree with one hand tied behind your back.

Take me up on my offer to have my decades of work in developing the finest set of AI tools available to retail investors and become a member of our RoboInvestor community. We put out two new recommendations every two weeks and alert you constantly throughout the week for entering orders with specific parameters. We do all the work and everyone prospers. Make RoboInvestor your best investment of 2020.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

(Want free training resources? Check our our training section for videos and tips!)

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

(Want free training resources? Check our our training section for videos and tips!)