FOMC and Government Shutdown Headline News Heavy Week

Major U.S. indices are down today after recording big losses to end last week. General trade optimism weened and economic reports from both the U.S. and China signaled at a more problematic recoupling for two of the world’s biggest economies. Industrial and retail data for China was lower than expected while U.S. manufacturing and service sectors fell to quarterly lows. Still, signs point to the nations working on a resolution as China has announced a three-month halt on auto tariffs starting in the new year, which follows the first major purchase of U.S. produce since the trade war started. Other major news to monitor this week includes the final Federal Reserve meeting for 2018 and the partial government shutdown that could occur should the border security budgetary issues do not get resolved. Currently, the market is retesting 2018 lows as the SPY broke $260. This is an outright bearish event and, in the short term, expect a potential pullback in the range of 5%-10%. For reference, the SPY Seasonal Chart is shown below:

The final two-day Fed meeting begins tomorrow and as many projected a fourth interest rate hike will likely be introduced. Powell will hold a press conference following the conclusion of the meeting and comments from the Fed Chair should inform investors for 2019 policy projections and direction. Other U.S. issues to follow this week include the possible government shutdown and the continued testimony of former FBI DIrector James Comey. A closed-door testimony will be made to the House’s oversight and judiciary committees. Situationally, the House and Senate will continue discussing ways to a avoid a government shutdown while retiring Republicans have signaled they do not intend to show up to any further votes on the matter. Several government agencies will run out of funding on December 21st and if a deal is not agreed upon regarding the annual homeland security budget and the border wall expect a partial government shutdown.

Several economic reports scheduled for this week include housing starts, existing home sales, and GDP Price Index. Earnings season is still a couple weeks away but reports will begin increasing next week, while this week we will see earnings from Oracle, Red Hat, FedEx, Micron, and Nike. On Friday, stock index futures, stock index options, stock options, and single stock futures will all expire in what is a called a quadruple witching, something that occurs for times in a year.

Globally, Asian markets are up today while European stocks are struggling. Some geopolitical developments to monitor include the recent comments from North Korea and the Yemen airstrikes. While commemorating the anniversary of Kim Jong II’s death, North Korea levied harsh words towards the U.S. and stalled nuclear talks. North Korea would like to remove the high ranking officials from these talks and continue negotiations on a direct level, likely in another Trump and Kim Jong Un summit. Elsewhere, tensions are escalating in Yemen after an unsuccessful start to a planned cease-fire saw pro-government airstrikes, resulting in several casualties. The airstrikes come from Saudi Arabia, currently engulfed in a violent coup that is backed by Iran. Global aid was blocked and it looks like the Yemen civil war will continue to despite the somewhat promising ceasefire that was planned. On Thursday, the Senate passed a vote to end American military aid for Saudis in response to the killing of Washington Post journalist Jamal Khashoggi while also limiting presidential war powers. As Yemen’s economy collapses, look for more global efforts to subvert the current crisis and likely geopolitical repercussions that would come.

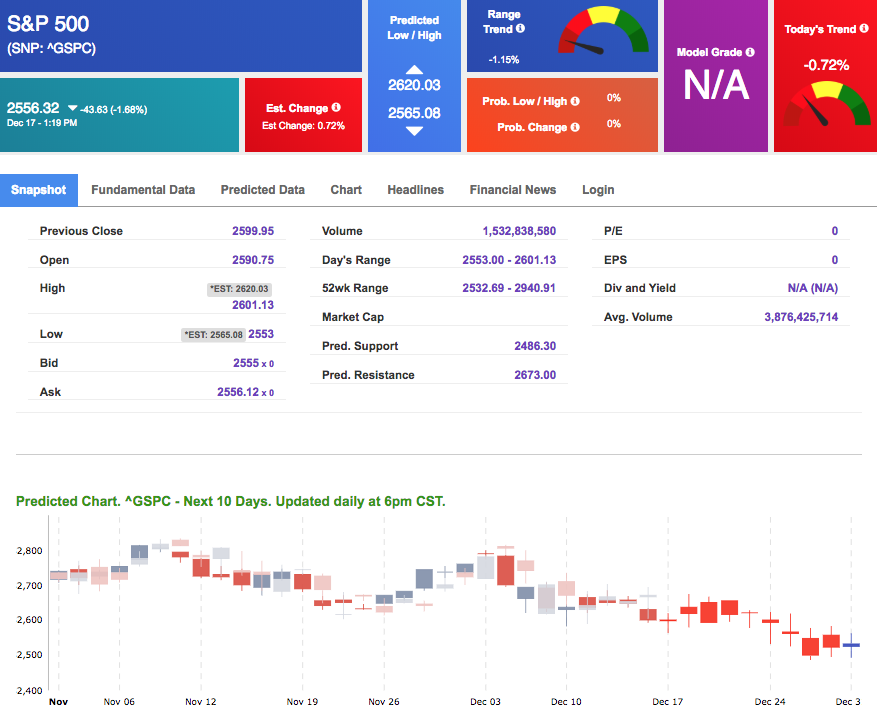

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.72% moves to -1.02% in five trading sessions. The predicted close for tomorrow is 2,620.03. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

YEAR-END SPECIAL:

Back by popular demand and to end the year on a good note, we are once again making the Lifetime Premium Membership available! Today only, we are offering LIFETIME ACCESS to our Premium Membership for less than the price we are currently charging for only 1 year of service!

CLICK HERE to Sign-up

Highlight of a Recent Winning Trade

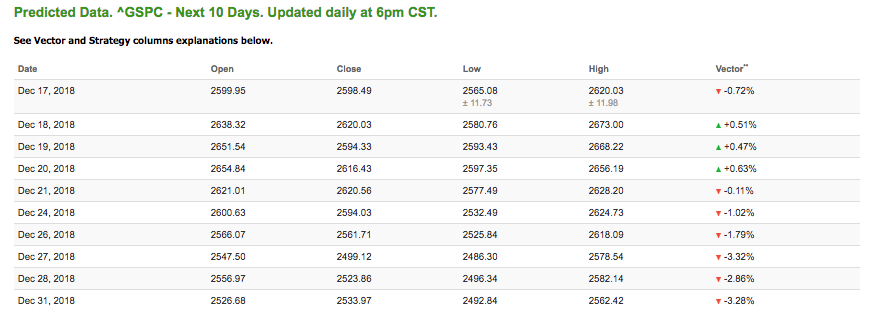

On December 11th, our ActiveTrader service produced a bullish recommendation for Edwards Lifesciences Corp (EW). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

EW entered the forecasted Entry 1 price range of $161.92 (± 1.11) in its third hour of trading and hit its Target price of $163.54 in that second to last hour of trading that day. The Stop Loss was set at $160.30.

Tuesday Morning Featured Stock

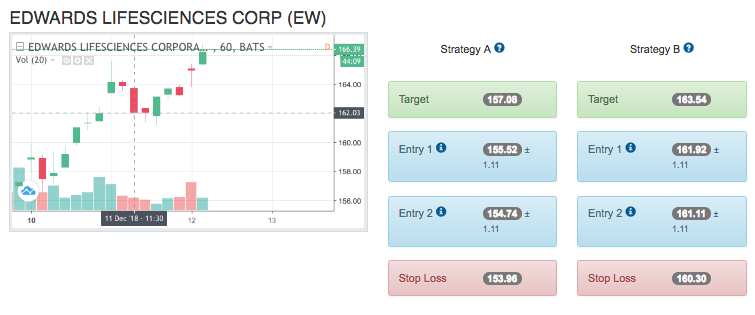

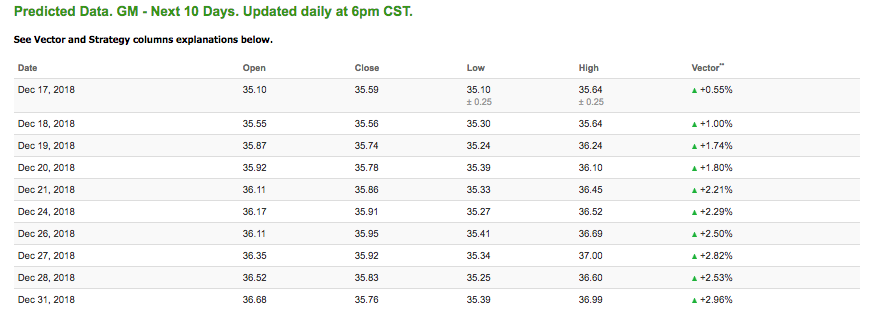

Our featured stock for Tuesday is General Motors Company (GM). GM is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $35.06 at the time of publication, down 0.11% from the open with a +0.55% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

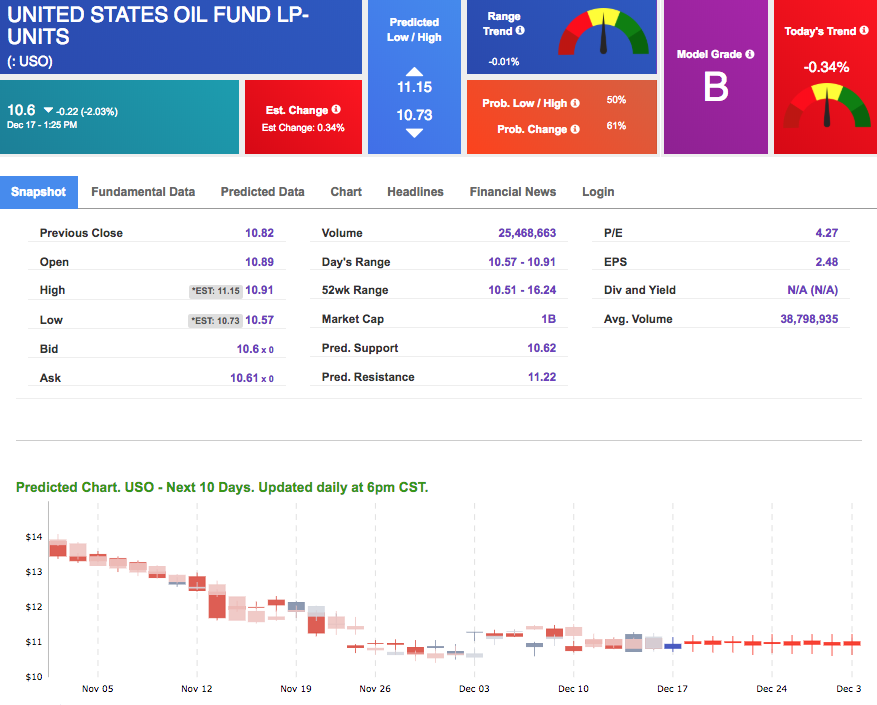

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $49.76 per barrel, down 2.81% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $10.6 at the time of publication, down 2.03% from the open. Vector figures show -0.34% today, which turns +0.13% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

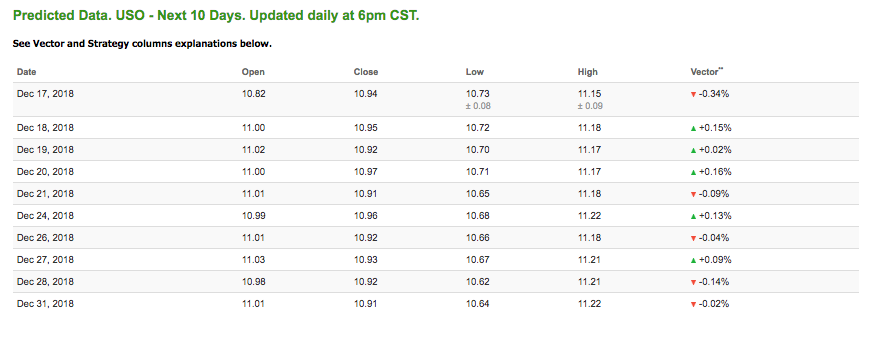

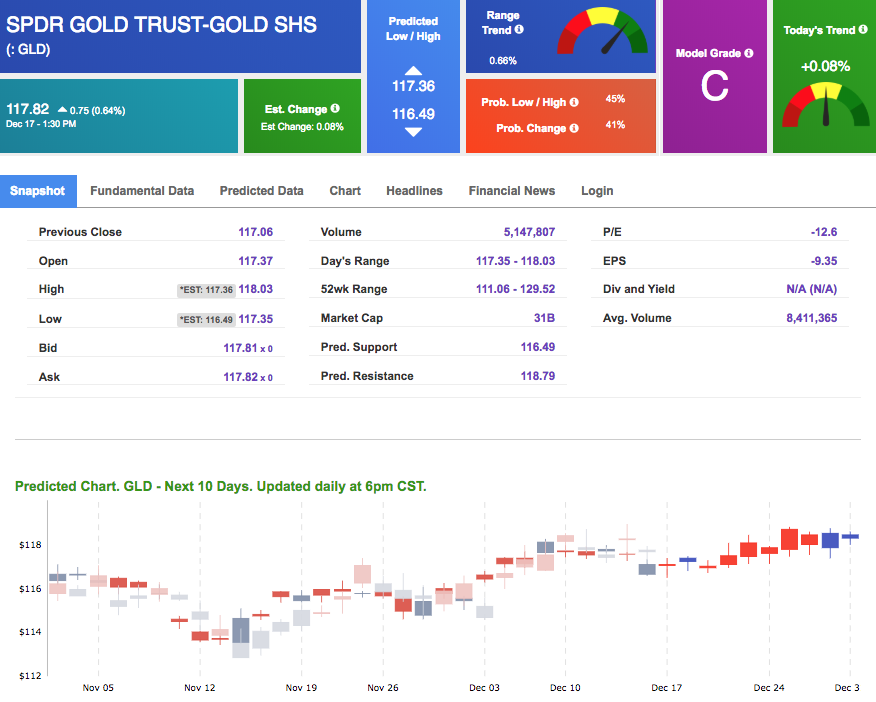

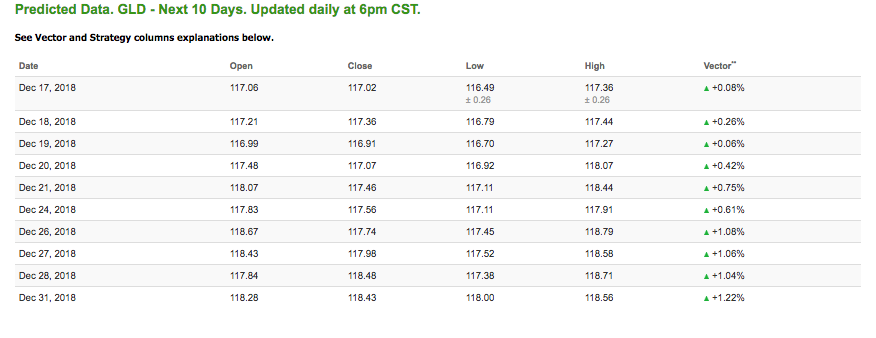

Gold

The price for February gold (GCG9) is up 0.65% at $1,249.50 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $117.82, up 0.64% at the time of publication. Vector signals show +0.08% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

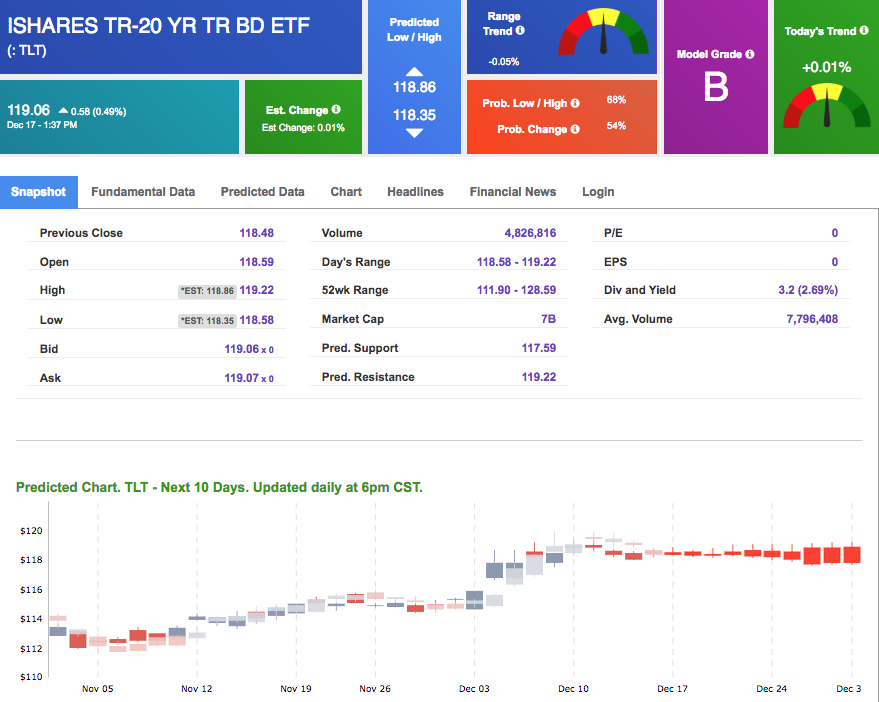

The yield on the 10-year Treasury note is down 1.25% at 2.86% at the time of publication. The yield on the 30-year Treasury note is down 1.00% at 3.11% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of +0.01% moves to -0.06% in two sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

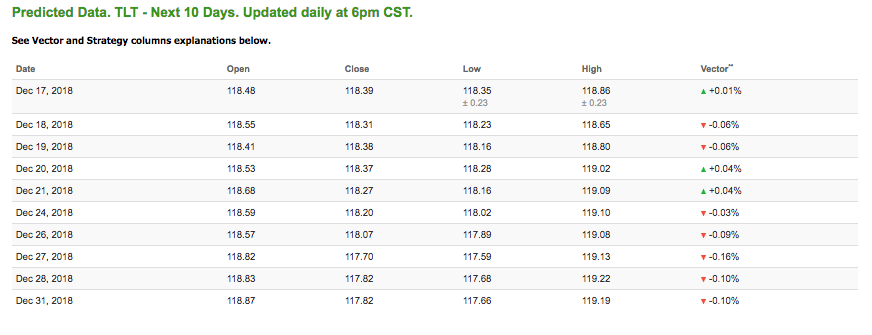

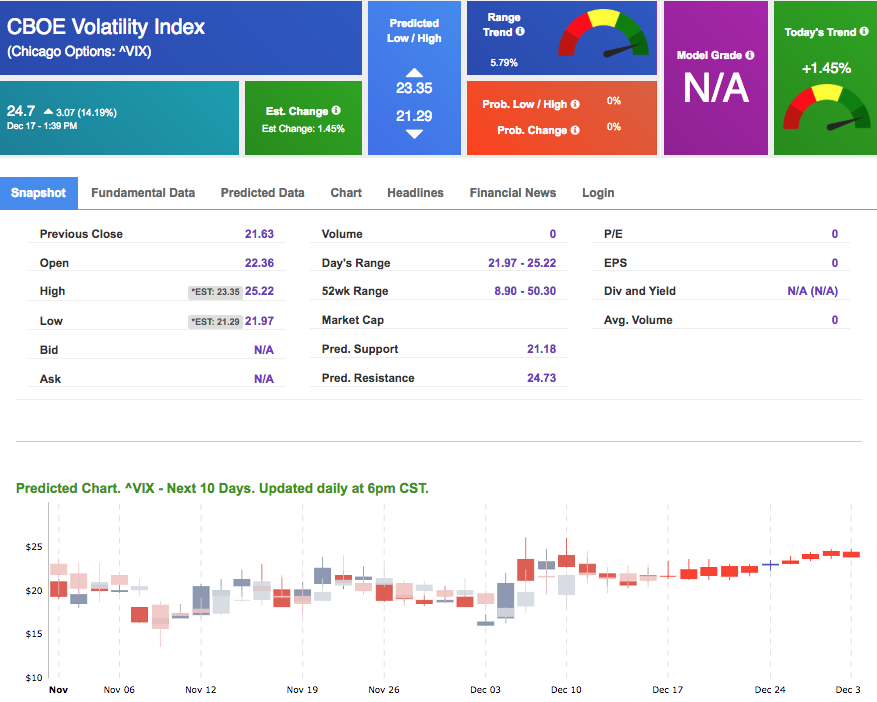

Volatility

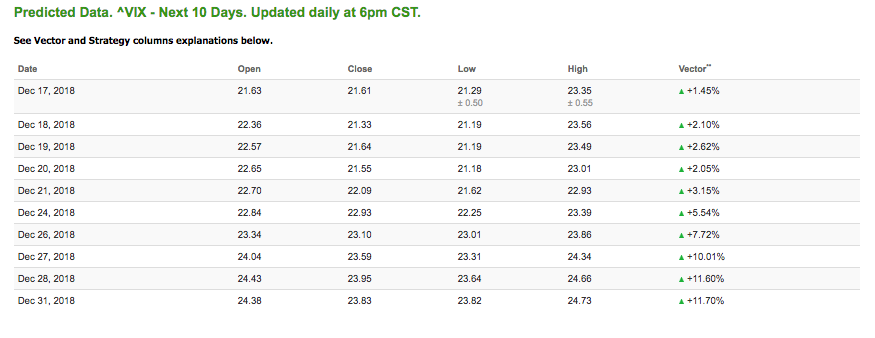

The CBOE Volatility Index (^VIX) is up 14.19% at $24.7 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $21.33 with a vector of +2.10%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

YEAR-END SPECIAL:

Back by popular demand and to end the year on a good note, we are once again making the Lifetime Premium Membership available! Today only, we are offering LIFETIME ACCESS to our Premium Membership for less than the price we are currently charging for only 1 year of service!