FOMC January Minutes Released, Markets Modestly Up

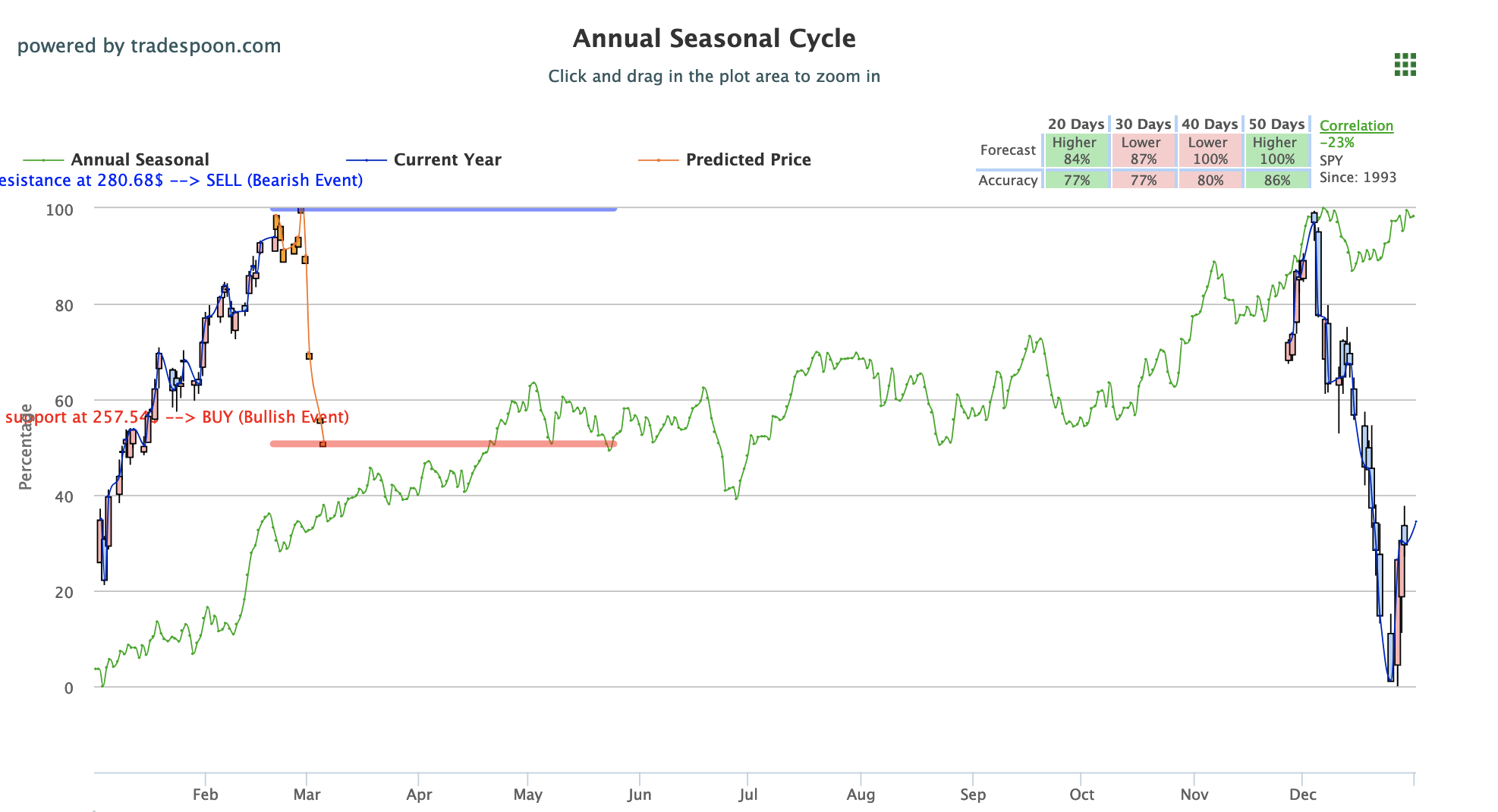

U.S. indices modestly rose in early morning trading ahead of today’s Federal Open Market Committee January-meeting minutes release. Global trade talks remain in the spotlight with developments in both China-U.S.and Brexit negotiations, ahead of their respective deadlines. Earnings season continues to wind down though several big-name companies are still scheduled to report. SPY support is currently at $272, which is the 200-day moving-average. If the average drops below this level we expect a downward trend. Based off most technical indicators the market is oversold and our strategy, for the time being, remains: buy the selloffs, avoid chasing the markets. For reference, the SPY Seasonal Chart is shown below:

FOMC Minutes from last month’s meeting were released today and indicated several interesting developments in policy and sentiment. Fed officials look to be split between two groups, those that believe rates should be raised if the economy continues this year as expected and those that believe rates should only be raised when key inflation indicators are met. These two groups still encourage a more dovish sentiment as expected after the four interest rate hikes we saw in 2018. Elsewhere, it was noted that most officials are in support of stopping the reduction of the balance sheet. This, in turn, indicates a more flexible Fed but will be more clear once upcoming policy updates take place. Currently, two interest rate hikes are expected in 2019.

Elsewhere, negotiations between the U.S. and China continue in Washington today. President Trump has once again reinforced his patient stance regarding the upcoming deadline for tariffs increased, stating there is “nothing magical” about March 1st. Recent news surrounding the meetings has now shifted towards a focus on currency with the U.S. looking for a policy from China that would keep the yuan, the Chinese currency, stable. Still, efforts to depreciate the yuan to counter tariffs will likely be met with more tariffs by the U.S., as previously noted by the Trump administration, and is worth monitoring. Globally, Asian markets closed higher along with European markets which also modestly rose.

Earnings continue to slowly roll out as the season winds down. CVS and Walmart reported recently while Kraft, HP, Nissan, and Berkshire are scheduled to report this week. Yesterday, Walmart earnings topped expectations helping shares rise 4%. However, today shares are struggling behind the news that the recent merger with British grocery chain J Salsbury is being blocked. CVS released earnings before market open today which missed expectations and is currently on track to close at almost 8% down. Next week will feature several key retail earnings such as Home Depot, Macy’s, Lowe’s, Best Buy, L Brands and more.

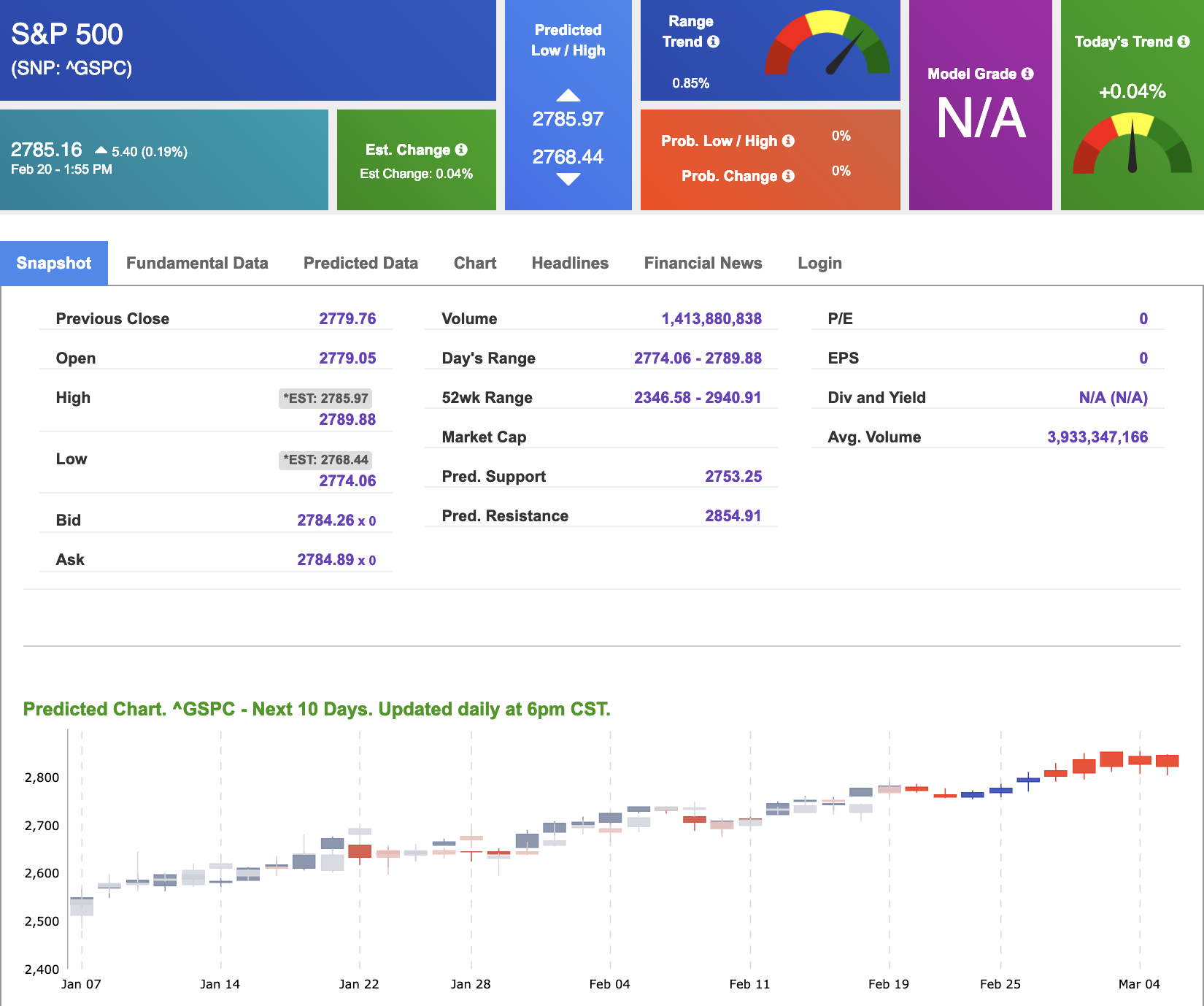

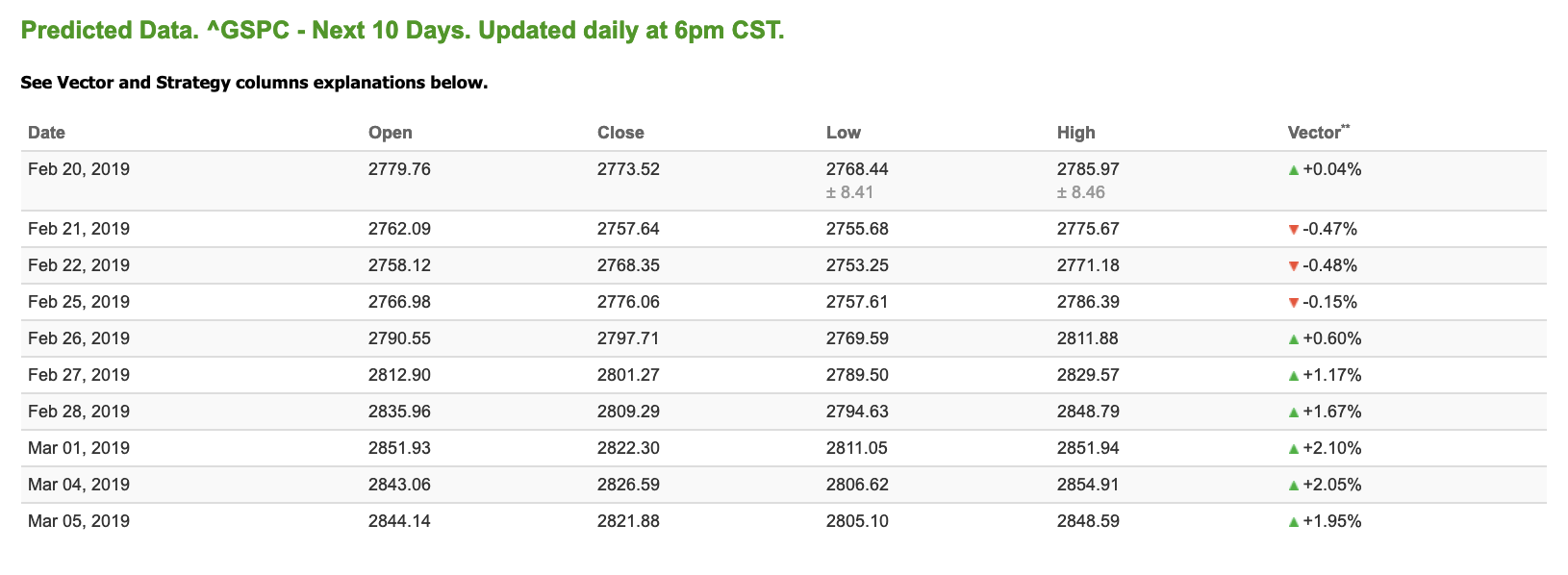

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.04% moves to +1.17% in five trading sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(LAST CHANCE) You Don’t Want to Miss This!

Today only, we are doing something we have RARELY do!

We are offering LIFETIME ACCESS to our Tools Membership for less than the regular price we normally charge for only 1 year of service!

***Starting next week, we will be adding an annual maintenance fee to all lifetime memberships, but if you sign up before that happens, you will be locked in and will not need to pay this fee!

Click Here to For More Information

Highlight of a Recent Winning Trade

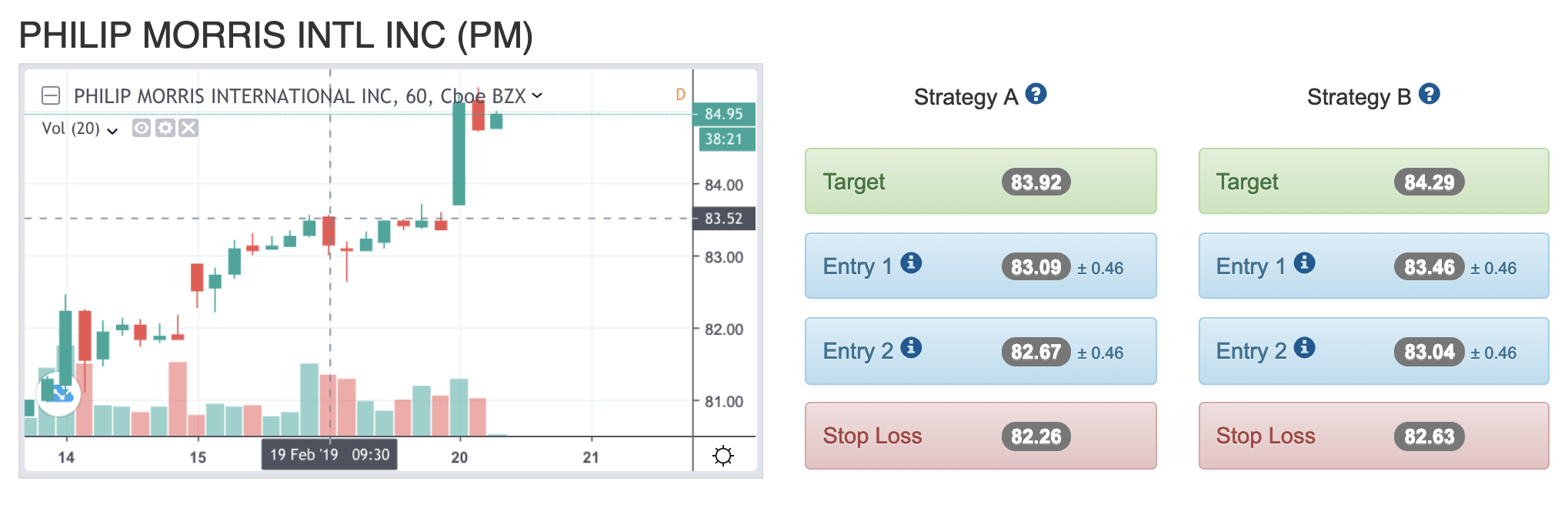

On February 19th, our ActiveTrader service produced a bullish recommendation for Philip Morris Inc. (PM). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

PM opened in its forecasted Strategy B Entry 1 price range $83.46 (± 0.46) and passed through its Target price $84.29 in the first hour of trading the following day, reaching a high of $85.12. The Stop Loss price was set at $82.63.

Thursday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

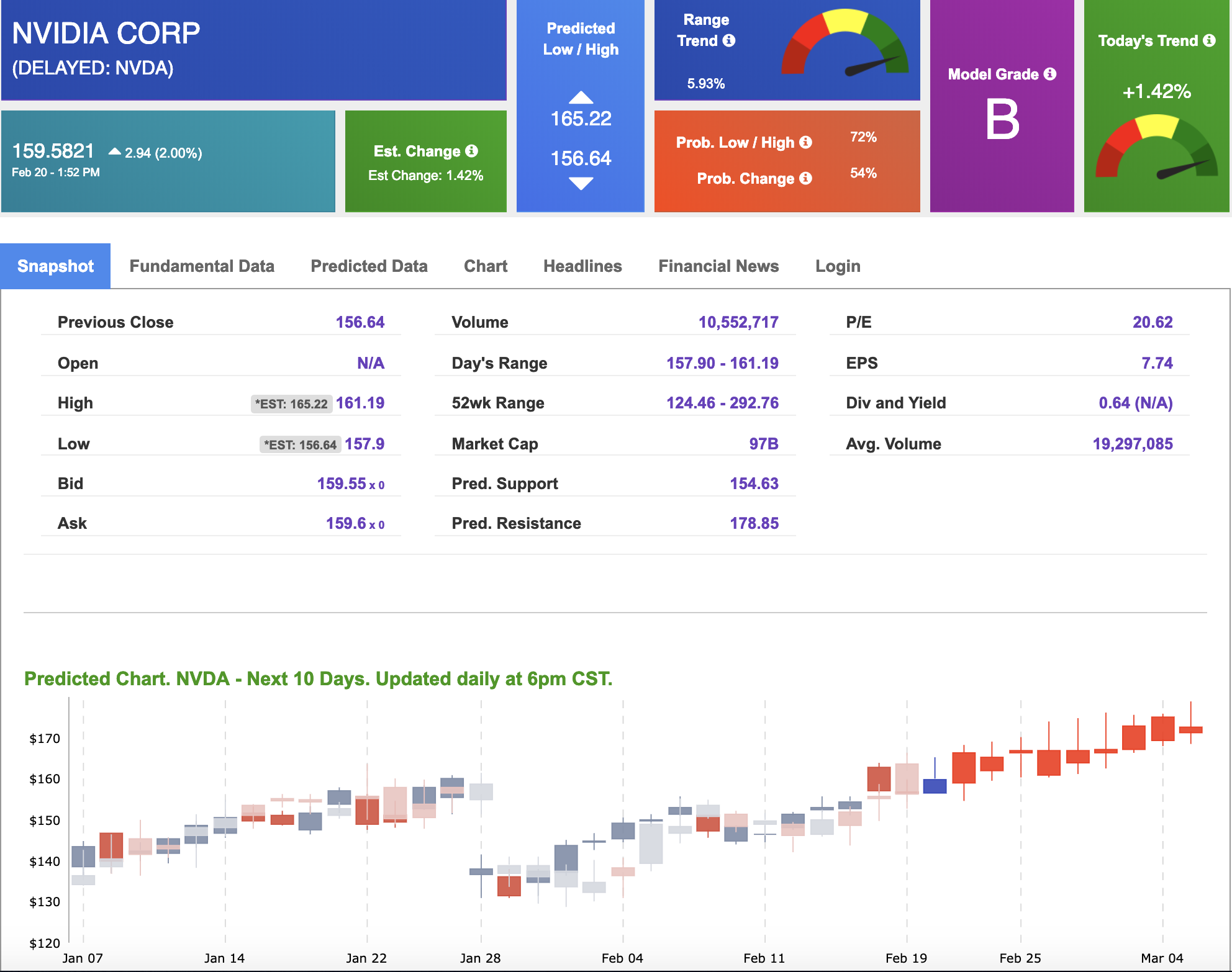

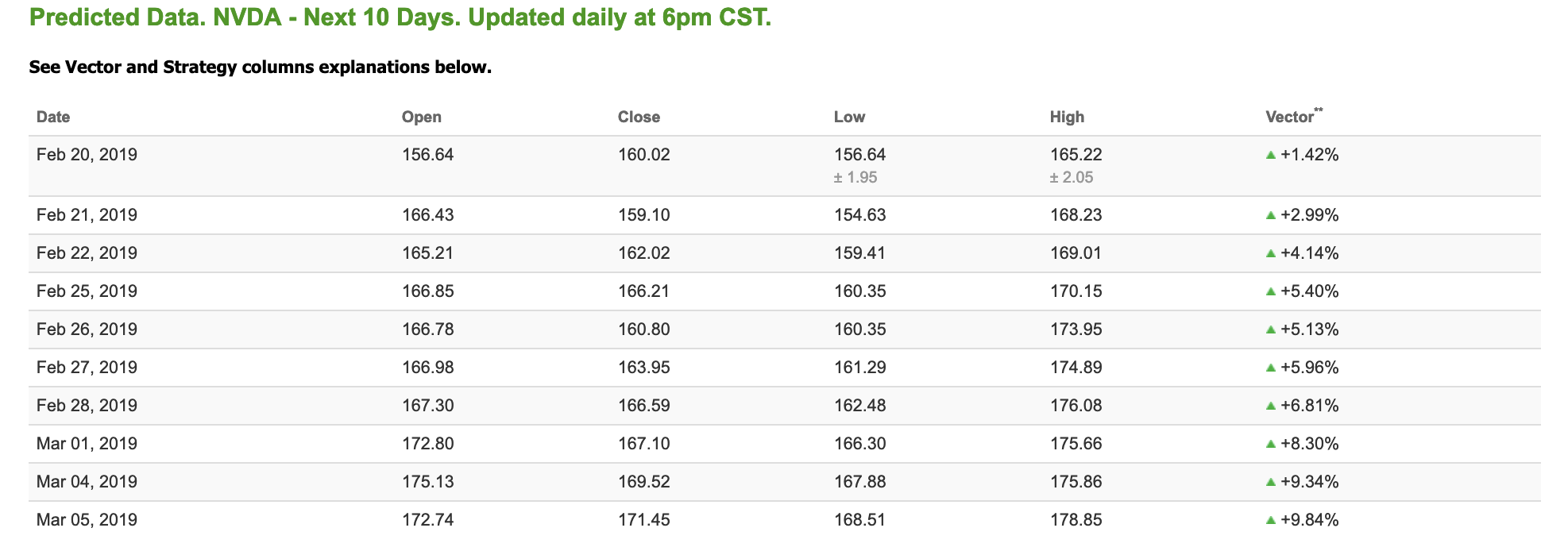

Our featured stock for Thursday is Nvidia Corp. (NVDA). NVDA is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $159.58 at the time of publication, up 2.00% from the open with a +1.42% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

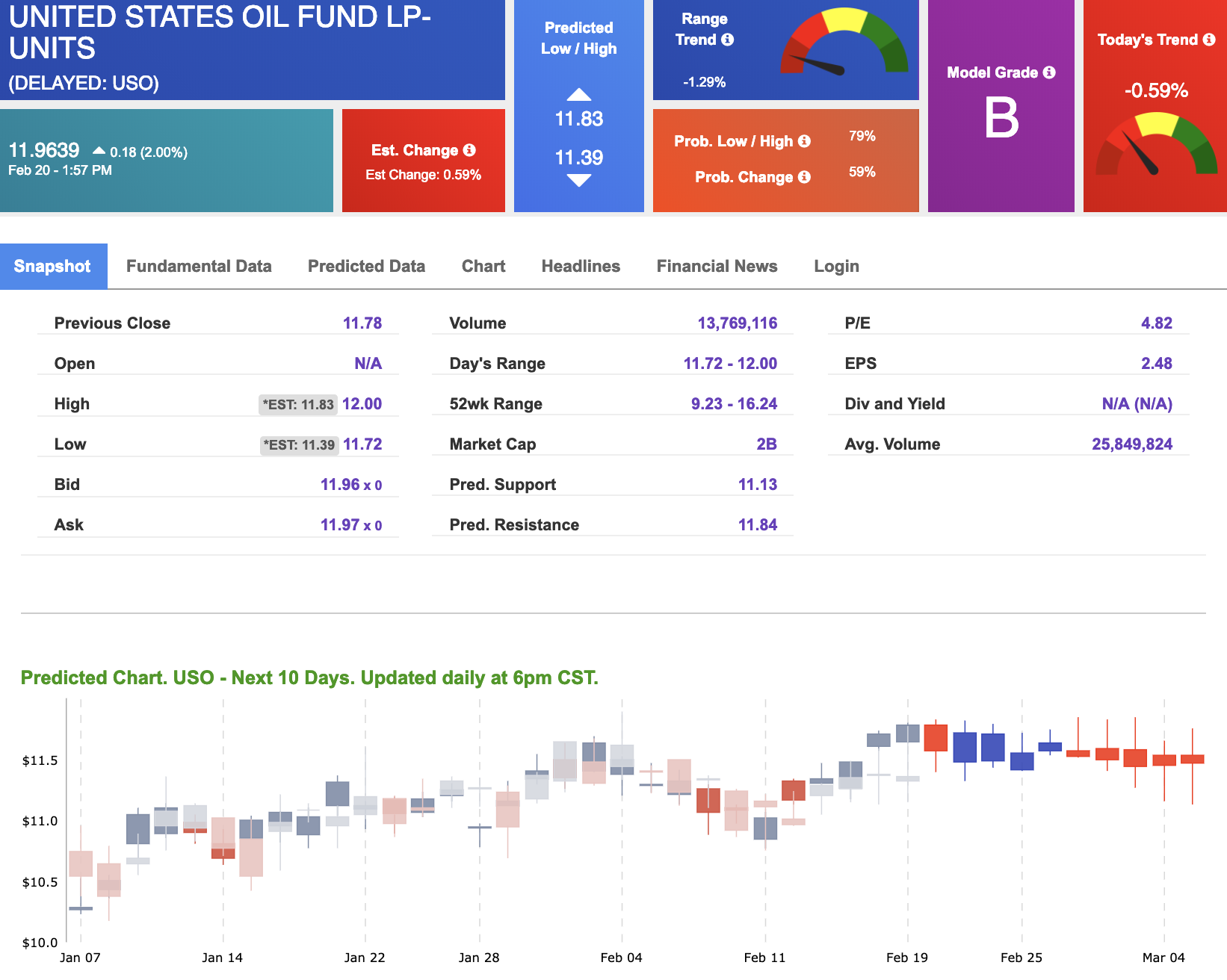

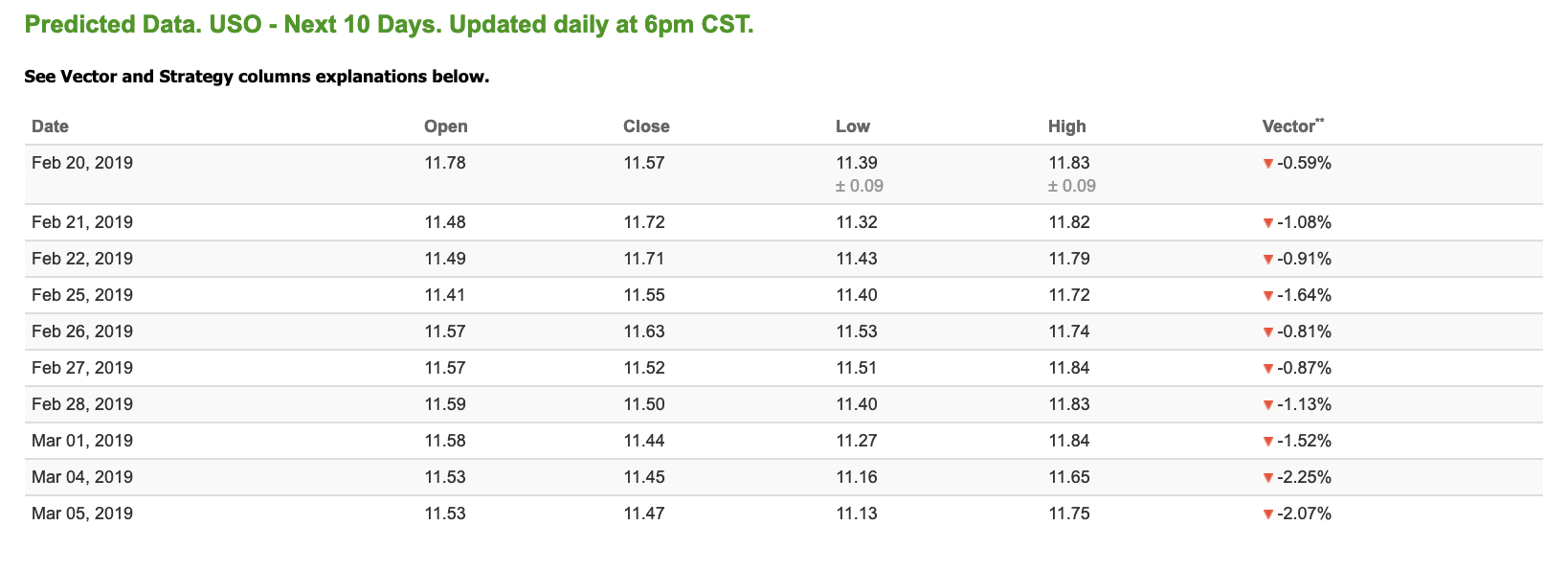

West Texas Intermediate for March delivery (CLH9) is priced at $56.90 per barrel, up 1.44% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $11.96 at the time of publication, up 2.00% from the open. Vector figures show -0.59% today, which turns -0.87% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

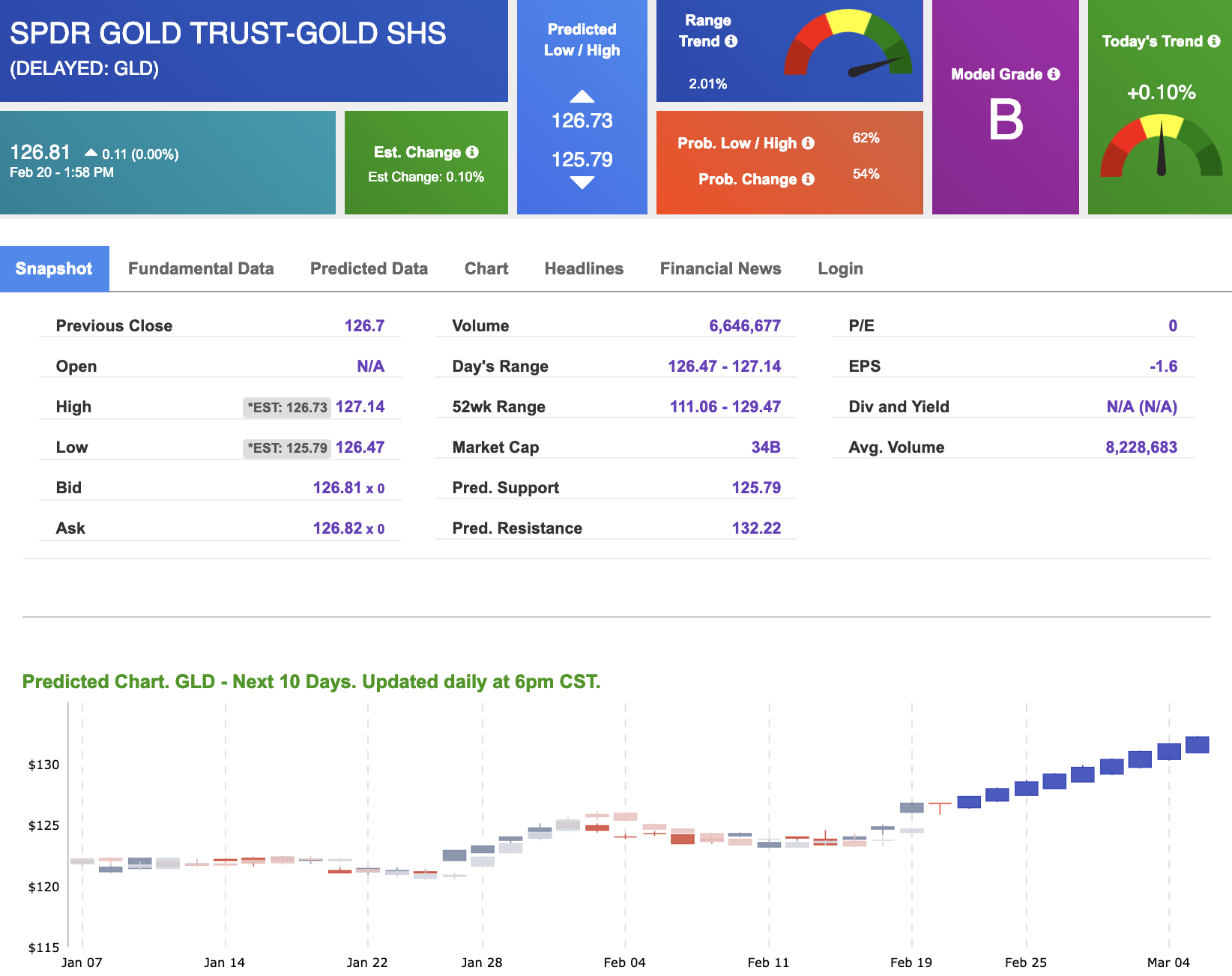

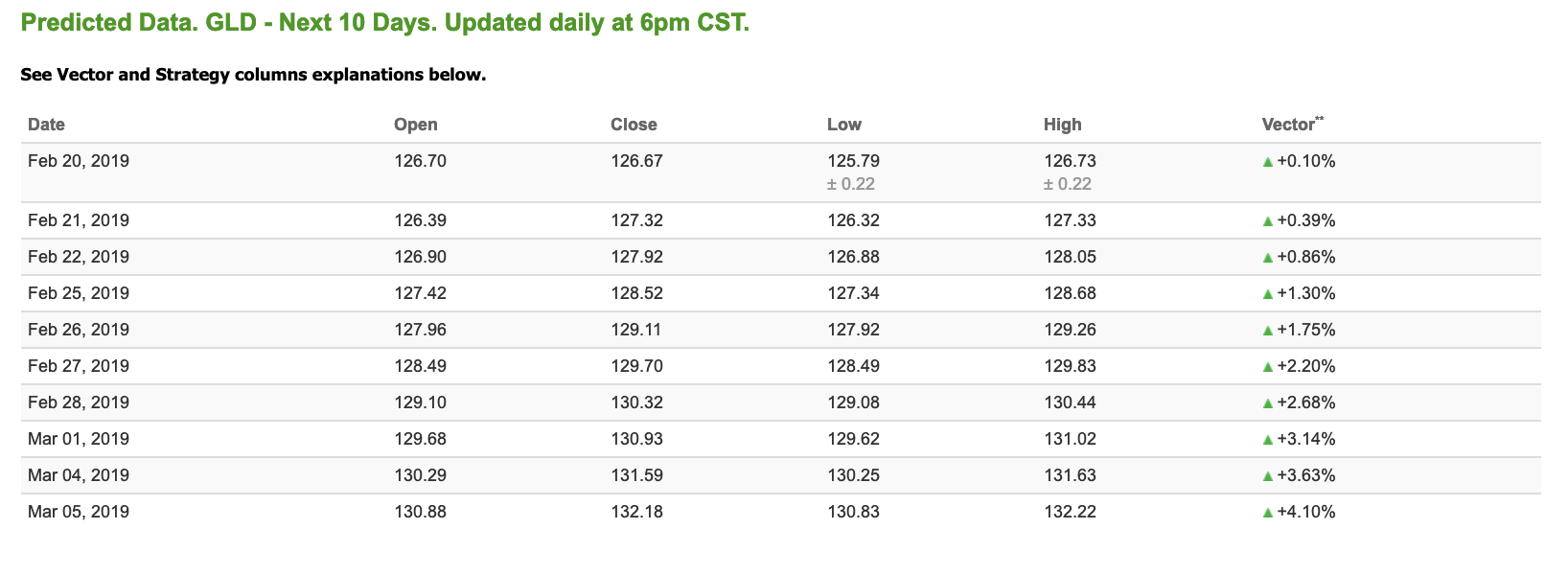

Gold

The price for April gold (GCJ9) is down 0.09% at $1,343.60 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $126.81, flat 0.00% at the time of publication. Vector signals show +0.10% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

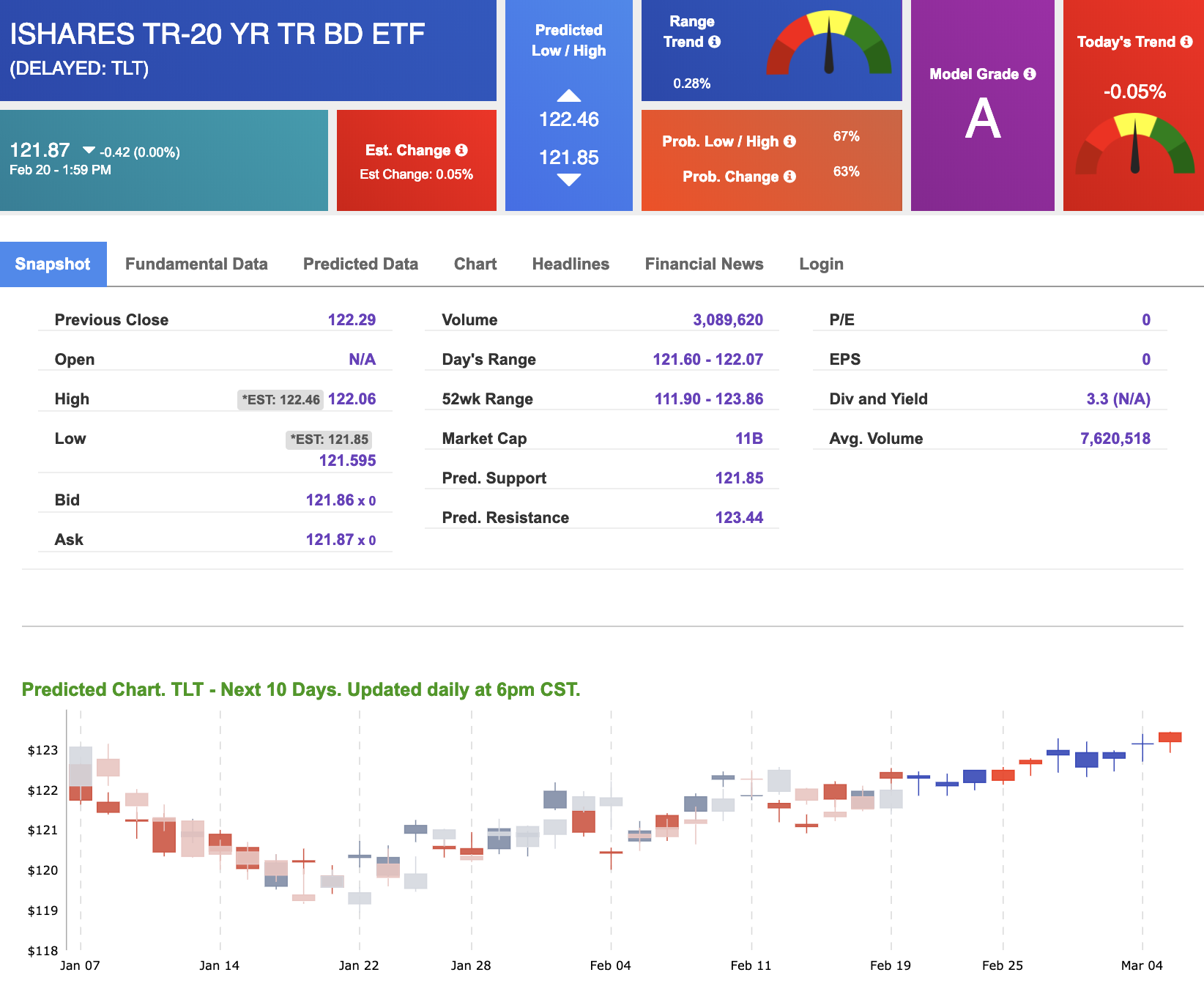

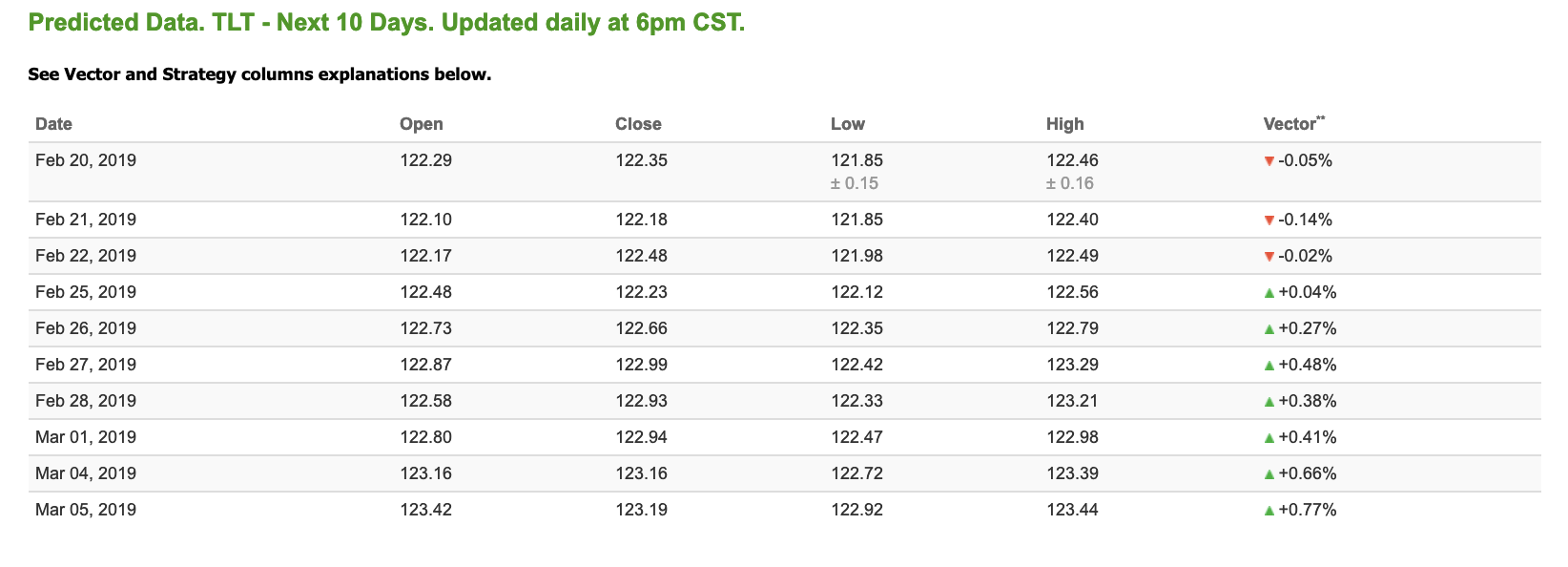

The yield on the 10-year Treasury note is up 0.34% at 2.65% at the time of publication. The yield on the 30-year Treasury note is up 0.61% at 3.00% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of -0.05% moves to +0.04% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

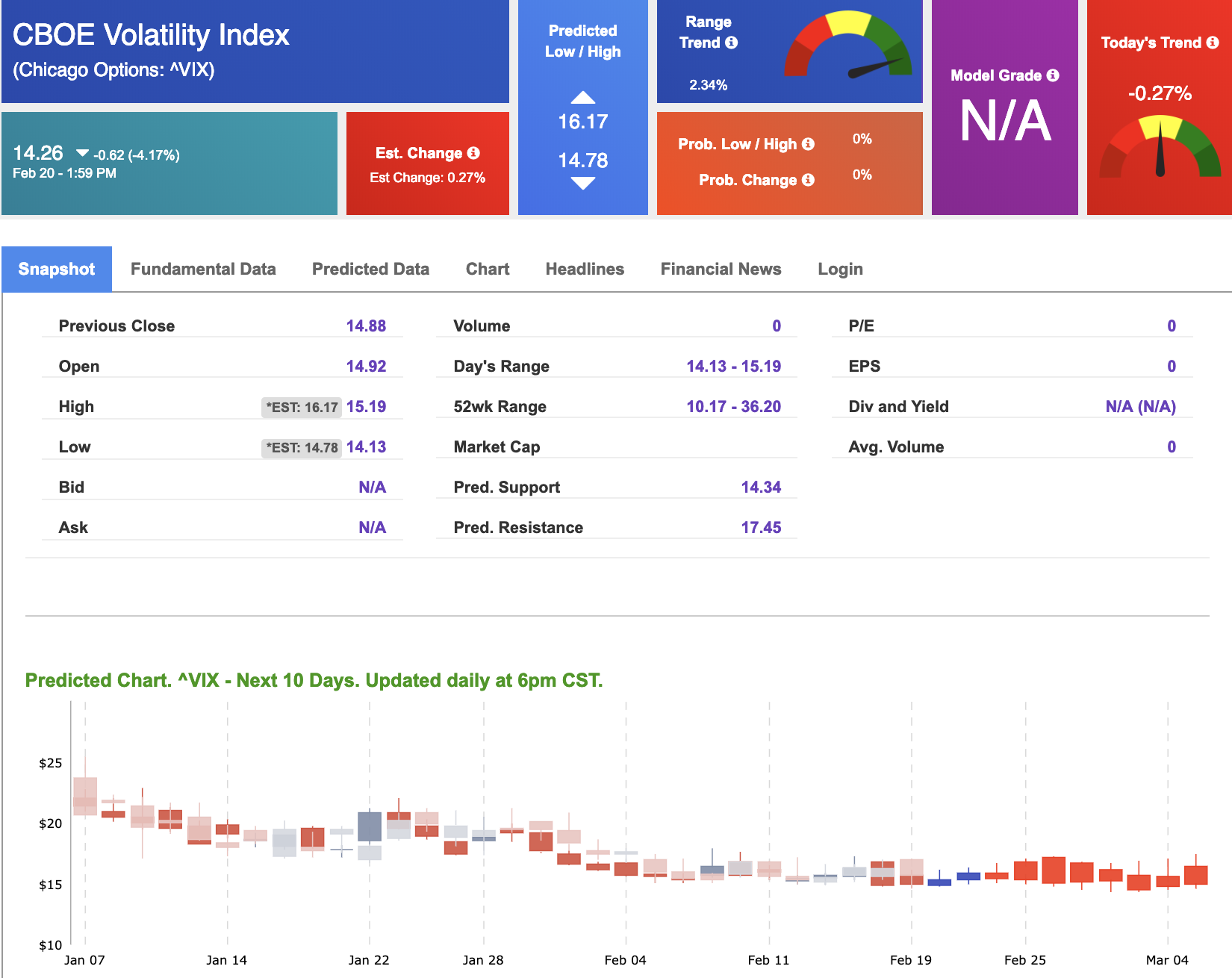

Volatility

The CBOE Volatility Index (^VIX) is down 4.17% at $14.26 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $15.91 with a vector of +2.02%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(LAST CHANCE) You Don’t Want to Miss This!

Today only, we are doing something we have RARELY do!

We are offering LIFETIME ACCESS to our Tools Membership for less than the regular price we normally charge for only 1 year of service!

***Starting next week, we will be adding an annual maintenance fee to all lifetime memberships, but if you sign up before that happens, you will be locked in and will not need to pay this fee!