Global Equities Rally After Mexico Tariffs Are Called Off

U.S. markets up today helped by the news

U.S. Stocks, indices, and futures are on the move up today following Friday’s announcement by President Trump that the U.S. will not move forward with proposed tariffs on Mexico.

Global equities ride the good news

Global equities were also able to rise off of the news, clearing the way for the U.S.-Mexico-Canada trade agreement to be finalized. China-U.S. trade tension remains as further tariffs are still possible.

United Technologies and Raytheon merger in focus

Major news to monitor includes the United Technologies and Raytheon merger as well as recently released global and U.S. economic data.

Economic data for this week

This week we will see May data for Core CPI, Federal Budget, Retail Sales, and Industrial Production.

(Want free training resources? Check our our training section for videos and tips!)

Buy SPY near $280

With the SPY trading above its 50 days moving average, $286, we expect the market to continue trading between $280-$294. We encourage our readers to buy near $280 and avoid chasing near $290.

Monitor overhead resistance at $290 and if market breaks above $290 for multiple days, the market would have potential to retest 52 weeks high. For reference, the SPY Seasonal Chart is shown below:

Reached deal between U.S.-Mexico moves markets in green

Major U.S. indices are in the green today supported by last Friday’s news that the U.S would not impose tariffs on Mexico after reaching an agreement regarding illegal immigration.

Mexican peso on a year’s high following the news

Also part of the deal, Trump stated Mexico agreed to purchase “large quantities of agricultural products” leading to a nice boost for both U.S. stocks and the Mexican peso, which reached a yearly high following the news.

S&P rise five days in a row

The S&P has risen for five straight days while the dollar is also up today. Global equities are also up today with Asian and European markets closed in the green today.

Labor data disappoints

On Friday, labor data disappointed, coming in below expectations but had a surprising effect on markets.

At least one rate cut by the Fed in the next two FOMC meetings

With lowering labor data, many investors and analysts are predicting at least one rate cut by the Fed in the next two FOMC meetings.

S&P have one of the best weeks of 2019

This, in turn, supported markets and boosted the S&P to close out one of its best weeks of 2019.

(Want free training resources? Check our our training section for videos and tips!)

Economic data reports this week

Several notable reports will release this week, beginning with Producer Price Index on Tuesday, Core CPI and Federal Budget on Wednesday, and Import Price Index on Thursday.

Lululemon and Broadcom earnings reports this week

Notable earnings, on the other hand, are light this week with Lululemon on Wednesday and Broadcom on Thursday.

A new aviation and defense conglomerate is set to be made with the sector’s largest merger ever being announced on Sunday. United Technologies Corp and Raytheon Co. agreed on a merger, worth over $120 billion, to combine their aerospace businesses. In the deal, United Tech shareholders will own 57% of the combined business while Raytheon holders will get 2.33 shares for each Raytheon share they own. The new company is set to assume about $26 billion in debt while the deal should close in early 2020.

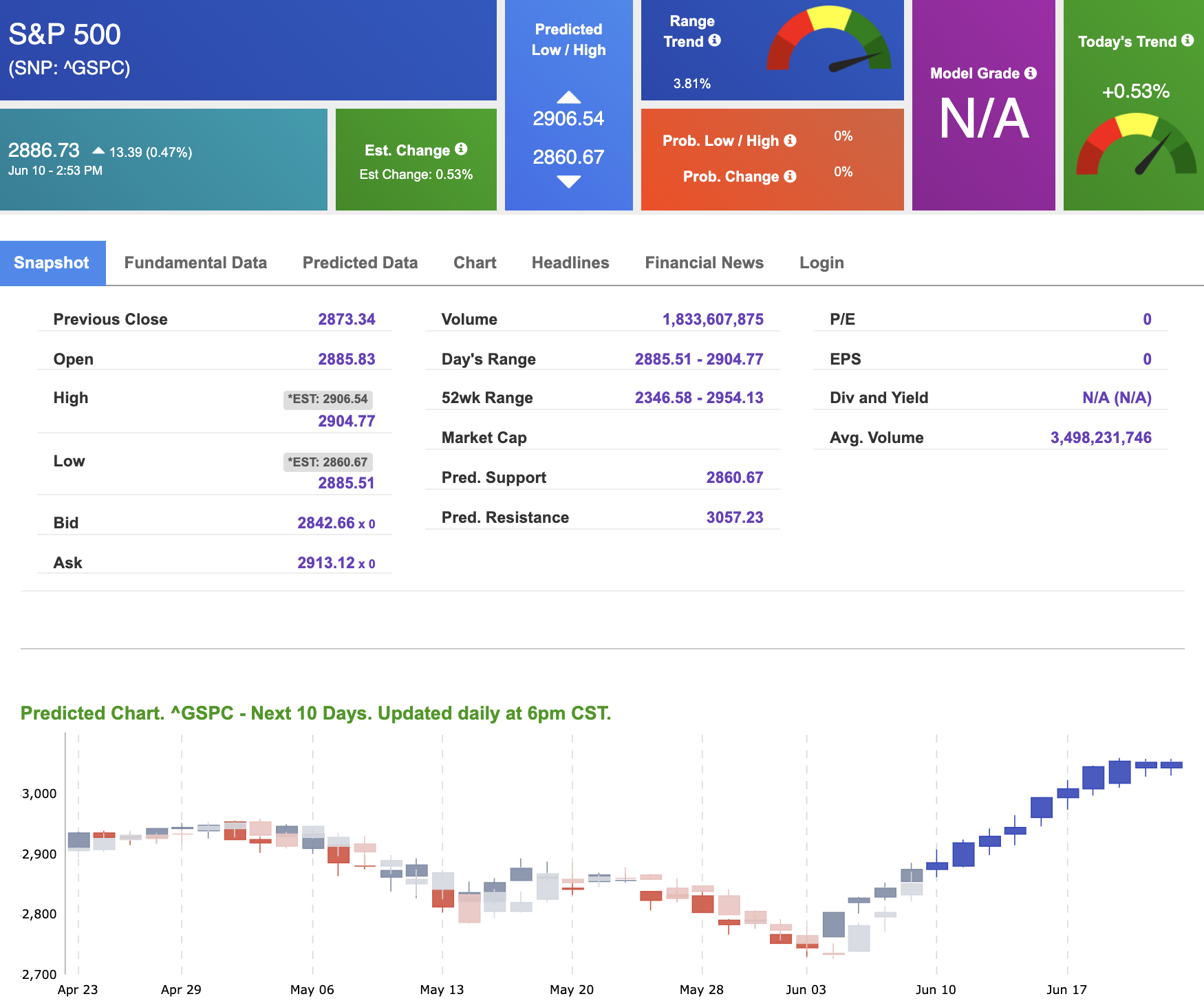

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows positive signals. Today’s vector figure of +0.53% moves to +4.61% in five trading sessions. Prediction data is uploaded after the market close at 6 pm, CST. Today’s data is based on market signals from the previous trading session.

Tick . . .tick . . . tick!

You’ve now got less than 11 hours to sign up!

Okay, what’s so great about this Tradespoon Tools Membership?

In a nutshell:

One, because of its consistent record: 75% of its trades are winners.

Two, because you get to customize the Tools Membership to fit your own personal investment parameters, your personal interests, and your goals.

Three, Tradespoon’s Tools will cut your research and decision-making time in half!

And FOUR, most importantly you’ll see for yourself if my Tradespoon research system delivers more-profitable results for you.

My Artificial Intelligence trading system has delivered a 75% winning record with to date gain of an incredible 1,285%!

Click Here to Learn More

Highlight of a Recent Winning Trade

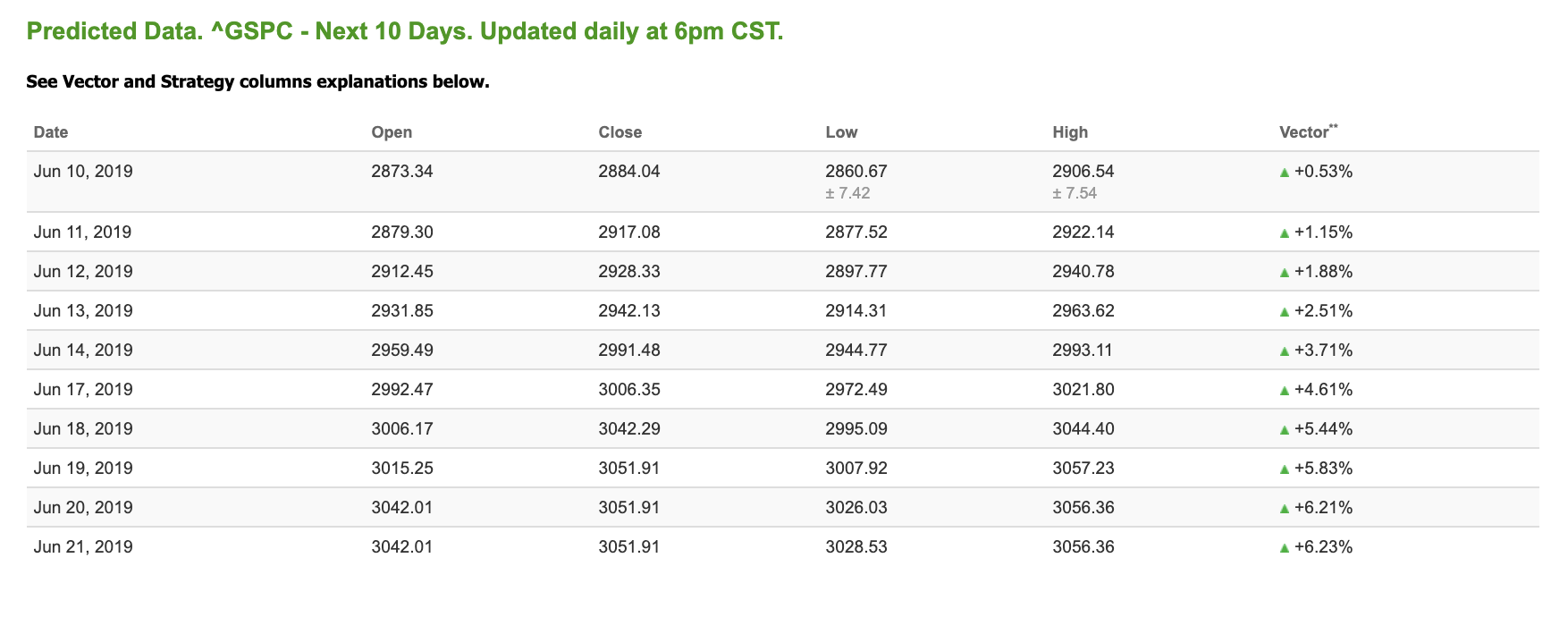

On June 5th, our ActiveTrader service produced a bullish recommendation for Under Armour Inc (UAA). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

UAA entered its forecasted Strategy B Entry 1 price range $24.70 (± 0.16) in its first hour of trading and passed through its Target price $24.95 in the second hour of trading that day. The Stop Loss price was set at $24.45.

Tuesday Morning Featured Symbol

*Please note: At the time of publication we do not own the featured symbol, CME. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

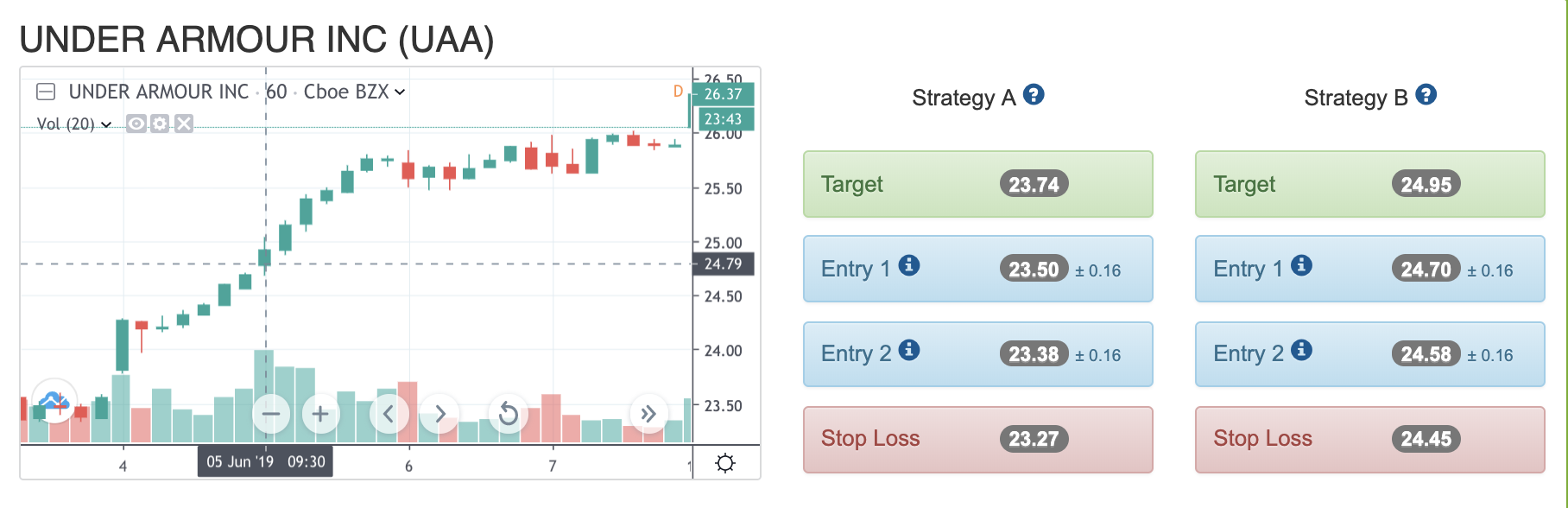

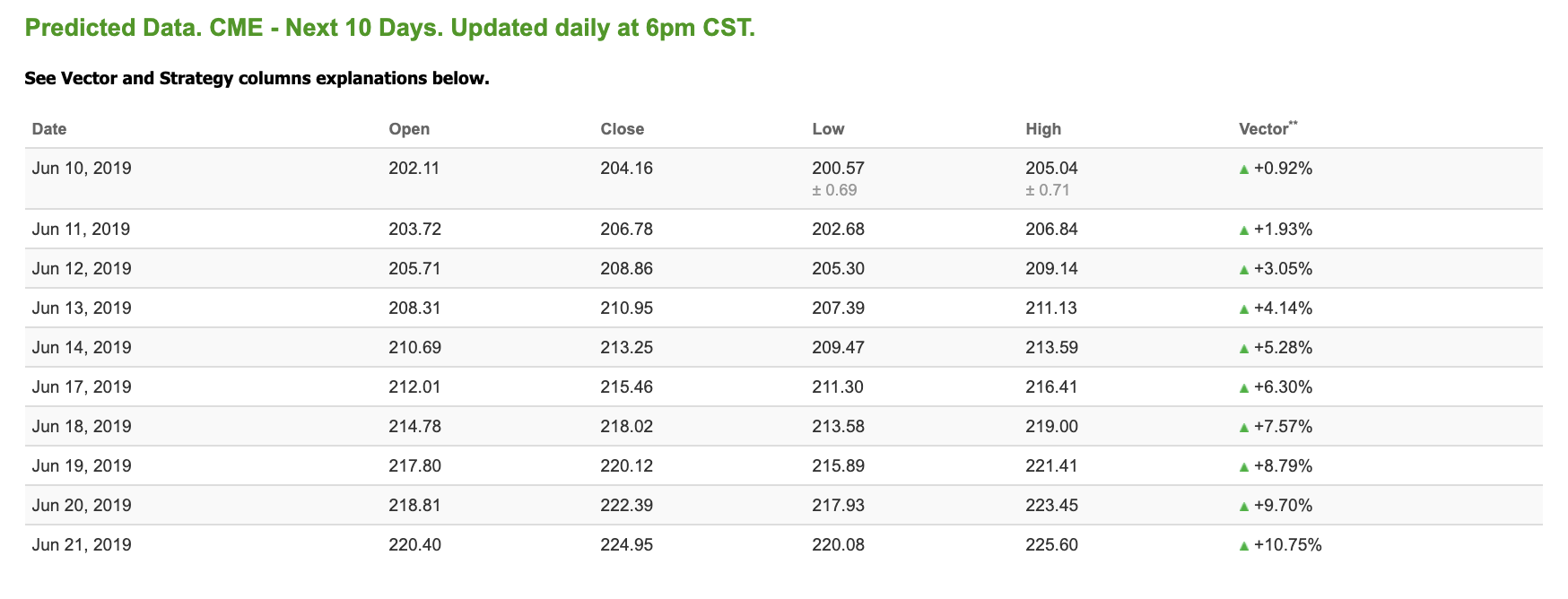

Our featured symbol for Tuesday is CME Group Inc. (CME). CME is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $203.94 at the time of publication, up 1.00% from the open with a +0.92% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

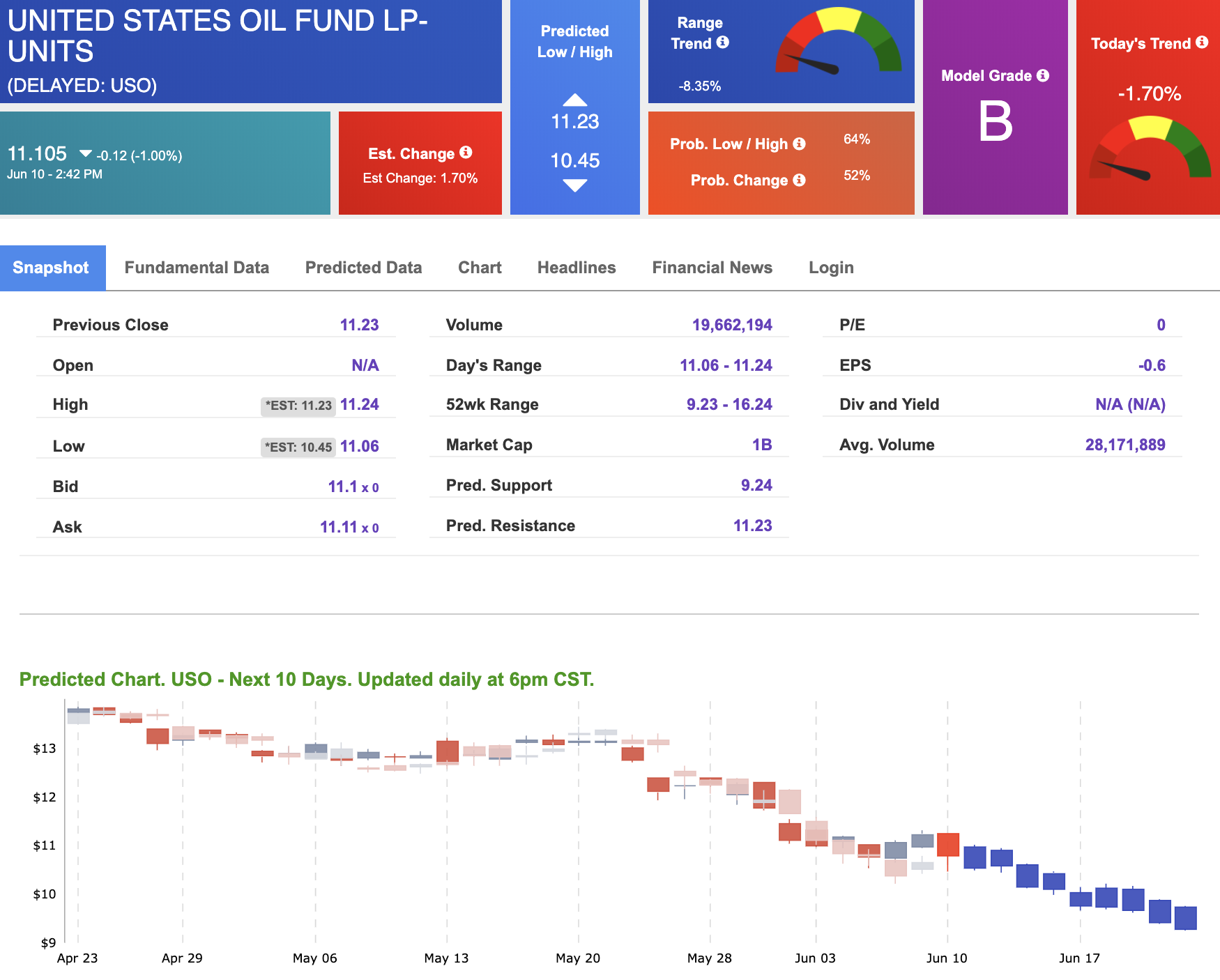

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $53.32 per barrel, down 1.24% from the open, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $11.10 at the time of publication, down 1.00% from the open. Vector figures show -1.70% today, which turns -10.94% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

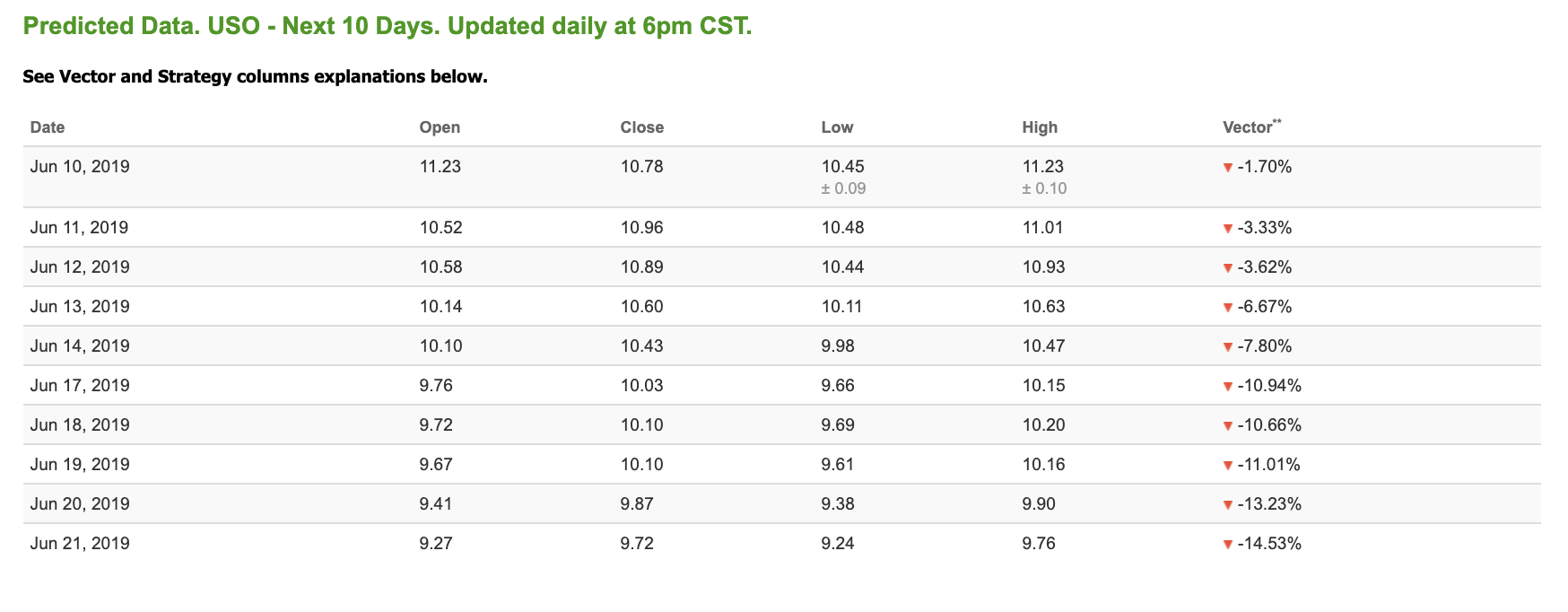

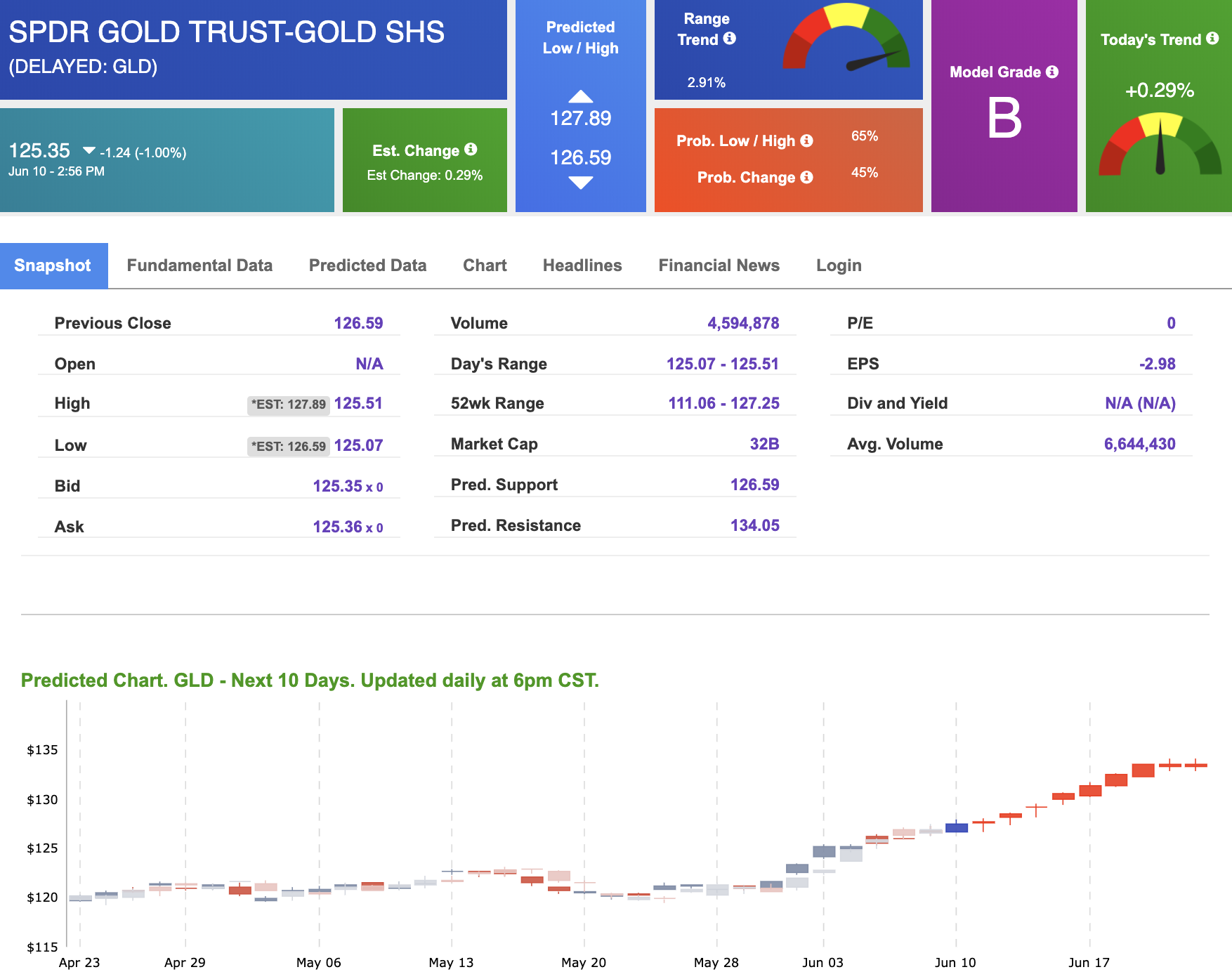

The price for the Gold Continuous Contract (GC00) is down 1.03% at $1,33230 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $125.35, down 1.00% at the time of publication. Vector signals show +0.29% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

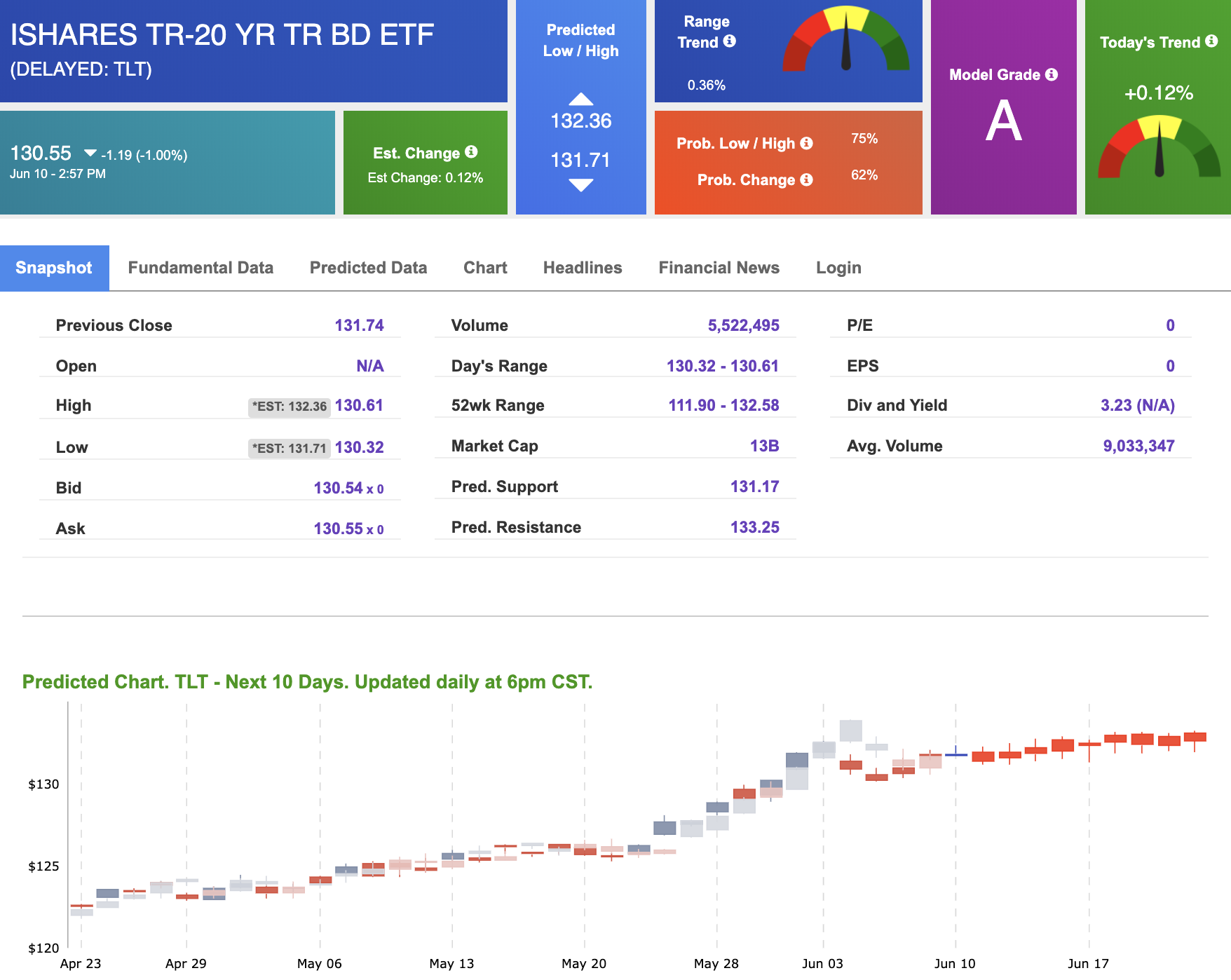

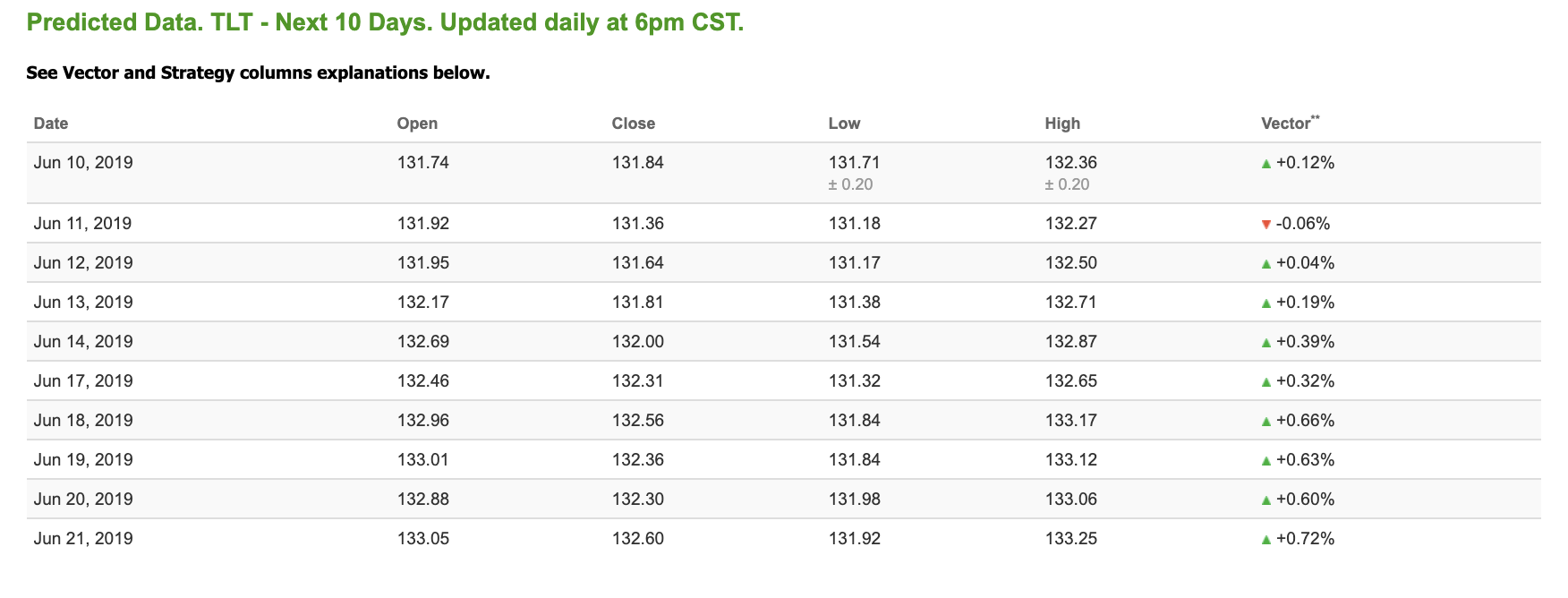

Treasuries

The yield on the 10-year Treasury note is up 2.78% at 2.14% at the time of publication. The yield on the 30-year Treasury note is up 1.90% at 2.62% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.12% moves to +0.19% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

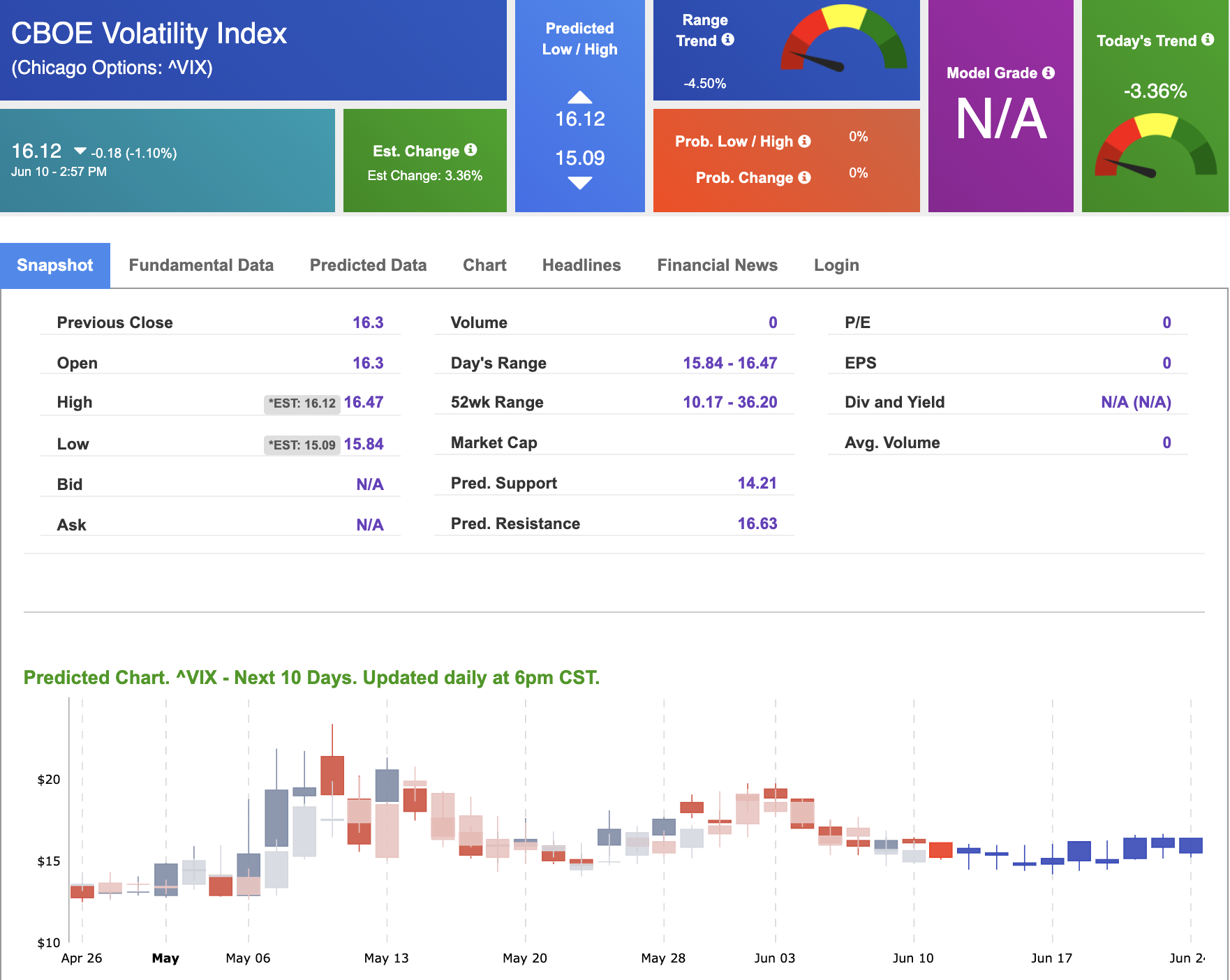

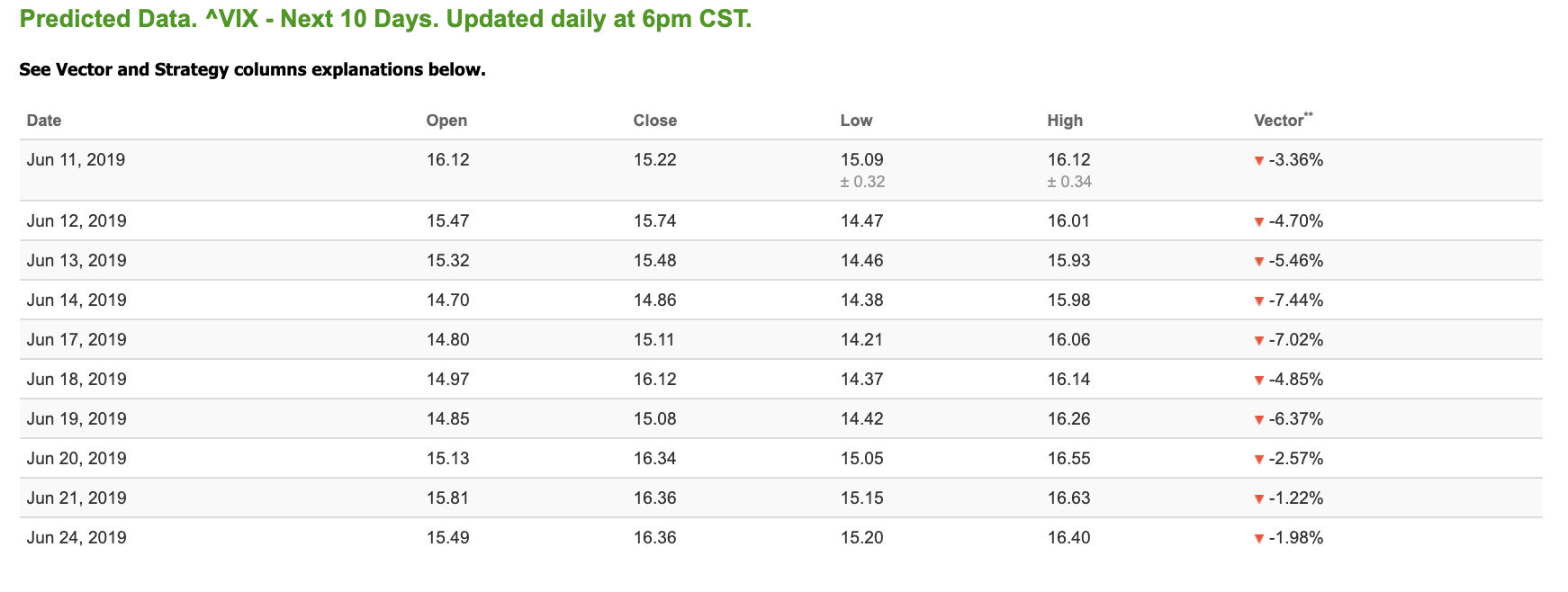

Volatility

The CBOE Volatility Index (^VIX) is down 1.10% at $16.12 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $15.74 with a vector of -4.70%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Tick . . .tick . . . tick!

You’ve now got less than 11 hours to sign up!

Okay, what’s so great about this Tradespoon Tools Membership?

In a nutshell:

One, because of its consistent record: 75% of its trades are winners.

Two, because you get to customize the Tools Membership to fit your own personal investment parameters, your personal interests, and your goals.

Three, Tradespoon’s Tools will cut your research and decision-making time in half!

And FOUR, most importantly you’ll see for yourself if my Tradespoon research system delivers more-profitable results for you.

My Artificial Intelligence trading system has delivered a 75% winning record with to date gain of an incredible 1,285%!