Global Markets Produce Impressive Rebound, Yuan Rate In Focus

All three major U.S. indices in the green today

Markets are continuing their impressive turnaround after sliding for most of Wednesday only to rebound before market close, with all three major U.S. indices in the green today.

Yuan near multi-year lows

Fears of overt Chinese currency manipulation were cooled when China fixed the yuan at a higher level than expected, but still near multi-year lows.

Roku and Lyft produced positive reports

Strong earnings and labor data have supported markets today with unemployment falling last week while Roku and Lyft produced positive reports. Look for Uber and Activision earnings today. Also impacting markets yesterday were crude oil levels which dropped to a seven-month low, but have since somewhat recovered.

(Want free training resources? Check our our training section for videos and tips!)

Short term SPY support sits at $277-$280

Biotech, banks, small caps, and energy sectors continue to struggle while short term SPY support sits at $277-$280. Stock market could overshoot to 50-days MA on SPY which would be around $293-$294 level, though further volatility is expected.

SPY Seasonal Chart

With this in mind, we will sell when the market is near $290 and look to buy near $270 for the SPY. Market Commentary readers are urged to have clearly defined stop levels for all positions during this period of volatility. For reference, the SPY Seasonal Chart is shown below:

China’s currency for the first time since 2008 weaker than 7

Today, market focus remains on earnings and U.S.-China relations. The People’s Bank of China fixed its currency for the first time since 2008 to be weaker than 7 but has since risen higher than estimated. The yuan is down over 3% in recent months, its lowest rate since 2015.

Further tariffs at the start of September

President Trump has already stated further tariffs will be imposed at the start of September with China responding likewise. Still, response to the weaker yuan is awaited from the Trump administration. Several analysts have predicted further tariffs could be in play.

(Want free training resources? Check our our training section for videos and tips!)

Following a dip in exports earlier this year, China reported better than expected data for the month of July, which saw exports rise over 3%. Continue monitoring U.S.-China interactions and reactions as we head closer to the September meeting between both nations trade representatives. Globally, Asain markets closed in the green while European markets were also up.

U.S. unemployment applications fell last week adding further evidence of a strong labor market. Strong earnings have also supported markets with most major corporate having already released, with better than expected earnings in the majority. Roku released data that impressed and produced a promising outlook, causing shares to impressively rise over 19%. Lyft reported yesterday to better than expected results while today we will see data from their rival Uber. Lookout for Activision Blizzard, CBS, and Yelp to report after the market closes today. Tomorrow, earnings load is light but we will see one key report: Producer Price Index. Next week, look for Core CPI, Federal Budget, Retail Sales, and Consumer Price Index. Earnings in focus for August 12-16 include Cisco, Samsung, Tilray, Walmart, and Alibaba.

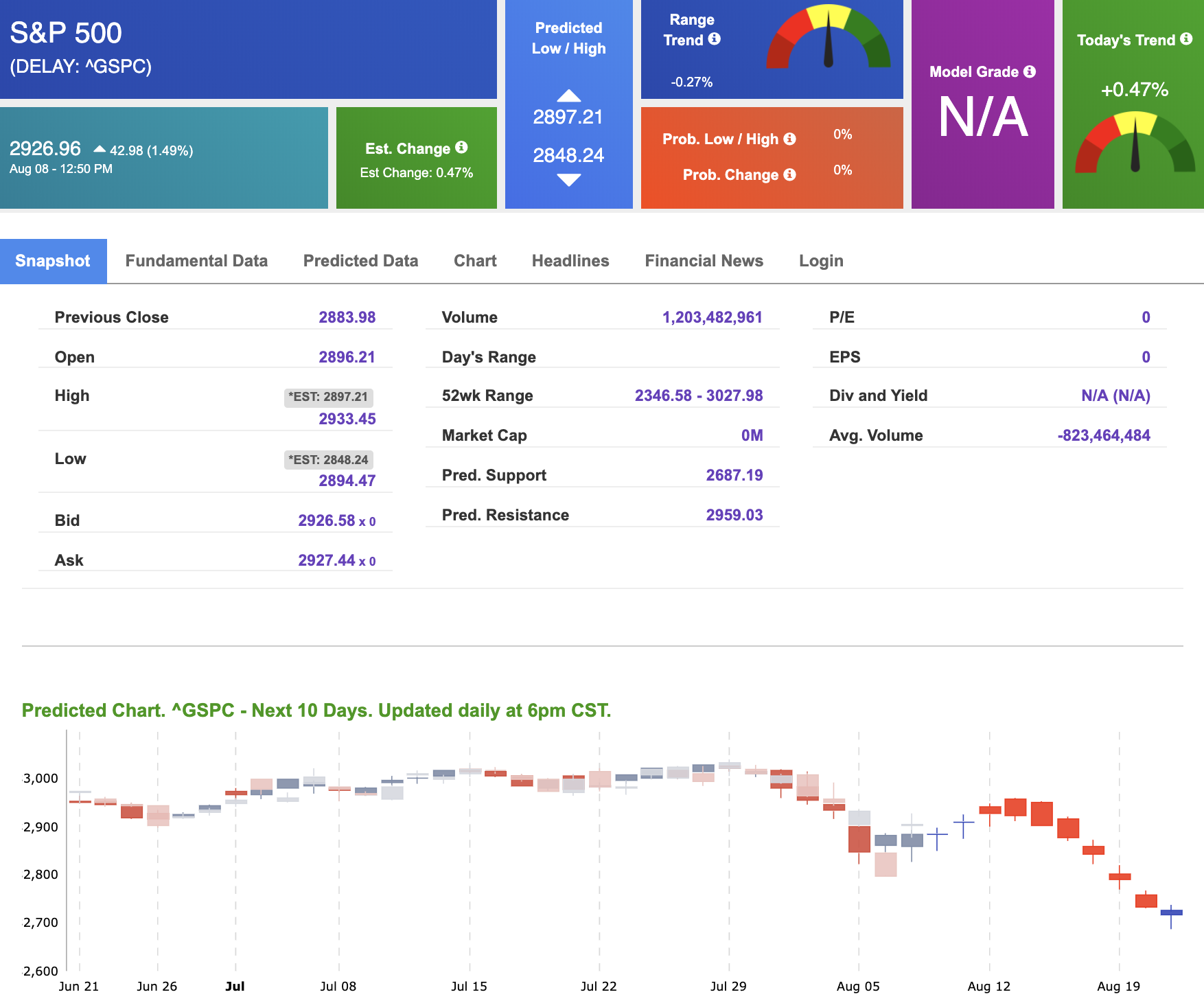

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows mixed signals. Today’s vector figure of +0.47% moves to +1.07% in five trading sessions. Prediction data is uploaded after the market close at 6 pm, CST. Today’s data is based on market signals from the previous trading session.

“I cannot guarantee your acceptance”

Are you aware that you are one of a very select few (for real) to whom I recently extended a limited-time invitation to “test-drive” a game-changing very personal new Elite Trading service from Tradespoon?

If you are quick enough, you can join me live, in my trading room (real-time) and duplicate my trades seconds after I make them.

-

This breakthrough service is limited to only 50 traders.

-

Acceptance is on a first come first served basis and when the 50 Elite seats are taken, that’s it.

-

There is no risk for your trial

Click on the link below and hope that one of those 50 Elite seats is still available. If they’re gone, I’m sorry. There’s nothing I can do.

Click here to learn more and check on availability

Highlight of a Recent Winning Trade

On August 1st, our ActiveTrader service produced a bullish recommendation for Entergy Corp (ETF). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

ETR entered its forecasted Strategy B Entry 1 price range $105.62 (± 0.23) in its first hour of trading and passed through its Target price $106.68 in the second hour of trading that day. The Stop Loss price was set at $104.56

Friday Morning Featured Symbol

*Please note: At the time of publication we do not own the featured symbol, EIX. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

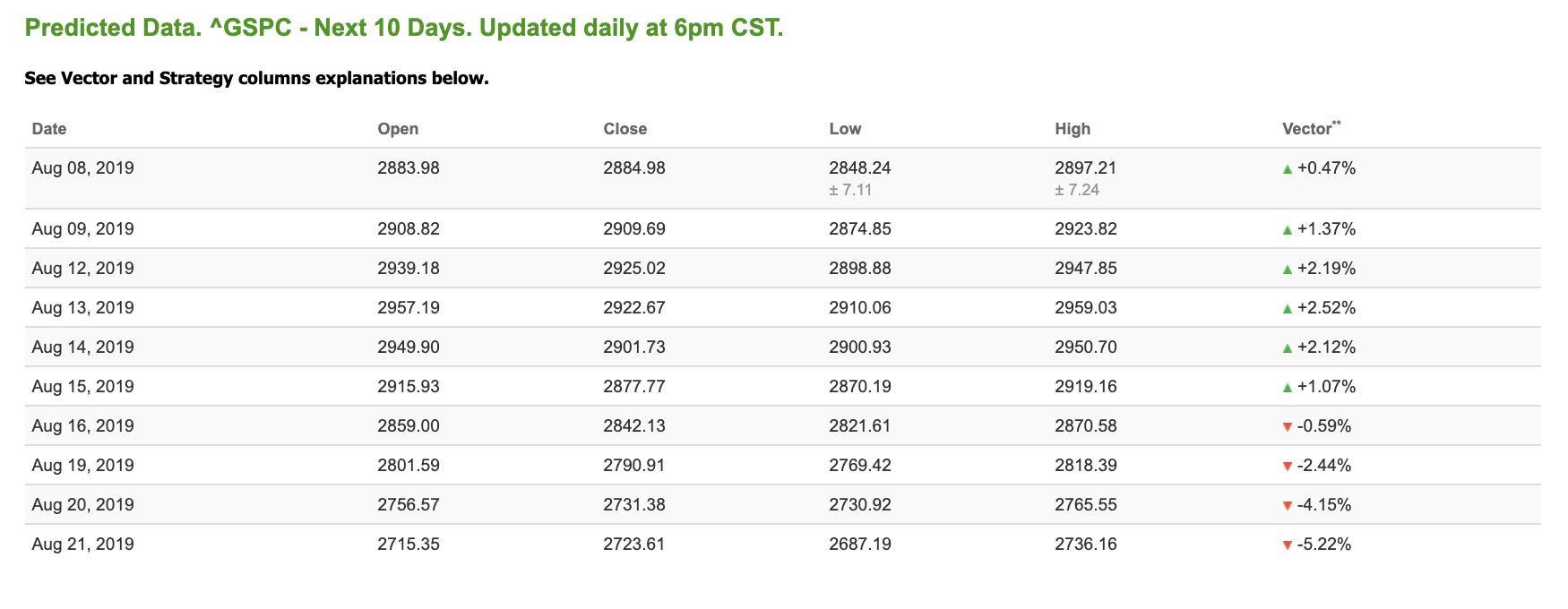

Our featured symbol for Friday is Edison International (EIX). EIX is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $75.14 at the time of publication, up 0.76% from the open with a +1.00% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $52.20 per barrel, down 2.17% from the open, at the time of publication.

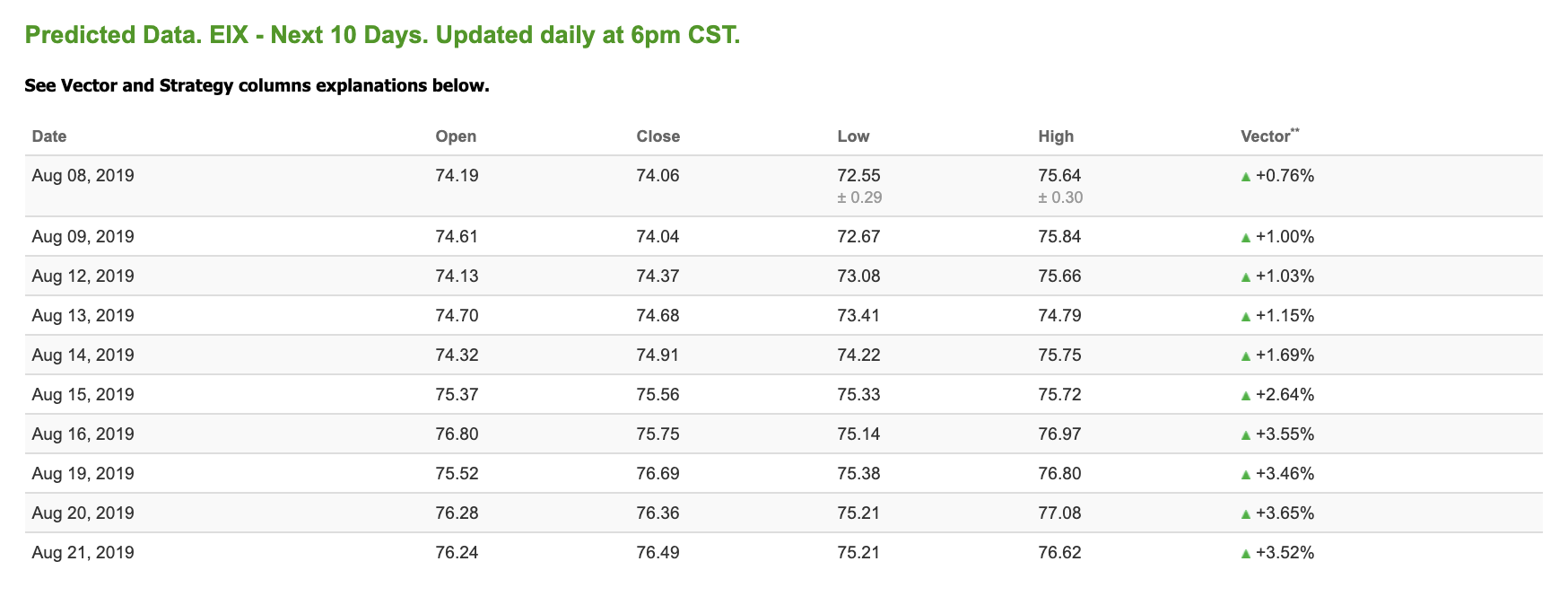

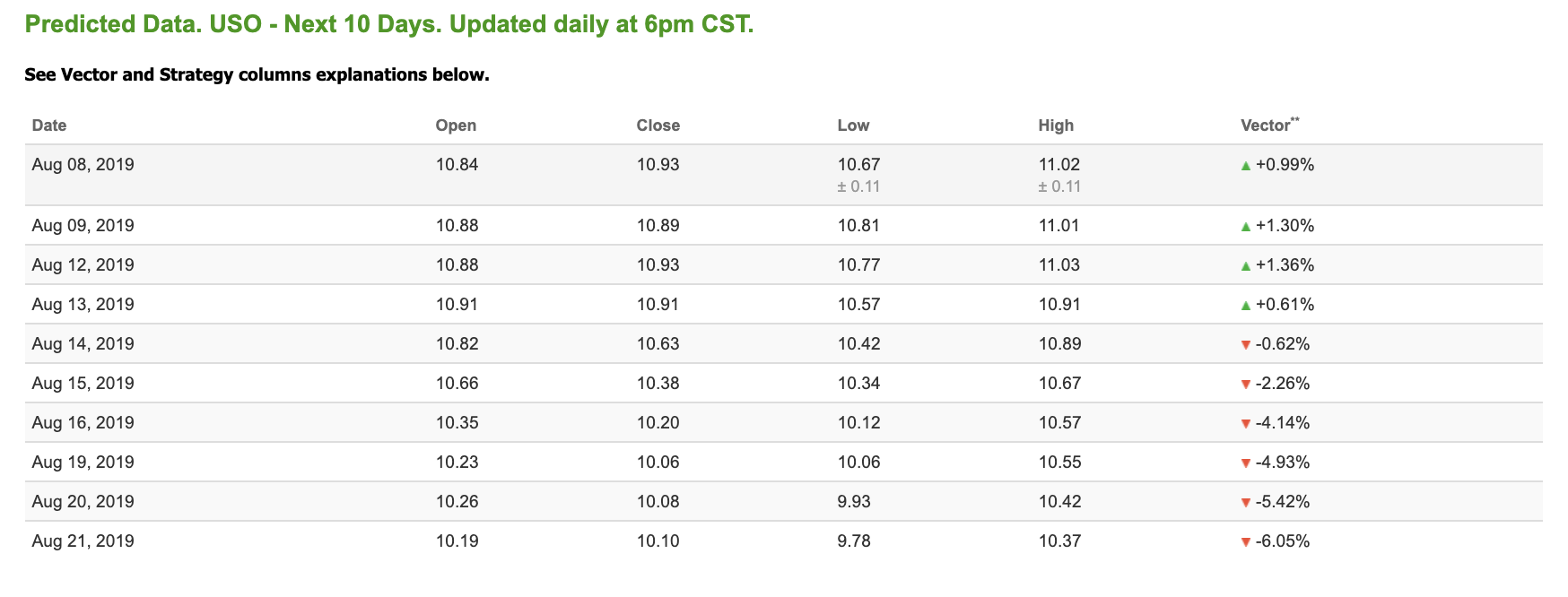

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $10.88 at the time of publication, up 0.37% from the open. Vector figures show +0.99% today, which turns -2.26% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for the Gold Continuous Contract (GC00) is down 0.22% at $1,516.40 at the time of publication.

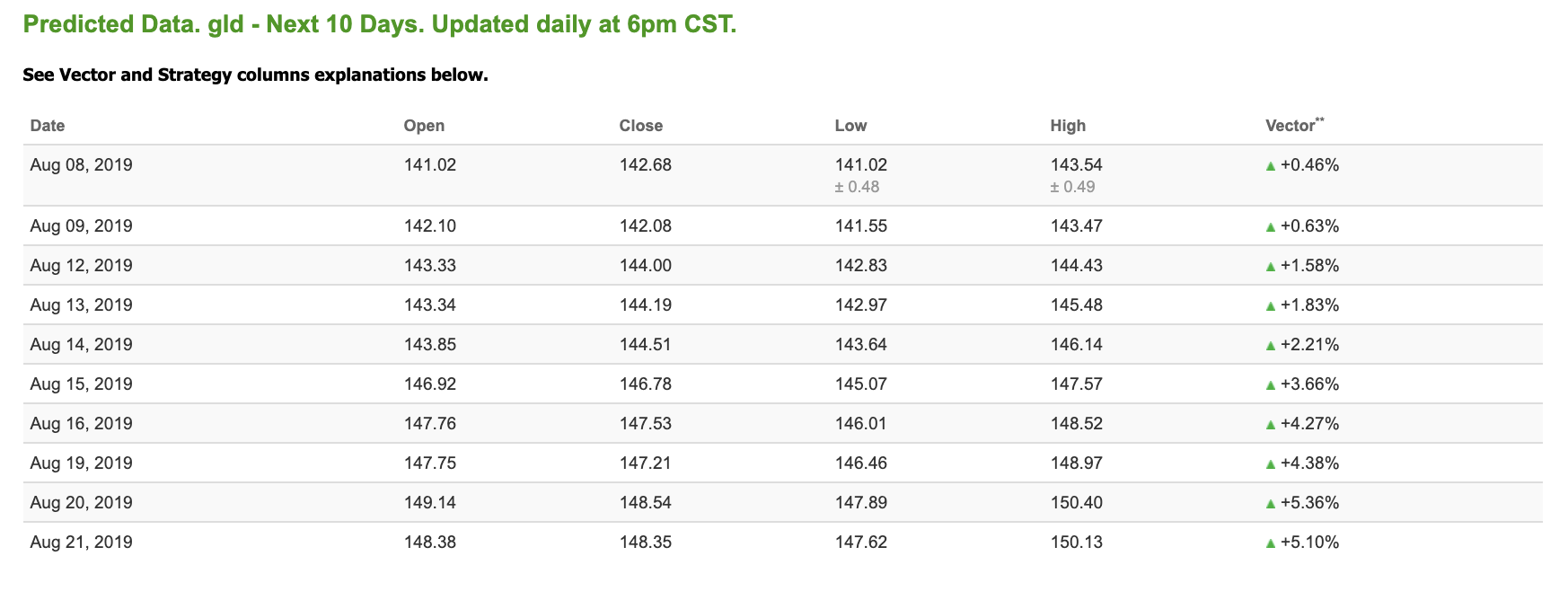

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $141.65, up 0.45% at the time of publication. Vector signals show +0.46% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is up 2.78% at 1.73% at the time of publication. The yield on the 30-year Treasury note is down 0.03% at 2.25% at the time of publication.

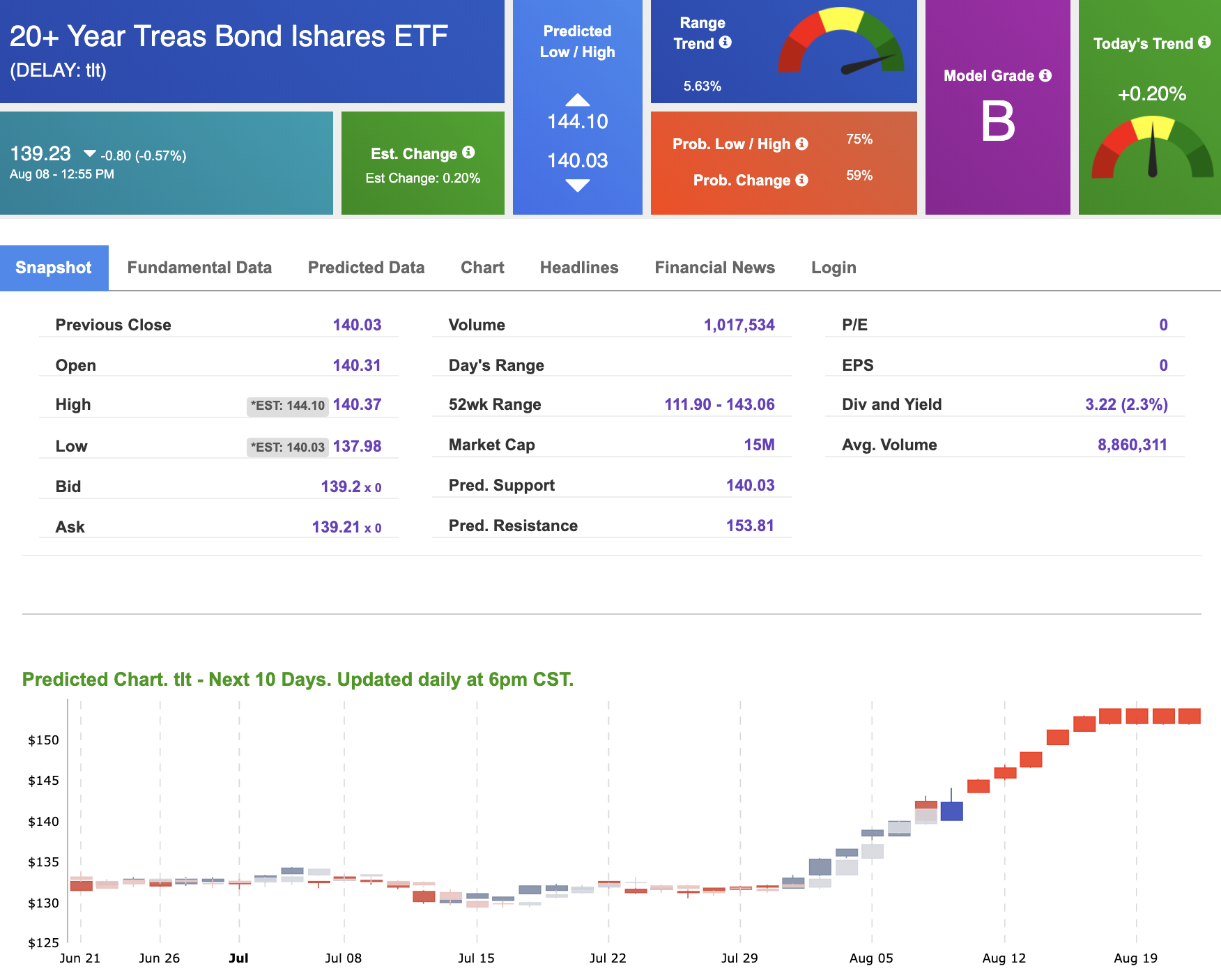

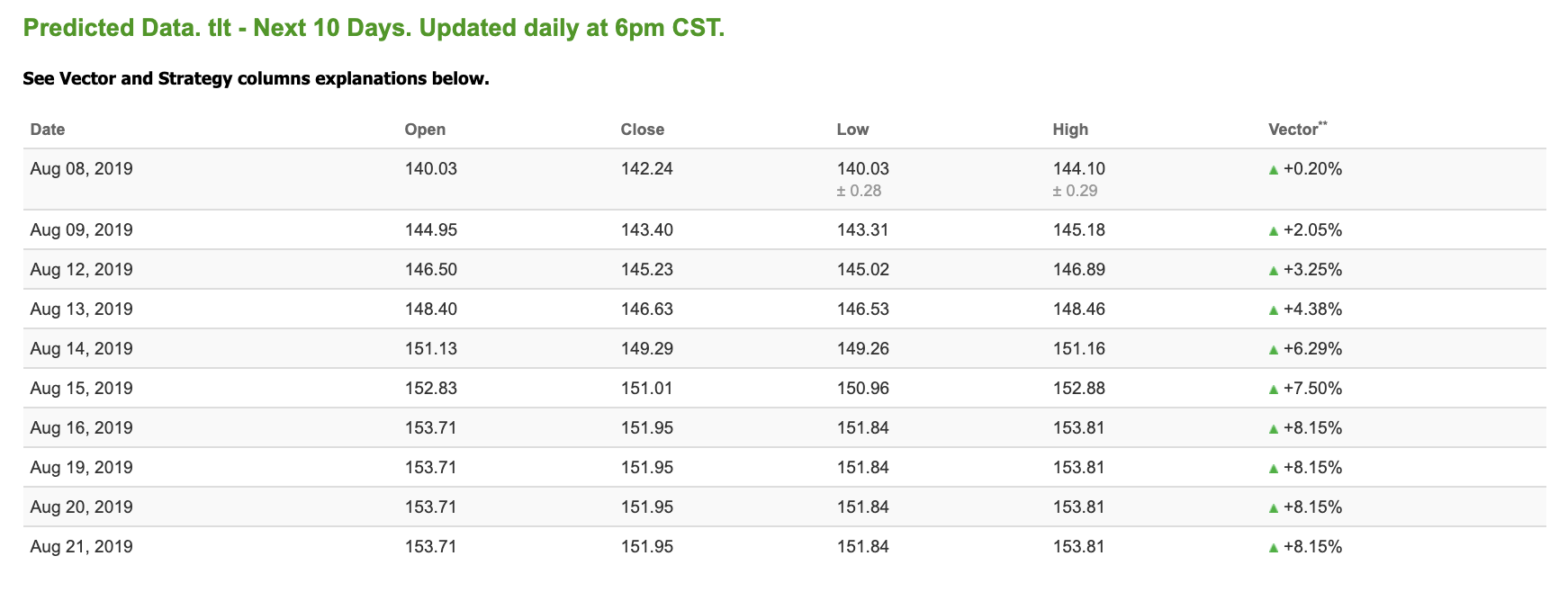

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.20% moves to +4.38% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

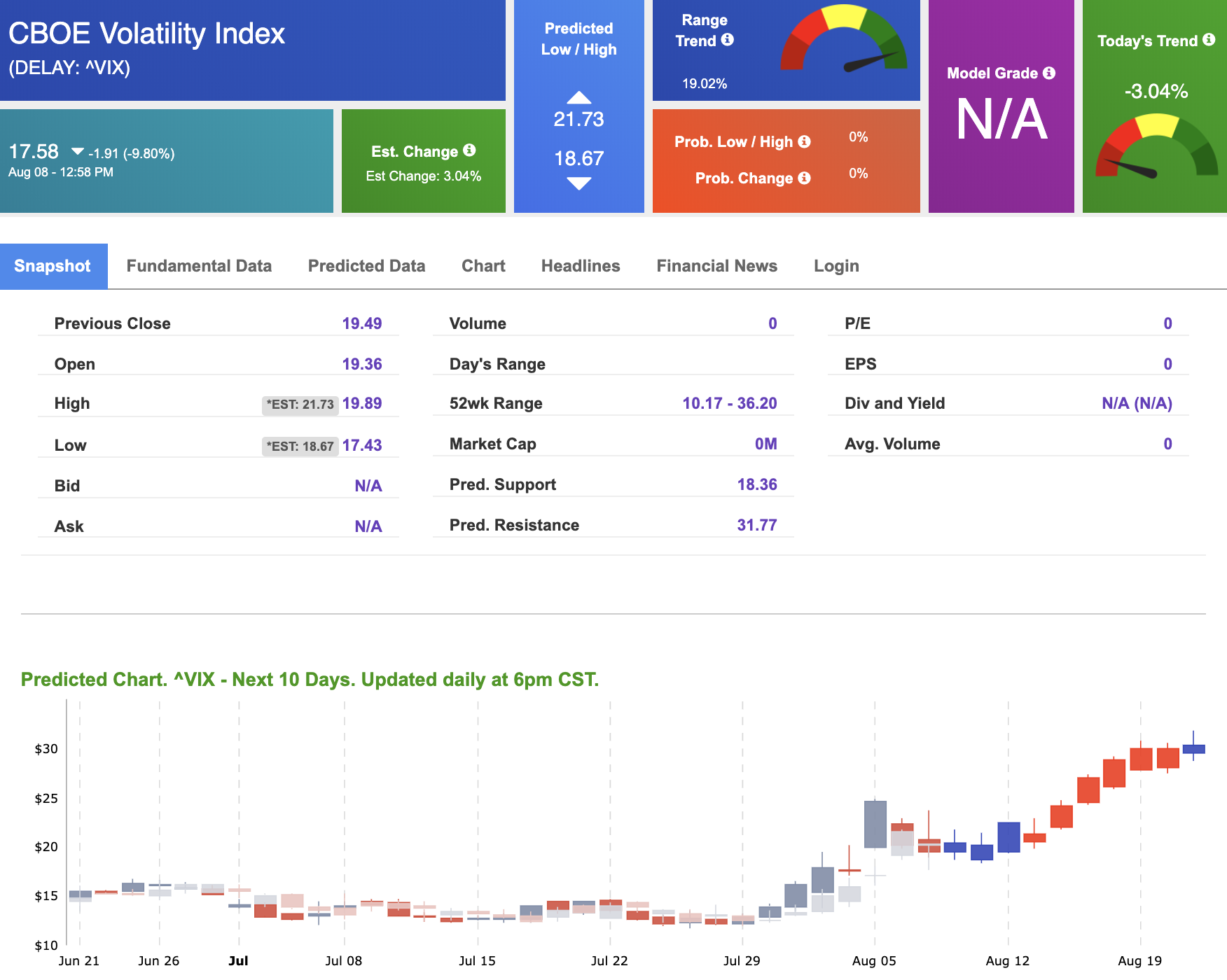

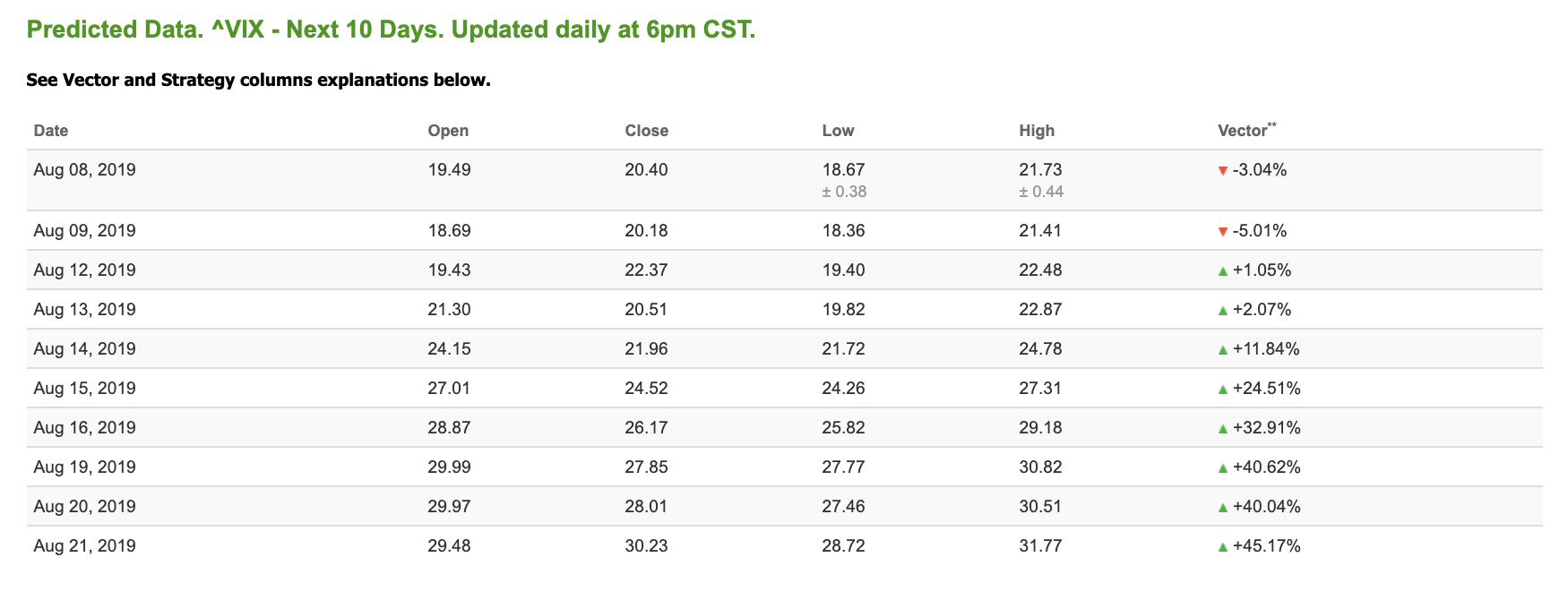

Volatility

The CBOE Volatility Index (^VIX) is down 9.80% at $17.58 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $20.18 with a vector of -5.01%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

“I cannot guarantee your acceptance”

Are you aware that you are one of a very select few (for real) to whom I recently extended a limited-time invitation to “test-drive” a game-changing very personal new Elite Trading service from Tradespoon?

If you are quick enough, you can join me live, in my trading room (real-time) and duplicate my trades seconds after I make them.

-

This breakthrough service is limited to only 50 traders.

-

Acceptance is on a first come first served basis and when the 50 Elite seats are taken, that’s it.

-

There is no risk for your trial