Global Negotiations In Focus, Chinese Tariffs Delayed

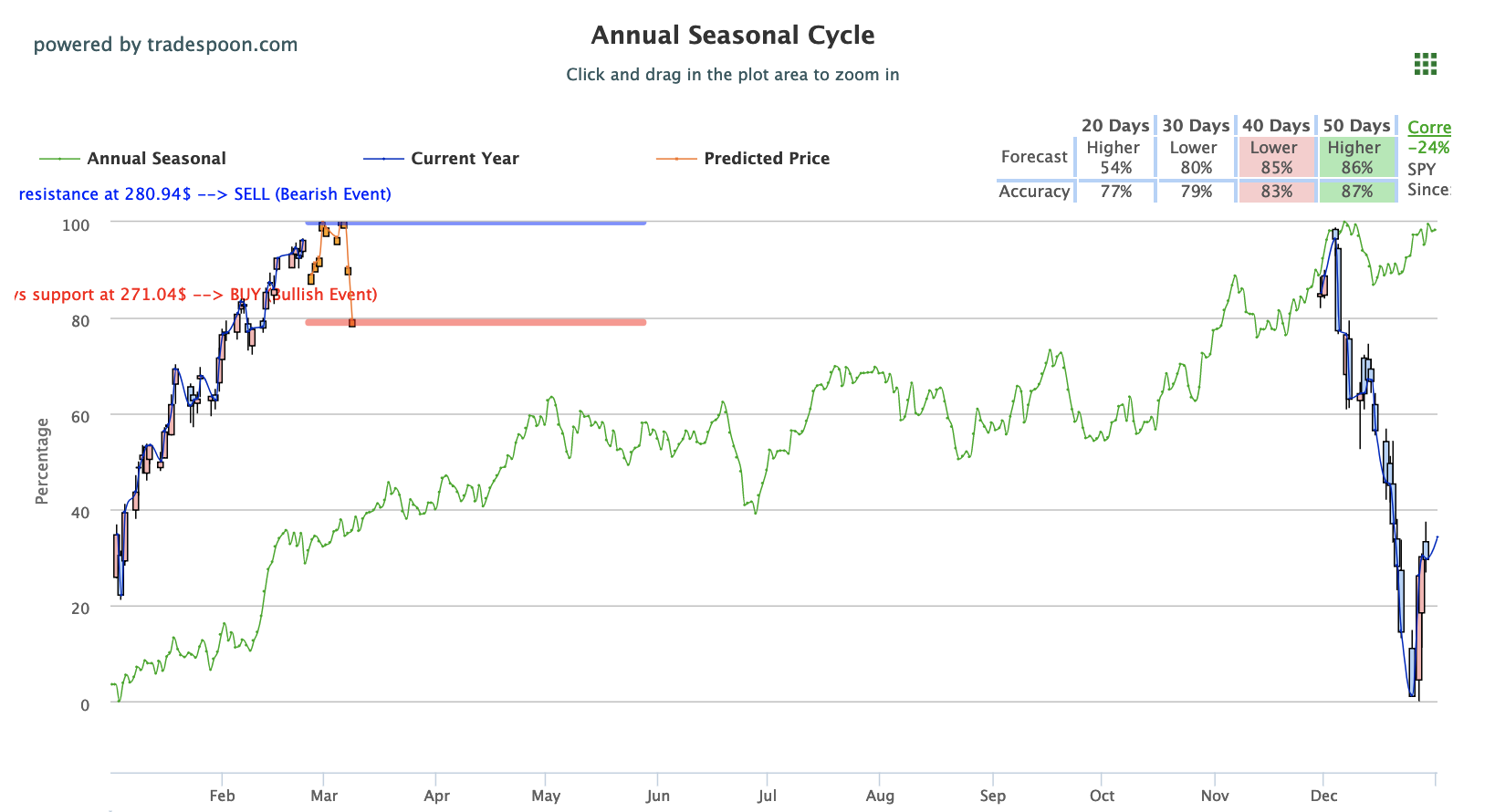

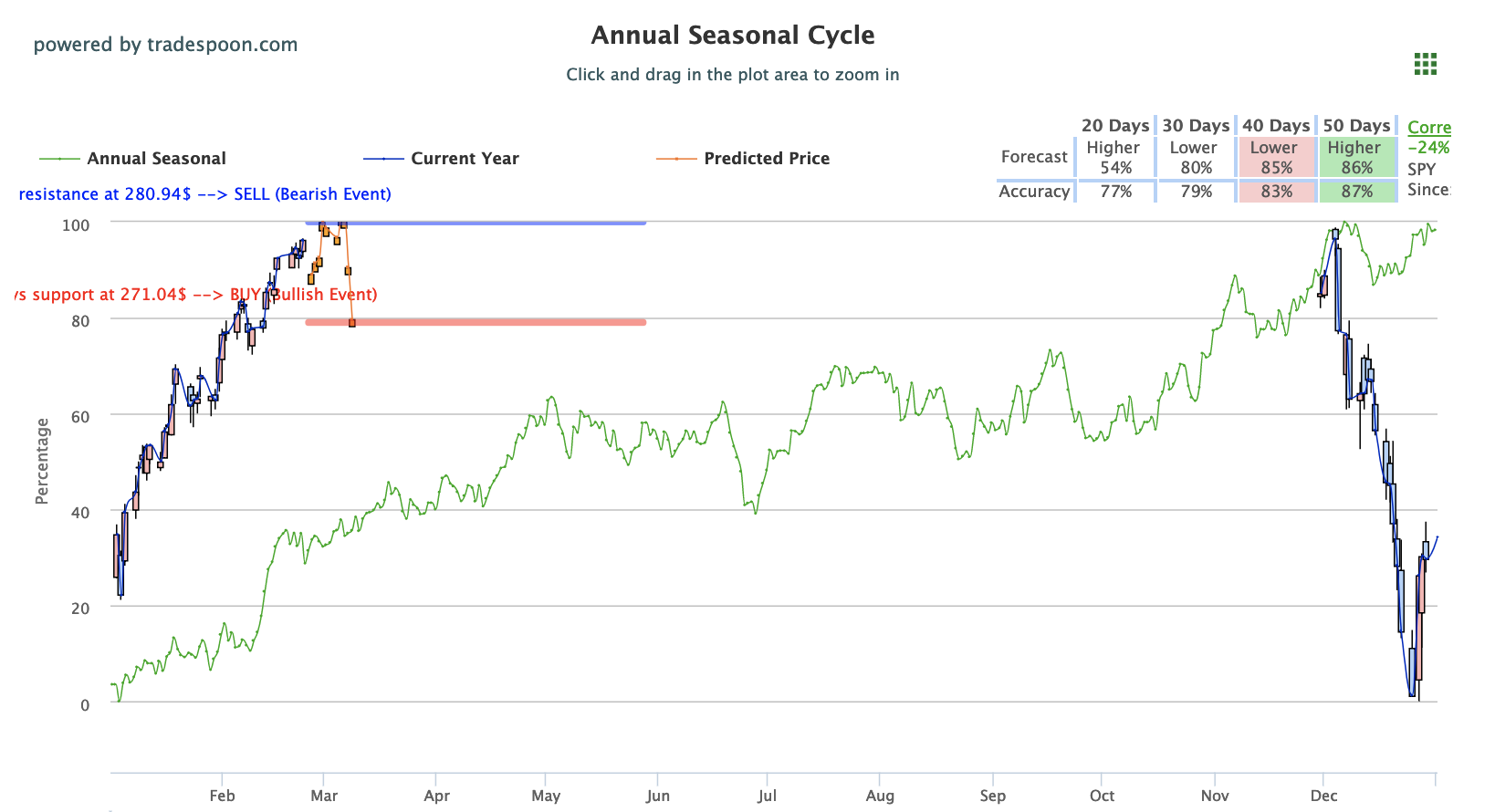

Major U.S. indices are trading higher today off promising geopolitical progress and delayed Chinese tariffs. President Trump cited “substantial progress” in the recent trade talks with China as the main motive for pushing back the deadline to increase tariffs. Later this week Trump is scheduled to meet with North Korean leader Kim Jong Un in Vietnam to discuss nuclear testing and trade. Big-name earnings to monitor this week include Home Depot and Macy’s tomorrow, Square Inq. on Wednesday, and JD.com and Marriott on Thursday. The SPY 200-day moving average, currently sitting at $274, is a major gauge for market direction and if average drops below this level we expect a downward trend. For reference, the SPY Seasonal Chart is shown below:

Just yesterday Trump tweeted his support for pushing back the March 1st deadline to increase tariffs on over $200 billion worth of goods only to confirm that same notion today. Both sides are looking to sign a trade agreement in the coming weeks and the issue now turns to how to best enforce and enact any of the agreed upon standards. President Trump and Chinese President Xi will look to meet next month to finalize the deal. Another major meeting on the docket includes this week’s meeting between Trump and North Korean leader Kim Jong Un in Vietnam. Denuclearization and nuclear testing remain at the forefront of talks while trade and economic concerns will come into play also. Trump has repeatedly stated his belief that there is a tremendous economic benefit for North Korea to denuclearize. Elsewhere, Prime Minister Theresa May has scheduled a final vote on her Brexit deal for March 12, just under three weeks away from the deadline to exit the European Union. Although Brexit status remains murky global markets are up today with equities rising worldwide. European markets rose modestly while Asian markets saw nice gains, specifically Shanghai composite index.

Other news to monitor this week includes the Mobile World Congress, currently taking place in Barcelona, and continued corporate earnings. Telecommunications giants are meeting in Spain to discuss mobile and cellular innovations, topics include 5G networks and global growth. Earnings for major retailers will be of key interest this week as Macy’s, Best Buy, TJX, Lowe’s and other major brands are scheduled to report. Shares of Berkshire rose after CEO Warren Buffett released his investment letter, detailing his observations of the American economy, while General Electric saw nice gains today after news of its biopharma-sector sale of Danaher made rounds. Shares of Kraft are down almost 2% today after plummeting 25% on Friday behind poor earnings and an SEC investigation.

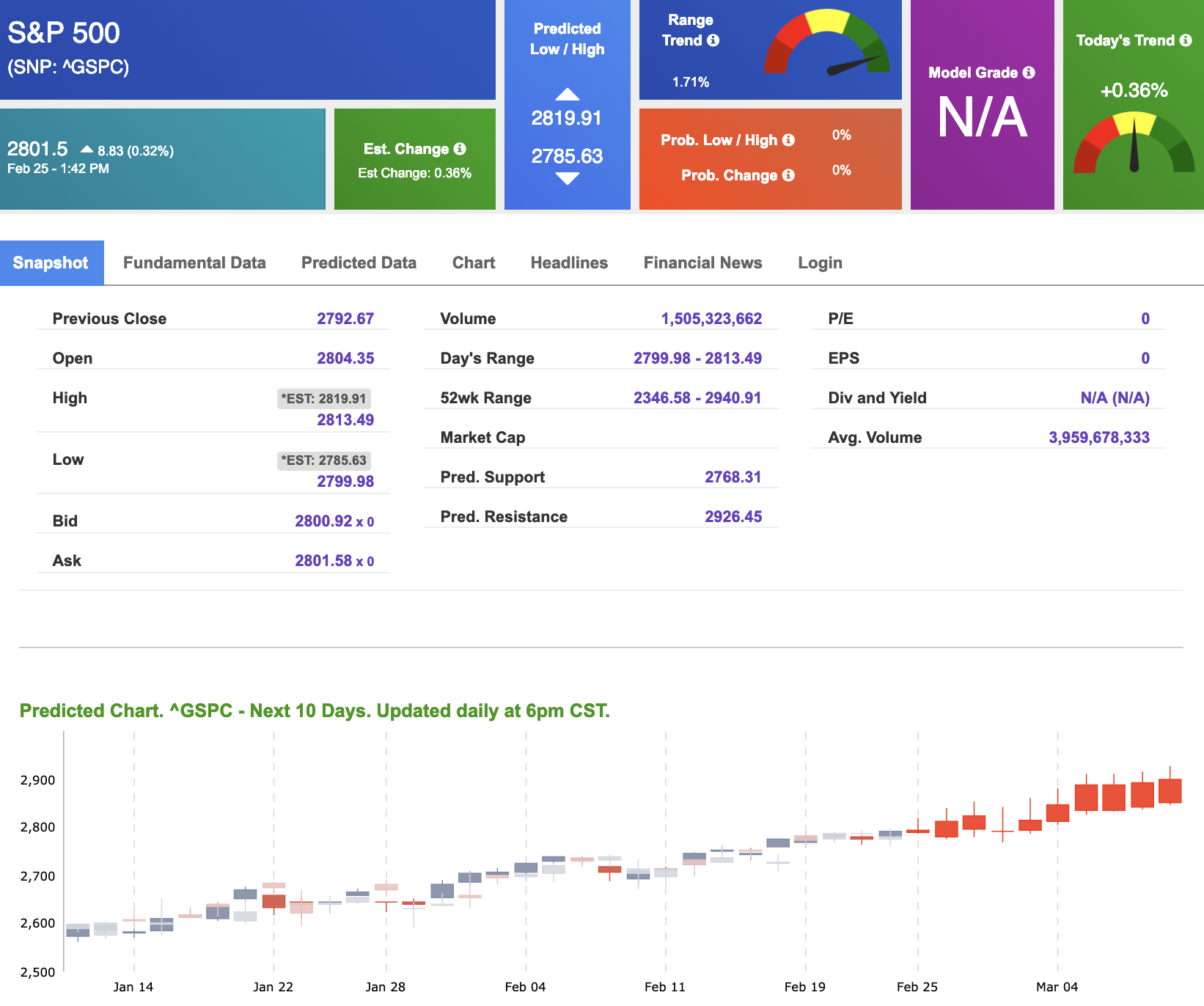

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows positive signals. Today’s vector figure of +0.36% moves to +1.77% in five trading sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Sign up now for Lifetime Premium Access and pay less than the cost of just 1 year and lock in …

PERMANENT UNLIMITED PREMIUM ACCESS!

One-time offer expires Thursday, Feb. 28th

- Subscribe now for less than the cost of one year at the regular rate!

- With 18 month trailing gains of 1,071%, and an 75% win-rate, a lifetime Membership could easily turn $100,000 into $1,170,749 and if the next few years are as good as the last 18 months even. . . $2.000,000. . .$5.000,000 or more.

- Tradespoon Premium Service is the only trading system you’ll ever need for timely buy/sell trading calls.

Click Here to Sign Up

Highlight of a Recent Winning Trade

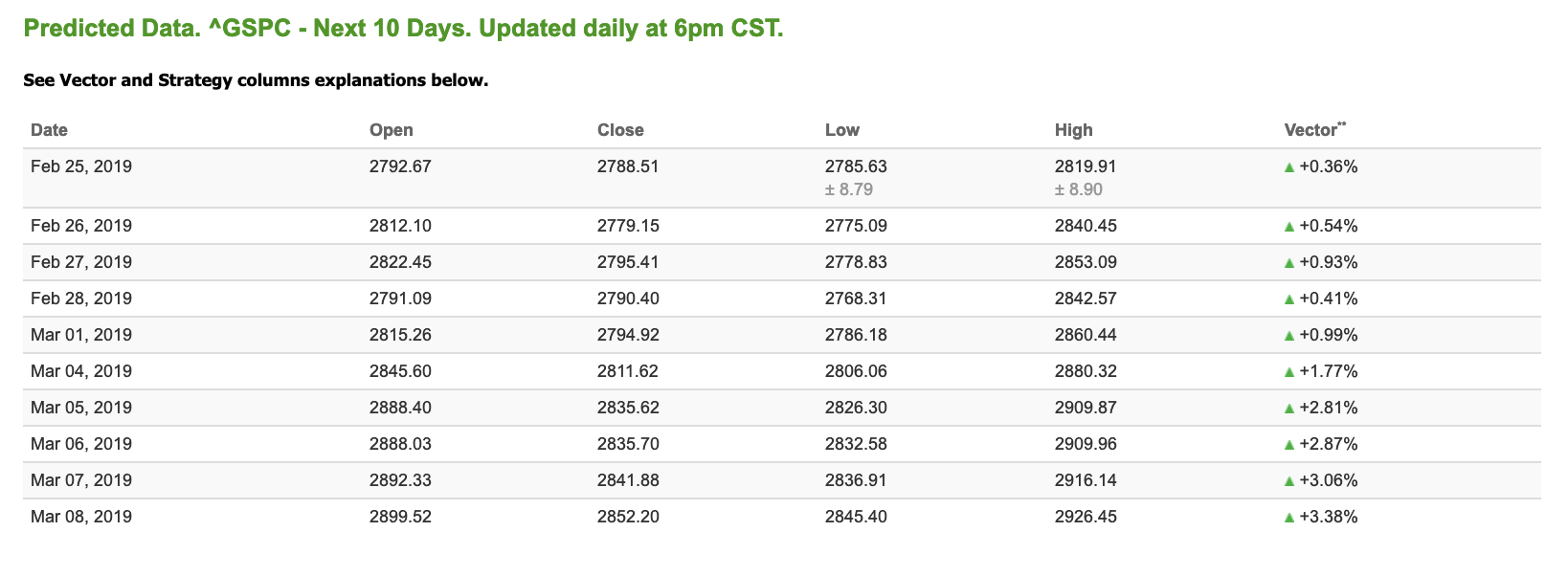

On February 19th, our ActiveTrader service produced a bullish recommendation for Philip Morris Inc. (PM). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

PM opened in its forecasted Strategy B Entry 1 price range $83.46 (± 0.46) and passed through its Target price $84.29 in the first hour of trading the following day, reaching a high of $85.12. The Stop Loss price was set at $82.63.

Tuesday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

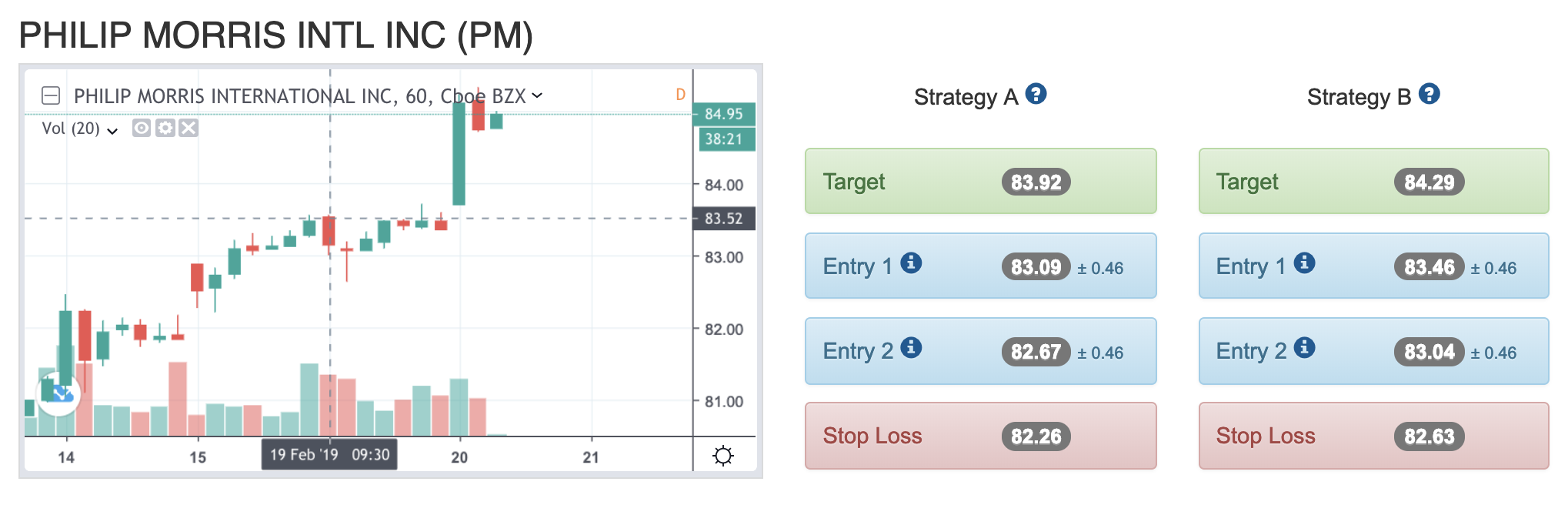

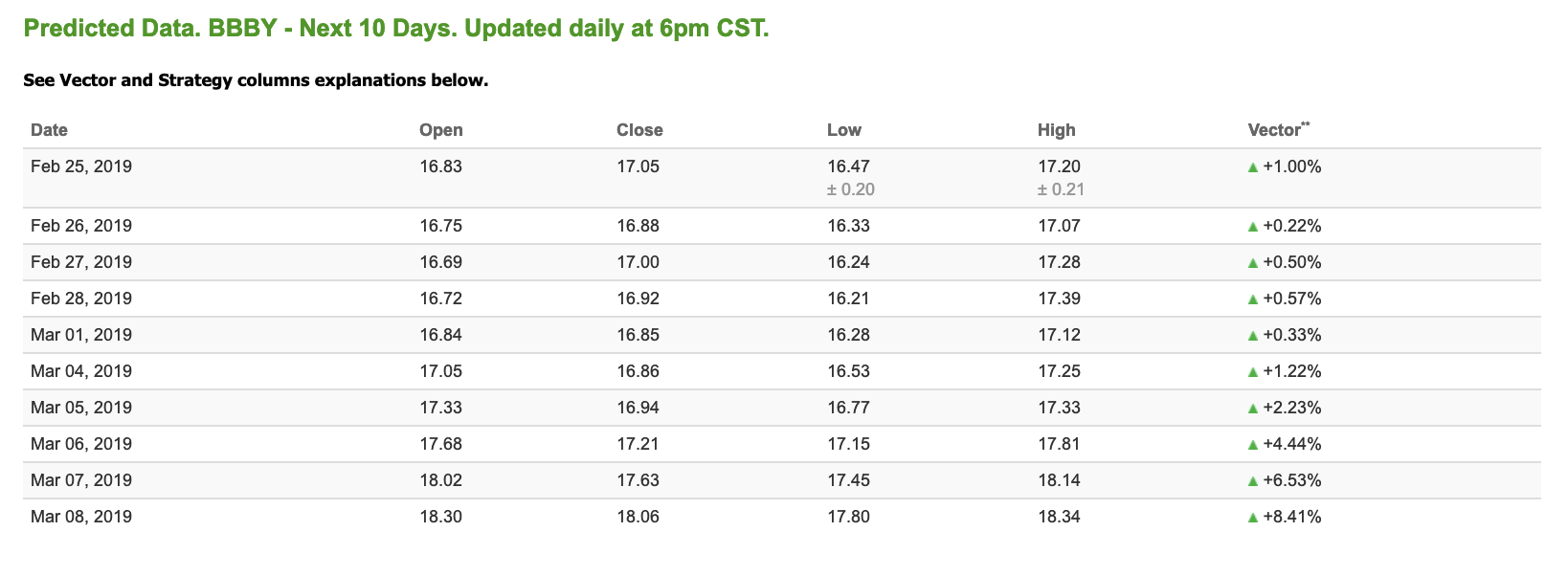

Our featured stock for Tuesday is Bed Bath & Beyond Inc. (BBBY). BBBY is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $16.76 at the time of publication with a +1.00% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

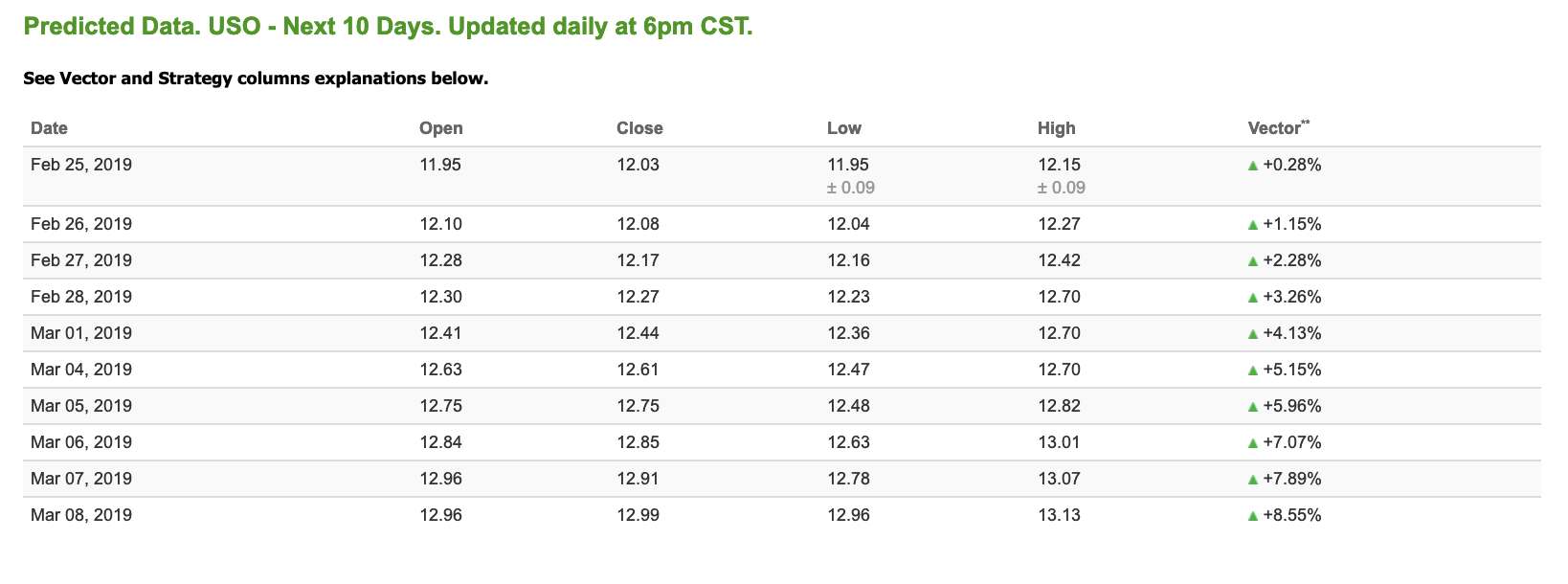

Oil

West Texas Intermediate for March delivery (CLH9) is priced at $55.44 per barrel, down 3.20% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $11.59 at the time of publication, down 3.00% from the open. Vector figures show +0.28% today, which turns +5.15% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

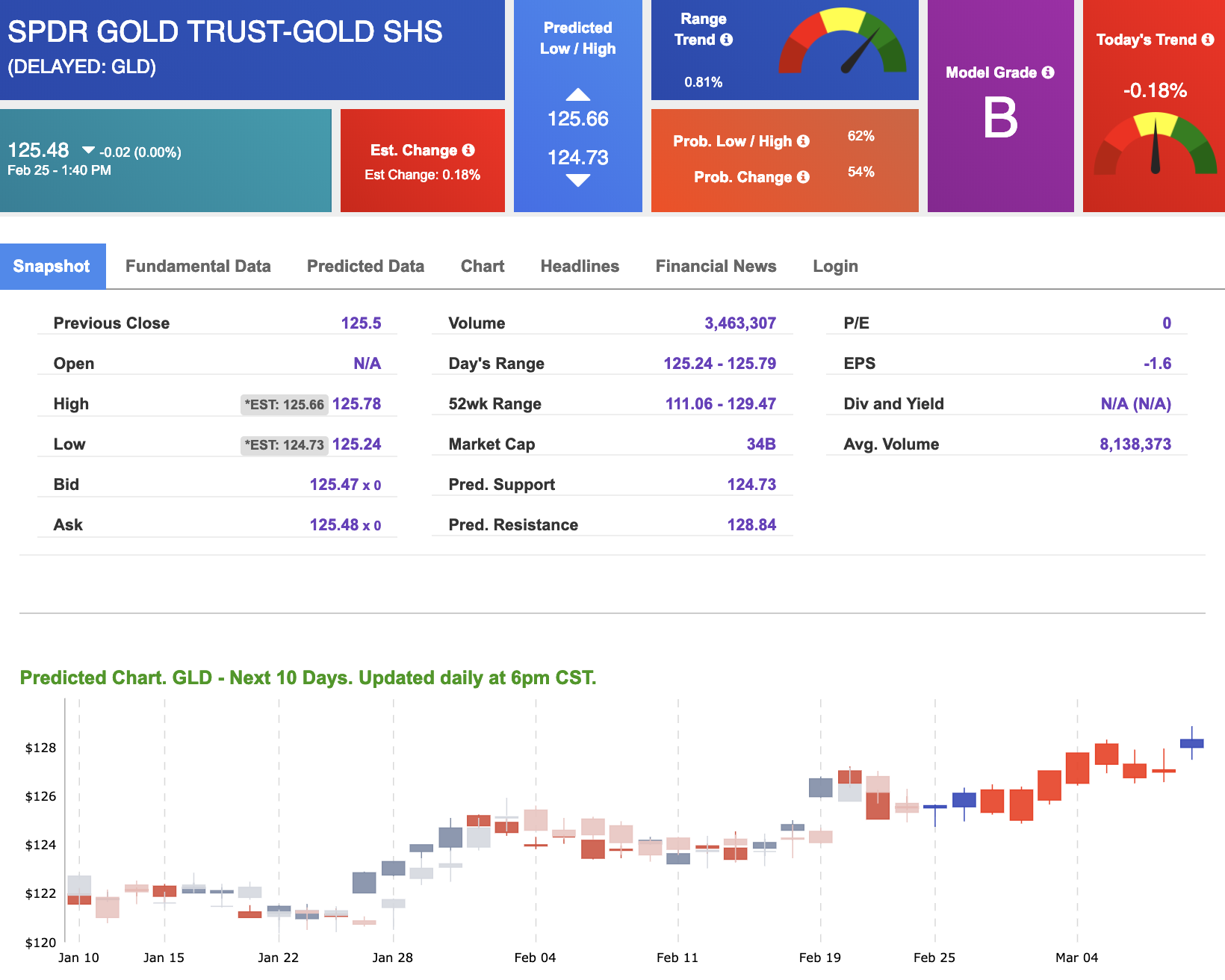

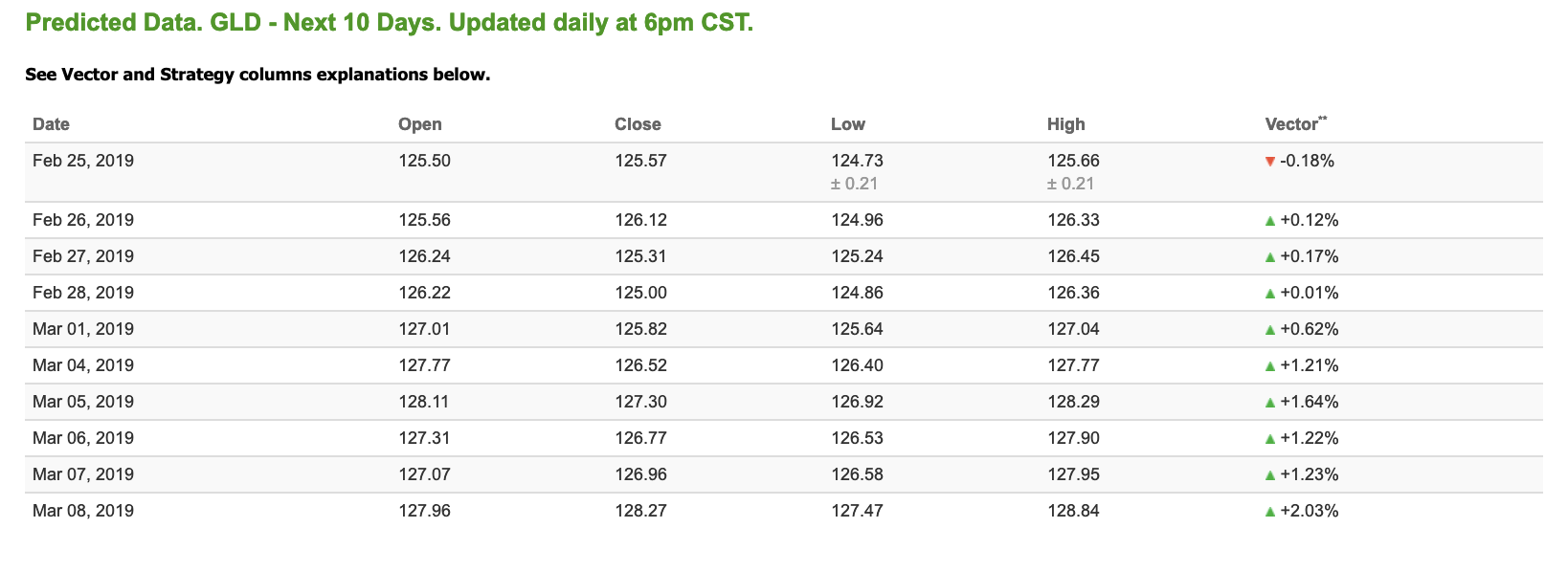

The price for April gold (GCJ9) is down 0.20% at $1,330.30 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $125.48. Vector signals show -0.18% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

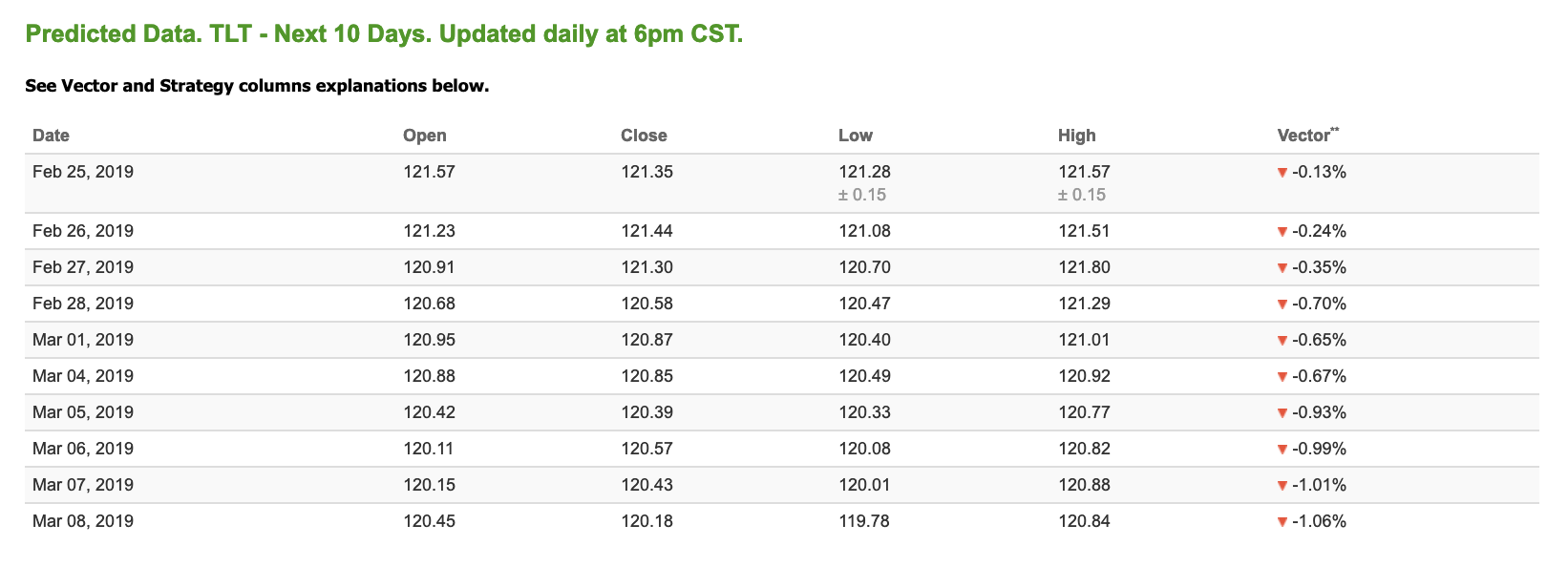

The yield on the 10-year Treasury note is down 0.87% at 2.67% at the time of publication. The yield on the 30-year Treasury note is down 0.62% at 3.03% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.13% moves to -0.70% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

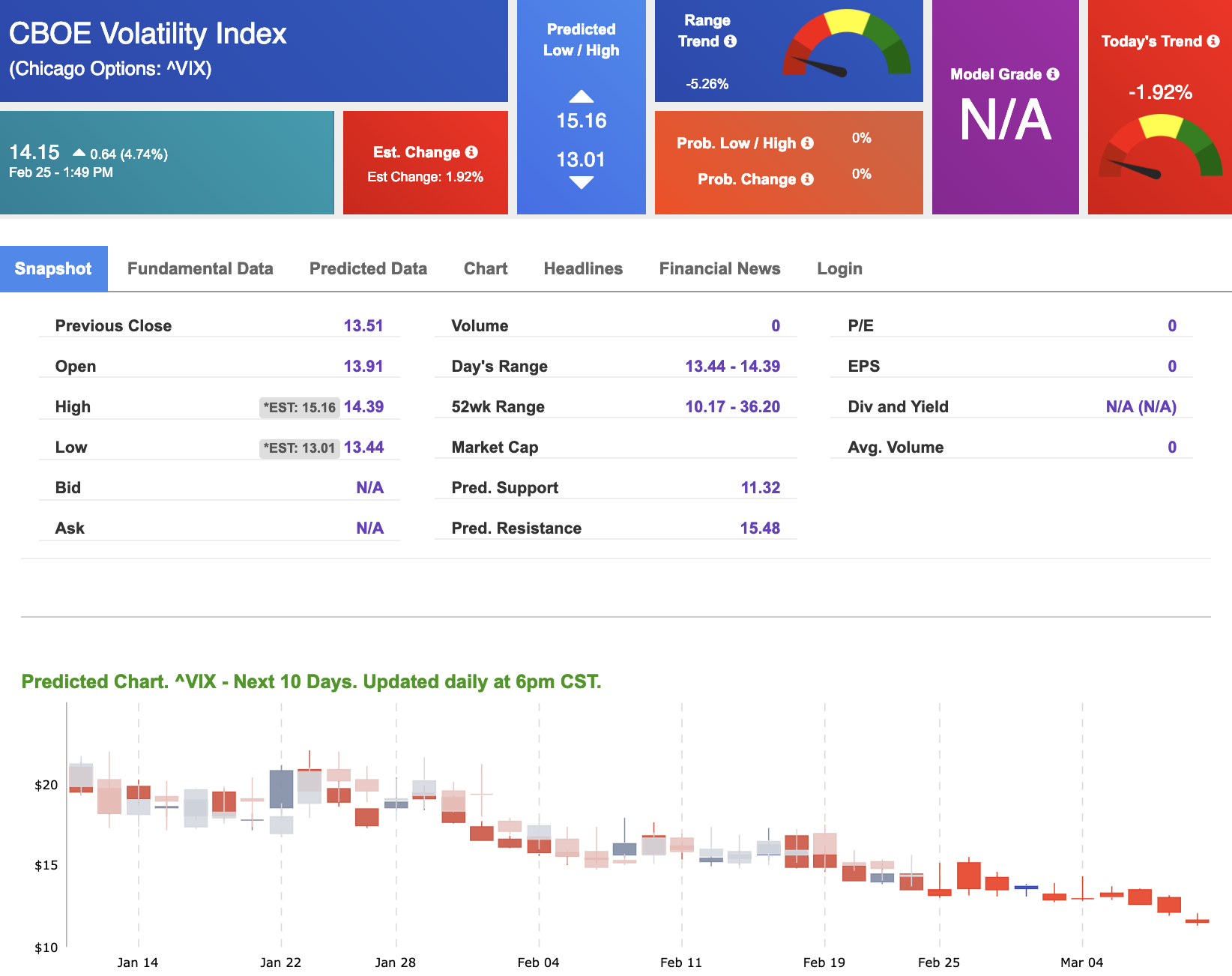

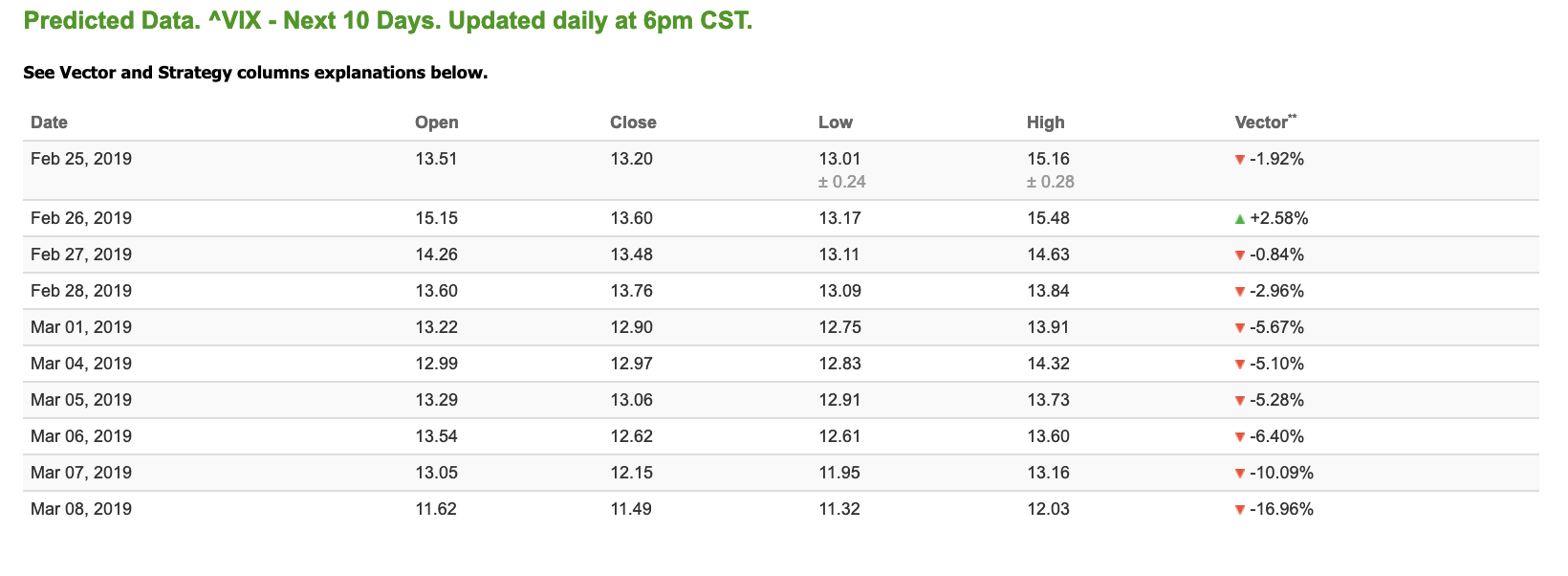

Volatility

The CBOE Volatility Index (^VIX) is down 4.74% at $14.15 at the time of publication, and our 10-day prediction window shows negative signals. The predicted close for tomorrow is $13.60 with a vector of +2.58%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Sign up now for Lifetime Premium Access and pay less than the cost of just 1 year and lock in …

PERMANENT UNLIMITED PREMIUM ACCESS!

One-time offer expires Thursday, Feb. 28th

- Subscribe now for less than the cost of one year at the regular rate!

- With 18 month trailing gains of 1,071%, and an 75% win-rate, a lifetime Membership could easily turn $100,000 into $1,170,749 and if the next few years are as good as the last 18 months even. . . $2.000,000. . .$5.000,000 or more.

- Tradespoon Premium Service is the only trading system you’ll ever need for timely buy/sell trading calls.