Government Shutdown Avoided with New Funding Bill, “High-Level” Talks in Beijing Begin

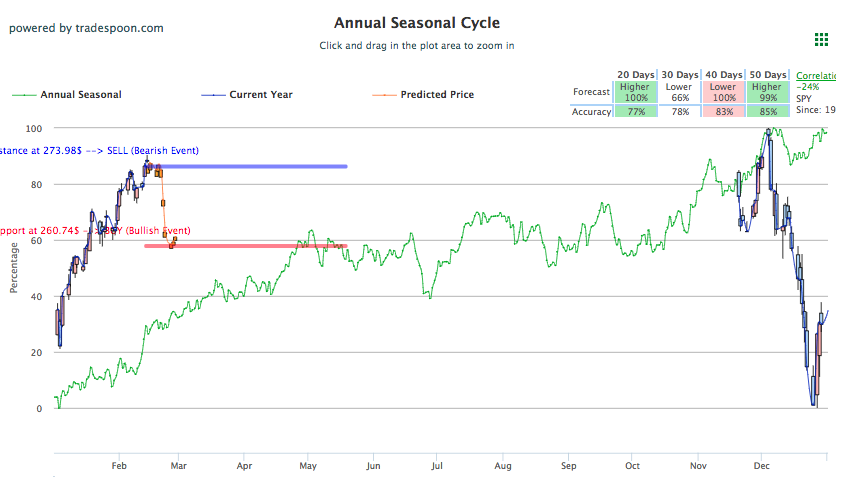

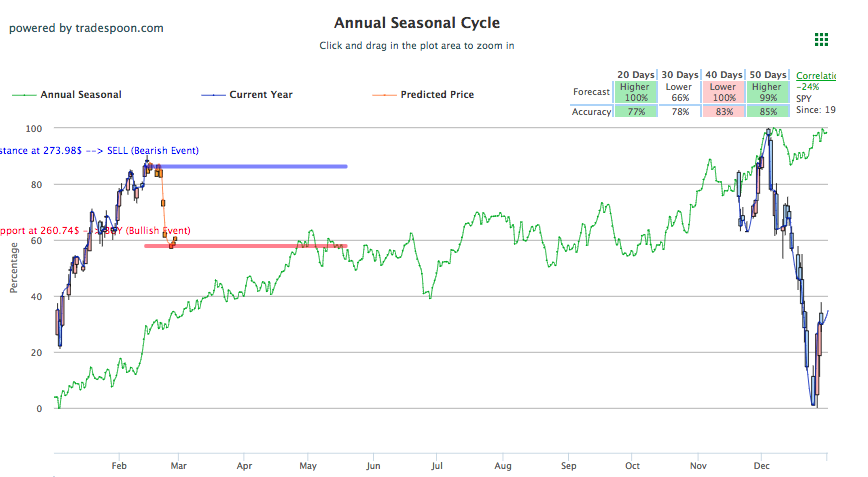

Major U.S. indices are mixed as China trade talks continue in Beijing while lawmakers in D.C. look to avoid another potential government shutdown before tomorrow’s deadline. Non-disruptive news from China and the bipartisan effort in Congress to keep the U.S. government open are supporting markets today while underwhelming economic data provides some pressure. Major earnings to close out the week include Coca-Cola, Nvidia, Canopy Growth, and Pepsico while other news to note today includes another scheduled Brexit vote and JPMorgan Chase’s new cryptocurrency. We encourage our highly-valued members to buy the selloffs and avoid chasing the market by incorporating our propriety tools to define support and resistance levels for opportunistic trades. Currently, SPY sits right at the 200-day moving-average, which is a key figure in predicting market movement. If average drops below this level expect a downward trend. Still, another major selloff, like the one we saw in December, is not likely for some time. SPY support level could retrace to $267 level in the weeks to come. For reference, the SPY Seasonal Chart is shown below:

Indicies are struggling for direction with the Dow is modestly down, S&P nearly flat, and Nasdaq up around 20 points. Congressional efforts to keep the government open are providing support in the form of good news as it is becoming more likely the shutdown will be avoided. Congress will vote on the spending bill today and, if it is passed, it will then go to the President to sign into effect. President Trump has already stated that another “shutdown would be a terrible thing,” and he, too, intends on avoiding it. The previous shutdown lasted 35 days, cost the U.S. government nearly $11 billion dollars, and has been reported to strongly affect federal employees personal finances. Almost half of all federal employees, 49%, fell behind on paying bills while 42% saw debt increase, according to Prudential. The new funding bill will not include all of the requested funding for a wall but will include more money for border fencing and immigration detention. Still, Trump intends to declare a state of emergency following the passing of this bill in order to attain money for the border wall. The current funding bill has designated $1.375 billion for border security.

Elsewhere, relations between the U.S. and China seem to be improving as Trump has openly stated his flexibility in regards to increasing tariffs. Presidents from both nations will likely not meet before the early March deadline although representatives in Beijing are currently working on scheduling these meeting. With three days of “deputy-level” meetings behind us, Treasury Secretary Mnuchin and U.S. Trade Robert Lighthizer will go on to “high-level” talks today in Beijing with Vice Premier Lie He. Also worth nothing, recent Chinese export data has been released to show improvement in the last month as compared to the struggles the nation faced toward the end of 2019.

Retail sales numbers for December have returned significantly underperforming previous years, providing some pressure on markets today. Several other key economic reports remain delayed. Earnings season is winding down with select few major-name still to report. Coca-Cola, Duke, and CME reported before the market open today while Nvidia, CBS, and Canopy Growth report after the closing bell. Cisco saw nice gains after earnings topped expectations yesterday. JPMorgan Chase has debuted its new JPM coin, a cryptocurrency aimed at becoming the first of its kind with real-world application. Another key vote in the Brexit process will take place on February 27th and will look to more clearly define the U.K.’s next steps while also serving as a measure of confidence in Prime Minister May’s handling of Brexit. Globally, European markets closed to mixed results while Asian markets closed lower.

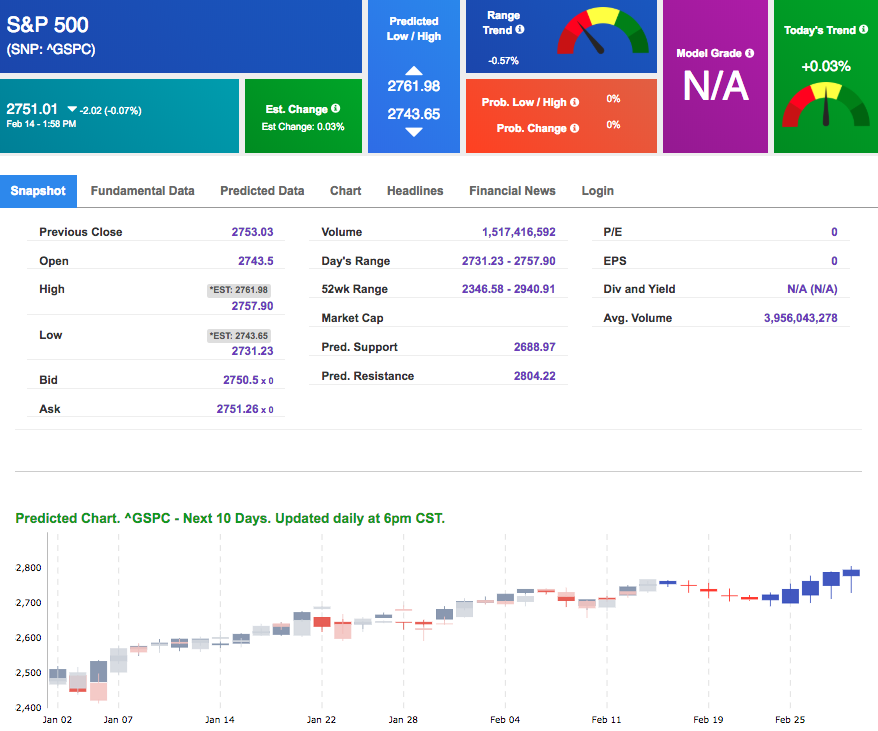

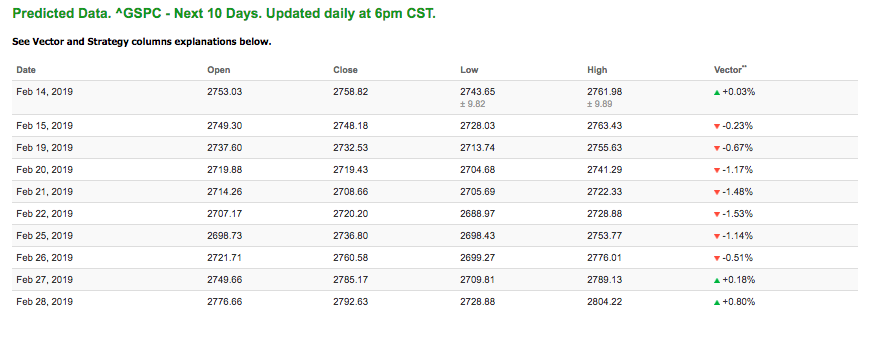

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.03% moves to -1.53% in five trading sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(FINAL OFFER) You Don’t Want to Miss This!

Today only, we are doing something we have RARELY do!

We are offering LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 1 year of service!

***Starting next week, we will be adding an annual maintenance fee to all lifetime memberships, but if you sign up before that happens, you will be locked in and will not need to pay this fee!

Click Here to For More Information

Highlight of a Recent Winning Trade

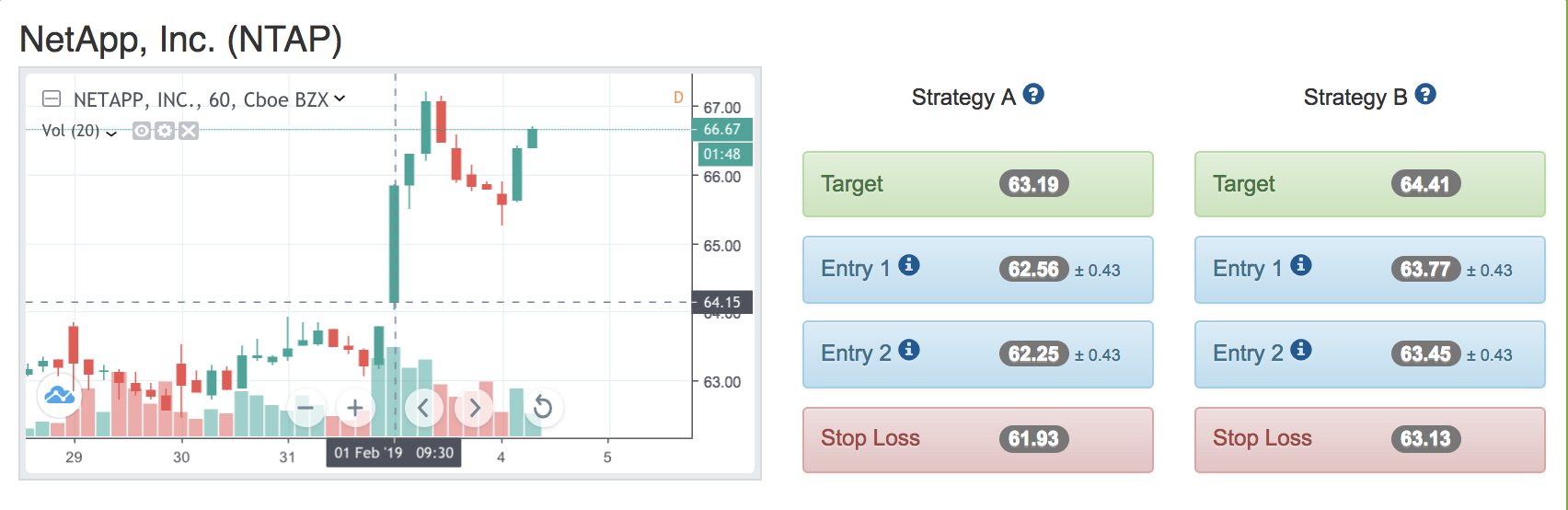

On February 1st, our ActiveTrader service produced a bullish recommendation for NetApp, Inc. (NTAP). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

NTAP opened in its forecasted Strategy B Entry 1 price range $63.77 (± 0.43) and passed through its Target price $64.41 in the first hour of trading, reaching a high of $67.06. The Stop Loss price was set at $63.13.

Friday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

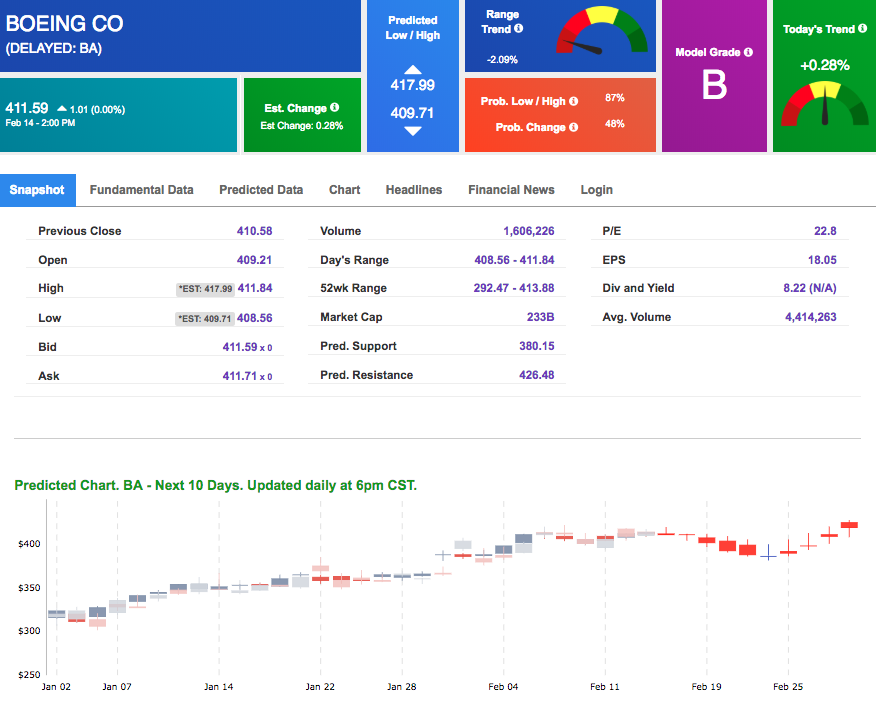

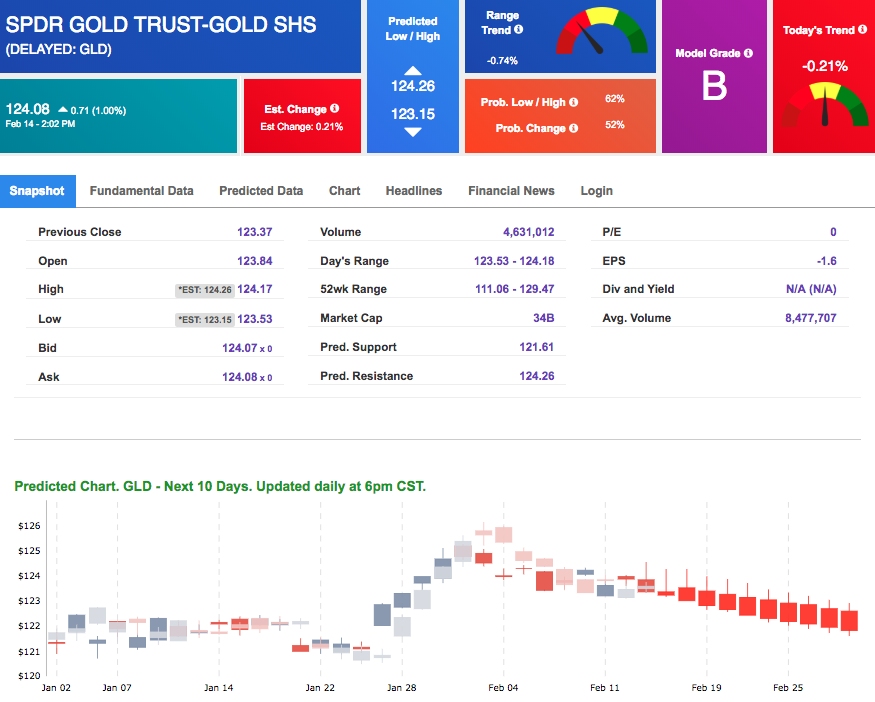

Our featured stock for Friday is Boeing Co. (BA). BA is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $411.59 at the time of publication with a +0.28% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

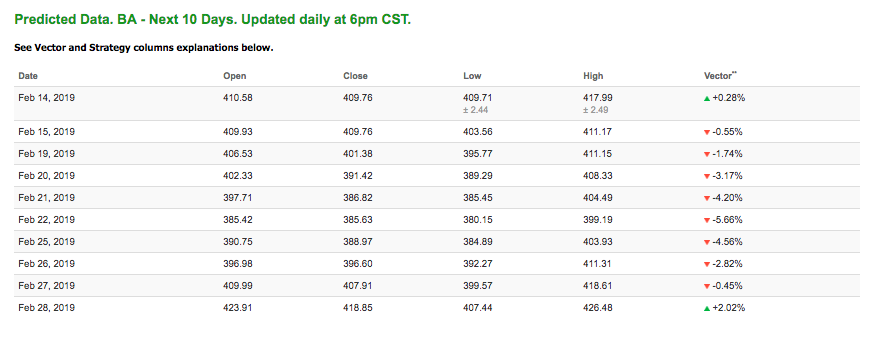

West Texas Intermediate for March delivery (CLH9) is priced at $54.51 per barrel, up 1.13% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mostly positive signals. The fund is trading at $11.46 at the time of publication, up 1.00% from the open. Vector figures show -0.48% today, which turns +1.70% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

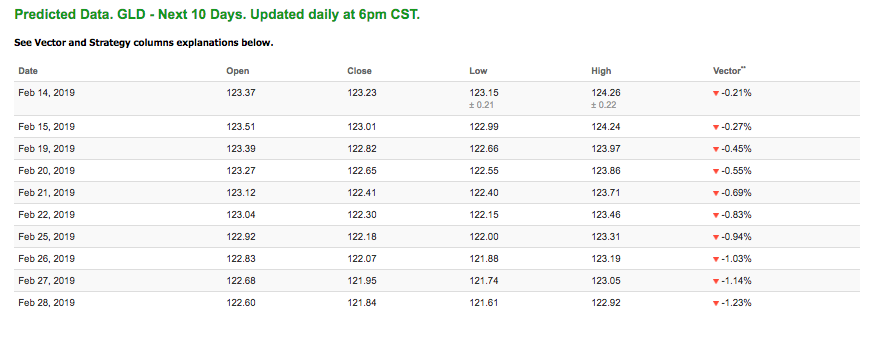

Gold

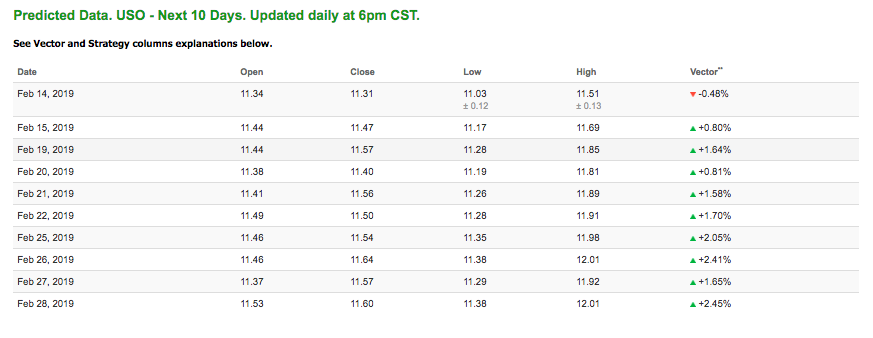

The price for April gold (GCJ9) is up 0.03% at $1,315.50 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly negative signals. The gold proxy is trading at $124.08, up 1.00% at the time of publication. Vector signals show -0.21% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

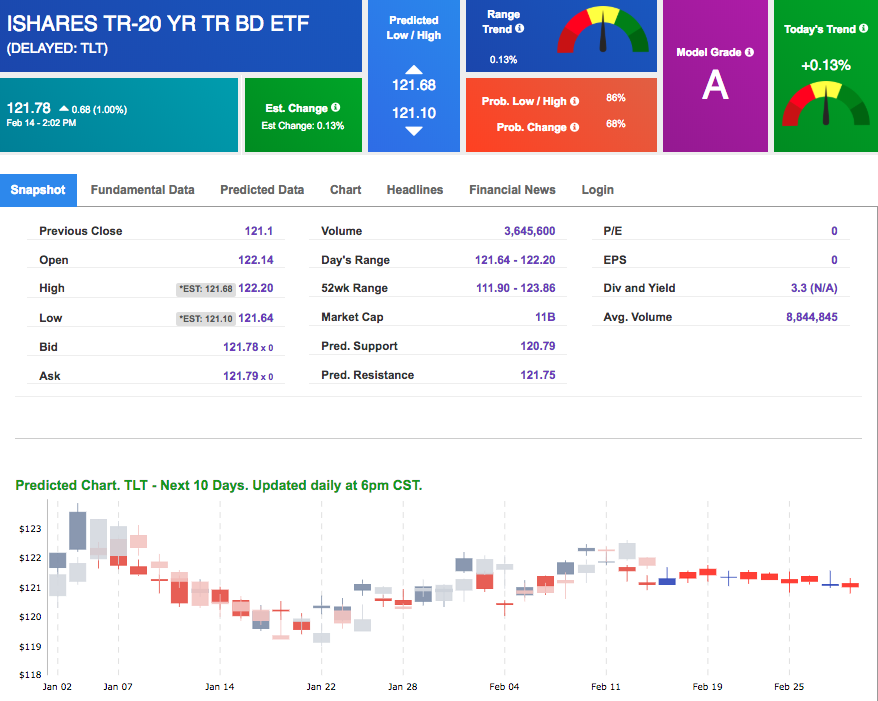

The yield on the 10-year Treasury note is down 1.73% at 2.65% at the time of publication. The yield on the 30-year Treasury note is down 0.71% at 3.01% at the time of publication.

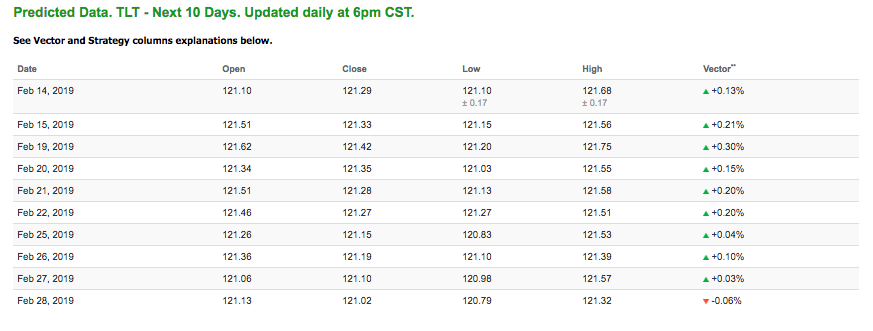

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.13% moves to +0.15% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

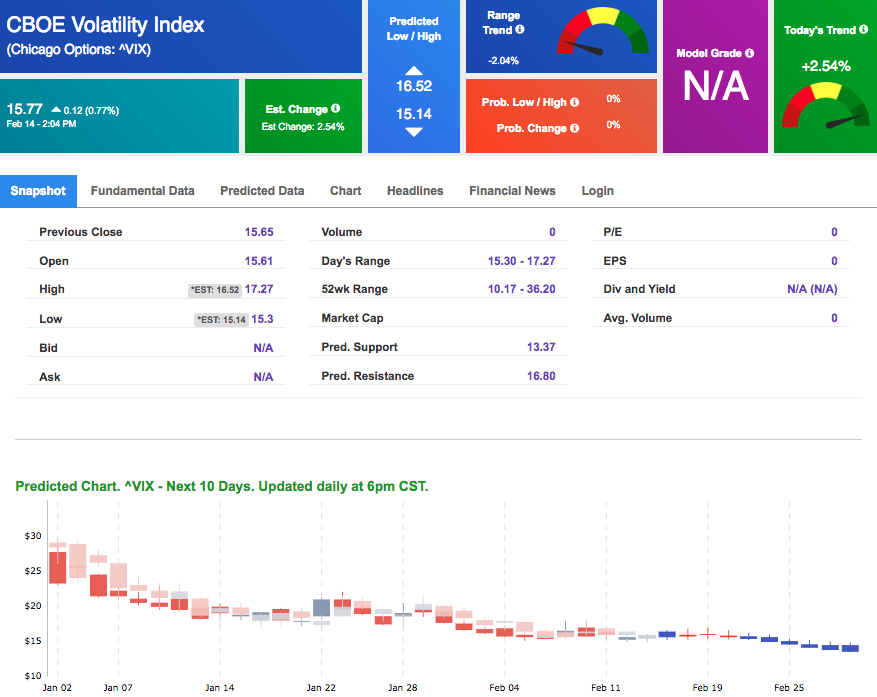

Volatility

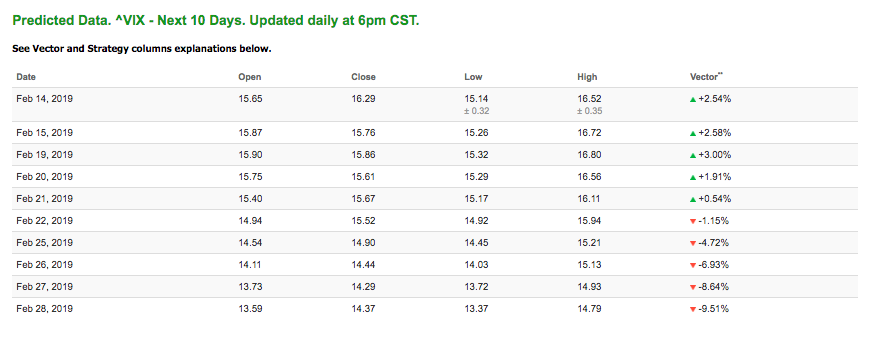

The CBOE Volatility Index (^VIX) is up 0.77% at $15.77 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $15.76 with a vector of +2.58%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(FINAL OFFER) You Don’t Want to Miss This!

Today only, we are doing something we have RARELY do!

We are offering LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 1 year of service!

***Starting next week, we will be adding an annual maintenance fee to all lifetime memberships, but if you sign up before that happens, you will be locked in and will not need to pay this fee!