Government Shutdown Could Be Avoided, U.S. – China Tariffs Paused

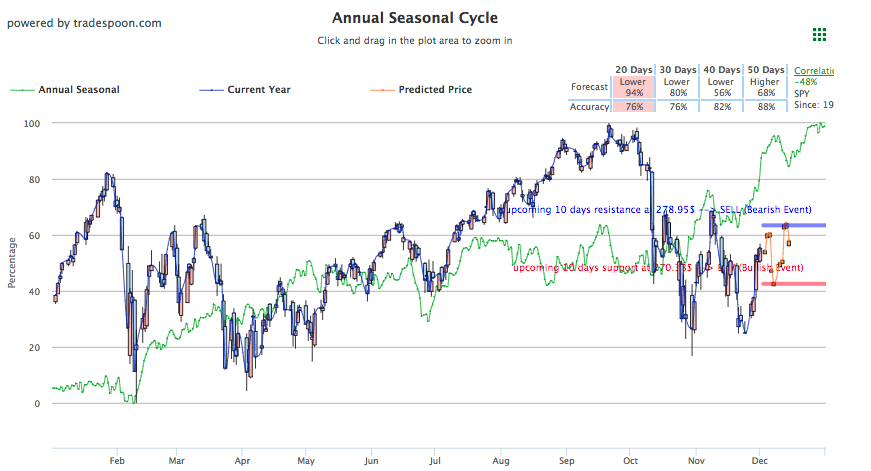

Stocks are up today as news of a tariff truce and further trade talks came out of the G20 summit to provide market-wide optimism. China and the U.S. were able to agree on a temporary halt on tariffs and a 90-day period to get negotiations worked out regarding intellectual property protection, cyber and agricultural issues, and other tech and economic concerns. Also worth noting, the partial government shutdown that was speculated for December 7th as Democrats have refused to support the $5 billion President Trump wants for the border wall will likely be averted. Unfortunately, President George H.W. Bush death has reshifted focus and tension in D.C. and the likely standoff between both parties will be avoided. Trump plans on signing a short-term funding bill to delay the shutdown while Republican and Democratic leaders are set to meet this week. In the short-term, the market looks overbought and SPY should trade above the 200-day moving average range, between $275 and the $282 overhead resistance. Market has a high likelihood of retesting 52 weeks high this month. For reference, the SPY Seasonal Chart is shown below:

All major U.S. stock and bond markets will be closed Wednesday, December 5th, as well as the federal government, in memory of the late Geroge H.W. Bush. The 41st U.S. President will be buried in D.C. on Wednesday where many U.S and world leaders will converge for the funeral. The week was already set to be an eventful one as Democrats and Republicans were gearing for a partial government shutdown regarding funding of the border wall. Trump is asking for $5 billion to fund the border wall while Democrats have agreed to $1.6 billion for border security, the disagreement could lead to a partial government shutdown, 25% of federal spending. A Tuesday morning meeting between both sides ahead of the Bush funereal could result in a short-term funding bill that should halt any possible government shutdown for two weeks.

This weekend’s G20 summit resulted in some good trade progress between the U.S. and China as both sides have agreed on a tentative deal to halt tariffs and work on a deal in the next 90 days. In an official statement from the White House, starting January 1, 2019, the planned increase on tariffs will not occur, keeping tariffs at 10% instead of 25%. Also in the statement, “China will agree to purchase a not yet agreed upon, but very substantial, amount of agricultural, energy, industrial, and other product” to improve the trade imbalance. The pause on tariffs will only be for 90-days where both sides hope to work out a sustainable trade agreement and if both sides are unable to come to an agreement in that period, the tariffs will once again increase. Not included in the statement, but coming from Trump’s twitter page, China has agreed to reduce tariffs on U.S. cars which are currently at 40%. Further details regarding the temporary trade agreement should continue to be made clear in the days to come as U.S. officials return from Argentina.

Other important news to note today includes changes in the oil-market landscape and the extent of Monday’s market-wide rally. Following the G20 summit, oil prices rose as Russia and Saudi Arabia agreed to extend output cuts and Qatar has announced its intent to leave OPEC starting January 1st, 2019. Elsewhere, Shell recently announced its initiative to address climate change. Short-term plans have been announced in hopes of reducing the company’s carbon footprint after investor pressure to address the topic grew. Similarly, in 2020, the oil-giant will reevaluate its plans and goals and set new ones, with plans of regrouping every three to five years. Shares of Shell rose 3% following the announcement. Devon, Marathon, and Apache also rose in midday trading, further adding to the today’s oil rally. Tech and auto stocks are also on the move up today, lining up with a bevy of sectors that are rallying behind renewed optimism in global trade relations. Globally, both Asian and European markets closed higher today.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mostly negative signals. Today’s vector figure of +0.12% moves to -2.74% in five trading sessions. The predicted close for tomorrow is 2,743.48. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On November 23rd, our ActiveTrader service produced a bullish recommendation for Genworth Financial Inc. (GNW). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

GNW entered the forecasted Entry 1 price range of $4.47 (± 0.04) in its first hour of trading and hit its Target price of $4.54 in the second hour of trading, reaching a high of $4.54 for the trading day. The Stop Loss was set at $4.43.

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 1 year of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

In addition, you will get Lifetime Access to our ActiveTrader service which includes daily high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!

Click Here to Sign Up

Tuesday Morning Featured Stock

Our featured stock for Tuesday is Applied Materials, Inc. (AMAT). AMAT is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $38.3 at the time of publication, up 2.75% from the open with a +0.85% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $52.61 per barrel, up 3.32% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $11.13 at the time of publication, up 3.73% from the open. Vector figures show -0.34% today, which turns -6.20% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for February gold (GCG9) is up 0.95% at $1,237.60 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $116.52, up 0.85% at the time of publication. Vector signals show +0.11% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is down 0.15% at 2.99% at the time of publication. The yield on the 30-year Treasury note is down 0.42% at 3.28% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.07% moves to -0.16% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

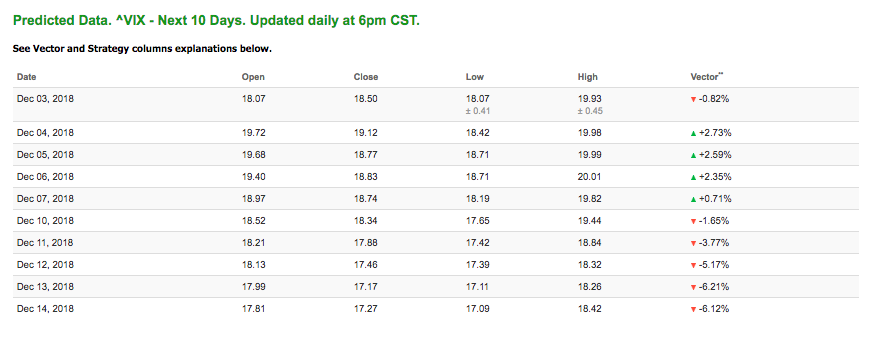

The CBOE Volatility Index (^VIX) is down 8.19% at $16.59 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $19.12 with a vector of +2.71%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

LIFETIME ACCESS to our Stock Forecast Toolbox Membership for less than the regular price we normally charge for only 1 year of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

In addition, you will get Lifetime Access to our ActiveTrader service which includes daily high-probability stock & option trade ideas with exact entry/exit points for both bullish and bearish traders!