How to Approach the Market as Volatility Skyrockets

As of midday, the major indices were set for their fourth consecutive day of 1%+ move; the longest streak since late October’s market bottom. What’s interesting is that in both cases, the days alternated between up and down. Such choppy and volatile action is often indicative of a trend change.

Again, I’m not quite ready to say that the market peaked last Monday when stocks suffered a sharp reversal — following the Jerome Powell reappointment as the Federal Reserve Chairman. However, I reiterate what I wrote yesterday, which is that I expect volatility to persist through December.

You might be saying, “That’s nice Steve, but what do I do with this vague prediction of yours?”

I don’t have a clear answer as one must always maintain a flexible mind frame and be ready to adjust to changing market conditions.

The main message I’d like to share is that volatility presents both an opportunity and a risk. The opportunities cannot be manufactured or controlled, they’ll present themselves in due course. You can set a game plan, and have price targets for triggering trades, but you must stay patient and be prepared to react decisively to when a setup meets your criteria.

On the other hand, risk is something we can proactively take steps to manage. One of the most important items to be aware of is that as volatility increases, market liquidity decreases. This means bid/ask spreads get wider and the number of shares or options contracts available to buy or sell at a given price diminishes. This is usually referred to as market depth and a lack of liquidity means a shallow market, which in turn, can create air pockets in prices moving quickly from one level to the next, with nary a trade occurring in between.

[$19 SALE ] Access the top-secret trading techniques you need to profit in Options Trading!

The inverse relationship of volatility to liquidity is understandable as no one wants to stand in front of a charging bull or raging bear. Hence, traders and market makers expand the spreads as to which they’re willing to buy or sell. Also, to reduce the number of shares or contracts they are willing to execute at any given price.

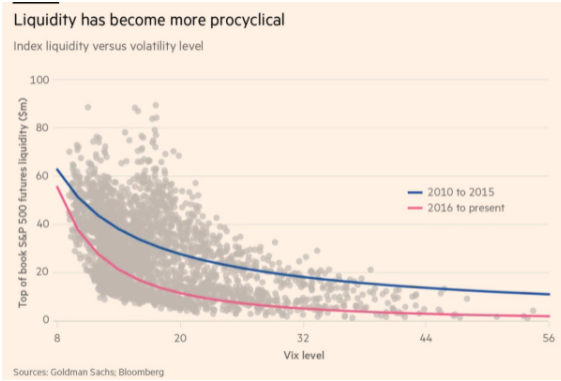

But the relationship between volatility and liquidity has become more extreme over the past few years as algorithmic trading, which tends to be trend-chasing, has become more dominant and market-making duties have mostly been turned over from humans to machines.

You can see over the past five years how liquidity has decreased when volatility increases.

When I was a market maker on the Chicago Board of Options Exchange (CBOE) floor, the rule was that you had to be “10 up.” Meaning, if someone asked for a price quote on a specific option strike you could provide any bid/ask you wanted but you had to commit to trading at least 10 contracts at those prices. I’m not sure when, or if, the rule formally changed or if it slowly disappeared as trading moved to electronic platforms. The upshot is, now you might see a bid/ask quote but when you put an order in the prices can change. Meaning even if you are willing to sell at the bid or buy on the offer your trade, not even a single contract, still might not be executed.

So, what can we do to mitigate the risk of being stuck in a low liquidity price vacuum? For starters, reduce your position size. If you usually allocate $1,000, cut it down to $500. Secondly, stick to the more liquid names, or ETFs especially, for short-term trades where you’re only looking for a relatively-small percentage move. Giving away $0.25-$0.50 on both the exit and entry of the $3-$5 option spread might wipe out nearly all the trade’s profit potential. On the other hand, if you’re taking a position you view as a longer-term investment it is easier to absorb a $0.50-$1.00 in price “slippage” if you think a stock is going to double or get cut in half over the next 6-12 months.

[LAST CHANCE] Try out the Options360 Concierge Trading Service for the low introductory rate of $19!

The post How to Approach the Market as Volatility Skyrockets appeared first on Option Sensei.