Markets Edge Higher Behind Tech Sector, Fed Data

This week’s focus turns towards consumer spending, inflation, and housing data

Tech-stocks are helping push markets higher as all three major U.S. indices closed in the green today. Last week, markets were assisted by positive payroll and retail data while this week’s focus turns towards consumer spending, inflation, and housing data. Several speeches from Fed District Presidents are scheduled for this week as well as the Fed’s bank stress-test results, which are set to be released on Thursday.

Short-term traders should consider adding to positions when SPY near $293

Looking at our latest models, we are projecting the SPY to trade between $270-$330 level in the next 2-3 weeks. We believe the market is unlikely to retest $260 SPY level at this time and we will continue monitoring the VIX, as the market can overshoot support and resistance levels when VIX is trading near $30 level. In the short term, we will be buyers into any corrections and it is our opinion the market is still overbought. Short-term traders should consider adding to positions when SPY near $293 and reducing exposure to the market at $320. SPY continues to trade above $300 and aggressive traders can consider adding to their positions until the market reaches $320 level. Investors should consider hedging portfolios into the rallies and we encourage maintaining clearly defined stop-levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Today, the Dow and S&P edged higher by 0.5% while the Nasdaq all saw gains of 1.9%. Globally, both Asian and European markets closed in the red. Oil and Gold saw modest gains. The dollar edged lower as long-term U.S. Treasury notes saw yields rise.

Key U.S. Economic Reports/Events This Week

- New Home Sales (May) – Tuesday

- St. Louis Fed President James Ballard Speech – Tuesday

- FHFA Home Price Index Year over Year (April) – Tuesday

- Chicago Fed President Charles Evans Speech – Wednesday

- St. Louis Fed President James Ballard Speech -Wednesday

- Weekly Jobless Claims (6/20) – Thursday

- Core Capital Goods Orders (May) – Thursday

- Durable Goods Orders (May) – Thursday

- GDP Revision (Q1) – Thursday

- Atlanta Fed President Raphael Bostic Speech – Thursday

- Fed Bank Stress Tests Results – Thursday

- Personal Income (May) – Friday

- Consumer Spending (May) – Friday

- Core Inflation (May) – Friday

(Want free training resources? Check our our training section for videos and tips!)

For reference, the S&P 10-Day Forecast is shown below:

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term negative outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Vlad’s Portfolio Lifetime Membership!

DO AS I DO… AS I DO IT WATCH LIVE AS I WORK THE MARKETS! TRY IT NOW RISK-FREE!

Click Here to Sign Up

Highlight of a Winning Trade

On May 28th, our ActiveTrader service produced a bullish recommendation for Texas Instruments (TXN). ActiveTrader is included in several Tradespoon membership plans and is designed for day trading, with signals meant to last for 1-2 days.

Trade Breakdown

TXN entered its forecasted Strategy B Entry 1 price range $117.82(± 0.88) in the first hour of trading that day and passed through its Target price of $119.00. The Stop Loss price was set at $116.64.

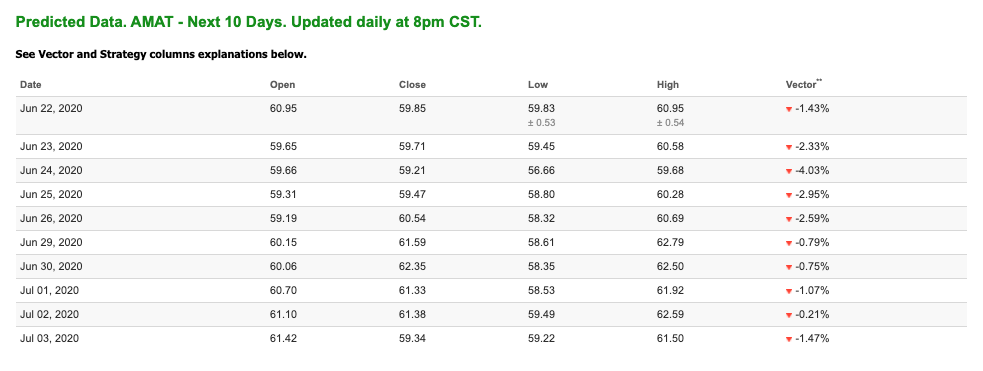

Tuesday Morning Featured Symbol

Our featured symbol for Tuesday is Applied Materials (AMAT). AMAT is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for current-day predicted support and resistance, relative to our entire data universe.

The stock is trading at $61.27, with a vector of -1.43% at the time of publication.

Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, AMAT. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

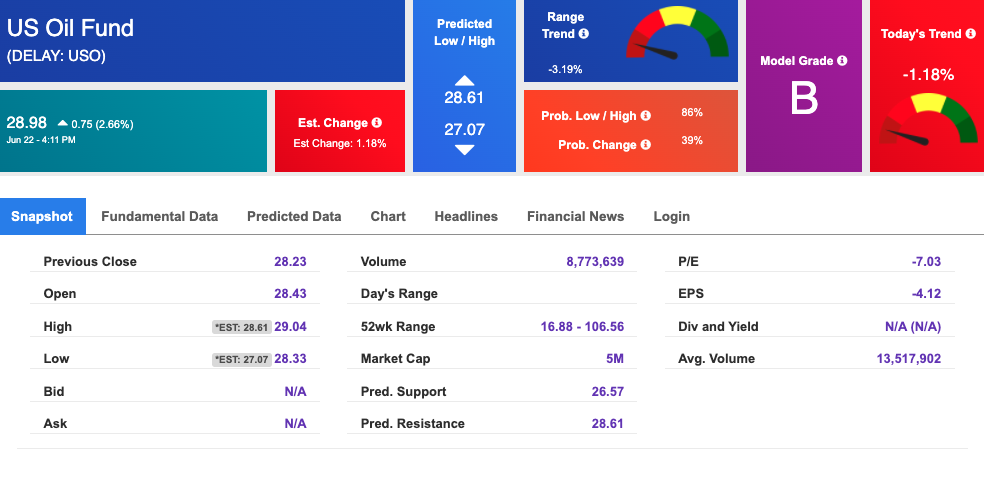

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $40.60 per barrel, up 2.14% from the open, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $28.98 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

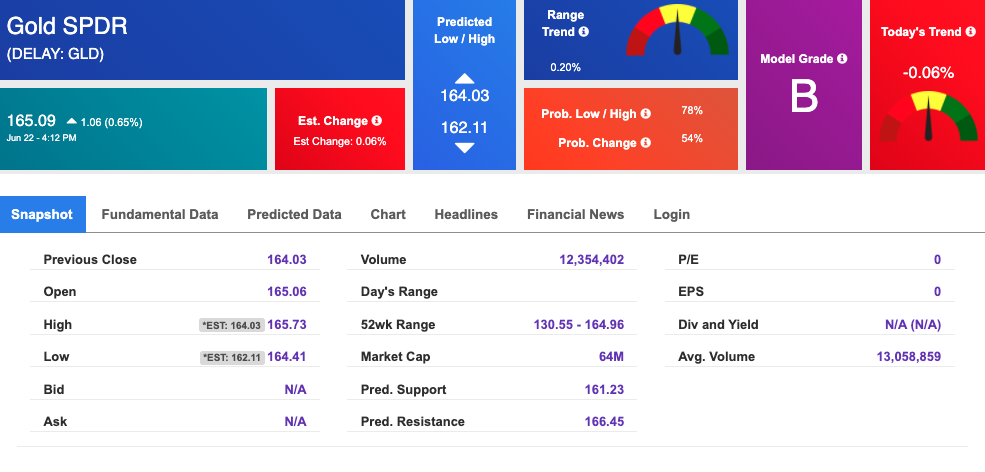

Gold

The price for the Gold Continuous Contract (GC00) is up 0.64% at $1,764.30 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $165.09, at the time of publication. Vector signals show 0.06% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

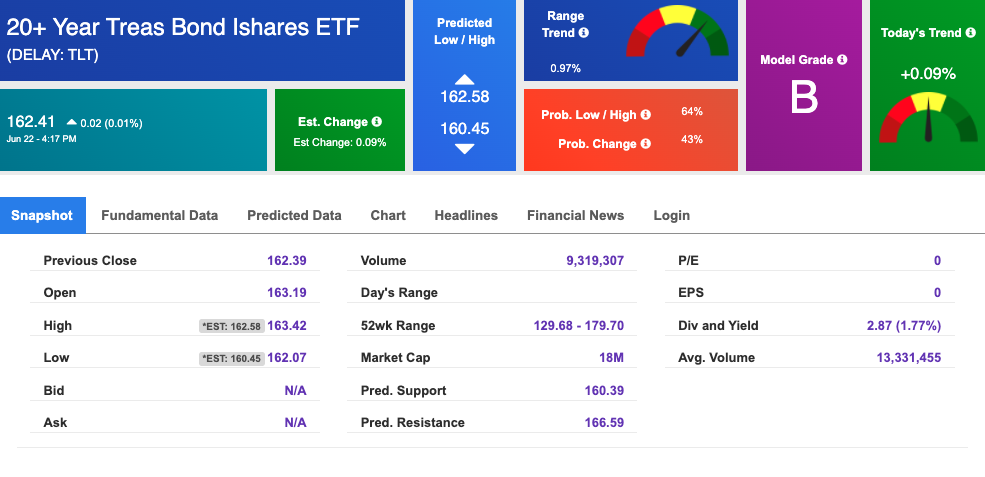

Treasuries

The yield on the 10-year Treasury note is up, at 0.706% at the time of publication.

The yield on the 30-year Treasury note is down, at 1.468% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

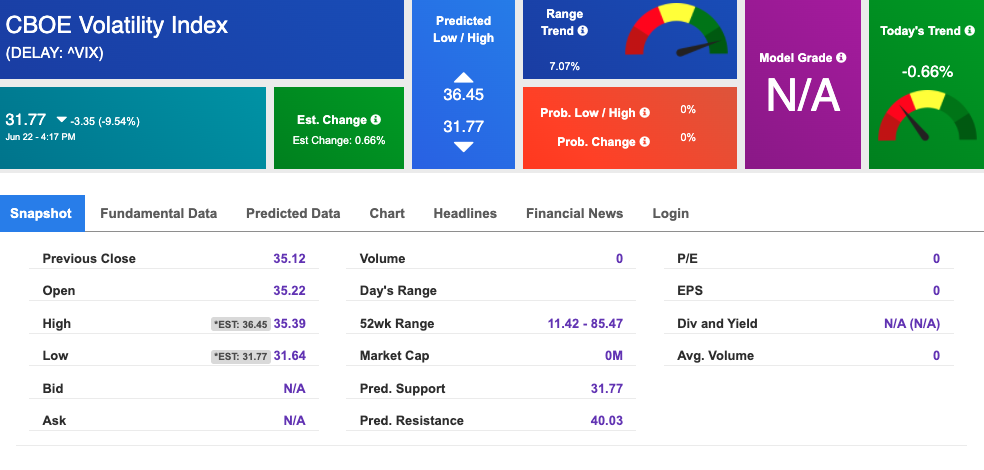

Volatility

The CBOE Volatility Index (^VIX) is $31.77 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.