Markets Rally on Monday, FOMC Minutes In Focus This Week

Market rally on Monday

Major U.S. indices are rallying to start the week after recent volatility and trade uncertainty weighed heavily on stocks, futures, and bonds.

July’s FOMC meeting in focus this week

The Federal Reserve will be in focus this week with July’s FOMC meeting minutes set to release on Wednesday and Fed Chair Jerome Powell set to speak on Friday. The latest minutes will provide further detail on the interest rate cut that was decided upon last month as well as an indication of current economic condition and possible future rate cuts.

Big-name retailers report earnings

Retail earnings will be primarily featured this week with Home Depot, TJX Companies, L Brands, Target, Lowe’s, and other big-name retailers also reporting.

U.S.-China talks in early September

The next meeting between the U.S. and China regarding trade will take place in early September and we expect volatility to continue.

(Want free training resources? Check our our training section for videos and tips!)

Potential for the market to overshoot 50-days MA on SPY

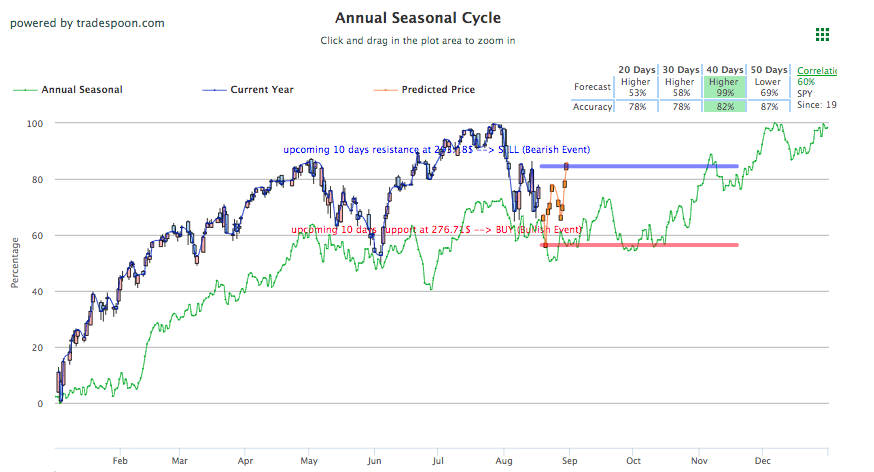

Market Commentary readers are encouraged to have clearly defined stop levels during this time. We see the potential for the market to overshoot 50-days MA on SPY, near $293-$294 level, while current SPY short-term support sits at $277-$282. At current market conditions, we will look to sell near $290 and buy near $278 for the SPY. For reference, the SPY Seasonal Chart is shown below:

Last week, trade and tariff uncertainty heavily weighed on stocks as both the Dow and S&P finished in the red for the week for the third straight week.

Over 1% gains all three major U.S. indices

Today, all three major U.S. indices are on track to close in the green with over 1% gains.

Chinese trade representatives travel to Washington

The next round of negotiations is scheduled for early September with Chinese trade representatives traveling to Washington to meet with Treasury Secretary Mnuchin and Representative Lighthizer. Major talking points between the two sides will be tariffs, intellectual property rights, agriculture, and tech transfer.

The President downplay talks of rescission

The latest comments from President Trump have also caught investors attention as the President downplayed talks of rescission and stated he did not want the U.S. to further do business with Chinese company Huawei. Globally, Asian and European markets closed in the green.

Minutes from July’s FOMC meeting in focus

This week’s feature economic report will be the minutes from July’s FOMC meeting. During this meeting, the Fed agreed to cut interest rates by a quarter-point which rallied markets but received some criticism from the President for not producing a larger interest rate cut.

Next FOMC, scheduled for mid-September, will also be key in this regard as several analysts are expecting another cut while Powell’s comments following the last meeting stated the Fed would be cautious with further cuts. The release of minutes from the last minute should provide some indication as to what the Fed could likely do next and how they view the current economic conditions. Also key this week will be retail earnings. Today Baidu is due to report after market close while tomorrow look for Home Depot, Kohl’s, TJX, and Urban Outfitters. Lowe’s Target, L Brands, and Nordstrom report on Wednesday; Dick’s Gap, and Ross Stores report on Thursday.

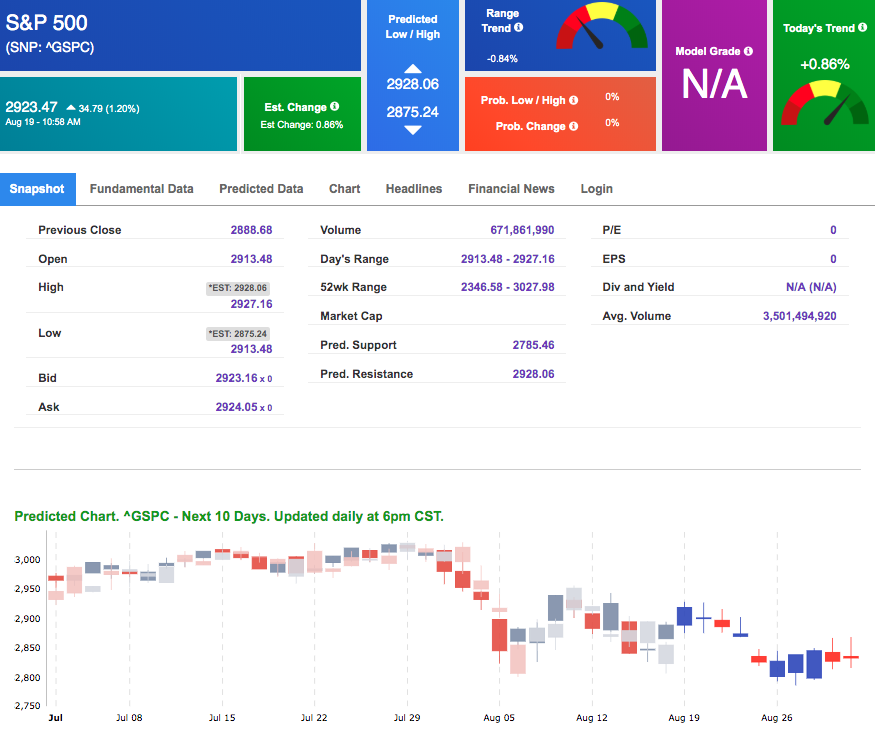

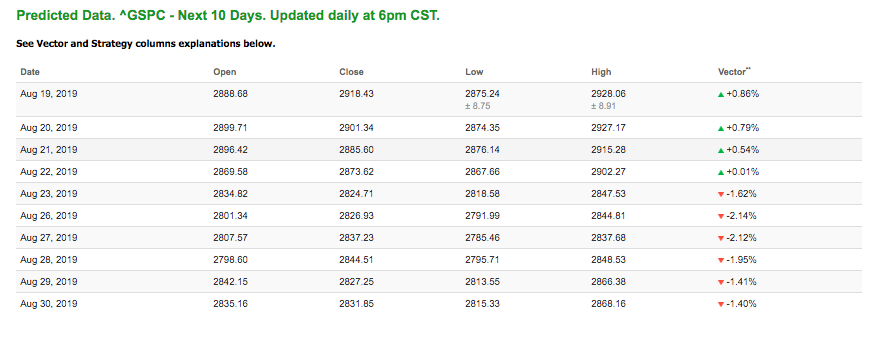

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows mixed signals. Today’s vector figure of +0.27% moves to -0.66% in five trading sessions. The predicted close for tomorrow is 2,926.72. Prediction data is uploaded after the market close at 6 pm, CST. Today’s data is based on market signals from the previous trading session.

Sign up now for Lifetime Access and pay less than the cost of just 1 year and lock in …

PERMANENT UNLIMITED ACCESS!

-

Subscribe now for less than the cost of one year at the regular rate!

-

With 36 month trailing gains of 1,314%, and an 75% win-rate, a lifetime Membership could easily turn $100,000 into $1,414,472

-

Tradespoon Premium is the only trading service you’ll ever need.

CLICK HERE TO SIGN UP

Highlight of a Recent Winning Trade

On August 16th, our ActiveTrader service produced a bullish recommendation for Crown Castle International (CCI). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

CCI entered its forecasted Strategy B Entry 1 price range $142.41 (± 0.73) in its first hour of trading and passed through its Target price $143.83 in the first hour of trading the following trading day. The Stop Loss price was set at $137.15

Tuesday Morning Featured Symbol

*Please note: At the time of publication we do not own the featured symbol, WEC. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

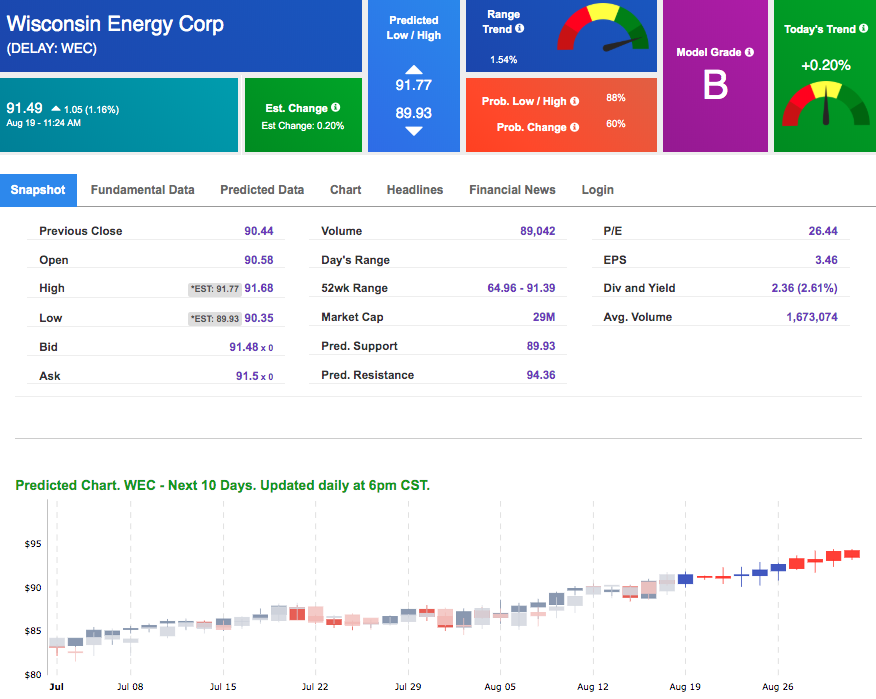

Our featured symbol for Tuesday is Wisconsin Energy Company (WEC). WEC is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $91.49 at the time of publication, up 1.16% from the open with a +0.20% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

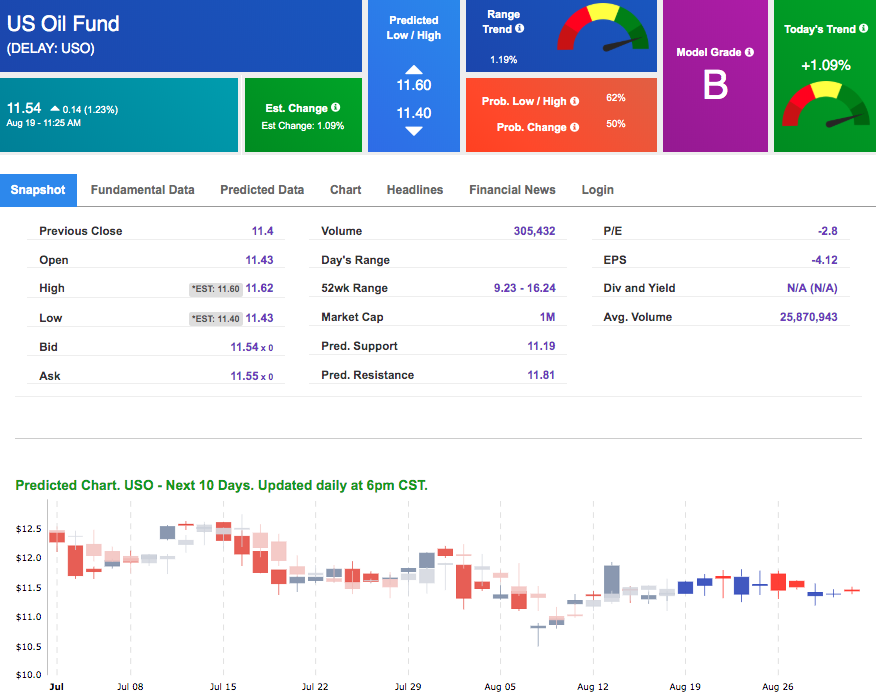

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $55.98 per barrel, up 2.02% from the open, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $11.54 at the time of publication, up 1.23% from the open. Vector figures show +1.09% today, which turns +1.65% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

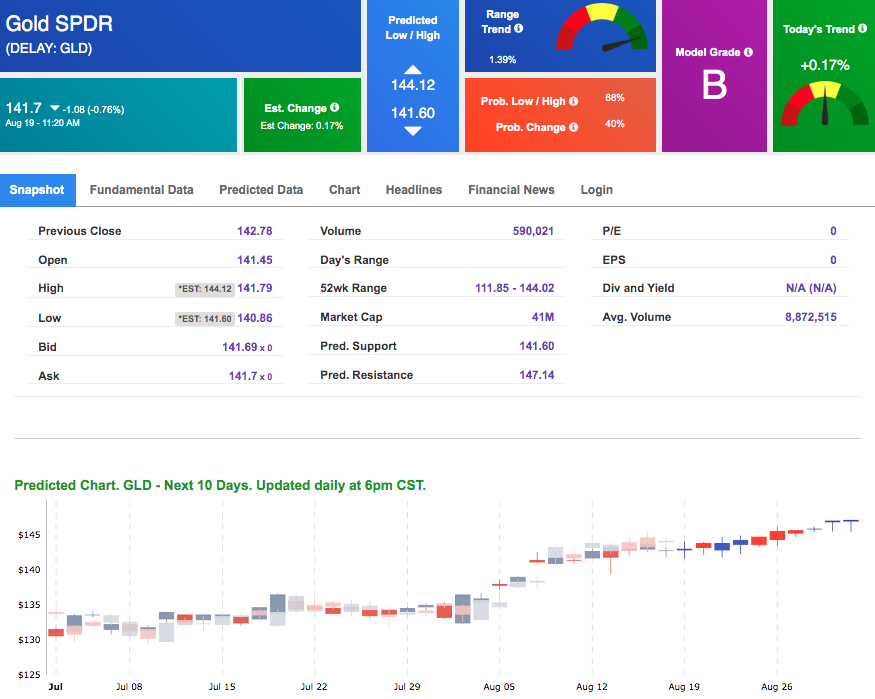

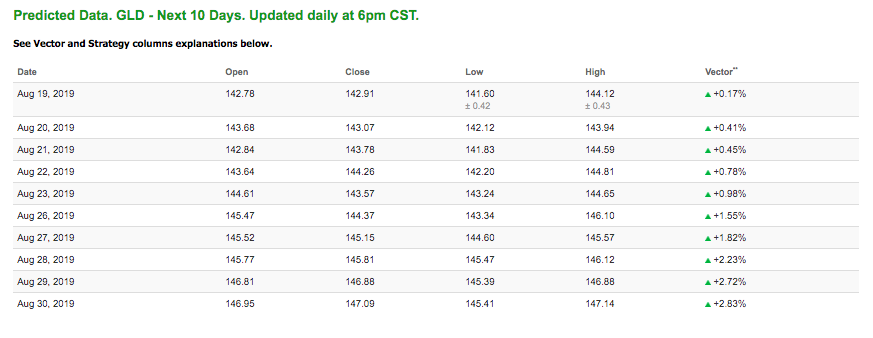

Gold

The price for the Gold Continuous Contract (GC00) is down 0.75% at $1,512.10 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $141.7, down 0.76% at the time of publication. Vector signals show +0.17% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

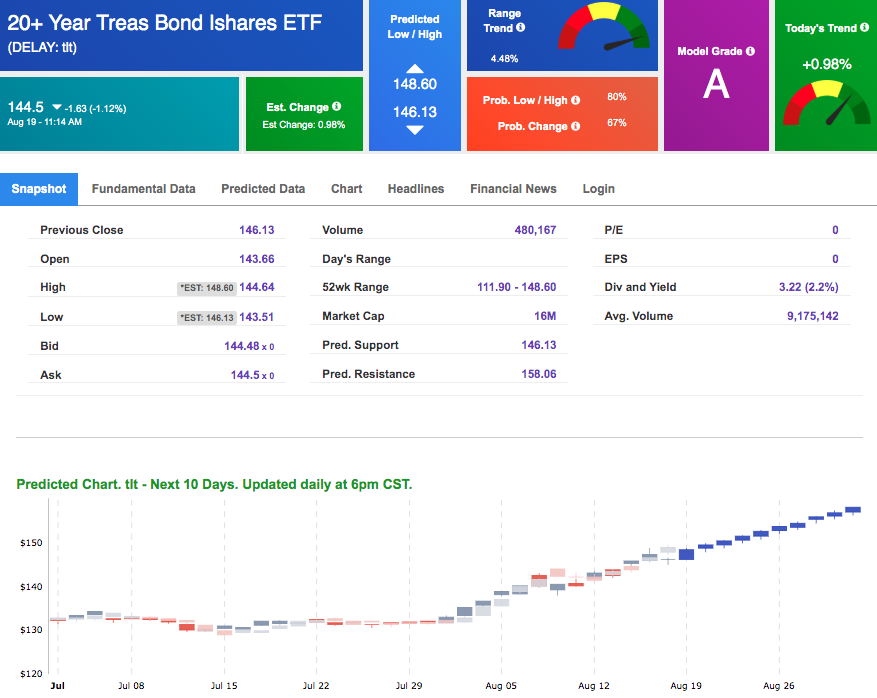

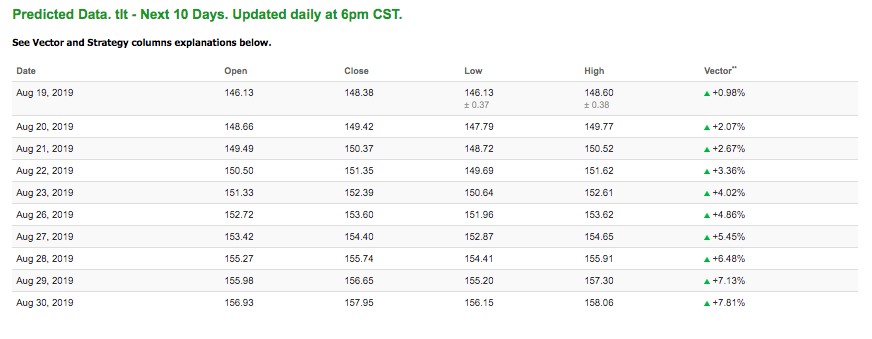

Treasuries

The yield on the 10-year Treasury note is up 2.39% at 1.60% at the time of publication. The yield on the 30-year Treasury note is up 2.25% at 2.09% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.98% moves to +3.36% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

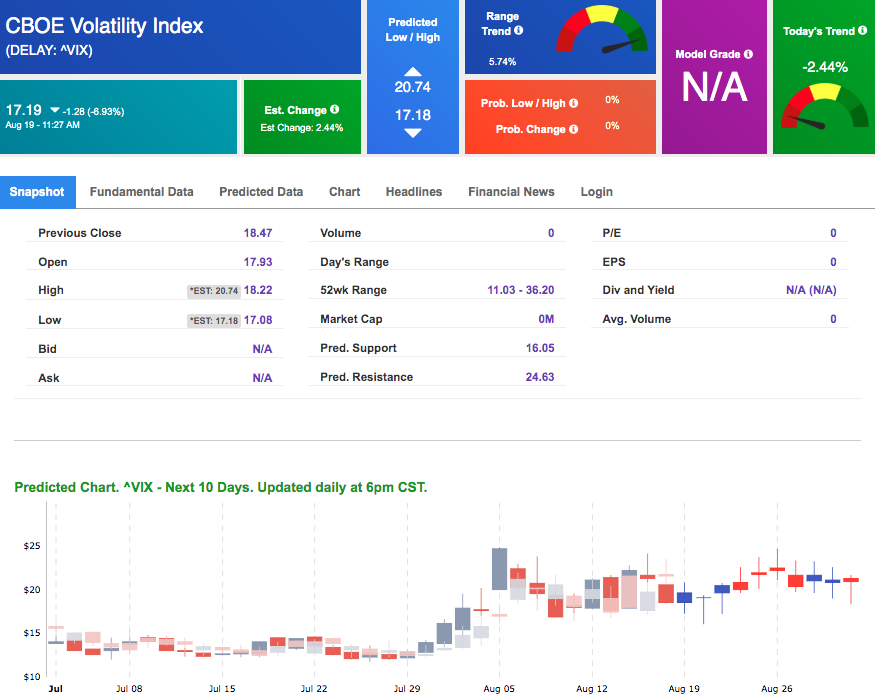

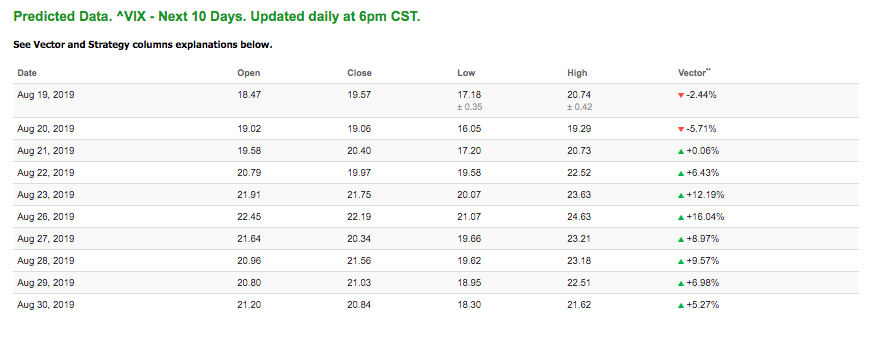

Volatility

The CBOE Volatility Index (^VIX) is down 6.93% at $17.19 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $19.06 with a vector of -5.71%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(Want free training resources? Check our our training section for videos and tips!)

Sign up now for Lifetime Access and pay less than the cost of just 1 year and lock in …

PERMANENT UNLIMITED ACCESS!

-

Subscribe now for less than the cost of one year at the regular rate!

-

With 36 month trailing gains of 1,314%, and an 75% win-rate, a lifetime Membership could easily turn $100,000 into $1,414,472

-

Tradespoon Premium is the only trading service you’ll ever need.