Mid-Day Market Rally Slows December Slide

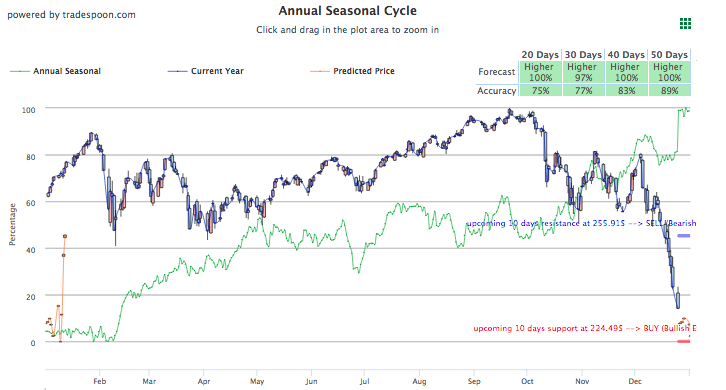

Returning from the Christmas holiday, markets lowered in early morning trading only to rally in the afternoon behind strong retail, energy, and tech information sectors. All three major U.S. indices are up today after sharp declines on Monday added to a historically bad December. The partial government shutdown continues to linger over the market as we head into 2019 and several federal departments are still without funding. Other things to note today include the oil rally and recent comments from President Trump regarding the Federal Reserve. The economic calendar lightens up as 2018 comes to a close and expect data to pick back up in January when earnings season begins. Still, investors should expect some downside as long as the market remains below $253.The market is in a correction and the SPY opened a door to potentially reaching $220 support. For reference, the SPY Seasonal Chart is shown below:

Retail sectors helped support the market today after an ugly Christmas Eve left the markets significantly lower. Amazon, in particular, had reported a strong holiday season and is seeing shares rise today over 6%. Overall, retail rose 2.5% while also supporting the rally, energy and tech sectors added nice gains of over 1.5%. Still, the S&P is down over 11% for the year while the Dow and Nasdaq are also down 10%. Oil also added to market-wide rally after being sharply down for most of December, reaching multi-year lows.

A slow week for significant economic data, investors will look to 2019 for December as well as year-end data for 2018. Earnings season picks up mid-January and until then the partial government shutdown looks to be the main point of interest for investors. On Friday, several federal departments were without funding for 2019 and effectively shut down. As lawmakers return from the Christmas holiday, look for more developments on the matter in the likes of stopgap funding bill or a full year funding resolution. The main point of contention remains border security and the border wall. Recently, President Trump reassured his faith in the economy, stating “the only problem our economy has is the Fed,” once again lobbying his disapproval of the recent fed interest rate hikes. Simultaneously, Trump urged investors to buy on the recent market dips, labeling them “a great opportunity to buy.”

Some major market movers today include Tesla, Roku, Kohl’s, and Home Depot, seeing shares rise in the range of 4-7%. As mentioned before, retail led the post-holiday rally today. Still, the sector is experiencing one of its worst months. Major retailers such as Target, Kohl’s, Macy’s, and Nordstrom are all down 10% for the month. The dollar made modest gains today while Asian and European markets closed to mixed results.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -2.03% moves to +7.61% in five trading sessions. The predicted close for tomorrow is 2,334.35. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

MIDNIGHT SPECIAL:

Monday, we sent out a ridiculous offer with LIFETIME ACCESS to our Market Commentary subscribers before we raise our prices on January 2nd!

It was a huge success and many people jumped at the opportunity but we also had our fair share of complaints because some people didn’t open the email until this morning and missed out.

So, we decided to open up this offer for one more day, but act fast, because at midnight, the offer is GONE!

CLICK HERE to Sign-up

Highlight of a Recent Winning Trade

On December 21st, our ActiveTrader service produced a bearish recommendation for Mastercard Inc. (MA). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

MA entered the forecasted Entry 1 price range of $182.71 (± 1.83) in its first hour of trading and hit its Target price of $180.88 in the third hour of trading that day. The Stop Loss was set at $184.54.

Thursday Morning Featured Stock

Our featured stock for Thursday is Barclays iPath S&P 500 VIX (VXX). VXX is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $47.73 at the time of publication, down 3.28% from the open with a +0.69% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

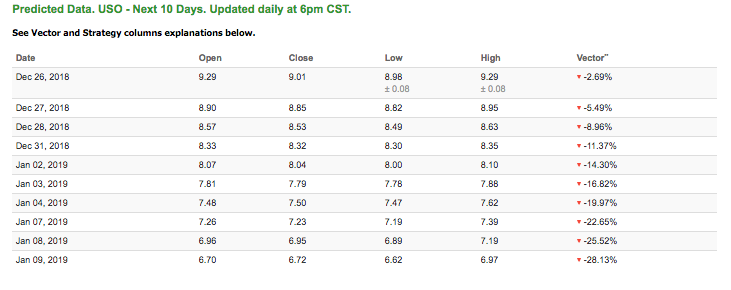

Oil

West Texas Intermediate for February delivery (CLG9) is priced at $45.94 per barrel, up 8.04% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $9.68 at the time of publication, up 4.20% from the open. Vector figures show -2.69% today, which turns -14.30% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for February gold (GCG9) is down 0.11% at $1,270.40 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $119.75, down 0.22% at the time of publication. Vector signals show +0.12% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is up 0.03% at 2.78% at the time of publication. The yield on the 30-year Treasury note is up 0.03% at 3.03% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.06% moves to +1.60% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is down 2.61% at $22.36 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $33.20 with a vector of -6.24%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

MIDNIGHT SPECIAL:

Monday, we sent out a ridiculous offer with LIFETIME ACCESS to our Market Commentary subscribers before we raise our prices on January 2nd!

It was a huge success and many people jumped at the opportunity but we also had our fair share of complaints because some people didn’t open the email until this morning and missed out.

So, we decided to open up this offer for one more day, but act fast, because at midnight, the offer is GONE!