Midterm Elections Are Almost Here, Will VIX Stay Up?

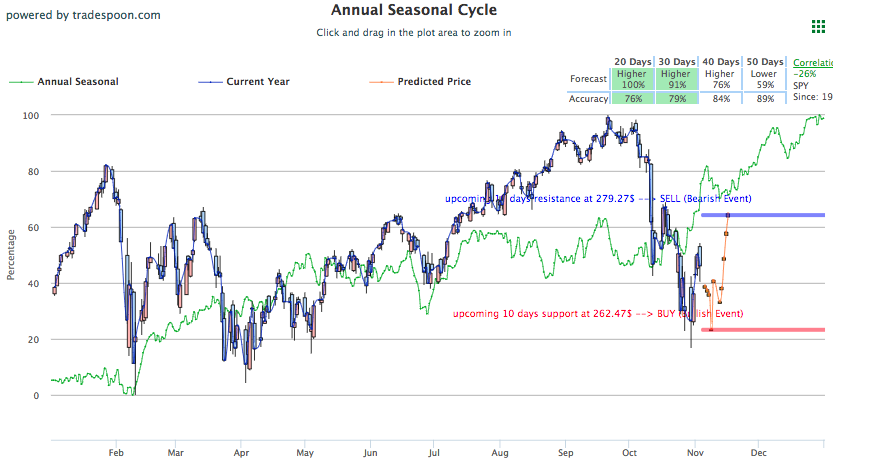

U.S indices inched in both directions as the Dow and S&P moved up while the Nasdaq moved down. Expect volatility to potentially retest $30 level. On Friday, all three indices closed lower after a short-lived rally on Thursday behind renewed optimism in China-U.S. trade relations and the continuation of great earnings. Friday’s falter did not tarnish the first positive week for all three indices since late September. Still, midterm elections loom over any sustainable rally, capping stocks from fully benefiting from plush earnings. Besides the regular load of earnings we are expecting this week, investors should also look to this week’s Fed policy meeting, which will take place on Wednesday-Thursday and is not expected to produce changes to the current interest rate, for more indicators of the current market conditions and trends. SPY Seasonal Chart shown below:

China and U.S. relations continue to flood headlines after some initial optimism was tweeted by President Trump which eventually was rebuked by top economic advisor Larry Kudlow, stating both sides were a long way from reaching an agreement. Some more optimism was brought on by today’s comments from Chinese President Xi, speaking at a trade expo in Shanghai, admitting to some unfavorable trading practices which he vowed China would address by opening its economy to more global imports and reducing harsh tariffs. Look for more on this in the weeks to come as both sides will likely look to meet if any trade agreement were to be worked out. Globally, Asian Markets are down today while European markets marginally split.

Iran sanctions kicked in today and oil prices certainly reflected that, rising a quick 7%. Last week it was announced that China, India, Italy, Greece, Japan, South Korea, Taiwan, and Turkey would be exempt from sanctions will nations such as France, Spain, and United Arab Emirates will be subject to sanctions as they are major importers of Iran oil. Iran President Hassan Rouhani has since announced his country would resist the new sanction and “will proudly break the sanctions,” indicating further turmoil between the two nations.

Last Friday saw an unusual hiccup in the usually immovable FANG group as Apple released earnings on Thursday that have since, continually, pushed the stock lower. While earnings returned virtually flat, news on one big measurement of consumer data was provided for one last time before it was announced Apple will no longer disclose those numbers. Unit sales will no longer be provided in earnings reports. Usually, unit sales were a core component of Apple earnings as sales of iPhones, Apple Watches, computers, and more were indicative of company growth. Now, newfound uncertainty has the reliable stock on shaky grounds, down 6% on Friday with another 3.5% down today. Over 200 companies report today while some big names set to report this week include Activision Blizzard, Adidas, CVS, Disney, Prudential, Toyota, and more.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.27% moves to -0.66% in five trading sessions. The predicted close for tomorrow is 2,926.72. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

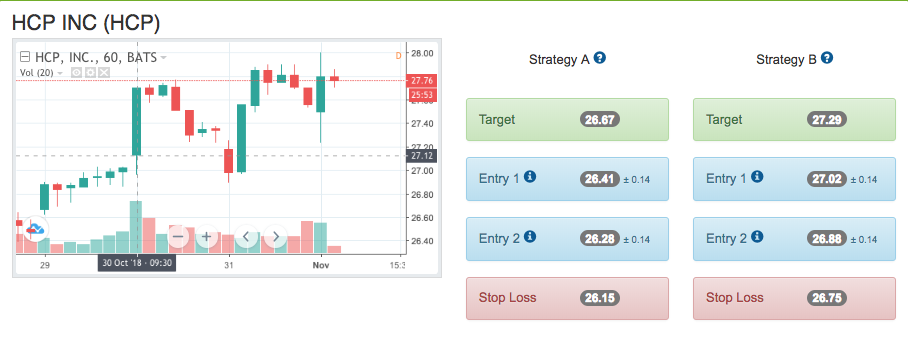

On October 30th, our ActiveTrader service produced a bullish recommendation for HCP Inc. (HCP). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

HCP entered the forecasted Entry 1 price range of $27.02 (± 0.14) in its first hour of trading and hit its Target price of $27.29 that hour, reaching a high of $27.84 for the trading day. The Stop Loss was set at $26.75.

You Don’t Want to Miss This!

Today only, we are going to do something we RARELY do!

We are offering LIFETIME ACCESS to our Stock Forecast Toolbox Membership!

This means that you will get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!

Click Here To Sign Up…

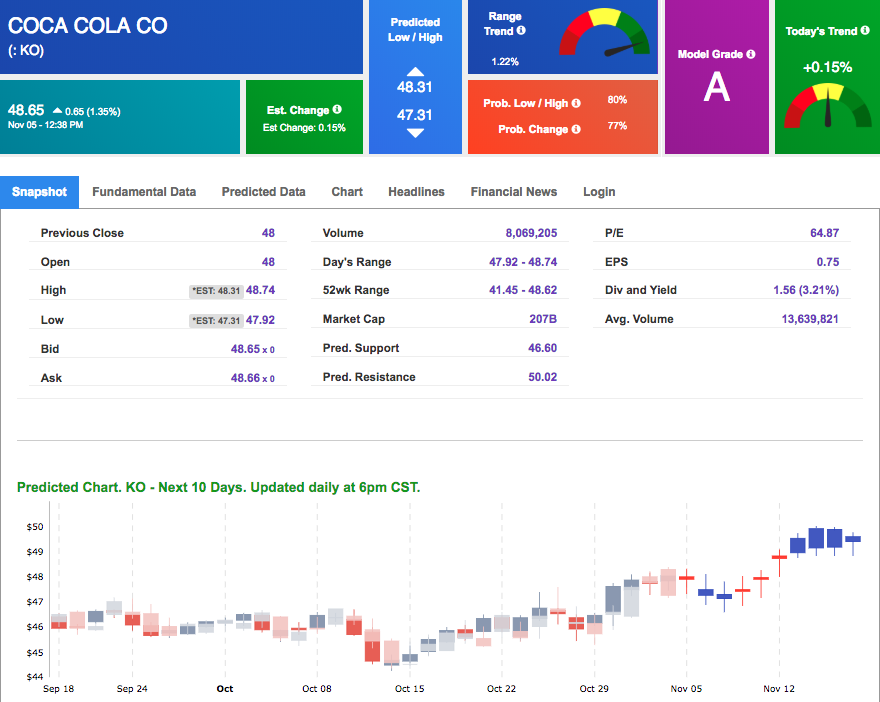

Tuesday Morning Featured Stock

Our featured stock for Tuesday is Coca-Cola Co. (KO). KO is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $48.65 at the time of publication, up 1.35% from the open with a +0.15% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for December delivery (CLZ8) is priced at $63.42 per barrel, up 0.44% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows mostly negative signals. The fund is trading at $13.4 at the time of publication, up 0.98% from the open. Vector figures show +0.50% today, which turns -2.15% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for December gold (GCZ8) is down 0.05% at $1,232.70 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows negative signals. The gold proxy is trading at $116.43, down 0.19% at the time of publication. Vector signals show -0.04% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

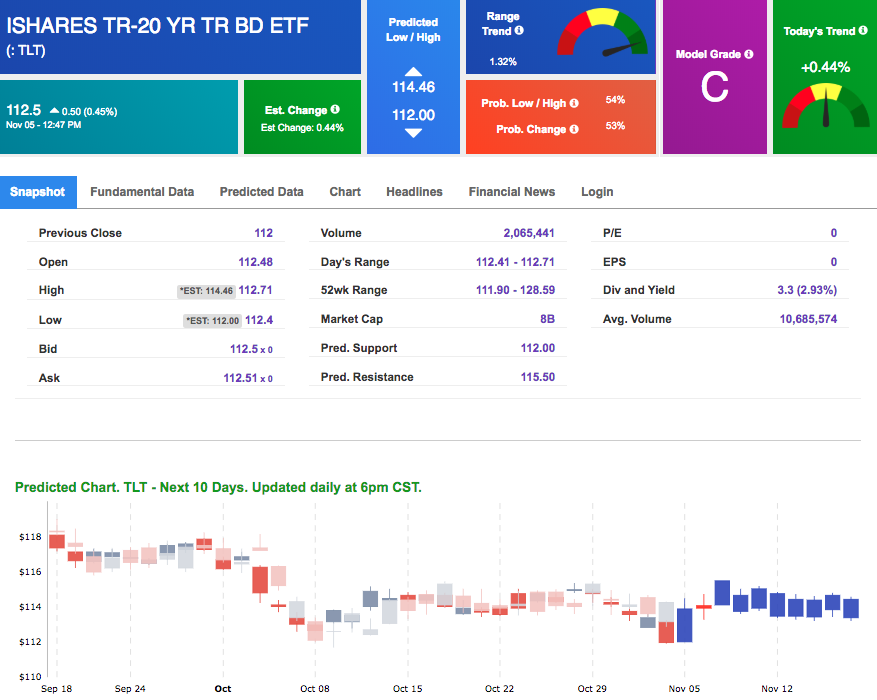

The yield on the 10-year Treasury note is down 0.56% at 3.20% at the time of publication. The yield on the 30-year Treasury note is down 0.59% at 3.43% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.44% moves to +1.49% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is up 4.97% at $20.48 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $21.60 with a vector of +9.55%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

You Don’t Want to Miss This!

Today only, we are going to do something we RARELY do!

We are offering LIFETIME ACCESS to our Stock Forecast Toolbox Membership!

This means that you will get Lifetime Access to our entire suite of trading tools, and after your initial payment, you will never be billed again for as long as you remain a member!