New Tarrifs Slow Markets as FOMC Set for Two-Day Meeting Tomorrow

After a strong week for U.S. stocks that saw a couple record highs, U.S. indices are slumping today. All three major indices are currently down as the latest round of Chinese and U.S. tariffs are set to go into effect. The U.S. levied 10% duties on $200 billion worth of Chinese goods while China levied 5%-10% duties on $60 billion worth of U.S. goods. A large industrial sell off also seems to be pressuring markets. For the S&P Index, the tech and consumer-discretionary sectors look to be among the biggest decliners. The market, mainly, has been able to shrug off trade tension and stay focused on economic data but today the market looks to feel some of the trade escalation as the new-set tariffs are put into effect and no meeting between the two sides has been set, as of yet. SPY Seasonal Chart forecast is shown below:

While Chinese officials have had some harsh words towards the U.S in relation to their negotiations, an agricultural Chinese delegation has met with U.S. officials in a continued effort to improve relations. Optimism looks low today as pressure from the new duties is felt but attempts at further trade talks continue as a meeting between the two, we believe, could occur in the next few weeks, but not yet set. Beyond trade tension, investors will be looking to the FOMC two-day meeting held this week, where it is more likely than not a new interest rate hike will be announced.

The interest rate hike, as indicated by Federal Chairman Jerome Powell, is part of a continued effort to curb inflation. Two more hikes were indicated earlier this summer and while the early August meeting did not bring an interest rate hike, most analysts believe a new one will be introduced by meeting’s end.

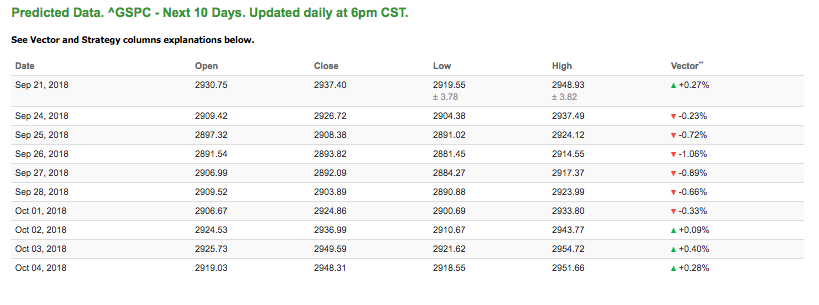

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.27% moves to -0.66% in five trading sessions. The predicted close for tomorrow is 2,926.72. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On September 20h, our ActiveTrader service produced a bearish recommendation for Twenty First Century Fox Inc (FOX). ActiveTrader included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

FOX entered the forecasted Entry 1 price range of $44.39 (± 0.06) in its second hour of trading and moved through its Target price of $43.95 the following trading session in its final hour of trading. The Stop Loss was set at $44.83.

Special Lifetime Offer – Watch where I trade my personal money, propose specific stop losses, time the market, show how I trade step-by-step, consider underlying volatility, and sell for big profits!

Click here for my Special Lifetime Offer!

Tuesday Morning Featured Stock

Our featured stock for Tuesday is Pfizer Inc (PFE). PFE is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $44.14 at the time of publication, up 0.18% from the open with a +0.31% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for October delivery (CLX8) is priced at $72.16 per barrel, up 1.95% from the open, at the time of publication. Oil prices surged today as an expected global supply disruption is expected following last weekend’s major producers’ meeting which reaffirmed the continued boost in output.

Looking at USO, a crude oil tracker, our 10-day prediction model mixed signals. The fund is trading at $15.22 at the time of publication, down 1.74% from the open. Vector figures show -0.44% today, which turns +0.58% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for December gold (GCZ8) is up 0.21% at $1,203.50 at the time of publication. The dollar’s muted movement has given room for gold to advance ahead of the FOMC meeting which while likely drive the dollar and then inversely gold.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $113.51, up 0.02% at the time of publication. Vector signals show +0.07% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is up 0.64% at 3.09% at the time of publication. The yield on the 30-year Treasury note is up 0.63% at 3.21% at the time of publication. The expected interest rate hike from this week’s FOMC meeting is already driving up yields and will likely continue impact prices as the week continues.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see negative signals in our 10-day prediction window. Today’s vector of -0.26% moves to -1.36% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is up 7.28% at $12.53 at the time of publication, and our 10-day prediction window shows all positive signals. The predicted close for tomorrow is $12.07 with a vector of +4.85%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.