Oil Rallies, U.S. Markets Continue Trading Higher

The worst part of the selloff is behind us

With the current market conditions in mind, we believe the market is still susceptible to a 10-20% selloff from current SPY levels. It appears the worst part of the selloff is behind us but investors should consider hedging portfolios into the rallies until the market breaks through $273 level. It is our opinion the market is overbought in the short term and long-term investors can consider buying equities with dollar-cost averaging in mind.

White House indicating a desire to reopen parts of the economy sooner than expected

All three major U.S. indices are booking nice gains today with the latest from the White House indicating a desire to reopen parts of the economy sooner than expected. Also supporting markets today is the apparent clarity in the upcoming Presidential election with Democratic nominee Bernie Sanders announcing the end of his candidacy, clearing the way for former Vice President Joe Biden. Look out for Fed Minutes from last month’s emergency meeting as well as continued economic data from the past month, shedding light on the virus’s economic impact so far. As usual, Market Commentary readers are encouraged to maintain clearly defined stop-levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Dow and S&P with gains of over 3% while the Nasdaq closed with 2.5% gains

Markets booked impressive gains today, one day after trading higher for the majority of the trading session only to turn lower before the close. The Dow and S&P saw the biggest boost today with gains of over 3% while the Nasdaq closed with 2.5% gains. The majority of gains arrived before noon as reports of a White House desiring to reopen parts of the economy sooner than expected provided somewhat positive economic sentiment.

Slow down of COVID-19 cases overseas has also helped public sentiment

Similarly, the slow down of COVID-19 cases overseas has also helped public sentiment. Currently, the U.S. death toll is just over 14,000 while the confirmed number of cases nears 450,000. New York currently holds the most confirmed cases by a wide margin with just under 150,000 cases while the second closest state is New Jersey with 47,000. Also supporting U.S. markets today was the apparent clarity for the upcoming presidential election with Bernie Sanders ending his campaign. This clears the path for Biden to receive the Democratic nomination.

Several stocks booked impressive gains today, including:

- BA +3% is counting their multi-day run after announcing several cost-cutting measures for the upcoming year

- FDX +8%, UPS +6% both reporting increased activity during the quarantine as well as a boost from Amazon announcing they are stopping their competing delivery service for the time being

- MRO +7% announced another cut this year’s budget

Oil booked impressive gains today, over 10% for U.S. Crude Oil, while gold saw slight pressure finishing modestly lower. The dollar traded modestly higher while Treasury yields also rose.

Key U.S. Economic Reports Out This Week:

- Weekly Jobless Claims (4/5) – Thursday

- Producer Price Index (March) – Thursday

- Consumer Sentiment Index (February) – Thursday

- Consumer Price Index (March) – Friday

- Core CPI (March) – Friday

(Want free training resources? Check our our training section for videos and tips!)

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Vlad’s Portfolio Lifetime Membership!

DO AS I DO… AS I DO IT WATCH LIVE AS I WORK THE MARKETS! TRY IT NOW RISK-FREE!

Click Here to Sign Up

Highlight of a Recent Winning Trade

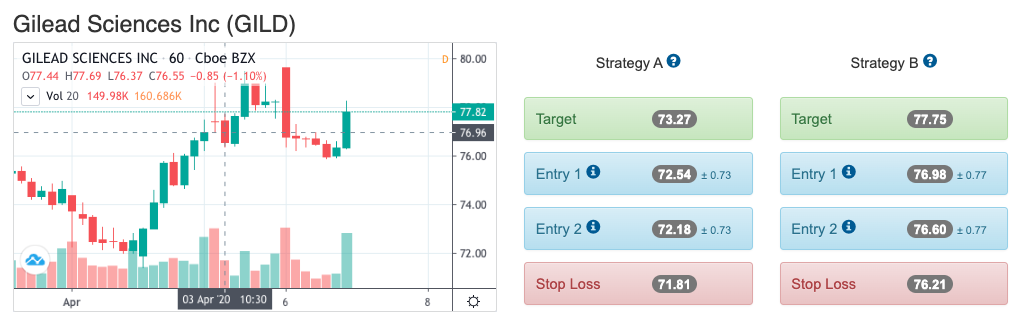

On April 3rd, our ActiveTrader service produced a bullish recommendation for Gilead Sciences Inc (GILD). ActiveTrader is included in several Tradespoon membership plans and is designed for day trading, with signals meant to last for 1-2 days.

Trade Breakdown

GILD entered its forecasted Strategy B Entry 1 price range $76.98(± 0.77) in the second hour of trading that day and passed through its Target price of $77.75 in the fourth hour of trading that day. The Stop Loss price was set at $76.21.

Tuesday Morning Featured Symbol

Our featured symbol for Thursday is Archer Daniels Midland (ADM). ADM is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (C) indicating it ranks in the top 50th percentile for accuracy for current-day predicted support and resistance, relative to our entire data universe.

The stock is trading at $119.48, with a vector of 1.64% at the time of publication.

Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does not have a position in the featured symbol, ADM. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $26.21per barrel, up 4.66% from the open, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $5.48 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for the Gold Continuous Contract (GC00) is down 0.41% at $1,677.50 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $156.88, at the time of publication. Vector signals show +0.30% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is up to 0.769% at the time of publication.

The yield on the 30-year Treasury note is up to 1.378% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is $45.24 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.