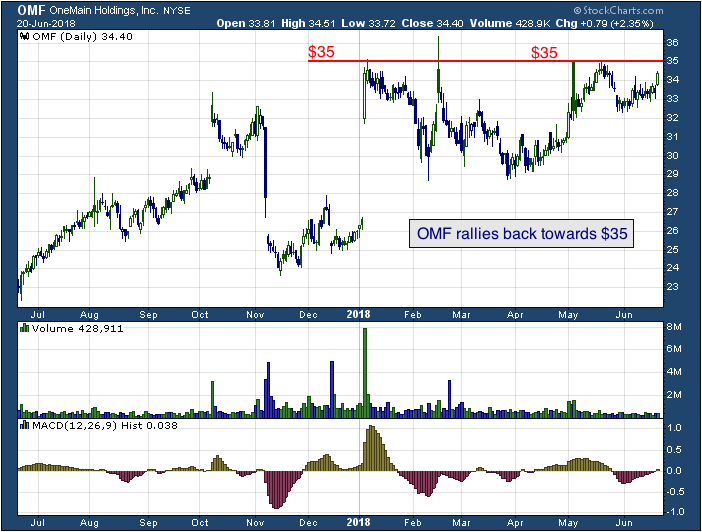

OMF rallies back towards $35

During the past six months, OMF has formed a level of resistance to watch at the $35 (red) mark. The stock has tested that mark multiple times since the beginning of January. A solid close above that $35 level would most likely lead to higher prices for OMF.

OneMain Holdings, Inc., through its subsidiaries, provides consumer finance and insurance products and services. The company operates in two segments, Consumer and Insurance, and Acquisitions and Servicing. It provides secured and unsecured personal loans; credit insurance products, such as life, disability, and involuntary unemployment insurance products; non-credit insurance; and auto membership plans, as well as retail sales finance services.

Take a look at the 1-year chart of OneMain (NYSE: OMF) below with my added notations:

During the past six months, OMF has formed a level of resistance to watch at the $35 (red) mark. The stock has tested that mark multiple times since the beginning of January. A solid close above that $35 level would most likely lead to higher prices for OMF.

The Tale of the Tape: OMF has a key level of resistance at $35. A long trade could be entered on a break through that level. However, if you are bearish on the stock, a short trade could be made on any rallies up to $35.

Before making any trading decision, decide which side of the trade you believe gives you the highest probability of success. Do you prefer the short side of the market, long side, or do you want to be in the market at all? If you haven’t thought about it, review the overall indices themselves. For example, take a look at the S&P 500. Is it trending higher or lower? Has it recently broken through a key resistance or support level? Making these decisions ahead of time will help you decide which side of the trade you believe gives you the best opportunities.

No matter what your strategy or when you decide to enter, always remember to use protective stops and you’ll be around for the next trade. Capital preservation is always key!

Good luck!

Christian Tharp, CMT

Our Experts Found 9 Stocks You Will Hold Forever

With individual stock selection now more critical than ever, this report is designed to bring you some of our top ideas for the year ahead. One of the companies highlighted in this report controls the smartphone market and now has its sights set on owning a bigger technology. It has the potential to be the most valuable stock in the history of investing. You need to find out the name of this company before the rest of the market does. This Report Is Completely Free, Download Your Copy Today