One Stock to Sell in the Rebound Rally

So much for the Santa Claus rally carrying over after New Year’s Day. As much as the market wanted to embrace a good start for 2019 the market got stung by a major index component issuing a profit warning. Shortly after yesterday’s closing bell, Apple lowered its revenue guidance for the first time since 2002.

The tech giant said it expects first quarter revenue of $84 billion, down from its previous outlook for sales between $89 billion and $93 billion. The news has weighed on the stock, Apple suppliers and the broad market.

The news comes when there was a compelling story in the M&A arena yesterday. Bristol-Myers Squibbwill acquire Celgene for $102.43 per share in cash and stock. The transaction, which has a total value of $74 billion, comes after Celgene’s share price dropped to its lowest level since mid-2013. M&A activity is typically viewed as a positive for the broader market, because it suggests that companies are seeing value in the market, which can draw other investors in. However, given the recent damage to investor sentiment, participants may show increased apprehension.

The Bristol-Myers Squibb for Celgene deal was a nice offset before the ISM Manufacturing Index for December was released showing a decline of considerably more than what the market expected. The decrease was fueled by a sharp pullback in the New Orders component, which is key leading indicator. The New orders Index decreased to 51.1% from 62.1%. The index pulled back considerably after hitting its highest level since August 2018.

“I’m investing my own money in each and every stock as my AI platform identifies.”

Sign up for RoboInvestor before my AI systems issue a “buy” signal on GWPH and other pot stocks. Fortunes are going to be made and lost in the pot boom with RoboInvestors destined to be on the “made” list. Be a RoboInvestor today and let’s money some money together for years to come.

Click Here – To See Where I Put My RoboInvestor Money

The reaction was to be as expected – selling pressure at the onset of trading took hold and all the major averages are starting 2019 down on average of -2.2%. The dollar is lower as are Treasury yields across the entire curve with the 10-yr T-Note yield falling below 2.6% and telegraphing that any further rate hikes by the Fed are off the table. As of this writing only utilities and REITs are showing any bullish strength as money rotates hard into ultra-defensive sectors.

All eyes and ears will be on Fed Chairman Jerome Powell when he delivers his first speech of 2019 today where global markets will move on his rhetoric as to whether he and his colleagues will pull back on further rate hikes if new data confirms the market’s pessimistic outlook. Yesterday’s manufacturing data and the pronounced move down in Treasury yields should give the Fed Chair an opportunity to deliver a dovish message that assuages the fear of the Fed being out of touch with the data trending lower.

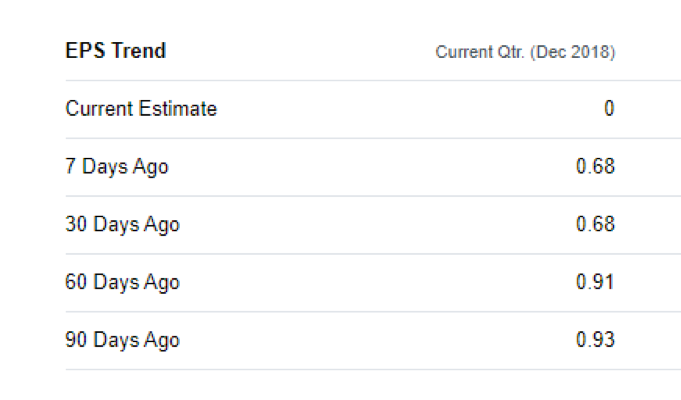

Assuming Powell doesn’t disappoint, great stocks will recover with the broader market while many stocks that have suffered technical damage in waning sectors will continue to break down. Those companies that are leveraged to a strong global economy are starting to see material capital outflows recently as it has become apparent that overall growth will slow in 2019 and into 2020. This is especially true for companies where earnings estimates are coming down during the past 30, 60 and 90 days.

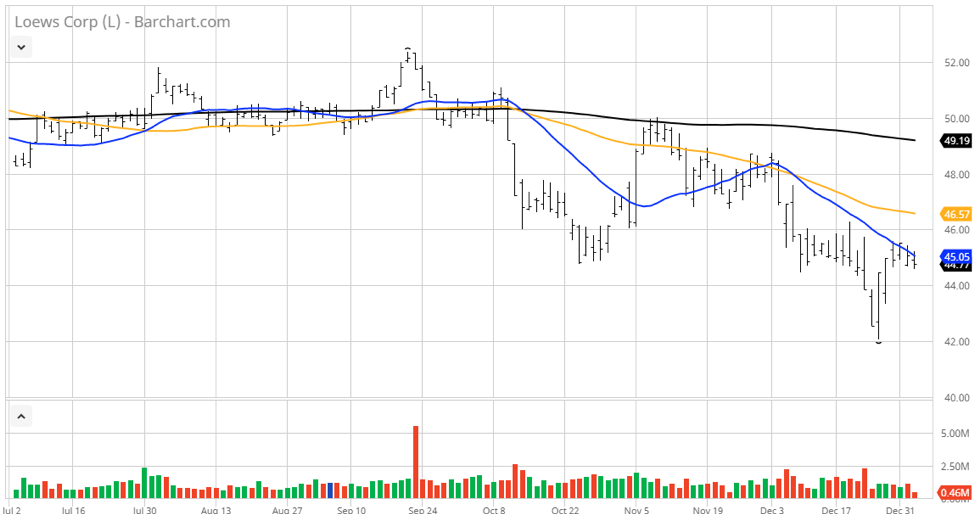

One stock that has showed up that has all the markings of trading lower in the days and weeks ahead is Loews Corp. (L). The company operates five major subsidiaries – CNA Financial, Diamond Offshore, Boardwalk Pipeline, Lowes Hotels and Consolidated Container Company. Being in the property casualty insurance, oil drilling, energy transfer, luxury hotel and plastic packaging businesses when the global economic growth is ticking lower.

For the fourth quarter of 2018 the consensus earnings estimate has been slashed by 26.9% to $0.68 from $0.93 per share. The breakdown in the stock back in October followed by the failed rally in early November that was followed by the resumption to the downside on rising downside volume is a bearish pattern. The late December rally that got the stock back up to $45 from $42 is a good place to exit based on short-term technical analysis. A second breach below $43 opens the way for the stock to trade down to $35 where it traded in early 2016.

While I expect the market to exhibit high levels of volatility throughout the year, I believe that 2,300—2,350 for the S&P will provide a solid floor for the market. This implies a wide trading range during the months ahead and a fine trading landscape for those stocks that have strong sales and earnings growth. Most all stocks with solid fundamentals have fallen victim to the market correction, but leading up to yesterday’s sell off, there were plenty of stocks we own in the RoboInvestor Portfolio that spiked higher from Christmas to New Year’s Eve.

Investing in the premier stocks that are confirmed by my Tradespoon tools where subscribers can also trade in and out of half positions has proven to be a very effective way to manage volatility. I’ll be recommending two stocks that we have exposure to over the weekend when the next copy of RoboInvestor is released Sunday for Monday’s opening bell.

Be sure to get your copy by signing up today for RoboInvestor and put my AI tools to work for your investing capital. There is plenty of money to be made from volatile markets, but timing how to do so is at a super high premium and is where an agnostic set of AI-driven tools becomes so valuable to creating wealth. Make January a month where facing broad market swings are something to look forward to and not where anxiety and stress rule the day. Become a RoboInvestor today and enjoy the ride.

“I’m investing my own money in each and every stock as my AI platform identifies.”

Sign up for RoboInvestor before my AI systems issue a “buy” signal on GWPH and other pot stocks. Fortunes are going to be made and lost in the pot boom with RoboInvestors destined to be on the “made” list. Be a RoboInvestor today and let’s money some money together for years to come.