Positive Earnings Support Markets, FOMC Leaves Rates Unchanged

Great start of todays trading session

Major indices edged higher in early morning trading behind impressive earnings from Apple yesterday and CVS before the market opened today.

Qualcomm, Prudential, MetLife, Kraft, Allstate, Marathon Oil, and Square reports today

Plenty of big names are still due to report today including Qualcomm, Prudential, MetLife, Kraft, Allstate, Marathon Oil, and Square.

FOMC meeting in focus

Also steering markets today is the conclusion of the two-day FOMC meeting which will be preceded by a press conference by Jerome Powell.

U.S. and China trade talks continue in Washington next week

In Beijing, trade talks between the U.S. and China wrapped up today and will relocate to Washington next week.

Economic data to be released

Look for weekly labor data tomorrow while Friday will feature monthly reports for both labor and manufacturing.

(Want free training resources? Check our our training section for videos and tips!)

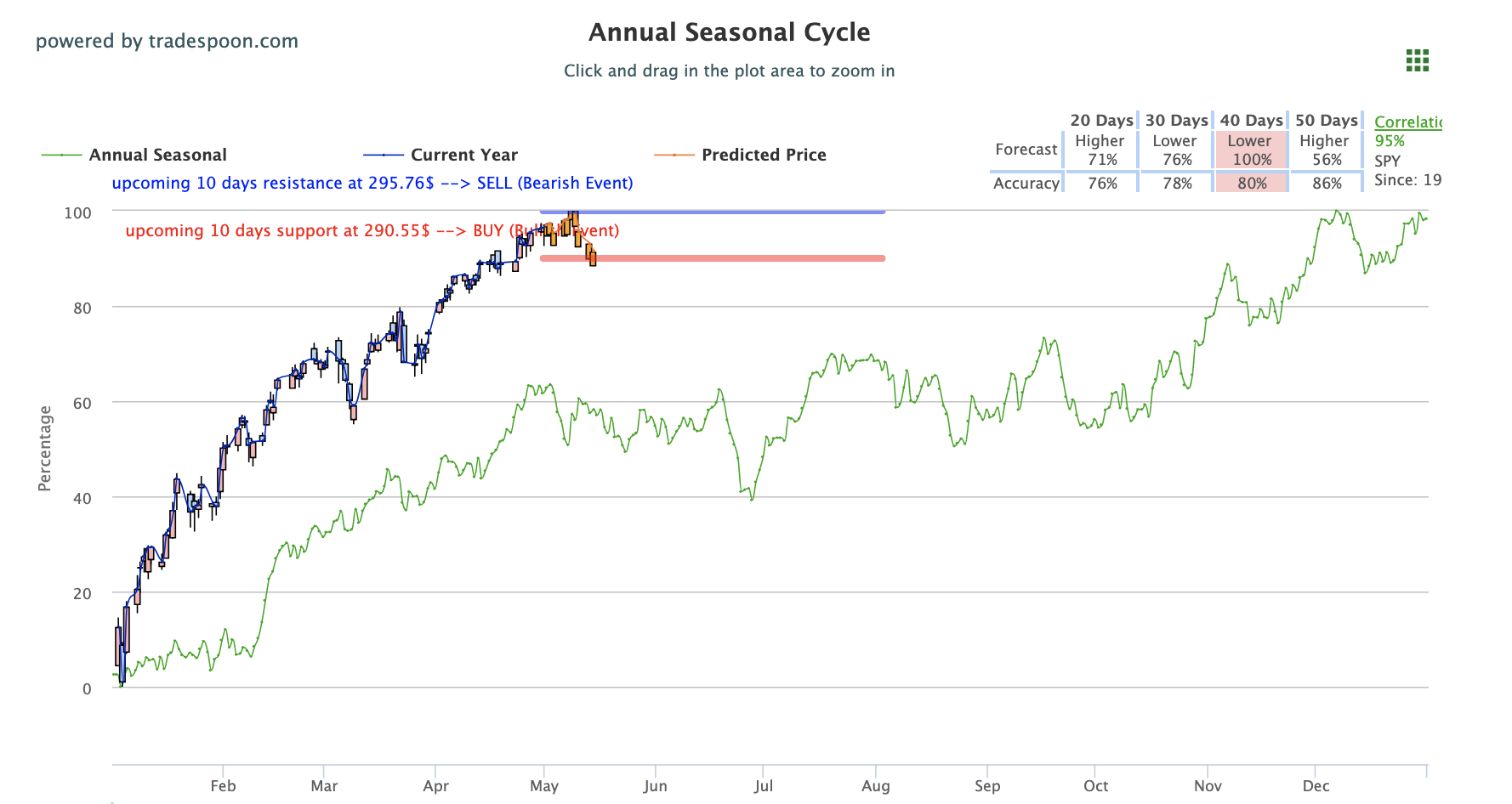

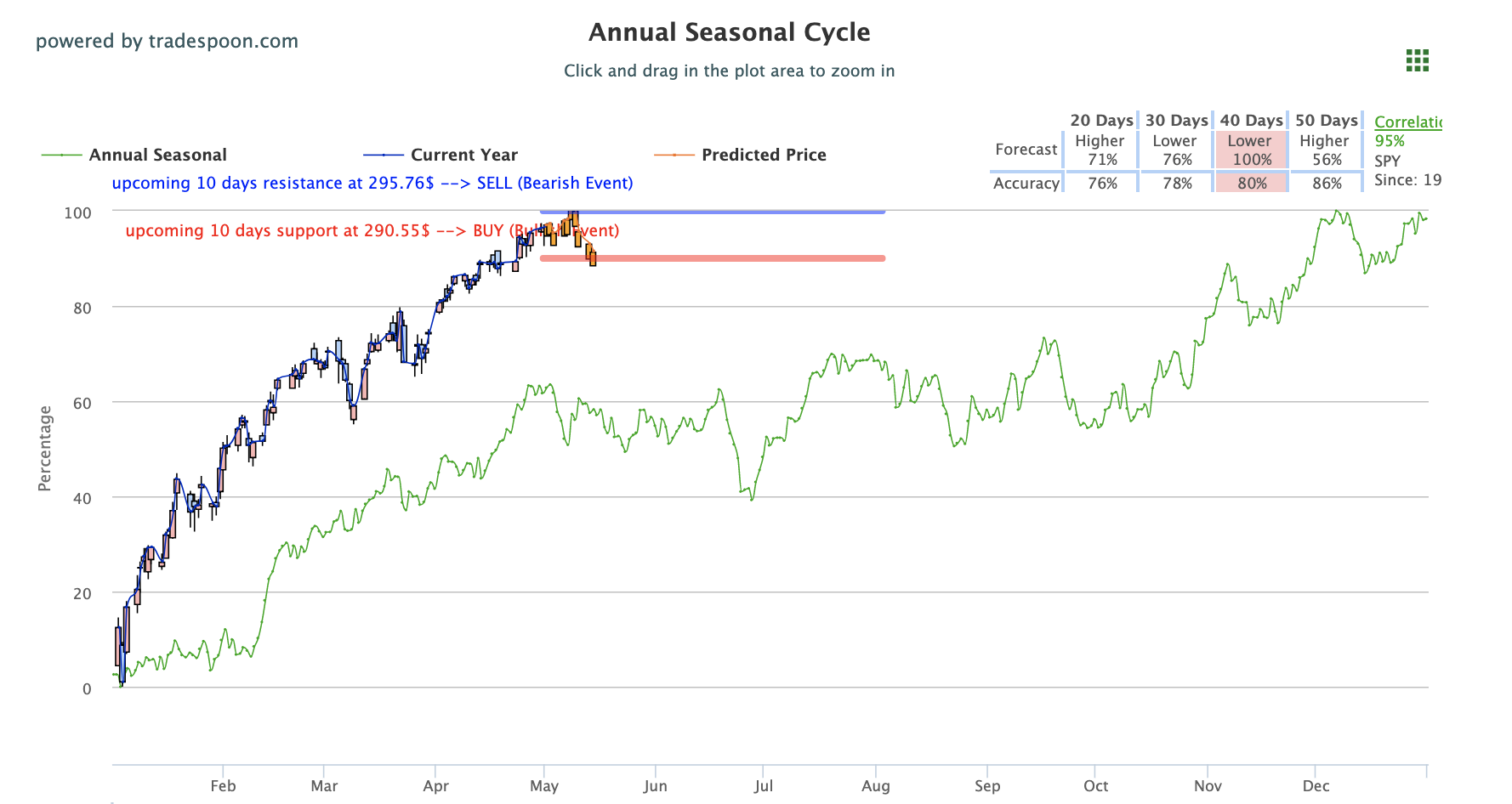

SPY to retest its 52 weeks high of $294

The SPY trades above its 50-day moving average and support stands at $286. Current market conditions have the SPY on track to retest its 52 weeks high of $294.

SPY Seasonal Chart

For reference, the SPY Seasonal Chart is shown below:

(Want free training resources? Check our our training section for videos and tips!)

Rates stay unchanged

The Federal Open Market Committee kept rates unchanged with their latest policy update.

Only one, if any, interest rate hike could occur in 2019

Powell has previously stated only one, if any, interest rate hike could occur in 2019. The following year looks to have a similar outline though plenty could still change between then and now.

Two driven factors of keeping rates unchanged

Maintaining maximum employment and price stability were the two driven factors of keeping rates unchanged.

President Trump call for rate cuts

President Trump recently called for rate cuts, which will not take place in today’s FOMC statement but not out of the realm of possibilities for future FOMC meetings taking place this year.

More likely the Feds will cut rates

With the current strong employment data, it seems more likely the Feds will cut rates than increase them this year but that is still yet to be decided.

(Want free training resources? Check our our training section for videos and tips!)

Yields higher ahead of Powell’s presser

Ahead of Powell’s presser, treasury yields saw pressure lowering ten and two-year yields noticeably but have since rebounded.

Fed remains “strongly committed” to its 2% inflation target

The Fed looks to continue stressing patience and comments from Powell will provide a good measure of current market sentiment and future guidance. One key takeaway from Powell’s presser was that the Fed remains “strongly committed” to its 2% inflation target.

Strong earnings reports from Apple and CVS

Yesterday’s strong Apple earnings supported markets after Google data underwhelmed earlier in the week. CVS also had a nice showing this morning, causing shares to rise over 5%. Apple is currently up 7% after earnings beat expectations, but still showed a slow down in revenue and profit.

Qualcomm, Marathon Oil, and Square reports

Look for Qualcomm, Marathon Oil, and Square earnings after market close today.

Tomorrow interesting reports

Activision, Gilead Sciences, and Samsung are set to report tomorrow while Adidas, Berkshire, and Dish are due tomorrow.

Global markets mixed

Globally, Asian markets closed mostly lower while European markets, apart from the U.K., finished in the green.

Trade talks were productive stated Treasury Secretary Steven Mnuchin

Over in Beijing, top trade delegations for the U.S. and China finished this week’s trade talks and will reconverge in D.C. next week. Treasury Secretary Steven Mnuchin stated yesterday talks were productive, providing some promise after initial optimism was muted by the elongated process and recent reports Trump was willing to walk away from talks.

Continuation of Uber’s IPO roadshow

Other news worth monitoring includes the continuation of Uber’s IPO roadshow as well as the recent resignation of Eric Schmidt, for Google CEO, from the company’s board.

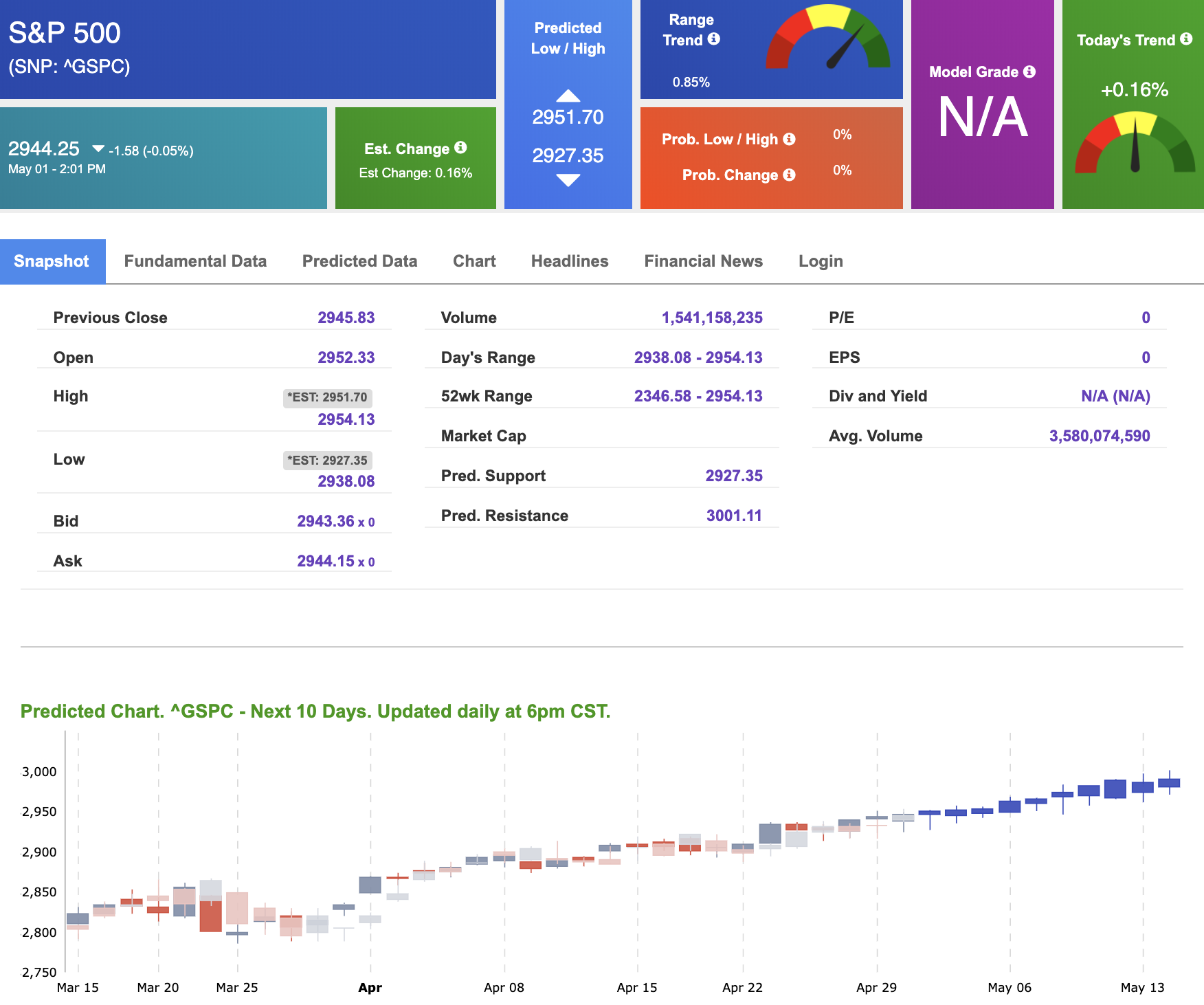

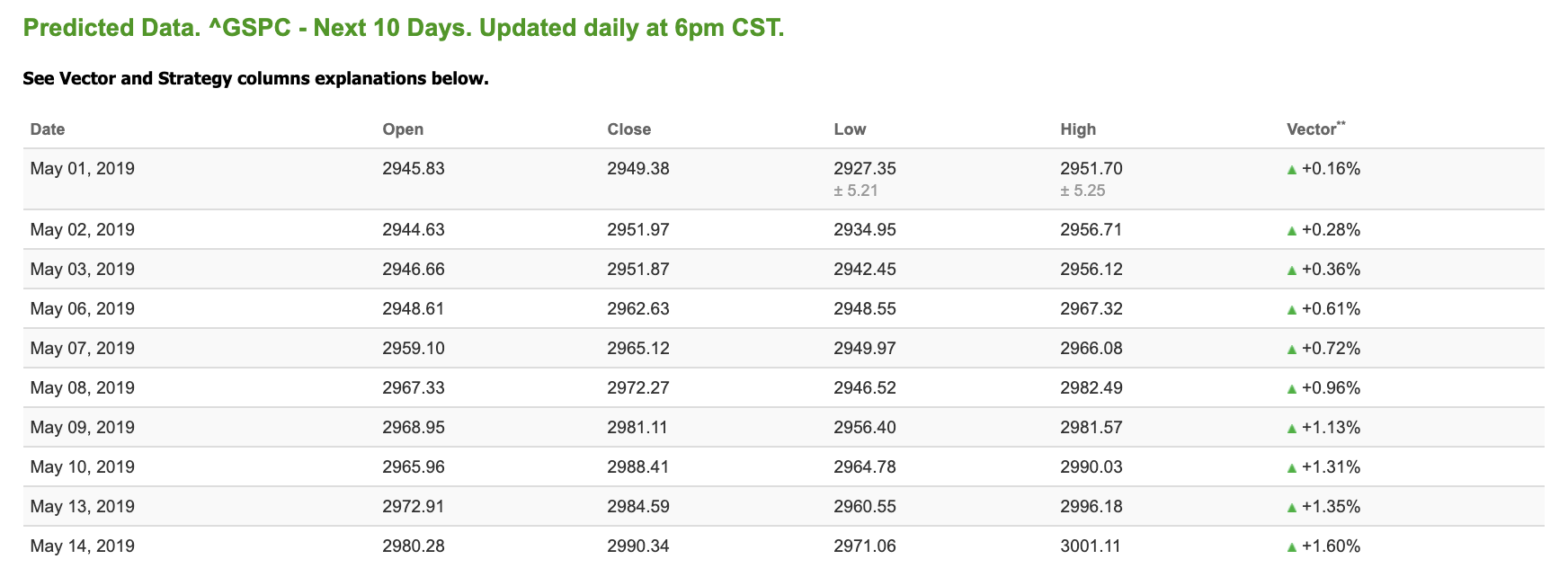

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows positive signals. Today’s vector figure of +0.16% moves to +0.96% in five trading sessions. The predicted close for tomorrow is 2,951.97. Prediction data is uploaded after the market close at 6pm, CST. Today’s data is based on market signals from the previous trading session.

(Want free training resources? Check our our training section for videos and tips!)

LAST TIME TO WATCH:

“How to Rack-Up a 10X Bagger with

Smokin’ Hot Cannabis Trades!”

Strategy Roundtable Session and get the names of the hottest stocks about to blow the lid off of their stock prices.

Click Here To Watch and Review

Highlight of a Recent Winning Trade

On April 25th, our ActiveTrader service produced a bullish recommendation for Constellation Brands Inc (STZ). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

STZ entered its forecasted Strategy B Entry 1 price range $210.14 (± 1.90) in its first hour of trading and passed through its Target price $212.24 in the first hour of trading that day. The Stop Loss price was set at $208.04.

Thursday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

(Want free training resources? Check our our training section for videos and tips!)

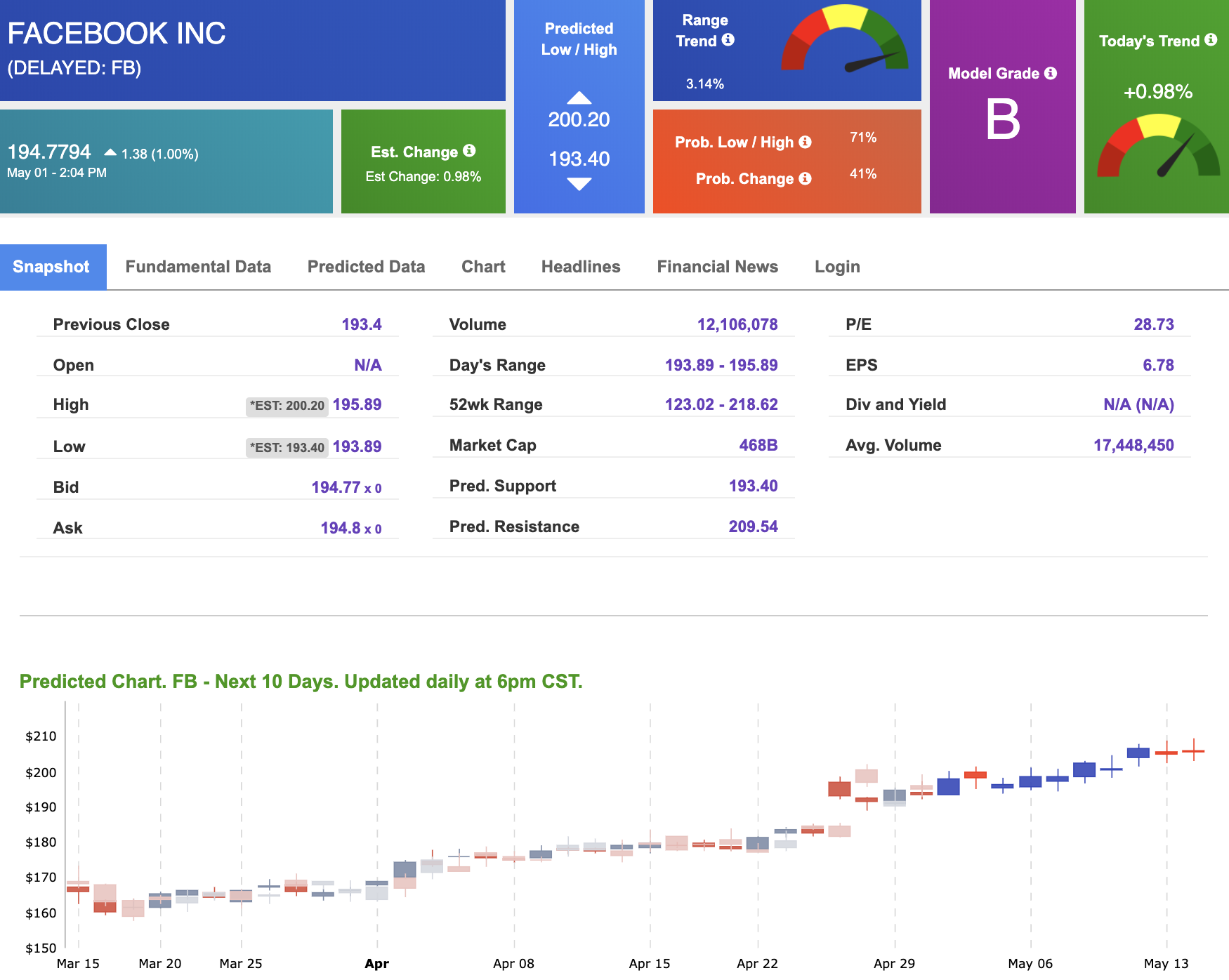

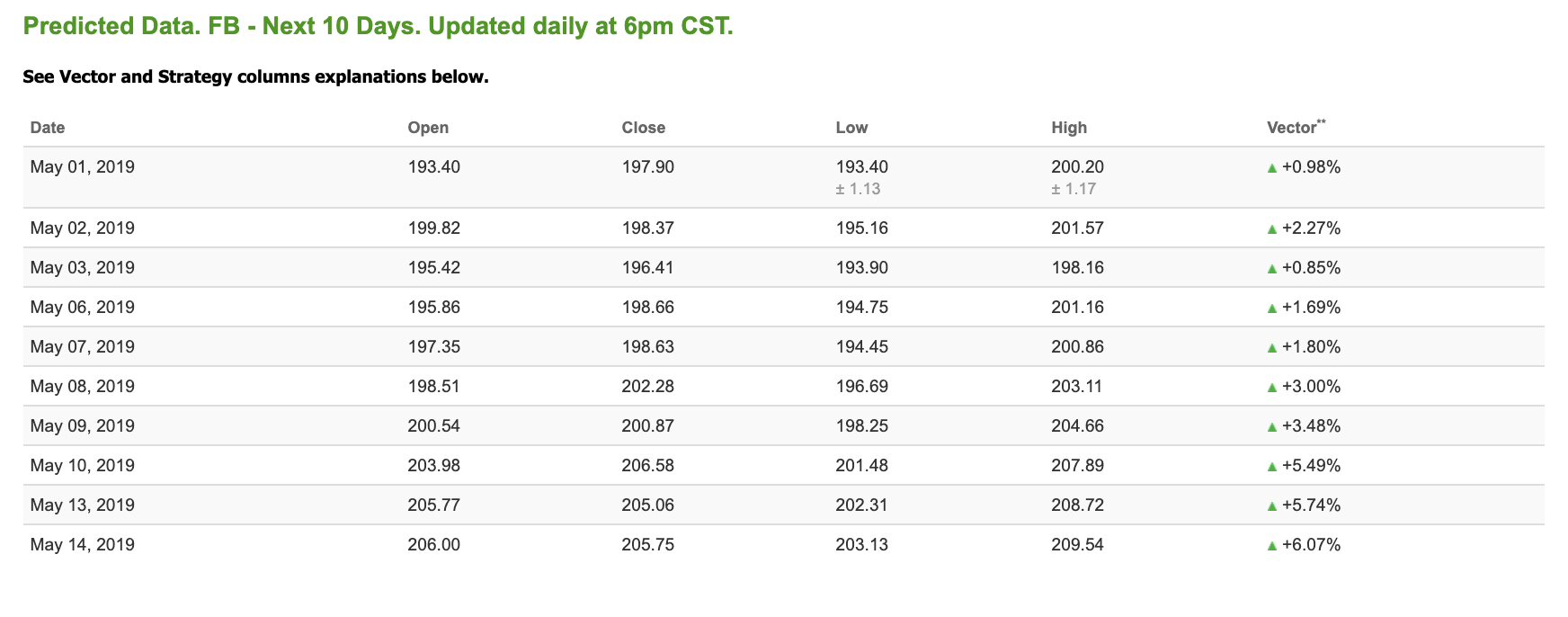

Our featured stock for Thursday is Facebook (FB). FB is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $194.77 at the time of publication, up 1.00% from the open with a +0.98% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

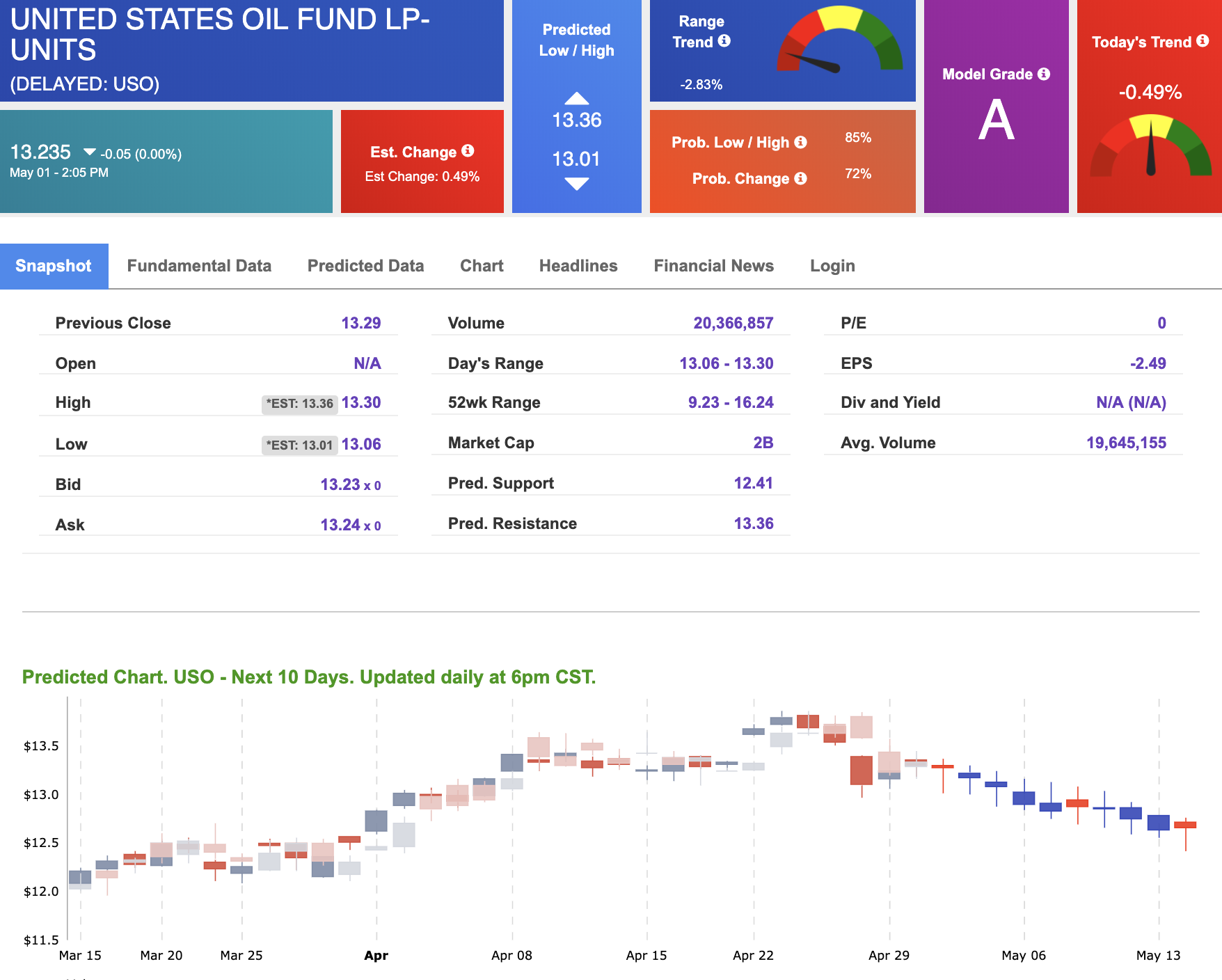

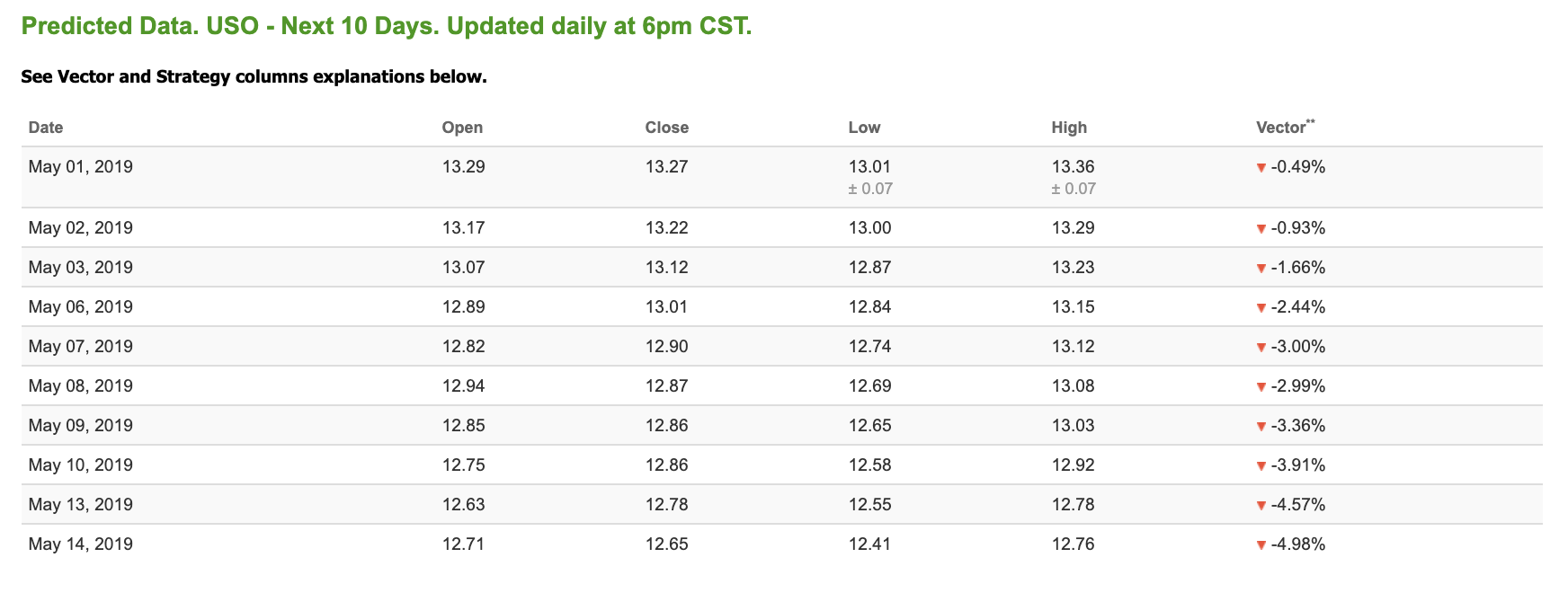

Oil

West Texas Intermediate for June delivery (CLM9) is priced at $63.65 per barrel, down 0.41% from the open, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $13.23 at the time of publication. Vector figures show -0.49% today, which turns -2.99% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

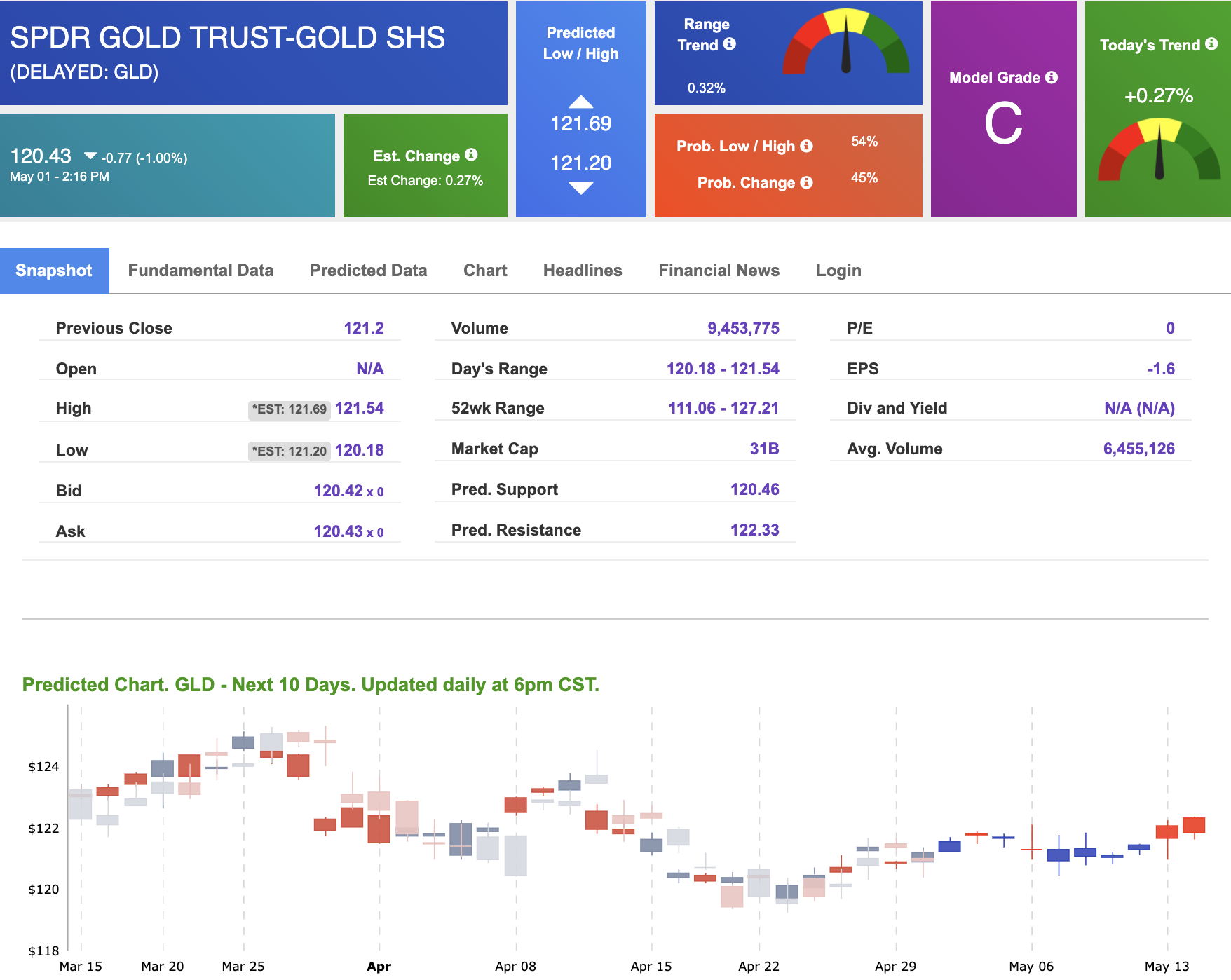

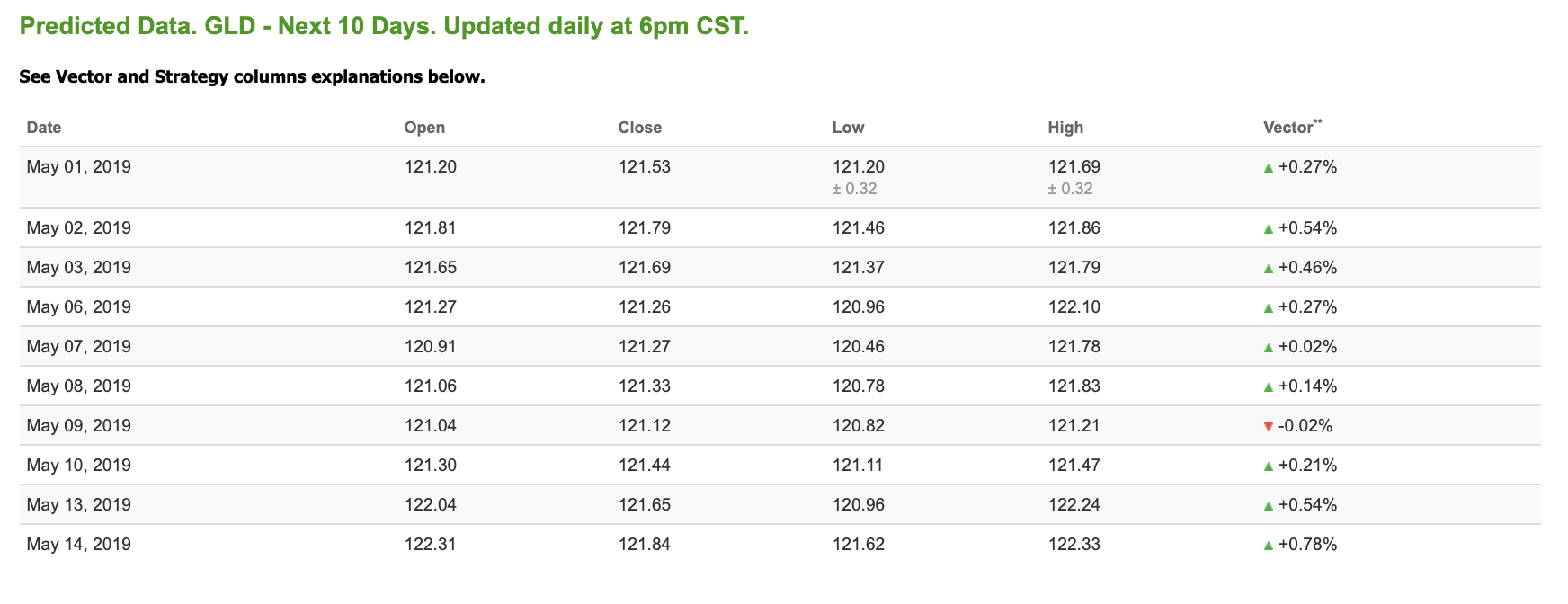

Gold

The price for June gold (GCM9) is down 0.65% at $1,277.20 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $120.42, down 1.00% at the time of publication. Vector signals show +0.27% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

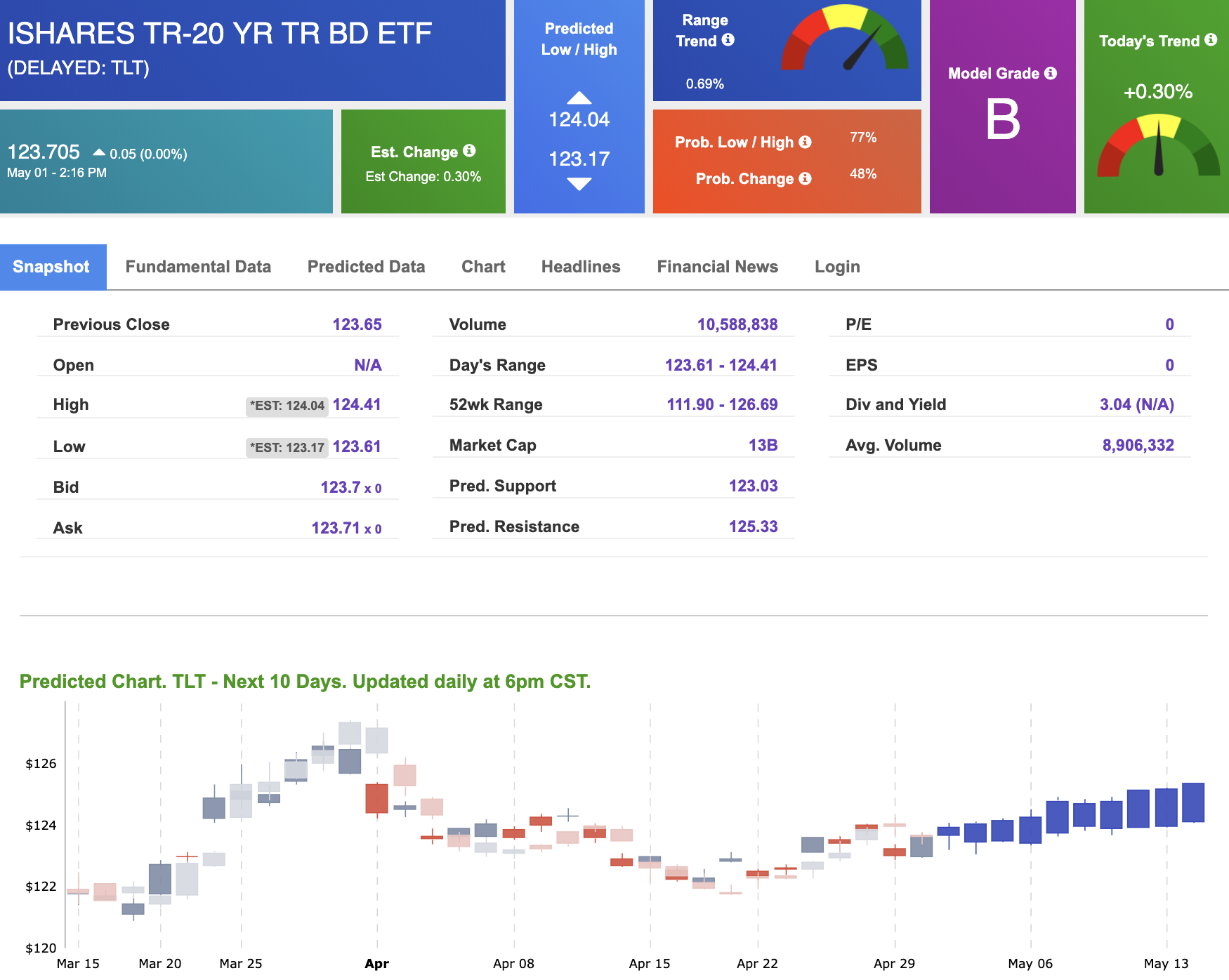

Treasuries

The yield on the 10-year Treasury note is up 0.50% at 2.51% at the time of publication. The yield on the 30-year Treasury note is down 0.35% at 2.92% at the time of publication.

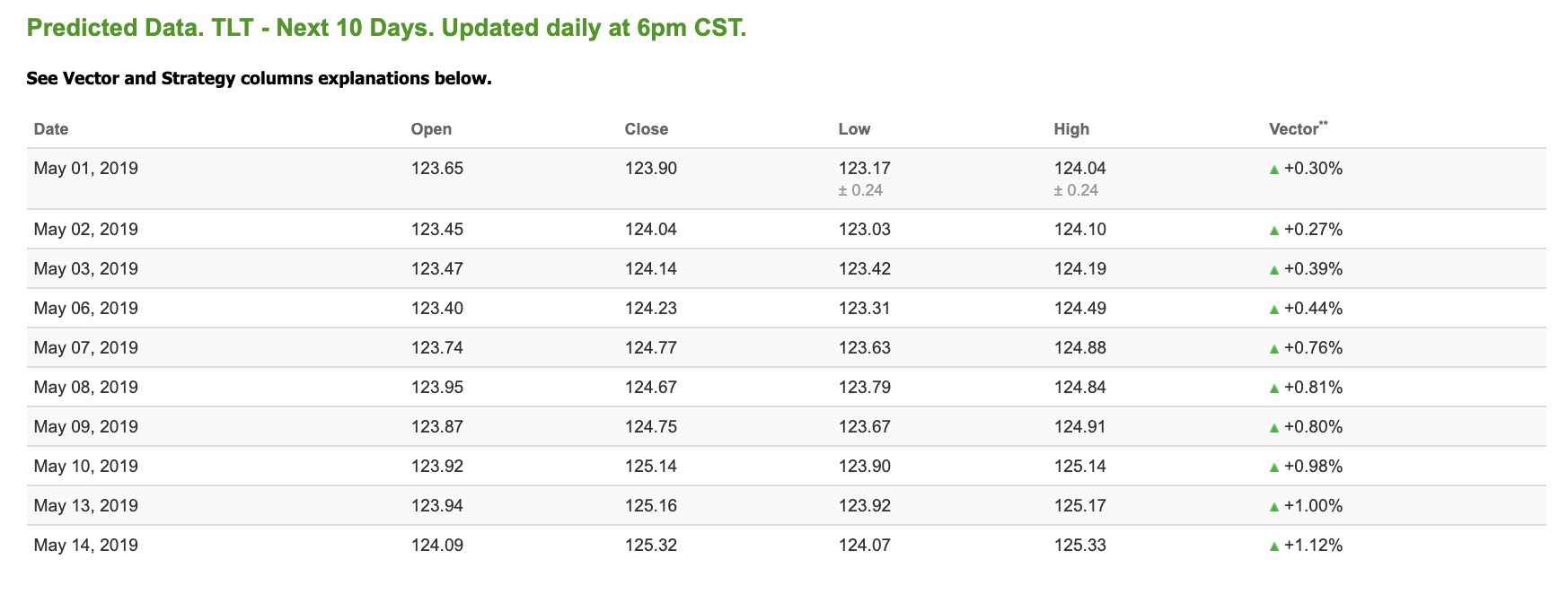

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.30% moves to +0.44% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

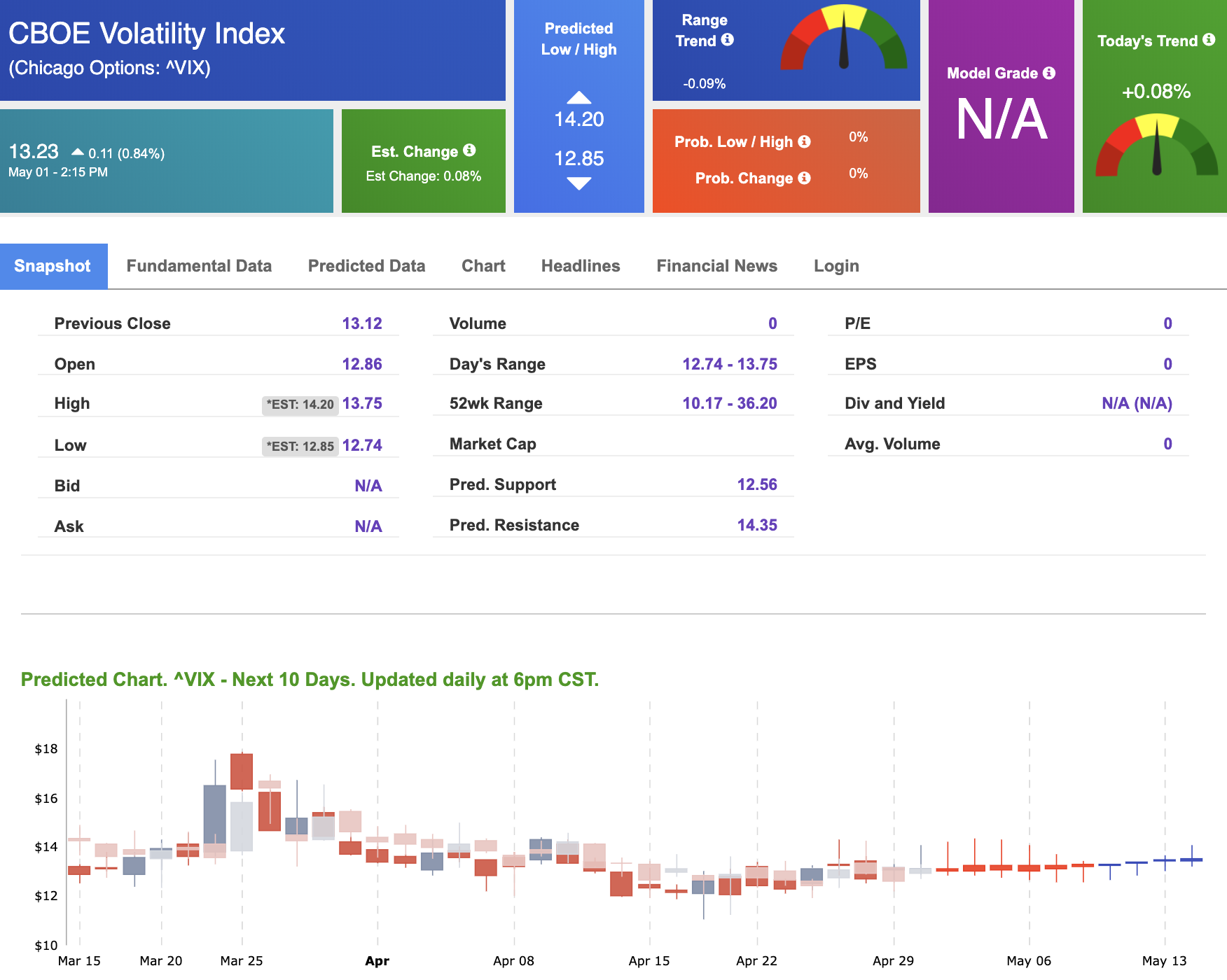

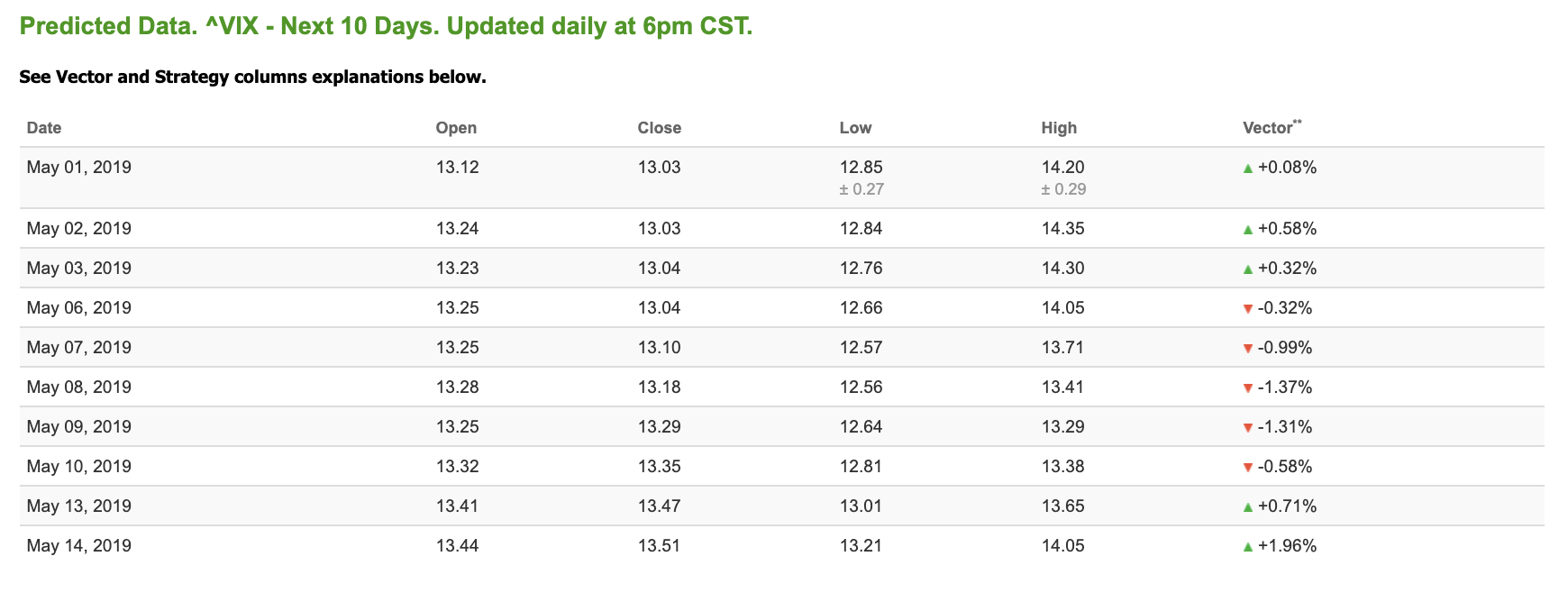

Volatility

The CBOE Volatility Index (^VIX) is up 0.84% at $13.23 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $13.03 with a vector of +0.58%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.