Primo Hot Pot Stock Validated by AI

RoboStreet – September 27, 2018

The Primo Hot Pot Stock

As the cannabis craze broadens out with several planned listings coming to market in the next six months, investors will have to separate the weeds from the chaff and determine which companies stand to dominate the category. Typically, first to market advantage has a lot to do with designating market leadership, but in this unique sector the regulatory landscape is still unfolding and Wall Street is scrambling to generate huge banking fees to underwrite IPOs.

Smart money seeking the most attractive risk/reward proposition in the space is targeting those marijuana stocks where strategic partnerships have been formed and research is being published by credible firms. Investing in any company requires some level of due diligence and in the case of the cannabis sector, a deep dive into the fundamentals of these fledgling companies is giving specific tickers a leg up in gaining the attention of professional money managers.

Getting a U.S. listing is hugely important and most companies are filing for listing on the Nasdaq as that exchange carries the reputation of where young and nascent industries go to build a following and raise capital. However, it’s my view that a listing on the NYSE brings more clout to the company in that the NYSE has the most rigorous listing in the requirements in the world.

The requirements typically measure the size and market share of the security being listed, and the underlying financial viability of the issuing firm. Exchanges establish these standards as a means of maintaining their own reputation. The NYSE requires firms to already have 1.1 million publicly-traded shares outstanding with a collective market value of at least $100 million. The Nasdaq requires firms to already have 1.25 million publicly-traded shares with a collective market value of $45 million. Both the NYSE and the Nasdaq require a minimum-security listing price of $4 per share.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

There is generally a listing fee involved as well as yearly listing fees, which scale up depending on the number of shares being traded and can total hundreds of thousands of dollars. Nasdaq fees are considerably lower than those of the NYSE, which has historically made the Nasdaq a more popular choice for newer or smaller firms.

Against this backdrop, there is only one company to date that is listed on the NYSE that represents a pure-play on the pot production business. EnterCanopy Growth Corporation (CGC). Together with its subsidiaries, CGC engages in growing, storage and sale of medical cannabis in Canada. Its products include dried flowers, oils and concentrates, soft-gel capsules, and hemps.

The company offers its products under the Tweed, Black Label, Spectrum Cannabis, DNA Genetics, Leafs By Snoop, Bedrocan Canada, CraftGrow, and Foria brand names. It also offers its products through Tweed Main Street, a single online platform that enables registered patients to purchase medicinal cannabis from various producers across various brands. The company was formerly known as Tweed Marijuana Inc. and changed its name to Canopy Growth Corporation in September 2015. Canopy Growth Corporation is headquartered in Smiths Falls, Canada.

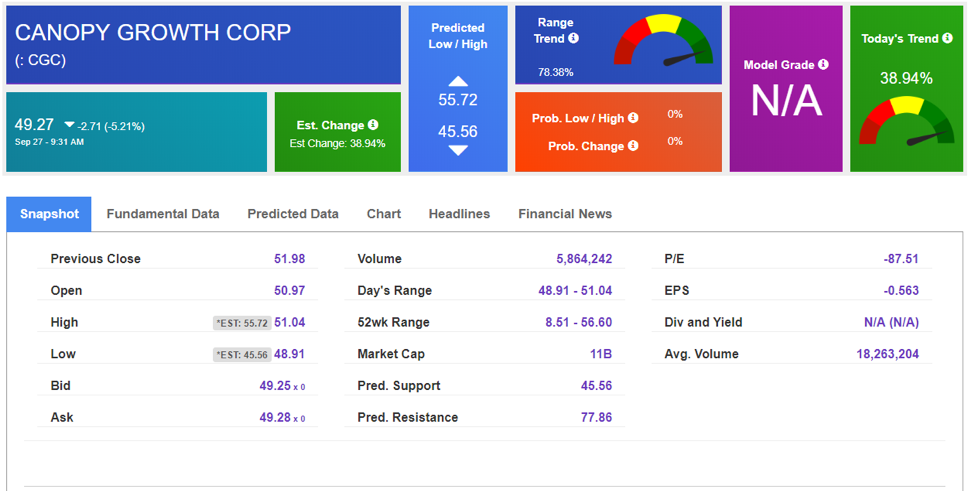

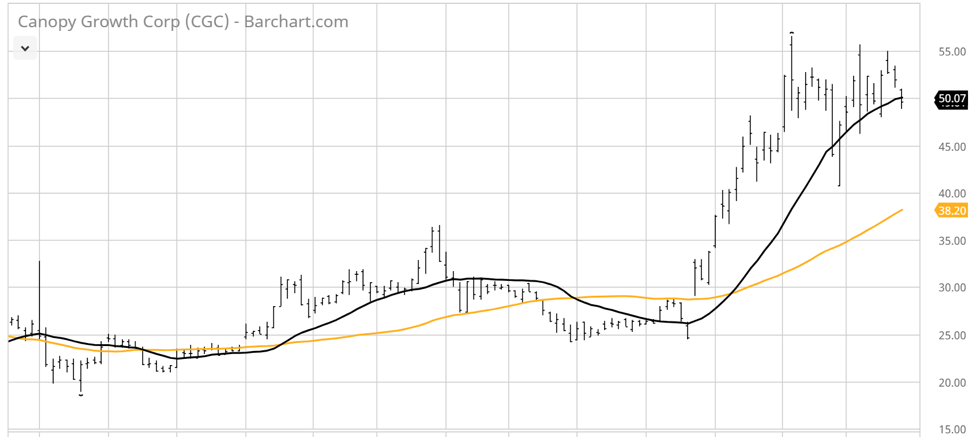

This week, Benchmark Company initiated Canopy Growth with a Buyand a CAD$100/US $77 price target, noting their positive view is based on Canopy’s exposure to meaningful demand drivers that include 1) Canopy’s early leadership in the medical cannabis market in Canada, 2) upcoming legalization of recreational cannabis in Canada, 3) international growth from countries that have legalized cannabis and likely future legalization of cannabis for medical and recreational use in the US and overseas, and 4) meaningful investment from Constellation Brands, which accelerates the ongoing build-out of its international production and distribution operations and domestic retail infrastructure to meet rapidly growing global demand, and which enables M&A opportunities and internal development of new brands and products that use cannabis as an active ingredient.Shares of CGC trade at $50US today implying 54% upside.

On August 15, 2018, Constellation Brands (STZ), a leading beverage alcohol company, and Canopy Growth Corporation announced a significant expansion of their strategic partnership to position Canopy Growth as the global leader in cannabis production, branding, intellectual property and retailing. Constellation Brands will increase its ownership interest in Canopy Growth by acquiring 104.5 million shares directly from Canopy Growth for $4 billion, thereby achieving approximately 38 percent ownership when assuming the exercise of the existing Constellation warrants. This kind of headline brings a whole new level of reassurance to the CGC investment proposition.

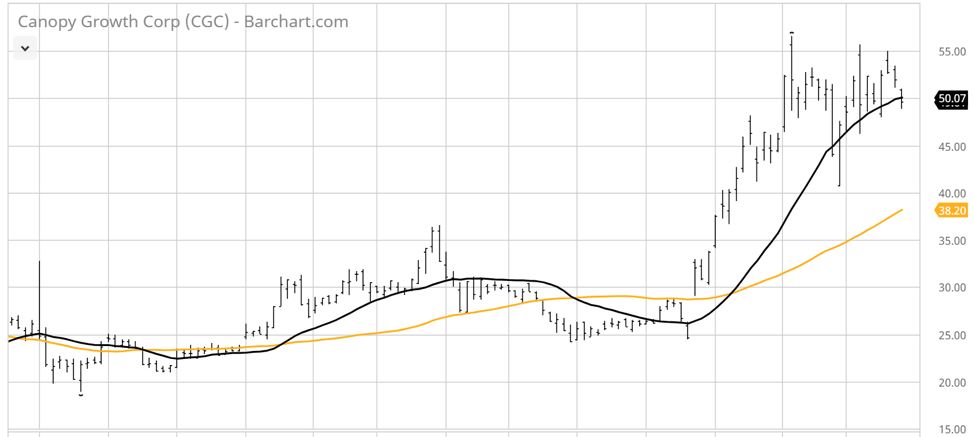

For the reasons stated within – namely a first to market status, an NYSE listing, a significant strategic partnership with one of the global consumer brand giants and a buy rating from a well-respected stock research firm – Canopy Growth is the primo pot stock on a purely fundamental basis. From a technical standpoint, the stock rates just as well.

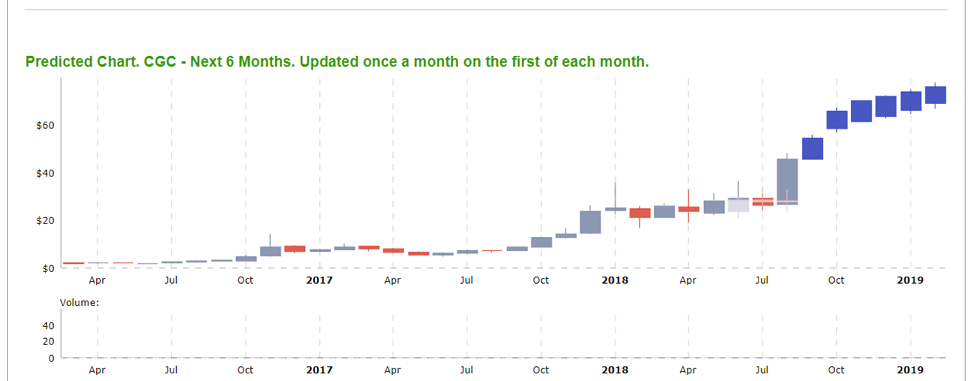

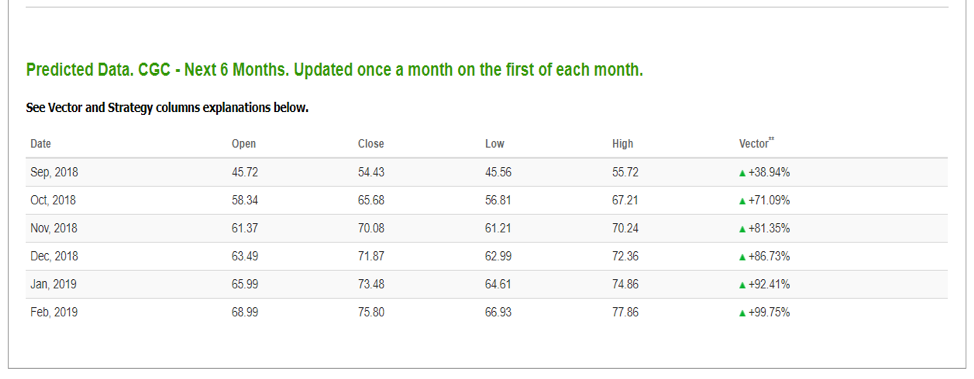

This is one sector, in my opinion,where artificial intelligence is not just a luxury,it’s absolutely vital to making the right investment decisions. My Tradespoon Stock Forecast Toolbox has corroborated the research put out byBenchmark. The data is still young since the company has a short history of being public, and my ‘always learning’ AI platform is adjusting. The six-month forecast for CGC has the stock seeking a potential price target of $77 which just so happens to coincide with the Benchmark price target.

So while the investing world scrambles to figure out a coherent strategy to buy into the hot, new sector fraught with uncertainty and a high level of risk, I concluded that limited exposure to the cannabis sector for those with the right risk profile should consider Canopy Growth for starters. As a RoboInvestor subscriber, my AI system will guide us into the right pot stocks at the right price and also get us out at the right price. If you are going to trade pot stocks without AI at your disposal, it’s like showing up to a gunfight with a knife. Instead, RoboInvestor subscribers will have the powerful AI tools that I developed over the years to make their investing experience a truly positive and profitable one.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.