Q1 Earnings Season Begins, FOMC Minutes Wednesday

Major U.S. Indices Trading Lower

Major U.S. indices trading lower today with little news to guide markets in either direction – especially during earnings season. Several positive developments regarding U.S.-China negotiations last week helped markets enjoy a multi-day streak. Now, investors and traders alike await formal news of a meeting between Trump and Xi to iron out the long-awaited deal. Last Friday’s employment reports returned positive to support market sentiment while over in the U.K. Brexit uncertainty remained.

(Need help understanding earning seasons? Check out our Training section!!)

Annual Seasonal Cycle

This week, we will see CPI data and last month’s FOMC minutes released midweek, while Q1 earnings season kicks off Friday with major banks JPMorgan Chase and Wells Fargo reporting. Short term support for the market remains at $280-284 after breaking out of range and remaining above 200-day moving average. Continue monitoring seasonal charts and 200-day moving for a good gauge on the momentum as the market remains on track to retest 52 weeks high of $294. For reference, the SPY Seasonal Chart is shown below:

Notable Progress with China

After notable progress between U.S. and China representatives in D.C. last week, President Trump joined negotiations on Thursday, leading many to believe a deal is within reach. Now, market-watchers await news of another meeting between the two sides, likely featuring both leaders and some tariff-centric resolution. China would like the U.S. to remove tariffs at once while the U.S. would prefer a deal that presented a gradual decrease of tariffs. As this and other differences continue to be worked out, global markets continue trading to mixed results, with both European and Asian markets closing as so today.

(Need help understanding earning seasons? Check out our Training section!!)

After a tough week for the U.K. which saw the pond and FTSE 100 struggle beneath Brexit uncertainty, news of a longer extension offered by the EU is supporting British assets today. If no deal is managed by week’s end, expect the next Brexit extension to keep the U.K. in the EU through 2020.

FOMC Members Scheduled to Speak

Tomorrow, several FOMC members are scheduled to speak, including Vice Chairman Rich Clarida while Wednesday will feature CPI data for March. Also on Wednesday, FOMC minutes from last month’s meeting will release along with the March Federal Budget report.

(Need help understanding earning seasons? Check out our Training section!!)

First quarter earnings season is set to kick off with several major banks on Friday while Delta Airlines, Bed Bath & Beyond, and Rite Aid will report in the days prior. Also worth monitoring, executives from Chase, Citigroup, Morgan Stanly, Goldman Sachs, and Bank of America are set to speak with members of the House Committee of Financial Sevices in Washington.

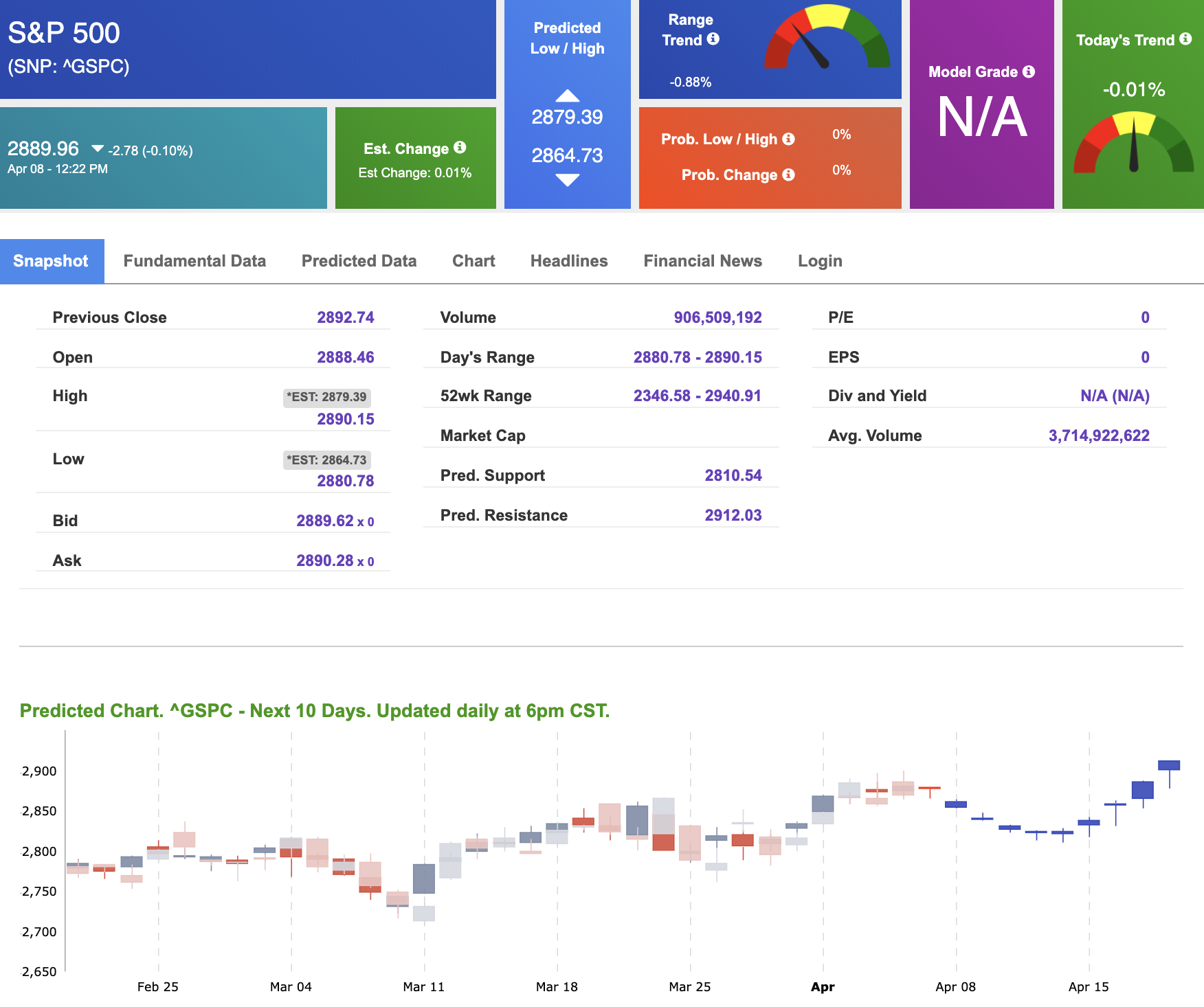

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows negative signals. Today’s vector figure of -0.01% moves to -1.89% in five trading sessions. The predicted close for tomorrow is 2,861.96. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(Need help understanding earning seasons? Check out our Training section!!)

Introducing WeeklyTrader by Tradespoon –

The Brand New Trading System for the Self-Directed Investor

You can have this AI-powered system

behind your portfolio today!

Put Vlad’s algorithms to work for you and bank triple-digit gains over and over again.

It just takes 15 minutes a week to set up your portfolio and kick back while you enjoy a 75% win rate.

And, you can join thousands of traders just like you that are beating the market – using this simple and straightforward system.

If you’re ready to enjoy the freedom that comes from this elite trading system and lock in a 50% discount on your Charter Membership, just click here to get started.

YES! Click Here To Start

Highlight of a Recent Winning Trade

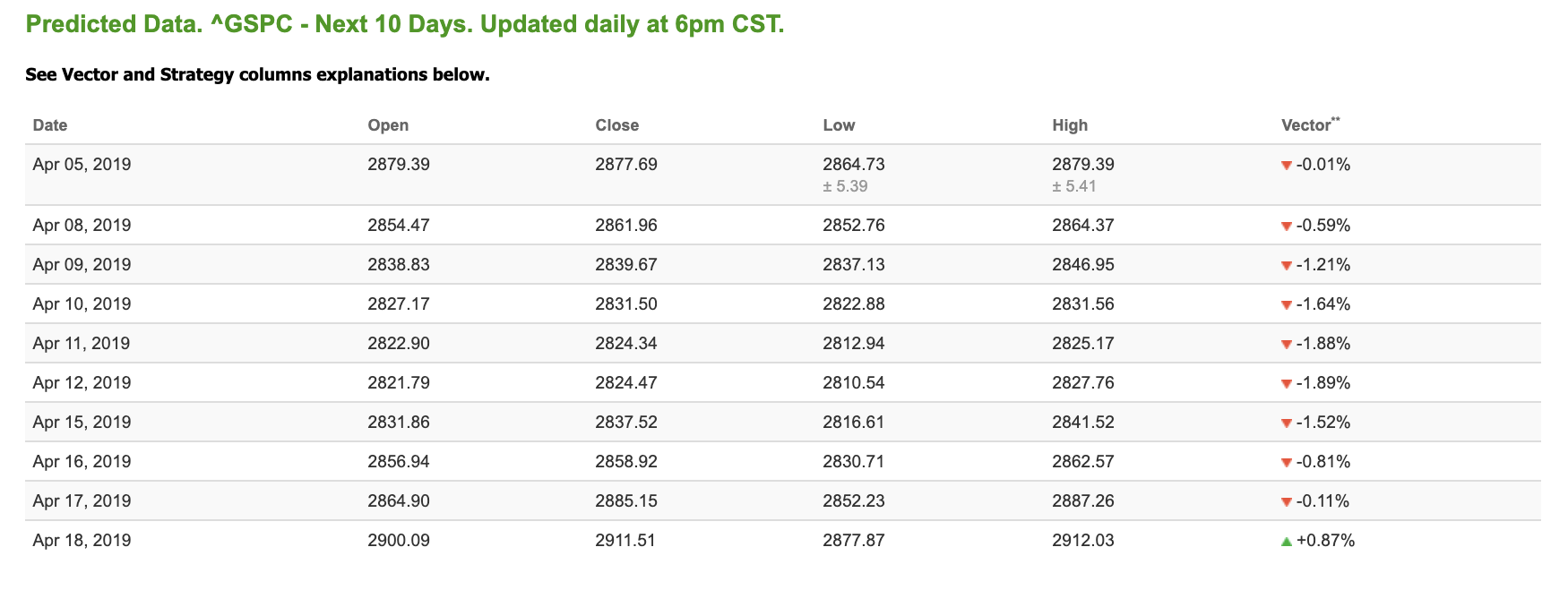

On March 29th, our ActiveTrader service produced a bullish recommendation for Xerox Corp (XRX). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

XRX entered its forecasted Strategy B Entry 1 price range $32.01 (± 0.16) in its second hour of trading and passed through its Target price $32.33 in the first hour of trading the following trading day. The Stop Loss price was set at $31.69.

Tuesday Morning Featured Stock

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

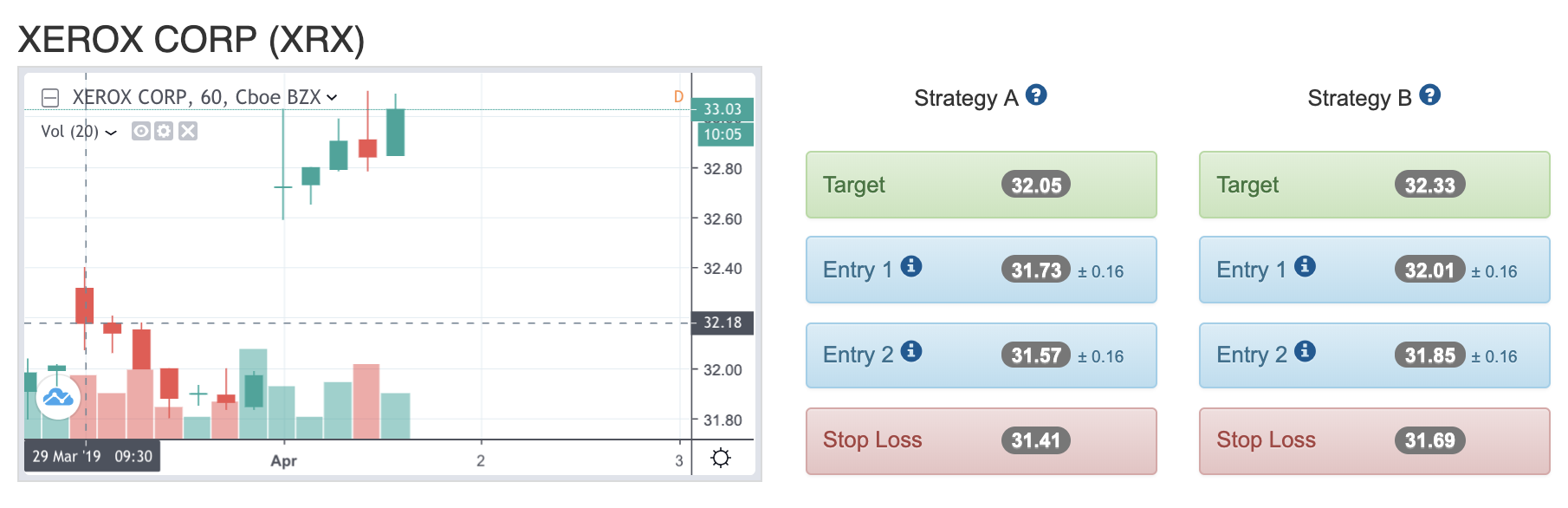

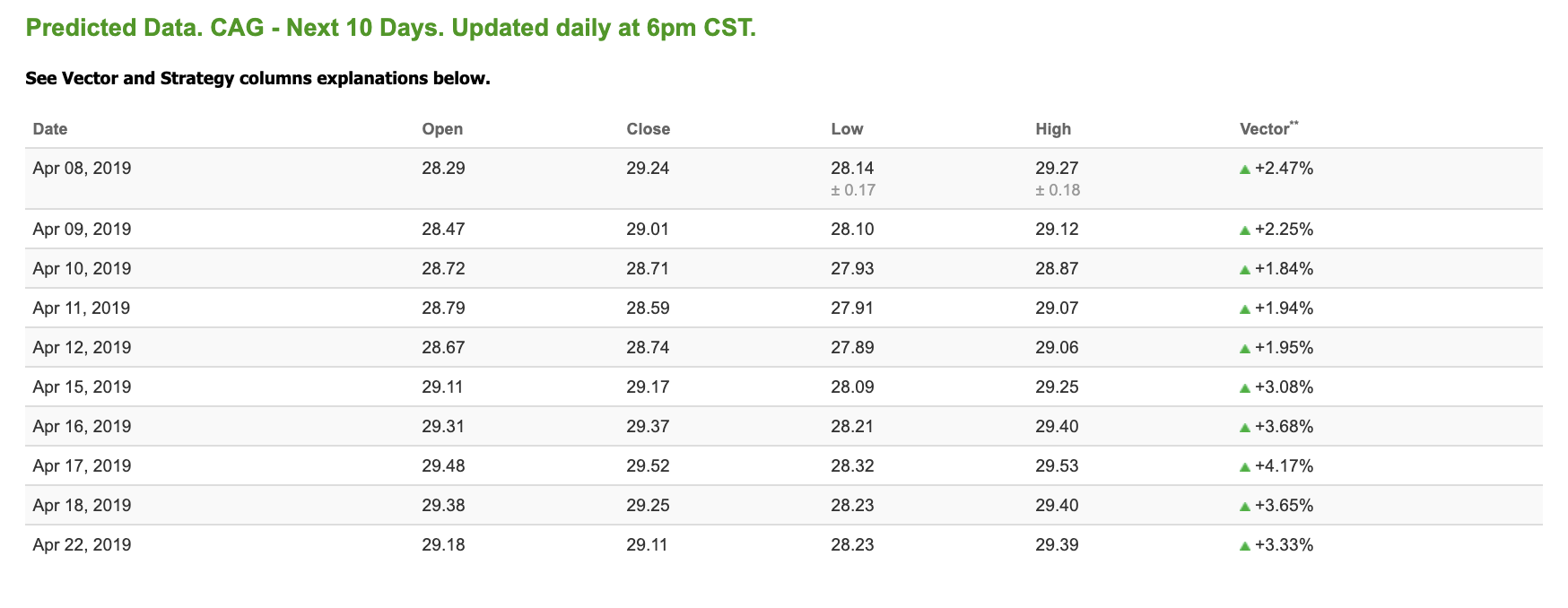

Our featured stock for Tuesday is Conagra Brands Inc (CAG). CAG is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $28.31 at the time of publication with a +2.47% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for May delivery (CLK9) is priced at $64.28 per barrel, up 1.90% from the open, at the time of publication.

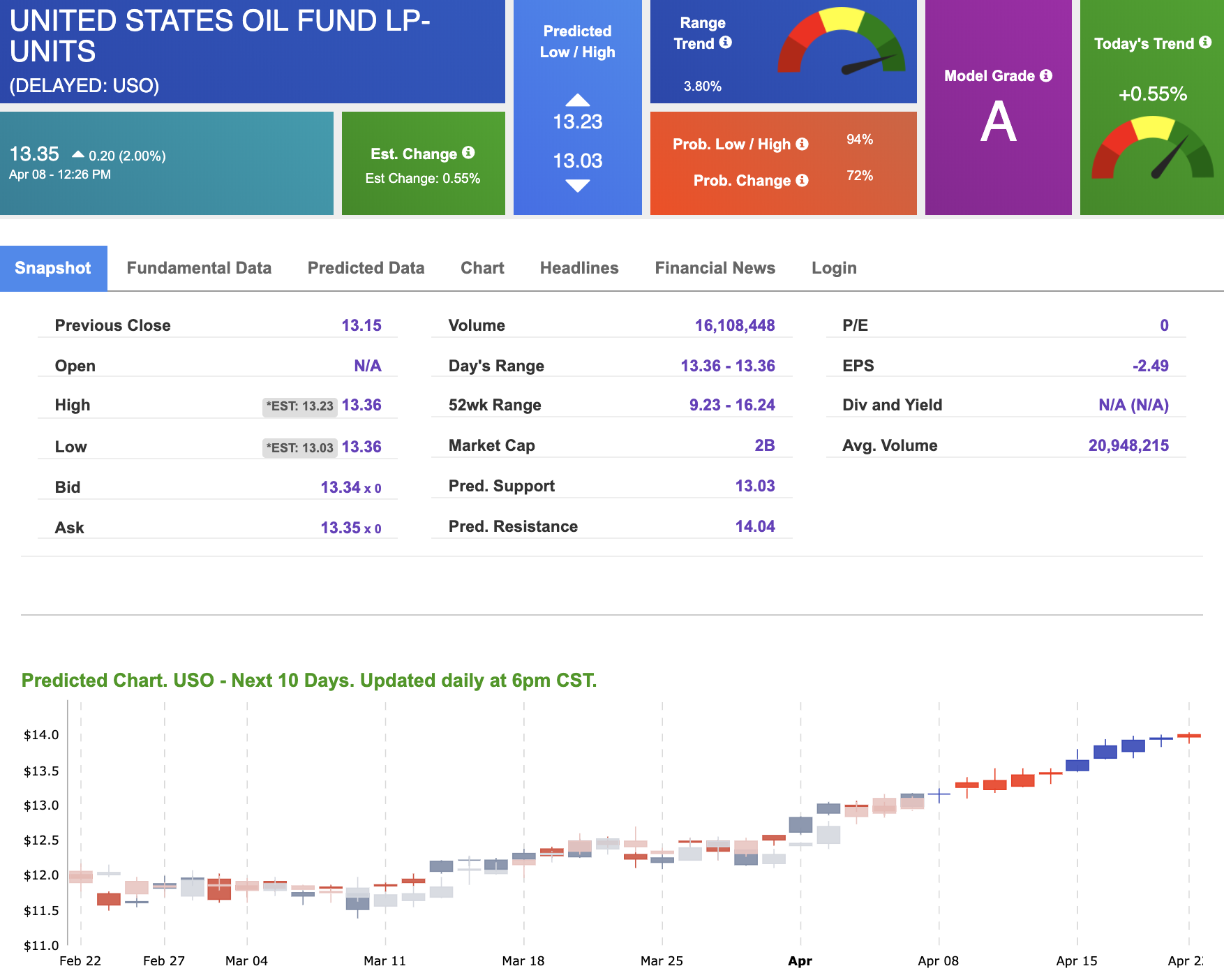

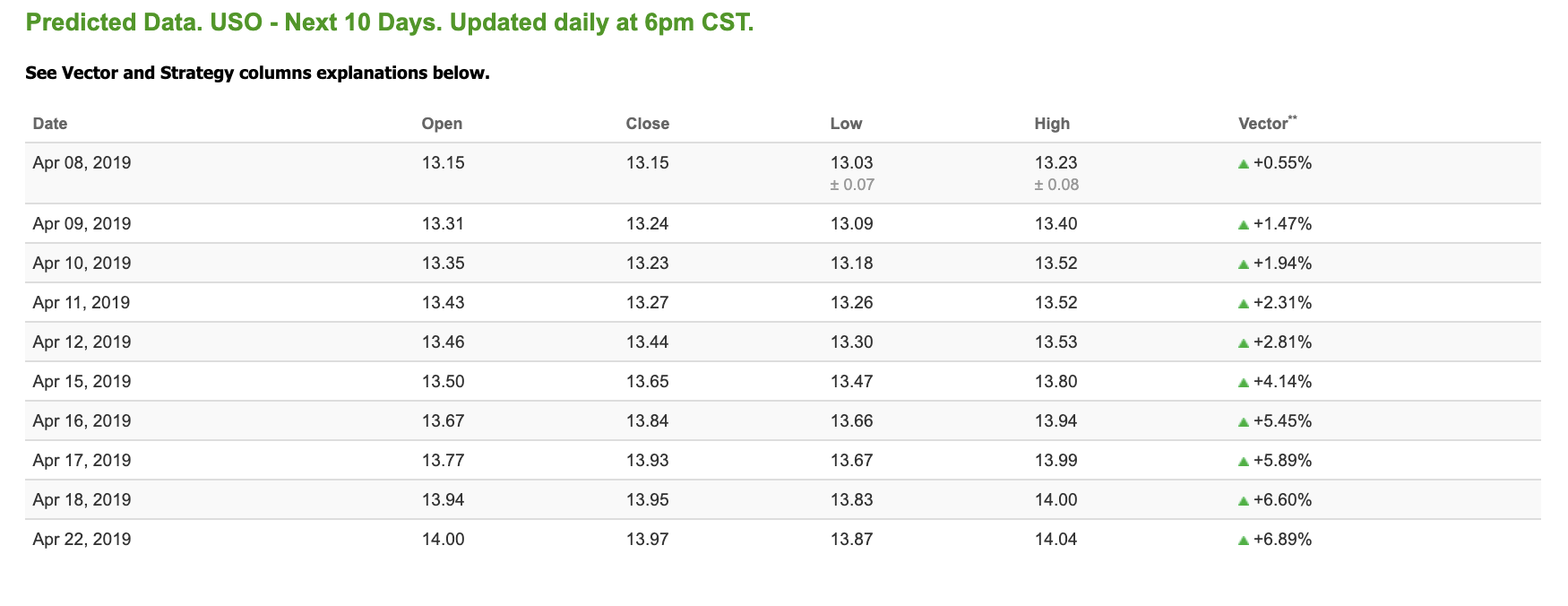

Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $13.35 at the time of publication, up 2.00% from the open. Vector figures show +0.55% today, which turns +4.14% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

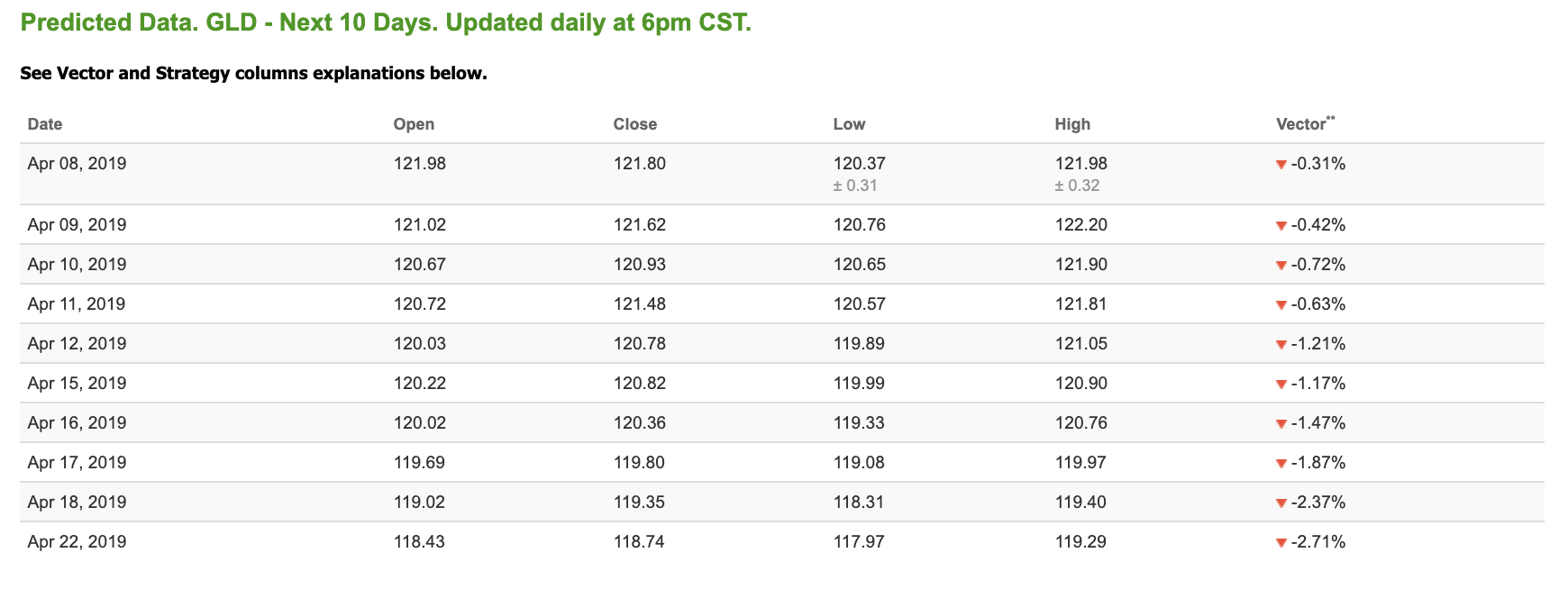

Gold

The price for June gold (GCM9) is up 0.46% at $1,301.60 at the time of publication.

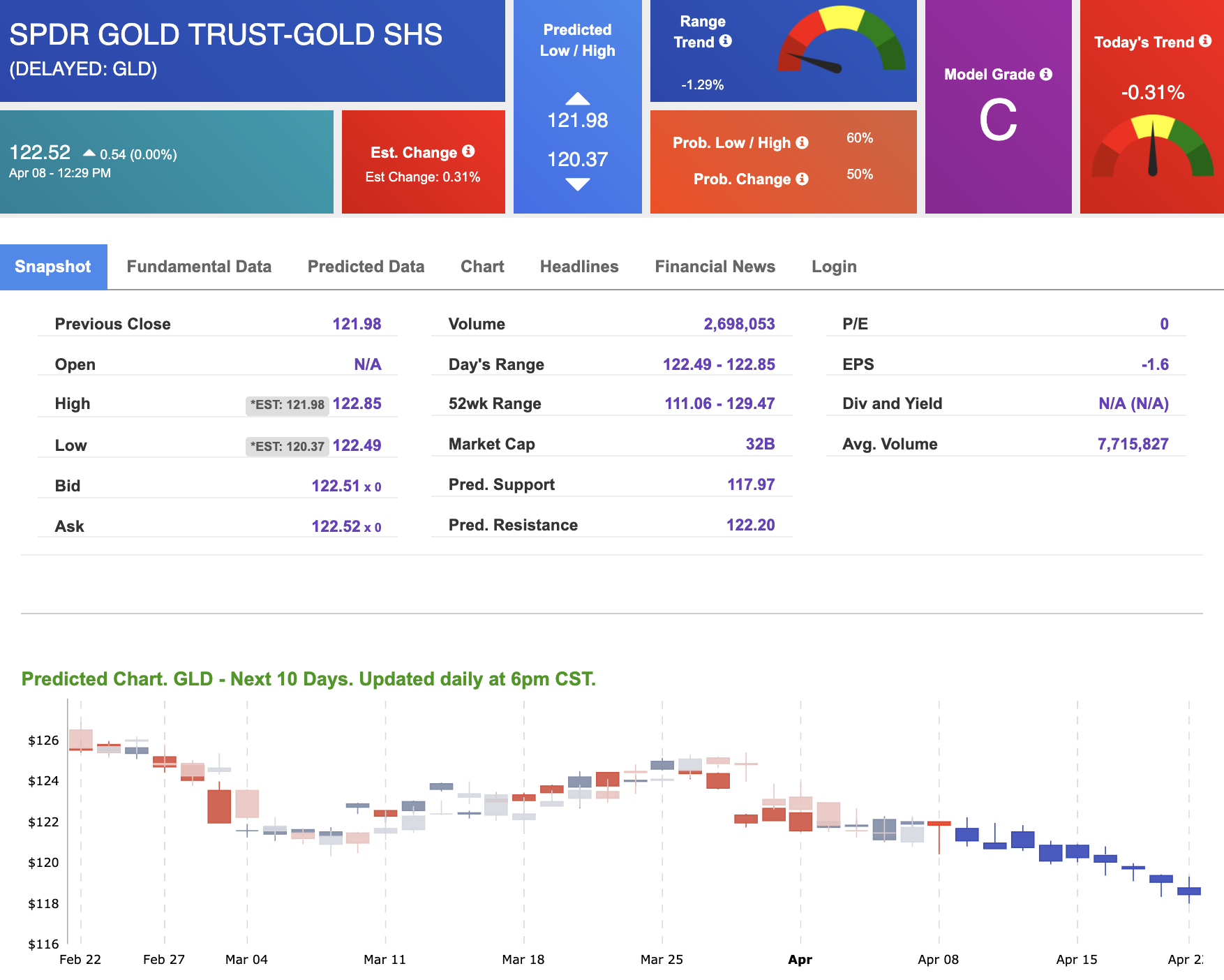

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows negative signals. The gold proxy is trading at $122.52. Vector signals show -0.31% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

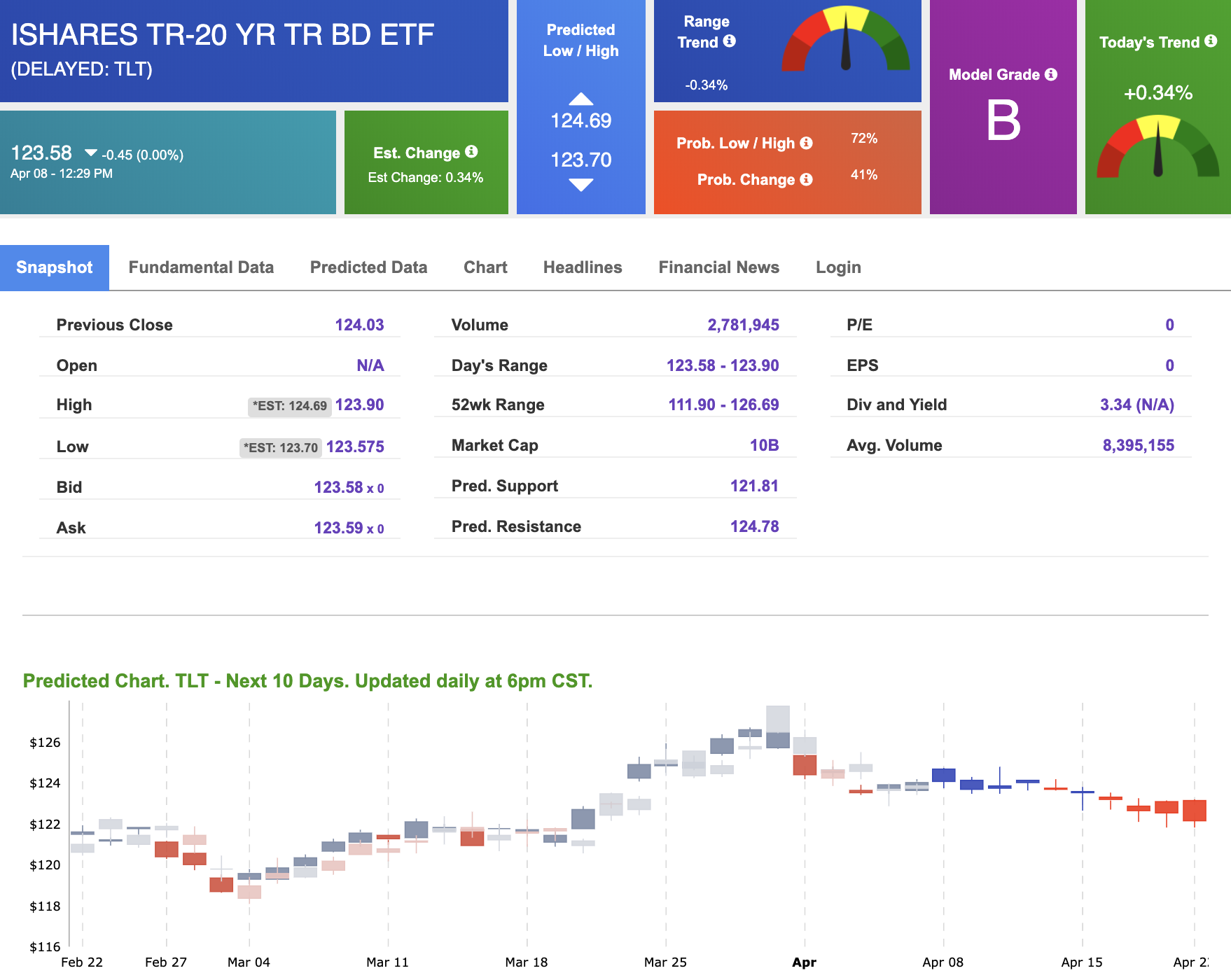

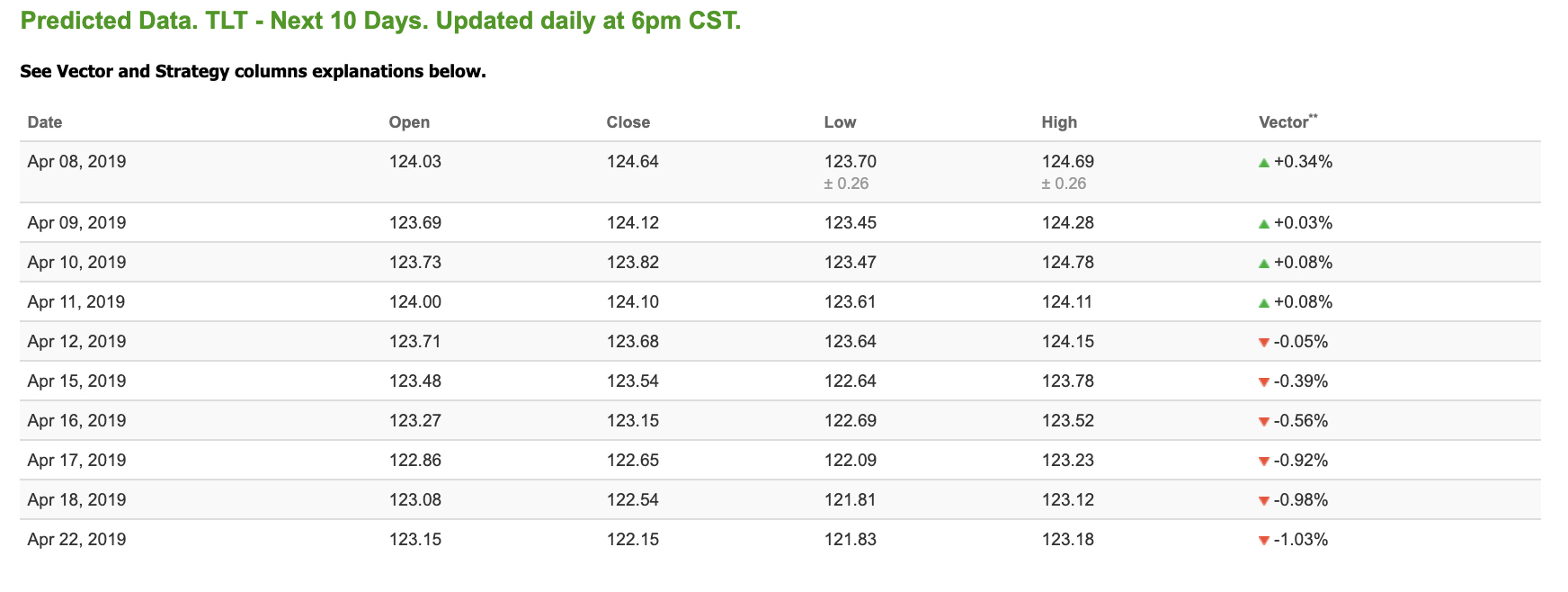

Treasuries

The yield on the 10-year Treasury note is down 0.04% at 2.51% at the time of publication. The yield on the 30-year Treasury note is up 0.05% at 2.92% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of +0.34% moves to +0.08% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

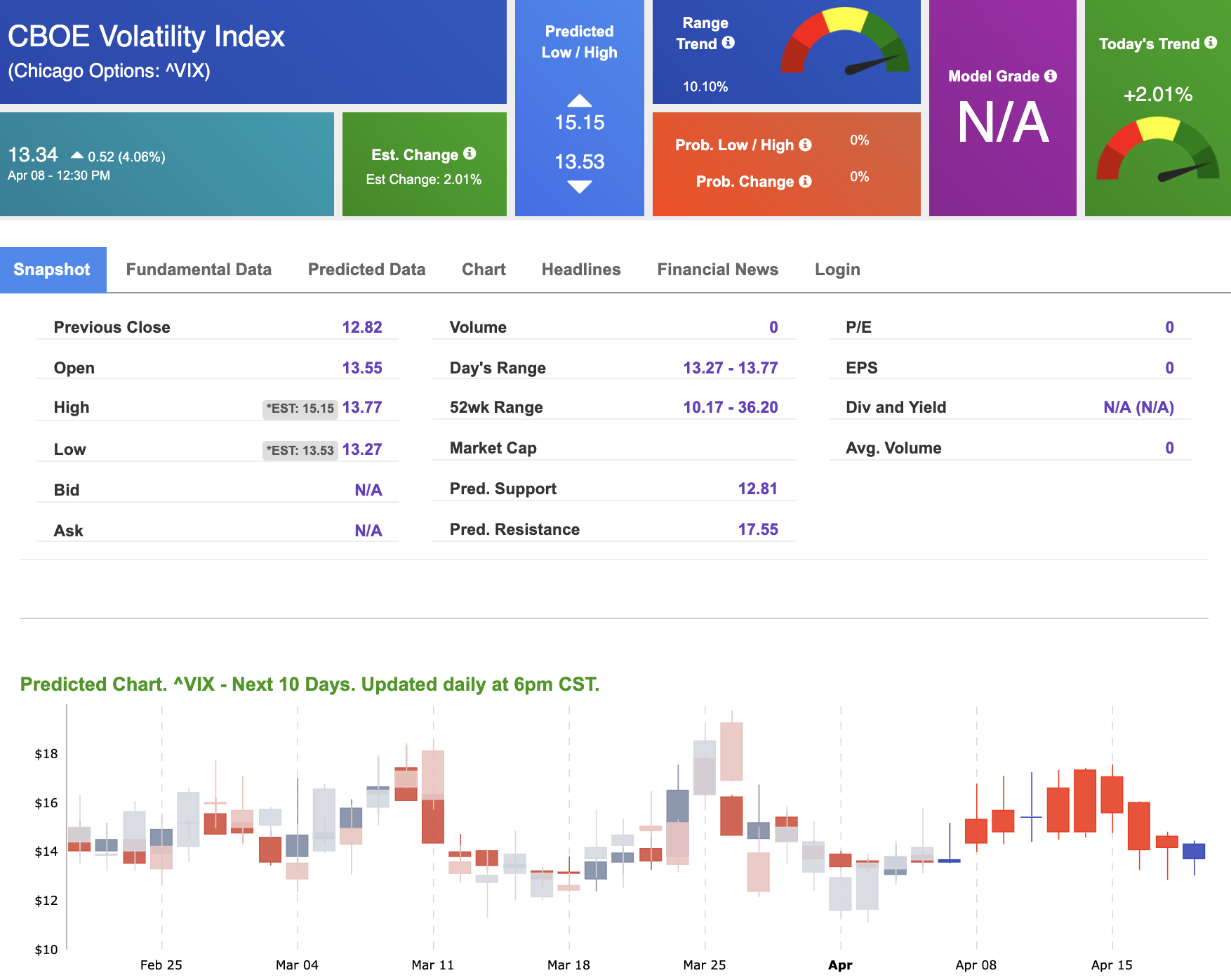

Volatility

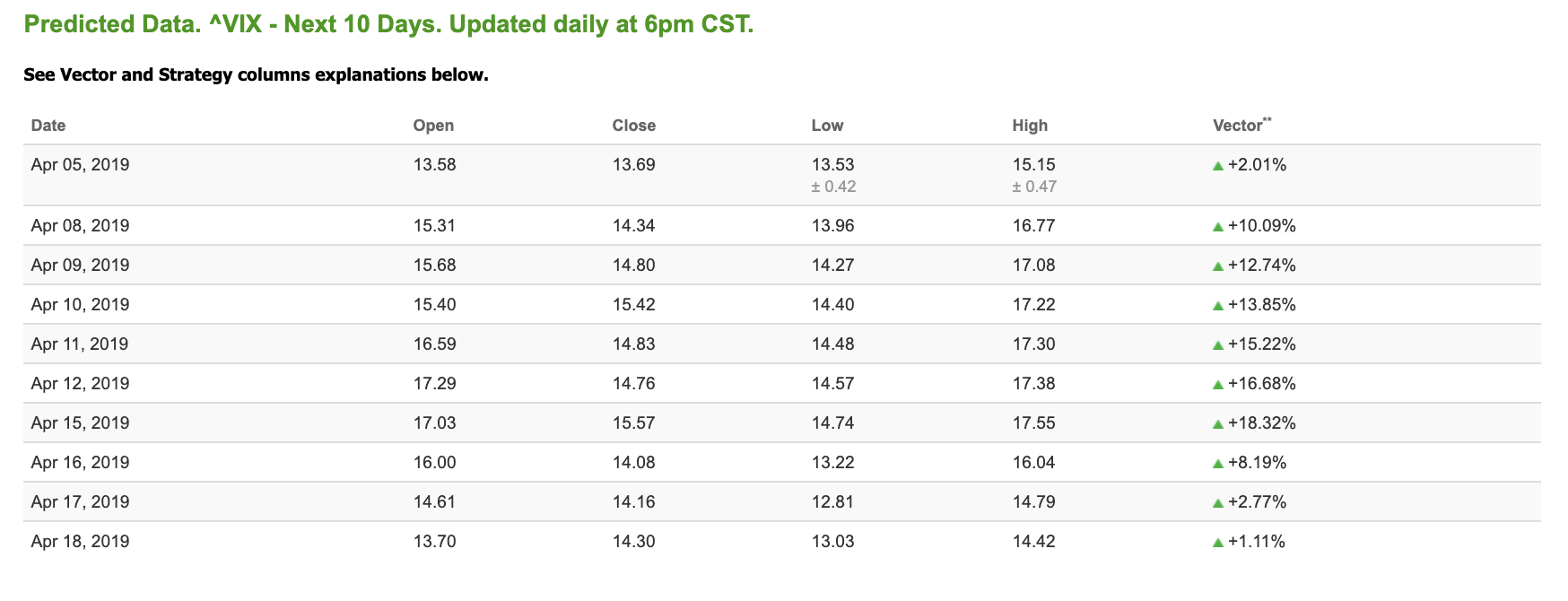

The CBOE Volatility Index (^VIX) is up 4.06% at $13.34 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $14.34 with a vector of +2.01%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Introducing WeeklyTrader by Tradespoon –

The Brand New Trading System for the Self-Directed Investor

You can have this AI-powered system

behind your portfolio today!

Put Vlad’s algorithms to work for you and bank triple-digit gains over and over again.

It just takes 15 minutes a week to set up your portfolio and kick back while you enjoy a 75% win rate.

And, you can join thousands of traders just like you that are beating the market – using this simple and straightforward system.

Enjoy the freedom that comes from this elite trading system and lock in a 50% discount on your Charter Membership, just click here to get started.