Social Media Execs Face Intelligence Committee, Canada And U.S Officials Meet

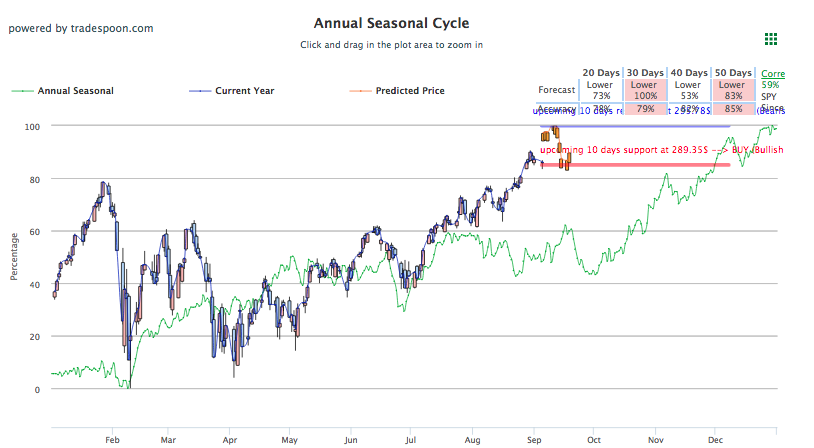

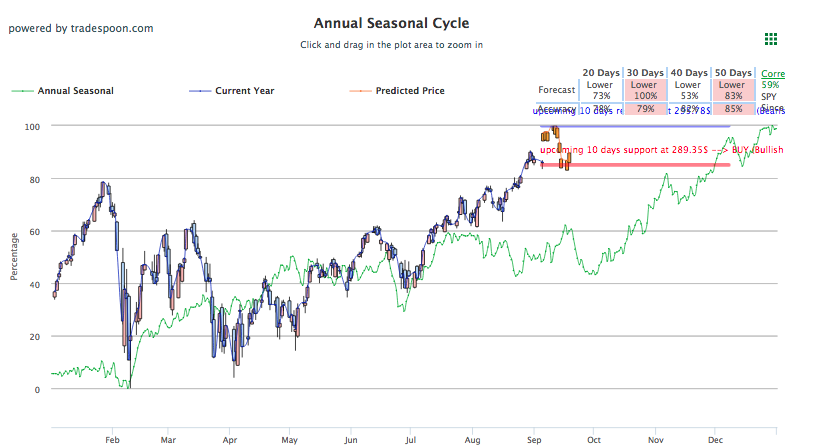

U.S. Stocks mostly fell today behind slumping tech stocks as Google, Facebook, and Twitter met with the Senate Intelligence Committee on Capitol Hill. A large sell-off in the tech sector followed as Microsoft, Netflix, and Amazon, along with the three companies mentioned above, saw significant losses for the day. Key support for SPY is at 286, mirroring January high. The next key support level is at 50-Day Moving Average which corresponds to 282. Trade-related concerns could also be weighing on markets as last week’s optimism to rework NAFTA is now pressuring markets, as a U.S.-Canada deal has yet to be resolved. SPY Seasonal Chart below.

After an extremely optimistic week that saw a bilateral deal between the U.S. and Mexico get made as well as a restart in negotiations with Canada pushes stocks to record highs, U.S. stocks mostly lowered today, with the exception of the slight gains made in the Dow, currently the only index edging higher. The current slump looks to mirror the shift in optimism from last week to this week, as tension with Canada continues to develop in front of today’s meeting between the Canadian Foreign Minister and a U.S. Trade Representative. Canadian Prime Minister Justin Trudeau said on Tuesday, “no NAFTA is better than a bad NAFTA deal for Canadians,” reaffirming trade tension and worry. Still, there has been plenty of good U.S. economic data to avert larger slumps or dips that would usually come with such trade concerns. Look for more news to surface after today’s meeting between the U.S. and Canada.

Elsewhere, emerging markets continue to struggle, with declines in Chinese markets and European markets. Chinese stocks had rebounded yesterday only to lower significantly today. Also pressuring Asians stocks is the current Typhoon Jebi, passing near Japan today and heading towards China, which has both nations in disaster relief efforts and could have its effects felt long after the typhoon ends. In other news, Nike stock dipped yesterday behind the backlash caused by the use of former NFL player Colin Kaepernick in an ad, while today Nike shares rose. Trump commented on the matter, and as he did with the NFL, publicly critiqued the company. Nike has been up for the year, currently, up 28%, and whether the current backlash is long-standing or affecting will be seen as the year unfolds.

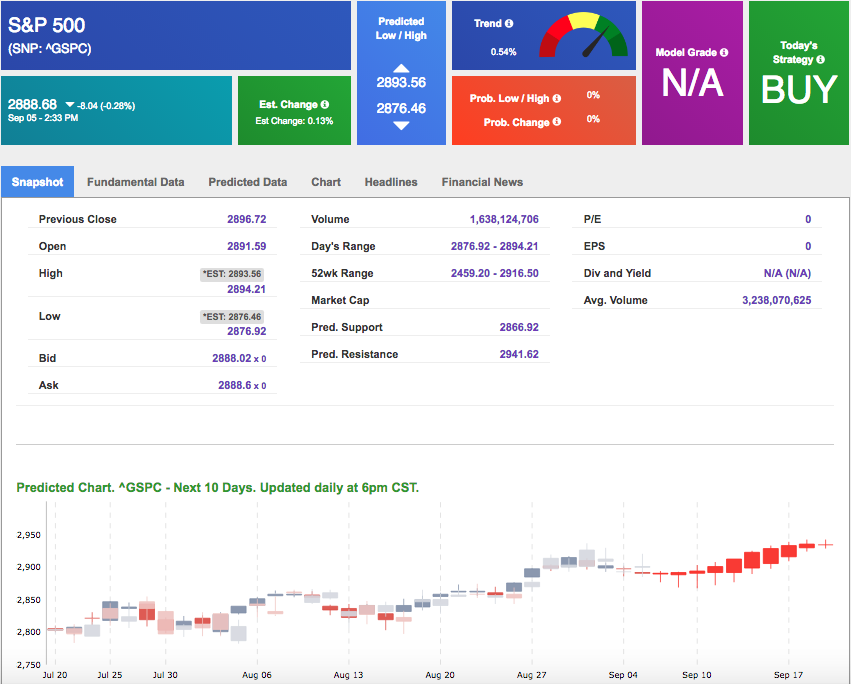

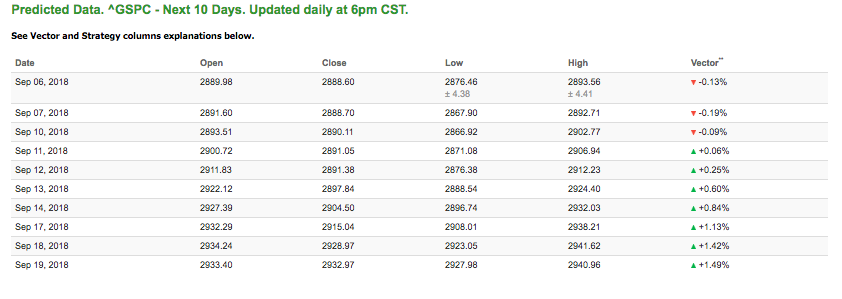

Using the ^GSPC symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of +0.19% moves to -0.15% in three trading sessions. The predicted close for tomorrow is 2,900.50. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

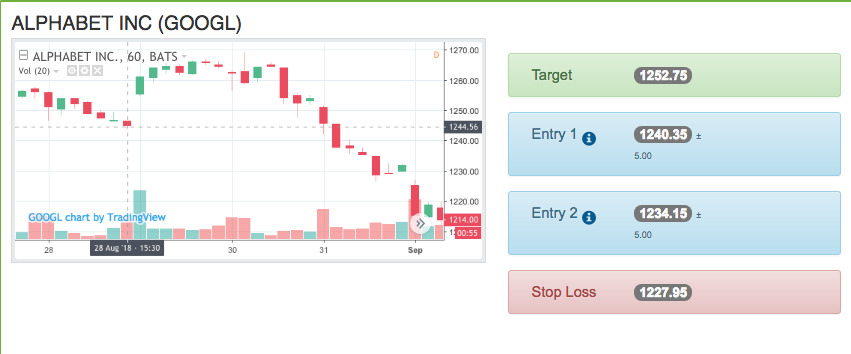

On August 28th, our ActiveTrader service produced a bullish recommendation for Alphabet Inc. (GOOGL). ActiveTrader is included in all paid Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

GOOGL entered the forecasted Entry 1 price range of $1240.35 (± 5.00) in its last hour of trading on Tuesday and opened above its Target price of $1252.75 today, reaching a high of $1261.11 in the first hour of trading. The Stop Loss was set at $1227.95.

Live Trading Room Update

See how we traded in volatile conditions and what you might expect in our next Live Trading Room. During recent volatility, we held Live Trading Room Session, on August 30th, where we had some great trades below!

Symbol. Net Gain%

| MSFT(OPTION) | 27.78% |

| FE | 37.21% |

| GLW | 11.90% |

| MSFT(OPTION) | 37.37% |

| TXN(OPTION) | 40.00% |

| MSFT(OPTION) | 44.44% |

| AMZN(OPTION) | 40.58% |

| GOOGL(OPTION) | 27.27% |

| GOOGL(OPTION) | 14.29% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time for the first hour of trading, but these Live Trading Sessions are only available for Premium Members.

We wanted to share the recording with you so you can see the profits you might be missing- even during volatile markets.

Click Here to Watch the Recording

Special Lifetime Offer – Watch where I trade my personal money, propose specific stop losses, time the market, show how I trade step-by-step, consider underlying volatility, and sell for big profits!

Click here for my Special Lifetime Offer!

Thursday Morning Featured Stock

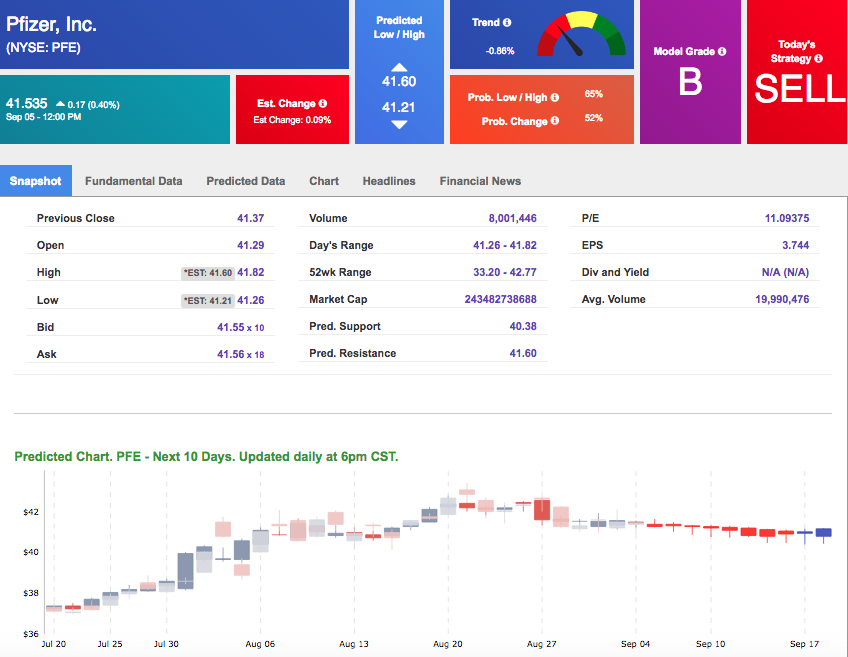

Our featured stock for Thursday is Pfizer, Inc. (PFE). PFE is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $41.535 at the time of publication, up 0.40% from the open with a -0.09% vector figure.

Thursday’s prediction shows an open price of $41.37, a low of $41.00 and a high of $41.48.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for October delivery (CLV8) is priced at $68.76 per barrel, down 1.60% from the open, at the time of publication. Oil prices continue to fall this week. A major storm passing through the Gulf of Mexico looked to endanger operations earlier but passed without harm. A small number of production has been shut down due to the storm but should not affect production going forward.

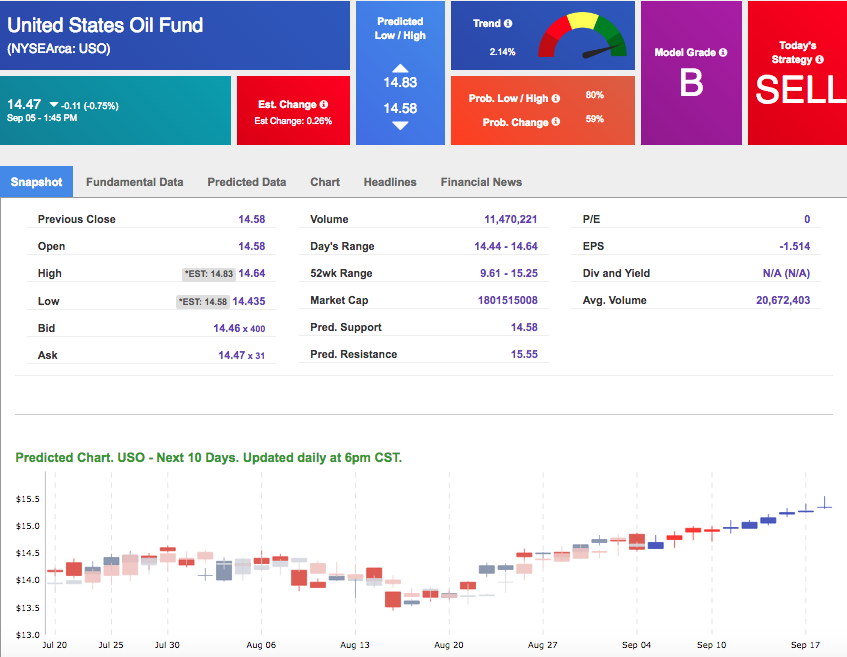

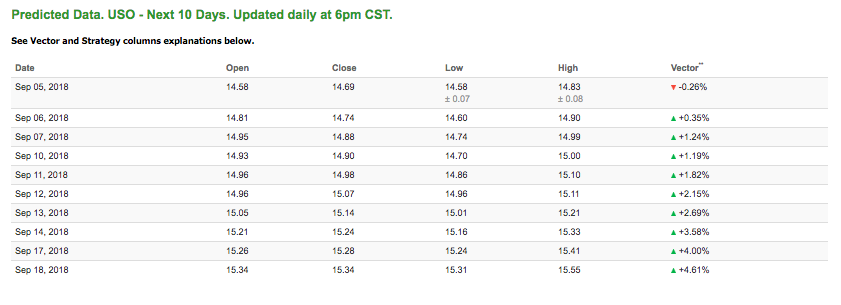

Looking at USO, a crude oil tracker, our 10-day prediction model mostly all positive signals. The fund is trading at $14.47 at the time of publication. Vector figures show -0.26% today, which turns +1.24% in two trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

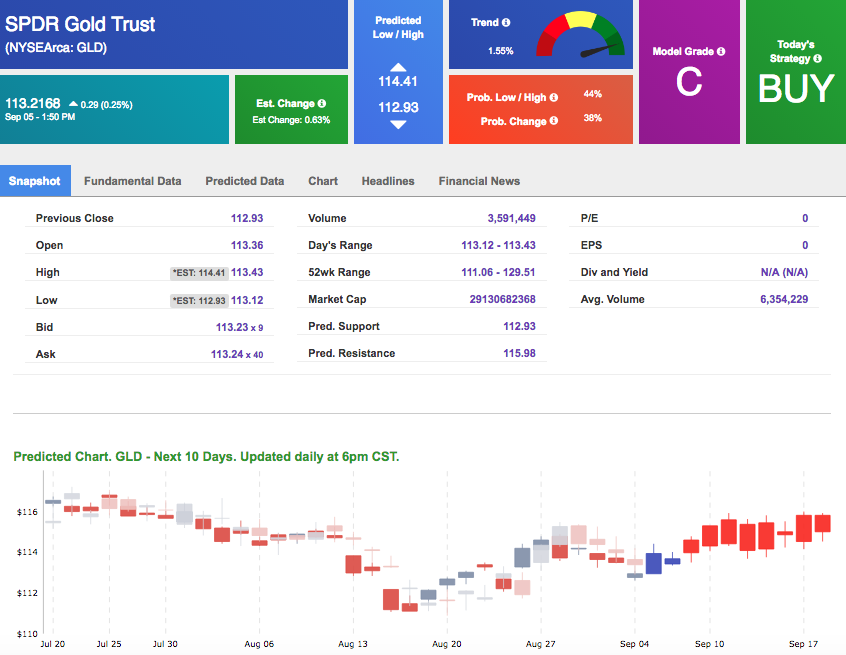

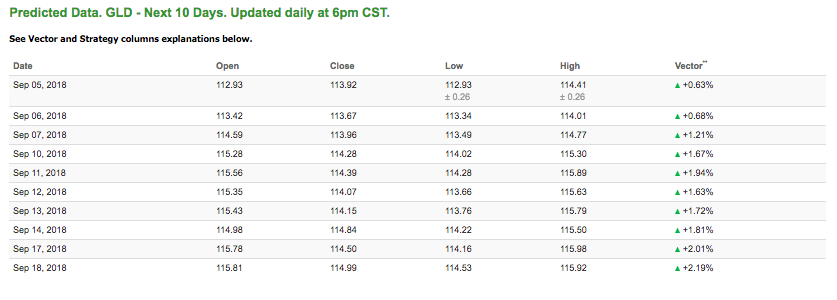

The price for December gold (GCZ8) is up 0.23% at $1,201.80 at the time of publication. Gold rose amid trade concerns to close above $1200 today. Concerns surrounding reworking a NAFTA deal with Canada and the tabled talks with China have the safe-haven shares rising while the dollar has struggled today.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $113.2168, up 0.25% at the time of publication. Vector signals show +0.63% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

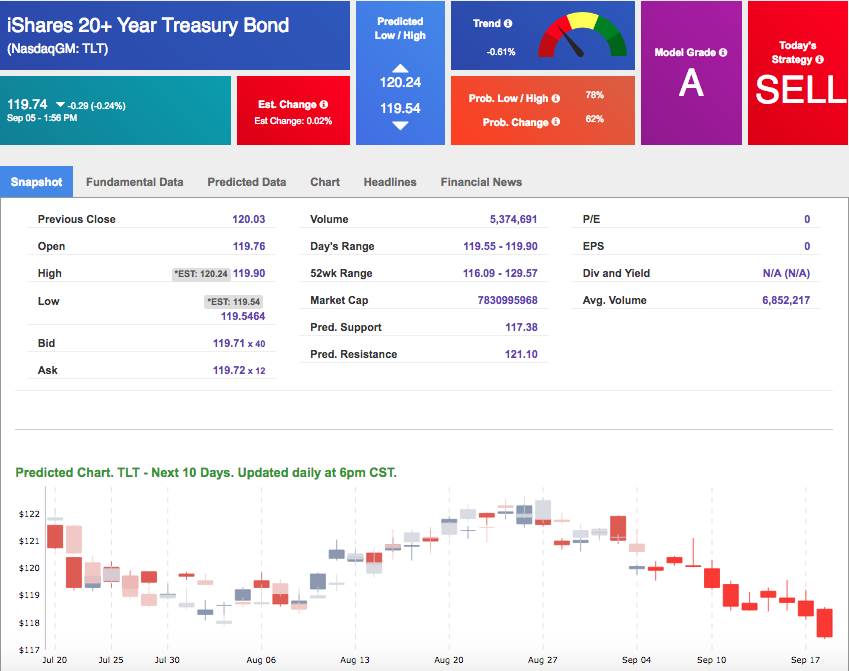

The yield on the 10-year Treasury is up 0.06% movement at 2.90% at the time of publication. Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mostly negative signals in our 10-day prediction window. Today’s vector of -0.02% moves to -0.23% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

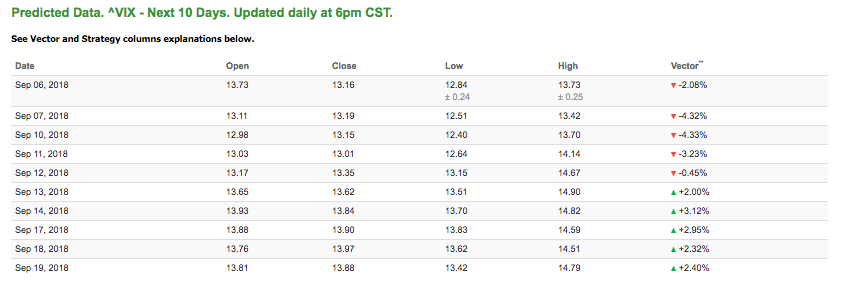

Volatility

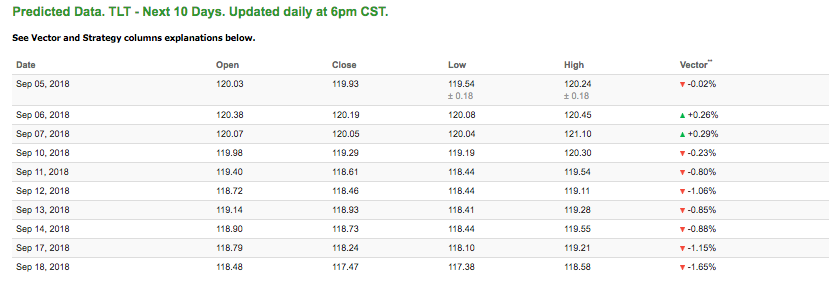

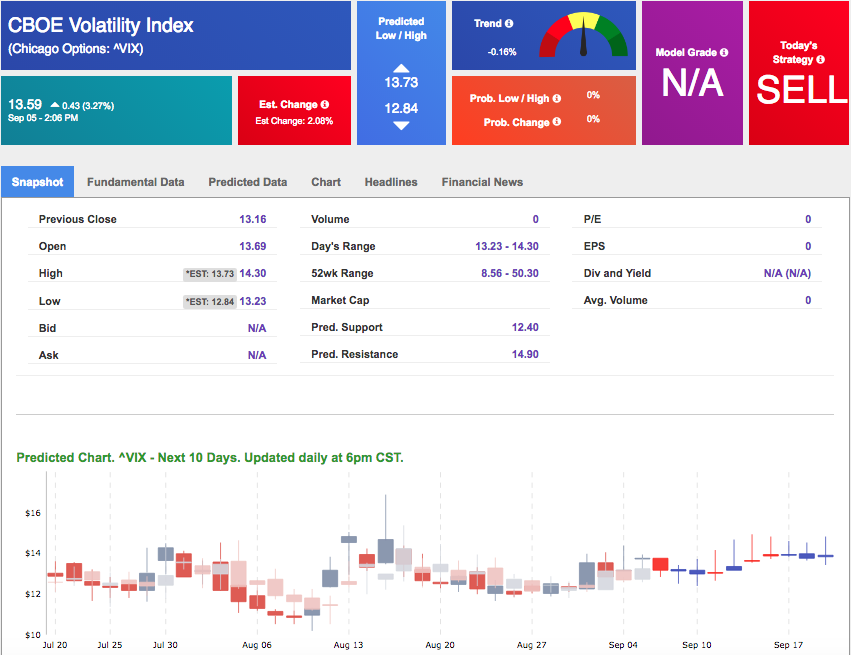

The CBOE Volatility Index (^VIX) is up 3.27% at $13.59 at the time of publication, and our 10-day prediction window shows mostly all negative signals. The predicted close for tomorrow is $13.19 with a vector of -4.32%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.