Spending Bill and COVID Relief Key in Busy Congressional Week, Fed Keeps Rates Unchanged

Focus remains on the latest version of the government spending bill

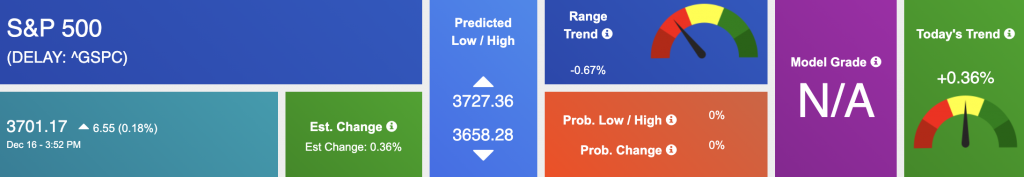

Markets traded to mixed results today, as the S&P and Nasdaq booked modest gains while the Dow closed 0.15% down. The latest decision from the Federal Open Market Committee was reported by Fed President Jerome Powell as once again the Feds decided to hold rates steady. Also worth noting is the Fed’s intent to continue purchasing bonds until certain levels of employment, inflation, and price stability are achieved. In D.C., the focus remains on the latest version of the government spending bill which could be worth north of $1 trillion and needs to arrive by week’s end to avoid a government shutdown.

Bill gains momentum via bipartisan effort

It appears the bill is gaining momentum via bipartisan effort, with many reporting the bill will likely be accomplished before Friday. Also receiving a bipartisan effort is the latest COVID stimulus package with congressional leaders meeting for an extended period on Tuesday, hashing out the major details involved in what would be the second stimulus in the last twelve months.

Optimism in agreement on a post-Brexit trade deal

Overseas, the U.K. and E.U. look to have made some progress as both sides displayed optimism in agreement on a post-Brexit trade deal. As a result, European markets traded higher throughout the day. Lookout for Lennar earnings after market close today while General Mills, Rite Aid, and FedEx are due tomorrow.

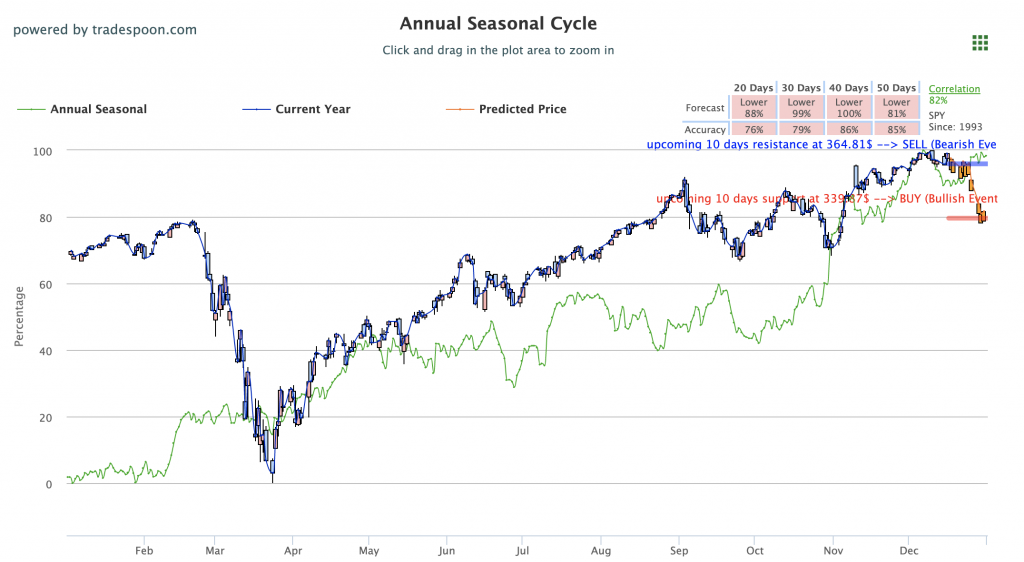

Although U.S. markets continue trading to mixed results this week, we are still seeing strong rotation from growth to value stocks and believe the SPY is on its way to retest its recent highs. Until an additional breakout is sustained, our models are projecting the SPY to trade between the $340-$375 levels. With the market prone to further corrections, the next level of support is set at $350. We encourage all market commentary readers to maintain clearly defined stop-levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Key U.S. Economic Reports/Events This Week

- Retail Sales (November) – Wednesday

- Business Inventories (October) – Wednesday

- FOMC Decision – Wednesday

- Weekly Jobless Claims (12/10) – Thursday

- Housing Starts (November) – Thursday

- Building Permits (November) – Thursday

- Current Account Deficit (Q3) – Friday

- Leading Economic Indicators (November) – Friday

Upcoming Earnings

- LEN – Lennar – Wednesday

- FDX – FedEx – Thursday

- GIS – General Mills – Thursday

- RAD – Rite Aid – Thursday

- BB – BlackBerry Limited – Thursday

- NKE – Nike – Friday

- DRI – Darden Restaurants – Friday

(Want free training resources? Check our our training section for videos and tips!)

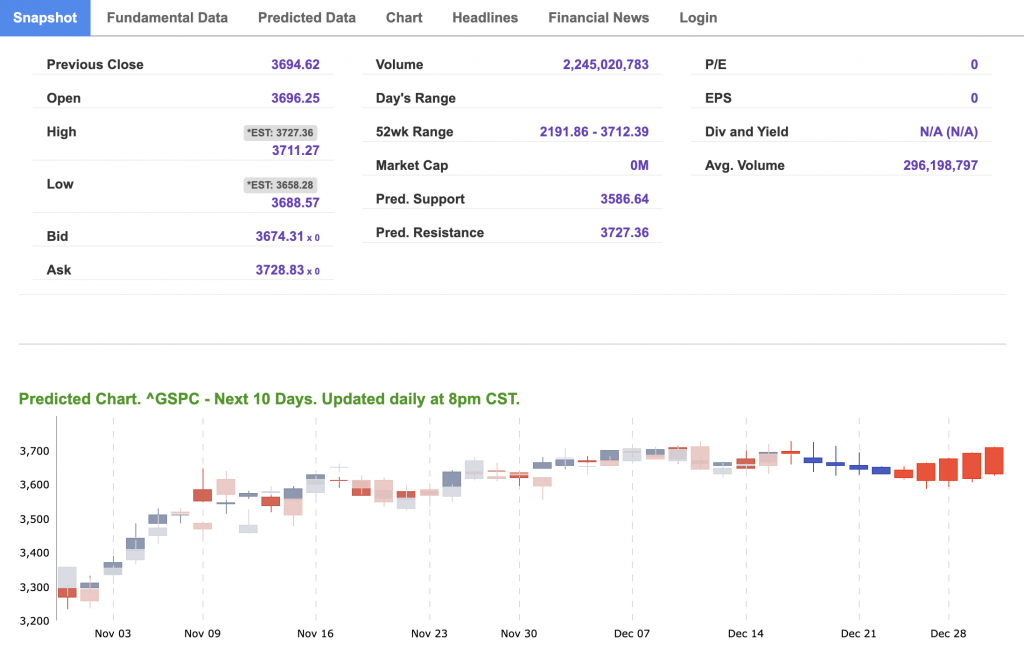

For reference, the S&P 10-Day Forecast is shown below:

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term mixed outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Vlad’s Portfolio Lifetime Membership!

DO AS I DO… AS I DO IT WATCH LIVE AS I WORK THE MARKETS! TRY IT NOW RISK-FREE!

Click Here to Sign Up

Thursday Morning Featured Symbol

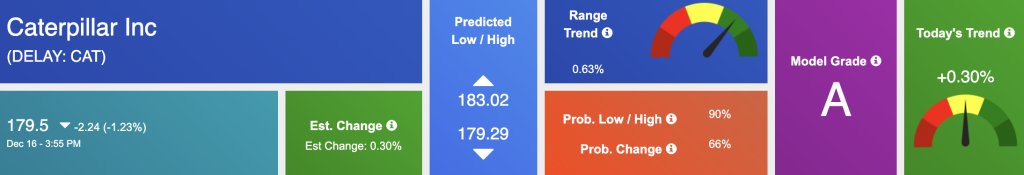

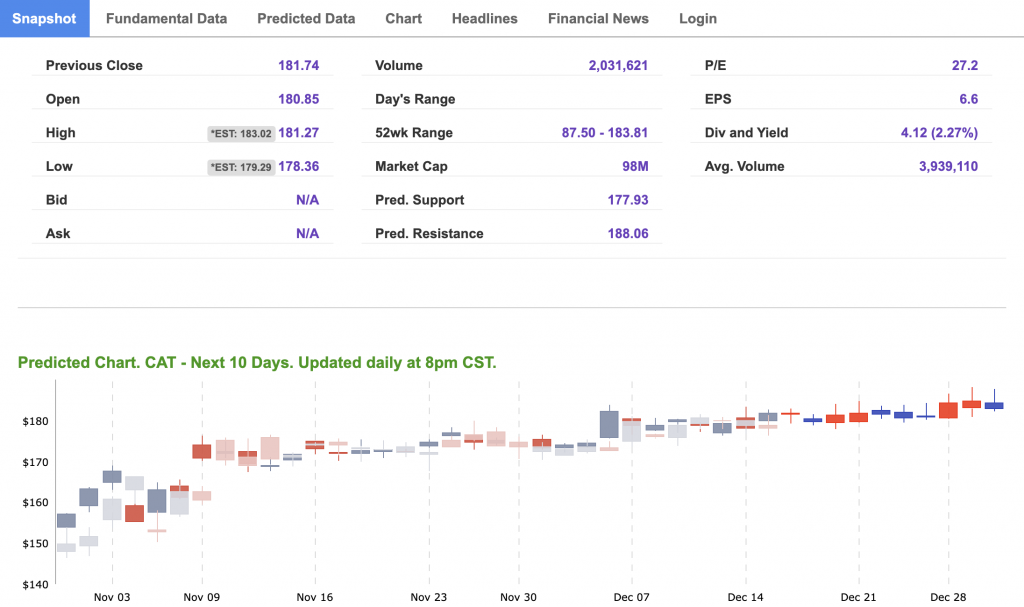

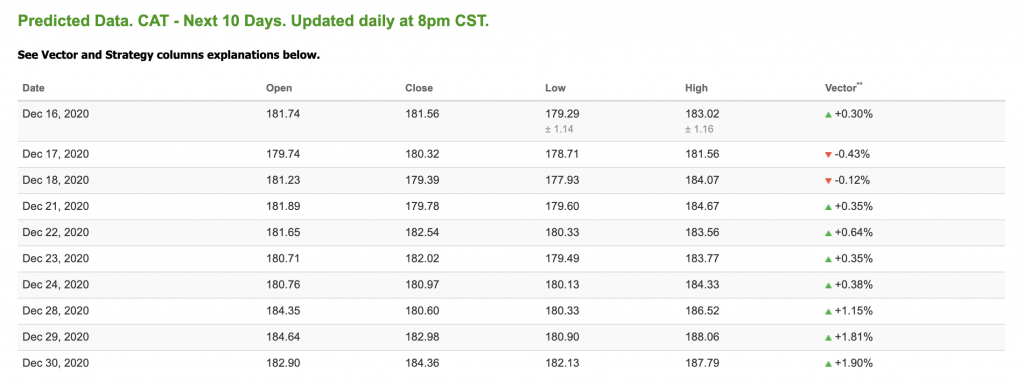

Our featured symbol for Thursday is Caterpillar Inc (CAT). CAT is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The stock is trading at $179.5 with a vector of +0.30% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, CAT. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

Oil

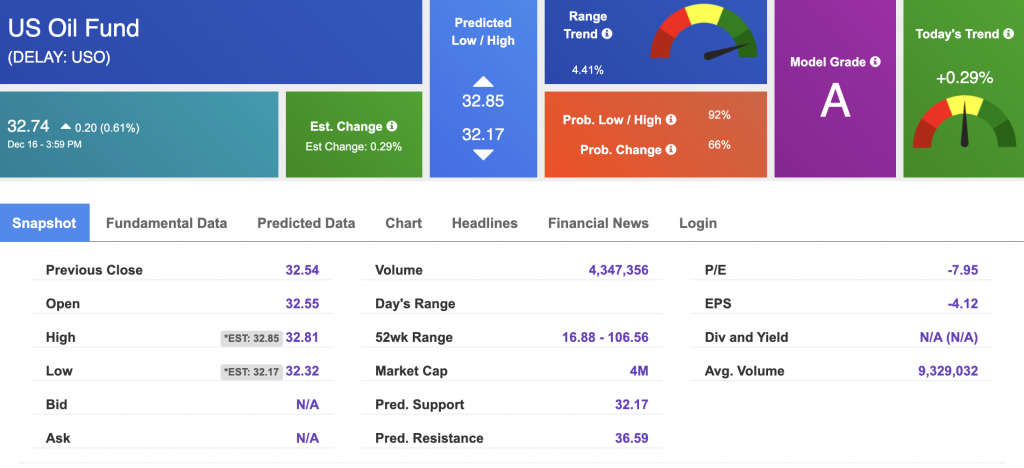

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $47.89 per barrel, up 051% at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $32.74 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

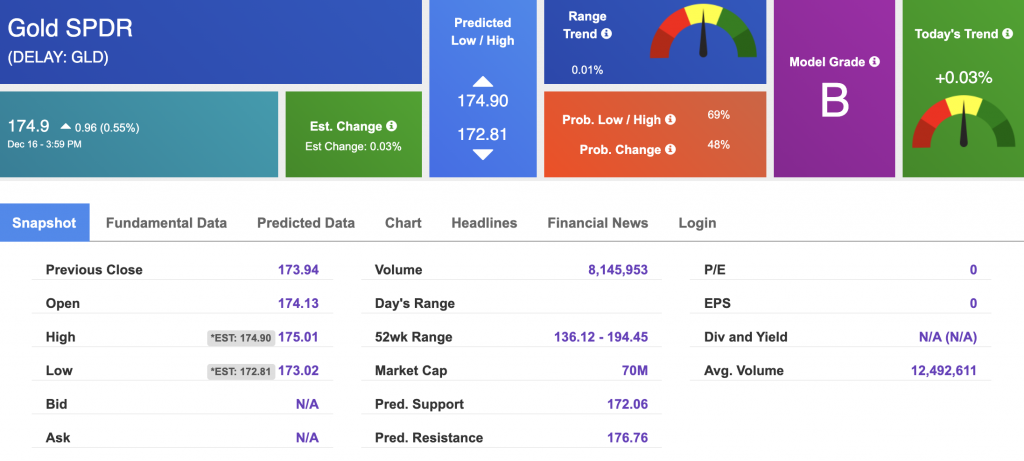

Gold

The price for the Gold Continuous Contract (GC00) is up 0.73% at $1868.80 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $174.9, at the time of publication. Vector signals show +0.03% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

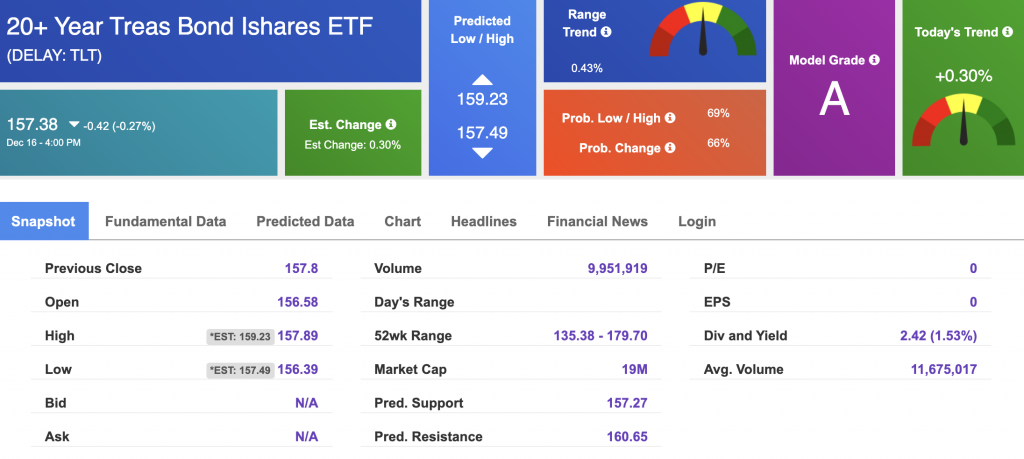

Treasuries

The yield on the 10-year Treasury note is up, at 0.916% at the time of publication.

The yield on the 30-year Treasury note is down, at 1.654% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

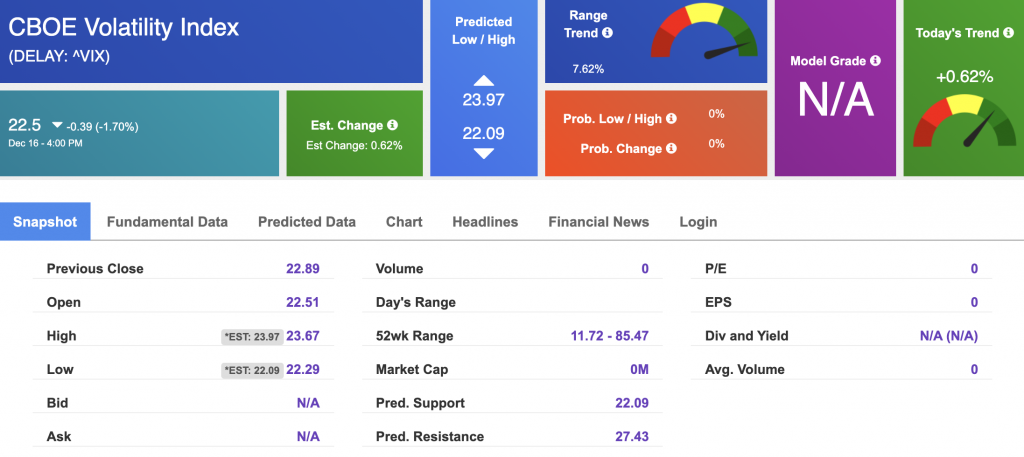

Volatility

The CBOE Volatility Index (^VIX) is $22.5 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.