SPY Trades at All-Time High, Oil and Gold Surge

Fourth straight day major U.S. indices in the green

Markets are extending their gains following yesterday’s no rate-change decision, notching four straight days major U.S. indices are in the green.

Gold and oil remain on the rise

Gold and oil remain on the rise while treasury notes are in the red today.

Rates cut if China-U.S. uncertainty continues to affect markets

Other than keeping rates unchanged, the biggest news from yesterday’s FOMC came in the form of Powell’s post-meeting presser where it was implied rates would be cut if China-U.S. uncertainty continues to affect markets as well as the removal of the term “patient” from the policy.

Notable earnings reports

Canopy Growth and Red Hat will report earnings after market close today, next week look for FedEx, Micron, and Nike earnings.

(Want free training resources? Check our our training section for videos and tips!)

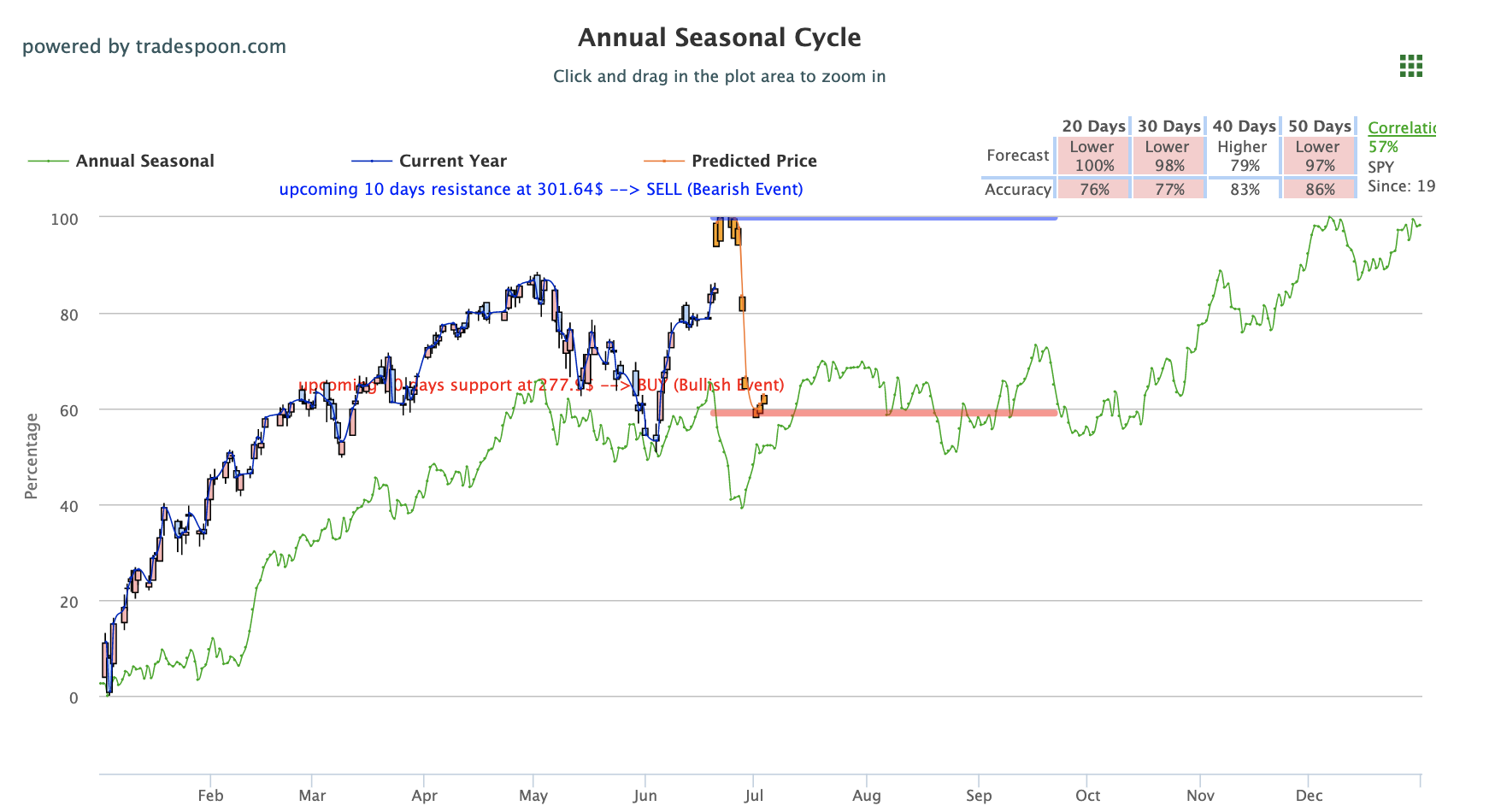

SPY buying opportunity near $286

Currently, the SPY is trading at an all-time high and we expect the market to remain between $286-$296. However, we do not see market momentum carrying SPY above $300 level. We encourage our readers to avoid chasing near $296 and look to buy near $286. For reference, the SPY Seasonal Chart is shown below:

Fed Chair Jerome Powell met with the press

After the conclusion of the two-day FOMC meeting yesterday, Fed Chair Jerome Powell met with the press to discuss the no rate change decision, citing low inflation and overall strong employment.

Trump-Xi meeting makes influence on Fed’s decision

Another factor likely influencing the decision is the upcoming G20 meeting in Japan at the end of the month where President Trump and President Xi are set to meet. England and Japan, also holding policy update meeting this week, similarly decided to keep rates unchanged and discussed the current global risk uncertainty.

(Want free training resources? Check our our training section for videos and tips!)

Oil prices moved up 5% following geopolitical tension in the Middle East where Iran has allegedly shot down U.S. drone flying in its airspace. President Trump has since then called the move “a very big mistake.” Gold futures also rose, up 3%, opposite of a lowering dollar and treasury yields currently in the red. Globally, markets closed in the green in both Asia and Europe. Next week, look for new home sales, GDP revision, core inflation, and personal income data.

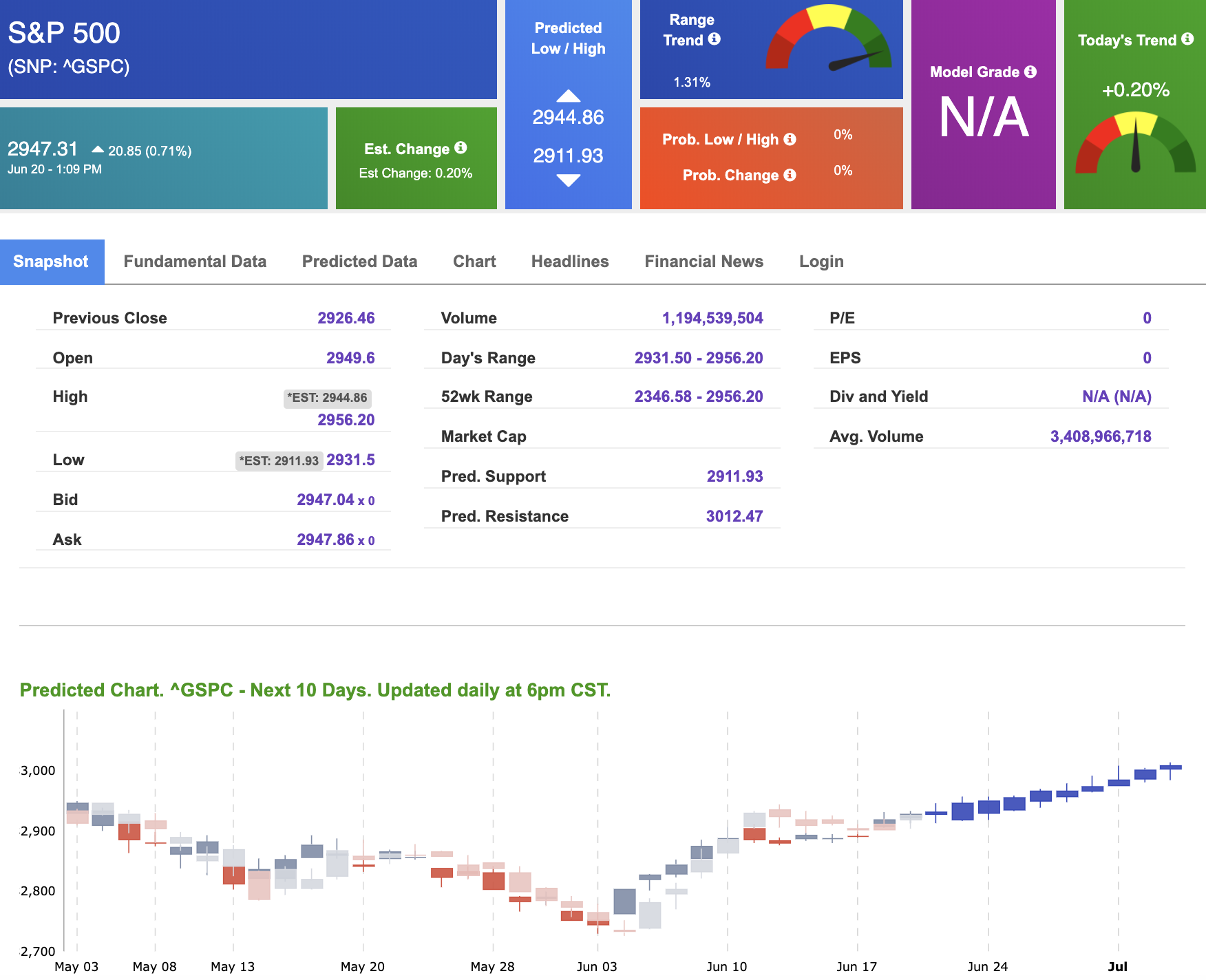

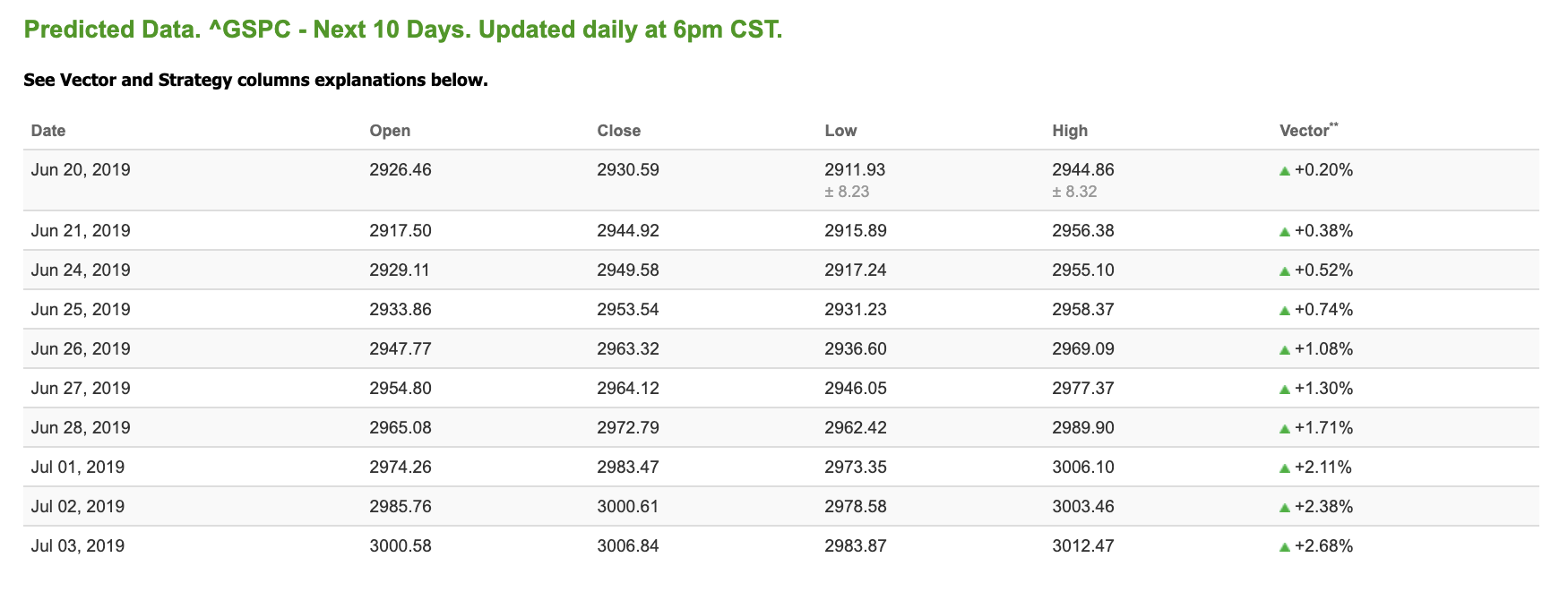

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows postive signals. Today’s vector figure of +0.20% moves to +1.30% in five trading sessions. Prediction data is uploaded after the market close at 6pm, CST. Today’s data is based on market signals from the previous trading session.

Last Chance: More than double the money in one day

Vlad Karpel took everything that he learned developing technologies for others, combined it with 18 years in groundbreaking fintech experience, and went to work building a brand new stock trading platform.

This time, however, he wasn’t interested in helping to build another platform for others… he wanted to see what he could do himself.

The result? An astonishing to-date returns of 1,275%. He even saw a 121.43% gain in a single day.

He was so impressed by the results that he wanted to make it available to other investors like him.

Click Here To Read More…

Highlight of a Recent Winning Trade

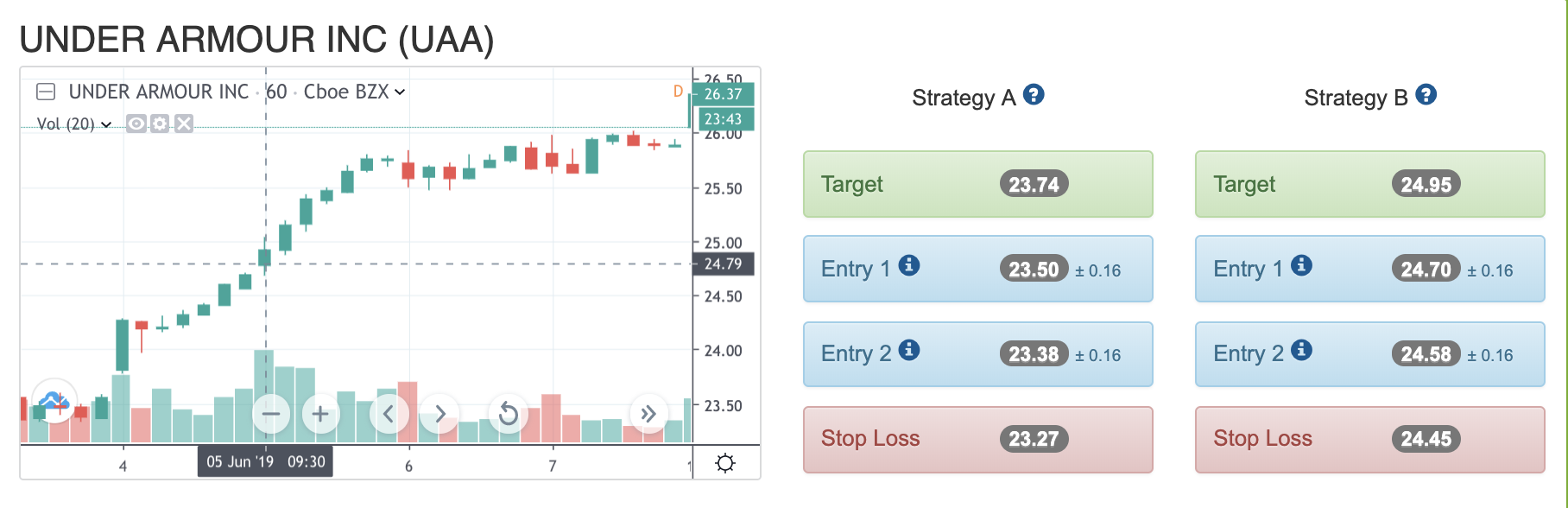

On June 5th, our ActiveTrader service produced a bullish recommendation for Under Armour Inc (UAA). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading.

Trade Breakdown

UAA entered its forecasted Strategy B Entry 1 price range $24.70 (± 0.16) in its first hour of trading and passed through its Target price $24.95 in the second hour of trading that day. The Stop Loss price was set at $24.45.

Friday Morning Featured Symbol

*Please note: At the time of publication we do not own the featured symbol, DHR. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Our featured symbol for Friday is Danaher Corp (DHR). DHR is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $143.94 at the time of publication, up 1.00% from the open with a +0.92% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

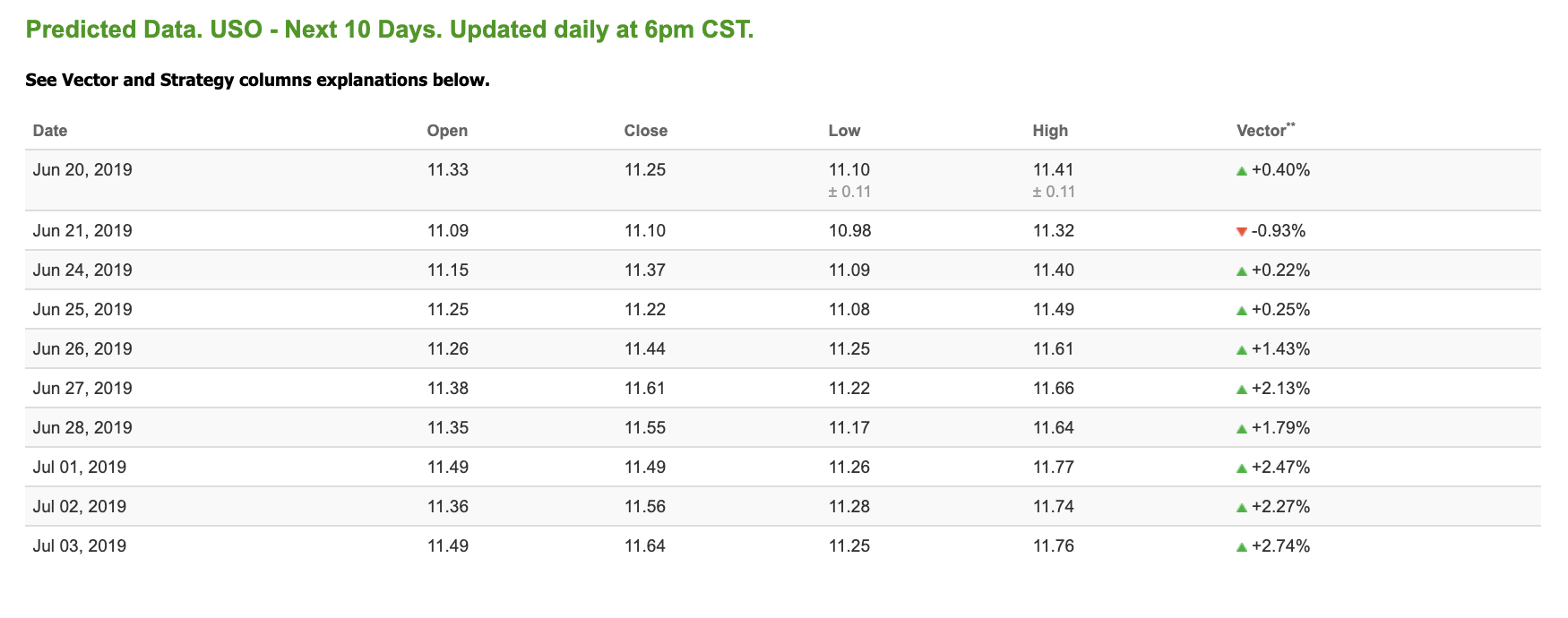

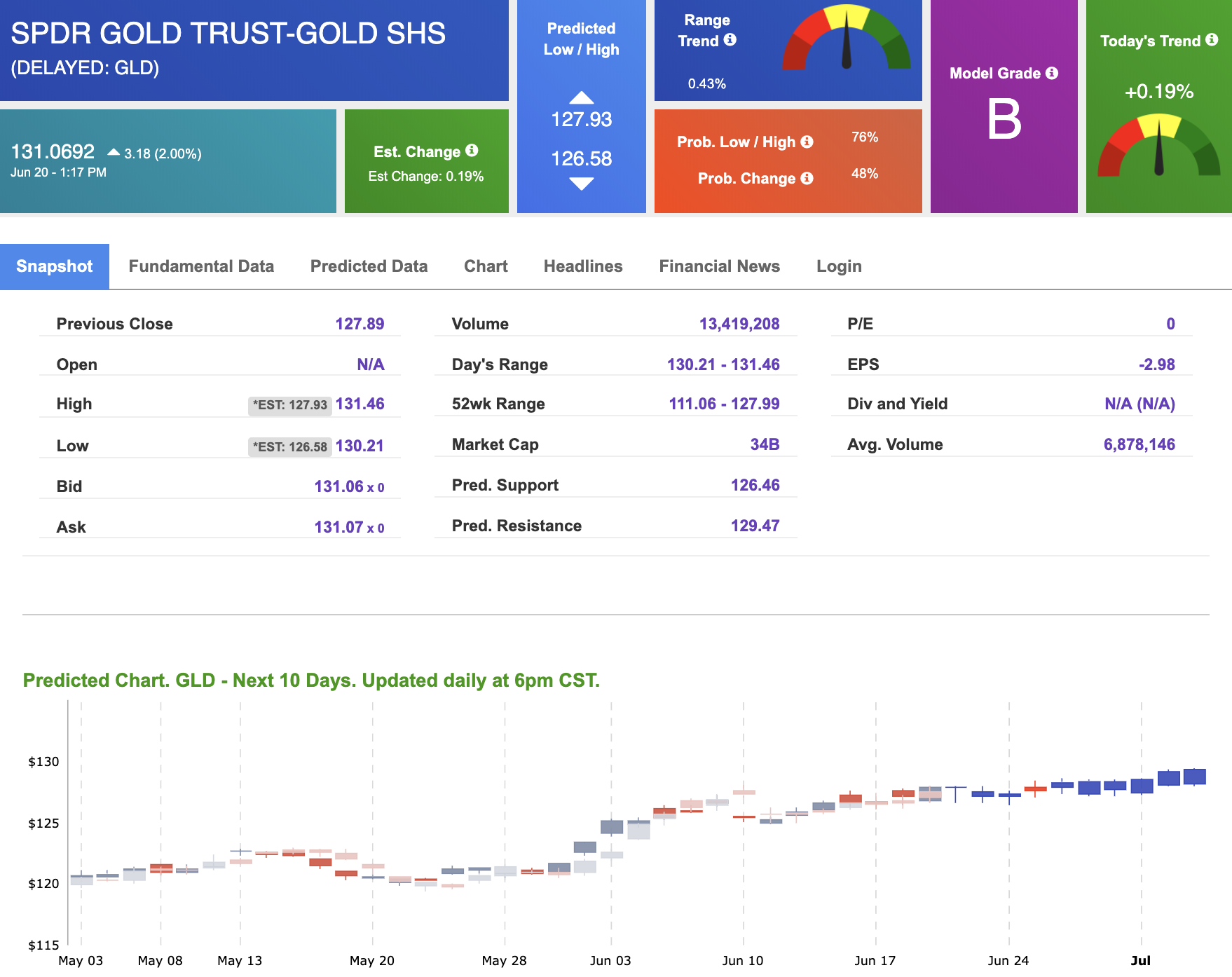

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $56.88 per barrel, up 5.80% from the open, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $11.82 at the time of publication, up 4.00% from the open. Vector figures show +0.40% today, which turns +2.13% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

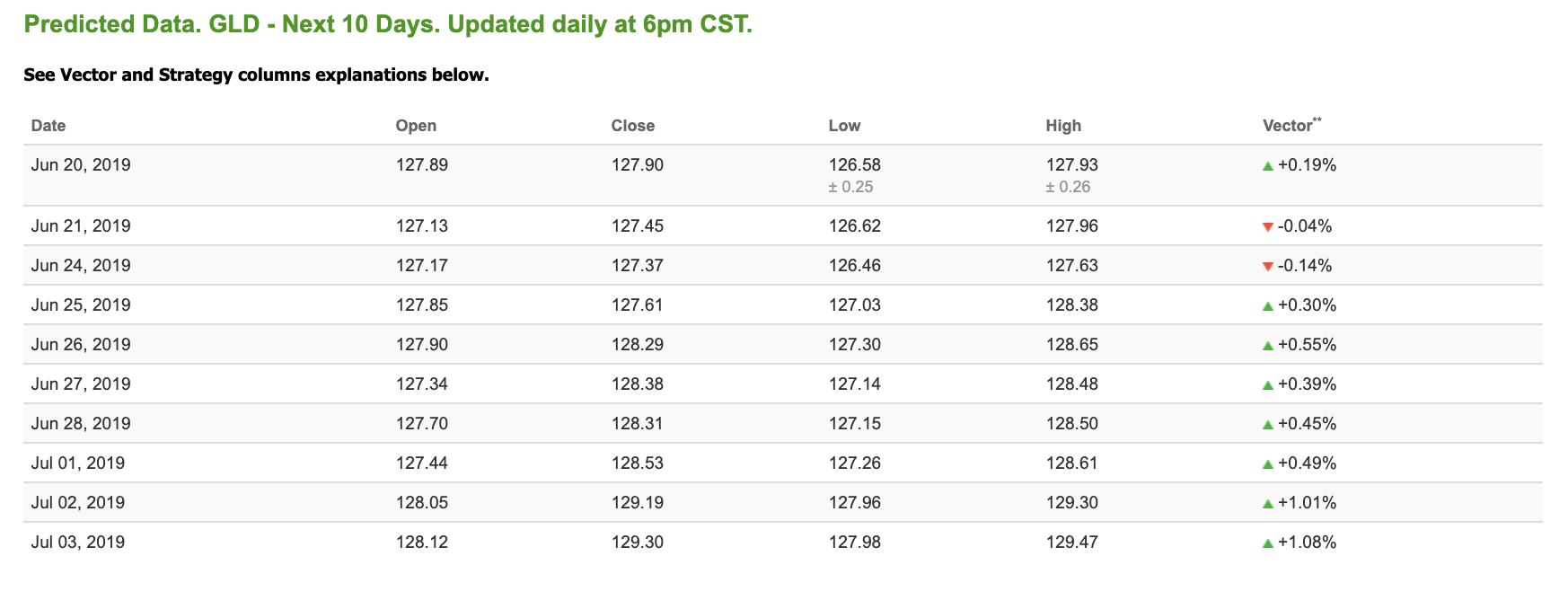

Gold

The price for the Gold Continuous Contract (GC00) is up 3.34% at $1,393.80 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly positive signals. The gold proxy is trading at $131.06, up 2.00% at the time of publication. Vector signals show +0.19% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

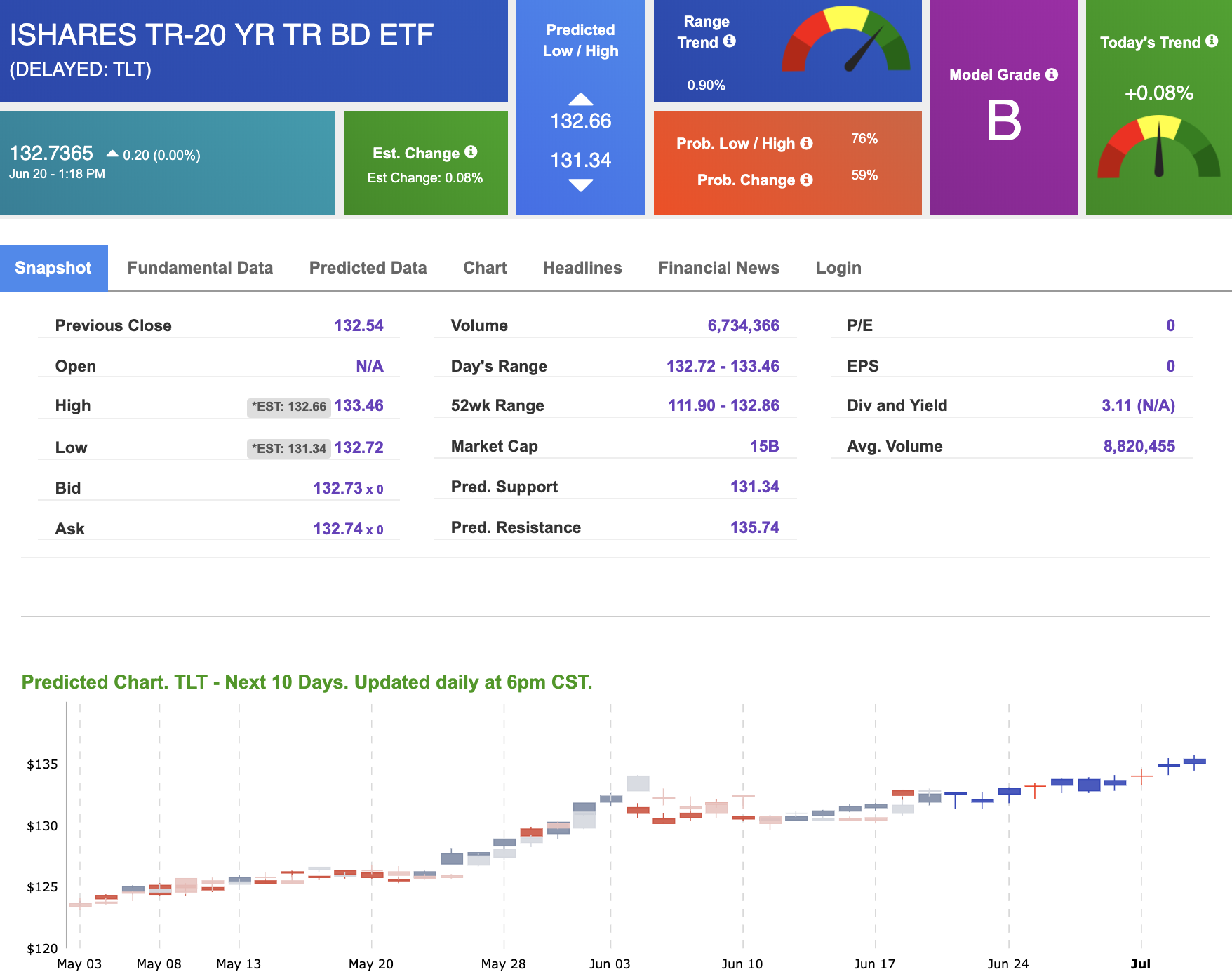

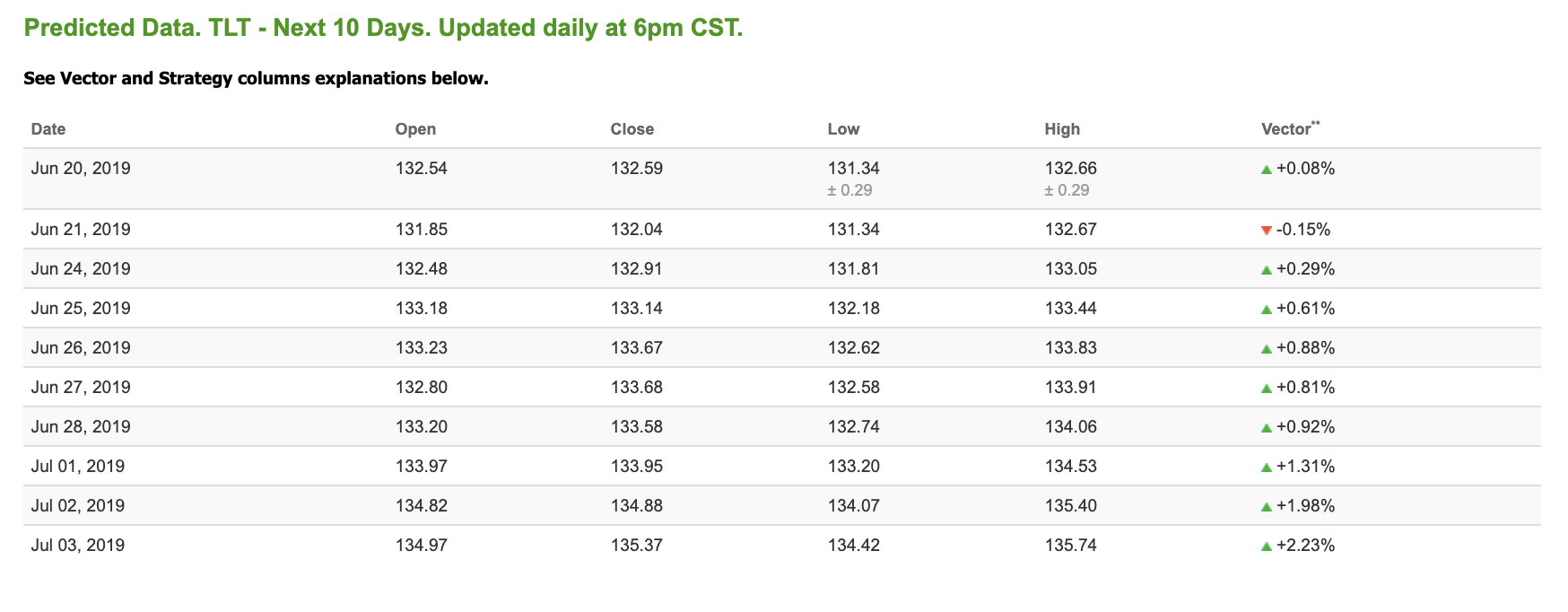

Treasuries

The yield on the 10-year Treasury note is down 1.15% at 2.00% at the time of publication. The yield on the 30-year Treasury note is down 0.31% at 2.53% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of +0.08% moves to +0.61% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

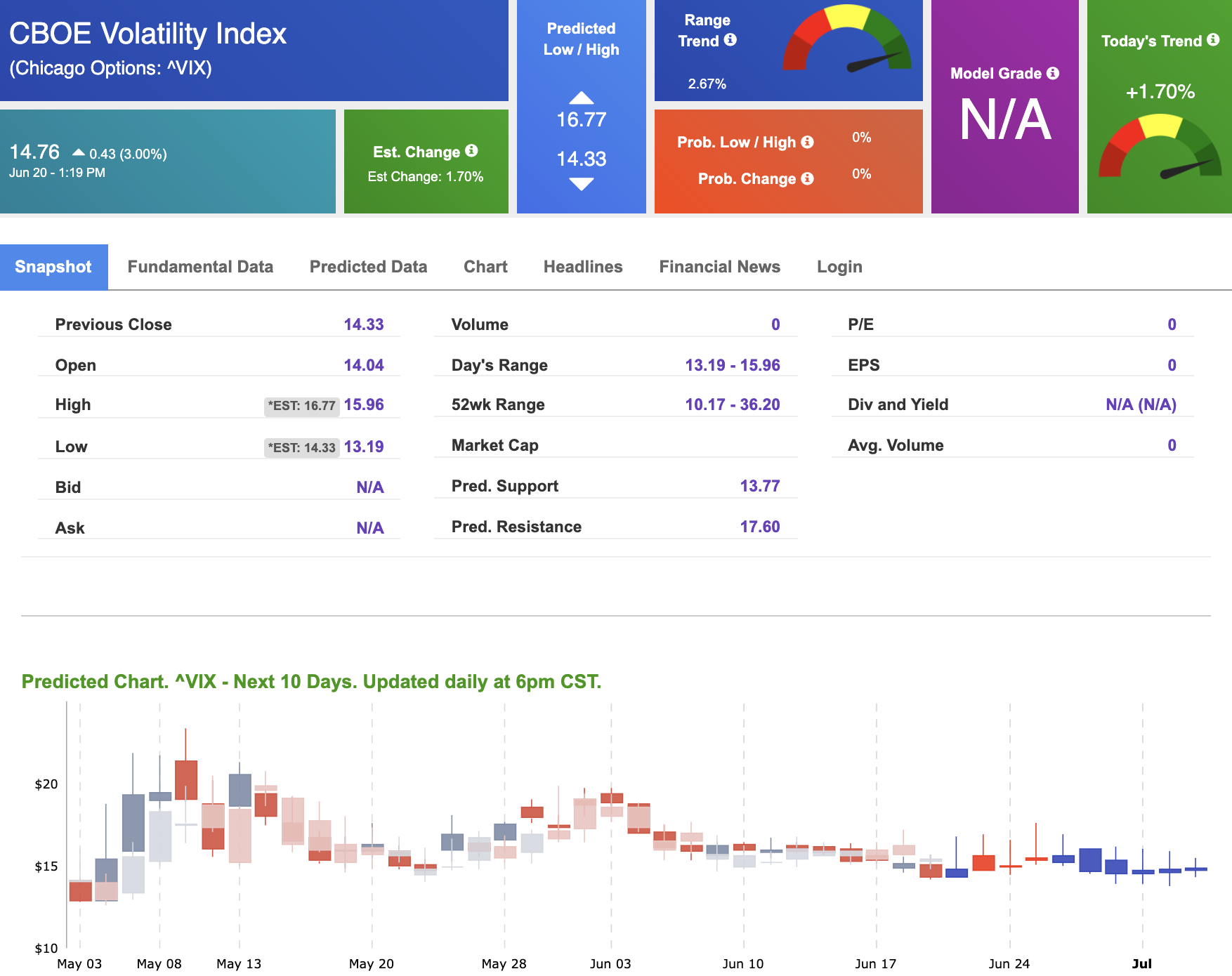

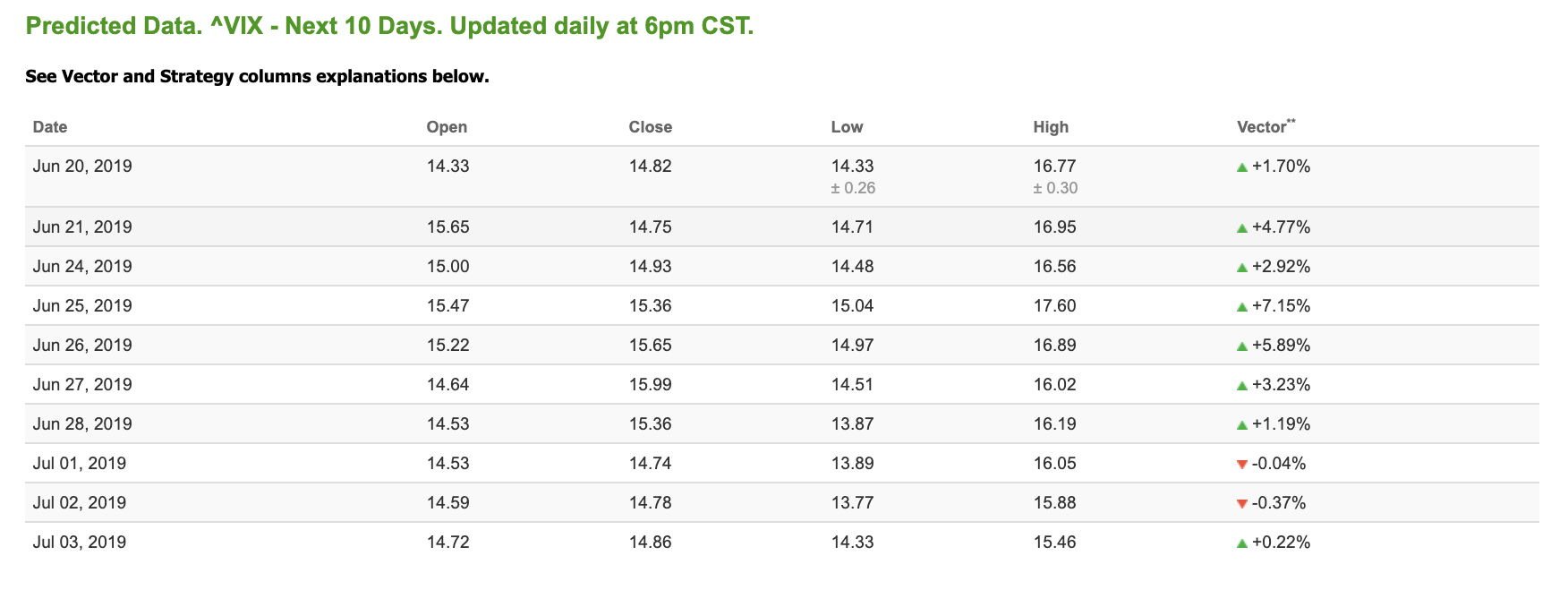

Volatility

The CBOE Volatility Index (^VIX) is up 3.00% at $14.76 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $14.75 with a vector of +4.77%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

(Want free training resources? Check our our training section for videos and tips!)