Stocks Rebound On Cyber Monday, Oil Also Up

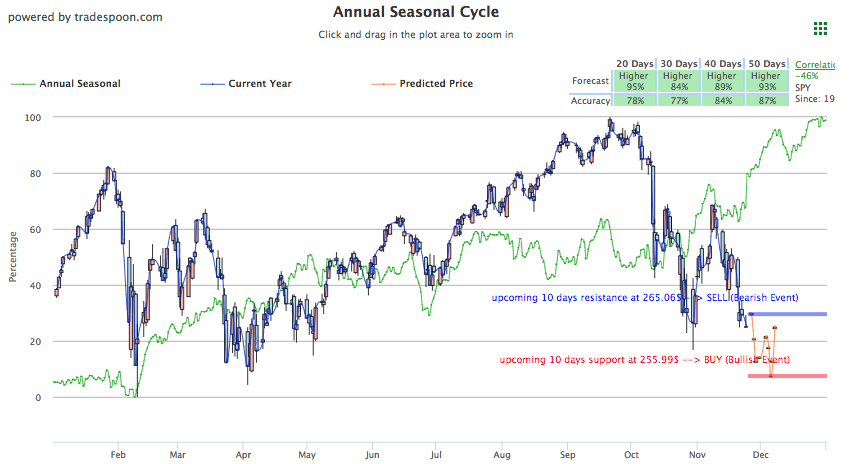

After the Thanksgiving holiday, markets have rebounded to start the week following one of the worst Thanksgiving weeks in recent history. The market looks to be oversold and several newsworthy events are planned for the week including speeches from both Fed Reserve Chairman and Vice Chairman as well as the G20 Summit in Argentina to end the week. Also worth noting, Saudi oil output continues to increase which brought oil to a year-low last week but is on the move up today while further turmoil continues to cloud the Brexit deal and the UK. With current market conditions, SPY support sits at $260 and overhead resistance is $270 in the short term. Investors should consider buying now. For reference, SPY Seasonal Chart is shown below:

All three major U.S. indices are up over 1% today which is serving as a nice rally following a trouble Thanksgiving week unlike in years past. Cyber Monday should continue to boost stocks that saw some gains to end the week after Black Friday began. In-store traffic was down but online shopping ticked up significantly at almost 30% up from last year. If this trend continues for the biggest day of online sales, the retail section will provide a nice boost to the market. Amazon, Best Buy, Target, and Walmart are all seeing nice gains today while Overstock.com is not finding the same luck, currently down 17%. Elsewhere, the financial sector is also providing support for the market with Goldman Sachs and JPMorgan up nearly 3% today.

Later this week, speeches from both Fed Reserve Chairman Powell and Fed Reserve Vice Chairman Clarida will provide investors with a good indication of market conditions and fourth quarter outlook as we head into the new year. The week will be capped with the start of the G20 summit in Buenos Aires which will host several world leaders and offer a good platform for several global and geopolitical issues to be discussed. China and U.S. relation will be at the forefront, with recent trade rhetoric wavering between optimistic to combative, and hopefully, news from the summit can produce some clarity. Climate change and trade are the topics scheduled to be featured and discussed during the 3-day summit.

One developing storyline to monitor is the escalating tension between Russia and Ukraine. Three Ukrainian boats were seized as they were trying to enter the Sea of Azov from the Black Sea. The boats were seized by Russian border guards who say the Ukrainian boats violated Russian territorial water after the area was temporarily closed to shipping. The seizure occurred near Crimea which is at the center of the two nations troubled relationship. This is the first major clash since Russia annexed the area in 2015. It was reported that the Russian guard opened fire on the boats before seizing them and Ukraine is considering imposing martial law. As the situation is still developing, look for the UN and G20 summit to offer further developments on the matter.

Other geopolitical news making waves today includes the recent report Brexit’s latest agreed-on plan will leave the UK significantly worse off and in debt an additional £100 billion pounds or about $128 billion dollars. The recently drafted deal was approved on Sunday and investors could see more developments for the UK in the days to come. Oil, which has been on the decline and fell significantly on Friday, is up today; there is optimism that the G20 summit will bring, as it often has, some sort of further negotiations regarding the commodity. Saudi output has continued to increase following slumping Iranian exports which were slowed by the U.S.-enforced sanctions that started earlier this month. Look for more developments and news on the commodity to come from the OPEC group meeting in Vienna, scheduled for December, which will cover its 2019 policy. Globally, both Asian and European markets are up today.

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mostly positive signals. Today’s vector figure of -0.14% moves to +3.24% in five trading sessions. The predicted close for tomorrow is 2,656.76. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

On November 23rd, our ActiveTrader service produced a bullish recommendation for Genworth Financial Inc. (GNW). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

GNW entered the forecasted Entry 1 price range of $4.47 (± 0.04) in its first hour of trading and hit its Target price of $4.54 in the second hour of trading, reaching a high of $4.54 for the trading day. The Stop Loss was set at $4.43.

$uper Cyber Monday $pecial!!!

What better way to celebrate Cyber Monday, than by offering Market Commentary subscribers a Ridiculously Awesome Deal!

We are offering LIFETIME ACCESS to our Premium Membership for less than the regular price we normally charge for only 1 year of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

This offer is only available until Midnight, so please act Fast before you miss out!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!

Click Here to Sign Up

Tuesday Morning Featured Stock

Our featured stock for Tuesday is Pulte Group Inc. (PHM). PHM is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $26.2 at the time of publication, up 1.08% from the open with a +0.23% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $51.64 per barrel, up 2.42% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $10.96 at the time of publication, up 1.21% from the open. Vector figures show +0.07% today, which turns -2.69% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for December gold (GCZ8) is down 0.07% at $1,222.60 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $115.57, down 0.17% at the time of publication. Vector signals show +0.28% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is up 0.87% at 3.07% at the time of publication. The yield on the 30-year Treasury note is up 0.28% at 3.32% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.05% moves to +0.58% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is down 10.18% at $19.33 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $20.49 with a vector of -2.07%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

$uper Cyber Monday $pecial!!!

What better way to celebrate Cyber Monday, than by offering Market Commentary subscribers a Ridiculously Awesome Deal!

We are offering LIFETIME ACCESS to our Premium Membership for less than the regular price we normally charge for only 1 year of service!

I want to make this offer a complete no-brainer! Would you rather sign up for just one year of service or get Lifetime Access for an even lower price?

This offer is only available until Midnight, so please act Fast before you miss out!

Just click the link below and it will take you to an upgrade page where you can claim this special offer!