Strong Employment and Earnings Data Continue to Push Markets Higher

Markets rise impressively with the Dow and S&P up over 1% today

For the third straight trading session, markets rose impressively with the Dow and S&P up over 1% today while the Nasdaq is on track for a 0.40% gain. News of progress on a possible treatment to the Wuhan virus has helped global markets while impressive ADP employment data and corporate earnings are supporting U.S. stocks. The latest employment report topped expectations as 291,000 private-sector jobs were added in January, while a 0.1% growth rate has been reported on S&P companies that have already released earnings. Today, we will see earnings from Qualcomm, Twilio, Spirit Airlines, and Grubhub after market close, as well as the pre-market releases of General Motors and Spotify.

(Want free training resources? Check our our training section for videos and tips!)

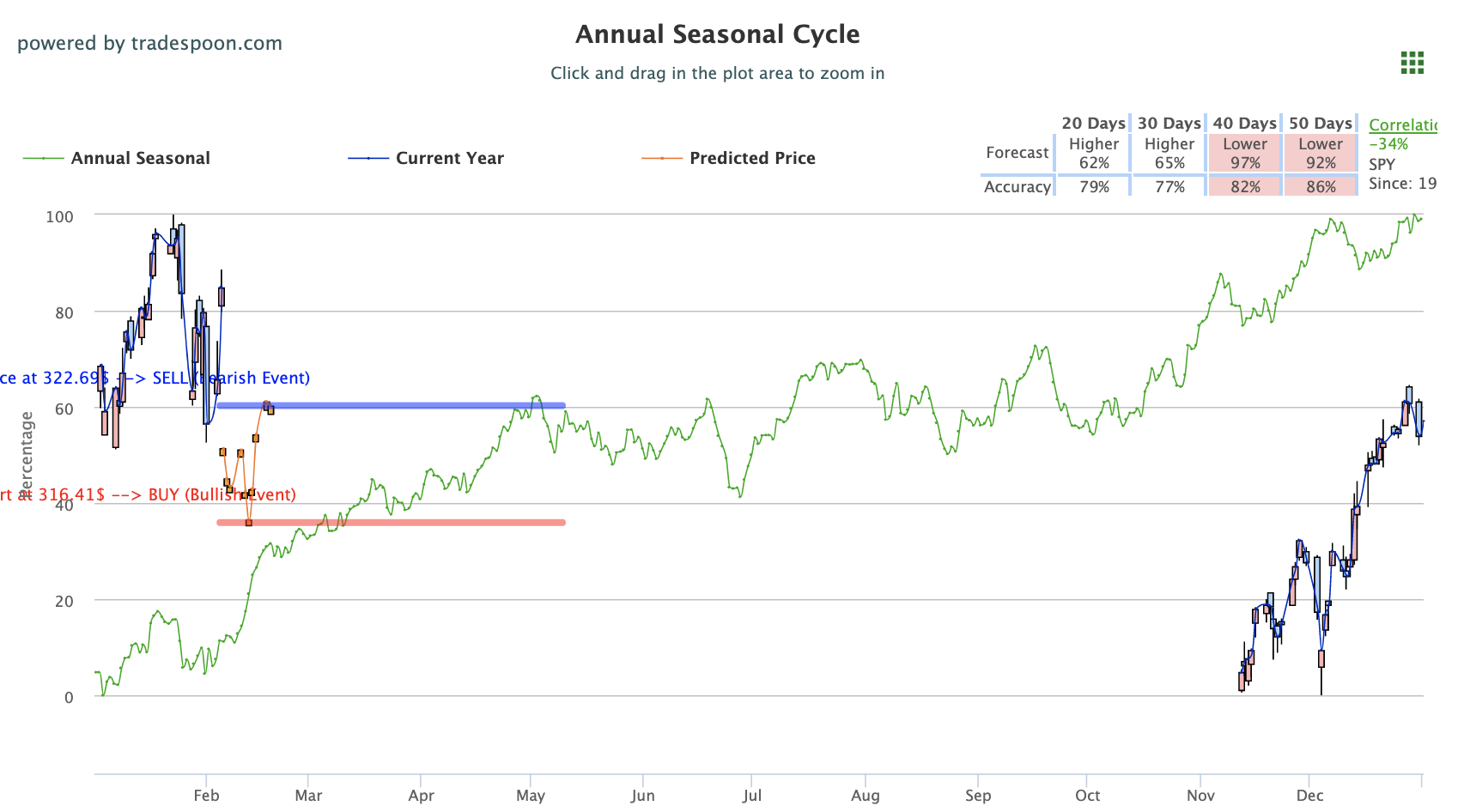

We will continue to look for buying opportunities near $320 as we believe the market will remain range-bound, between $320 and $333, for the next 2-4 weeks. With the current 50-days M.A. on the SPY at $320, the same as its support level, we remain bullish during this earnings seasons. Still, we expect a 2-5% correction in the next 4-6 weeks as the market loses momentum and we will look to short the market near $330-$333 level. Market Commentary readers are encouraged to maintain clearly defined stop-levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Progress on the Coronavirus treatment has been reported in the U.K.

Several factors are contributing to the market’s third straight day of trading higher as progress on the Coronavirus treatment has been reported in the U.K. while several key data reports are showing a strong and growing U.S. economy. Globally, both Asian and European markets traded significantly higher. Although the death toll continues to rise, the latest reports coming from China indicate a heightened containment effort as well as global research towards treatment. In the U.K., scientists have reported progress on a vaccine for the virus spreading in China which helped sparked some optimism. Still, U.S. researchers are predicting it will be difficult to contain the virus only to China and advise all nations to take heightened measures of precaution.

Today’s earning releases included Spotify and General Motors before the market open, as well as several key reports to be released after the closing bell. Yesterday’s key releases included Disney, Chipotle, Ford, and B.P. while tomorrow Twitter, Uber, T-Mobile, and Philip Morris are due to release corporate earnings. Thus far, nearly 50% of S&P companies have reported with a 0.1% growth rate on those companies, much higher than the nearly 2% decline that was expected. Plenty of key earnings are still due to release including Abbvie, HDFC Bank, Honda, Restaurant Brands, Loews, Lyft, Cisco, and Alibaba. Q4 Productivity and Unit Labor Cost data are due tomorrow.

(Want free training resources? Check our our training section for videos and tips!)

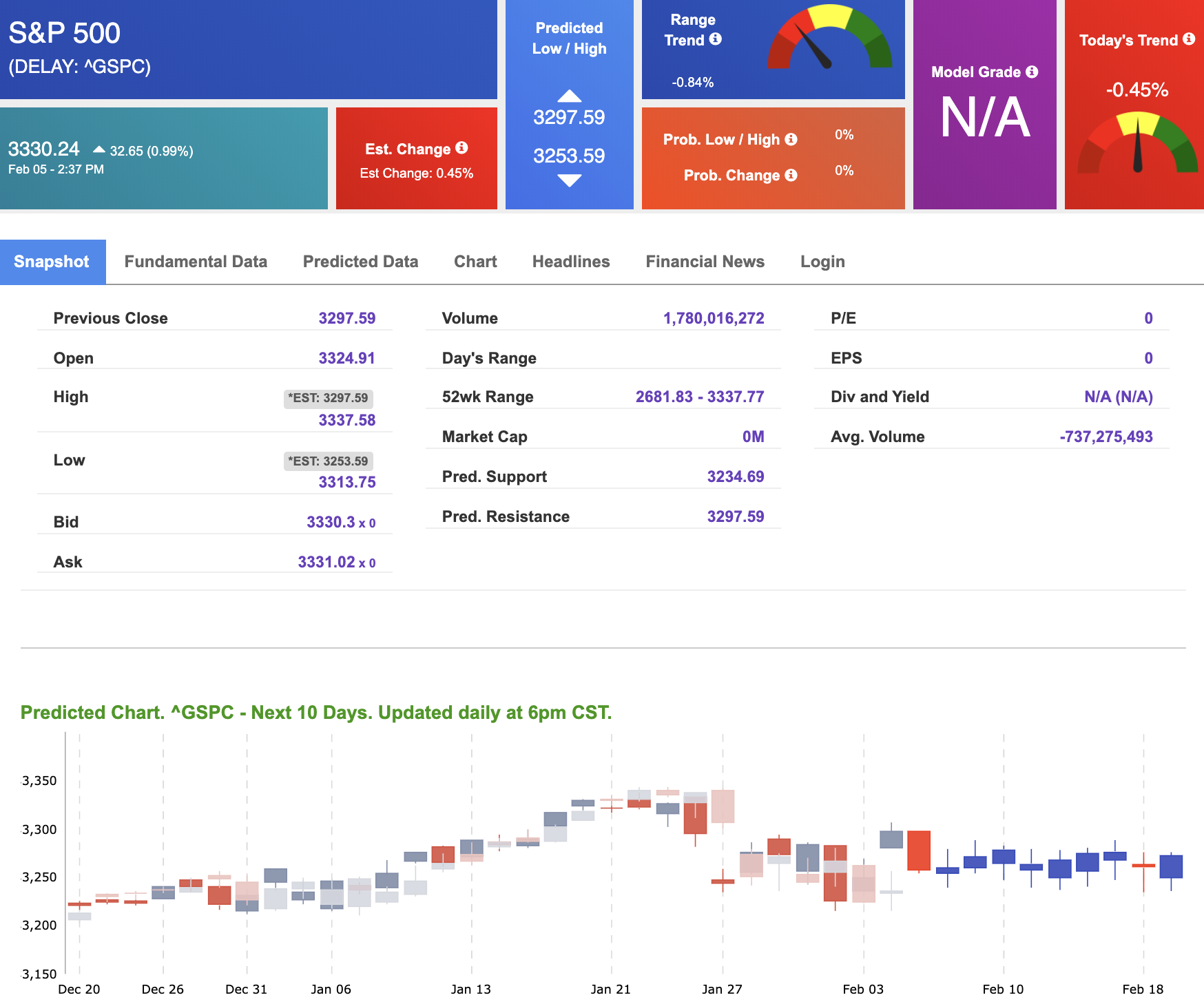

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term negative outlook. Today’s vector figure of -0.45% moves to -0.96% in four trading sessions. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Vlad’s Portfolio Lifetime Membership!

DO AS I DO… AS I DO IT WATCH LIVE AS I WORK THE MARKETS! TRY IT NOW RISK-FREE!

Click Here to Sign Up

Highlight of a Recent Winning Trade

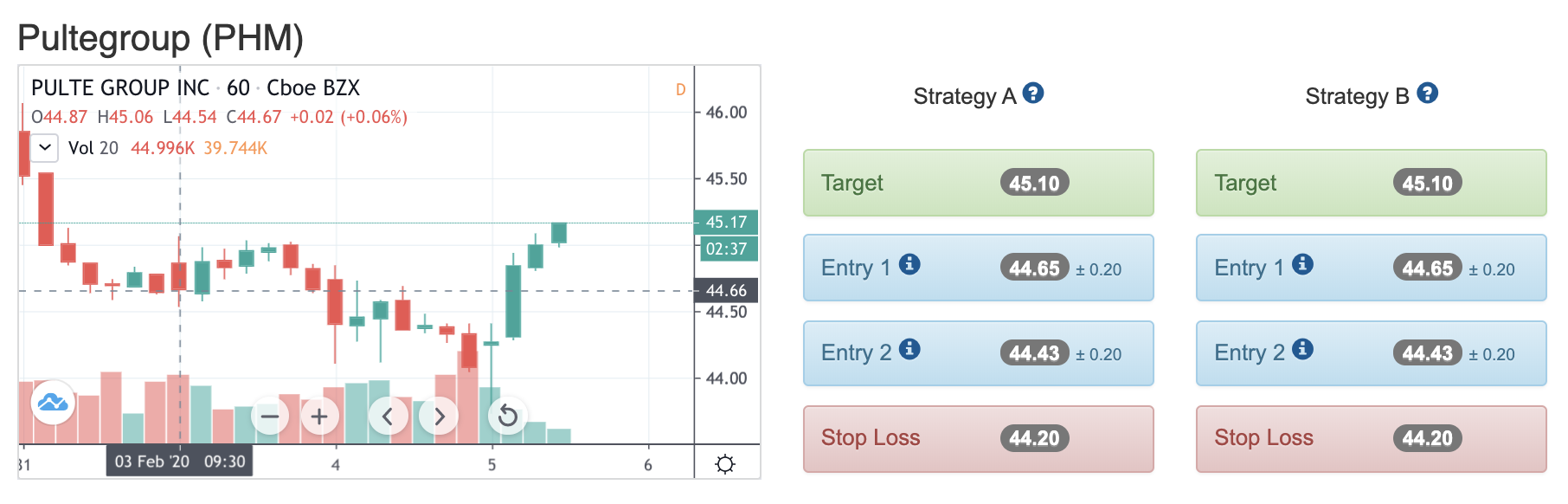

On February 3rd, our ActiveTrader service produced a bullish recommendation for Pultegroup (PHM). ActiveTrader is included in all paid Tradespoon membership plans and is designed for day trading, with signals meant to last for 1-2 days.

Trade Breakdown

PHM entered its forecasted Strategy A Entry 1 price range $44.65(± 0.20) in its first hour of trading that day and passed through its Target price of $45.10 in the fourth hour of trading on February 5th. The Stop Loss price was set at $44.20.

Thursday Morning Featured Symbol

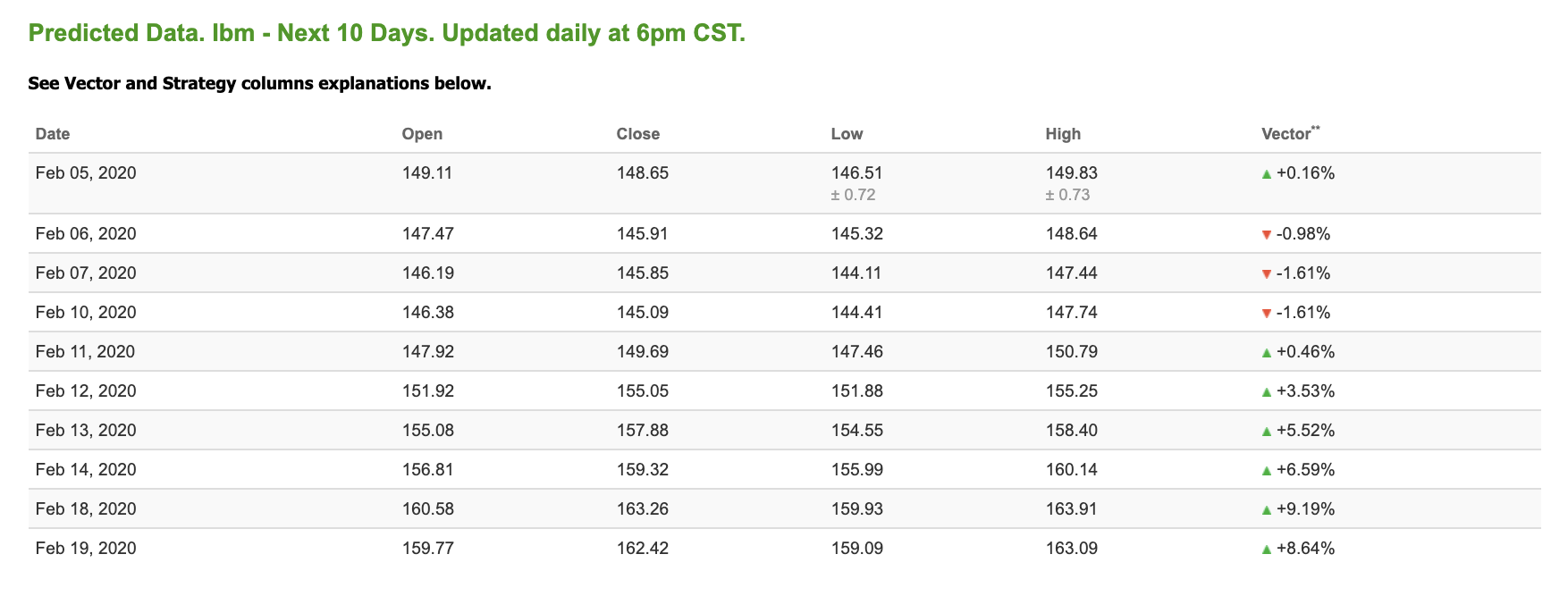

Our featured symbol for Thursday is International Business Machines (IBM). IBM is showing a positive vector in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for current-day predicted support and resistance, relative to our entire data universe.

The stock is trading at $157.3 at the time of publication, with a +0.16% vector figure.

Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does not have a position in the featured symbol, PHM. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $52.91 per barrel, down 0.81% from the open, at the time of publication.

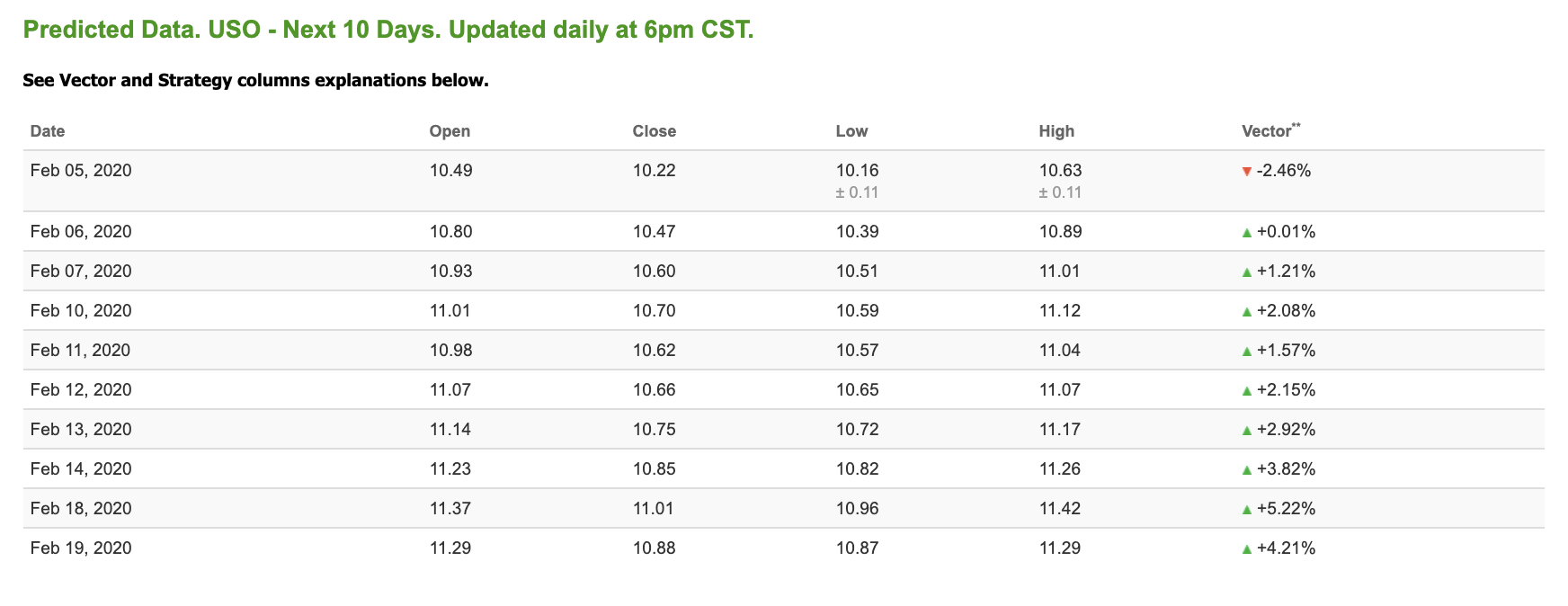

Looking at USO, a crude oil tracker, our 10-day prediction model shows mostly positive signals. The fund is trading at $10.44 at the time of publication. Vector figures show -2.46% today, which turns to +2.08% in three trading sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for the Gold Continuous Contract (GC00) is up 0.12% at $1,572.30 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows positive signals. The gold proxy is trading at $146.43, at the time of publication. Vector signals show +0.25% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is up 0.27% at 1.59% at the time of publication.

The yield on the 30-year Treasury note is up 0.87% at 2.05% at the time of publication.

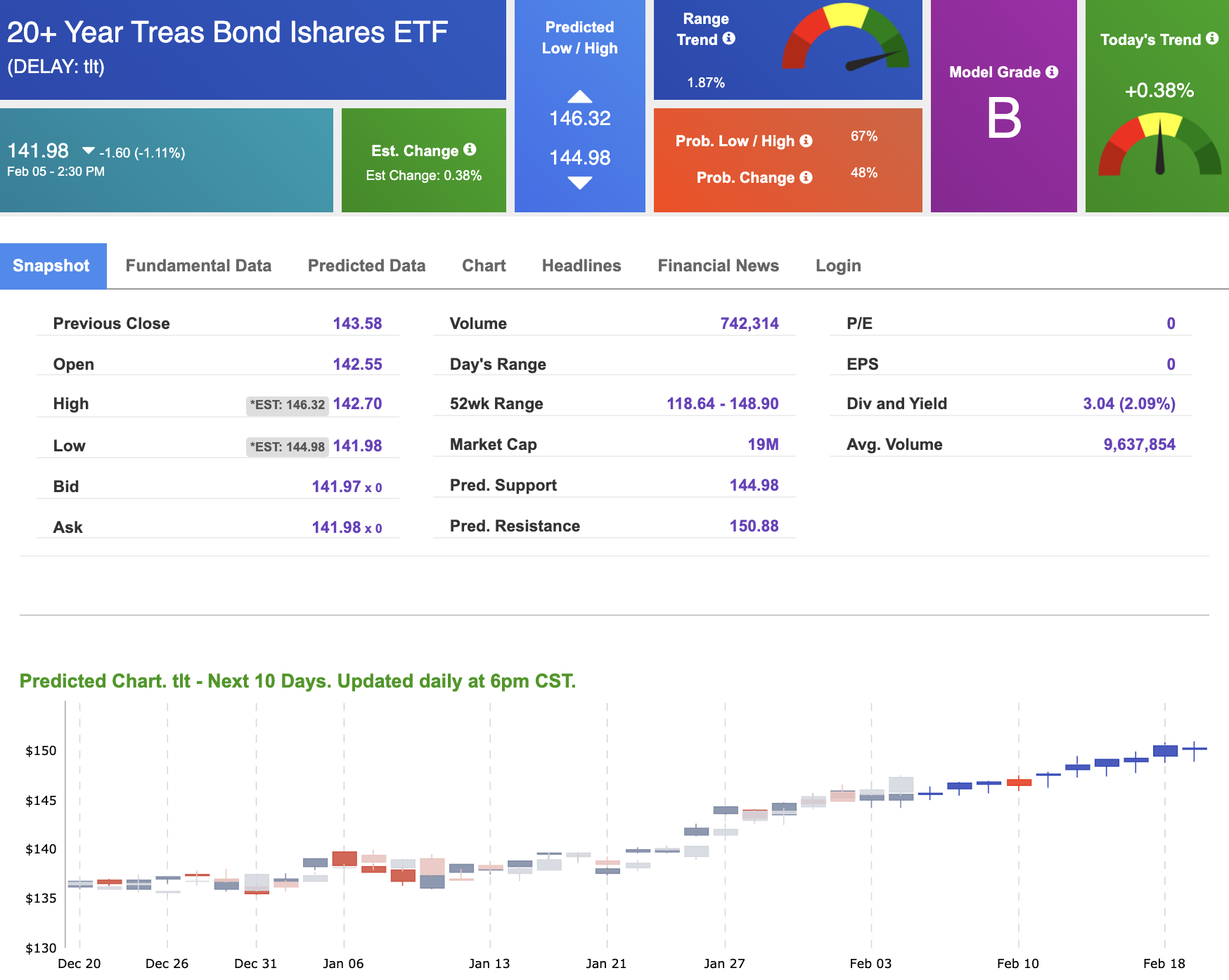

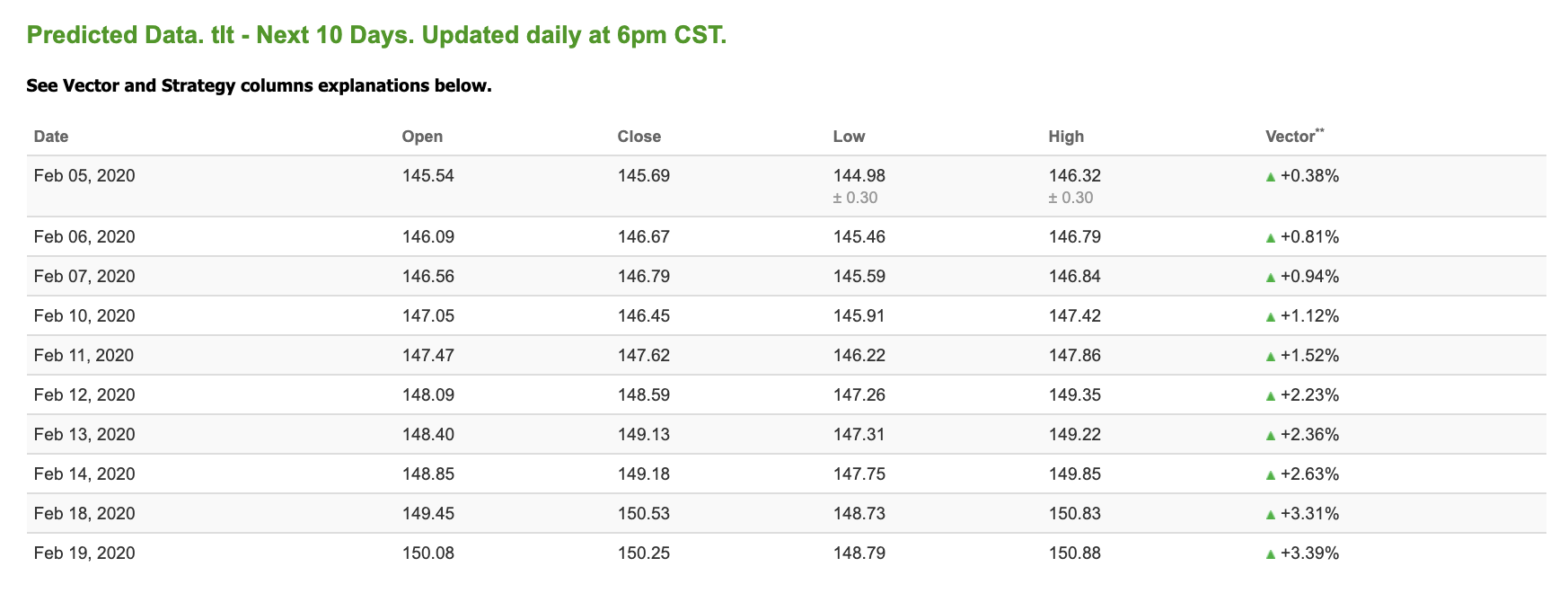

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.38% moves to +1.12% in three sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

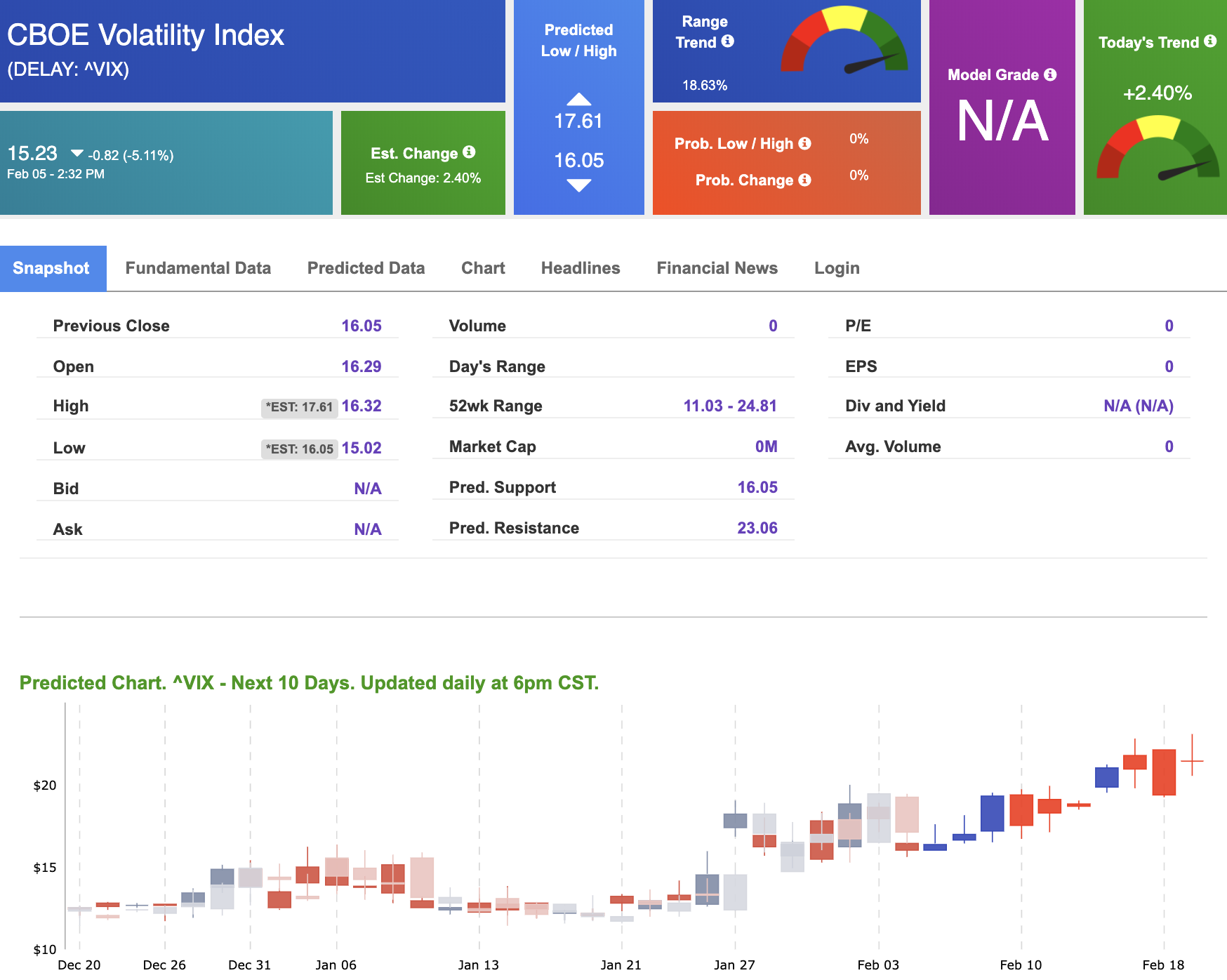

Volatility

The CBOE Volatility Index (^VIX) is $15.23 at the time of publication, and our 10-day prediction window shows positive signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.