Options: The Right Time for Buy-Write?

With the major indices pushing to all-time highs, and some of the many names sitting large double digit percentage, it can difficult not only holding on, but climbing aboard even the bluest chip names like Amazon (AMZN) and Microsoft (MSFT) at this stage. Fortunately, there’s an options trading strategy that can help you overcome this problem.

One way to overcome the psychological hurdle of buying new highs is called the Buy-Write. That is, buying shares and simultaneously selling call options against overwriting the stock.

The purpose of the buy-write is two fold; it immediately reduced you effected cost basis or purchase price, and it helps generate some incremental income through the decay of the call’s premium you’ve collected.

But be warned: while this is a relatively simple strategy, especially if applied to just and handful of issues, if one want to expand the application to 50 stocks or even the full index it can be labor-intensive. Buy-write requires not only a considerable amount of time in selecting covered-call candidates, but also requires maintaining and adjusting the positions. That, in turn, can lead to significant cost in the form of trading commissions and tax considerations.

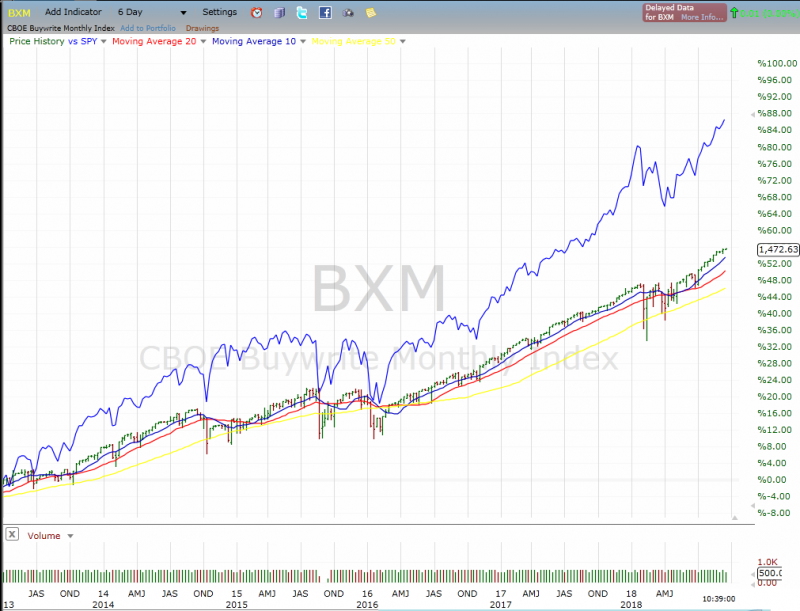

There is also the very real downside that a buy-write approach could vastly underperform during periods of strong bull market. Like we seen during the past few years. As you can see, despite the CBOE Buy-Write Index steady and impressive 55% gain since 2014, it lags the SPY by some 35 points during that time period.

Source:Freestockcharts.com

Related: 3 Approaches to a Double-Edged Sword

The post Options Trading: The Right Time for Buy-Write appeared first on Option Sensei.