Top Pot Stock!

RoboStreet – October 4, 2018

Top Pot Stock Is the Right Choice for U.S. Medical Market

The fanfare surrounding the cannabis industry is growing in popularity with investors seeking to cash in on what they hope will be the next sector of the market to enrich portfolios with exponential growth prospects. The legislation passed in Canada to legalize recreational use of marijuana takes effect on October 17 and there is widespread speculation that once legal use is established in Canada, several more states in the U.S. will move to pass similar legislation for both medical and recreational pot use.

Some economists say the industry won’t be able to meet demand during the first year, and that prices will rise or supply will run out. Dispensary owners in Colorado expressed similar anxieties in 2014 when recreational pot was legalized and for a short period pot prices rose sharply only to fall dramatically after copious supplies entered the marketplace.

“There is not currently enough legal supply of marijuana to actually supply all the recreational demand in Canada,” economist Rosalie Wyonch of the C.D. Howe Institute, a public policy think-tank. “We didn’t have enough producers far enough ahead from legalization that they’ll actually be able to deliver enough product to market by the time legalization happens.”

The governmental agency Health Canada estimates annual demand in the country to be 926,000 kilograms or about 2 million pounds. There’s no reliable data on the exact supply of licensed recreational vendors, however the most recent estimates put the nation’s supply of medical marijuana at 66,404 kilograms of dried cannabis. A survey from Statistics Canada showed that about 4.6 million Canadians, or 16% of the population, used cannabis in the second quarter of 2018.

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

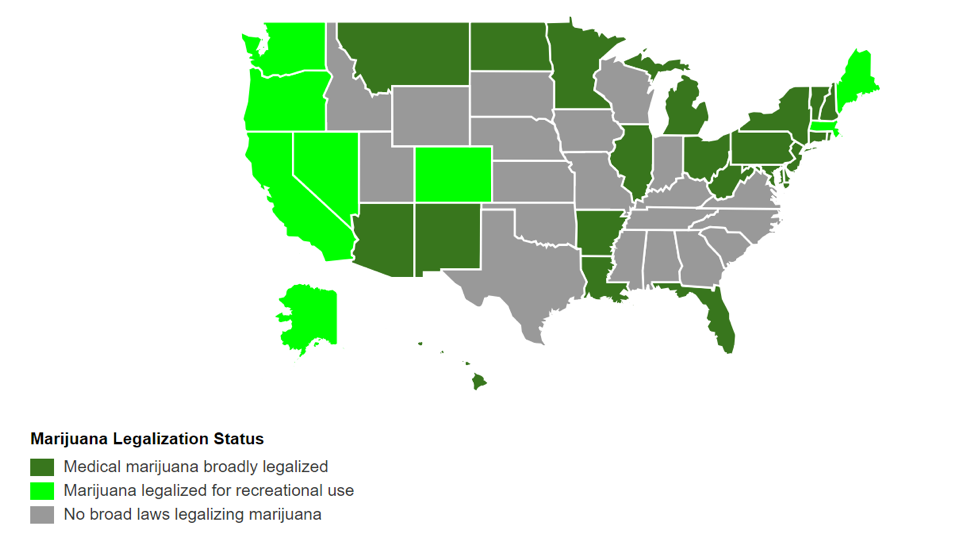

So, while the trend toward recreational marijuana use is very real, the avenue by which it will be rolled out in the U.S. will follow the likely approval of the legal purchase of weed for medicinal purposes first by states considering deregulation. The vast majority of states allow for a limited use of medical marijuana under certain circumstances. Some medical marijuana laws are broader than others, with types of medical conditions that allow for treatment varying from state to state. Louisiana, West Virginia and a few other states allow only for cannabis-infused products, such as oils or pills.

Other states have also passed narrow laws allowing residents to possess cannabis only if they suffer from select rare medical illnesses.

Currently, 19 states allow for the purchase of pot for medicinal purposes while 7 states have extended use to recreational purposes. The road to legalization of weed is clearly laid out and politicians are much more inclined to approve medical weed over recreational weed to not make waves with large elements of their voter bases. This is a well-defined ‘walk before we run’ strategy that makes good and rational sense.

With the understanding that medical weed is going to be at the forefront of the marijuana movement, there is one company that has an early lead in the U.S. medical marijuana market that just so happens to trade as an American Depository Receipt (ADR) on the Nasdaq.GW Pharmaceuticals PLC ADR (GWPH) is a biopharmaceutical company focused on discovering, developing and commercializing novel therapeutics from its proprietary cannabinoid product platform in a broad range of disease areas.

GW, along with its U.S. subsidiary Greenwich Biosciences, has received U.S. FDA approval for EPIDIOLEX (cannabidiol) oral solution for the treatment of seizures associated with Lennox-Gastaut syndrome (LGS) or Dravet syndrome in patients two years of age or older. The company submitted a regulatory application in Europe for the adjunctive therapy of seizures associated with LGS and Dravet syndrome. The company continues to evaluate EPIDIOLEX in additional rare epilepsy conditions and currently has ongoing clinical trials in tuberous sclerosis complex (TSC).

GW commercialized the world’s first plant-derived cannabinoid prescription drug, Sativex(R) (nabiximols), which is approved for the treatment of spasticity due to multiple sclerosis in numerous countries outside the United States and for which the company is now planning a U.S. Phase 3 trial. The company has a deep pipeline of additional cannabinoid product candidates which includes compounds in Phase 1 and Phase 2 trials for epilepsy, glioblastoma, autism spectrum disorder, and schizophrenia.

The great strides GW is making on the pharmaceutical front are many, with several strategic partnerships formed that hold great promise for new therapies to be launched. The company has license and development agreements with Otsuka Pharmaceutical Co. Ltd.; Almirall S.A.; Bayer HealthCare AG; Ipsen Biopharm Ltd; and Neopharm Group. Based out of Cambridge, U.K. it primarily operates in Europe, the United States, Canada, and Asia.

Wall Street has taken a keen interest in the future of GW as six research firms now cover the company and stock. Most notably, on September 28, 2018, Morgan Stanley raised their target price to $240. The stock currently trades at $155, implying upside stock appreciation potential of 54% over the next year, which would be a fantastic gain within a mature bull market.

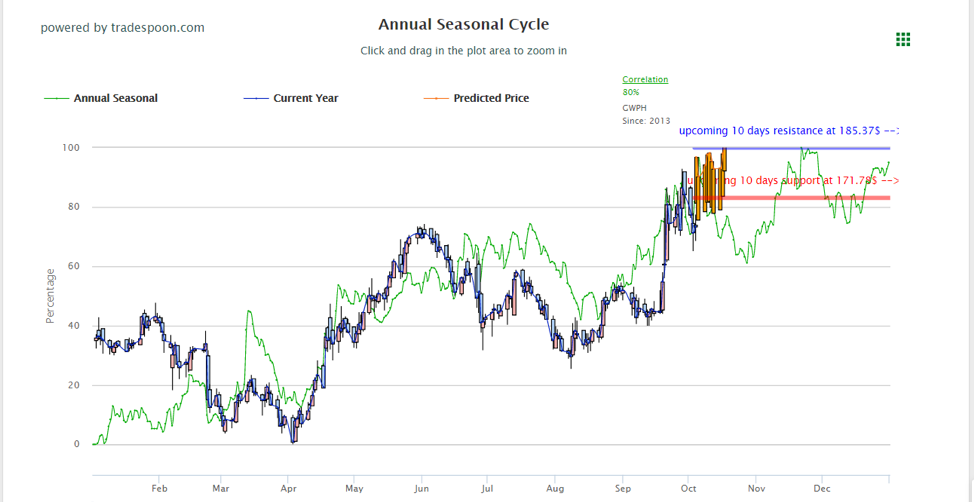

My AI-powered Tradespoon Seasonal Chart screener is also “high” on the near-term prospects of GW Pharmaceuticals. While the stock is trading around $155, there is good potential for the stock to trade up to $171-$185 depending on the investing landscape. The market has run into some selling pressure this week as Treasury bond yields spiked to the highest level since 2011. To this point, having a technically-driven AI platform that can discern when to buy shares in GWPH are crucial for executing a high-quality purchase – to which subscribers to RoboInvestor will be privy to when the time to pull the trigger comes.

I’ll be sure to provide the best risk/reward strategies for investing in pot stocks as, for the past three weeks, I’ve been fleshing out some of the ways we’ll go about it. But rest assured, getting it right requires artificial intelligence, especially in such a nascent sector where historical data is very limited. Having an ‘always thinking’ AI system in place to buy and sell stocks at just the right times is invaluable. I invite everyone that wants to get into the pot stock craze do so without paying crazy prices for what is a sector super-charged with emotional trading. Taking the emotion out of investing is how the best and wealthiest investors make their fortunes and Tradespoon’s RoboInvestor is the perfect way to put this investing profile to work for those seeking to gain serious wealth.

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.