Trump Announces Additional $200 Billion in Chinese Tariffs

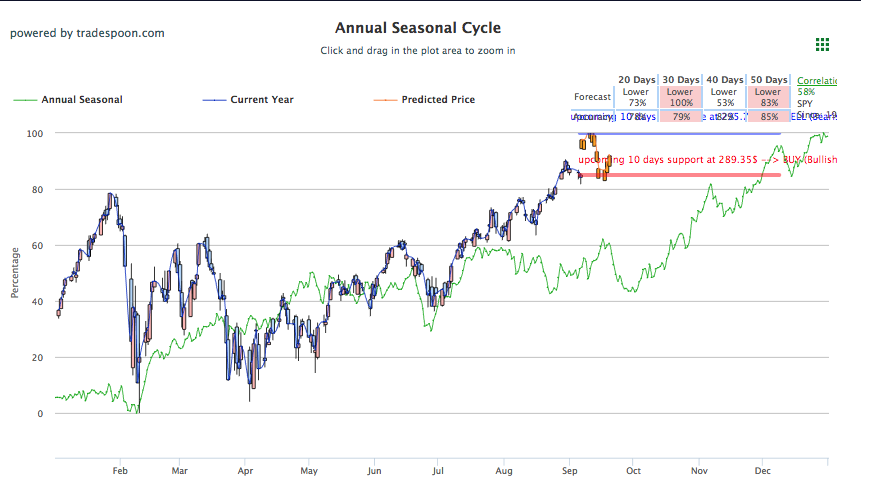

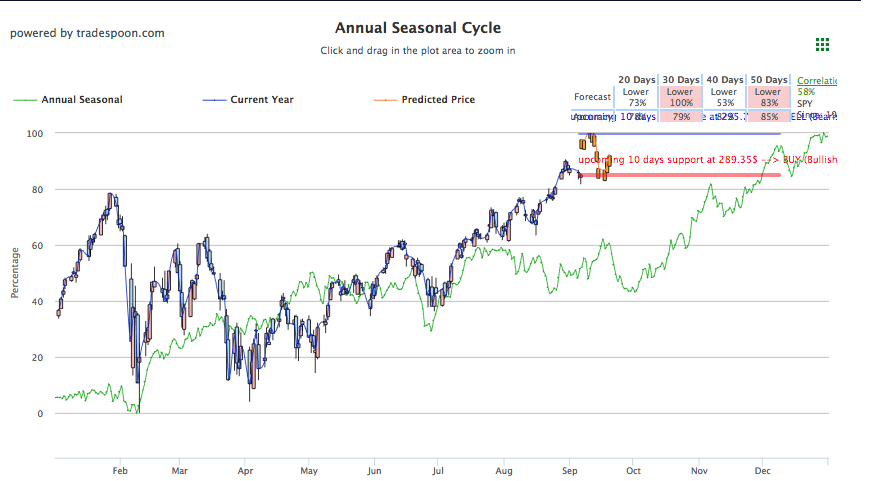

After a strong week which saw many record highs broken, U.S. stocks have strung together a string of losses this week, making it one of the worst weeks in 2018. Nasdaq is currently on track for its worst week since March and the S&P is on its third straight day trending down. Causing the selloff pressure is most likely the looming tariffs on $200 billion of Chinese goods Trump announced, which could come as soon as this week, along with other trade concerns that have remained. Key support for SPY remains at 286, while the next key support level is 282, corresponding with the 50-day moving average. With tech and emerging markets continuing to struggle, investors should consider hedging and monitoring seasonal charts for consistent support and resistance levels.

Investors will be closely monitoring a couple of developments today as tech execs are testifying in D.C. and trade news continues to pour in. First, executives from Facebook and Twitter will continue their testimony in front of the Senate Intelligence Committee regarding misinformation and how to combat it or what proactive actions can be taken. Google, also expected at the hearing, did not send a representative and were a no show today. The social-media giants will report on progress from their previous meeting, which took place last November. This trickled into one of the worst days for the tech sector this year yesterday, which continues today as all but Netflix from the FAANG group are trending significantly lower today. Elsewhere, a Canada-U.S. renegotiation of NAFTA continues. Both sides are looking to come to an agreement that would make sense for each country, as the U.S. and Mexico were able to last week. Trade tensions will continue to mount without a deal but having already brokered one with Mexico some optimism should remain.

Recent labor reports have provided positive sentiment with lower jobless claims and an increase in private sector jobs in the month of August. Payroll reports also point to a growth in U.S. labor. Looking deeper into the report we see that midsized companies added the most jobs in August with 111,000 while the business sector topped all sectors with 38,000 jobs added.

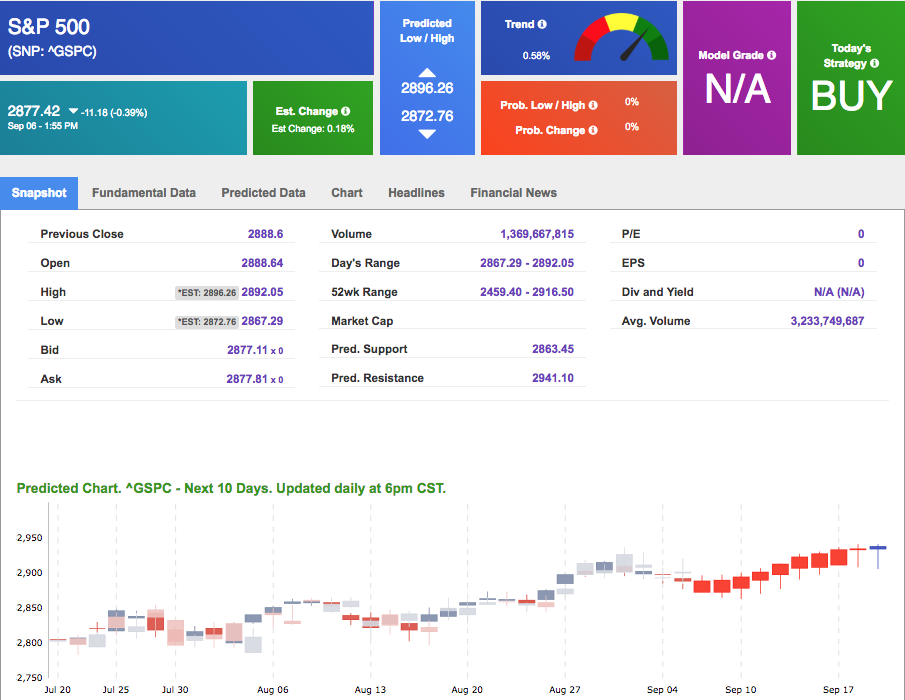

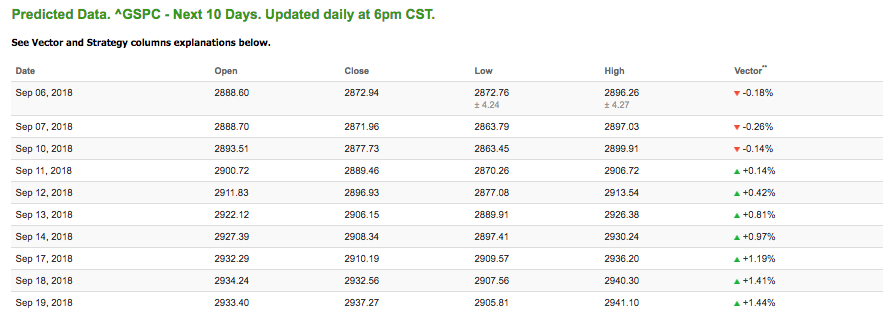

Using the ^GSPC symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.18% moves to +0.81% in five trading sessions. The predicted close for tomorrow is 2,871.96. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

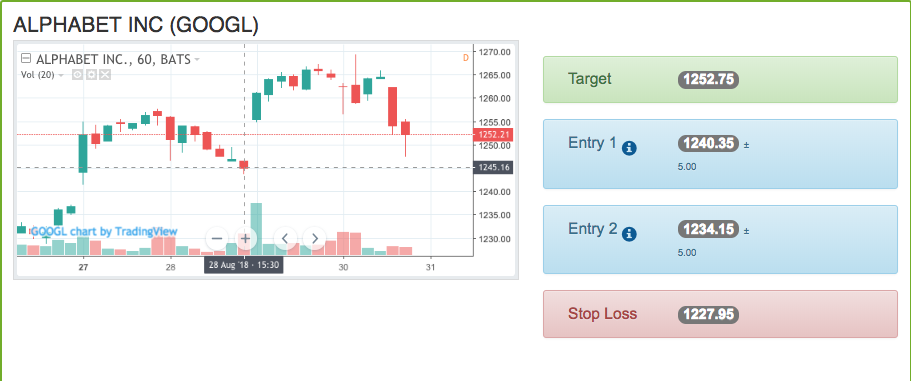

Highlight of a Recent Winning Trade

On August 28th, our ActiveTrader service produced a bullish recommendation for Alphabet Inc. (GOOGL). ActiveTrader is included in all paid Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

GOOGL entered the forecasted Entry 1 price range of $1240.35 (± 5.00) in its last hour of trading on Tuesday and opened above its Target price of $1252.75 today, reaching a high of $1261.11 in the first hour of trading. The Stop Loss was set at $1227.95.

Live Trading Room Update

See how we traded in volatile conditions and what you might expect in our next Live Trading Room. During recent volatility, we held Live Trading Room Session, on September 4th, where we had 10 out of 11 winning trades!

Symbol Net Gain%

| COST(OPTION) | 31.58% |

| PGR(OPTION) | 21.43% |

| MMM(OPTION) | 36.84% |

| CMCSA | 32.50% |

| COST | 36.13% |

| BAX | 44.29% |

| NDAQ | 54.29% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time for the first hour of trading, but these Live Trading Sessions are only available for Premium Members.

We wanted to share the recording with you so you can see the profits you might be missing- even during volatile markets.

Click Here to Watch the Recording

ALL-NEW

Breakthrough, mind-boggling, high-tech Artificial Intelligence platform available to Tradespoon’s individual investors:

100% of the Trades So Far Are Profitable

Click Here – To See Where AI Places My Money

Friday Morning Featured Stock

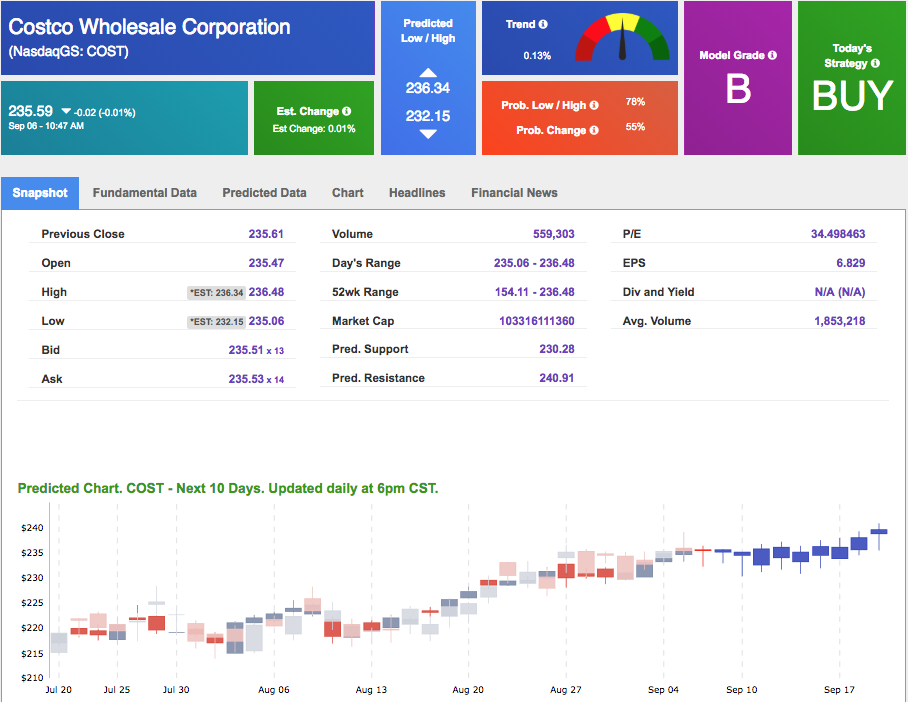

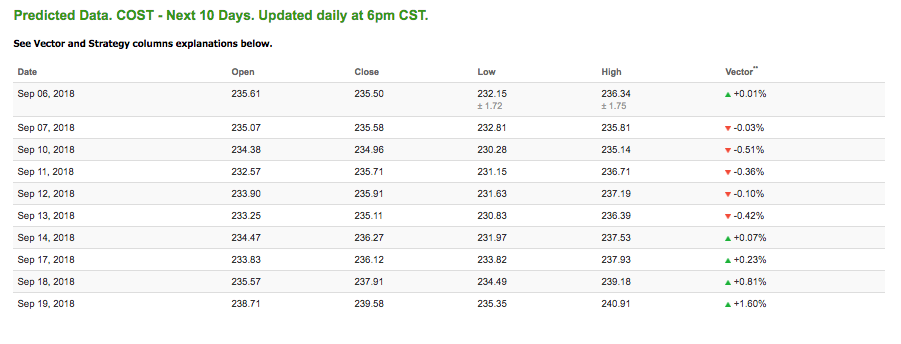

Our featured stock for Friday is Costco Wholesale Corporation (COST). COST is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks,please click here.

The stock is trading at $235.59 at the time of publication, down 0.01% from the open with a +0.01% vector figure.

Friday’s prediction shows an open price of $235.07, a low of $232.81 and a high of $235.81.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for October delivery (CLV8) is priced at $67.32 per barrel, down 2.17% from the open, at the time of publication. Oil futures lowered today to continue the string of losses for the week that has kept the commodity down. Iranian sanctions due to begin in early November are likely putting some pressure on oil along with the reported fall of domestic crude supplies last week, as reported by the EIA.

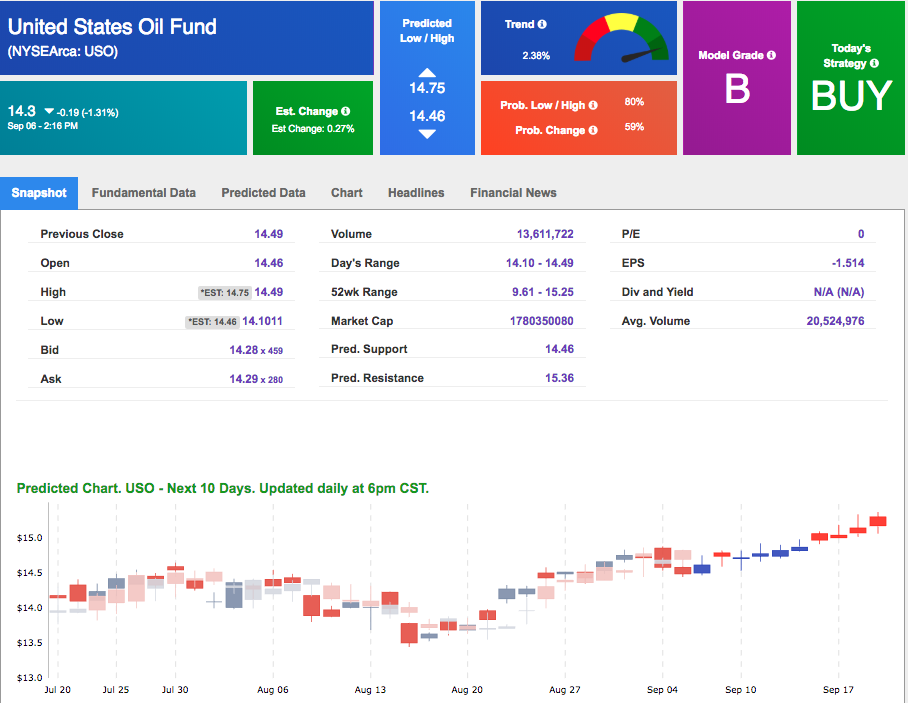

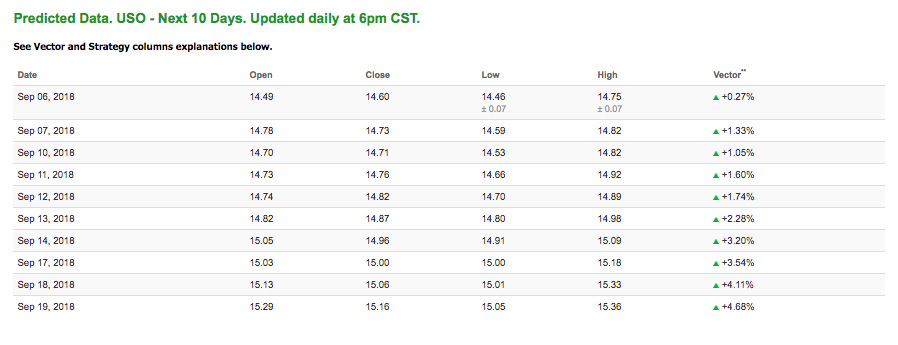

Looking at USO, a crude oil tracker, our 10-day prediction model all positive signals. The fund is trading at $14.3 at the time of publication, down 1.31% from the open. Vector figures show 0.27% today, which turns 1.05% in two trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

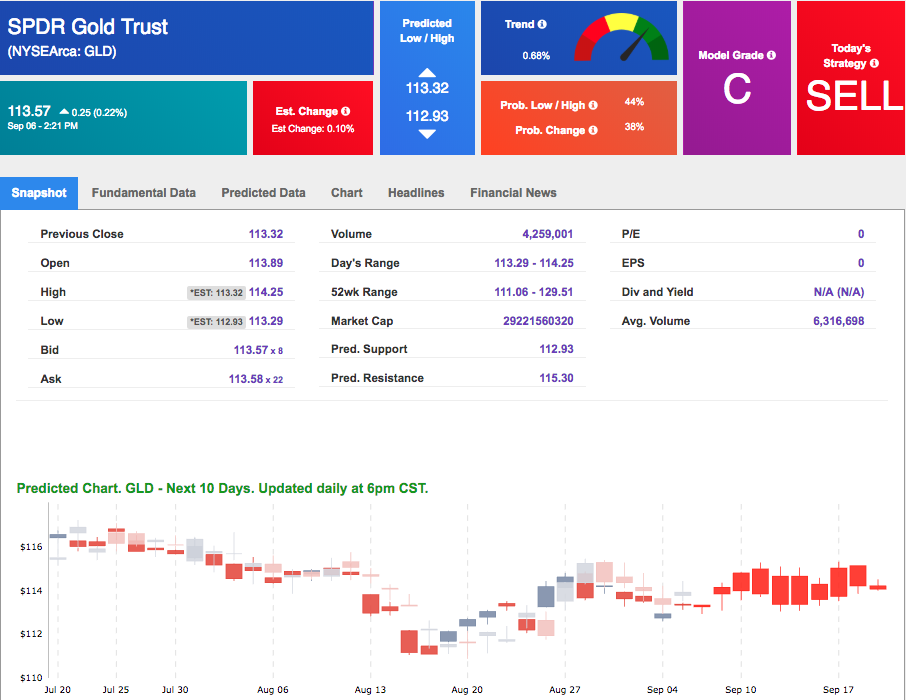

The price for December gold (GCZ8) is up 0.18% at $1,202.50 at the time of publication. Gold continues to climb above $1200 level after increased volatility in the dollar this week, currently sightly down after being up in early morning trading. U.S. economic reports continue to support the dollar through tariff and geopolitical concerns have kept the currency down.

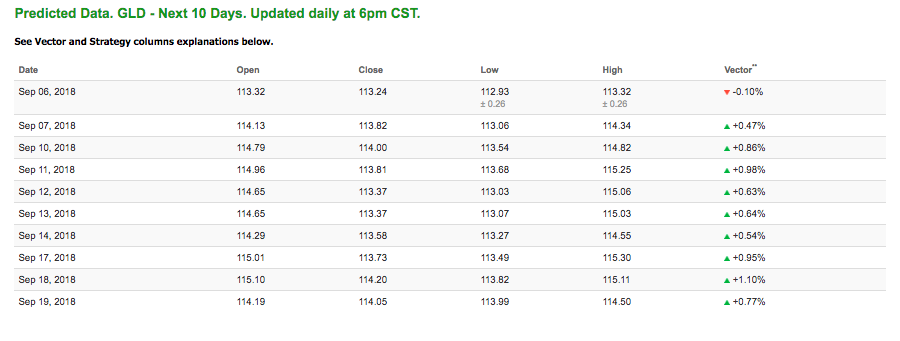

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mostly all positive signals. The gold proxy is trading at $113.57, up 0.22% at the time of publication. Vector signals show -0.10% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is down 0.90% at 2.88% at the time of publication. Ahead of tomorrow’s big jobs report, U.S. Treasury yields mostly lowered though not by much and will look for economic data and the upcoming FOMC meeting to guide its direction.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of -0.06% moves to +0.31% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

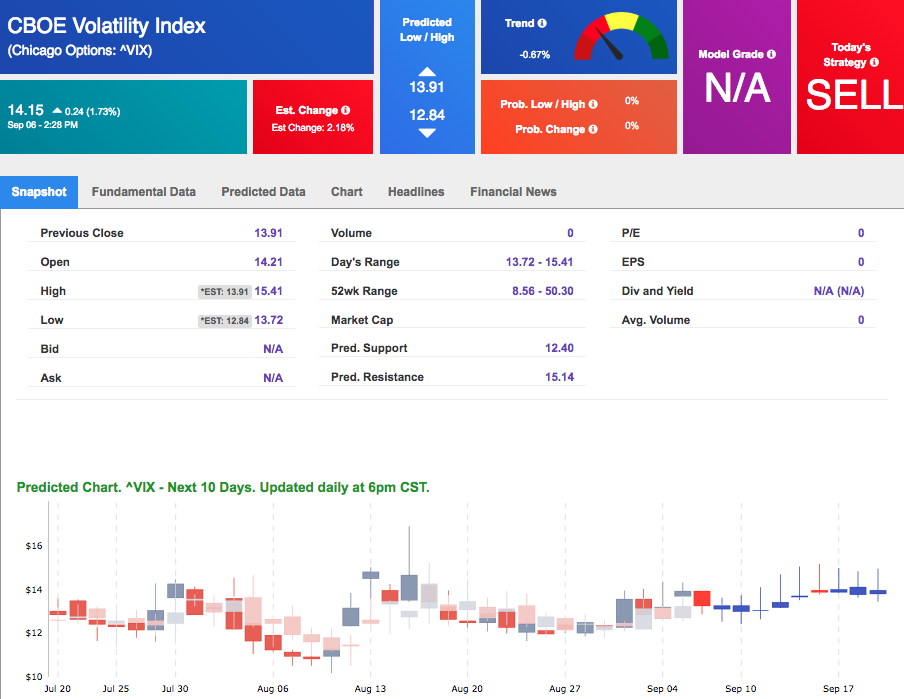

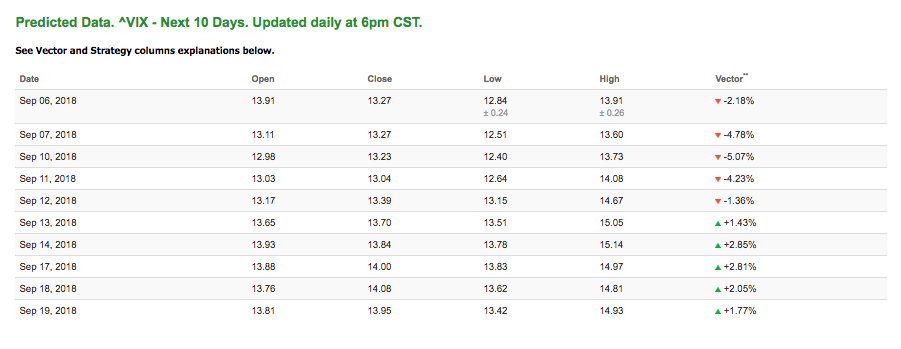

The CBOE Volatility Index (^VIX) is up 1.73% at $14.15 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $13.27 with a vector of -4.78%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.