U.S.-China “Phase One” Deal Stalls Following Hong-Kong Congressional Bill

Diminishing optimism regarding “phase one” trade deal weighs on stocks

All three major U.S. indices are on track to close in the red, following several record-days for the Nasdaq, as diminishing optimism regarding “phase one” of the U.S.-China trade weighs on stocks. With the first part of the deal likely being pushed back to next year, uncertainty regarding the mid-December tariffs remains as both sides continue to discuss core issues. Yesterday, Congress approved a bill to support human rights in Hong Kong which triggered China’s response, threatening to “take strong countermeasures” if the bill is passed.

Earnings help Target and Lowe’s shares go up

Target and Lowe’s reported earnings before the market open today which topped expectations and sent shares higher. Last month’s FOMC minutes were released today, providing further detail regarding last month’s monetary policy update.

(Want free training resources? Check our our training section for videos and tips!)

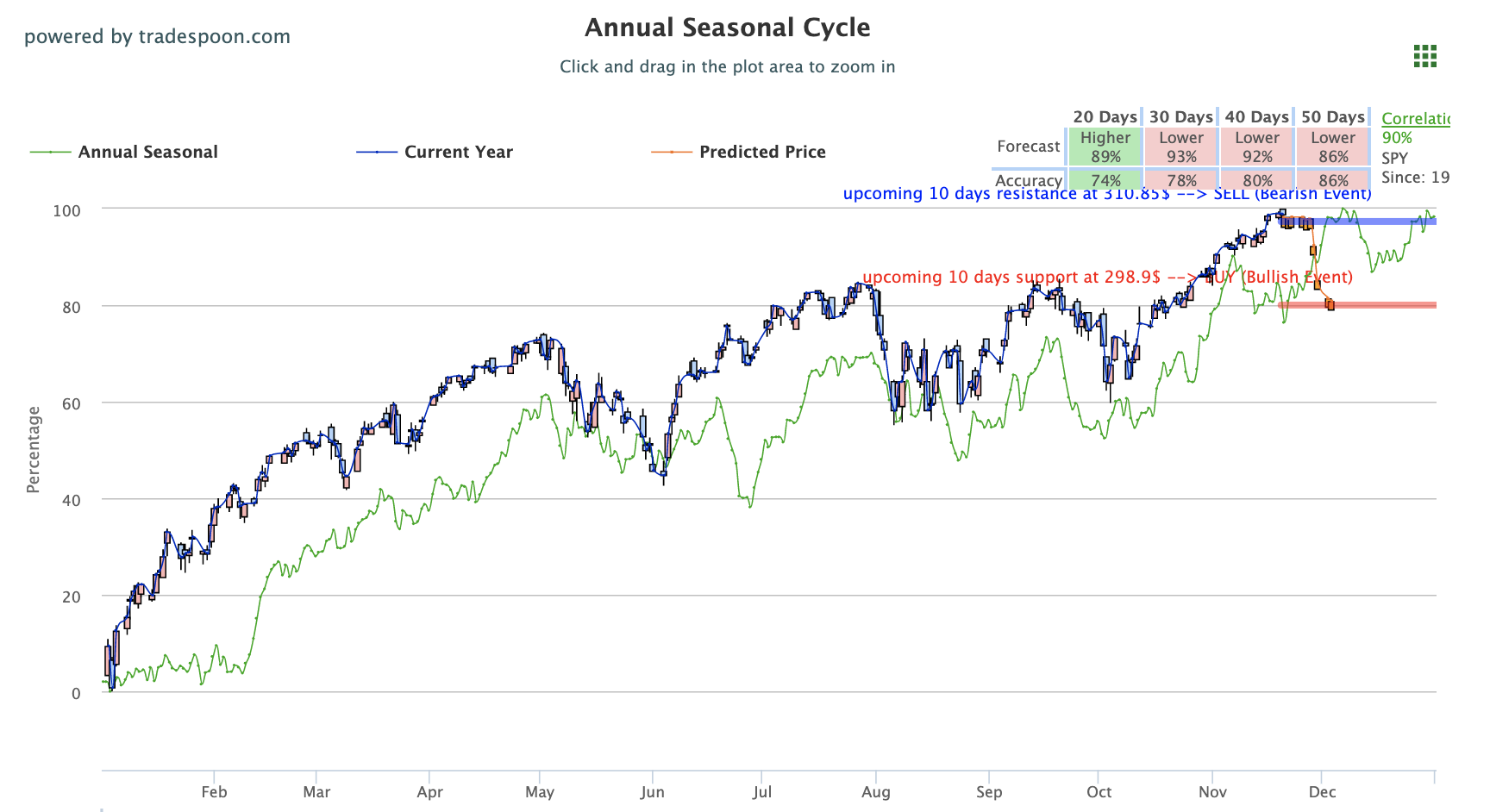

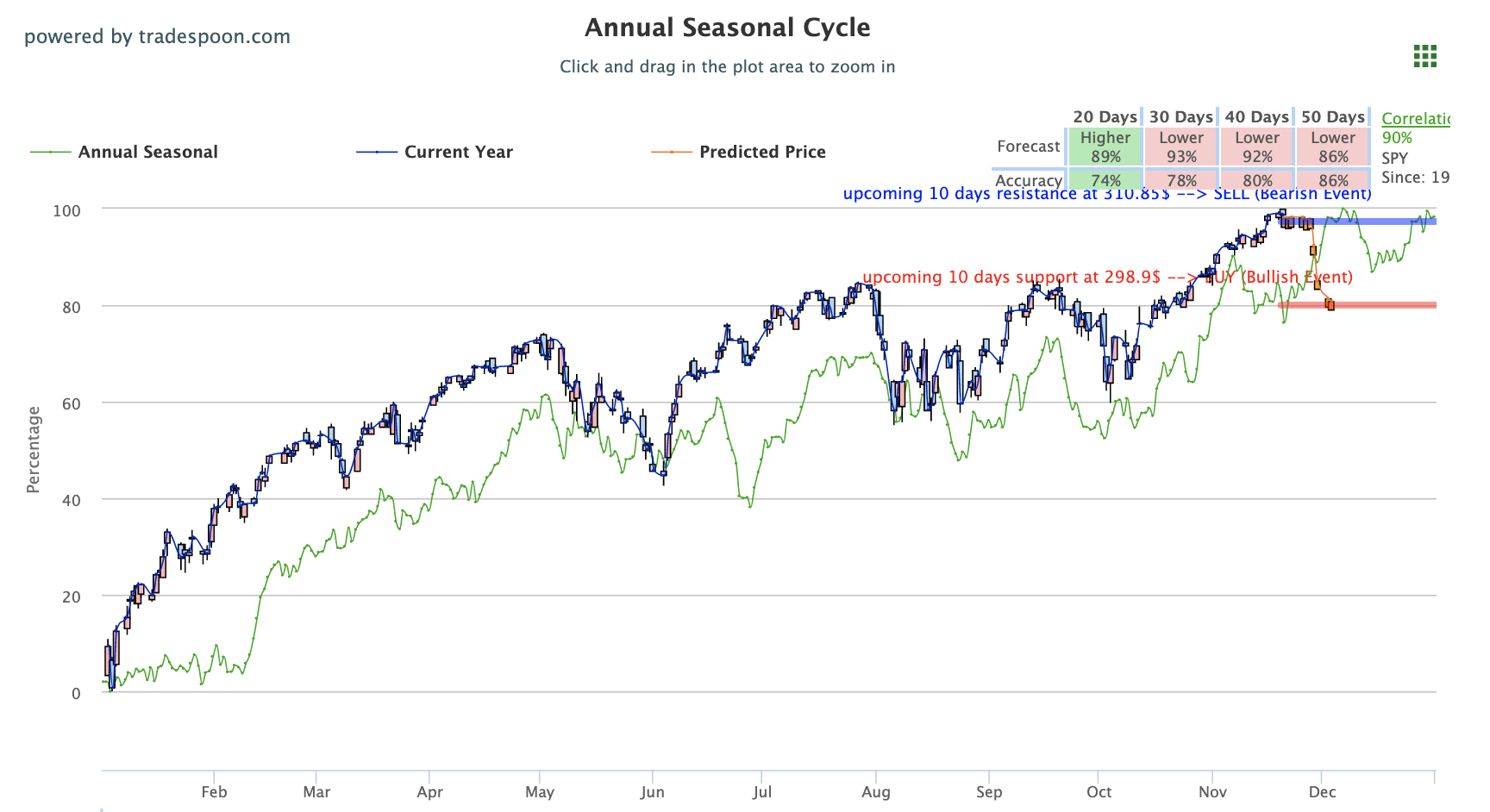

SPY overhead resistance remains $310 and we will look to buy when the SPY is near $297 level. There is little evidence we will retest 200 days MA, and we expect further volatility as well as shallow pullbacks. We encourage Market Commentary readers to maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Completion of the “phase one” trade deal pushing into next year

With the latest hiccup in the U.S.-China negotiations likely pushing the completion of the “phase one” trade deal into next year, markets traded lower both domestically and globally. Yesterday, Congress voted on a human rights bill which would directly affect the Hong Kong protests, causing China to respond. The bill warns China of using violence to suppress demonstrations while also supporting protestors.

Unclear if the two sides will meet before the year’s end

Today, China stated that if the bill were to be passed they would have to take “strong countermeasures” providing further uncertainty regarding the December tariffs and the initial plan for tariff rollbacks. The latest conflict has stalled trade talks and it remains unclear if the two sides will meet before the year’s end.

Apart from the U.S.-China trade deal, markets today are reacting to the latest economic reports, including FOMC minutes from last month’s meeting. Lowe’s and Target earnings, released before the market open, caused shares to rise over 3% after reports topped expectations. Last month’s FOMC featured the third straight interest rate cut with comments from Fed Chair Powell that indicated the Fed will likely put a pause on interest rate changes for the time being. The minutes do not provide a better indication of how long the Fed is looking to wait but does point to inflation, labor, and retail/manufacturing data as key indicators for future decisions. Tomorrow, look out for several notable retail earnings, such as Macy’s, Nordstrom’s, and Ross Stores, as well as October existing-home sales data and weekly labor data.

(Want free training resources? Check our our training section for videos and tips!)

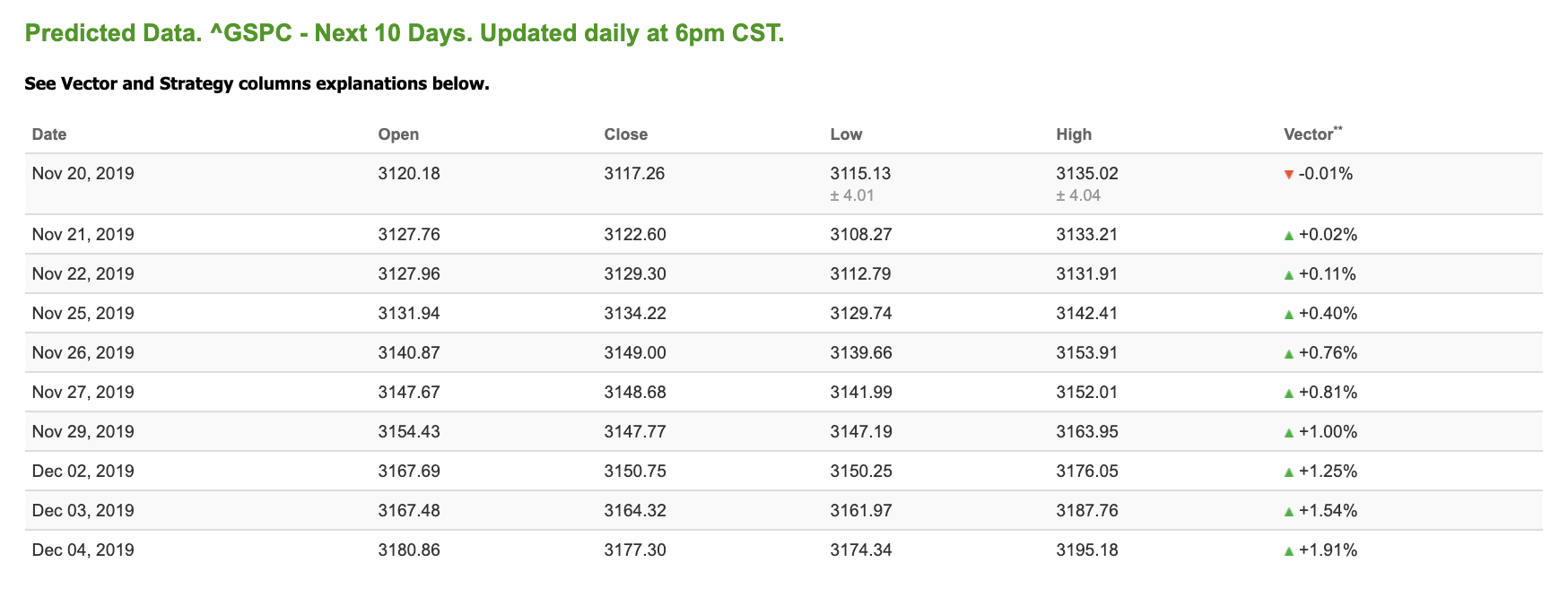

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a mostly positive outlook. Today’s vector figure of -0.01% moves to +0.81% in five trading sessions. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

As a Lifetime Member of the Elite Trading Circle, you’ll always have instant access to just about any investing tool you’ll ever need.

And the technology will continue to be upgraded and refined to meet evolving market environments as the years go by.

So, your lifetime Membership will never be behind the times.

I guess I need to make one qualification for this offer:

This offer is good today only! You need to act immediately because at midnight the offer is GONE!

Just use the form below to claim this special offer!

Click Here to Sign Up

Highlight of a Recent Winning Trade

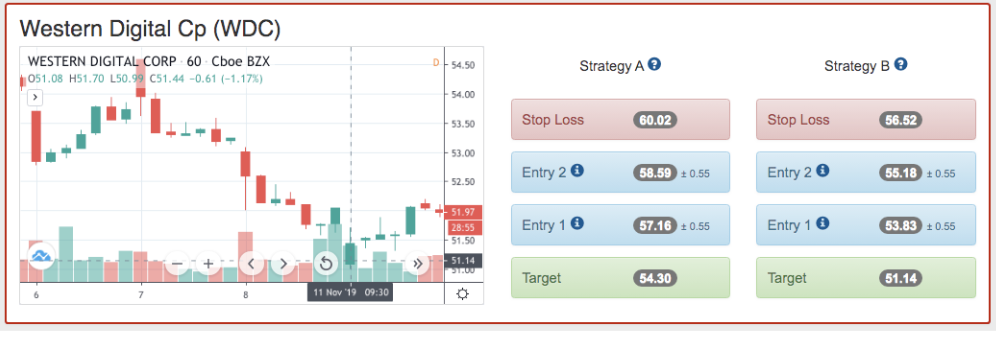

On November 4th, our MonthlyTrader service produced a bearish recommendation for Western Digital (WDC). MonthlyTrader is included in Tools, Premium or available as a single subscription and is designed for 5-20 day trades.

Trade Breakdown

WDC entered its forecasted Strategy B Entry 1 price range $53.83 (± 0.55) in its first hour of trading on 11/06 and passed through its Target price of $51.14 in the first hour of trading the following Monday. 11/11/19. The Stop Loss price was set at $56.52.

Thursday Morning Featured Symbol

*Please note: At the time of publication Vlad Karpel does not have a position in the featured symbol, CAH. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or MonthlyTrader recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

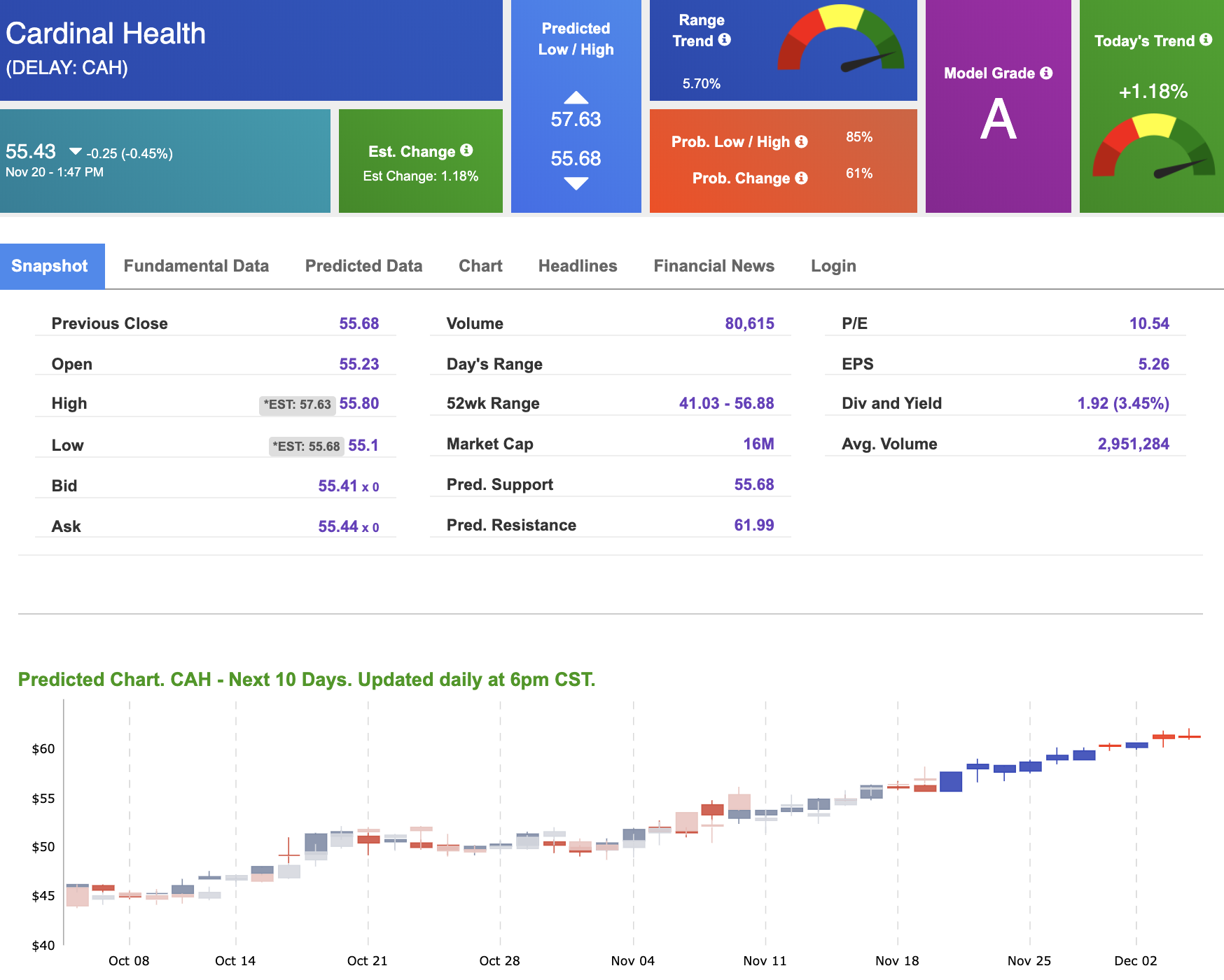

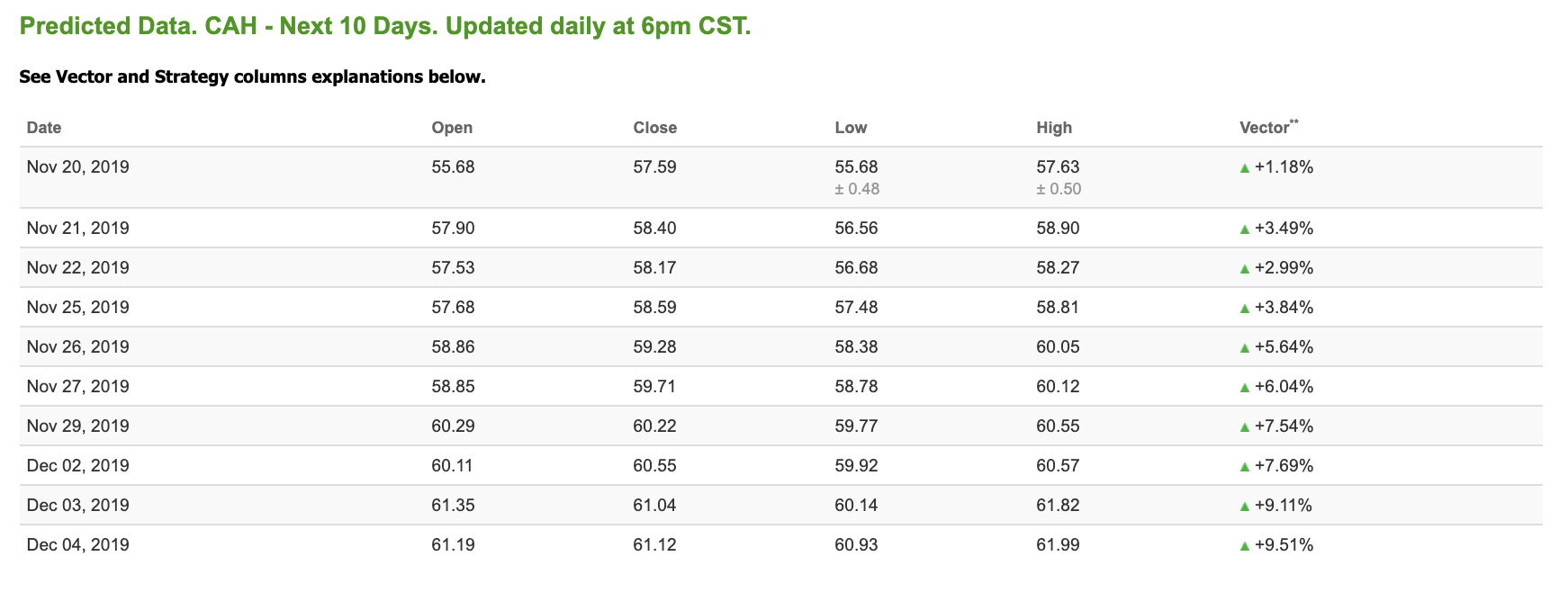

Our featured symbol for Thursday is Cardinal Health (CAH). CAH is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (A) indicating it ranks in the top 10th percentile for accuracy for current-day predicted support and resistance, relative to our entire data universe.

The stock is trading at $55.43 at the time of publication, down 0.45% from the open with a +1.18% vector figure.

Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $56.91 per barrel, up 3.08% from the open, at the time of publication.

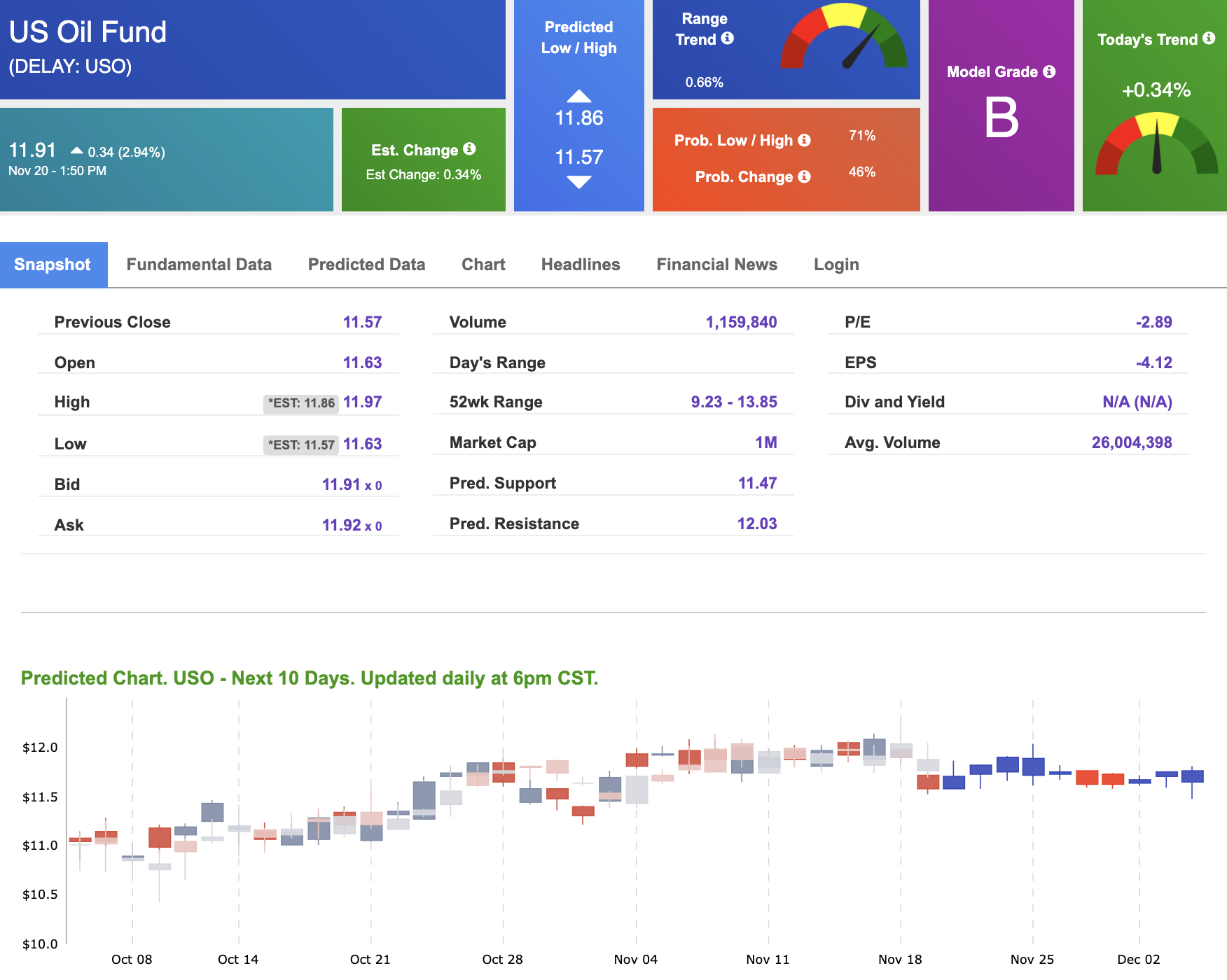

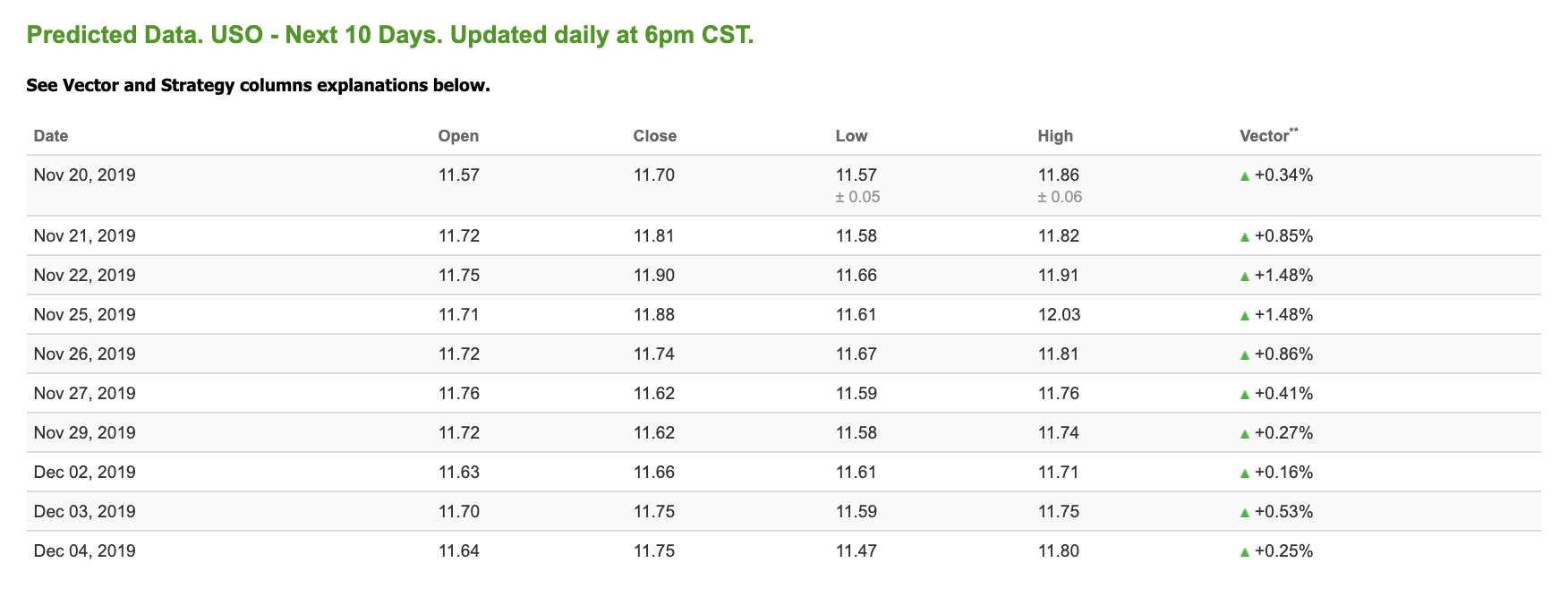

Looking at USO, a crude oil tracker, our 10-day prediction model shows positive signals. The fund is trading at $11.91 at the time of publication, up 2.94% from the open. Vector figures show +0.34% today, which turns +0.41% in five trading sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Gold

The price for the Gold Continuous Contract (GC00) is down 0.20% at $1,471.30 at the time of publication. Gold prices have been sensitive to any commentary coming out of the U.S./China trade deal. Gold was under pressure after reports of phone conversations being “constructive” between the two parties to the negotiations, but weakening indices, treasury yields, and the U.S. dollar helped the safe-haven metal regain its support.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $138.58, down 0.08% at the time of publication. Vector signals show +0.25% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

The yield on the 10-year Treasury note is down 2.78% at 1.74% at the time of publication. The yield on the 30-year Treasury note is down 2.20% at 2.20% at the time of publication.

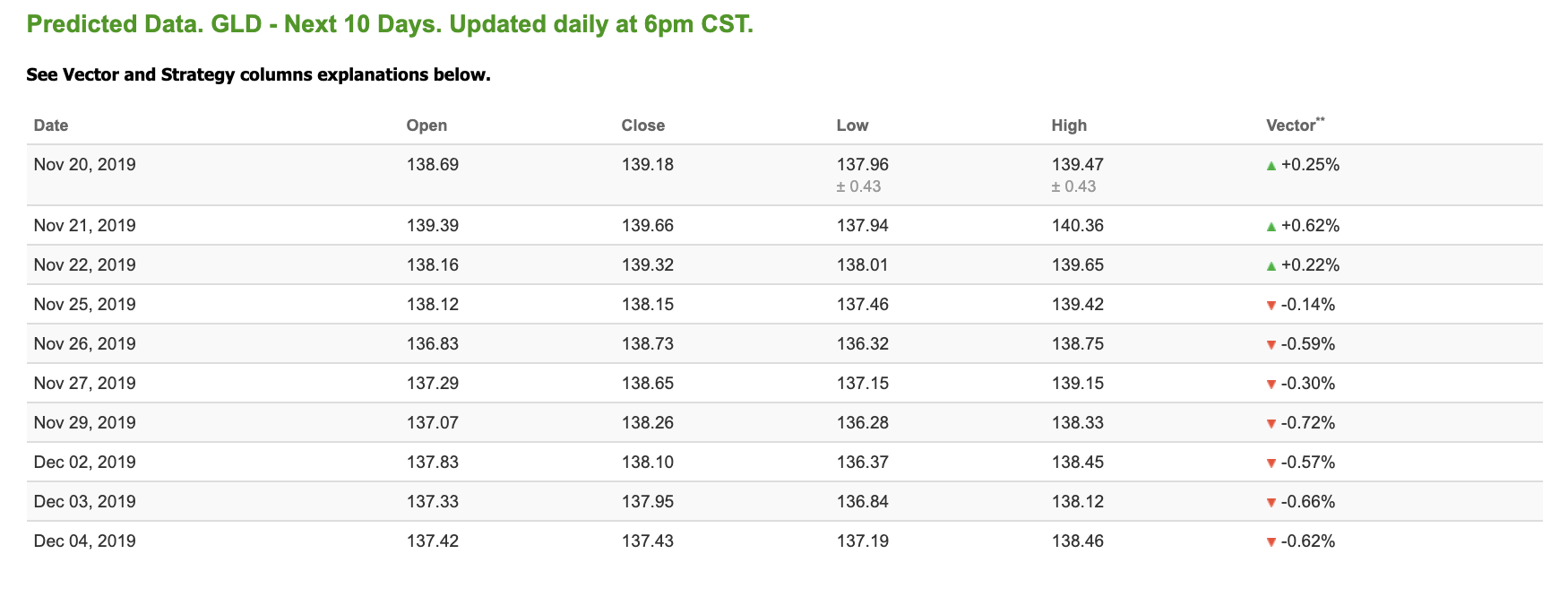

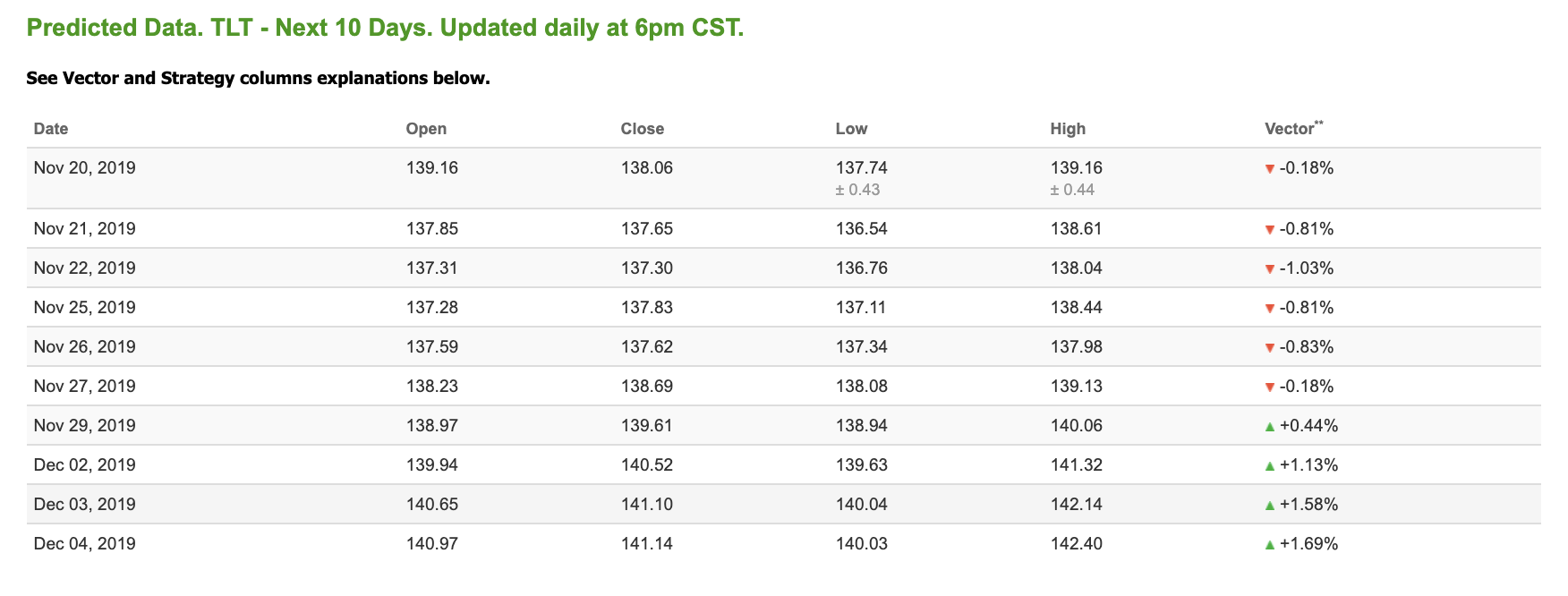

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of -0.18% moves to -0.81% in three sessions. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

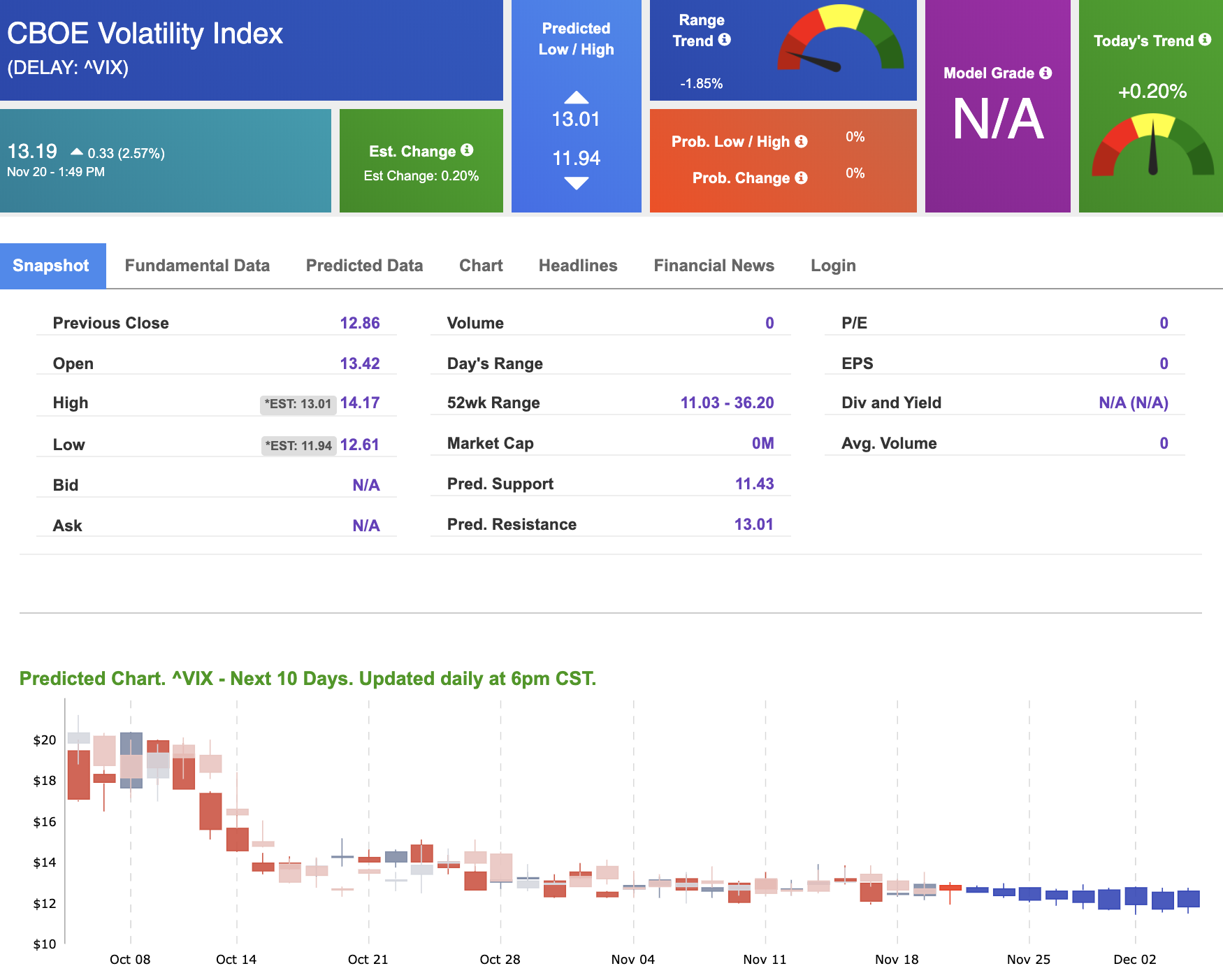

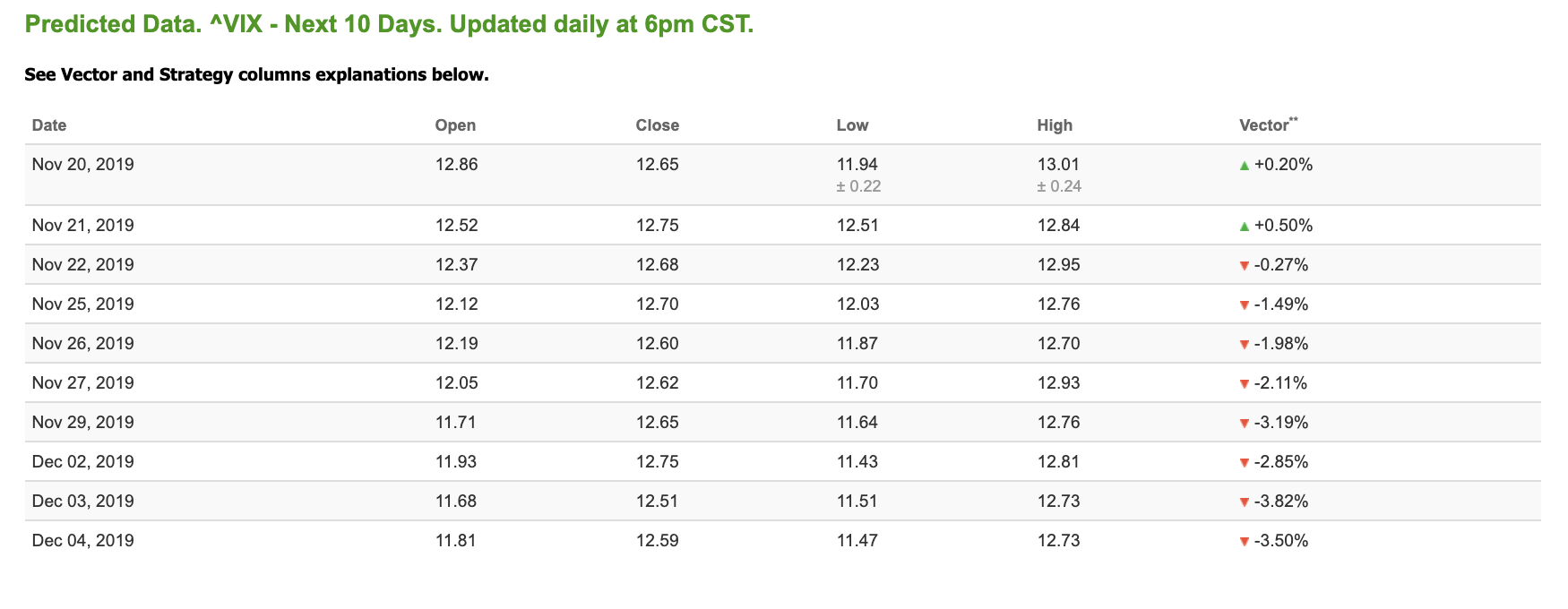

Volatility

The CBOE Volatility Index (^VIX) is up 2.57% at $13.19 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.