U.S. Markets Continue Shaking Off Global Concerns

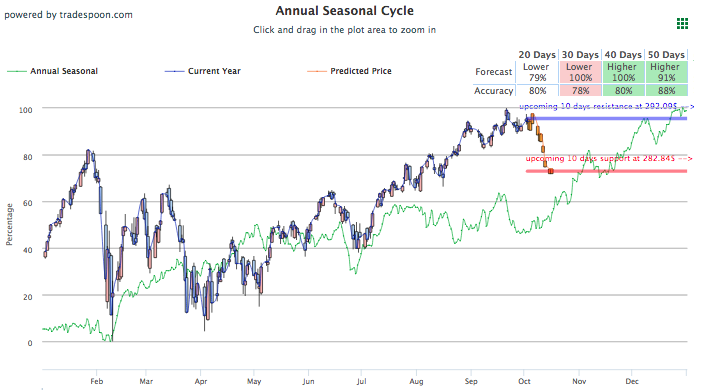

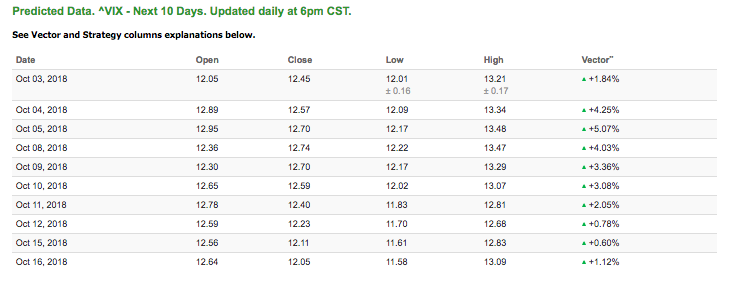

U.S. Stocks continue to rally behind the recently reworked North American Trade Agreement, USMCA, as the Dow is on track for its fifth straight day of gains, while the Nasdaq and S&P are also making sizeable gains. Still, it is best not to chase the market. Small caps, financials, and technology are all currently underperforming. Looking at the short time upside, there looks to be little to none until we have a 2-3% correction later this month. The market shook off global concerns once more as the Italy budget deficit issue largely came and went without much of a market reaction, all three major U.S. indexes look to double-digit gains while the Dow nears an all-time high. SPY Annual Seasonal Chart forecast is shown below:

This week, three labor reports are still due, including weekly jobless claims and September jobs report. Private sector employment numbers for Septembers exceeded expectation, adding 230,000 jobs. Big market-movers today include J.C. Penny which saw a +10% boost after they announced their new CEO and European markets which rose behind optimism in an Italian budget deficit resolution. Currently, the notion seems to hold that the Italian government will yield to the EU. Cleveland and Chicago Fed Presidents are scheduled to speak, separately, today. U.S. bonds, both short and long-dated, soared and are currently nearing yearly highs, as the much stronger than expected recent economic data affirms market optimism and economic outlook.

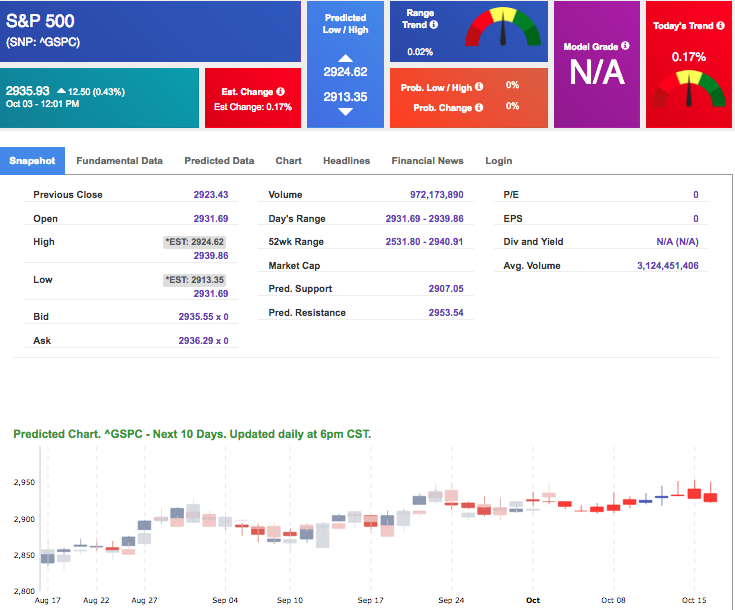

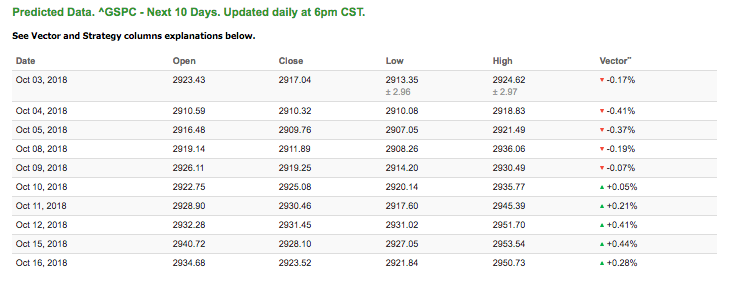

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.17% moves to +0.05% in five trading sessions. The predicted close for tomorrow is 2,910.32. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

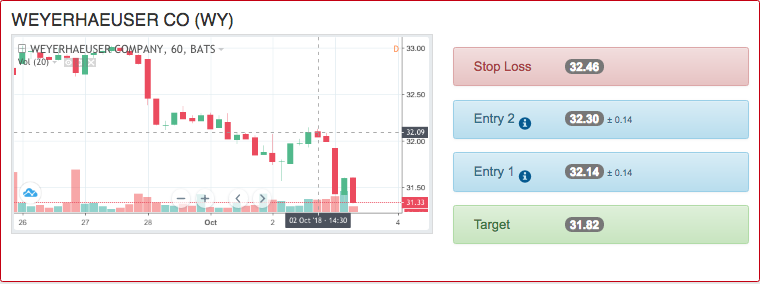

On October 2nd, our ActiveTrader service produced a bearish recommendation for Weyerhaeuser Co (WY). ActiveTrader included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

WY entered the forecasted Entry 1 price range of $32.14 (± 0.14) in its second to the last hour of trading and moved through its Target price of $31.82 in its first hour of trading the following day. The Stop Loss was set at $32.46.

Pre-Columbus Day Sale!

With gains to date of 836%*, and a 80% win-rate, a lifetime Premium Membership could easily help you turn your $100,000 into $836,000 and if the next few years are as good as the last you can make. . . $1,600,000. . . $2,400,000 or more*. Limited time offer!

CLICK HERE NOW

Live Trading Room Update

See how we traded in volatile conditions and what you might expect in our next Live Trading Room. During recent volatility, we held Live Trading Room Session, on August 30th, where we had some great trades below!

| Symbol | Net Gain% |

| ADBE (OPTION) | 46.34.% |

| MUR | 60.61% |

| ADSK | 32.45% |

| LLY | 19.01% |

| XLF (OPTION) | -100.00% |

Our Live Trading Room is open every trading day from 9:15 am Eastern Time for the first hour of trading, but these Live Trading Sessions are only available for Premium Members.

We wanted to share the recording with you so you can see the profits you might be missing- even during volatile markets.

Click Here to Watch the Recording

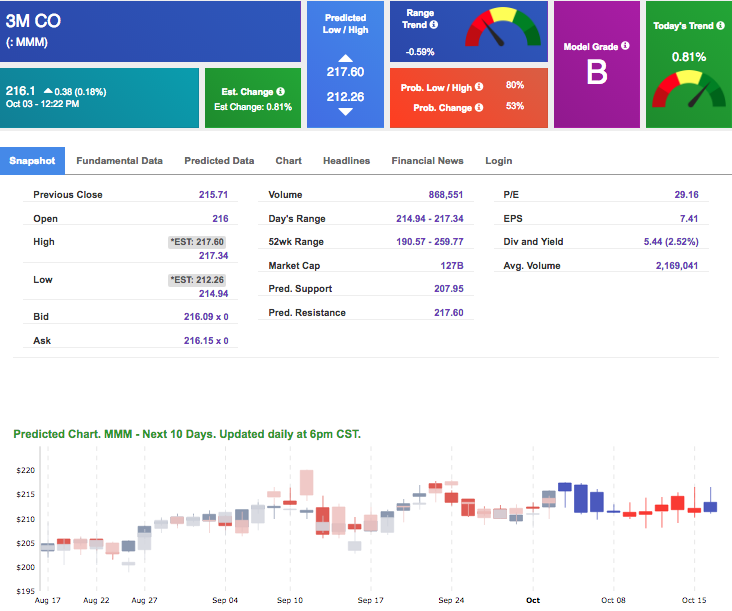

Thursday Morning Featured Stock

Our featured stock for Thursday is 3M Co (MMM). MMM is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (B) indicating it ranks in the top 25th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

The stock is trading at $51.82 at the time of publication, up 0.38% from the open with a +0.29% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks please click here.

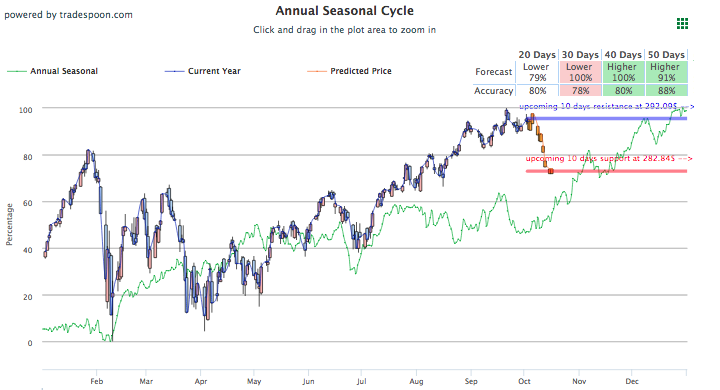

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

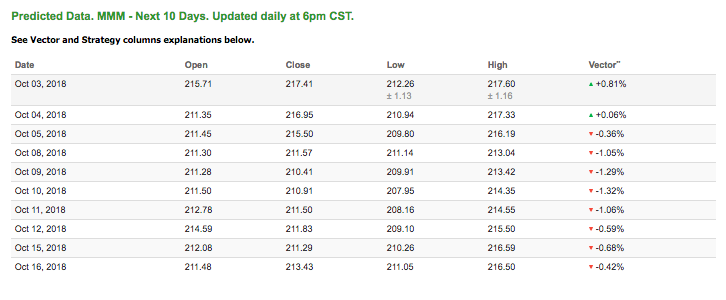

Oil

West Texas Intermediate for October delivery (CLX8) is priced at $75.49 per barrel, up 0.35% from the open, at the time of publication. Oil futures continue to rise counter to the recent EIA report of rising inventories. This coupled with the oncoming Iranian sanctions, with the expected decline in global production, have supported the commodity.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $16.05 at the time of publication, up 1.13% from the open. Vector figures show -0.05% today, which turns +3.17% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

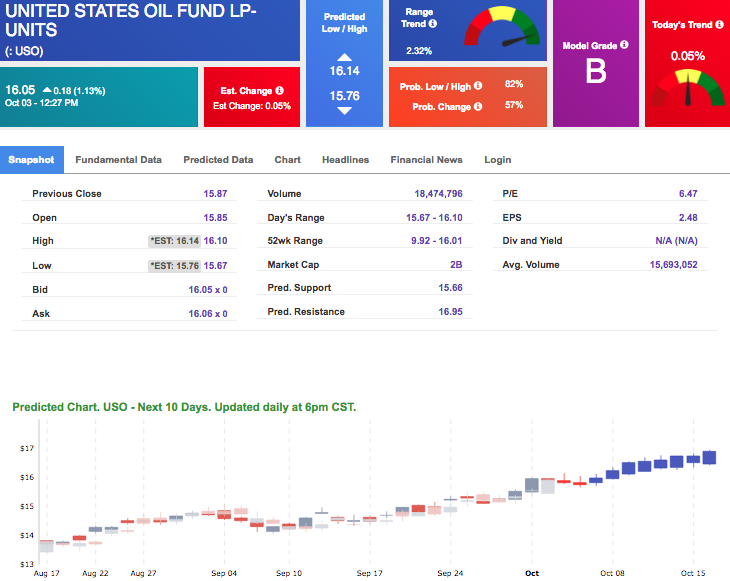

Gold

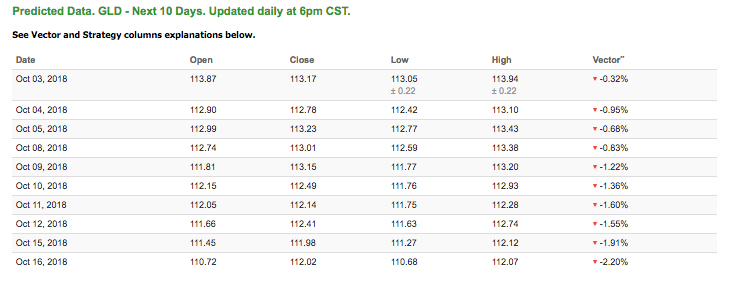

The price for December gold (GCZ8) is down 0.33% at $1,203.10 at the time of publication. Gold continues to waver from gains to losses today while the dollar is holding a nice gain. EU developments and the job reports due this week will surely continue to influence the safe haven commodity.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows all negative signals. The gold proxy is trading at $113.44, down 0.38% at the time of publication. Vector signals show -0.32% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

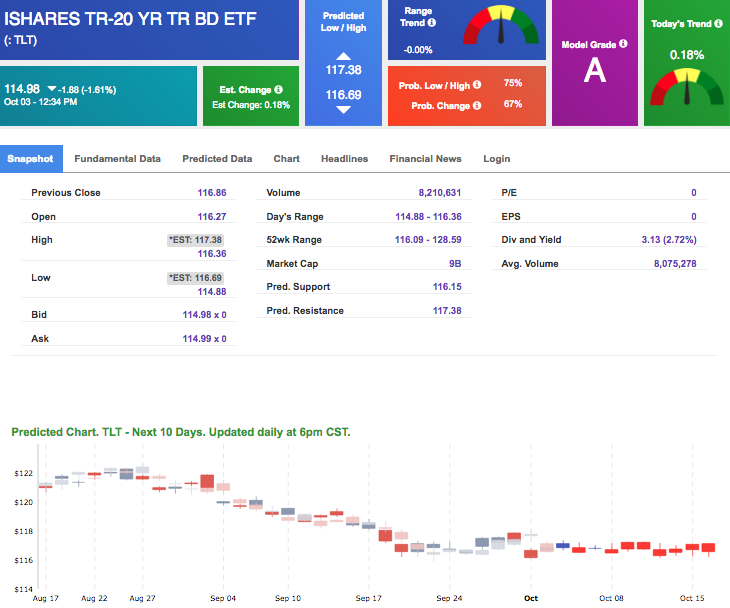

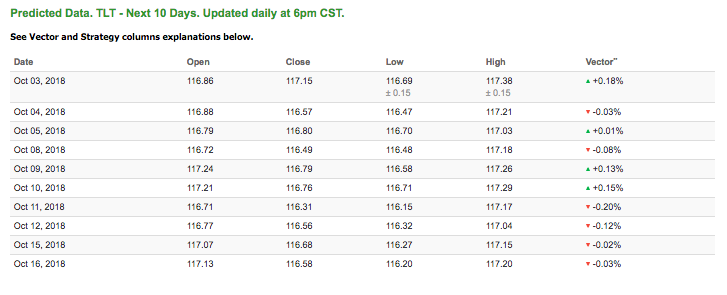

The yield on the 10-year Treasury note is up 2.29% at 3.14% at the time of publication. The yield on the 30-year Treasury note is up 2.32% at 3.39% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Today’s vector of +0.18% moves to -0.08% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

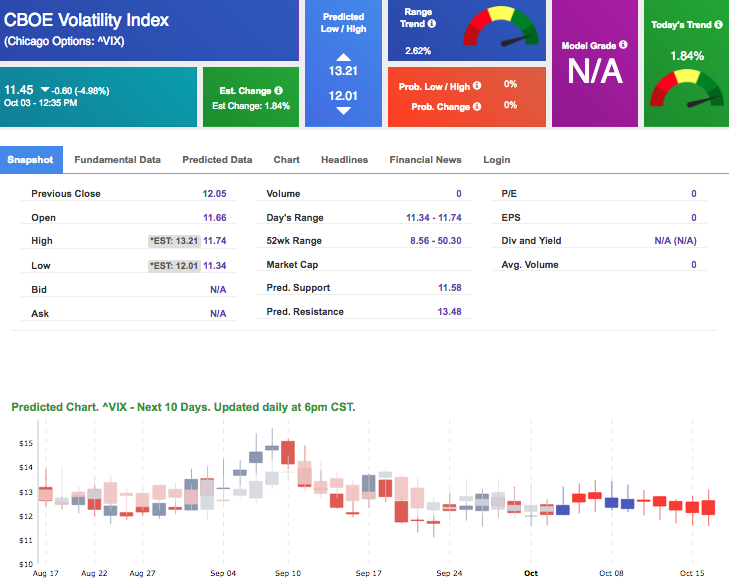

Volatility

The CBOE Volatility Index (^VIX) is down 4.98% at $11.45 at the time of publication, and our 10-day prediction window shows positive signals. The predicted close for tomorrow is $12.57 with a vector of +4.25%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.