Vlad’s Top Buy-Rated Emerging Market Trades!

RoboStreet – June 4, 2020

Dollar Down – Emerging Markets Up

The rally has broadened out to include domestic mid-caps, small-caps, and now the emerging market sectors. Weakness in the dollar is pushing investor interest into liquid Chinese stocks and other Asian equities where they have lagged the U.S. rally for weeks. But that is all changing of late.

The market was able to recover most of the losses for this year. The theme of the week continues to be the weak U.S. Dollar. Commodities, Emerging Market, Financial, Industrial, and Small Cap stocks continue to outperform the market. Healthcare and Technology sectors continue to underperform value stocks.

At this point, risk vs reward does not warrant chasing the rally, as SPY approaches $310-$315 level.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

I expect the market volatility and the three percent daily market moves to persist. At this point, I believe we have set the bottom (market can overshoot support and resistance levels especially when VIX is elevated).

I believe the worst part of the sell-off is behind us. Please monitor VIX level as current levels are above the historical average. My strategy is to buy 5-10% market corrections.

Based on our models, the market (SPY) will trade in the range between $275 and $320 for the next 4 weeks.

Our proprietary AI tools we employ for our RoboInvestor Portfolio to select stocks and ETFs are bullish on two particular trades that I want to bring to everyone’s attention.

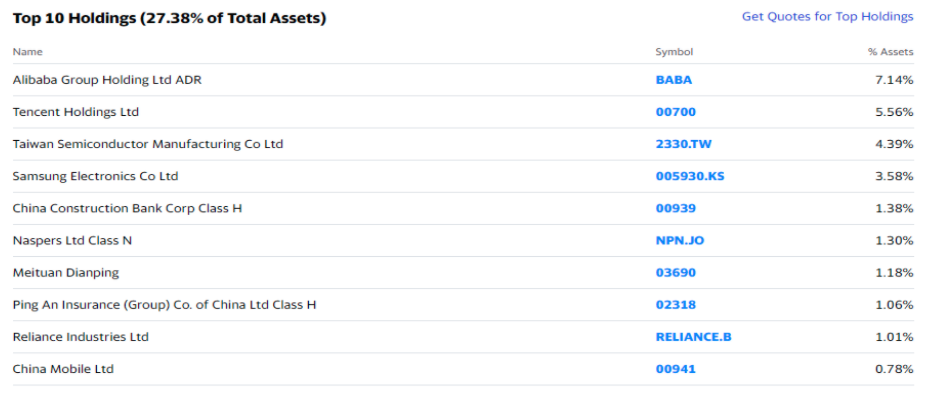

The first is the iShares MSCI Emerging Markets ETF (EEM) that trades like water and is in the midst of a powerful uptrend from the March lows. Below are the top holdings.

As I noted earlier, the rally in emerging markets is being led by China and Asian stocks, making EEM the ideal ETF to work with from a sector standpoint. And our AI-driven Seasonal Chart shows shares of EEM to be short-term overbought, but looking very bullish for the next 30, 40 and 50-day periods.

(Want free training resources? Check our our training section for videos and tips!)

For our RoboInvestor subscribers, I’ll be considering adding EEM to our RoboInvestor Portfolio in the near future when my 20-day indicator flashes green. You don’t want to miss out on that buy signal! We make money for our RoboInvestor members 88.19% of the time we put money to work. Imagine stepping to the plate and having a 0.881 batting average. By comparison, Ty Cobb had a lifetime average of 0.366.

Next up is Alibaba Group Holding Ltd. ADR (BABA), the big eCommerce merchandiser in China that is also the top holding in EEM. China was first to recover from COVID-19 and has seen its economy first to bounce back as well.

Alibaba is not just a big company with a market cap of $555 billion, it’s a fast-growing company – very fast. 2020 revenues are forecast to soar by 29.90% and earnings per share are set to rise by 13.6% this year and accelerate by 26.68% to $9.59 per share as an average forecast from the 34 analysts that cover the stock.

At its current price of $220, BABA is set to consolidate its recent 10% gain and then set up for a move to challenge its 52-week high of $231, that if breached, will open the way for further gains. It’s a powerful chart that deserves investors’ attention.

Applying our Seasonal Chart to BABA, our algorithm is flat-out bullish on the current uptrend. Investors seeking a good emerging market single stock candidate should at BABA as their go-to trade.

If you don’t have a system in place that is picking winners almost 90% of the time, then please take a moment to seriously consider RoboInvestor as your primary platform for producing a steady stream of profits the results in genuine wealth creation. This is my life’s work, my money is in on every trade with yours, and we’re winning – all the time!

Make RoboInvestor your next trade and let’s build wealth together. I look forward to welcoming you aboard!

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.