Warning! Warning! Vlad’s Junk-Bond Alert

RoboStreet – July 2, 2020

Watch Out For Falling Junk In the Bond Market

Back on March 20, right before the market bottomed, S&P Global Ratings put out a dire forecast that high-yield default rates would likely rise to 10% over the next 12 months because of the coronavirus crisis. This would represent a tripling of the expected default rate of just over 3.1%. S&P said a protracted recession could make the numbers worse.

The junk default rate in 2019 rose to 3.3%

The junk default rate in 2019 rose to 3.3%, the highest level in three years, and well above the non-recession norm of 2.4%. Those defaults amounted to $38.6 billion, a 32% surge from 2018, according to Fitch.

Fitch predicts U.S. high yield default rate will approach 5%–5.5%

“The current recession in the U.S. this year is coming at a time when the speculative-grade market is historically vulnerable to a liquidity freeze or an earnings drop,” Nick Kraemer head of S&P Global Ratings Performance Analytics, said in a statement. As the market has recovered somewhat, Fitch Ratings is a bit less bearish and anticipates the U.S. high yield default rate will approach 5%–5.5% and the highest level since 2010.

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

Volume of June Trailing Twelve Months (TTM) default rate would reach $22.5 billion for May, topping the $21.2 billion from last month

According to Fitch, the June Trailin June Trailing Twelve Months (TTM) default rate g Twelve Months (TTM) default rate could finish as high as 5.5% as Chesapeake Energy Corp., Hertz Corp., and California Resources Corp. all file for bankruptcy along with the completion of a few energy distressed debt exchanges led by SM Energy Corp. said Eric Rosenthal, Senior Director of Leveraged Finance. “If these potential defaults occur, volume would reach $22.5 billion for May, topping the $21.2 billion from last month.”

The Top Bonds of Concern total stands at $52.4 billion

Fitch’s Top Bonds and Tier 2 Bonds of Concern combined amount surged to $230.8 billion from $189.8 billion last month and now accounts for 18% of the high yield index. The Top Bonds of Concern total stands at $52.4 billion, up from $44.1 billion last month, with energy comprising 58% of the volume.

Just as few investors had foreseen the wave of mortgage defaults

Just as few investors had foreseen the wave of mortgage defaults and the chaos they caused in the financial system a decade ago, few had considered the possibility that corporate revenue could evaporate virtually overnight. Some had stress-tested their portfolios to factor in recessions that would depress revenues and corporate profits, but they didn’t envision the possibility sales would go to zero.

The Fed’s recently stated they would use their set of tools to support the junk bond market so as to maintain stability. The junk bond market in the U.S. currently stands at around $1.2 trillion. This kind of intervention smacks of moral hazard on the part of the Fed as buying bonds from issuers who already had their fair share of financial issues before the COVID-19 pandemic are seen, unwarranted bailout candidates.

(Want free training resources? Check our our training section for videos and tips!)

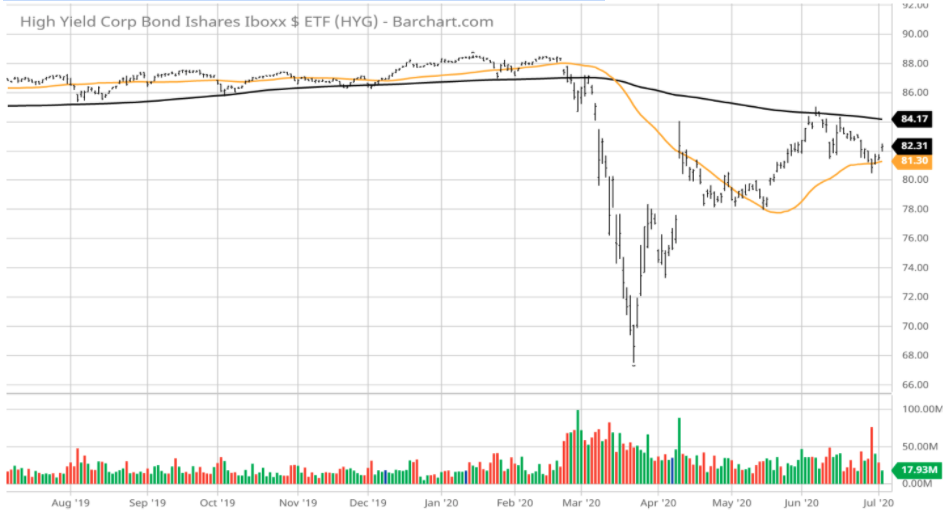

HYG is the largest sub-investment grade bond fund traded

The High Yield Corporate Bond iShares iBoxx $ ETF (HYG) is the largest sub-investment grade bond fund traded. From the one-year chart below, shares of HYG were making their way back up towards the previous highs and have now started to falter as these noted bankruptcies are becoming news.

Total assets are around $24 billion with about 51% rated BB

Total assets are around $24 billion with about 51% rated BB, 35% rated B and just over 10% rated below B. It wouldn’t take much to topple this market in a protracted economic downturn, and is why the chart is looking vulnerable with the resurgence of COVID-19.

(Want free training resources? Check our our training section for videos and tips!)

I bring this up because there seems to be a blind eye towards what might be shaping up as a bumpy ride over the next four to six weeks when second-quarter earnings season unfolds. Companies will have to reveal just how good or bad business conditions are and the charts are suggesting the news is going to be net bearish.

In our RoboInvestor advisory service, we trade only blue-chip stocks and ETFs that are devoid of exposure to the junk bond market. And what will likely occur is that money will rush out of the high-yield debt market and into more investment-grade bonds and big-cap stocks that don’t have highly leveraged balance sheets.

Our most recent trades we closed out for profits

Just as an example, our most recent trades we closed out for profits were in best-of-breed stocks like Square Inc. (SQ), Chevron Corp. (CVX), Freeport McMorran (FCX), BlackRock Inc. (BLK), CVS Healthcare (CVS), Cisco Systems (CSCO) and Target Corp. (TGT). We only utilize institutional favorites with highly liquid options chains.

(Want free training resources? Check our our training section for videos and tips!)

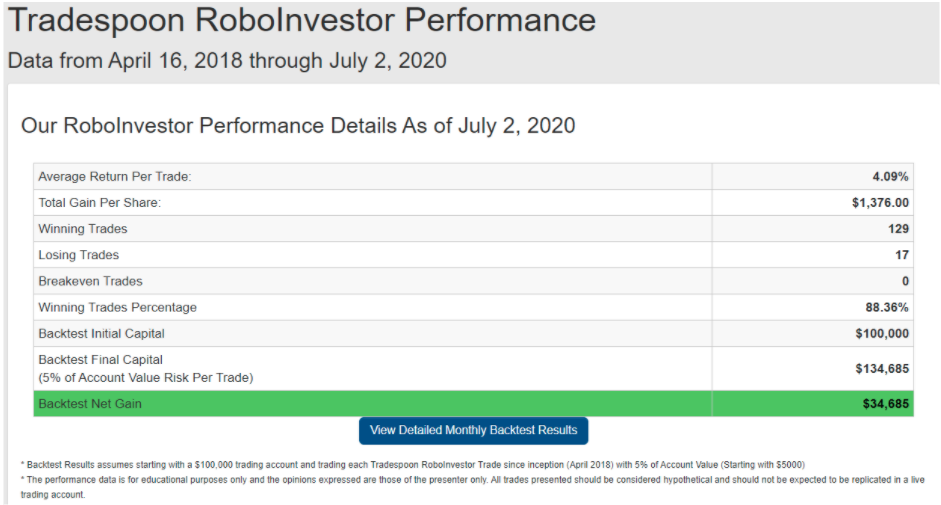

Our track record is with a winnings trade percentage of 88.36%

Our track record is nothing short of amazing, with a winnings trade percentage of 88.36%, making for one of the most enviable performance records on Wall Street. I’ve spent years crafting the AI science that is behind RoboInvestor and what goes into the RoboInvestor Portfolio – and I invite you to join me in taking your portfolio down a more successful path than any other service can offer.

(Want free training resources? Check our our training section for videos and tips!)

Take advantage of our special 4th of July offer to sign up for RoboInvestor and make a commitment to take action for the second half of 2020 that will make a huge difference to your net worth and your whole investing experience!

(Want free training resources? Check our our training section for videos and tips!)

“I’m investing my own money in each and every stock as my AI platform identifies.”

“I’m investing my own money in each and every stock as my AI platform identifies.”

And remember we’re not talking about day-trading here. I’m looking for 50-100% gains inside of the next 3 months, so my weekly updates are timely enough for you to act.

Click Here – To See Where I Put My RoboInvestor Money

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

(Want free training resources? Check our our training section for videos and tips!)