What’s Next for FAANG Stocks?

Big cap tech stocks, especially those comprising FAANG — Facebook (FB) Amazon (AMZN) Apple (AAPL), Microsoft (MSFT) Netflix (NFLX), and Alphabet (GOOGL) — had been carrying the major indices for a majority of the past two years. Bears like to point out that those five stocks accounted for 20%-plus of the SPDR 500 (SPY), and a full 50% of the Nasdaq 100 (QQQ). Additionally, this heavy weighting and their outperformance contributed to nearly 75% of the SPY and QQQ gains during the 18-month period from January 2019 to July 2020.

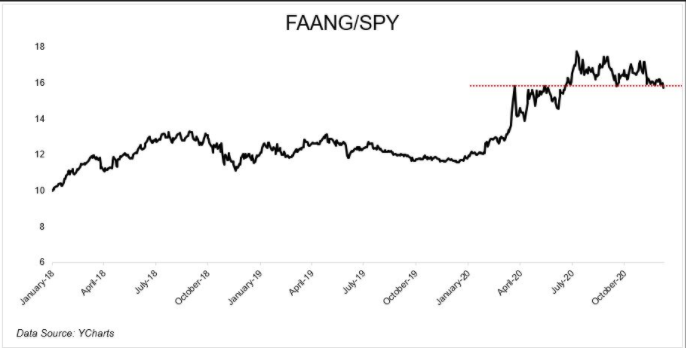

But, there’s been a notable rotation over the past few months with investors anticipating a covid-19 vaccine and the economy reopening with small caps, value, and cyclicals notably surging ahead while FAANG has gone nowhere.

As you can see, the FAANG no longer carries the SPY higher. It now seems poised at a crucial juncture, either to break down further or reassert their leadership.

As we drill down further, you can see their September peak and decrease over the past three months. I threw in Tesla (TSLA) to illustrate just how monstrous it’s been. I bet the S&P committee wishes they had added it in April when it initially qualified to be included in the index.

While it’s very healthy for the market to experience a broadening of breadth, the mega-cap resolution out of these consolidations is going to weigh heavily in determining the direction of the next major SPY and QQQ index moves.

Presently, it seems like FAANG will resume its leadership. Check out these converging trend lines defining the series of lower highs and higher lows in the market’s biggest names. Note: All have posted decent gains over the past two days and appear poised for a new bull leg higher.

The Options360 service is currently long AAPL, has an iron condor with a bullish bias in FB, and I’m looking at adding MSFT. As each of these stocks’ stages a breakout, they’ll be added to the overall bull case, and be another dagger for the permabear crew.

The post What’s Next for FAANG Stocks? appeared first on Option Sensei.

(Want free training resources? Check our our training section for videos and tips!)