Worst December in Years Continues, Global and Domestic Pressures Remain

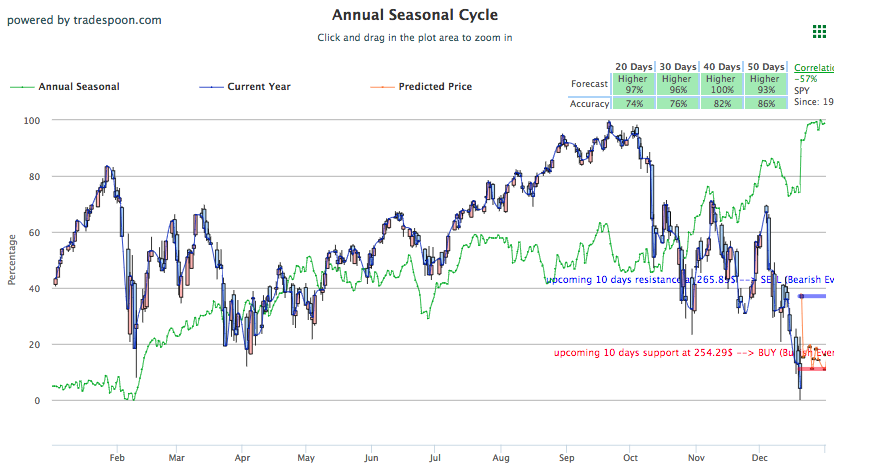

Markets are down after the fourth interest rate hike of the year was introduced yesterday, raising rates from 2.25% to 2.5%, in the updated fed policy, which also indicated at two hikes for 2019. All three major U.S. indices are also trading lower over the fear of a partial government shutdown that could occur tomorrow when nine federal departments run out of funding tomorrow. Other major news today include the U.S. withdrawal from Syria, the SEC’s study regarding the stock market, Altria’s big e-cig investment, and the recent social media slides for Facebook and Twitter. As long as the market remains below $263 LEVEL for SPY, investors should consider hedging positions by buying VXX or an SPY put spread. In our opinion, the market is oversold and the VIX and VIX put-to-call ratio is at an extreme level, considered to be contrarian signal indicating the market selloff approaching the end. The next level of support for SPY is at $240. For reference, the SPY Seasonal Chart is shown below:

This December has been one of the worst for the generally bullish month, succumbing to several global and domestic pressures, which have the month on pace for a historical worst. With low volume, general lack of economic reports, and earning season still several months away, there is not much to pull markets up. Geopolitical issues will remain in focus while domestically all eyes will remain on the partial government shutdown and the updated fed policy. The new policy indicates two hikes for 2019 and although the policy is more dovish than the previous policy, several comments within the policy and from Chair Powell following the meeting have lessened this pre-FOMC sentiment. Some key points to note in the updated policy include the addition of the word “some” before “further gradual increases,” indicating a less tight Fed moving forward, and acknowledgment of the recent volatility as cause to monitor global and political developments and “their implications for the economic outlook.”

A bipartisan effort is making its way through Congress as lawmakers in D.C. desperately try to resolve the budgetary issue before funding runs out. Yesterday, the Senate was able to pass a stopgap bill that will provide funding through February, but the bill must still be approved by the House and signed by President Trump before tomorrow’s deadline. Several insiders and White House officials have indicated Trump is likely to sign the bill, including Kellyanne Coneway.

Globally, both Asian and European markets lowered. Just yesterday President Trump ordered the withdrawal of all 2,000 U.S. troops in Syria, which should be complete in the within 30 days. This came as shock and flustered American allies such as Israel and Britain. Trump declared “we have won against ISIS” while some in D.C. are unsure of what it means in regards to further military action in the Middle East. This also contradicts recent statements from the Pentagon and leaves Iran and Russia as the two nations still involved in the Syrian conflict. Russia welcomed the news while lawmakers from both sides of the aisle argued for Trump to reconsider.

Other major news to note today includes the SEC continued study into the stock market and subsequent fees, which had been strongly opposed by several trading companies and venues. Altria, a major player in the alcohol and tobacco market, had recently approved a $12.8 billion investment in the current leading e-cig manufacturer Juul, causing Altria shares to trade lower today. Finally, social media giants Facebook and Twitter have come under recent scrutiny causing both stocks to trade lower. Facebook was flagged with recent reports that the company misrepresented the private user data it has shared with other companies while Twitter, currently down 11%, is falling behind negative analysis from short-seller Citron Research which dubbed the platform a “toxic place” primed for problematic and abusive user interactions. Next week the market will close early for the Christmas holiday on Monday and fully closed on Tuesday.

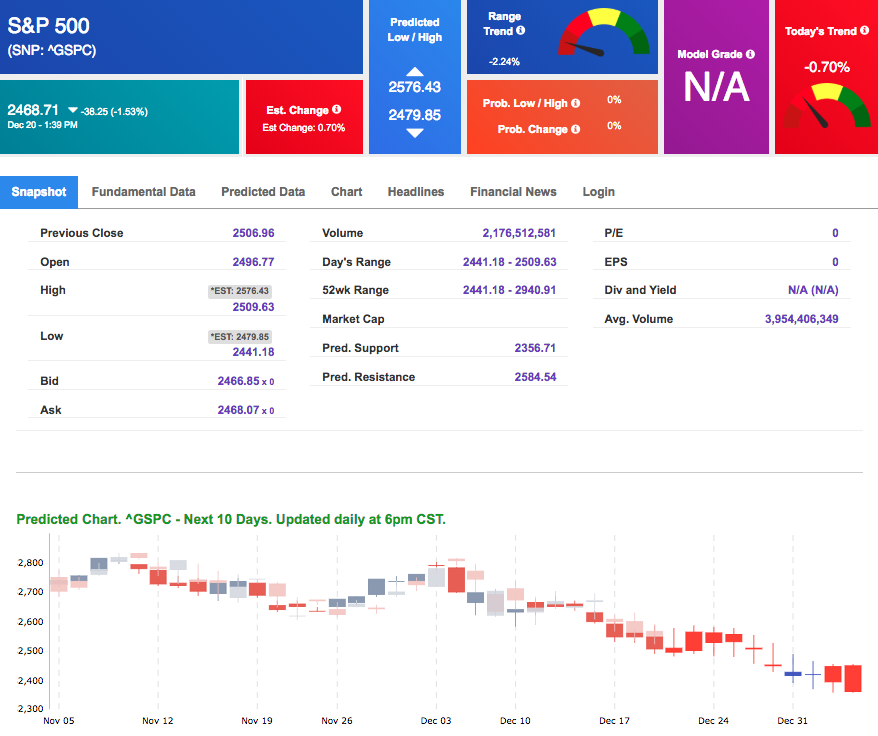

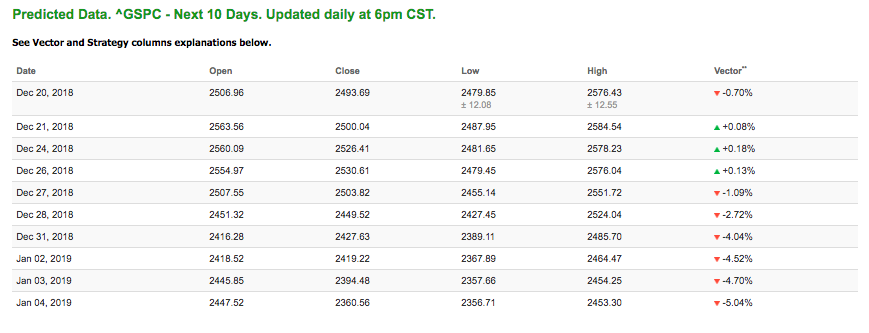

Using the “^GSPC” symbol to analyze the S&P 500, our 10-day prediction window shows mixed signals. Today’s vector figure of -0.70% moves to -2.72% in five trading sessions. The predicted close for tomorrow is 2,500.04. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Highlight of a Recent Winning Trade

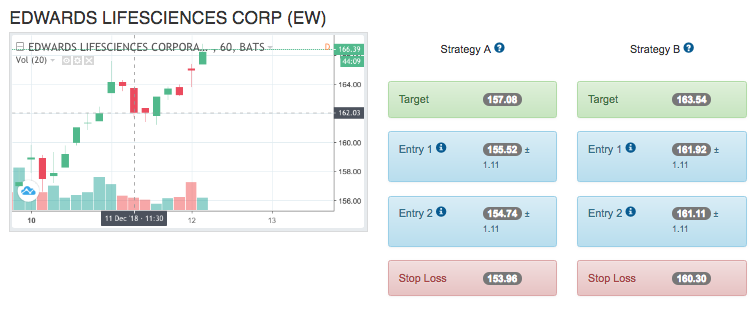

On December 11th, our ActiveTrader service produced a bullish recommendation for Edwards Lifesciences Corp (EW). ActiveTrader is included in all Tradespoon membership plans and is designed for intraday trading.

Trade Breakdown

EW entered the forecasted Entry 1 price range of $161.92 (± 1.11) in its third hour of trading and hit its Target price of $163.54 in that second to last hour of trading that day. The Stop Loss was set at $160.30.

YEAR-END SPECIAL:

Back by popular demand and to end the year on a good note, we are once again making the Lifetime Premium Membership available! Today only, we are offering LIFETIME ACCESS to our Premium Membership for less than the price we are currently charging for only 1 year of service!

CLICK HERE to Sign-up

Friday Morning Featured Stock

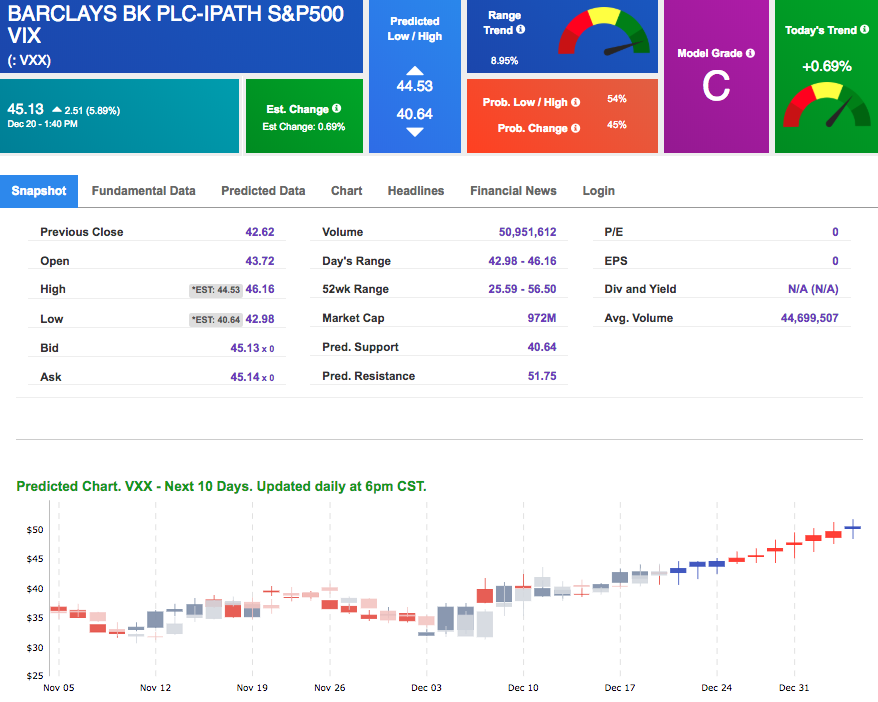

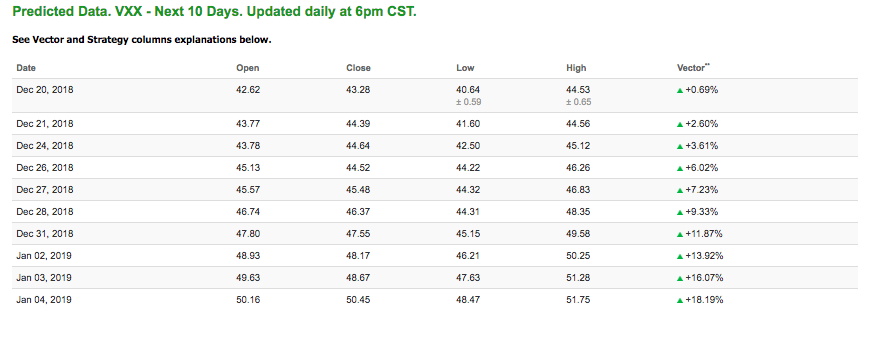

Our featured stock for Friday is Barclays iPath S&P 500 VIX (VXX). VXX is showing a confident vector trend in our Stock Forecast Toolbox’s 10-day forecast. This stock is assigned a Model Grade of (C) indicating it ranks in the top 50th percentile for accuracy for predicted support and resistance, relative to our entire data universe.

*Please note: Our featured stock is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader or ActiveInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

The stock is trading at $45.13 at the time of publication, up 5.89% from the open with a +0.69% vector figure.

Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for next trading session relative to the average of actual prices for the last trading session. The column shows expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

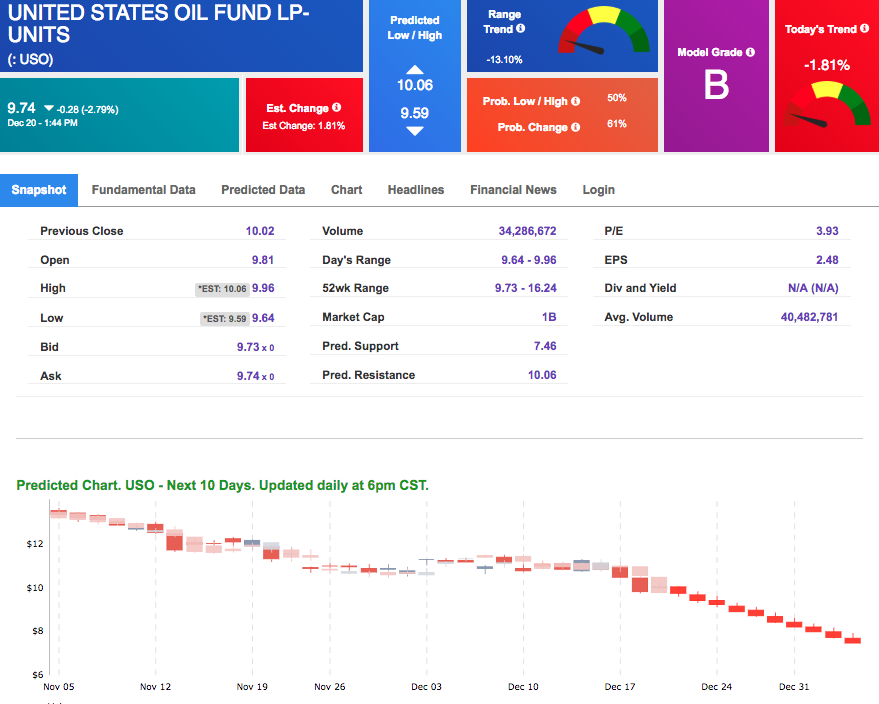

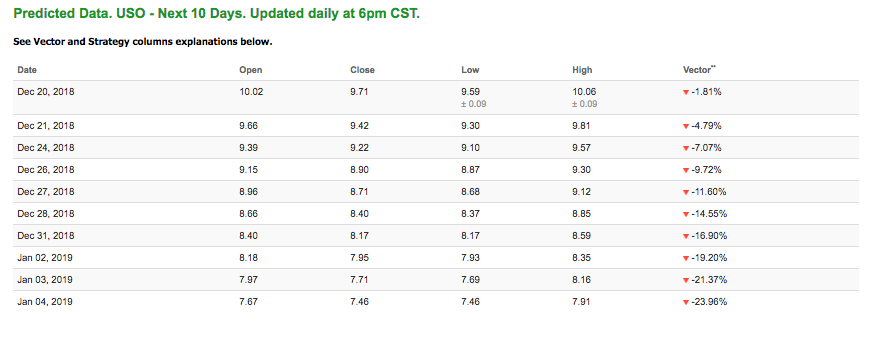

Oil

West Texas Intermediate for January delivery (CLF9) is priced at $46.20 per barrel, down 4.09% from the open, at the time of publication. Looking at USO, a crude oil tracker, our 10-day prediction model shows negative signals. The fund is trading at $9.74 at the time of publication, down 2.79% from the open. Vector figures show -1.81% today, which turns -14.55% in five trading sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

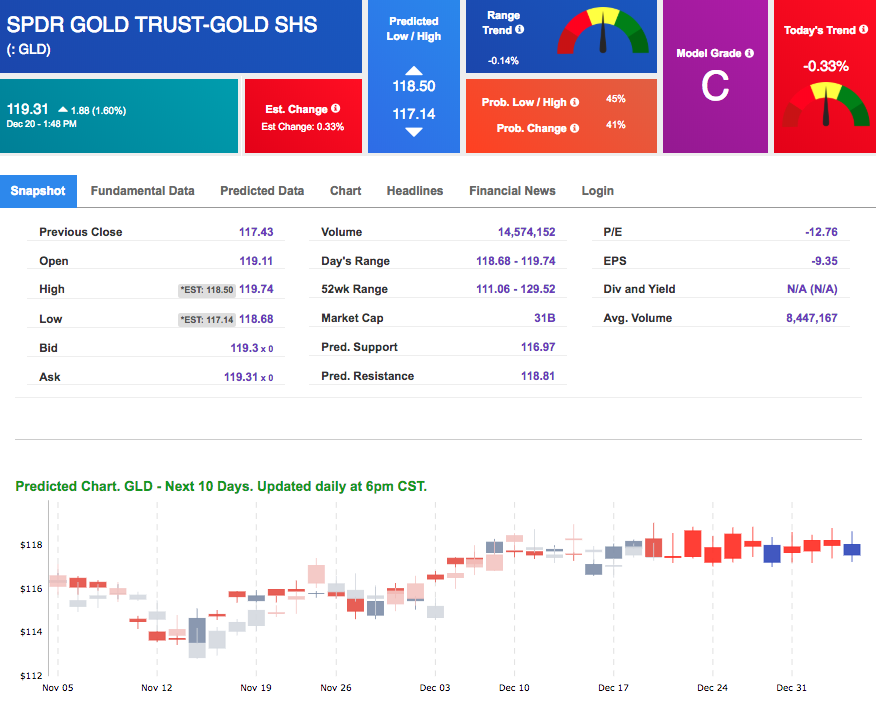

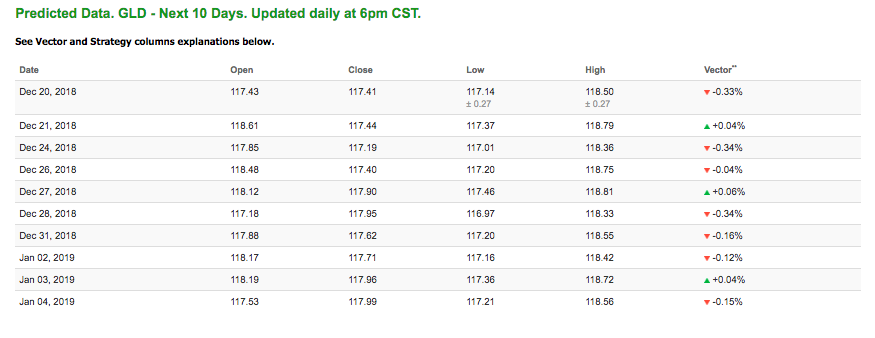

Gold

The price for February gold (GCG9) is up 0.70% at $1,265.20 at the time of publication. Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $119.31, up 1.60% at the time of publication. Vector signals show -0.33% for today. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Treasuries

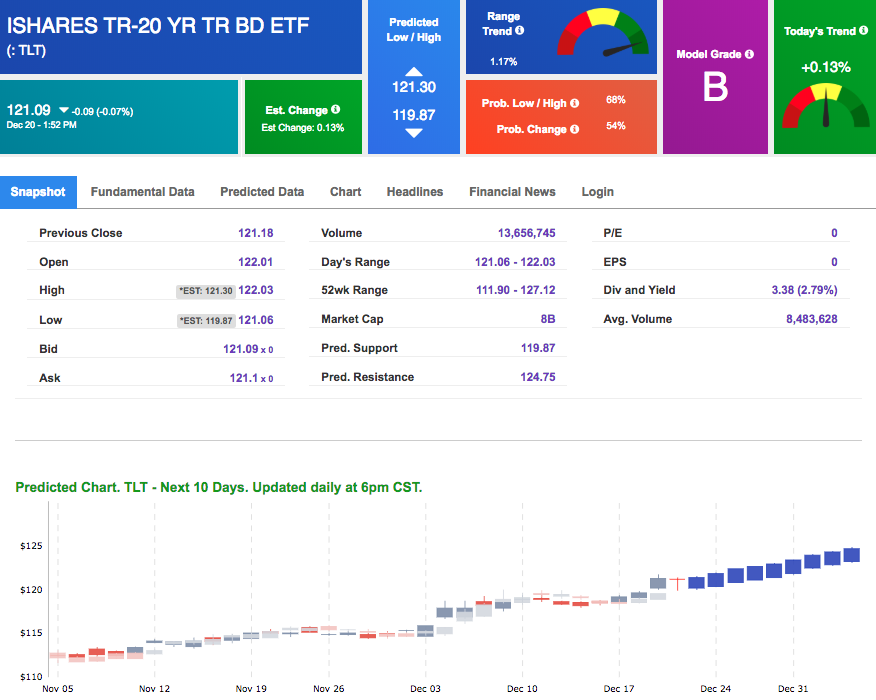

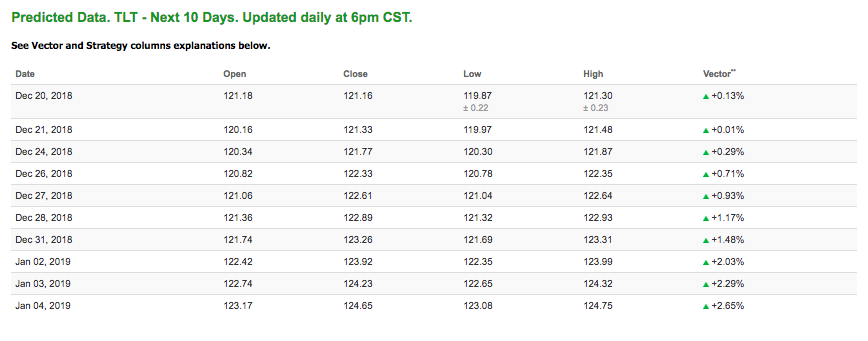

The yield on the 10-year Treasury note is up 0.45% at 2.79% at the time of publication. The yield on the 30-year Treasury note is up 0.96% at 3.01% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see positive signals in our 10-day prediction window. Today’s vector of +0.13% moves to +0.71% in three sessions. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

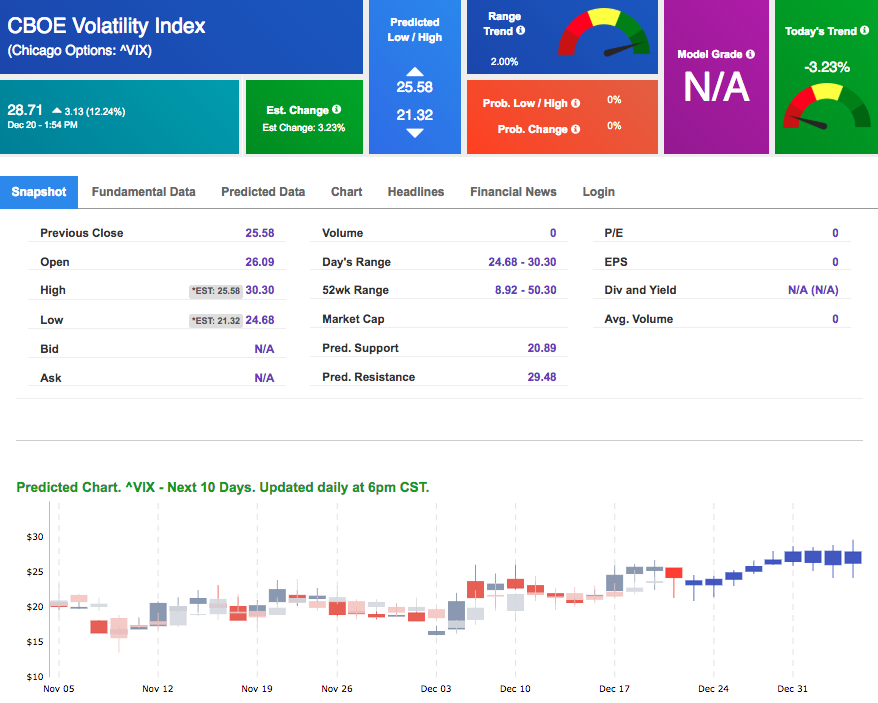

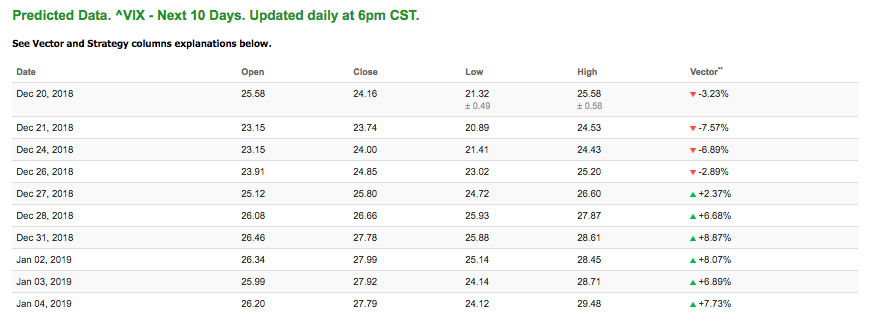

The CBOE Volatility Index (^VIX) is up 12.24% at $28.71 at the time of publication, and our 10-day prediction window shows mixed signals. The predicted close for tomorrow is $23.74 with a vector of -7.57%. Prediction data is uploaded after market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

YEAR-END SPECIAL:

Back by popular demand and to end the year on a good note, we are once again making the Lifetime Premium Membership available! Today only, we are offering LIFETIME ACCESS to our Premium Membership for less than the price we are currently charging for only 1 year of service!