S&P and Nasdaq Reach All-Time Highs, Q2 Bank Earnings Due This Week

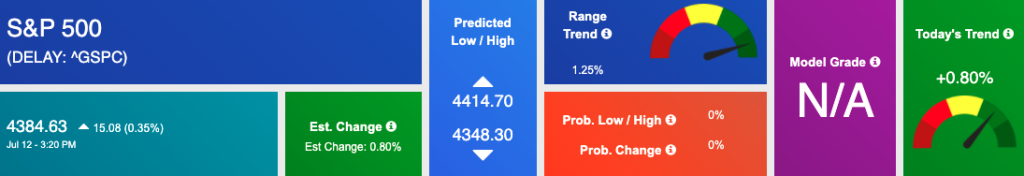

After producing a nice recovery to end last week, U.S. indices are continuing to trade higher with all three major benchmarks trading higher. Both the S&P and Nasdaq hit all-time intraday highs as the Nasdaq hit $14,761 while the S&P touched $4,381. Earnings season will be the biggest factor for market movement in the next few weeks as the latest corporate earnings season is due to begin, as always, with major banks. On Tuesday, earnings season kicks off with JPMorgan Chase, Goldman Sachs, and PepsiCo while Bank of America, Citigroup, PNC Financial, and Wells Fargo are also due to release this week. Also likely to impact markets this week will be tomorrow’s release of the Federal Budget and Core CPI report, while Wednesday’s release of the latest Beige Book will headline the week in economic reports.

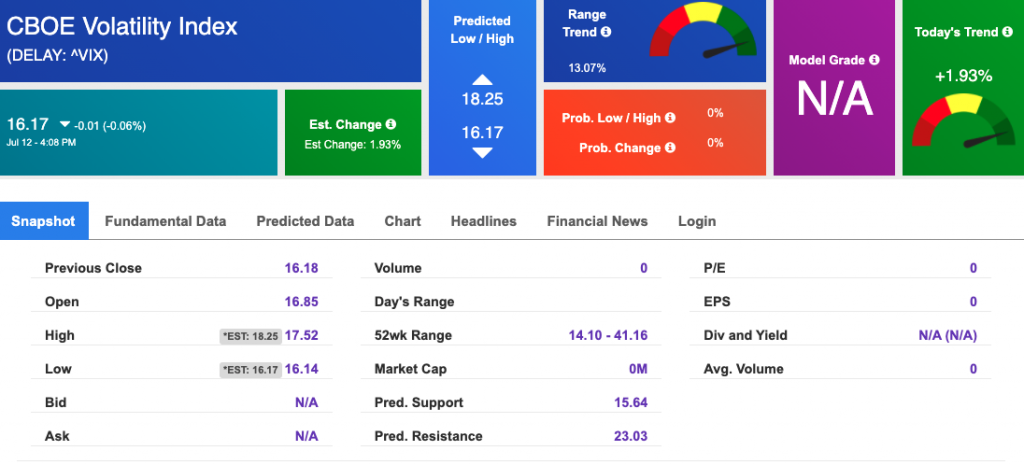

The delta variant of the COVID virus is causing some alarm globally while vaccination efforts continue. With news of the latest strand of the virus growing, volatility may be sparked in the market as the VIX currently trading near the $18 level. The start of the earnings season and interest rates are the main events that continue to drive the market this week. JPM, TSM, and DAL are key earnings announcements this week that can potentially influence the market direction.

Please watch the critical support levels on the SPY at $428 and $435. The market is trading in a well-defined range. We do expect a short-term correction to start in the next two weeks. Globally, European markets finished in the green while Asian markets were mixed. We encourage all market commentary readers to maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

Key U.S. Economic Reports/Events This Week:

- Consumer Price Index (June) – Tuesday

- Core CPI (June) – Tuesday

- Federal Budget (June) – Tuesday

- Producer Price Index (June) – Wednesday

- Beige Book – Wednesday

- Weekly Jobless Claims (7/10) – Thursday

- Import Price Index (June) – Thursday

- Industrial Production (June) – Thursday

- Retail Sales (June) – Friday

- Consumer Sentiment Index (July) – Friday

- Business Inventories (May) – Friday

Upcoming Earnings:

- JPM – JPMorgan Chase – Tuesday

- PEP – PepsiCo – Tuesday

- GS – The Goldman Sachs Group – Tuesday

- BAC – Bank of America – Wednesday

- WFC – Wells Fargo – Wednesday

- C – Citigroup – Wednesday

- BLK – Blackrock Inc – Wednesday

- PNC – PNC Financial – Wednesday

- TSM – Taiwan Semicondoctor – Thursday

- UNH – UnitedHealth Group – Thursday

- MS – Morgan Stanley – Thursday

- USB – U.S. Bancorp – Thursday

- PGR – The Progressive Corp – Thursday

- SCHW – The Charles Schwab Co.- Friday

- ERIC – Ericsson – Friday

‘If you’re looking for free trading resources… click here’

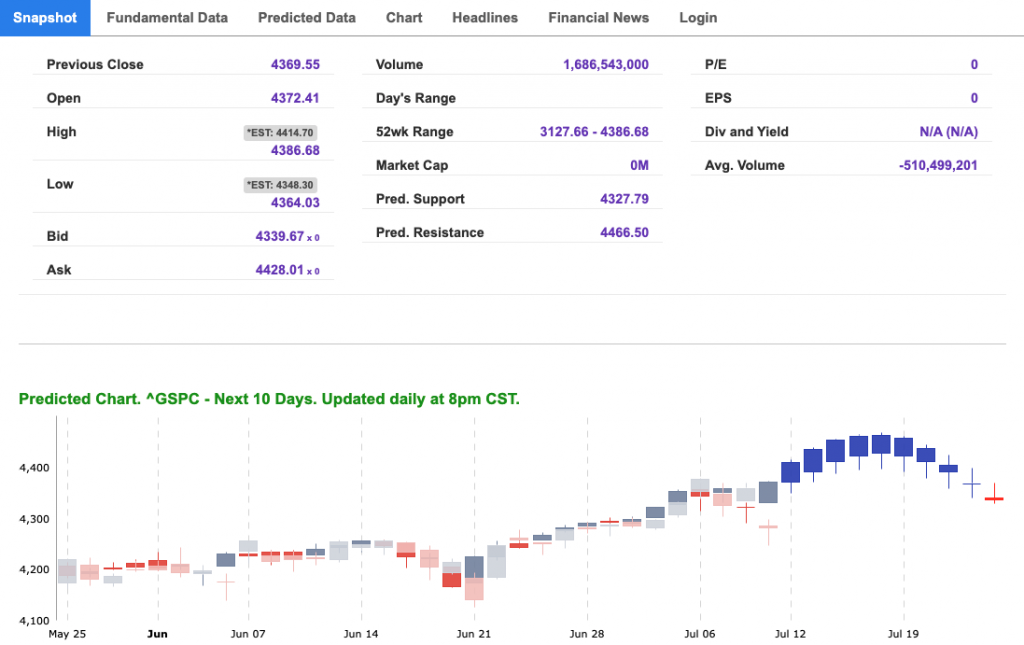

For reference, the S&P 10-Day Forecast is shown below:

Using the “^GSPC” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term mixed outlook. Prediction data uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Vlad’s Portfolio Lifetime Membership!

DO AS I DO… AS I DO IT WATCH LIVE AS I WORK THE MARKETS! TRY IT NOW RISK-FREE!

Click Here to Sign Up

Tuesday Morning Featured Symbol

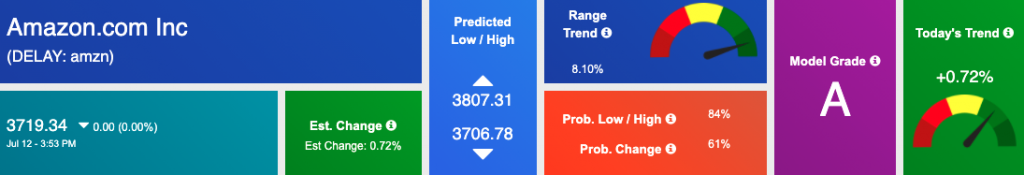

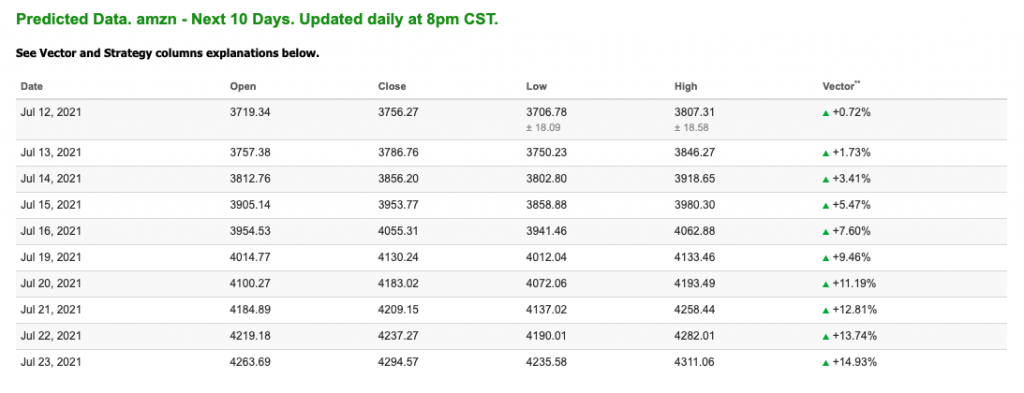

Our featured symbol for Tuesday is Amazon.com Inc (AMZN). AMZN is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The stock is trading at $3719.34with a vector of 0.72% at the time of publication.

10-Day Prediction data uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, AMZN. Our featured symbol is part of your free subscription service. Not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

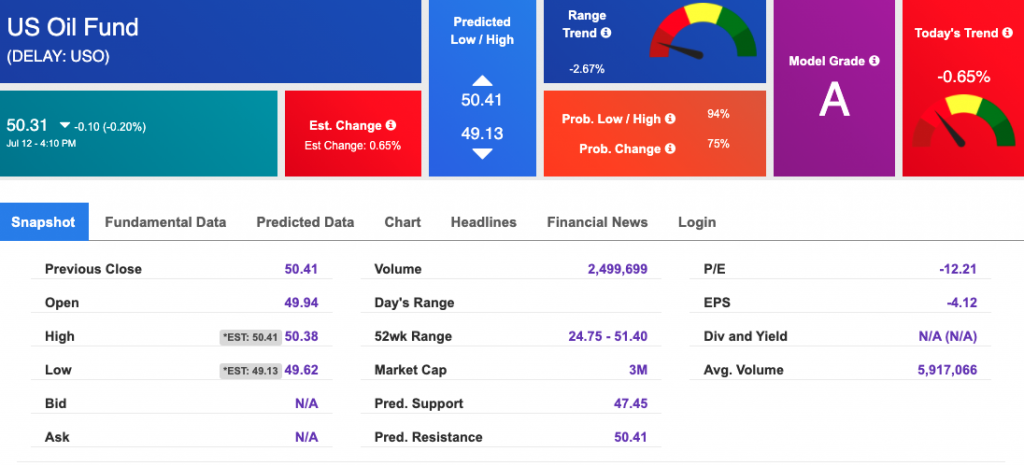

Oil

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $74.18 per barrel, down 0.51% at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $50.31 at the time of publication. Prediction data uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

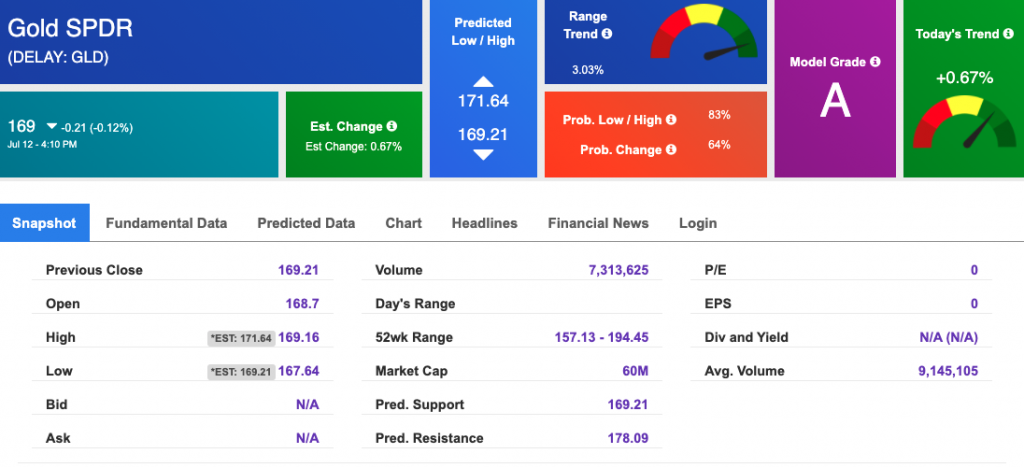

Gold

The price for the Gold Continuous Contract (GC00) is down 0.22% at $1806.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $169 at the time of publication. Vector signals show +0.67% for today. Prediction data uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

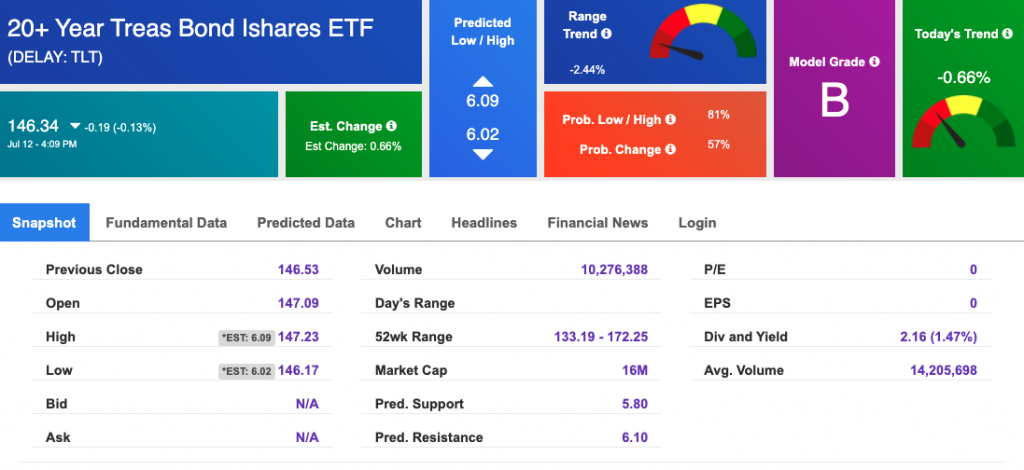

Treasuries

The yield on the 10-year Treasury note is up, at 1.365% at the time of publication.

The yield on the 30-year Treasury note is up, at 2.001% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Volatility

The CBOE Volatility Index (^VIX) is $16.17 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.